Essence of the question

Despite numerous changes in terms of insurance coverage for working citizens, reports will still have to be submitted to the Pension Fund.

Although the list of forms has been significantly reduced, you will now have to submit information monthly. Violations of current surrender rules result in large fines. State employees and non-profit organizations do not have privileges in this matter and are required to report on the same basis as all Russian enterprises and organizations.

To generate reports to the Pension Fund, you will have to use specialized programs. Some public sector employees have the right to submit reports on paper. But even when filling it out, you will have to take into account numerous rules and factors. A program developed by representatives of the Pension Fund of the Russian Federation will help you avoid mistakes - this is Spu_orb.

The software allows you not only to quickly and easily generate reports, but also to carry out special checks that eliminate errors and warnings in reports. The software will have to indicate what the main category of the IP payer is (the explanation for 2020 is presented below).

What is an IP payer code?

In general terms, the term IP refers to individual information. Until 2021, enterprises submitted data on contributions to compulsory pension insurance from personnel earnings to the Pension Fund of the Russian Federation. From 01.01.17, chapters were added to the Tax Code of the Russian Federation. 34. In this regard, the administration of contributions was transferred to the tax office.

In the new calculation, Section is devoted to personalized information. 3. Personal data for individuals, as well as the amount of payments accrued by the employer, are indicated here. In page 200 subsection. 3.2.1 enter the category code of AP (insured person). If an enterprise accrues payments to staff subject to an additional tariff, such data is displayed in subsection. 3.2.2. In this case, according to gr. 270 additionally indicates the tariff code.

Unified calculation of insurance premiums 2018

What is the code

Special codification of payers is provided for the following types of pension reporting:

- applications according to unified forms ADV-1, ADV-2, ADV-3;

- individual information on insured persons - forms SZV-STAZH, SZV-KORR, SZV-ISKH;

- information about additionally transferred contributions - forms DSV-1, DSV-3;

- documents for assigning a pension and other reporting forms at individual requests of the Pension Fund of the Russian Federation.

Previously, a special code - payer category in the Pension Fund of Russia (classifier 2020) - was used to prepare calculations for insurance premiums until 2021. Let us remind you that when transferring the rights of an insurance administrator to the Federal Tax Service, the need to submit RSV-1 to the Pension Fund of the Russian Federation is abolished.

So, what is the main category of IP payer? This is a specific coding of insured persons by main types (categories). Note that this type of encoding for the main categories of IP payer, decoding and codification were created by the developers of the Spu_orb software. When creating the codes, they were guided by Appendix No. 8 to the Order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ [email protected] and Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p.

Main categories of IP payer

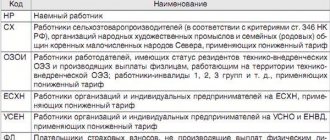

Which payer category in the Pension Fund of Russia should be indicated in the RSV-1 report? The classifier explains this in the table “Category Code of the Insured Person”. Thus, the main categories of payers correspond to the following codes:

- “NR” - the report indicates organizations, individual entrepreneurs and citizens who are not entrepreneurs, paying remuneration to individuals and paying contributions to the Pension Fund in accordance with Article 58.2 of Law No. 212-FZ of July 24, 2009,

- “FL” – indicate individual entrepreneurs, private lawyers and notaries, as well as other private practitioners who do not make payments to other individuals (Clause 2, Part 1, Article 5 of Law 212-FZ).

Having determined the category of the payer in the Pension Fund of Russia, the classifier is used when filling out individual personalized accounting (IP) information. As part of the RSV-1 form, Section 6 is provided for this. Indicators are entered separately for each individual who has received remuneration from the contribution payer over the last three months. When filling out the IS, classifier codes are used depending on the information entered: category of the insured, special working conditions, basis for calculating length of service, etc.

>The main category of IP payer in 2021

Where to indicate the payer category

You will only have to indicate the code in the reporting forms SVZ-ISH and SZV-KORR. This problematic detail must be selected from the drop-down list on the “Basic Data” software tab in the “Enterprise Details” section.

If you enter incorrect data in the field, the program will display an error message. As a result, the report filled out with an error will not be accepted by the Pension Fund. Read on to find out what data to enter in the field.

Main category of IP payer

Current as of: October 3, 2021

What is the main category of IP payer? The question is not at all idle, especially for those who have ever used or are using the Pension Fund of Russia program “Spu_orb”. It is intended for the preparation of reporting documents that contribution payers are required to submit to the Pension Fund. You can download it from the Pension Fund website.

When using “Spu_orb” it is necessary to indicate the basic details of the policyholder, as in many other accounting programs. In one of the program windows, a cell appears with the name “Main category of IP payer” with a drop-down list of codes. These are the category codes of the insured person. And in this cell you need to indicate the code to which most of your individuals belong. That is, those to whom your organization makes payments and rewards.

How to identify codes

State employees, when filling out reports to the Pension Fund of the Russian Federation, for the most part must enter the code “NR”. It refers to employees with whom the company has entered into employment contracts. In favor of these employees, the policyholder makes payments for which insurance premiums are calculated.

The code “main category of IP payer” is suitable for LLCs and individual entrepreneurs, non-profit enterprises and organizations and for public sector organizations. Key conditions: an employment contract has been concluded with the employee and insurance coverage is paid from the remuneration due to him.

However, this is not the only code. A popular meaning that is found in the normal activities of Russian organizations, for example, VZhED is a payer category, which means persons insured in the compulsory pension insurance system as foreign persons and stateless persons who are temporarily registered in the territory of the Russian Federation.

How to fill out the details

For organizations and individual entrepreneurs who pay insurance premiums, it is almost always necessary to indicate “NR” in the “Main category of payer” field. This coding is provided for employees performing work under an employment contract and receiving wages from the organization.

A complete list of codes for categories of insured persons, currently in force and previously in force, is listed in Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p, which approved reports on individual information of insured persons. They are also used when filling out calculations for insurance premiums. The most common codes are given in the table:

| Code | Name | Notes |

| HP | Employee of the policyholder | Indicated for all categories of employees from whose payments the organization pays social contributions to compulsory pension insurance |

| SDPZG | Voluntarily joined OPS persons working abroad | Persons who voluntarily pay contributions for themselves |

| FL | Individuals | Indicated if the payer of insurance premiums does not make payments to other individuals (clause 2, clause 1, article 419 of the Tax Code of the Russian Federation) |

| PNED | Organizations and individual entrepreneurs on the simplified tax system for certain types of activities | Company employees applying reduced social security rates in accordance with paragraphs. 5 p. 1 art. 427 Tax Code of the Russian Federation |

| VZHNR | Temporary resident | Indicated by policyholders who engage employees temporarily residing in the territory of the Russian Federation in accordance with 115-FZ |

| VPNR | Temporarily staying | Indicated by policyholders who hire employees temporarily staying in the Russian Federation |

Legal documents

- Resolution of the Board of the Pension Fund of the Russian Federation dated January 11, 2017 No. 3p

- Art. 419 Tax Code of the Russian Federation

- Art. 427 Tax Code of the Russian Federation

- 115-FZ

What are the insurance premium payer rate codes for 2017?

To correctly indicate the codes of the payer of insurance premiums in 2017, use Appendix No. 5 to the order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/ You will also find a list of codes at the end of this article.

Tariff codes for calculating insurance premiums are divided into three groups:

| Group name | What codes are included? | Characteristics of the group |

| General rates | from 01 to 03 code | These codes are put by companies and individual entrepreneurs, including simplifiers and on UTII, using regular insurance premium rates. |

| Preferential rates | from 04 to 16 code | These codes are set by companies and individual entrepreneurs listed in Article 427 of the Tax Code of the Russian Federation, and as a result, are entitled to a preferential rate of insurance premiums. |

| Additional rates | from 21 to 29 code | Companies and individual entrepreneurs whose activities fall under Article 428 of the Tax Code of the Russian Federation have an obligation to pay contributions on additional tariffs. In particular, this applies to harmful and special working conditions. |

Attention!

If an organization pays premiums simultaneously for several tariffs, then it must fill out several Appendices 1 to Section 1 of the calculation of insurance premiums in 2021 (for each tariff code per application).

Payer rate codes for calculating insurance premiums: general group

Tariff codes from the general group are used by organizations and businessmen who pay contributions based on 30% of the income of their employees.

Tariff codes from the general group are used by most companies and individual entrepreneurs to calculate insurance premiums in 2021. These are the most popular codes:

Payer tariff code for calculating insurance premiums: for beneficiaries

Let us remind you that the conditions for companies and individual entrepreneurs to receive preferential rates for paying insurance premiums are clearly stated in Article 427 of the Tax Code of the Russian Federation. Accordingly, when filling out the calculation of KND 1151111, tariff codes from the category of preferential or reduced rates are used by fee payers who:

Let's look at a few of the most popular tariff codes from the preferential group.

Code 08

The most common payer tariff code in this category is 08. It came in 2021 to replace code 07, which was used by simplifiers when filling out RSV-1 in the Pension Fund of the Russian Federation.

Code 08 is assigned to companies engaged in preferential activities under the simplified tax system, with an annual income of no more than 79 million rubles and their share of preferential business is at least 70%. These types of simplifiers pay contributions only to the Pension Fund at a rate of 20%.

Tariff code 12

Beneficiaries also include individual entrepreneurs with a patent; they pay contributions in the amount of 20% and put tariff code 12 in the calculation of insurance premiums for 2017 (only if the businessman’s activities do not fall under clauses 19, 45–48, clause 2, article 346.43 of the Tax Code of the Russian Federation ).

Code 09

Pharmacies on UTII, or other companies on the same taxation system if they are engaged in pharmacology, are considered beneficiaries. Tariff code – 09.

Tariff code 05

Code 05 – set by companies from special economic zones.

See the table at the end of the article for all tariff codes with explanations from the preferential group.

Payer codes for additional tariffs

Additional tariffs are used by companies and individual entrepreneurs that have particularly difficult working conditions or are located in areas with a harsh climate. The conditions for using additional tariffs are indicated in Art. 428 and Art. 429 of the Tax Code of the Russian Federation. Use the codes like this:

Table of all payer tariff codes for calculating insurance premiums in 2021

We have listed all the codes that can be used when filling out the contribution report in the table.

| Decoding |

| Payers of insurance premiums who are on the general taxation system and apply the basic tariff of insurance premiums |

| Payers of insurance premiums who are on a simplified taxation system and apply the basic tariff of insurance premiums |

| Payers of insurance premiums paying a single tax on imputed income for certain types of activities and applying the basic tariff of insurance premiums |

| Payers of insurance premiums are business entities and business partnerships whose activities consist of the practical application (implementation) of the results of intellectual activity (programs for electronic computers, databases, inventions, utility models, industrial designs, selection achievements, topologies of integrated circuits, production secrets ( know-how), the exclusive rights to which belong to the founders (participants) (including jointly with other persons) of such business entities, participants of such business partnerships - budgetary scientific institutions and autonomous scientific institutions or educational organizations of higher education that are budgetary institutions, autonomous institutions |

| Payers of insurance premiums who have entered into agreements with the management bodies of special economic zones on the implementation of technology-innovation activities and make payments to individuals working in a technology-innovation special economic zone or industrial-production special economic zone, as well as payers of insurance premiums who have entered into agreements on the implementation tourism and recreational activities and making payments to individuals working in tourist and recreational special economic zones, united by a decision of the Government of the Russian Federation into a cluster |

| Payers of insurance premiums operating in the field of information technology (with the exception of organizations that have entered into agreements with the management bodies of special economic zones on the implementation of technology-innovation activities and making payments to individuals working in a technology-innovation special economic zone or industrial production zone) |

| Payers of insurance premiums who make payments and other remuneration to crew members of ships registered in the Russian International Register of Ships for the performance of labor duties of a ship crew member |

| Payers of insurance premiums applying the simplified taxation system, and the main type of economic activity, which is specified in subparagraph 5 of paragraph 1 of Article 427 of the Code |

| Payers of insurance premiums who pay a single tax on imputed income for certain types of activities and have a license for pharmaceutical activities - in relation to payments and rewards made to individuals who, in accordance with the Federal Law of November 21, 2011 No. 323-FZ “On the Fundamentals of Protection health of citizens in the Russian Federation have the right to engage in pharmaceutical activities or are allowed to carry them out |

| Payers of insurance premiums are non-profit organizations (with the exception of state (municipal) institutions), registered in the manner established by the legislation of the Russian Federation, applying a simplified taxation system and carrying out activities in the field of social services for the population, scientific research and development, education, healthcare in accordance with the constituent documents , culture and art (activities of theatres, libraries, museums and archives) and mass sports (with the exception of professional) |

| Payers of insurance premiums are charitable organizations registered in accordance with the procedure established by the legislation of the Russian Federation and applying a simplified tax system |

| Payers of insurance premiums are individual entrepreneurs applying the patent taxation system in relation to payments and remunerations accrued in favor of individuals engaged in the type of economic activity specified in the patent, with the exception of individual entrepreneurs carrying out the types of business activities specified in subparagraphs 19, 45- 47 paragraph 2 of Article 346.43 of the Tax Code of the Russian Federation |

| Payers of insurance premiums who have received the status of participants in a project for the implementation of research, development and commercialization of their results in accordance with the Federal Law of September 28, 2010 No. 244-FZ “On Innovation” (Collected Legislation of the Russian Federation, 2010, No. 40, Art. 4970; 2021 , No. 27, Art. 4183) |

| Payers of insurance premiums who have received the status of a participant in a free economic zone in accordance with the Federal Law of November 29, 2014 No. 377-FZ “On the development of the Crimean Federal District and the free economic zone in the territories of the Republic of Crimea and the federal city of Sevastopol” (Collection of Legislation of the Russian Federation, 2014, No. 48, Art. 6658; 2021, No. 27, Art. 4183) |

| Payers of insurance premiums who have received the status of a resident of a territory of rapid socio-economic development in accordance with Federal Law dated December 29, 2014 No. 473-FZ “On territories of rapid socio-economic development in the Russian Federation” (Collected Legislation of the Russian Federation, 2015, No. 1, Art.26; 2021, No. 27, Art.4185) |

| Payers of insurance premiums who have received the status of resident of the free port of Vladivostok in accordance with the Federal Law of July 13, 2015 No. 212-FZ “On the Free Port of Vladivostok” (Collected Legislation of the Russian Federation, 2015, No. 29, Art. 4338; 2021, No. 27, Art. 4306) |

| Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 1 of Article 428 of the Code |

| Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 2 of Article 428 of the Code |

| Payers of insurance premiums paying insurance premiums at additional tariffs established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - dangerous, subclass of working conditions - 4 |

| Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.4 |

| Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.3 |

| Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.2 |

| Payers of insurance premiums paying insurance premiums at additional rates established by paragraph 3 of Article 428 of the Code when establishing the class of working conditions - harmful, subclass of working conditions - 3.1 |

| Payers of insurance premiums paying insurance premiums for additional social security specified in paragraph 1 of Article 429 of the Code |

| Payers of insurance premiums paying insurance premiums for additional social security specified in paragraph 2 of Article 429 of the Code |

Payer category in the Pension Fund of Russia – classifier 2021

In addition to the IP code, when preparing a single calculation, the accountant must indicate the taxpayer's tariff code. The values of this indicator are given in Appendix 5 of the Procedure for filling out the report. The relevant data should be entered in gr. 1 adj. 1 section 1, as well as in gr. Section 270 3.2.2 section 3. When analyzing the coding, it is clear that the classification is performed depending on the basis for using contribution rates:

- 01 – intended for payers on OSNO and applying the basic rate.

- 02 – valid for payers on the simplified tax system using the basic rate.

- 03 – relevant for UTII payers who apply the basic rate.

- 04-16 – used by payers entitled to preferential (reduced) contribution rates. In this case, partial or complete exemption from the obligation to calculate and pay contributions to the budget is possible.

- 21-29 – intended for payers charging contributions according to additional tariffs. Such rates are mainly used by organizations that have workplaces with hazardous conditions. The hazard/harmfulness class is confirmed by the results of the SOUT (Workstation).

If you find an error, please select a piece of text and press Ctrl+Enter.