Introduction

Today, on the Internet and even in specialized magazines, you can easily find information on how to prepare a VAT Declaration in the 1C: Accounting 8, edition 3.0 program. Also, many resources have published articles about the organization of VAT accounting in this program and about the existing VAT accounting checks in the program and ways to find errors.

Therefore, in this article we will not once again describe in detail the principles of organizing VAT accounting in 1C: Accounting 8; we will only recall the main points:

- For VAT accounting, the program uses internal tables, which in 1C terms are called “Accumulation Registers”. These tables contain much more information than in the postings on account 19, which allows you to reflect in the program

- When posting documents, the program first performs movements in the registers, and based on the registers it generates postings for accounts 19 and 68.02;

- VAT reporting is generated ONLY according to register data. Therefore, if the user enters any manual entries into VAT accounts without reflecting them in the registers, these adjustments will not be reflected in the reporting.

- To check the correctness of VAT accounting (including the correspondence of data in registers and transactions), there are built-in reports - Express check of accounting, VAT accounting analysis.

However, the average accountant user is much more accustomed to working with “standard” accounting reports - Balance Sheet, Account Analysis. Therefore, it is natural that the accountant wants to compare the data in these reports with the data in the Declaration - in other words, check the VAT Declaration for turnover. And if the organization has simple VAT accounting - there is no separate accounting, no import/export, then the task of reconciling the Declaration with accounting is quite simple. But if some more complex situations arise in VAT accounting, users already have problems comparing data in accounting and data in the Declaration.

This article is intended to help accountants perform a “self-check” of filling out the VAT Return in the program. Thanks to this article, users will be able to:

- independently check the correctness of filling out the VAT Declaration and compliance of the data in it with accounting data;

- identify places where the data in the program registers diverges from the data in accounting.

Example of filling out line 070

We will show you how to fill out line 070 of section 3 of the VAT return using an example.

LLC "PolyTekhProm" is engaged in the wholesale supply of metal structures according to customer orders. The company concludes contracts with the condition of prepayment (from 10% to 50% of the contractual delivery amount).

In the second quarter of 20XX, PolyTechProm LLC:

- sold metal structures in the amount of RUB 24,000,000. (including VAT = RUB 4,000,000);

- received an advance payment in the amount of 12,000,000 rubles. (VAT = 12,000,000 rubles × 20 / 120 = 2,000,000 rubles);

- purchased metal and components from suppliers in the amount of RUB 13,200,000, including VAT = RUB 2,200,000.

Thus, in the first quarter:

- accrued VAT amounted to RUB 6,000,000. (RUB 4,000,000 + RUB 2,000,000);

- VAT deductible: RUB 2,200,000;

- VAT payable: RUB 6,000,000. – 2,200,000 rub. = 3,800,000 rub.

How PolyTechProm LLC will fill out section 3 (including line 070) of the VAT return, see the sample (only completed lines are shown):

Read about the nuances of filling out each line of the VAT return in ConsultantPlus. To do everything correctly, get trial access to the system and go to the Ready solution. It's free.

Initial data

So, for example, let’s take an organization that is engaged in wholesale trade. The organization purchases goods both on the domestic market and through import. Goods can be sold at rates of 18% and 0%. At the same time, the organization maintains separate VAT accounting.

In the first quarter of 2021, the following transactions were recorded:

- Advances were issued to suppliers, invoices for advances were generated;

- Received advances from customers, generated invoices for advances;

- Goods were purchased for activities subject to 18% VAT;

- Goods were purchased for activities subject to 0% VAT;

- Imported goods were purchased, customs VAT was registered;

- Input VAT has been registered for the services of third-party organizations, which should be distributed to operations at 18% and 0%;

- A fixed asset was purchased at a VAT rate of 18%, the tax amount must be distributed among operations at different VAT rates;

- Goods were sold at a VAT rate of 18%;

- Goods were sold for activities subject to 0% VAT;

- Some of the goods on which VAT at a rate of 18% was previously accepted for deduction were sold at a rate of 0% - the restoration of VAT accepted for deduction is reflected;

- The shipment without transfer of ownership and then the sale of the shipped goods are reflected;

- Confirmed 0% rate for sales;

- Regular VAT operations were completed - sales and purchase book entries were generated, VAT was distributed for transactions at 18% and 0%, purchase book entries were prepared for the 0% rate.

What information does line 130 of the VAT return contain?

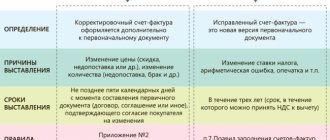

Partners who work on a prepaid basis are familiar with filling out this line. Buyers who have made an advance payment and received an advance invoice with a separate VAT amount, write this value in line 130, since it is entered into the document to reflect the received right (not obligation!) to deduct VAT on the payment made (clause 12 of Article 171 of the Tax Code RF).

Line 130 is located in the deductions part of section 3 of the declaration. The latest changes to the document form (order of the Federal Tax Service dated December 28, 2018 N SA-7-3/853) did not affect it - the line number and name were retained. The tax on the advance payment is calculated by separating its value from the total amount of the advance payment at a calculated rate of 20/120 or 10/110, depending on the category of goods. The advance invoice must be submitted to the supplier no later than 5 days from receipt of payment.

The deduction from the advance payment mirrors the obligations of the seller who received the advance payment to calculate VAT payable on it. It is important to remember that the deduction is applicable to any advance receipt - both monetary and non-monetary.

To exercise the right to such a deduction, the buyer should:

- In the supply agreement, indicate a mandatory condition for the transfer of an advance payment;

- Transfer the advance and have payment documents confirming this fact (acts of transfer of property or offset of claims);

- Receive an invoice from the supplier for the amount of the advance with allocated VAT and register it in the purchase book;

- Paid purchases will be used in activities subject to VAT.

The buyer may refuse to use the deduction. It is better if the decision on its application or non-application is recorded in the company's accounting policy.

1.Verified data

After completing all regulatory VAT operations, the VAT Declaration is completed with us as follows:

Lines 010-100:

Lines 120-210:

Let's start checking the Declaration.

Line 090: Data Display Guide

In section III of the VAT return on line 090, from the total amount of restored VAT on line 080, the tax that was accepted for deduction in the reporting period when transferring partial and full prepayment to the supplier is displayed, and is now recognized as closed and restored due to the receipt of valuables, writing off the debt to the seller or termination of the contract with him. Thus, the amount on line 090 is a component of the amount on line 080.

In order to avoid errors in calculating the amount of tax and to correctly enter it in the declaration in line 080 of section 3, transfer the total amount for tax recovery from the sales book, and in line 090 separately display the amount of VAT recovered from the prepayment invoice.

Or on the website. It's fast and free!

2.Check Section 4

To begin with, since we had sales at a 0% rate, let’s check the completion of Section 4 of the Declaration:

To do this, you need to compare the data in Section 4 with the turnover on account 19 according to the VAT accounting method “Blocked until confirmed 0%” in correspondence with account 68.02. To do this, we will generate an “Account Analysis” report for account 19, setting it to select by accounting method:

The credit turnover on account 68.02 in this report shows us the total amount of tax that “fell” on confirmed sales at a rate of 0%. This amount must coincide with line 120 of Section 4 of the VAT Declaration .

Reinstatement of VAT to the supplier on partial prepayment

Below is a list of reasons why an advance may be considered closed:

- delivery of the goods for which the advance payment or part thereof was transferred has been completed;

- the supplier returned the advance payment in full or in part.

- the advance on account of subsequent delivery ceased to qualify as such due to a change in its purpose;

- there was a fact that the amount of an unclosed prepayment was written off to the financial results;

- prepayment is taken into account when offsetting mutual claims.

The tax authorities may require an explanation in case of refusal to restore the tax.

When recovering the amount of value added tax (which corresponds to the amount of the closed prepayment at the calculated rate), the accounting entry is carried out as follows:

D 76 / VA K68 / 02,

where 76 / VA is a subaccount for VAT accounting for the prepayment issued.

The restored amount is defined as the turnover in the debit of subaccount 76/VA in correspondence with the credit of subaccount 68/02 for the reporting period in the declaration.

Only a cadastral engineer has the right to determine the boundaries of a land plot.

Have you not received your land tax receipt? How to pay the fee in this case, read here.

What does the land plot plan look like? You will find a sample in this article.

3.Check Section 3

Next, we check Section 3 of the Declaration. The main report that we will use when checking Section 3 of the Declaration is Analysis of Account 68.02. For the 1st quarter of 2021, the report looks like this:

- Line 010

This line shows the amounts from the sale of goods, works, services at a rate of 18% and the amount of tax calculated from such transactions. Therefore, the amount of tax on this line must correspond to the amount of credit turnover on account 68.02 in correspondence with accounts 90.03 and 76.OT (shipments without transfer of ownership):

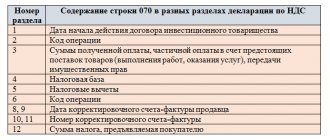

- Line 70

Line 070 indicates the amount of VAT on advances received from customers in the reporting period. Therefore, to check this amount it is necessary to look at the credit turnover on account 68.02 in correspondence with account 76.AB :

- Line 080

The line should reflect the VAT amounts subject to recovery for various transactions. This line includes the amount of VAT on advances to suppliers credited in the reporting period, as well as the amount of VAT recovered when changing the purpose of use of valuables.

VAT on advances to suppliers is accounted for in account 76.VA, so we check the amount of credited VAT against the credit turnover of account 68.02 in correspondence with account 76.VA. The amounts of restored VAT are reflected in accounting as credit turnover on account 68.02 in correspondence with subaccounts of account 19 :

- Line 090

This line is a clarification to line 080 - the amounts of VAT on advances to suppliers credited in the reporting period are shown separately here:

- Line 120

How to check line 120 of the VAT return if the organization maintains separate accounting for VAT? The line must reflect the amount of tax on purchased goods, works, services, which is subject to deduction in the reporting period. Therefore, to check the value of this line, it is necessary to subtract the turnover on the debit of account 68.02 in correspondence with accounts 19.01, 19.02, 19.03, 19.04, 19.07 the turnover on account 19 using the VAT accounting method “Blocked until confirmation of 0%” in correspondence with account 68.02 (amount , specified in line 120 of Section 4 of the Declaration).

- Line 130

The line indicates the amount of VAT on advances issued to suppliers in the reporting period. We check the amounts of accrued VAT using the debit turnover of account 68.02 in correspondence with account 76.VA :

- Line 150

Line 150 indicates the amount of VAT paid at customs when importing goods. The value in this line must match the debit turnover on account 68.02 in correspondence with account 19.05 :

- Line 160

The line is filled in with the amounts of VAT that our organization paid when importing goods from the countries of the Customs Union. This line is checked against the debit turnover of account 68.02 in correspondence with account 19.10 :

- Line 170

And finally, line 170 is filled in with VAT amounts on buyer advances received during the reporting period. This value is reflected in accounting as a debit turnover on account 68.02 in correspondence with account 76.AB :

Procedure for tax refund on advances

The supply agreement may provide for partial or full prepayment for products, work or services. The use of such calculation options allows companies, using clause 12 of Art. 171 of the Tax Code of the Russian Federation, accept for offset the VAT included in the amount of the advance payment. It is first necessary to secure this provision in the company’s accounting policies.

In addition, to implement the above opportunity, the following documents are required:

Original payment document.

A contract that necessarily contains a condition for partial or full advance payment.

Having fulfilled all the requirements, the buyer can take credit for the tax paid along with the advance payment, but only at the end of the accounting period. This is due to the fact that over time the goods may be fully supplied, so the refund must be made after the time allowed for the formation of the tax base.

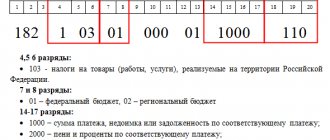

For all prepayments made at the end of the tax period, the amount of VAT is determined by multiplying it by the appropriate tax rate. After which, an account is generated for the received value: Dt 68 “VAT” Kt 76 “Advances issued”.

The turnovers received from all transactions are added up, and the result is entered into the declaration on line 130 “The amount of tax presented to the taxpayer-buyer when transferring the amount of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, subject to deduction from buyer."

This is interesting: Work experience for early retirement

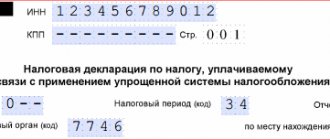

How to enter data into it is stated in clause 38.9 of the Procedure for filling out a tax return for value added tax, approved by Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3 / [email protected] (hereinafter referred to as the Procedure for filling out).

4.Results of the inspection

If we put together all the checks for Section 3 and reflect them in the “Account Analysis” report for account 68.02, we will get this “coloring”:

Based on the results of the audit, we see that all the amounts reflected in the accounting “found” their place in the VAT Declaration. And each line from the Declaration, in turn, can be deciphered by us from the position of reflecting the data in accounting. Thus, we are convinced that all operations in the program are reflected correctly, without errors, the data in the registers and transactions match and, therefore, our VAT reporting is correct and reliable.

How to correctly format line 090

The total values obtained from records of tax restoration in connection with the supply of products previously paid in advance are entered in cell 090, which is part of section 3 of the declaration. Field name “Tax amounts subject to recovery in accordance with subparagraph. 3 p. 3 art. 170 of the Tax Code of the Russian Federation” fully reflects the content of the data entered into it.

At the same time, the amount from this cell is included in the total amount of the restored tax given in line 080 “Tax amounts subject to restoration, total”. This is stated in Art. 38.5 Filling procedure.

The amounts received in field 080 participate in the formation of the final tax burden in field 110 “Total tax amount calculated taking into account the restored tax amounts.” It is also part of section 3, and the sequence of filling it out is regulated by clause 38.7 of the Filling Out Procedure.

The state gives buyers the opportunity to offset partially paid VAT on advances for the upcoming supply of products. At the same time, after receiving the previously paid batch of products, the tax accepted for deduction must be calculated again and transferred to the appropriate budget. In order to reflect the restored tax in the VAT return, line 090 is used, which is included in section 3. The rules for its registration are established by order No. ММВ-7-3 / [email protected]

Current practice suggests that attempts by organizations to challenge the need to restore taxes end in court proceedings, and decisions in favor of the taxpayer are not made so often.

Tax deductions for VAT

Article 171 of the Tax Code of the Russian Federation stipulates that tax deductions are made on the basis of invoices issued by sellers after the purchase of goods. The VAT tax deduction also applies to goods and property rights. The main condition is confirmation of physical payment of tax when importing into Russia or other states that are under its jurisdiction.

Tax deductions for VAT are carried out not only on documents that confirm the amount of payment, but also on other confirming forms, in accordance with paragraphs 3-8 of Article 170 of the Tax Code of the Russian Federation.

The conditions for a VAT tax deduction are:

- Goods accepted for accounting and property rights that will be applied for VAT-taxable transactions;

- Work, property and rights have been taken into account;

- There is an invoice, which is issued in full compliance with Article 169 of the Tax Code of the Russian Federation;

- There are other documents that indicate the fact of payment of VAT on the purchased goods;

- VAT can be refunded after paying the tax or paying for the goods.

A VAT deduction can be obtained from:

- Amounts of taxes paid by tax agents;

- Amounts of taxes that are presented by the seller to the buyer and paid by sellers for the sale of this product;

- Amounts of taxes paid by the seller after the goods are returned by the buyer during the warranty period;

- Amounts of tax paid by the taxpayer on partial payment towards future supplies;

- Amounts of tax that are presented to contracting firms when carrying out capital construction or installation of fixed assets;

- Amounts of tax paid for construction materials necessary to complete capital construction;

- Tax amounts spent on construction work for personal consumption. The cost of such work should be included in expenses when calculating income tax:

The funds that the taxpayer received as a contribution to the authorized capital, property, property rights and intangible assets are subject to tax deduction under Article 170 of the Tax Code of the Russian Federation. However, such a deduction is applied only in cases where transactions are recognized as objects of taxation.

What are the tax deductions for VAT?

According to current legislation, tax payments can be divided into general and special. General taxes are governed by basic rules that support the possibility of such a refund. Due to the fact that the main object of taxation is sales, in this case the VAT deduction will be an “output” tax on the acquisition. This is regulated in the second paragraph of Article 171 of the Tax Code of the Russian Federation. The remaining deductions mentioned in paragraph 2-12 of the same article are special and apply to certain situations. Among them are those cases where funds were spent:

- During business trips;

- When issuing an advance;

- When returning goods;

- During capital construction and construction work;

- When prices for goods and services change.

When calculating the amount of tax deductions for VAT, the provisions of Article 171 of the Tax Code of the Russian Federation should be taken into account. The final VAT amount is obtained by summing incoming and outgoing VAT; for this reason, it can be used as an offset to the amount of tax already paid as part of payments to suppliers.

VAT restoration: mission accomplished

The list of cases when it is necessary to restore “input” VAT is quite extensive. This includes the receipt of goods for which an advance payment was previously made, and the use of property in non-VAT-taxable activities, and the seller reducing the cost of previously shipped goods, etc.

An article prepared based on materials from the reference book “Annual Report 2012”

Value added tax, previously accepted for deduction, must be restored, for example, when using certain values:

— for transfer to the authorized capital of other companies;

— conducting activities that are not subject to VAT;

— sales outside the territory of the Russian Federation;

— carrying out operations that are not considered the sale of goods (works, services).