Reasons for refusing the simplified tax system

Why they refuse:

- Termination of activities. In this case, the liquidation procedure is practically no different from the general system and includes the implementation of all the necessary stages, including the preparation of an interim liquidation balance sheet.

- Transition to another tax regime. A change in the tax regime occurs on the basis of a voluntary decision of the taxpayer or due to forced circumstances.

Reasons for voluntary refusal:

- buyers (customers) who provide the largest turnover of the company are VAT payers. Cooperation with a simplified counterparty becomes unprofitable for them due to the impossibility of refunding tax amounts;

- next year it is planned to open branches or increase staff;

- Individual entrepreneurs switch to the regime for the self-employed (used in some regions of Russia).

Forced refusal occurs due to exceeding the maximum amount of revenue or other criteria, compliance with which is mandatory under the simplified tax system. In all cases, it is necessary to notify the tax authorities of the change in regime.

What is a notice of liquidation

Closing a company is a complex legal procedure that must be notified to all interested parties. A notice of winding up is a formal document that contains the decision to close a company. It is sent so that the other party can present its demands.

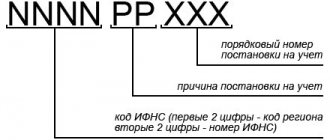

Depending on who the creditor notifies about the upcoming liquidation, the notification may be in a free format or approved . Thus, the notification for the tax service is filled out in accordance with the Order of the Federal Tax Service of 2012 No. ММВ-7-6 / [email protected] of 2021 “On approval of forms and requirements for the execution of documents submitted to the registration authority for the state registration of legal entities...”.

While notification of creditors and employees about liquidation occurs in a free format.

How to notify the tax office

In case of a voluntary transition, a notification to the tax service must be submitted no later than January 15 of the year in which the transition is planned. If you decide to change the regime later than this period, then the transition is possible only next year. The recommended form of notification is 26.2-3. Submission of a tax return payable in connection with the application of the simplified system and payment of the tax is carried out within the usual deadlines:

- for organizations - no later than March 31 of the year following the expired tax period;

- for individual entrepreneurs - no later than April 30 of the year following the expired tax period.

In case of termination of an activity in respect of which the simplification was applied, it is necessary to submit a notification within 15 working days after the relevant decision is made.

Deregistration from off-budget funds

An individual entrepreneur who has made a decision to terminate his entrepreneurial activities must be deregistered from extra-budgetary funds. The legislation establishes a different procedure for deregistration from extra-budgetary funds for individual entrepreneurs who entered into employment contracts and made payments under civil law contracts, and for individual entrepreneurs who did not enter into employment contracts and did not make payments under civil law contracts.

As a general rule, deregistration from off-budget funds of individual entrepreneurs who are not employers and have not made payments under civil contracts is carried out by the tax authority. The tax authority, within no more than 5 working days from the date of state registration of the fact of termination of the activities of an individual as an individual entrepreneur, submits information from the Unified State Register of Individual Entrepreneurs to state extra-budgetary funds for deregistration of the individual entrepreneur as an insurer (clause 3.1 of Article 11 of Law No. 129- Federal Law).

In a similar manner, deregistration of an individual entrepreneur with the Pension Fund of the Russian Federation in connection with the termination of business activities is carried out on the basis of information from the Unified State Register of Individual Entrepreneurs. The date of deregistration is the date of making an entry in the Unified State Register of Individual Entrepreneurs on state registration when an individual ceases to operate as an individual entrepreneur. When deregistered, the individual entrepreneur is given a notice of deregistration with the territorial body of the Pension Fund of the Russian Federation (clauses 26, 28 of the Procedure for registration and deregistration with the territorial bodies of the Pension Fund of the Russian Federation of policyholders making payments to individuals, approved by the Board of the Pension Fund of the Russian Federation dated October 13, 2008 N 296p).

TERMINATION OF IP

Deregistration of an individual entrepreneur with the Compulsory Medical Insurance Fund is carried out in the event of expiration (termination) of employment contracts concluded by individual entrepreneurs with employees, as well as contracts of a civil law nature (clause 22 of the Rules for registration of policyholders in the territorial Compulsory Medical Insurance Fund for compulsory health insurance, approved by Government Resolution Russian Federation dated September 15, 2005 N 570).

Individual entrepreneurs who have concluded employment contracts with employees, as well as paying remuneration under civil contracts for which insurance premiums are calculated in accordance with the legislation of the Russian Federation, are required to independently carry out the procedure for deregistration with the Federal Social Insurance Fund of the Russian Federation (clause 1, section 1 of the Registration Procedure as insurers of legal entities at the location of separate divisions and individuals in the executive bodies of the FSS of the Russian Federation, approved by Resolution of the FSS of the Russian Federation dated March 23, 2004 N 27).

WHO IS A SMALL ENTERPRISE?

Individual entrepreneurs are deregistered as insurers in the Federal Social Insurance Fund of the Russian Federation if there is no debt on mandatory payments. In doing so, they must submit the following documents to the fund:

- application for deregistration;

- the first copy of the registration notice;

- certified copies of documents confirming the circumstances that are the reason for deregistration.

Procedure for termination of activities

The procedure for terminating activities under the simplified tax system is divided into several stages:

- Decision-making.

- Submission of notification in the appropriate form. It must be completed manually or in a machine-readable manner. The document is provided in person, transmitted via telecommunications channels or sent by registered mail.

- Filing reports and paying taxes.

Risks of refusing the simplified tax system

It is necessary to analyze current turnover, sources of replenishment of working capital and the reliability of counterparties. It is advisable to request the following documents from existing and potential buyers (customers):

- copies of tax returns and financial statements for the last reporting period;

- a certificate of the status of settlements with the budget;

- certificate of turnover on the current account.

In addition, it should be clarified whether the main suppliers are VAT payers. If you work with companies that use special regimes, VAT refunds are impossible, which means that the point of refusing simplification is lost.

In what cases is the notification not completed?

The notice is not filled out:

- upon liquidation;

- during the planned transition to OSNO or another special regime for those types of activities that are subject to a single tax under the simplified tax system;

- if the established criteria for simplification are exceeded (forced refusal).

Notice of termination of activities on UTII

In response to the taxpayer’s application to cancel the imputation, the tax inspectorate sends a notice that confirms the termination of this type of activity. This is how UTII payers are deregistered. Documentary confirmation of acceptance of the application is sent by the tax authority within 5 days.

Violation by a taxpayer of the deadlines for submitting an application in the UTII-3 or UTII-4 form entails its deregistration and the issuance of a notification no earlier than the last day of the month specified in the application (clause 3 of Article 346.28 of the Tax Code of the Russian Federation).

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Registration of activities of an individual entrepreneur

Note 1

An individual entrepreneur is any individual who has undergone the state registration procedure established by law as a subject of independent entrepreneurial activity. The main goal of individual entrepreneurship is to obtain regular, systematic profit.

The main condition for registering a person as an individual entrepreneur is the fact of his legal capacity and his reaching the age of majority, that is, his 18th birthday. Sometimes a person can register as an individual entrepreneur before reaching 18 years of age. A person’s ability to become an entrepreneur at the age of 16 is determined by the court or guardianship authorities. At the age of 14, you can carry out entrepreneurial activities only if you have a passport and permission from the child’s legal representatives (parents, guardians, trustees, etc.). Individual entrepreneurs can be citizens of another state. To do this, you must have temporary or permanent registration in Russia.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

In the Russian Federation, individual entrepreneurs cannot be:

- law enforcement officers;

- judges and military personnel;

- citizens who are prohibited from carrying out commercial activities;

- persons - debtors (banks, credit organizations, etc.).

You can register as an individual entrepreneur in person or with the help of an intermediary (agency, personal representative). It is possible to transfer registration to another authorized person after the citizen has begun this process independently.

Note 2

All types of entrepreneurial activity are included in the All-Russian Classifier of Types of Economic Activities.

When registering, you can specify several types of activities - main and additional. This is provided in order to optimize taxation, to obtain appropriate licenses and permits from controlled authorities.

An individual entrepreneur is required to pay taxes, the amount of which depends on the reporting system he has chosen. An entrepreneur can independently choose one of the taxation regimes: general or traditional taxation, simplified taxation and unified tax on temporary income (UTII).

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

The simplified taxation system is divided into two types: by income (tax rate is 6%), or by income and expense difference (with a rate of 15%). With a single tax on income, the fiscal authorities themselves determine the amount of accrual for the entrepreneur based on the following criteria: area of the outlet, number of employees, availability of vehicles, etc.

The UTII tax return is submitted once a quarter if the annual turnover is no more than 150 million rubles, and if the company has no more than 100 people on staff. The territory of the Russian Federation also has a patent taxation system and a unified agricultural tax.

To register a citizen of the Russian Federation as an individual entrepreneur, the following documents are required:

- application for registration;

- Russian passport - original;

- copies of all pages of the passport;

- (taxpayer identification number (TIN);

- receipt of payment of state duty;

- application for preferential tax treatment.

An individual entrepreneur does not need to register a legal address if the registration address is indicated. There is no need to register an individual seal of an entrepreneur.