Let's look at the features of reflecting VAT recovery in 1C when offsetting advances issued to suppliers.

You will learn:

- features of offset of advance payment upon receipt of goods (works, services);

- what document is used to document VAT recovery when offsetting an advance payment?

- what transactions and movements in the VAT tax register are generated in the sales book, what lines of the VAT declaration are filled out.

For more details, see the online course: “Accounting and tax accounting in 1C: Accounting 8th ed. 3 from A to Z"

Restoring VAT in 1C 8.3: step-by-step instructions

Attention! The VAT rate has been changed from 01/01/2019 from 18% to 20% and from 18/118 to 20/120.

The organization made a 100% prepayment to the supplier Avtopark LLC for a Ford Mondeo car. An advance invoice was registered for the advance payment in the amount of RUB 792,960. (including VAT 18%).

On April 2, when receiving a Ford Mondeo car, the previously issued advance was offset in the amount of RUB 792,960.

Let's look at the instructions for registering an advance payment in 1C 8.3 Accounting step by step. PDF

| date | Debit | Credit | Accounting amount | Amount NU | the name of the operation | Documents (reports) in 1C | |

| Dt | CT | ||||||

| Acquisition of a non-current asset | |||||||

| April 02 | 08.04.1 | 60.01 | 672 000 | 672 000 | 672 000 | Accounting for a non-current asset | Receipt (act, invoice) - Equipment |

| 19.01 | 60.01 | 120 960 | 120 960 | Acceptance for VAT accounting | |||

| 60.01 | 60.02 | 792 960 | 792 960 | 792 960 | Advance offset | ||

| Registration of SF supplier | |||||||

| April 02 | — | — | 792 960 | Registration of SF supplier | Invoice received for receipt | ||

| Reinstatement of VAT when offsetting the supplier's advance payment | |||||||

| 30 June | 76.VA | 68.02 | 120 960 | Restoration of VAT payable | Generating sales ledger entries | ||

| — | — | 120 960 | Reflection of VAT in the Sales Book | Sales book report | |||

First, find out about the transfer of an advance to the supplier and the deduction of VAT from the advance payment.

Recovering VAT from advances received

The prepaid payment system involves receiving an advance payment and paying VAT on these amounts by the seller. The buyer has the right to accept these amounts for deduction (clause 1 of Article 154, clause 12 of Article 171, clause 9 of Article 172 of the Tax Code of the Russian Federation).

From 01.10.2014, the procedure for VAT restoration has been changed: the amount of VAT previously claimed for deduction on the basis of an advance invoice received from the seller is restored by the buyer in full if the shipment is equal to or exceeds the amount of the advance, and is restored in accordance with the invoice for shipment, if it is less than the advance payment.

You will find all the nuances of recovering VAT from an advance payment in the article “When and how can a buyer recover VAT from a transferred advance payment? ”

Acquisition of a non-current asset

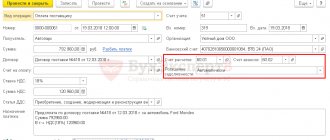

The receipt of a non-current asset and the simultaneous offset of the advance issued to the supplier is reflected in the document Receipt (act, invoice) type of operation Equipment in the section Fixed assets and intangible assets – Receipt of fixed assets – Receipt of equipment.

Please note when filling out the Calculations you indicate:

- Advance offset method – Automatically , which triggers automatic advance offset in the context of the Counterparty and the Agreement when posting a document.

Find out more about setting up the advance payment method

See also the key points for registering the acquisition of a non-current asset and accepting VAT for deduction on it

Postings for offsetting advances issued in 1C 8.3

When posting a document, the advance payment previously issued to the supplier is offset in the amount of the uncredited prepayment amount under the contract, but not more than the total amount under the document:

- Dt 60.01 Kt 60.02 – offset of advance payment issued to the supplier.

Registration of SF supplier

To register an incoming invoice from a supplier, you must indicate its number and date at the bottom of the Receipt document form (act, invoice) and click the Register .

The Invoice document received is automatically filled in with the data from the Receipt document (act, invoice) .

Find out more about accepting VAT for deduction when purchasing OS.

Reinstatement of VAT when offsetting the supplier's advance payment

Regulatory regulation

The organization must restore (reflect for payment) VAT, previously accepted for deduction, from advances transferred to suppliers as of the date (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation):

- offset of the advance, i.e. during the period of acceptance for accounting of goods (works, services) from the supplier;

- refund of the advance due to changes in conditions or termination of the contract.

Tax amounts are subject to restoration in the amount corresponding to the offset (refunded) amount of the prepayment under the agreement (Letter of the Ministry of Finance of the Russian Federation dated November 28, 2014 N 03-07-11/60891).

For the amount of restored VAT:

- in the sales book, a registration entry is made for the advance income tax, the VAT on which was previously accepted for deduction, with the transaction type code 21 “Advances issued”;

- In accounting, the entry Dt 76.VA “VAT on advances and prepayments issued” Kt 68.02 is generated.

Restoring VAT in 1C 8.3

You can restore VAT in 1C 8.3 when offsetting a supplier's advance using the document Generating Sales Book Entries in the Operations - Period Closing - Regular VAT Operations section.

To automatically fill out the Advance Recovery , you must use the Fill .

VAT recovery: postings in 1C 8.3

Restoring VAT postings in 1C 8.3:

- Dt 76.VA Kt 68.02 – restoration of VAT from an advance previously accepted for deduction;

The document generates movements in the VAT Sales :

- record of advance SF with the transaction type code “Advances issued” for the amount of restored VAT.

Sales Book report can be generated from the Reports – VAT – Sales Book section. PDF

Let's check the calculation of the amount of VAT recovered when crediting the advance using the following algorithm:

- Let's determine the amount of the offset advance, for which VAT was previously accepted for deduction - Dt 60.01 Kt 60.02 RUB 792,960.

- Let's perform an arithmetic check of VAT recovery from the offset advance using the formula:

VAT for recovery = 792,960 * 18/118 = 120,960 rubles.

To check the amount of recovered VAT, you can generate the report Turnover balance sheet for account 76.VA by counterparty.

VAT on advances issued in 1C 8.3 according to Dt 76.VA coincides with the verified amount. There is no balance on account 76.VA for the invoice, on which VAT was previously accepted for deduction. This means that VAT has been restored correctly for the entire amount of the advance invoice.

VAT declaration

In the VAT return, the amount of VAT subject to recovery is reflected:

In Section 3, page 080 “Tax amounts subject to recovery, total”, page 090 “Tax amounts subject to recovery...”: PDF

- the amount of VAT subject to recovery.

In Section 9 “Information from the sales book”:

- advance invoice received, transaction type code "".

Transition to simplified tax system. VAT restoration.

- ... In the event that a value added tax taxpayer switches to a simplified taxation system, then it is necessary to follow the special procedure for the restoration of VAT amounts provided for in paragraphs. 2 p. 3 art. 170 of the Code, according to which, when a taxpayer switches to a special tax regime in accordance with Ch. 26.2 of the Code, the amounts of VAT accepted for deduction by the taxpayer on goods (work, services), including fixed assets and intangible assets, and property rights in the manner prescribed by Chapter. 21 of the Code are subject to restoration in the tax period preceding the transition to the specified regimes...

{Question: About the procedure for restoring VAT amounts accepted for deduction by the taxpayer on goods (works, services), including fixed assets and intangible assets, and property rights when the VAT payer switches to the application of the simplified tax system, as well as the absence of grounds for application by the above taxpayers who have switched to the simplified tax system, the procedure for VAT restoration provided for in paragraph 6 of Art. 171 Tax Code of the Russian Federation. (Letter of the Federal Tax Service of Russia dated December 13, 2012 N ED-4-3/21229) {ConsultantPlus}}

- In the last quarter before the transition to the simplified tax system, restore the VAT accepted for deduction on the inventories, fixed assets and advances issued as of December 31.

For inventories and advances, restore the deduction in full. For OS and intangible assets, apply the formula (clause 2, clause 3, article 170 of the Tax Code of the Russian Federation):

In the sales book, record invoices for which tax was deducted. For identical goods, take any invoices for the required amount. If the storage period for the invoice has expired, register an accounting certificate calculating the amount of restored VAT (clause 14 of the Rules for maintaining the sales ledger).

Reflect the restored VAT in line 080 of section. 3 VAT returns for the 4th quarter (clause 38.6 of the Procedure for filling out the declaration).

In other income tax expenses, include the VAT recovered on the inventories and fixed assets (Letter of the Ministry of Finance dated 04/01/2010 N 03-03-06/1/205). Include the VAT recovered from advances paid in the cost of goods, works, services and, together with it, take into account the costs of the simplified tax system.

{Typical situation: How to restore VAT when switching to the simplified tax system (Glavnaya Kniga Publishing House, 2018) {ConsultantPlus}}

- Reflection of the restored VAT in section. 3 VAT returns

In line 080 section. 3 VAT returns, provide the total amount of tax to be recovered.

Individual amounts of the restored tax are additionally reflected in line 090 and (or) line 100 of section. 3.

Line 090 section. 3 VAT returns are filled out by buyers. In it you need to indicate the amount of “advance” VAT, which was previously declared for deduction, and is now being restored. Most often this happens when the seller presents tax on the entire cost of goods, work, services, property rights and it is accepted for deduction.

Another reason to restore the “advance” VAT and fill out this line appears when the seller returned the advance to the buyer, since the contract was terminated or changed (clause 3, clause 3, article 170 of the Tax Code of the Russian Federation).

Ready-made solution: How to fill out a VAT return for a Russian organization (ConsultantPlus, 2018) {ConsultantPlus}

- Example 1.

At the time of transition to the simplified tax system, the organization’s warehouse contains materials for which the “input” VAT is in the amount of 18,200 rubles. accepted for deduction. The organization also has fixed assets on its balance sheet, the residual value of which as of December 31, 2021 is 150,000 rubles. In relation to this fixed asset, VAT was previously accepted for deduction in full.

In the declaration for the fourth quarter of 2021, the company must reflect the amount of restored VAT in the amount of:

— 18,200 rub. - based on materials;

— 27,000 rub. - according to OS (RUB 140,000 x 18%).

The total amount of restored VAT for the fourth quarter of 2021 is shown on line 080 of section 3 of the declaration. Please note that the relevant invoices (accounting statements) must be recorded in the sales ledger. They must also be shown in section 9 of the declaration for the fourth quarter of 2021.

For your information!

If the amount of VAT on goods purchased before the transition to the simplified system was not deducted, then these tax amounts do not need to be restored (see letter of the Ministry of Finance dated October 18, 2021 N 03-07-14/60503).

In the event that from January 1, 2021 you switch to “imputation”, you need to act in almost the same order. The peculiarity is that VAT needs to be restored only for those goods (works, services), etc. that will be used in “imputed” activities.

"Advance" VAT

From the total amount of restored VAT for the fourth quarter of 2021, indicated on line 080 of section 3 of the declaration, the amounts of restored VAT from the advance are separately allocated - they are shown on line 090 of section 3 of the declaration.

Let us recall that “advance” invoices received from sellers are recorded in the purchase ledger when VAT is accepted for deduction. Information about each such invoice is indicated in section 8 of the declaration. The total amount of VAT on these invoices is reflected on line 130 of section 3 of the declaration.

Article: VAT reporting for the fourth quarter of 2021 (Morozova O.) (“Information bulletin “Express Accounting”, 2016, N 48-49) {ConsultantPlus}

Additional Information:

- Example. Restoration of VAT upon transition to the simplified tax system

As of December 31, 2018, the following are included in the accounting records:

- advance payment to the supplier - 100,000 rubles, VAT 18,000 rubles. accepted for deduction;

- balance of goods - 1,500,000 rubles. The latest invoices for him are for 590,000 rubles. (VAT 90,000 rub.) and by 1,300,000 rub. (VAT 198,305 rub.);

- Fixed assets with an initial cost of 5,000,000 rubles, a residual value of 2,500,000 rubles, VAT of 900,000 rubles. accepted for deduction.

The organization is restoring:

- VAT on advance payment - 18,000 rubles. Registers the supplier's invoice for this advance in the sales book;

- VAT on goods - 270,000 rubles. (RUB 1,500,000 x 18%). In the sales book, registers 2 invoices for goods: one - for 590,000 rubles, VAT 90,000 rubles, the second partially - for 1,180,000 rubles, VAT 180,000 rubles;

- VAT on fixed assets - 450,000 rubles. (900,000 rub. x 2,500,000 rub. / 5,000,000 rub.). In the sales book, it registers the supplier's invoice on the operating system, but only for 2,950,000 rubles, VAT 450,000 rubles.

{Typical situation: How to restore VAT when switching to the simplified tax system (Glavnaya Kniga Publishing House, 2018) {ConsultantPlus}}

- Cannot be restored

It should be noted that in some cases it is not necessary to restore the “input” VAT when switching to the simplified tax system. We are talking about the following situations:

- if VAT was not previously deductible (see, for example, Letters of the Ministry of Finance of Russia dated November 5, 2013 N 03-11-11/46966, dated February 16, 2012 N 03-07-11/47);

- if, before the transition to the simplified tax system, the goods that will be resold on the simplified market were purchased under the general taxation regime without VAT (see Letter of the Ministry of Finance of Russia dated March 14, 2011 N 03-07-11/50);

- when “input” VAT relates to services (works) that were used under the general taxation regime, that is, in transactions subject to VAT. For example, these could be services under a rental agreement (leasing). Despite the fact that the agreement itself is transferable, that is, it affects both the “general regime” and “simplified” periods, VAT relating to the “general regime” period does not need to be restored (see, for example, Letter of the Ministry of Finance of Russia dated October 8, 2015 N 03-07-11/57730).

Article: VAT problems during the transition to the simplified tax system (Morozova O.) (“Information bulletin “Express Accounting”, 2015, N 46) {ConsultantPlus}