Why did you enter the report?

Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 explains in detail what it is and who takes the SZV-STAZH in 2021. A form has been developed in accordance with paragraph 2 of Art. 8 Federal Law of April 1, 1996 No. 27 “On individual (personalized) accounting in the compulsory pension insurance system.” This report is necessary to collect information about length of service and contributions, which will be reflected in the future on the individual personal accounts of the insured persons, on the basis of which an insurance pension is then assigned.

How to fill out the SZV corr form in SPU ORB

— — Sections 1-3 are to be filled out — Data on “forgotten” employees is ENTERED Territorial conditions (code), Special working conditions (code), Calculation of length of service, Conditions for early assignment of a labor pension — To be filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (appendix to the Resolution of the Pension Fund of the Russian Federation Board of January 11, 2017 No. 3p).

SZV-STAZH and EDV-1 are sent electronically using special communication channels and electronic signatures if the employer submits reports for 25 or more individuals.

Instructions for filling out the corrective form SZV-KORR, sections 1-3 Instructions for filling out the corrective form SZV-KORR, section 4 Instructions for filling out the corrective form SZV-KORR, sections 5, 6 The form can be submitted to an insured person who has an individual the account contains data that needs to be corrected, otherwise it is an error.

If the form specifies the type of information “About” is shown in a simple example of preparing annual reports for an individual entrepreneur without employees.1. Installing the latest version of “Spu_orb”, unpack and install the latest version of Spu_orb (If you already have it installed, you can see the program version in the very top line of the window or in the top menu - “Help” - “About the program”).

Who rents

All economic entities that have employees are required to submit reports to the Pension Fund. Not only organizations, but also individual entrepreneurs, lawyers, notaries, and detectives are required to submit it.

IMPORTANT!

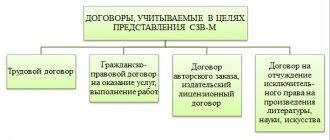

Having an employment contract with an employee is not the only condition. A report should be submitted to the Pension Fund for employees working under civil contracts, as well as under copyright contracts and licensing agreements.

Reporting is generated not only for working citizens. You will also have to report on the unemployed. The responsibility falls on government agencies. The Employment Center reports to the Pension Fund on citizens officially recognized as unemployed.

IMPORTANT!

If the organization’s staff includes a manager, who is also the only founder, then you will still have to submit a SZV-STAZH.

Form

The report, the form of which was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018, contains 5 sections:

- information about the policyholder - the organization that submits the report;

- reporting period;

- information about the periods of work of insured persons - the tabular part of the report, which describes information separately for each employee;

- information on accrued insurance contributions to the Pension Fund;

- information on pension contributions paid under early non-state pension agreements.

In addition to the form, the Resolution of the PFR Board approved the procedure for filling it out. In 2021, this procedure has undergone minor changes: a new code “VIRUS” has been introduced, which is entered in column 10 if the corresponding codes are entered in columns 9 or 12. This code is used when filling out reports regarding employees of medical organizations and their departments working with COVID -19.

Otherwise, the procedure for filling out the SZV-STAZH form has not changed.

Made a mistake? Use free instructions from ConsultantPlus experts to correctly fill out and submit the correction form. If you don't do this on time, you will pay a fine.

to read.

Due dates

The form must be submitted no later than March 1 of the year following the billing period. Since in 2021 March 1 is a Monday, a working day, the deadline for submitting the report will not be postponed. The report must be submitted no later than March 1, 2021.

We recommend preparing and sending information to the Pension Fund in advance. This will protect the institution from penalties. If an error is discovered in the reporting, there is time to correct it and submit an adjustment report. Otherwise, the organization will be punished with a ruble.

| Employee category | Deadline and where to apply |

| Current employees | Until 03/01/2021 - to the Pension Fund of Russia (*within five days from the date the request was received by the employee) |

| Those working under civil contracts (in case of calculation of insurance premiums) | |

| Fired in 2020 | |

| Those leaving in 2021 | In the hands of the resigning employee on the day of dismissal + to the Pension Fund of the Russian Federation in the next reporting period (until 03/01/2022) |

| All employees during liquidation and reorganization of the enterprise | In the hands of those dismissed on the day of dismissal + to the Pension Fund of the Russian Federation within one month from the date of the interim liquidation balance sheet or transfer act |

| Retiring | To the Pension Fund of the Russian Federation within three calendar days from the date of the employee’s application for a pension |

| Individual entrepreneur without employees | They don't rent |

Submission of the SZV-STAZH report to the Pension Fund of the Russian Federation is possible only together with the EDV-1 form, which contains information on the policyholder.

Sample of filling out SZV-STAZH and ODV-1

Copyright: Lori's photo bank The SZV-STAGE form is being submitted by employers for the first time this year.

A report on the length of service of employees for 2021 must be submitted to your Pension Fund office at the place of registration of the policyholder no later than March 1, 2021. Explanations on how to fill out the SZV-STAZH, a sample of filling out the report and the accompanying list of EDV-1 can be found in our material. The employer’s obligation to annually report on insured persons within the framework of personalized accounting is provided for in paragraph.

2 tbsp. 11 of the Law of 04/01/1996 No. 27-FZ (as amended on 12/28/2016), for this purpose a new reporting form SZV-STAZH was developed (adopted by Resolution of the Pension Fund Board of 01/11/2021 No. 3p, Appendix No. 1).

Special Moments

Providing pension information in the SZV-STAZH form has a number of characteristic nuances. Here are the instructions for filling out the SZV-STAZH in 2021:

- Submit the report even if there were no accruals in favor of the insured persons during the reporting period. The regulation mainly affects companies whose staff includes a manager who is the only founder. In other situations, when there have been no accruals for a long time, you will have to submit information in any case.

- If during the reporting period your organization has already submitted data to the Pension Fund of the Russian Federation on an employee (for example, the employee retired in May), then still include it in the annual report. Otherwise, discrepancies will arise in the database of the controlling fund, and the lack of information will entail the imposition of an administrative penalty on the company.

- If in the reporting year citizens from places of deprivation of liberty were involved in work in the organization, then they should also be included in the reporting. Request the necessary information about prisoners in FSIN institutions. Periods of work will be included in the length of service on the basis of Art. 1 of Law No. 27-FZ of 04/01/1996.

- If there are no employees on the staff of an individual entrepreneur, but the functions of the head of the company are performed by the merchant himself under a contract, there is no need to submit data to the Pension Fund. This is all explained by the fact that individual entrepreneurs independently calculate and pay insurance premiums for their own benefit. Therefore, there is no need to submit information about the individual entrepreneur’s experience.

Be sure to check whether the listed exceptions occur in the activities of your organization.

Information SZV-STAZH and EDV-1 in the Pension Fund for 2021

→ Section updated February 22, 2021 Deadline expired March 1, 2021 Attention! New forms Information on the insurance experience of insured persons must (, ):

- organizations;

- Individual entrepreneurs who have employees and/or have prisoners with individuals of the GPD.

- OPs that have a separate balance and current account, as well as accrual payments in favor of individuals.

The SZV-STAZH form is filled out for insured persons with whom the following agreements were concluded in the reporting year ((hereinafter referred to as the Procedure)):

- copyright contracts in favor of the authors of works under agreements on the alienation of the exclusive right to works of science, literature, art, publishing license agreements, license agreements on granting the right to use works of science, literature, art.

- GPA for the performance of work/provision of services;

- employment contracts;

The information is submitted to the PFR branch at the place of registration of the organization/SP/IP.

Delivery format

The type of reporting to the Pension Fund of the Russian Federation directly depends on the average number of employees.

If a company employs 25 people or more, the SZV-STAZH report must be filled out online on the Pension Fund website and sent electronically; a paper report will not be accepted. For non-compliance with the reporting format requirements, separate administrative measures are provided.

If the number of the company does not reach 24 people, then calmly report on paper. The company has the right to simplify and speed up document flow with regulatory authorities by switching to electronic data exchange, that is, sending reports electronically.

IMPORTANT!

To generate electronic reporting, you will need a special enhanced digital signature. It should be issued in the name of the manager or another responsible person vested with the appropriate authority (signature authority).

An electronic signature that does not meet the current requirements for cryptographic information protection is not used to sign electronic reports. The Pension Fund of Russia will refuse to accept such a report.

Separate divisions: how to report

Check that two prerequisites are met:

- Who calculates and pays wages to employees of the department.

- Does the separate division have a separate current account?

If a separate division has opened an independent current account in any banking organization (with the Federal Treasury for public sector institutions), and the OP independently calculates wages and pays them from its current account in favor of employees, then you will have to submit a separate SZV-STAZH for the separate division .

The rule only applies if two conditions are met simultaneously. If only one of the above conditions is met, then the parent agency is required to report.

Filling out SZV-STAZH for a separate unit has several nuances:

- Information must be submitted to the territorial office of the Pension Fund at the location of the separate unit.

- The report should indicate the registration number of the policyholder that was assigned to the separate unit upon registration with the Pension Fund of Russia.

- Fill out the checkpoint and tax identification number in the same way as the registration number. Indicate the values that were assigned to the separate division, not the parent organization.

Filling rules

Instructions on how to fill out the SZV-STAZH are as follows:

Step 1. Fill out section No. 1.

In the information about the policyholder we indicate:

- registration number;

- INN of a legal entity is 10 digits, dashes are placed in the last two cells of the form;

- KPP - reason code for registration;

- name of the insured organization.

The type of information is marked based on the following conditions: if the information is submitted for the first time - “initial”, in case of errors in the initial data - “additional”, when assigning a pension to the insured person (accounting for the data of the reporting period (year), for which the SZV-STAZH form is still not submitted) - “appointment of pension”.

Step 2. Fill out section No. 2.

Enter the year of the billing period. In our case, this is 2021.

Step 3. Fill out section No. 3.

Columns 6 and 7 “Operation period” are filled out within the reporting period. If the report is submitted for 2021, then the dates are indicated only within this year (from 01/01/2020 to 12/31/2020). If work is carried out under two contracts (labor and civil partnership), both periods are indicated on different lines. When assigning a pension, column 7 indicates the date of expected retirement.

Columns 8–13 of Section 3 are filled out according to the classifier (appendix to the procedure for filling out the SZV-STAZH form).

Columns 9, 12, 13 of Section 3 are filled in if special working conditions are documented; the employee’s employment in special conditions complies with the requirements of current regulatory documents; there is payment of insurance premiums at an additional tariff or pension contributions in accordance with pension agreements for early non-state pension provision.

If it is necessary to display more than one code at the same time, they are indicated in two lines.

Step 4. Fill out sections No. 4 and No. 5.

The answer to the question whether or not to fill out paragraph 4 in SZV-STAZH and paragraph 5 of this report depends on the type of information specified earlier - these sections are filled out only for the form where the type of information is “Pension assignment”.

The preparation of the final details looks traditional - the name of the position of the responsible person, signature, transcript of the signature, date and seal.

Example of filling out SZV-STAZH:

How to fill out SZV-STAZH

The report should include those employees for whom pension insurance contributions must be paid. If you have an employee for whom these contributions are not paid, then you do not need to include him in the report. For example, if you work with a self-employed person and have not entered into an agreement with him, then he will not appear in SZV-STAZH.

Sections 1 and 2

Fill in the lines with registration number, INN and KPP according to the extract from the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs. In the “Name (short)” line, enter the name of the organization according to the statutory documents; there is no need to translate the Latin alphabet. Entrepreneurs enter their full name with the prefix IP.

In the “Information Type” block, select the form type:

- “Initial”, if you are submitting information for the first time in a year;

- “Additional”, if the original form had an error and it was necessary to correct it;

- “Pension assignment” if the employee retired during the reporting year.

In the “Calendar year” field, enter the reporting year. If you submit the form for the year, keep in mind that you need to indicate the previous one. That is, in 2021 you submit reports for 2021, and in 2021 you passed the SZV-STAZH for 2021.

Section 3

Let's look at the graphs that cause difficulties. In columns 6 and 7 you need to indicate the dates of hiring and dismissal. All dates are indicated within the reporting period, that is, it is necessary to reflect those events that occurred only in the specified year.

Column 11 contains information about vacations, sick leave, maternity leave, educational leave, substitutions and other events in the employee’s work life. All marks can be found in the classifier - for example, it is built into the “New Astral Report”.

If an employee decides to resign on the last day of the reporting year, then the date indicated in the report is December 31. it must be entered in column 14.

Fill out columns 8, 9, 10, 12 and 13 if the employee works in conditions that allow him to retire early - hazardous production, work in the far north, and so on.

Filling out a report upon dismissal

Upon dismissal, the employee is issued a SZV-STAZH only with his personal data (clause 4 of article 11 of Law No. 27-FZ). If this requirement is violated, Rostrud will impose a fine (key provisions are posted on the Rostrud website).

IMPORTANT!

It is advisable to keep a log of issued forms so that written confirmation from the employee of receipt of the document is preserved.

The SZV-STAZH is filled out for a resigning employee in almost the same way as for existing employees. The differences concern only two points:

- the first is filling out the reporting period (if leaving in 2021, indicate the current year);

- the second is column 7 in part 3 (the last working day or the date on which the contract (labor or civil law) was terminated is entered in this column).

Here is an example of filling out SZV-STAZH when dismissing an employee in 2021:

Step-by-step instructions for filling out the certificate of experience in the spu orb program

They will only be accepted in this form.

The obligation to submit a new report to the Pension Fund began in 2021 (previously it was only upon liquidation of an organization), but employers were previously required to issue extracts from SZV-STAZH to all employees upon their dismissal or upon separate request.

In this case, the data in the form must be given specifically to the employee to whom the document should be issued, since personalized accounting information is legally classified as personal data that cannot be disclosed by virtue of Article 7 of Federal Law No. 152 of July 27, 2006.

In addition to full-time employees, contractors under civil contracts at the end of the contract have the right to receive an extract.

This should happen on the final working day when the remaining required documents are issued.

Where are the reports submitted?

The completed report is submitted:

- If an entrepreneur does this, at his place of residence;

- If a company does this, at its location;

- Divisions that keep records independently - at their location.

Reporting methods

The report has two ways of transmitting it to the pension authority:

- Paper form. Only those enterprises and entrepreneurs who employ no more than 25 people have the right to submit a report in this form. The report form must be filled out yourself on a computer, printed in duplicate, and in addition, you must bring an electronic file on a flash drive.

There are two questions in the section, and the answers to them must be marked in the appropriate field.

Step-by-step instructions for filling out the certificate of experience in the spu orbi program latest version

- columns 3, 4 – the corresponding amounts of payments, taking into account the adjustments.

Section 6

In section 6, add (p.p.

the registration number of the policyholder in the Pension Fund of the Russian Federation in the adjustment period is indicated.

In the fields "TIN"

and

“KPP”

are reflected by the TIN and KPP (if any) of the policyholder.

Block “Information on adjusting the earnings of APs”

filled out if it is necessary to clarify data on the employee’s income recorded on his individual personal account (IPA), accrued and paid insurance premiums.

Attention! To fill out the section, you must click on the “+Information”

.

According to the line “Adjustment of AP’s earnings”

reflected:

- month for which corrections are made;

- in the field “Amount of payments, total”

for adjustments for reporting periods for 1996-2001.

Step-by-step instructions for filling out the certificate of experience in the spu orb program latest version

There are three of them, they are indicated in the “Type of information” column with a special code (clause 4.1 of Appendix 5 of Resolution No. 3p).

Option 1.

The “CORR” (corrective) information type indicates that you are making corrections to the information about the insured person specified in sections 3 – 6 of the report:

- information about wages and other remunerations of an employee (section 4) replaces the information reflected on the individual personal account (IPA) of this employee;

- information on insurance premiums (section 4) is supplemented with information recorded on the employee’s personal data record;

- the information in sections 5 – 8 replaces the information reflected on the employee’s HUD.

For filling out the CORR SZV, a sample with the “CORR” type of information is presented in the window below and is available for download:

Option 2.

The information type “OTMN” (cancelling) involves filling out only sections 1 and 2 of the form.

Step-by-step instructions for filling out the SZV-experience in the SPU ORB program

The rule for this date is that if it falls on a weekend, the final filing deadline will automatically move to the first closest working day.

In 2021, this report was not required to be submitted. For the first time, business entities will do this until March 1, 2021 for the period of 2021.

However, there are also two cases in which it will be necessary to immediately issue a SZV-STAGE:

- If an employee applies for a pension and brings a notification of this event to his accounting department, then a form must be filled out for him and submitted within three days from the fact of the notification;

- It is necessary to draw up a SZV-STAGE upon dismissal of an employee.

Attention

Before filling out the SZV-STAZH in 1C, we will provide a short reference. SZV-STAZH is a new form of reporting to the Pension Fund, approved by Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2018 N 3p. Information on the insurance experience of insured persons in the SZV-STAZH form, as a general rule, is submitted to the Pension Fund of the Russian Federation no later than March 1 of the year following the reporting year.

Features of filling out information on the SZV-STAZH form in the 1C Accounting 3.0 program

Preparatory stage before drawing up the SZV-STAZH form in the 1C program (ed. 3)

In the 1C ZUP 3.0 and 1C Accounting 3.0 programs, the SZV-STAZH form is filled out automatically.

, example of filling out the SZV-KORR form

- FORM of the SZV-KORR form “Data on the adjustment of information recorded on the ILS ZL” (.xls, 58 Kb)

- EXAMPLE of filling out the SZV-KORR form type “KORR” (.xls, 59 Kb)

- EXAMPLE of filling out the SZV-KORR form type “OTMN” (.xls, 59 Kb)

Penalties

By submitting the SZV-KORR pension form, the policyholder actually admits the presence of errors in previously submitted reports or failure to submit reports for one of the employees.

To do this, go to the “Employers” section, click on the link “Free programs, forms, protocols”. Form title

At the beginning of the form, provide information to identify the policyholder: number in the Pension Fund of Russia, INN and KPP.

On the other hand, if an agreement has been signed with him, but there is no activity, then it is necessary to submit a report to the Pension Fund, indicating only the director.

At the moment, the Pension Fund has not given any explanations regarding the submission of a zero report by organizations.

Example of filling out the form

You can download the SZV-KORR report form on our website using this link in Excel format. Let us explain how to fill out a correction report and decipher the features using a specific example.

Next, we will describe step by step the procedure for filling out the SZV-KORR form.

Information type

In the “Type of information” column the code is indicated (p.

4.1 Applications 5):

- - “CORR” (corrective) – if you need to clarify previously submitted data, which are provided for in Section.

Seeing you off to retirement

When applying for a pension, an employee must submit information to the Pension Fund using the SZV-STAZH form. The filing deadline is within three days from the date of receipt of a written application from the employee. Consequently, the future pensioner is required to submit an application to the employer. There is no unified application format; draw up the document in any form. For example, it looks like this:

An example of filling out a report when registering an employee for retirement:

How to fill out the accompanying inventory

You cannot send the SZV-STAZH form alone to the Pension Fund. It is mandatory to fill out an accompanying list of submitted documents. Without it, the report will be returned. For the inventory, use the unified form EDV-1.

Form EDV-1 was approved by Resolution of the Board of the Pension Fund of the Russian Federation No. 507p dated December 6, 2018 and has not changed in 2021.

The structure of the accompanying inventory contains five sections:

- Details of the policyholder. We fill in the same order. We indicate the registration number of the organization or separate division. Then enter the tax identification number and checkpoint. And only then enter the short name of the organization.

- Reporting period. We indicate for what period we submit information to the Pension Fund. We select the type of information from the proposed options: initial, corrective or canceling.

- List of incoming documents. It is necessary to indicate the number of insured persons for whom information is sent to the regulatory authority.

- Data on the policyholder on the presence of debts on insurance, funded pensions and other tariffs of insurance contributions. The report contains a separate table to reflect information about debt repayment.

- Section to reflect the grounds for early receipt of a pension.

The accompanying inventory is signed by the head of the insured organization. Or another responsible person vested with appropriate authority.

How to make a SZV experience report on SPU Orb

New form of the annual report to the Pension Fund of Russia Deadlines for submitting SZV-STAZH Example of filling out the SZV-STAZH report Resolution of the Board of the Pension Fund of the Russian Federation dated December 6, 2018 No. 507p approved a new form of the annual report - SZV-STAZH.

The resolution also provides the procedure for its preparation.

All insurers, without exception, are required to submit this report to the Pension Fund for each working (insured) individual - both for individuals with whom employment contracts have been signed, and for those employed under GPC agreements.

The updated SZV-STAGE form, submitted in 2021 based on the results of 2020, can be downloaded from the link below. SZV-STAZH 2021 The business entity-insurer submits a new report to the Pension Fund with the accompanying report - EDV-1, the form of which is also updated by Resolution No. 507p.

These reports are linked to each other and are presented as a single package.

How to make a report to the Pension Fund of the Russian Federation in the spu_orb program?

To enter data, generate a report and upload data to a magnetic medium, you will need the latest version of the Spu_orb program, which you can use without fear of inspections by regulatory authorities. Spu_orb is an official program from the Pension Fund of the Russian Federation.

Distributed free of charge. Designed for filling out reporting forms to the Pension Fund. Allows you to fill out the forms: DSV-1, DSV-3, ADV-1, ADV-2, ADV-3, ADV-8, ADV-9, ADV-10, ADV-11, RSV-1, RSV-2, RV- 3, SPV-1, SZV-6-1, SZV-6-2, SZV-1, SZV-3, SZV 4-1, SZV 4-2, SZV-K. The program is written and supported by the Orenburg branch of the Pension Fund of Russia.

The work of “Spu_orb” is shown using a simple example of preparing annual reports for an individual entrepreneur without employees.1. Installing the latest version of “Spu_orb”, unpack and install the latest version of Spu_orb (If you already have it installed, you can see the program version in the very top line of the window or in the top menu - “Help” - “About the program”).

Sample of filling out SZV-STAZH and ODV-1

Copyright: Lori's photo bank The SZV-STAGE form is being submitted by employers for the first time this year.

A report on the length of service of employees for 2021 must be submitted to your Pension Fund office at the place of registration of the policyholder no later than March 1, 2021. Explanations on how to fill out the SZV-STAZH, a sample of filling out the report and the accompanying list of EDV-1 can be found in our material.

The employer’s obligation to annually report on insured persons within the framework of personalized accounting is provided for in paragraph.

Instructions for filling out the SZV corr for 2021 in the SPU orb

> > The third type is needed when the filler has not added information about the employee to the reporting.

Let's look at the step-by-step procedure for filling out the SZV CORR form. It consists of 6 sections. Sections 1-2 are completed for all three types of forms.

You can find the form in the Resolution of the Pension Fund Board of January 11, 2017 No. 3p (Appendix 3). In addition, it can be downloaded from the Pension Fund website. To do this, go to the “Employers” section, click on the “Free programs, forms, protocols” link.

For example, in 2021, an accountant discovered incorrect information about an employee in reporting to the Pension Fund for 2021.

SZV-experience: sample of filling out reports

/ / / 7, In 2021, SZV-STAZH new reporting for all employers was introduced. The author of its creation was the Pension Fund, since when the administration of social contributions was transferred to the Federal Tax Service, the fund stopped receiving information about the length of service of employees.

This year, a new form must be handed out to resigning employees, but starting from 2021, all business entities must report on it.

articles

Until 2021, organizations and entrepreneurs submitted a RSV-1 report to the Pension Fund, from which the body received information about the guardianship of the insured persons.

SPU orb program

Depending on the type of the SZV-KORR form, certain sections indicated in the table are filled out: Form type Sections to be filled out in the form SZV-KORR form with the “KORR” type Sections 1-3 and at least one of the sections 4-6 of the form.

Only the data specified in sections 3-6 of the form are corrected: Section 4, columns 1-6 - data on earnings (remuneration), income, amount of payments and other remunerations of the insured person REPLACE the data recorded on the ILS AP Section 4, columns 7-13 - data on accrued and paid insurance premiums SUPPLEMENT the data recorded on the ILS of the AP Sections 5 - 6 - REPLACE the data recorded on the ILS of the AP Form SZV-KORR with the type “OTMN” Only Section 1 and Section 2 are subject to completion - the data recorded on the ILS for reporting period, which is being adjusted Form SZV-KORR with the type “SPECIAL” Sections 1-3 must be filled out - data on “forgotten” employees is entered Territorial conditions (code), Special working conditions (code), Calculation of length of service, Conditions for early assignment of labor pensions - Filled out in accordance with the Classifier of parameters used when filling out information for maintaining individual (personalized) records (Appendix to the Resolution of the Pension Fund of the Russian Federation Board of January 11, 2017 No. 3p).

Registration of SZV-STAZH in 1C and other programs

submitted annually, the first time it will be submitted to the local Pension Fund before March 1, 2021, with the exception of cases and.

Organizations that have labor relations with more than 25 employees and contract workers during the reporting period are required to submit the form electronically. and need information about salary, etc.

payments to insured persons, periods of work and corrective information. Bukhsoft online - the program allows you to freely test reports sent to government agencies, including the Pension Fund of Russia in accordance with its technical requirements. Program:

- provides technical support, guarantees and instant updates when introducing new forms, as is the case with the SZV-STAZH form.

- performs automatic calculation;

- is a universal and simple solution for an accountant;

- covers all reporting submitted by legal entities and individual entrepreneurs;

- forms everything automatically;

When using the paid version of the program, the user can:

Software

Program for preparing reporting documents for the Pension Fund of Russia "Spu_orb" version 2.93 according to forms ADV-1, ADV-2, ADV-3, ADV-8, ADV-9, SZV-1, SZV-3, SZV-4-1, SZV-4 -2, SZV-6-1, SZV-6-2, SZV-6-3, SZV-6-4, SPV-1, SPV-2, ADV-10, ADV-11, ADV-6-4, SZV -K, SZV-SP, DSV-1, DSV-3, RSV-1, RSV-2, RV-3, SZV-M, ODV-1, SZV-ISKH, SZV-KORR, SZV-STAZH, application for appointment pensions, birth information, death information.

The “Spu_orb” program provides the ability to prepare reporting documents for submission to the Russian Pension Fund.

Here you have the opportunity to enter, print and upload bundles of documents for the Pension Fund.

The program works with the following forms of documents: Questionnaires of insured persons: ADV-1 Application for exchange of an insurance certificate: ADV-2 Applications for the issuance of a duplicate insurance certificate: ADV-3 Information about death: ADV-8, Information about birth, Information about death Individual information : SZV-1, SZV-3, SZV-4-1, SZV-4-2, SZV-6-1, SZV-6-2, SZV-6-3, SZV-6-4, SPV-1, SPV -2, ODV-1, SZV-ISKH, SZV-KORR, SZV-STAZH

We fill out and submit the SZV-STAZH form to the Pension Fund of Russia

Didukh Yulia Author PPT.RU January 24, 2021 The SZV-STAZH report is a relatively new format for reporting to the Pension Fund.

Employers must submit this form annually.

A new form has been approved for reporting for 2021. Let's take a closer look at the procedure for drawing up a report for the Pension Fund; the current sample can be downloaded for free.

ConsultantPlus TRY FOR FREE The reporting procedure for Russian organizations and individual entrepreneurs who are insurers of their employees in pension, social and medical insurance has changed significantly since 2021. The administration of insurance funds is now handled by the Federal Tax Service of Russia, which accepts a new unified calculation from contribution payers.

However, funds that retained a number of their functions also introduced new reports. In particular, the Pension Fund adopted, which approved four new forms at once.

But in 2021, the forms have been adjusted.

Programs for filling out SZV-STAZH: 1C, SPU ORB, PFR, ZUP and others

Online application Full name (required) Phone (required) Question (required) The SZV-STAZH report is submitted annually, the first time it will be submitted to the local Pension Fund before March 1, 2021, with the exception of cases of liquidation of the organization and retirement of the employee. Organizations that have labor relations with more than 25 employees and contract workers during the reporting period are required to submit the form electronically.

To fill out this form, organizations and individual entrepreneurs need information about salary, etc.

payments to insured persons, insurance premiums, periods of work and corrective information. Bukhsoft online - the program allows you to freely test reports sent to government agencies, including the Pension Fund of Russia in accordance with its technical requirements.

The program: covers all reporting submitted by legal entities and individual entrepreneurs; is a universal and simple solution for an accountant; generates everything automatically; carries out

> > Reproduction in the spu_orb program of the entire database for periods starting from 2010, for which in the “Service” - “Data Import” mode, the ability to import (download) files (XML, DBF format) for various reporting periods is implemented (Fig.

12). Reproducing in the spu_orb database only the amount of debt for insurance premiums in the context of insured persons, which arose at the beginning of the current reporting period, for which in the “Service” mode - “Data import” - “Debt SZV-6 according to the Pension Fund of Russia” (Fig.

2) the ability to download the amount of debt at the beginning of the period for insured persons for documents SZV-6-1 and SZV-6-2 from a special file with data on the policyholder on the amount of existing debt in the context of insured persons has been implemented. Rice. Info RSV-1: Formation and printing ATTENTION!

For the 1st quarter of 2012, the amounts indicated in the tables of the RSV-1 report (with the exception of some lines) are indicated in rubles and kopecks!!!

You might also be interested in:

Source: https://em-an.ru/kak-delat-otchet-szv-stazh-na-spu-orb-70519/

How to punish for violations and mistakes

Fines are provided for under Article 17 of the law on personal registration of insured persons and under the Code of Administrative Offenses.

| Violation | Fine |

| The report was not submitted on time | 500 rubles for each insured person |

| An error was made | 500 rubles for each employee whose information is found to contain errors |

| The format for providing information in electronic form is broken | 1000 rubles |

| The procedure for submitting SZV-STAZH when registering an employee for retirement was violated | 50,000 rubles (Part 1 of Article 5.27 of the Administrative Code) |

IMPORTANT!

Information from the SZV-STAZH reporting must coincide with the monthly SZV-M form and the quarterly DAM. If information about the employee was not received by the Pension Fund on a monthly basis, then the controllers will have a discrepancy. There is a fine for failure to provide information. The form and sample for filling out the SZV-M report (experience) can be found in the special material “Submitting reports: instructions for filling out the SZV-M.”