Is it necessary to apply?

In 2021, the use of an online cash register for payments is mandatory for most taxpayers. Simply installing a new type of cash register is not enough. Registration with the Federal Tax Service is required.

The user fills out a special card, which reflects all the mandatory information about the new unit and the features of its use. If during the course of business the specified information changes, the taxpayer must submit application 1110061 for re-registration of the cash register.

The form was approved by order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20/ [email protected] (as amended on September 7, 2018)

Who needs a cash register?

Don't waste your time and money! Check with ConsultantPlus whether you must use cash register equipment. After all, there are exceptions to the law.

How does re-registration of an online cash register differ from its re-registration?

Re-registration of a cash register is a procedure that consists of two stages:

- deregistration of cash registers;

- subsequent registration of the cash register.

But why does the need for re-registration arise? Is it really impossible to get by with a simple “one-step” re-registration?

It turns out not.

The fact is that the legislation clearly states a number of reasons under which an online cash register must be deregistered with the Federal Tax Service. These grounds can be classified into two categories:

- Grounds for deregistration of a cash register at the user’s initiative:

- transfer of an online cash register to another business entity;

- loss or theft of an online cash register;

- breakdown of the online cash register.

- Grounds for deregistration of an online cash register at the initiative of the Federal Tax Service:

- termination of business activity by an economic entity (which is accompanied by a corresponding entry in the Unified State Register of Legal Entities or Unified State Register of Individual Entrepreneurs);

- detection of non-compliance of cash register with legal requirements;

- expiration of the fiscal accumulator (the case we mentioned above).

The deregistration of a cash register is confirmed by a special card, similar to the card that confirms the registration of an online cash register. This is one of the documentary differences between re-registration and re-registration - in the first case, a new cash register registration card is issued (and it is on the basis of the information in it that it will be necessary to “monitor” the emergence of reasons for the next re-registration). A new card is also issued upon re-registration of a deregistered cash register - but within the framework of a different legal procedure.

If the online cash register is deregistered by the Federal Tax Service due to the expiration of the Federal Tax Service, then within 60 days after this the user must transfer fiscal data from this fiscal drive to the Federal Tax Service through the Personal Account. And if the drive is broken, carry out its examination in the manner provided for in clauses 8.1 and 16 of Art. 4.2 of Law No. 54-FZ.

By the way, the same must be done if the breakdown became the reason for replacing the FN (and, accordingly, the basis for re-registration of the cash register). But more on that later.

In the meantime, let us summarize the above theses about the reasons for re-registration of cash registers and the differences between this procedure and re-registration in a small table.

Table

When you need to re-register or re-register an online cash register:

| Cause (event) | Required procedure | Comments |

| The address, place of payment has changed (or other details of the registration card - taking into account the peculiarities of the change in the state of the fiscal drive) | Re-registration of an online cash register | A new cash register registration card is issued upon completion of re-registration |

| The fiscal drive has broken down and its service life has not expired. The fiscal drive has been replaced for other reasons not related to its service life. | A new registration card is issued. If the drive is broken, it needs to be examined | |

| The online cash register is broken (regardless of the state of the fiscal drive) | Removal of a cash register from registration at the user’s initiative | If necessary, the CCP is re-registered |

| Online cash register stolen (with or without storage) | ||

| The online cash register has been transferred (with or without storage) to another company | ||

| The service life of the FN has expired (whether it is broken or not does not matter) | Removal of cash registers from registration at the initiative of the Federal Tax Service | You need to transfer fiscal data from the drive to the Federal Tax Service through your Personal Account. If the FN is broken, then you need to have it examined |

| The business entity has ceased operations | If necessary, re-register the online cash register |

So, we learned about when re-registration of a cash register is necessary. Now let's get acquainted with the procedure for carrying it out.

When to apply

You will have to notify the inspectorate in certain cases. Moreover, for each reason, the Federal Tax Service has approved specific codes that are reflected in the application. The reasons for re-registering the cash register with the Federal Tax Service are as follows:

| Code to be reflected in the application | Contents of the base |

| Code 1 | Change of address and (or) location of installation (use) of the cash register. Please note that if the address of the organization has changed, but the place of use of the online cash register remains the same, then it is not necessary to send an application for re-registration of the cash register when changing the address to the Federal Tax Service (clause 4 of Article 4.2 of Law No. 54-FZ). Since information about the location of a legal entity is not reflected in the registration card. But if, together with the cash register, for example, you changed the location of your trading activity, you will have to submit an application to the tax service. |

| Code 2 | Change of fiscal data operator |

| 3 | Changes in information about the use of cash registers as part of an automatic device for calculations. This code must also be used when re-registering a cash register due to changes in information about the automatic device for payments. |

| 4 | We make the appropriate mark if the basis for filing an application with the Federal Tax Service was a change in the fiscal drive |

| 5 | We reflect the transfer of the cash register to the mode of transferring fiscal data to the inspectorate through a specialized fiscal data operator |

| 6 | We record the transfer of the cash register to a mode that does not provide for the mandatory transfer of fiscal data to the Federal Tax Service through the OFD |

| 7 | Changing the name of the organization |

| 8 | Other reasons |

IMPORTANT!

A unified application for KKM re-registration must be submitted within the time limit established by clause 4 of Art. 4.2 of Law No. 54-FZ. This must be done no later than the next business day after changing the information specified in the cash register registration card.

Re-registration of cash registers when replacing the Federal Tax Code

The need to re-register an online cash register in this case is due to the fact that the new drive will have, at a minimum, a new serial number - which is included in the list of “changeable” information in the cash register registration card.

Sometimes in negotiations and correspondence of technical specialists you can hear the phrase “re-registration of the fiscal drive.” Such a procedure is not provided for by law, since, one way or another, the online cash register is re-registered. However, the only reason for this may be the replacement of the drive - and such an unofficial formulation is quite applicable.

At the same time, the reason for replacing the fiscal drive plays a vital role. It is noteworthy that Law No. 54-FZ does not directly indicate any of them (unlike the grounds for re-registration of an online cash register). But when studying its provisions, one can draw an indirect conclusion that it is legitimate to distinguish the following two types of reasons for replacing a drive:

- Reasons not related to the service life of the fiscal storage device (“validity period of the fiscal attribute key”) and the technical conditions of its operation.

Examples of such reasons are theft of the drive, damage, “glitch”.

- Reasons related to the service life and technical conditions of the drive .

So, the drive can be replaced:

- when the end of its service life approaches;

- when the expiration date of the fiscal data format supported by the drive approaches.

A separate reason for replacing a drive is, in fact, the end of its service life (expiration of the “fiscal attribute key”). In this case, the “replacement” of the drive should be understood not only as its physical replacement, but also as the mandatory deregistration of the cash register - instead of re-registering the online cash register. These are the requirements of paragraph 16 of Art. 4.2 of Law No. 54-FZ.

Let us take a closer look at what the legal consequences of the expiration of the storage device may be in the context, however, of another important issue - which is to determine the differences between the procedure under consideration - re-registration of an online cash register, from re-registration of a cash register with the Federal Tax Service.

How to fill out the application form

The algorithm for filling out an application directly depends on the method of submitting it:

| Electronic | On paper |

| Use the cash register account, which is located in the taxpayer’s personal account on the website of the Federal Tax Service of Russia. IMPORTANT! The digital application is signed with an enhanced qualified electronic signature. Otherwise, the document cannot be sent for consideration to the inspection. | Use the form given in Appendix No. 1 to the order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20/[email protected] The procedure for filling it out is regulated in Appendix No. 5 to the said order. IMPORTANT! Follow the generally accepted rules for filling out paper forms for the Federal Tax Service:

|

The algorithm for filling out an application for re-registration is similar to the rules for filling out the initial registration of an online cash register with the Federal Tax Service. But there are exceptions:

- The “Re-registration Reason Code” is filled in on the title page. All cells in this field must be filled out. Select the reason for re-registration and put “1” in the appropriate cell, which means “yes”. If there are several reasons, then it is necessary to note them all. In this case, you cannot simultaneously select reasons “5” and “6”. In the remaining cells, put “2”, which means “no” (clause 8 of the Procedure given in Appendix No. 5 to the order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20 / [email protected] ).

- Do not indicate OGRN/OGRNIP at the top of each page of the application if the organization is foreign.

- Do not fill in the fields that are intended to be filled in by a tax authority employee: information about the registration of the cash register with the tax authority, the number of pages of the application and documents attached to it, the date of submission of KND1110061 and its registration.

- Leave line 150 blank if the organization does not use a cash register to generate BSO in electronic form and print them on paper.

- Do not fill out section 3 if the company uses a cash register without electronically transmitting fiscal data to the Federal Tax Service. But in this case, you will have to fill out line 170 “TIN of the fiscal data operator”, putting zeros in it.

If you fill out an application manually, enter the information in the fields from left to right in capital block letters. If there are empty columns or fields, a dash is placed in them.

How to re-register an online cash register through your personal account on the Federal Tax Service website

As an example, let's consider how to re-register a cash register in connection with a change in the OFD without replacing the fiscal drive, when the user decided to switch to working with another fiscal data operator - Kontur.OFD.

When changing the OFD, you need to re-register the cash register with the Federal Tax Service, as well as change the online cash register settings to those that will be provided by the new fiscal data operator.

At the same time, it is allowed to re-register the online cash register, even in cases where there are untransferred fiscal documents at the cash register. They will be sent to the Federal Tax Service after the OFD is changed by the new fiscal data operator.

Step-by-step instruction:

- On the official website of the Tax Service nalog.ru, go to the “Taxpayer’s Personal Account” and select the subsection “Accounting for Cash Register Equipment”.

- In the list of registered online cash registers, select the one that needs to be re-registered and click on its registration number in the “RN KKT” column.

- In the “Details of information on cash register equipment” window that opens, click on the “Re-register” button, after which the “Application for re-registration of cash register equipment” will open.

- At step No. 1, check the box “Re-registration of cash registers due to a change in fiscal data operator.”

- At step No. 2, from the list of fiscal data operators, select Closed Joint Stock Company “Proizvodstvennaya.

- At step No. 3, you should sign the application with your enhanced qualified electronic signature and send it to the Federal Tax Service for consideration.

- An information message “Request added” will appear. In order to track the status of the application, without clicking on the “Ok” button, you need to follow the link “Information about documents sent to the tax authority” in the text of the message itself.

- After successful completion of the online cash register re-registration process, the “Status” column will display the status “KKT re-registered”. Here you can print out a cash register registration card with new data.

- At the next stage, you will have to adjust the cash register settings (by specifying the necessary data for the new fiscal data operator Kontur.OFD).

- At the online checkout itself, generate and print a Re-registration Report (or a Report on Changes in Registration Parameters). To do this, you may need to indicate the reason for the re-registration of the cash register - indicate “Re-registration of the cash register due to a change in the fiscal data operator.”

- At this point, the process of re-registration of the online cash register is completed and the transfer of fiscal data to the Tax Service of Russia will be carried out through Kontur.OFD.

Step-by-step instructions for re-registering an online cash register in connection with replacing the FN and OFD can be downloaded HERE (in PDF format).

The following procedure is a type of re-registration, in which the cash register is first deregistered and then registered again.

We will select cash registers for your business. We will deliver anywhere in the Russian Federation!

Leave a request and receive a consultation within 5 minutes.

Where to submit it

A paper application may be submitted to any territorial tax office. Prepare an electronic document in the taxpayer’s personal account on the official website of the Federal Tax Service, in the special section “KKM Account”.

A complete guide to cash register technology

ConsultantPlus has collected everything you need to know in one instruction. If you have any questions, you will definitely find the answers in this material.

Briefly

- Re-registration of cash registers is required in case of replacement of the fiscal data storage device or any change in the registration data specified in Art. 4.2 Federal Law-54. To start the re-registration procedure, an application from the owner of the technical equipment is required. It is issued on paper or using an enhanced electronic signature, on the Federal Tax Service website, in the cash register office.

- To re-register in connection with replacing a drive, you must additionally attach a closure report and a registration report (changes in registration parameters) generated by the machine.

- If it is not possible to transfer data due to a breakdown of the physical device, contact the manufacturer, who provides the appropriate technical conclusion.

- If the re-registration is successful, the Federal Tax Service provides the company with a cash register card with updated data.

- Re-registration associated with a change in the legal address of the company or the address for using the online cash register is necessary, except for the use of cash register systems in traveling trade. Here it is enough to set the parameters for the permanent location of the cash register outside of trading operations and the vehicle used in trading during initial registration.

What to do next

In case of re-registration of the cash register in connection with the replacement of the fiscal drive, the generated reports (fiscal data) must be submitted along with the application (clause 4, 14, article 4.2 of Law No. 54-FZ). They are submitted electronically.

After the re-registration procedure, the taxpayer must receive a new card via online cash register. The registration form is issued within ten working days from the date of submission of the unified form (Clause 7, Article 4.2 of Law No. 54-FZ). The procedure for issuing it is the same as for registering a cash register.

Legal documents

- by order of the Federal Tax Service of Russia dated May 29, 2017 No. ММВ-7-20/ [email protected]

- Law No. 54-FZ

Re-registration of information in the cash register card and data on FN

In order to change the information in the online cash register card or inform the Federal Tax Service about replacing the fiscal drive, the cash register user needs to:

- Send an application in the prescribed form to the Federal Tax Service. This must be done no later than the working day following the one on which the events that gave rise to re-registration occurred.

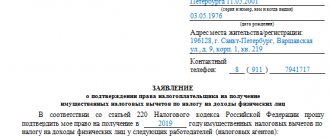

The application form for re-registration of cash register equipment (form according to KND 1110061) and the procedure for filling it out are approved by Order of the Federal Tax Service of the Russian Federation dated May 29, 2017 N ММВ-7-20 / [email protected] (Appendix No. 1 and No. 5, respectively).

The application can be sent to the Federal Tax Service in paper form or through the personal account of the KKT user. At the same time, if the reason for re-registration is the replacement of a fiscal drive, then the application must be supplemented with two fiscal reports:

- about changes in information on registering cash registers;

- about closing the drive.

- Wait until the Federal Tax Service issues a new card for registering an online cash register. The Tax Service is given 5 working days from the date of receipt of the application to solve this problem.

1. Ask our specialist a question at the end of the article. 2. Get detailed advice and a full description of the nuances! 3. Or find a ready-made answer in the comments of our readers.

The card is sent to the taxpayer:

- through your Personal Account;

- through the mediation of the OFD.

At the taxpayer's request, the Federal Tax Service can issue a paper version of the card.

The law provides for cases in which the Tax Service has the right to refuse re-registration, namely:

- when trying to register a fiscal drive that is not included in the registry;

- when providing the Federal Tax Service with insufficient information necessary for re-registration.

We will solve any problems with your equipment!

Leave a request and receive a consultation within 5 minutes.