Conditions for returning personal income tax when purchasing an apartment

In the case of purchasing an apartment, it is possible to return part of the invested funds through the use of property deductions (Article 220 of the Tax Code of the Russian Federation). They exist in two forms that can be used together:

- Direct costs of purchase or construction:

- their volume is limited to 2,000,000 rubles;

- the deduction can be attributed not to one, but to several objects;

- if the apartment is sold without finishing (and this is reflected in the contract), then it is permissible to include the costs of finishing work and materials in the amount of purchase costs.

- Mortgage interest. This deduction is also limited in amount (RUB 3,000,000). Additionally, it can only be applied to one object.

The procedure for obtaining a deduction when purchasing an apartment with a mortgage is described in detail at ConsultantPlus. You can view the experts’ explanations and see the line-by-line filling out of the declaration for the mortgagee by gaining access to the system for free.

Deductions can be used:

- in relation to income taxed at a rate of 13%;

- if there is a right to property, which will be confirmed by the corresponding certificate issued when purchasing the object, or an acceptance certificate for shared participation in construction;

- for expenses that have documentary evidence and were made by the taxpayer personally, not at the expense of budget funds (or maternity capital funds) and not when purchased from a related party;

- each of the owners for the full amount when purchasing in joint or shared ownership;

- when parents purchase housing registered for children under 18 years of age.

Read more about deductions for a mortgage in the material “Tax deduction when buying an apartment with a mortgage (nuances)” .

Where and how to submit an application for a property deduction for the purchase of an apartment?

The application is submitted to the Tax Inspectorate at the place of registration of the citizen . If the apartment is located in another area, or another city, or another region, the place of submission does not change. If there is no permanent registration, then at a temporary place.

First you will need to register with the tax authority. And then just submit an application for deduction. To search for a specific inspection address, you must enter your address on the Federal Tax Service website. You can apply:

- citizen personally;

- or a trusted representative.

In person and by mail

An application can be submitted in several ways:

- Personally or through an authorized person using a notarized power of attorney . You can contact the tax authority on any working day in accordance with the schedule for receiving citizens, or you can sign up for a specific time through an online registration on the website nalog.ru.

- By mail . You can send an application with all attached documents by registered mail with a list of attachments and declared value. One copy of the inventory indicating all the documents will be sent to the tax authority, and the other with a postal stamp will remain with the applicant. The value of the letter will provide the greatest control over the safety of the item. The date of submission of the application will be considered the day the letter is delivered to the post office.

- Submitting documents online . Through the taxpayer’s personal account, you can generate a declaration, sign it with an electronic signature, add a package of scanned documents, and send it for verification. Upon completion of the desk audit, create and submit an application for payment of the deduction. This method is convenient when all original documents for the apartment have already been provided to the tax office, i.e., upon repeated annual application.

What other documents should be attached?

The following documents will need to be attached to the application for a refund of overpaid tax:

- declaration in form 3-NDFL;

- certificate of income for the calendar year in form 2-NDFL;

- certificate of ownership of the apartment or an extract from the Unified State Register of Real Estate, in the absence of a certificate;

- purchase and sale agreement + transfer and acceptance certificate;

- act of acceptance and transfer of living space acquired under a shared construction agreement;

- application for distribution of deductions from the second spouse + marriage certificate (in case of joint property);

- child's birth certificate (if the owner is a child);

- power of attorney (if documents are submitted by an authorized person);

- loan agreement + document with loan repayment schedule + bank certificate about interest paid for the year (if interest paid on the mortgage is returned);

- documents confirming repair costs (if money spent on repairs is returned);

- a pension certificate or a certificate from the Pension Fund of the Russian Federation, if the applicant is a pensioner (we told you more about when a pensioner can claim a deduction when buying an apartment here).

If possible, copies should be made of documents, but even if the applicant has not done this, the tax employee is obliged to do this himself free of charge.

Property tax deduction is a measure of additional state support for a citizen . It’s not that difficult to use—the main thing is to prepare in advance. Make sure to complete the application correctly and submit it on time with all the necessary attachments, and calmly wait for the money to be transferred.

Ways to return tax

You can get your tax refund in the following ways:

- In the year the right to a deduction arises, submit to the Federal Tax Service at your place of permanent residence the entire package of documents relating to it, and receive from the tax office a notification of the right to a deduction for its application at the place of work. If this year the deduction amount is not used in full, then next year you must again contact the Federal Tax Service for notification of the remaining deduction. And so on every year until the full amount is selected.

The procedure for providing a deduction for the purchase of housing at work is described in detail at ConsultantPlus. Get trial access to the system and proceed to the material.

- After the end of the year in which the right to deduction arises, submit to the Federal Tax Service a 3-NDFL declaration for the past year, drawn up taking into account the amount of deduction possible for the year. The amount of the deduction cannot be greater than the amount of annual income. The declaration must be accompanied by 2-NDFL certificates confirming the amount of income and the amount of tax withheld from it, a set of documents giving the right to deduction, and an application for a personal income tax refund for the past year. If there is a need to return the balance of the deduction in the following years, the taxpayer can choose one of 2 ways: receiving an annual notification for the current year for the employer or annually submitting a declaration for the past year to the Federal Tax Service. When choosing the first route, an application for a personal income tax refund to the employer is submitted together with a notification of the right to deduction received from the INFS. If you do not use the deduction at work, you will be able to submit the declaration again to the Federal Tax Service at the end of the year.

A sample application to the INFS to receive a notification confirming the right to a property tax deduction can be found in the article “Application for a property tax deduction.”

Resubmission of the set of documents entitling the right to deduction will not be required with any of the applications relating to the balance of the deduction in subsequent years.

Return of personal income tax through the Federal Tax Service is possible only if a declaration is submitted for the tax period (clause 7 of Article 220 of the Tax Code of the Russian Federation), i.e. at the end of the year. The Federal Tax Service will check the submitted declaration within 3 months (clause 2 of Article 88 of the Tax Code of the Russian Federation) and after another 1 month (clause 6 of Article 78 of the Tax Code of the Russian Federation) will return the tax to the bank account that the taxpayer will indicate in the application.

For information on the declaration form used for the 2020 report, see our material.

Peculiarities

3-NDFL is a mandatory document for individuals (ordinary citizens) who wish to receive a deduction for real estate. There are two property deductions:

- From buying a home.

- From the sale of real estate.

A deduction from a purchase is the most profitable, because it allows you to return the funds and receive them in cash. And compensation from the sale is provided only in the case when the citizen does not want to pay tax on the sale of property.

You can receive a deduction when purchasing a home. In this case, a citizen can return 13% of the transaction, but not more than 260,000 Russian banknotes. In addition to this, it became possible to return money for interest rates on a mortgage loan - up to 390,000 rubles. Thus, a total return of 650,000 rubles is possible.

To receive this deduction in 2021, you need a certificate of income from work. If a citizen works simultaneously in several jobs, then a certificate is needed for each. In addition, you will need other papers. For example, declaration 3-NDFL.

Right to Refund

All working citizens have this right. After all, they are the ones who can provide the necessary information.

But there are cases when the tax service denies a tax deduction. For example, if the buyer and seller of real estate are related by blood.

Also, those citizens who have already received it in full form will not be able to receive the deduction. That is, 260,000 from the treasury have already been returned to such a citizen.

Reasons

The issuance of tax deductions in the Russian Federation is written in Article 220 of the Tax Code of the Russian Federation. Under this article, a deduction is issued only in two cases:

- if the real estate was purchased only with your own funds, and it cost up to 2 million rubles - if the real estate was worth more, then the deduction is still provided only for two million;

- if the owners took out a mortgage on the apartment.

This is interesting! In both cases, you can receive a tax deduction of 13%. The area and size of the property are not important.

It is worth noting that the tax deduction for a home can only be issued once. That is, if a citizen buys another home, then he is no longer entitled to a tax deduction. This is how it was until 2014

. In 2021, due to the entry into force of new government decrees, every citizen can use their right to a refund an unlimited number of times, but the total amount of all refunds should not exceed 260,000 rubles.

Registration procedure

To get a real estate tax deduction, you need to go to your local tax office.

They will immediately tell you the amount that can be returned, but it is better to have a complete package of documents with you.

It is also worth taking into account that there are several ways to submit documents to the tax office:

- In person, bringing all completed documents and certificates with you.

- By post - using a parcel or letter.

- Online on the website of the federal tax service.

- Online through the State Services portal.

List of documents

Typically, tax deductions are processed quickly. But the amount comes in parts to the specified bank account. Often the larger the amount, the more parts will be used. The following are the documents that need to be attached to the declaration. These include:

- Agreement on the purchase of housing in various forms (purchase or sale, etc.).

- Payment documents - certificates, receipts, checks.

- Ownership of housing.

- Agreement on the transfer or acceptance of housing.

- Application for distribution of deductions in shares between husband and wife.

- Mortgage loan agreement and certificate of interest that was paid.

All listed papers are submitted by the declarant along with 3-NDFL.

Required papers for registration of 3-NDFL with social deduction (list for the tax office).

To confirm your right to a social deduction, you need to provide the following documents:

- Contract for obtaining education (its copy).

- Contract for treatment of yourself or a relative (its copy).

- A document confirming all transfers made to charitable foundations - checks or receipts.

- Documents on payments to various authorities.

- Permission issued by an educational institution (copy and original).

- Permission issued by a medical institution (copy and original, just in case).

- Extracts of medical prescriptions that were purchased for money.

- A document that can confirm that the applicant is related to the person who received treatment or training.

- Help 2-NDFL.

- If required, you must provide a document confirming full-time study, because the deduction is not refunded for part-time study.

Difficulties filling

The filling process can be considered difficult, since ordinary residents do not encounter it (except in very rare cases). If a resident is officially employed, then the 3-NDFL declaration is filled out for him by the employer (usually this is a list of responsibilities of the chief accountant or other subordinates).

Thus, having bought a home and decided to return taxes for it, a citizen is faced with the routine filling out of tax forms. And it is quite natural that this causes him many problems and difficulties.

This is interesting! Oddly enough, Russia is one of the top countries with the most complex tax system. Journalists from a well-known publication, together with tax workers, conducted a study in 2021, according to which the Russian system of tax deductions and forms is one of the most difficult to understand.

Therefore, we will try to figure out how to fill out a declaration for compensation without unnecessary routine.

Documents evidencing the right to return

The right to a tax refund for a purchased apartment will be confirmed by the following documents:

- certificate of ownership, and in case of shared participation in construction - an acceptance certificate;

- purchase agreement or share participation in construction;

- when purchasing for a child - a birth certificate;

- mortgage agreement, if any;

- documents on payment of interest;

- contract for finishing work, if the apartment was purchased without finishing;

- payment documents for payment of the cost of the apartment, and for finishing costs - building materials and finishing work performed.

About the nuances of applying the deduction for equity participation agreements that provide for the breakdown of the cost into parts, read the material “What is the amount of the personal income tax deduction if the cost of an apartment in a shared-use house is divided into parts?” .

Is it always necessary to fill out 3-NDFL for property deduction?

You can do without filling out 3-NDFL for a property deduction when using deductions for the costs of purchasing (or building) housing and mortgage interest.

This is acceptable in situations where, in the year of collecting the full package of documents required for such a deduction, a person applies to the Federal Tax Service for a notification of the right to deduction and, on the basis of this notification and a similar document received annually in subsequent years, returns the tax at work.

If he uses only this algorithm of actions to return personal income tax on this basis, then he may not need a 3-NDFL declaration to receive a property deduction in connection with the purchase of a home.

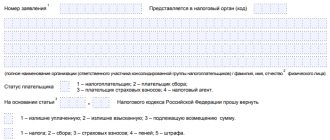

Filling out a return application

There is no need to fill out an application for a deduction for the purchased apartment. According to the Federal Tax Service, it is enough to submit a declaration, which plays the role of such a statement. However, to receive a tax refund, an application will still be required (Clause 6, Article 78 of the Tax Code of the Russian Federation). Moreover, it will contain the details of the account to which the money should be returned.

For such an application, there is a specific form approved by Order of the Federal Tax Service of Russia dated 02/14/2017 No. ММВ-7-8/ [email protected] From 01/09/2019 it is valid as amended by Order of the Federal Tax Service dated 11/30/2018 No. ММВ-7-8/ [email protected] ]

On our website you can also see a sample application drawn up on the current form.

Whether an individual entrepreneur can take advantage of a tax deduction when purchasing an apartment and apply for a personal income tax refund, read the material “Tax deduction when purchasing an apartment for individual entrepreneurs (nuances).”

What deductions will require 3-NDFL?

Declaration 3-NDFL in connection with deductions is filled out when there is a need to return the overpaid tax on it with the help of the Federal Tax Service. These may be deductions:

- standard (personal or children's) or social expenses for treatment, training, if the person did not use them at the place of work;

- social (for charity, for contributions to a non-state pension fund or additional contributions to the Pension Fund), which are provided only by the Federal Tax Service;

- investment (for securities), if it is not used in full by tax agents;

- property (for the sale of property, receipt of compensation for real estate, purchase of housing and interest on a mortgage), in relation to some of which submission of a declaration to the Federal Tax Service is mandatory.

The Federal Tax Service has the right to issue a tax refund only after checking the declaration, all data of which is confirmed by copies of documents indicating the right to apply the required deduction (or deductions).

For information on how to fill out the 3-NDFL declaration, read the article “Filling out the 3-NDFL declaration for property deduction”.

Declaration form 3-NDFL for 2021, submitted in 2021, was updated by order of the Federal Tax Service dated August 28, 2020 No. ED-7-11/ [email protected] You can download it on our website by clicking on the picture below.

Results

When purchasing (or acquiring through equity participation) an apartment, an individual can take advantage of two property deductions for personal income tax:

- in the amount of purchase or construction costs (within 2,000,000 rubles, but with the possibility of use for several objects);

- in the amount of interest on the mortgage (within RUB 3,000,000 and applicable only to one of the objects).

The right to deduction is checked and confirmed by the Federal Tax Service. And the tax itself can be reimbursed either at the place of work (by reducing current accruals), or by receiving the amounts overpaid for the year from the Federal Tax Service (after filing a declaration there at the end of the year of acquiring the right to deduction). Reimbursement of the full amount of tax may take several years. There is no need to write any application for reimbursement. But if you receive tax from the Federal Tax Service, you will need to apply for its refund. There is a specific form for such an application.

Sources:

- Order of the Federal Tax Service of Russia dated February 14, 2017 N ММВ-7-8/ [email protected]

- Tax Code of the Russian Federation

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Process of filling out a tax return

Many people are faced with a situation where they cannot correctly fill out form 3-NDFL in order to apply for a tax deduction.

There are several options for correctly filling out documentation:

- fill it out yourself via the website;

- fill out with the help of inspectors at the tax organization

- fill out documents in a company that specializes in processing papers and declarations;

- use a special program that can be downloaded on the Internet and on our website - link at the very beginning of the article.

Calculation algorithm

According to Article 220 of the Tax Code, the tax deduction is 13%, but there are some special features. It depends on what work status you are in at the moment and what you were in when you bought the property.

There are a lot of pages in a tax return that need to be filled out, including additional ones:

- The title page is the main part of the document. Information about the owner and the tax authority is indicated here, which is important.

- Next, fill out a paper with income data.

- Page with expenses and profits.

This is all the first section. Then fill out the second section:

- you need to calculate all taxes and expenses;

- The tax deduction itself is calculated, that is, its total part.

Interesting points

There are many different nuances that depend on the social status of the buyer and seller.

You can learn about the features of filling out a deduction declaration from the video:

Let's look at other features:

- Pensioners can apply for a tax deduction for the last three years. But if three years have passed since retirement, then it is no longer possible to return taxes.

- If an apartment has several owners, then the consent of all owners is required to sell it.

- You can file a tax deduction using Microsoft Excel. Blank forms and examples of a completed 3-NDFL declaration for the 2021 tax deduction were given at the beginning of the article.

Submission deadlines

According to the laws of the Russian Federation, it is not necessary to submit 3-NDFL; citizens can do this, but there are no specific time restrictions. It is submitted if a resident wants to receive an income tax deduction.

You need to know this! There is no statute of limitations for exercising the right to a tax refund. You can use your right to a property deduction months and even years after the transaction. But you need to keep in mind some features - the tax is refunded only for the last 36 months.

Thus, if you take into account some features, filling out a property deduction declaration will be much easier. Moreover, at the beginning of the article a link is provided for 3-NDFL for the 2021 tax deduction.