The educational teacher answers.

“Pure” GPC are persons with whom only civil law contracts (GPC) have been concluded for the performance of work or the provision of services.

Let's analyze how such employees get into the “Calculation of insurance premiums” in section 3.

The designation of an insured person in the compulsory social insurance system (OSI) for such employees is automatically marked with the number 2.

In lines 160 and 170, sign 1 is set. In line 180, for employees with whom only GPCs are concluded, sign 2 is indicated.

In this regard, such employees do not fall into the second column of line 010 of Appendix No. 2.

However, they are indicated in lines 010, 020, 030 of Appendix No. 1, subsection 1.1.

Let us note that according to the control ratios (letter of the Federal Tax Service of Russia dated December 29, 2017 No. GD-4-11 / [email protected] ), the indicators in the second column of line 010 of Appendix No. 2 should be equal to the number of persons for whom line 180 of Section 3 indicates sign 1.

Persons insured in the field of OSS are listed in 255-FZ. In particular, these include:

- persons working under an employment contract, including managers who are the only founders;

- civil and municipal employees.

According to paragraph 1 of Art. 420 of the Tax Code of the Russian Federation, the object of taxation of insurance premiums is payments and other remuneration in favor of individuals insured under a specific type of insurance. GPC employees are not insured in the field of compulsory health insurance in case of disability and in connection with maternity. Accordingly, the following are not subject to taxation of OSS contributions:

- GPC remuneration;

- reimbursement of expenses incurred by individuals.

These amounts are not reflected at all in Appendix No. 2 (neither on line 020, nor on line 030). This was noted by specialists from the Federal Tax Service of Russia in a letter dated December 28, 2018 No. BS-4-11/ [email protected]

To work effectively in the 1C: Salaries and Personnel Management 8 program, edition 3.1, we recommend taking 1C courses in the “Salaries and Personnel” direction.

The training course conducts classes for both beginners and experienced 1C users.

Calculation of insurance premiums (RAV) is a quarterly reporting form that policyholders submit to the Federal Tax Service. From this article you will find out who submits the DAM and when you need to submit the calculation, and you will also find a form, sample and instructions for filling out.

RSV - what is this form? Who should submit the report and when?

RSV is a quarterly report on insurance contributions of all types: pension, social and medical insurance.

The report is submitted by all organizations and entrepreneurs who are policyholders, even if they do not regularly pay contributions for their employees. The type of contract is not important: employees under a contract are accountable for in the same way as employees under an employment contract.

Organizations, separate divisions and branches report to the tax office at the place of business or accounting.

Please note that from January 1, 2021, amendments to the Tax Code introduced by Federal Law No. 325-FZ of September 29, 2019 are in effect. According to the new edition of paragraph 7 of Article 431 of the Tax Code, separate divisions submit calculations at the location of the separate divisions of the organization for which the organization has opened bank accounts and which accrue and make payments and other remuneration in favor of individuals.

Individual entrepreneurs and self-employed citizens submit calculations to the tax office at their registration address.

It is also important to know that from January 1, 2021, insurers with more than 10 people are required to submit calculations electronically (amendments to Article 431 of the Tax Code of the Russian Federation were introduced by Federal Law No. 325-FZ of September 29, 2019).

Even if you did not make contributions for employees during the reporting period, still submit the calculation to the tax office. This is necessary so that you are not considered late and are not charged a fine. To do this, fill out the required sections of the calculation and submit the tax zero form.

The deadline for submission is established by the Tax Code of the Russian Federation - the 30th day of the month following the reporting period. In 2021, the DAM must be submitted within the following deadlines:

| Reporting period | Deadline for submission (2020) |

| 2019 | January 30 |

| I quarter 2020 | April 30 |

| 6 months 2020 | July 30 |

| 9 months 2020 | October 30 |

On the DAM, general transfer rules apply. Therefore, if the last day of delivery falls on a weekend or holiday, the deadline is extended to the next working day. There will be no such shifts in 2021.

Prepare and send a calculation of insurance premiums via Kontur.Extern.

If the policyholder submits the report later than the due date, he will be fined. The fine is equal to 5% of the contributions reflected in the report. It is charged for each full and partial month of delay. At the same time, you will not be able to pay a fine of less than 1,000 rubles, but you will not be punished for more than 30% of the contributions.

Another trouble that awaits latecomers is the blocking of their current account. The tax office has the right to block it for being late by more than 10 working days.

Don't miss: reminder on how to fill out insurance premium calculations

For a separate division of a Russian organization vested with the authority to accrue payments and remuneration in favor of individuals, the checkpoint is indicated in accordance with the notice of registration of the Russian organization with the tax authority. — The field “At location (accounting) (code)” is filled in in accordance with the codes given in Appendix No. 4 to the Procedure, in particular: “120” - at the place of residence of the individual entrepreneur, “214” - at the location of the Russian organization, “222” - at the place of registration of the Russian organization at the location of the separate division. — When filling out the “Submitted to the tax authority (code)” field, the code of the tax authority to which the calculation is submitted is reflected.

We recommend reading: Usually legal norms in the laws of Hammurabi

— The field “Code of the type of economic activity according to the OKVED2 classifier” is filled in according to the All-Russian classifier of types of economic activity OKVED2 OK 029-2014

Calculation of insurance premiums: form in 2020

Beginning with reporting for the first quarter of 2021, policyholders must use a new form for calculating insurance premiums. Its form, procedure for filling out and electronic format were approved by order of the Federal Tax Service dated September 18, 2019 No. ММВ-7-11/ [email protected]

What has changed in the new form?

- Added "Payer Type" code. It has the value “1” if over the last three months of the reporting (settlement) period there were payments and other remuneration in favor of individuals, and the value “2” if there were no such payments. If code “2” is specified in the “Payer Type” field, then the calculation (zero) includes:

- Title page.

- Section 1 without applications with zero values in lines 031-033, 051-053, 071-073, 091-093.

- Section 3 (subsection 3.1).

- The directory of payer tariff codes has been changed. Now all payers applying the basic tariff, regardless of the tax regime, will indicate code “01”.

- Indicators for the last three months are not summarized.

- Personal data needs to be adjusted in a new way.

- A new code has been introduced for organizations that, during the year, deprived a branch or other separate division of the authority to charge payments to individuals, or closed it completely.

Each tax return and contribution report has its own code - KND. RSV form for KND - 1151111.

The calculation form consists of 24 sheets. It includes a title page, three sections and appendices. All policyholders must fill out:

- Title page.

- The first section contains summary data on contributions.

- The third section indicating individual information (subsection 3.1).

Sample of filling out the calculation of insurance premiums (includes only mandatory sections) - download.

Fill out all other calculation sheets only if you have completed the appropriate actions or belong to the category that must fill it out. So, for payers who made payments in the last three months of the reporting period, you should fill out:

- Appendix 1 to section 1, subsections 1.1 and 1.2 with the calculation of the amounts of all contributions.

- Appendix 2 to section 1 with calculation of contributions in case of temporary disability and in connection with maternity.

- Section 3.

To fill out the calculation of contributions, just use the filling procedure.

| RSV section | Who should fill out |

| Section 1, appendix 1, subsection. 1.3 | Those who paid contributions at additional rates |

| Appendix 1.1 | Those who paid salaries to pilots or workers in the coal industry |

| Section 1, Appendix 3 | Those who provided benefits to employees |

| Section 1, Appendix 4 | Those who paid benefits to victims of the Chernobyl nuclear power plant at the expense of the federal budget |

| Section 1, Appendix 5 | IT companies with reduced tariffs |

| Section 1, Appendix 6 | NPO on the simplified tax system |

| Section 1, Appendix 7 | Those who do animation |

| Section 1, Appendix 8 | Those who paid income to foreigners temporarily staying in the country |

| Section 1, Appendix 9 | Those who paid income to student groups and individual students |

| Section 2, Appendix 1 | Heads of peasant farms |

How to fill out the insured person’s sign in the system at a reduced rate

In January, February and March 2021, he received 30,000 rubles monthly.

The accountant included the entire amount in the base for calculating insurance premiums. The accountant filled out subsection 3.2 as follows: If you apply different tariffs for insurance contributions, fill in the required number of lines. In subsection 3.2.2, reflect the payments from which pension contributions were calculated at additional tariffs.

The decoding of the columns of this section is as follows: Column Filling 260 Serial number of the month in the calendar year (“01”, “02”, “03”, “04”, “05”, etc.) for the first, second and third month of the last three months of the billing year (reporting) period, respectively. 270 Tariff code. 280 Amount of payments from which contributions were calculated at additional tariffs. 290 Amount of insurance They proceed from the fact that the organization receives the status of an employer upon registration, therefore they are required to provide a report even if they do not conduct activities and have no employees.

Procedure for filling out the RSV

Title page

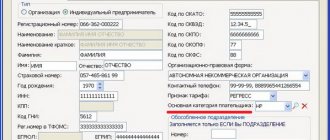

First of all, on the title page, fill in the name and TIN/KPP of the organization or individual entrepreneur. If you are filling out the RSV on behalf of a separate division that independently pays salaries to its staff, then indicate the checkpoint of the specific division.

Please indicate the correction number. These are three digits in the format 001, 002, etc. For the initial calculation, enter 000.

To indicate the period for which the DAM is submitted, in the line “Reporting period code”. For example, code 33 means that the period is 9 months.

Submit the RSV to the Federal Tax Service where you are registered. In the “Federal Tax Code” line, indicate the number of your inspection.

In the line “At location”, enter the three-digit code corresponding to the place where the calculation is submitted to the Federal Tax Service. You can view the codes in Appendix No. 4 of the Order of the Federal Tax Service of Russia dated September 18, 2019 No. ММВ-7-11/ [email protected]

If an organization submits an updated payment for a closed enterprise or one deprived of the authority to accrue payments, then in the “Form of reorganization (liquidation) (code)/Deprivation of authority (closing) of a separate division (code)” field, enter code “9”, and in the “TIN/ KPP of a reorganized organization / TIN/KPP of a deprived of authority (closed) separate division”, indicate the TIN/KPP of this unit.

Enter the OKVED code, full name of the signatory and the date of signing the calculation. Leave the column “To be completed by a tax authority employee” empty.

Section 1

In the first section, indicate “Payer Type”:

“1” - if in the last three months of the billing (reporting) period payments and other remuneration were actually made in favor of individuals;

“2” - if in the last three months of the billing (reporting) period no payments and other remunerations were actually made in favor of individuals (in relation to all employees);

write down the code OKTMO and KBK. Fill in all other lines with data from appendices 1 and 2. Therefore, start filling out section 1 from appendix 1.

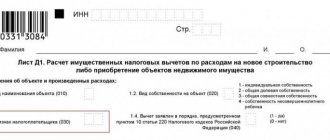

Appendix 1. In it, reflect information about contributions to compulsory health insurance and compulsory medical insurance. The application itself consists of three subsections. Let's look at how to fill out the mandatory subsections 1.1 and 1.2.

Subsection 1.1. To be completed in relation to contributions to compulsory pension insurance.

In line 001, indicate the code of the applicable tariff in accordance with Appendix 5 to the filling procedure. If more than one tariff is applied in the reporting period, then you must fill out Appendix 1 for each tariff.

In line 010 the number of insured persons is entered, in line 020 - the number of employees with insurance contributions.

If you have employees whose income exceeds the maximum base, then enter their number in line 021.

In line 030, enter the amount of staff income. And enter non-taxable income (for example, sick leave) in line 040. In line 045 you can indicate the amount of actually incurred and documented expenses associated with the extraction of income received under an author's order agreement, an agreement on the alienation of the exclusive right to the results of intellectual activity. Line 050 is the difference between lines 030, 040 and 045.

If you exceed the maximum base for calculating insurance premiums, write down the excess amount on line 051.

Line 060 for each column is equal to the amount of contributions accrued at the corresponding rate for all employees.

Lines 061 and 062 are intended to break down the calculated contributions from income without exceeding the base and from income exceeding it.

Lines 030 to 062 are filled in in the following sections:

- total since the beginning of the billing period;

- for each of the three months.

Subsection 1.2. It will reflect information on compulsory medical insurance contributions. Contains the same lines as subsection 1.1. Fill in the same way. Only line 060 is equal to line 050 multiplied by the compulsory medical insurance contribution rate. Remember, the compulsory medical insurance subsection is required to be filled out, even if you apply a compulsory medical insurance rate of 0%.

Appendix 2. It describes the calculation of social insurance contributions. On this sheet there is line 001 “Payer tariff code”, where you must indicate the code of the applied tariff in the same way as filling out Appendix 1. Fill out as many pages with lines 001 - 060 as the number of tariffs applied in the reporting period. In line 002 “Payment characteristic”, indicate the characteristic. If Social Insurance directly pays benefits to your employees, enter 1. If you make these payments yourself and then offset them, then enter 2.

In line 010 the number of insured persons is entered, in line 015 - the number of employees with insurance contributions.

In line 020, indicate the amounts of payments, in line 030 - amounts that are not subject to contributions, and in line 040 - amounts exceeding the maximum base for calculating contributions.

Line 050 = page 020 - page 030 - page 040.

If a general tariff is applied and income was paid to foreigners temporarily staying in the Russian Federation, then their payments should be indicated in line 055, in order to be separated from the general base and charged contributions at a rate of 1.8%. By multiplying the base (line 050 - line 055) by 2.9% and adding line 055 * 1.8% you will get the value for line 060.

If you put the number 2 in line 002, then fill out lines 070, 080 and 090 (to be filled in for the payer as a whole, i.e. one page for all applicable tariffs). In the first, indicate the amounts of benefits issued to you, and in line 080 - the amounts reimbursed to you by Social Insurance. In line 090, record the difference between the amount of Social Security contributions and the benefits paid. Line 090 cannot contain a value with a minus. To indicate a sign, use the codes:

- 1 - for positive values, that is, this is the amount that needs to be paid additionally to Social Security;

- 2 - for expenses exceeding the amount of contributions.

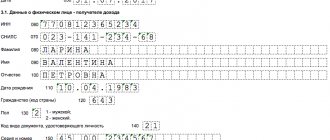

Section 3

To be completed for each employee.

Line 010 indicates the information cancellation indicator “1”, in case of cancellation of previously submitted information on the insured person. In this case, in subsection 3.2 in lines 130–170, 190–210, dashes are indicated. When submitting the calculation for the first time, the field is not filled in.

Write down all the employee’s details: INN, SNILS, full name, date of birth and gender. Also indicate the code of the country of citizenship (for Russians - 643) and the code of the type of identity document (in practice, this is a passport of a citizen of the Russian Federation, that is, code 21).

In subsection 3.2.1, in column 120, write down the month number, that is, the first month of the last three is 1, the second is 2, the third is 3.

To fill out column 130, please refer to Appendix 7 of the Procedure for filling out the DAM; it contains codes for the categories of insured workers.

The amounts of income and accrued insurance premiums are filled in in columns 140–170. If additional tariffs were applied, then fill out subsection 3.2.2, columns 180–210. In this case, in column 190, indicate the code of the insured person in accordance with Appendix 8 of the Filling Out Procedure.

gstockstudio/.com

The base for calculating insurance premiums for OSS in case of temporary disability and in connection with maternity (VNiM) does not include any remuneration (clause 3 of Article 422 of the Tax Code) paid to individuals under civil contracts. This type of insurance does not apply to persons receiving remunerations under the GPA, the subject of which is the performance of work, provision of services (Article 2 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and connection with motherhood"). Such persons are not insured against VNiM (letter of the Federal Tax Service of Russia dated July 31, 2021 No. BS-4-11/14783).

In this regard, for such individuals the indicators term 010-070 of Appendix No. 2 to Section 1 of the calculation of insurance premiums are not filled out.

At the same time, section 3 “Personalized information about insured persons” of the calculation is filled out for all insured persons for the last three months of the settlement (reporting) period, including in favor of whom payments and other remunerations were accrued in the reporting period within the framework of labor relations and GPA.

More information about insurance premiums from an advance payment under a civil contract with an individual can be found in the “Encyclopedia of Solutions” of the online version of the GARANT system. Get full access for 3 days for free!

Line 180 of subsection 3.1 of section 3 of the calculation indicates the sign of the insured person in the compulsory social insurance system. This indicator is required to be filled out. For persons in respect of whom payments were made under the GPA, the indicator “2” should be indicated - they are not insured persons (in the OSS system).

Sign of an insured person in the pension and social insurance system

In this case, do not put the “No” sign, separate the series and document number with a space; – in lines 160, 170 and 180 – the sign of the insured person in the system of compulsory pension, medical and social insurance: “1” – is an insured person, “2” – is not an insured person. 2. Federal Law of December 29, 2006 No. 255-FZ On compulsory social insurance in case of temporary disability and in connection with maternity Article 2.

Persons subject to compulsory social insurance in case of temporary disability and in connection with maternity209 1. Citizens of the Russian Federation, foreign citizens and stateless persons permanently or temporarily residing in the territory of the Russian Federation are subject to compulsory social insurance in case of temporary disability and in connection with maternity, and also foreign citizens and stateless persons temporarily staying

What is the difference between an offset scheme and a direct payment system?

In the first case, the employer serves as an intermediary between the state and the citizen, who receives temporary disability benefits while officially employed by him. This happens as follows - social benefits are initially paid by the employer, who can then reimburse their expenses by contacting the Social Insurance Fund. Among the advantages of such a system is its familiarity to the population and the absence of the need to control the issuance of benefits separately, but there are also disadvantages:

- benefits depend on the employer (if he does not have money for payments, the incapacitated employee will be left with nothing and will be forced to go to court);

- the offset scheme creates problems for employers, which makes them even more diligent in hiding income and the number of employees;

- the presence of an intermediary extends the payment process.

As an alternative, there is a direct payment system, according to which the employer does not participate in the distribution of benefits. Money for socially vulnerable categories of the population comes directly from the state, which is beneficial for all parties:

- the employer will not be able to appropriate the benefits to himself;

- those who are unable to work will receive their money faster, regardless of the profitability of their place of work;

- the employer will be less biased towards employees on benefits (for example, pregnant women on maternity leave).

In all respects, the direct issuance system is more beneficial for everyone - therefore, the FSS plans to transfer all subjects of the Russian Federation to it.

Sign of payments in the calculation of insurance premiums

The attribute of payments in the context of insurance premiums is noted in column 001 of the DAM form document. The characteristic in question has only two designations: 1 and 2. Other marks are unacceptable

Field 001 is entered as 1 if the employer makes direct payments of disability benefits.

Other employers - enter the value 2 in the specified field

If the company has more than 25 employees, the form must be submitted electronically.

PRACTICAL ENCYCLOPEDIA OF AN ACCOUNTANT

Complete information about accounting rules and taxes for an accountant. Only a specific algorithm of actions, practical examples and expert advice. Nothing extra. Always up-to-date information.

Connect berator

Some users who have a preferential tariff for SMEs and have exceeded the maximum base for contributions began to complain that the tax office was sending them a negative report on the DAM with the following description of the error:

Error 0400400013; The amount of accrued CBs (cumulatively from the beginning of the billing period) for the insured person exceeds the maximum allowable 284240 Error 0400400013; SNILS x-x-x x line 170 / tariff * 22% = 284240.01

Indeed, in certain cases, calculation using the formula given in the description of the error can lead to a result on contributions up to the excess, a penny more than it should be:

And taking into account rounding, contributions will be in the amount of 284,240.01 rubles.

In order to quickly solve the problem and still pass the DAM, you can transfer the penny that arises to contributions in excess of the maximum base.

To do this, you should find in which of the months of the second or third quarter at a preferential rate the amount of contributions from a base not exceeding the maximum value is rounded up when using the check using the formula described above and leads to the appearance of an extra penny. Next, create a document Recalculation of insurance premiums (Taxes and contributions – Recalculation of insurance premiums) and fill it out. A penny from the base before it is exceeded should automatically be transferred to the base above the limit.

Let's consider the situation using the example of filling out a report for the first half of 2021.

According to the basic tariff for the six months, the employee’s contributions are calculated in the amount of RUB 172,995.84.

At a reduced rate - 50,565.53 rubles.

At the same time, the following contributions were calculated at a reduced rate for the last three months:

For April and May, 14,287 rubles each. (from base to RUB 142,870)

For June – 21,991.53 rubles. (from the base to exceeding RUB 219,915.27).

If you calculate the amounts for the second quarter using the formula given in the error description, you will get:

Taking into account rounding = RUB 284,240.01.

If you check for the last three months at a reduced rate, it turns out that for June the amount of contributions according to the formula should be rounded up by 1 kopeck:

- 21,991.53 (contributions for June at a reduced rate) / 10% (preferential rate) * 22% = 48,381.366 rubles. or 48,381.37 rubles.

Therefore, we will make adjustments per penny in June for June. To do this, enter the document Recalculation of insurance premiums and fill it out. A penny in contributions from the base up to the limit will be transferred to contributions above the limit

After this, automatically in Section 3 at a reduced rate for June, the amount of contributions from a base not exceeding the limit (line 170) will decrease by 1 kopeck

Corresponding changes will also occur in Subsection 1.1 for a preferential tariff (tariff code 20), where contributions for June from the base before the excess will decrease by 1 kopeck (line 061), and from the base above the limit will increase by the same kopeck (line 062)

The described changes in the DAM using the example of the first half of the year can be made manually, without using the document Recalculation of insurance premiums, but in the next quarter in the Calculation of salaries and contributions on the Contributions tab, the program automatically entered a line with the transfer of kopecks.

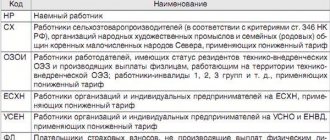

Insured person category codes for 2021: table with explanation

What category codes for insured persons should be used in 2021 when filling out a single calculation of insurance premiums?

How to find out these codes? Have these codes changed after the cancellation of the RSV-1 calculation? What code is used to designate employees under labor and civil law contracts?

You will find answers to these and other questions, as well as a table with decoding codes for 2021 in this table.

In 2021, tax inspectorates continue to monitor insurance premiums (Chapter 34 of the Tax Code of the Russian Federation). Therefore, calculations of insurance contributions for compulsory pension (social, medical) insurance must be sent to the Federal Tax Service. The new form for calculating insurance premiums consists of the following: title page; sheet “Information about an individual who is not an individual entrepreneur”;

The calculation of insurance premiums is completed for all insured persons, including those dismissed in the previous reporting period

Announcements June 20, 2021 The program was developed jointly with Sberbank-AST CJSC.

Moreover, you need to report using a new form for calculating insurance premiums, which was approved by order of the Federal Tax Service of Russia dated October 10, 2016 No. ММВ-7-11/551.

Students who successfully complete the program are issued certificates of the established form.

July 4, 2021 You will learn about current changes in the Constitutional Court by becoming a participant in the program developed jointly with Sberbank-AST CJSC. Students who successfully complete the program are issued certificates of the established form. November 27, 2021 Tax officials spoke about the features of compiling calculations for insurance premiums for reporting periods () ().

In particular, they recalled the mandatory inclusion in the calculation of data on employees who resigned in the previous reporting period and did not receive payments in the reporting period.

Let us remind you that the calculation form, the procedure for filling out the calculation and the format for submitting the calculation in electronic form have been approved.