Home / Taxes / What is VAT and when does it increase to 20 percent? / Book of purchases and sales

Back

Published: December 28, 2017

Reading time: 9 min

0

293

A tax document containing all the data on invoices on which VAT payers calculate tax for a certain quarter is called a purchase book.

- Shopping book - what is it?

- What information is required?

- What is not included in the document?

- What is reflected in the document?

- Purchase book according to resolution 1137

- Important Features

- Conclusion

Shopping book - what is it?

The purchase book is compiled according to the model of Appendix 4 of the Decree of the Government of the Russian Federation of December 26, 2011, No. 1137 (hereinafter referred to as Decree No. 1137).

Since October 1, 2017, a revised sample of this document has been used (the resolution was edited by the Government of the Russian Federation dated August 19, 2017, No. 981).

Taking into account the information contained in the purchase book, the amount intended for payment of VAT is subsequently recorded in the tax return.

The information obtained from the book is one by one written directly into the declaration. For these purposes, its sample (which was approved by the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected] ) contains section 8 . The number of sections is equal to the number of entries that are entered in the purchase book for the quarter.

Accounting for purchases is a mandatory requirement for all citizens and enterprises making VAT payments (clause 3 of Article 169 of the Tax Code of the Russian Federation).

Only they are authorized to deduct VAT using purchase ledger data. Calculations for deducted tax in accounting are noted using the entry Dt 68 Kt 19.

Extract from the sales book: rules for document execution

An extract from the sales book plays the role of a document that is necessary for the tax authorities when conducting various audits of reporting on taxes paid to the budgets of various levels.

Why do you need an extract from the sales book?

An extract from the sales book is a special reporting document drawn up at the request of the tax authorities, which contains information about the completed trade and financial interaction with various tax agents. This document is compiled based on the data contained in the sales book.

In accordance with Part 4 of the Amendments approved by Decree of the Government of the Russian Federation No. 735 of July 30, 2014, amended to Decree of the Government of the Russian Federation No. 1137 of December 26, 2011, the sales book is a mandatory reporting document that must be filled out by each participant in economic activity on the territory of the Russian Federation, regardless of whether it is subject to taxation or completely exempt from it.

The information included in the extract from the sales book is provided for the trading participant in respect of whom a request was submitted from the tax authorities.

As a rule, the formation of such a request occurs during inspections of certain counterparties, or the organization itself, which must provide such an extract.

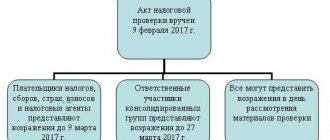

Tax audits

There are two types of tax audits:

- Comprehensive, when all reporting documentation of a specific organization or individual entrepreneur is checked. The purpose of such an audit occurs in cases where tax officials have questions regarding the reporting provided by one or another participant in tax legal relations (regardless of whether he is subject to taxes at various levels or is completely exempt from them).

- A random audit, during which only those data that have raised doubts among tax officials are checked (for example, the accuracy of the displayed amounts of value added tax payable to the budget).

Since when conducting such audits the tax inspectorate and its employees often do not need to review all the reporting documents available in a particular organization, extracts from such reports come to help in checking the available information.

The most common are extracts from the sales ledger.

What statements do the tax authorities require?

Depending on the data being checked, they can be divided into:

- An extract for a specific tax period. This option is the most voluminous, because during its preparation, an organization or individual entrepreneur will have to provide information about all transactions for the sale of various goods that were carried out within the designated period (month, quarter, year, etc.). If it is necessary to check data for several such periods, then independent statements must be prepared for each of them.

- An extract on transactions subject to VAT, indicating tax rates. This version of the extract is studied by tax authorities in cases where it is necessary to provide information about what specific transactions subject to VAT were carried out, what profit was received and what funds were contributed to the budget as a result of such transactions.

- Statement on counterparties. This version of the extract is required by the tax authorities in cases where it is necessary to check a specific counterparty of an organization or legal entity. Such a document is used, as a rule, when conducting counter tax audits (for example, if during an audit of one organization doubts arose about the tax “purity” of transactions carried out by this organization with its counterparties and during a chain audit of counterparties it was necessary to clarify the information provided by the latter to tax officials) .

Which version of the extract should be generated by the audited organization is determined by tax officials in the request they prepare, depending on the goals and purpose of the audit.

Requirements for drawing up an extract

Due to the fact that since October 2021, the requirements for maintaining a sales book have become uniform for all participants in tax and economic legal relations, this reporting document is now drawn up in electronic and paper form, which has significantly simplified the mechanism for drawing up an extract from this document, regardless of what of the types this document must be compiled.

Since October 2021, it also now has its own updated requirements, non-compliance with which entails a fine of up to thirty thousand rubles.

These mandatory requirements include:

- Providing statements in paper and electronic versions (the electronic version must be in Ecxel format). At the same time, both paper and electronic versions are compiled in several copies, since one set must remain in the organization as a reference (in case the copies submitted to the tax authorities are lost);

- Information about several counterparties, tax periods, transactions subject to VAT in such periods is generated as independent documents (this design option is preferable for the convenience of verifying the information provided);

- If the extract consists of several sheets, each of them is certified by the signature and seal of the manager, all are stitched into a single document and also certified by the signature and seal of the manager, and all sheets must be numbered;

- The head of the organization and its chief accountant are fully responsible for drawing up the statement (including responsibility for the accuracy and completeness of the information provided);

- This document is sent to the tax authorities either by personal delivery, or by registered mail via mail with notification (when using the latter option, it is necessary to make an inventory of all sheets of the document placed in the envelope, as well as other documents attached to this extract).

Compilation rules

The preparation of an extract from the sales book is carried out in accordance with the provisions of the current tax legislation. As mentioned above, this document is prepared both in paper and electronic form.

A sample statement is available for review via the link.

In both versions, the following information should be reflected within the framework of this document:

- In the upper right corner of the document, information is indicated about which tax authority this document is sent to (that is, the data specified in the request to display information about the inspecting tax division is reflected), including information about the head of this division. In the same part of the sheet information is indicated about who exactly (the full name of the legal entity or individual entrepreneur) is drawing up this extract.

- Information is provided about the period for which this extract is provided (data is taken from the request provided by the tax authorities) in terms of months (if we are talking about a quarter - for three months, for a year - for twelve months, etc.).

- In addition, when filling out the “header” of the document, it is necessary to indicate all counterparties with whom trading interaction was carried out (unless the extract is provided not for specific counterparties, but by tax periods or by the number and financial content of transactions carried out).

- All information of interest to the tax authorities is indicated in the form of a table, each of the columns of which contains certain information (the month in which a particular transaction was carried out; its total amount; the amount of those funds that are subject to taxation at one of the value added tax rates established by law ; information about the quantity of goods in terms of their value, which is not subject to taxation).

All of the listed data must be summed up, and the result obtained must be certified by the signature of the chief accountant and his seal (if there is such an employee in the organization) or the manager.

The electronic version is certified with an electronic digital signature (but without the function of encrypting the certified data).

Conclusion

An extract from the sales book is one of the rather important reporting documents, information from which allows not only to check the organization or individual entrepreneur who provided this extract, but also to monitor compliance with tax legislation by counterparties.

Depending on the purposes of the audits, various versions of such statements are distinguished, however, each of them, regardless of their version, must meet the requirements specified in tax legislation both for the design and for the content of information in this reporting document.

Source: https://zakonguru.com/nalogi-2/nds/kniga/vypiska-2.html

What information is required?

According to paragraph 2, ordinary, adjustment and corrected invoices are entered in the book.

They can be on paper forms or in electronic form. Entries in them are usually made on a computer. Some information may be entered manually.

The purchase ledger contains the following invoices:

- issued by persons selling products or services (rule 2 of the Rules for maintaining a purchase ledger);

- compiled when providing goods, works, services (GWS) (clause 22 of the Rules of Practice);

- adjusted when the price initially specified by the seller decreases and the buyer increases it (clauses 9 and 12 of the Rules of Practice);

- necessary when carrying out construction and installation works for personal use (clause 20 of the Rules of Practice);

In addition, the sales book also includes documentation that can be considered sufficient grounds for deducting VAT:

- papers (it is acceptable to include copies of them) that contain information about expenses for work trips (clause 18 of the Rules of Practice);

- documents that confirm the fact of payment of tax when importing (clause 6 of the Rules);

- statements on the import of goods and payment of indirect taxes - when importing goods from countries included in the EAEU (clause 6 of the Rules of Practice).

What is not included in the document?

Invoices that do not comply are not entered into the purchase ledger (according to paragraph 3 of the Rules for maintaining the purchase ledger):

- the provisions of Article 169 of the Tax Code of the Russian Federation;

- established samples (Appendices 1 and 2 of Decree No. 1137).

Also, invoices drawn up (clause 19 of the Rules of Maintenance) are not entered:

- when provided free of charge, technical specifications containing tangible and intangible assets;

- commission agent (agent) from the principal (principal) for goods and services intended for sale, property rights, as well as advances issued on account of this sale;

- commission agent (agent) from the supplier of goods and services or property rights received for the principal (principal), counting allocated advances;

- on the amount of advance payment for goods and services received in actions that do not require VAT payments;

- advance invoices issued after the supplier receives shipping invoices.

What is reflected in the document?

The purchase book contains:

- The header contains information about the taxpayer-buyer, that is, its full or abbreviated name according to the statutory documents (or full name of the individual entrepreneur, INN and KPP). Data on tax cycles (with start and end dates).

- The tabular section contains information about the documents used to calculate VAT and its value.

If GWS are provided for actions subject to taxation at rates of 18, 10 and 0%, then the invoice is noted at the parts corresponding to these rates (clause 6 of the Rules for maintaining a purchase book, letter of the Ministry of Finance of Russia dated March 17, 2015 No. 03-07-11/14238 and 03/02/2015 No. 03-07-09/10695).

If the supply is intended for taxable and non-taxable actions, then the document is drawn up for the amount of the deduction after determining the size of the accounted share (clause 6 of the Rules of Practice).

Purchase book according to resolution 1137

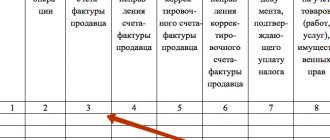

According to the provisions of resolution 1137, the purchase book is compiled as follows (clause 6 of the Rules for maintaining the purchase book):

- Column 1. The serial number of the invoice mark (including the adjustment number) is assigned.

- Column 2. The transaction type code is entered (until July 2021, it was allowed to use codes from the order of the Federal Tax Service of Russia dated February 14, 2012 No. ММВ-7-3/ [email protected] and from the letter of the Federal Tax Service of Russia dated January 22, 2015 No. ГД-4-3/ [ email protected] , but, starting from July 2021, in the code section they use exclusively the order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3 / [email protected] ).

- Column 3. Usually the serial number and time of drawing up the supplier's invoice are recorded. If the tax deduction is certified using other documentation (customs certificate, applications for import of products, etc.), then the details of these papers are entered.

According to the edited resolution No. 1137, in column 3 the following should be taken into account:

| Information necessary to correctly fill out column 3 | Under what circumstances are they necessary? |

| Number and time of filing an application for the import of products and payment of indirect taxes with marks from tax structures indicating payment of VAT | When importing products into the Russian Federation from EAEU countries |

| Number of the customs declaration drawn up during the customs procedure for registering the release of products for internal use at the end of the customs operation of the free customs zone on the territory of the SEZ in the Kaliningrad region | When marking VAT in the purchase book, calculated in accordance with paragraph 14 of Article 171 of the Tax Code of the Russian Federation |

| The number and time of execution of a payment and settlement document or other paper containing generalized information noted by the supplier in the sales book. | When determining VAT on prepayment paid towards the provision of GWS and subject to accounting from the date of provision of GWS. |

- Columns 4–6. Contains serial numbers and dates of corrected and/or adjusting invoices.

- Column 7. Enter the number and time of drawing up the document certifying the fact of payment of VAT. Details of the payment order are noted in column 7 in the case where the tax is calculated only after it has been paid. This happens, for example, when importing products into the Russian Federation (see letter from the Ministry of Finance of Russia dated November 26, 2014 No. 03-07-11/60221) or when returning an advance to the person making the purchase in cases of cancellation or correction of the agreement (letter from the Ministry of Finance of Russia dated March 24 .2015 No. 03-07-11/16044 and 03/23/2015 No. 03-07-11/15889).

- Column 8. Enter the exact date of receipt of products (production of work or services), as well as the acceptance of rights to property.

- Columns 9 and 10. Contain the names, TIN or KPP of the person selling services or products.

- Columns 11 and 12. Are drawn up by the buyer-committent (principal). Here you enter the name, tax identification number and checkpoint of the intermediary commission agent (agent) who receives products or services.

- Column 13. Enter the registration number of the customs declaration when selling products imported into the Russian Federation, if customs registration is determined by the legislative acts of the Customs Union. Making a column is not required when recording information on an adjustment (or corrected adjustment) invoice in the purchase book.

- Column 14. Contains the name and code of the currency (only when receiving products and services and rights to property for the currency of other countries).

- Column 15. The price of products or services, transfer of rights to property or the amount of advance payment including VAT is indicated.

- Column 16. Contains the amounts of VAT that are subject to deduction.

Marriage registration during pregnancy can be done on the day of filing the application. An application for marriage registration can be submitted online. You can find out how and where to do this in our article.

As a result of declaring a marriage invalid, legal consequences arise. Read more about them here.

Extract from the sales book, sample

The document is issued simultaneously in electronic and paper form. One copy remains in the accounting department in case of loss.

- If the extract takes several pages, then each of them must be certified with the director’s signature and seal.

- In addition, all pages need to be numbered and stitched.

- Sent by registered mail with an inventory attached. The day for submitting the statement is considered to be the sixth day after the date of dispatch. It is possible to take the document personally to a representative of the organization.

The most common mistakes when compiling:

- Error in the exact timing of the transaction. If a transaction for one quarter is mistakenly linked to another quarter, then VAT is not charged for the period in which the transaction took place.

- Incorrect distribution of products by types of tax rates. This may result in an inaccurate determination of the total tax amount.

Errors lead to fines being imposed, and the document is sent for revision.

What you need to know

Firms register in the sales book all invoices that are drawn up based on the results of the sale of goods, work or services to contractors. At the same time, the consolidated accounting document is compiled by both organizations and individual entrepreneurs.

Even if a company does not pay VAT to the treasury, being a subject of a special taxation regime (USN, UTII, Unified Agricultural Tax), it is obliged to keep a sales book (Article 145 of the Tax Code of the Russian Federation).

In addition, since 2021, the procedure for filling out and submitting this consolidated accounting document to the tax authorities has changed somewhat, in particular (Order of the Federal Tax Service No. ММВ-7-3 / [email protected] , 2019):

- basic information, which subsequently serves as the basis for calculating VAT, is prescribed in section 9;

- There will no longer be a need to include adjustment invoices in the consolidated report that are associated with an increase in the price of goods and services supplied;

- Maintaining a ledger in electronic form becomes a prerequisite (it is in Excel that a sample extract from the sales ledger must now be submitted to the tax department).

If sales book information is submitted using the old form, the Federal Tax Service will impose a fine of up to 30,000 rubles on individual entrepreneurs and organizations.

Basic moments

Organizations and individual entrepreneurs that operate within the framework of the simplified tax system, UTII or unified agricultural tax are exempt from the obligation to keep a purchase book, since they do not pay VAT to the treasury.

At the same time, as mentioned above, all business entities without exception are required to maintain a sales book (Resolution of the Government of the Russian Federation No. 735, 2019).

Typically, the sales book contains details and basic information of such documents as:

| Invoices | Reflecting the provision of goods, works or services to customers |

| Strict reporting forms and cash registers | Which serve as a reflection of similar operations |

It should be emphasized that registration of securities in the book is carried out in the period when the obligation to pay VAT to the treasury arises (in chronological order).

Typically, one sales ledger is kept per quarter for recording invoices. At the end of the reporting period, its sheets are numbered, it is filed, certified by the signature of the director of the company and her seal.

After this, they keep the document at the enterprise for another 5 years and, if necessary, send extracts from it to the Federal Tax Service.

Why is this necessary?

The sales ledger can be viewed as a highly significant consolidated accounting document that reflects information such as:

- shipment of goods, performance of work or provision of services;

- receiving advance payments from counterparties;

- return of previously shipped goods;

- transfer of property rights to other persons and organizations;

- carrying out business transactions that are not subject to tax by law, but are related to the main activities of the company.

Many entrepreneurs, mainly those who operate under preferential tax regimes and do not pay VAT, are wondering - why keep this summary report?

However, the book, in addition to the function of accounting for transactions that become the basis for paying value added tax, has other uses, in particular:

- The sales book records information about all unpaid transactions of the company, which allows you to quickly track debtors and receivables.

- The information contained in the summary document is the basis for making management decisions regarding increasing or decreasing the output of certain types of goods and services, future cash receipts, etc.

- The book allows you to track trends taking place in the market, in different regions, during certain periods of the year, etc.

As for the usefulness of the document for the tax authorities, this is, of course, the calculation of VAT and control over the pricing policy of individual enterprises (this indirect tax is included in the price of the goods).

What does transaction type code 26 mean in the sales book, see the article: transaction type code in the sales book.

Where to see a sample sales book from 2021, .

Legal grounds

The need to maintain a sales book for registering invoices issued to counterparties is established by Article 161 of the Tax Code of the Russian Federation.

It also spells out the need to generate any kind of primary accounting documents (check, receipt, cash register tape, invoice, invoice).

In addition, certain issues of the formation and submission of this important document to the tax authorities are prescribed in such regulatory legal acts as:

| Standard | |

| FZ-134 | Determines the introduction of amendments to the Tax Code of the Russian Federation regarding the mandatory use of the electronic format of the sales book and its extracts for individual entrepreneurs and organizations |

| Order of the Federal Tax Service No. ММВ-7-3/ [email protected] | Establishes the importance of filling out section 9 in the new form of the sales book (its information is subsequently reflected on the statement) |

| Decree of the Government of the Russian Federation No. 735 | Indicates that all individual entrepreneurs and organizations, without exception, are required to keep a sales book, including those business entities that use preferential tax payment systems to the budget (Unified Agricultural Tax, simplified tax system, UTII) |

Extract from the sales book by counterparty (sample)

As mentioned above, when conducting a counter tax audit, the Federal Tax Service may request an extract from the sales book from the entrepreneur.

If the tax department does not see the need to verify the entire summary report, then it asks the company to provide it with information regarding:

- a specific period of time (quarter, half-year, year);

- certain types of goods and services;

- certain counterparties of the company.

The statement must contain information about the counterparties who entered into transactions with this company, as well as at what rate such transactions were taxed.

Sample extract from the sales book:

How to form it

It should be clarified that an extract from the sales book is generated exclusively at the request of the tax department and the need for it does not always exist.

: purchase book and sales book, VAT declaration

Most often, the Federal Tax Service wants to check the procedure for paying VAT by a specific counterparty of the company.

There are several important rules to consider when preparing a sales ledger statement, including:

- The form must be filled out both electronically and in paper form. In this case, a separate copy of the document must remain at the enterprise in case the original is lost.

- Full name is written in the upper right corner of the document. the head of a specific department of the Federal Tax Service (from which, in fact, the request came), as well as the full name of the organization, its tax identification number and checkpoint.

- If the tax authorities have requested information regarding several counterparties at once, it is advisable to prepare them on separate sheets.

- If the extract includes more than one sheet, then each of them must be signed and stamped by the head of the company.

- All sheets of the document must be numbered and laced together.

- The head of the company and its chief accountant are responsible for the correctness of the statement.

The extract is sent to the Federal Tax Service Inspectorate by registered mail (in this case, an inventory of papers should be compiled by mail - all sheets of the document offered for the letter) or submitted in person to the department.

Compilation example

It was already mentioned earlier that it is advisable to draw up an extract sheet for a specific counterparty: this way you can reflect in detail all the transactions that were made with him over a certain period (usually a year or quarter).

Accordingly, when receiving a request from the Federal Tax Service regarding several partners, several sheets will be drawn up, the design of which is absolutely identical:

| Firstly | In the upper right corner write the full name of the department of the Federal Tax Service, full name. its manager, the name of the company, its tax identification number and checkpoint |

| Secondly | Next, it is indicated for what period the document is being drawn up in months (for example, for 3 calendar months, not for a quarter) |

| Third | Below are the date and place of drawing up the document, as well as the name of the counterparty company |

All information of interest to the tax department is presented in the form of a table, which has the following fields:

- month in which the transaction was carried out;

- its total amount;

- an indication of which part of the funds provided by the counterparty is affected by VAT at a rate of 18%, 10% and 0%;

- part of the goods (in value terms, which are exempt from VAT).

The data in all columns of the table is summarized and certified by the signature of the manager and chief accountant (if we are talking about an organization), as well as a seal.

Important Features

The following rules must be kept in mind:

- The purchase book can be kept on paper or in electronic format.

- Price parameters must be indicated in rubles. There is only one exception in the form of column 15, which is issued when receiving goods, services or rights to property for the currencies of other states).

- In order not to violate the rules and correctly correct the erroneous mark, the taxpayer must record the invoice on an additional sheet for the same tax quarter when the first invoice was issued. You can cancel the document in the same way.

- A paper purchase book at the end of the next quarter (no later than the 25th day of the month following the end of the quarter) must be signed by the boss (or responsible employee), all pages numbered and laced, sealed.

- Purchase books must be kept for 4 years from the date of the last entry.

Features of registering invoices in the purchase book

Despite the fact that employees of the financial and tax departments issue letters with enviable regularity explaining the procedure for filling out the purchase book and sales book, many accountants do not have a decrease in the number of questions related to the preparation of these documents. Deciding to help our readers, the editors of the “VAT from A to Z” editor sent a request to the Ministry of Finance back in the summer of this year. Recently we finally received a response from the financial department (letter dated November 16, 2006 No. 03-04-09/22).

What they asked So, the editors asked for clarification of the following questions:

“1. The company registers in an additional sheet of the purchase book only those invoices from the supplier that are subject to cancellation (that is, they were compiled with violations). Do we understand correctly that the company should register corrected incoming invoices not in an additional list to the purchase book, but in the purchase book itself? If yes, then in what period should this be done? When was the corrected invoice actually received by the company? Or in the month the original invoice was received?