Let's consider the features of reflecting an advance invoice from a supplier in 1C and accepting VAT for deduction on it.

You will learn:

- what conditions must be met in order to exercise the right to deduct VAT on an advance invoice from a supplier;

- how to register an invoice for an advance payment from a supplier in 1C;

- what document formalizes the acceptance of VAT for deduction from advances issued;

- what transactions and movements in the VAT tax register are formed in the purchase book, what lines of the VAT declaration are filled out.

Registration of SF for advance payment from supplier

Regulatory regulation

The organization has the right to accept for deduction VAT presented by the supplier when transferring an advance payment to him (clause 12 of Article 171 of the Tax Code of the Russian Federation).

VAT on advances issued to suppliers is deductible if the conditions are met (clause 9 of Article 172 of the Tax Code of the Russian Federation):

- the contract provides for advance payment;

- payment was made against future supplies for activities subject to VAT;

- a correctly executed advance SF is available;

- Payment documents are available confirming the transfer of the advance to the supplier.

For the amount of input VAT accepted for deduction:

- in the purchase book, a registration entry is made for the advance SF with the transaction type code 02 “Advances issued”;

- In accounting, the entry Dt 68.02 Kt 76.VA “VAT on advances and prepayments issued” is generated.

In this case, it is necessary to take into account the following features associated with the acceptance of VAT for deduction on advance invoices from suppliers:

- accepting VAT for deduction is a right, not an obligation, therefore it is not necessary to accept VAT for deduction for each tax return, especially if the shipment from the supplier occurs in the same tax period;

- transferring the deduction for advance SF for three years is impossible , because it is provided only for VAT deductions when purchasing goods (works, services).

Making a deduction: necessary conditions

The law provides for conditions under which you can deduct VAT on an advance payment received from a counterparty. Conventionally, they can be divided into two groups:

- Deduction upon shipment of goods. If you act as a supplier (performer), and the buyer, according to the contract, transfers you an advance on account of future deliveries, then you have the right to deduct the amount of VAT from the advance. We emphasize that you can reflect the deduction only upon shipment, and not at the time the advance is credited to your bank account.

- Deduction when returning goods. If, upon receipt of the goods, the buyer finds out that for one reason or another the goods are not suitable for him (not of proper quality, does not correspond to the nomenclature, etc.), then, guided by the terms of the contract, you are obliged to accept the returned goods and return them to the buyer previously received advance. At the time of acceptance of the goods and return of the advance payment, you can take advantage of the deduction. Please note that VAT cannot be deducted from an advance payment for the transfer of property rights.

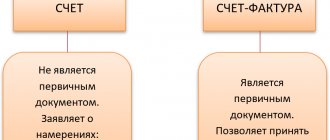

Invoice for advance payment

Those. the deduction for advance SF must be made in the period when the right to it arose (clause 2 of Article 171 of the Tax Code of the Russian Federation, Letter of the Federal Tax Service of the Russian Federation dated 01/09/2017 N SD-4-3 / [email protected] );

Accounting in 1C

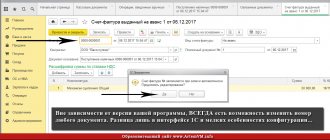

The document Invoice, a received type of transaction for an advance payment, is generated on the basis of the document Write-off from a current account by clicking the Create based on and - Invoice received .

The document Invoice received for advance payment is automatically filled in with the data from the document Write-off from the current account :

- Invoice No. and from – number and date of the invoice received from the supplier;

- Received – the actual date of receipt of the invoice from the supplier;

- Transaction type code - 02 “Advances issued”.

If the document has the Reflect VAT deduction in the purchase book , then when it is posted, entries will be made to accept VAT for deduction.

Find out more about Options for accepting VAT for deduction using the document Invoice received .

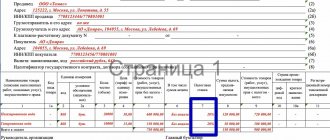

Postings according to the document

The document generates transactions:

- Dt 68.02 Kt 76.VA – acceptance of VAT deduction from the advance payment transferred to the supplier.

The document generates movements in the VAT Purchases register :

- registration of advance SF supplier with transaction type code 02 “Advances issued” for the amount of accepted VAT for deduction.

Purchase Book report can be generated from the Reports – VAT – Purchase Book section. PDF

Reporting

How to reflect a deduction in a purchase ledger

Registration of invoices for advances in the purchase book is carried out by buyers according to the general rule. In this case, the right to deduction arises if the invoice is received during the current quarter - no later than the 25th day of the next month. If the document is registered in the purchase book later than the specified date, then the VAT amount can be deducted in the next quarter.

Registration of accounts must be carried out as the right to deduction arises. The exceptions in this case are invoices for export transactions - they must be registered only if there is a document confirming the right to apply the zero VAT rate.

Creating an invoice for an advance payment from a sales ledger

IHow to automatically generate a sales book in an advance invoice to obtain the following details: payment document number and the date of its creation? I saw how this topic was discussed and people said that this is completely unnecessary... according to the law of 2002.. but according to the government decree of 02.2004, it is necessary that these invoices have a payment number and date. Please tell me! Maybe someone solved this problem?

Get your work in order using the 1C configuration “IT Department Management 8”

ATTENTION!

If you have lost the message input window, press

Ctrl-F5

or

Ctrl-R

or the Refresh button in your browser.

The thread has been archived. Adding messages is not possible.

But you can create a new thread and they will definitely answer you!

Every hour there are more than 2000

people on the Magic Forum.

Entrepreneurs have been using the opportunity to deduct “input” VAT on preliminary payments for a long time. However, the question of whether an “advance” invoice is needed if the shipment occurred within 5 days after the advance payment still remains open.

An accountant often asks whether it is necessary to draw up an “advance” invoice if goods are shipped within 5 calendar days from the date of receipt of the advance payment.

Doing it right

If the seller receives an advance payment, the VAT tax base must be determined twice: on the day the advance payment is received and on the day the goods are shipped (clauses 1 and 14 of Article 167 of the Tax Code). The invoice is also drawn up twice. Initially, upon receipt of an advance, the seller is obliged to issue the mentioned document no later than 5 days from the date of transfer of money, and also register the paper in the sales book (clause 3 of Article 168 of the Tax Code of the Russian Federation). Then, as the obligations are fulfilled, the seller deducts the VAT paid on the advance, again records in the purchase book the already issued invoice for the advance (clause 8 of Article 71 of the Tax Code of the Russian Federation, clause 6 of Article 172 of the Tax Code of the Russian Federation) and issues a new invoice - an invoice upon the sale of goods (works, services) and again registers the paper in the sales book (clause 3 of Article 168 of the Tax Code of the Russian Federation).

Let’s say that the receipt of prepayment and shipment took place in one quarter, and not even 5 days have passed since the receipt of funds. Why, then, use a complex mechanism with “advance” invoices if this does not in any way affect the calculation of the final VAT amount?

And here’s the rub: let’s say the receipt of prepayment and shipment took place in one quarter, and not even 5 days have passed since the receipt of funds. Why, then, use a complex mechanism with “advance” invoices if this does not in any way affect the calculation of the final amount of VAT to be paid to the budget (or reimbursed from the budget)?

Restoring an advance in the VAT purchase book

What is the procedure for the seller to fill out column 15 of the purchase book when partially deducting VAT?

07/29/2019Russian tax portal

Answer prepared by:

Expert of the Legal Consulting Service GARANT

Candidate of Economic Sciences Ignatiev Dmitry

The answer has passed quality control

In the third quarter of 2021, the organization paid an advance in the amount of 2,342,283.58 rubles, VAT 18% - 35,7297.50 rubles. This operation was reflected in the seller’s sales book in the third quarter of 2021 using code “02”. In the fourth quarter of 2021, goods were sold in parts and reflected in the sales book using code “01”. In the purchase book for the fourth quarter of 2018, an entry was made using the code “22”. VAT on the advance payment has been restored.

What is the procedure for the seller to fill out column 15 of the purchase book when partially accepting for deduction the VAT previously calculated by him upon receiving an advance payment from the buyer?

On this issue we take the following position:

Formally, the seller in this case must reflect in column 15 of the purchase book the full amounts of payment, partial payment previously received on account of upcoming deliveries of goods. However, we believe that another approach is also possible: upon the fact of partial shipment of goods on account of the received advance payment, column 15 of the purchase book reflects only the amount of the received advance payment that corresponds to the cost of the goods shipped by the seller.

Justification for the position:

Rules for maintaining a purchase book used in VAT calculations (hereinafter referred to as the Rules), in pursuance of clause 8 of Art. 169 of the Tax Code of the Russian Federation were approved by Decree of the Government of the Russian Federation dated December 26, 2011 N 1137.

Clause 22 of the Rules establishes that invoices registered by sellers in the sales book, upon receipt of the payment amount, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, are registered by them in the purchase book upon shipment of goods (performance of work , provision of services) against the received payment amount, partial payment indicating the corresponding amount of VAT in accordance with clause 6 of Art. 172 of the Tax Code of the Russian Federation.

According to paragraphs. “t” clause 6 of the Rules in column 15 “Cost of purchases according to the invoice, the difference in cost according to the adjustment invoice (including VAT) in the currency of the invoice” of the purchase book indicates the cost of goods (work, services), property rights indicated in column 9 on the line “Total payable” of the invoice, and in the case of transferring the amount of payment, partial payment on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights - the transferred amount of payment, partial payment on the invoice , including VAT. When the seller reflects in the purchase book the amounts of VAT calculated on payment, partial payment received on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights to the persons specified in paragraphs. 1 clause 3 art. 169 of the Tax Code of the Russian Federation, subject to deduction from the date of shipment of goods (performance of work, provision of services) for payment, partial payment, in column 15 the data from column 9 is indicated in the line “Total payable” of the invoice.

The Rules do not establish the specifics of how sellers fill out column 15 of the purchase book with partial deduction of VAT previously calculated on payment, partial payment received on account of upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

Formally, this means that the seller in such cases must be guided by the general procedure for filling out this column, which involves reflecting in it the full amount of payment, partial payment previously received for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights.

At the same time, in our opinion, another approach to filling out column 15 of the purchase book in the analyzed situation is possible, consistent with the procedure for determining the amount of VAT to be deducted from the seller: upon the fact of partial shipment of goods (performance of work, provision of services), transfer of property rights to the account of the prepayment received must reflect only the amount of the prepayment received that corresponds to the cost of the goods shipped by the seller (work performed, services rendered) and property rights transferred.

We have not found any official explanations or materials from judicial practice on the issue of filling out column 15 of the purchase book in such cases. We remind you that the technical features of filling out individual columns of the purchase book are determined by the Federal Tax Service of Russia (clause 25 of the Rules). Given the ambiguity of this issue, we recommend that organizations seek appropriate clarification from the tax department.

Post:

Comments

Expert opinion

If, within 5 calendar days, counting from the date of receipt of the prepayment, goods are shipped against this payment, then invoices for prepayment should not be issued to the buyer, as representatives of the Ministry of Finance claim, this point of view is reflected, in particular, in Letters from October 12, 2011 No. 03-07-14/99, dated March 6, 2009 No. 03-07-15/39. To justify their position, officials refer to the provisions of paragraph 3 of Article 168 of the Tax Code of the Russian Federation, but they do not provide any additional argumentation.

At the same time, financiers did not fail to note that the organization is still obliged to issue an invoice for the advance payment received, regardless of in which quarter the prepaid goods are shipped. They also indicate the obligation of companies to charge VAT both on the day of receipt of the advance payment and on the date of shipment of goods, if both dates fall within the same quarter. This position is shared by tax officials.

Yana Lazareva, expert at Calculation magazine

« Previous :: Next »