Home » Payment systems » When do you need to connect a payment agent, and when do you need an online cash register?

0

MasterCode 07/26/2019 3179

Despite the great popularity of online shopping, many people still confuse payment agents and online cash registers. Let's figure it out.

Payment agent is a legal entity or individual entrepreneur engaged in accepting payments from individuals. Not all payment agents meet the modern requirements of the Federal Tax Service of the Russian Federation.

Online cash register is a cash register technology that complies with the new edition of Federal Law 54. Such a cash register sends electronic receipts to the fiscal data operator immediately after payment has been processed. The OFD, in turn, registers checks and redirects them to the tax office.

Thus, the payment agent and the online cash register solve completely different problems: the first was created to increase the number of payments, the second to legalize business activities and issue automatic reports to the tax authorities.

What cash registers do agents need?

Agents who transact with a third party on its own behalf and at the expense of the principal, use online cash registers on a general basis, however, they must indicate in the cash receipt some additional details that characterize them as an agent, as well as the details of the supplier or principal. There is no special cash register equipment for agents; they can use any cash register available in the Cash Register Register. This can be a portable device, for example, Mercury or MSPOS, or a fiscal registrar, for example, Atol or Shtrikh.

Agents, principals and online cash desks between them

If a law has been adopted in Russia, this does not mean that it works. If the law seems to be working, this does not mean that everything will be the same in six months. Therefore, it is better to prepare for each law purely as a student or in Russian - at the very last moment or even a little later. It has long been known: if you rush, you will make people laugh. But in the case of Law 54, it was not those who needed it who rushed, and it was not the people who laughed, but the state and especially the cash oligarchs. By the way, some of these representatives can really be called people with a stretch.

We will talk about one Internet company. We won’t personalize it, conventionally calling it something rollicking - “Eh-stretch-your-soul-into-an-accordion-company,” for example. This is a collective image. There are thousands of similar companies and entrepreneurs in Russia. The first half of 2017 was the same for everyone.

Online checkouts and selection

So, in March, the “Eh-stretch-your-soul-into-an-accordion-company” (ERDGK), the horse had not yet fallen.

In April, he lay down a little and turned on his side. In May, he was finally fully harnessed. And along with the horse and a lawyer. And he began to plow and look for the best offers at the online checkout. In the same May, Atol.Online finally entered the market with the first of its kind specific offer for renting a cash register as a service. Almost immediately the ERDGK (not to be confused with Erdogan and RDGK-10 - both examples are about gas pressure) settled on Atol. But for the sake of decency, I studied competitors. Moreover, every competitor, no matter who you take, had more profitable offers. But something was still missing.

Starrus, a checkout-as-a-service solution similar to Athol’s, was slightly cheaper, but became available only in July, after Law 54 came into force. Iretail never got the opportunity for a checkless machine, that is, they apparently didn’t count on a pure online business at that time. Maybe things have changed now. Kassa24.Online - Strof partners - were the most attractive and cheapest, but they started too late. And they didn’t offer the same online box office rental. Just buy Shtrikh and install it next to your computer. And struggle with maintenance. There were also numerous intermediaries, all integrated as one with Atol.

Therefore, no matter how much I wanted to go to the dear and important Atol, I had to. Moreover, to fork out for several cash registers, although ERDGK is not such a big company, in terms of turnover, one would be enough.

We decided, tested with grief in half and connected. July was approaching. A week before, the Ministry of Finance reassured everyone by deferring the execution of the sentence for persons released on parole (Already Executed Agreement). The ERDGK, and at the same time the whole country, breathed a sigh of relief and went on vacation. But that was after the first of July. And there was also a day before...

Online cash registers and drawbar

It must be said that in April and May the company consulted with the local tax office.

She asked what she should do, which clients should connect online cash registers and in what cases, and which should not. There was only one answer: by law, every entrepreneur is required to use cash registers when making payments. So everyone should connect. And all this in a pleasant female voice. That is, if the company that owns the marketplace works with an entrepreneur, then the cash register must be connected by both the company and the entrepreneur. It was not clear how to separate payments from buyers in this case. That is, each operation must go through two cash registers in duplicate? The seller-principal and the company-agent (they worked with clients under a classic agency agreement)? Nobody at the tax office gave a clear answer to these questions, because Federal Law-54 was also a surprise to them. And the Internet was full of contradictory debates. At this time, alarmingly positive news was constantly floating around about the progress of preparations for the law: “More than half of the entrepreneurs have already acquired online cash registers, and for the other half there are not enough of them due to the lack of fiscal drives, of which 2 times more have already been produced,” than cash registers, but it’s unclear where they ended up in the hands of speculators, that is, us. In this regard, the preliminary results of the transition under Law 54 can be called not only satisfactory, but also optimistic, although one third of entrepreneurs will not have time to switch to online cash registers by the first of July and will be fined, despite the delay.”

Something like this if you season it with vinaigrette.

July was approaching. On June 30, the ERDGK decided to clarify whether the position of the local tax office on the double cash issue had changed. Just in case - you never know - even the thought of the tax office can be fleeting. And a miracle! A pleasant female, but now cruel-sounding voice said: if ERDGK is an agent under an agency agreement, then it must accept payments for goods through its cash register. The principal entrepreneur selling goods through this company is absolutely not obliged to connect a cash register.

And a couple of weeks later, mere mortals received an explanatory letter from the Ministry of Finance regarding the agency agreement. The date was June 26, but it appeared on the Internet only in mid-July. According to this letter, the almost official position of the tax office is as follows:

Under a transaction made by an agent with a third party on his own behalf and at the expense of the principal, the agent acquires rights and becomes obligated, even if the principal was named in the transaction or entered into direct relations with the third party for the execution of the transaction. Taking into account the above, when selling goods by an agent, CCT is mandatory. At the same time, in accordance with the above paragraph, in a transaction concluded by an agent with a third party on behalf and at the expense of the principal, the rights and obligations arise directly from the principal. In this case, the CCT is applied by the principal.

Why is the position “almost” official?

Because the letter is explanatory in nature and does not entail the emergence of legal norms. What the tax office points out right there, hinting at absolute democracy in Russia (fantastic!):

... the directed opinion of the Department is of an informational and explanatory nature on the application of the legislation of the Russian Federation and does not prevent one from being guided by the norms of legislation in an understanding that differs from the interpretation set out in this letter.

In fact, this means that if you have a different understanding of Law 54, the tax office will have to explain it in court if specific disagreements arise.

Because for tax employees, management’s opinion has more than a regulatory nature. More likely, even an obsequious regulatory nature. And they will defend exactly this opinion. Everything would be fine - this is even great news for customers. After all, you won’t have to shell out fifty dollars at your cash register. Yes, only ERDGK, just like the state, strongly advised clients to connect their online cash register before July 1. And among them there were the most conscientious ones who went and did as the law commanded. And besides, several solutions for various cash registers have already been implemented on the ERDGK Internet platform - why, one might ask, if there is such a turnaround from July 1 - and only one is enough - your own? I had to quickly withdraw the offer and apologize, explaining the advantages of the new option. And also change the integration option to the appropriate one.

Think about it for a moment. If one company has so many entrepreneurial clients who bought unnecessary cash registers, then how many are there throughout the country? And why did this option become widely available and almost officially permitted right before the first of July?

Online cash registers and life's uncertainty

At the same time, similar options with an agency agreement from little-known but increasingly popular services on forums began to appear online. Because the desire to still get away from the expensive Law-54 is quite understandable. And at the moment there are several controversial options to avoid connecting online cash registers:

- We have already talked about the agency agreement (do not confuse the relationship with the paying agent with it - this is another story and even the law is 161). Briefly, the scheme looks like this: entrepreneur -> agency agreement -> platform agent -> cash desk -> buyer.

- Through the invoicing system using the Nextpay service as an example. It is very widely discussed and also criticized. The point is to relieve the seller of such an important element as the moment of payment. That is, the seller issues an invoice, the buyer pays it through the bank in any way, a check is not needed, because The moment of payment is unknown to the seller. This scheme promises to be declared illegal soon.

- Working with courier services. This is a special version of the first. Only here all types of delivery except courier are excluded. And an agency agreement is already concluded with the delivery service. And the moment of payment is postponed to the time of delivery.

- And yet the most popular, judging by the criticism of the law, is “Lie low in Bruges (Gdov, Rzhev, Mtsensk, Lensk...).” And the most risky. But half the country lives exactly like this. Only if it is relatively simple to conduct a shadow business offline, then online entrepreneurship becomes more and more difficult with each re-adjustment of Roskomnadzor.

Now in “Eh-stretch-your-soul-into-an-accordion-company” everything seems to be fine.

Clients still ask what’s the catch, and why don’t they need to connect an online cash register? They don't believe their luck. ERDGK doesn’t believe it either. And the option of integrating each client into the cash register system is still kept in reserve. Because in December the Ministry of Finance promised to formulate amendments to Law 54. He is waiting for December ERDGK and is tormented by simple complex questions: who is laughing the most in this situation? And how many people in power have made money by selling unnecessary devices, expensive flash drives, as well as profiteering with the law? And the answer appears, although out of place, but, so to speak, rhetorical, not requiring further questions: “This is Russia. Business".

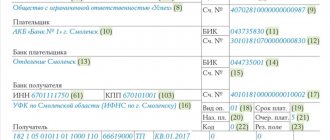

What details should the agent indicate on the cash receipt?

The composition of the additional details of a cash register receipt depends on what kind of agent the cash register user is. There are 7 types of agents:

- bank payment agent;

- bank payment subagent;

- payment agent;

- payment subagent;

- attorney;

- commission agent;

- an agent who is not a bank paying agent (subagent), paying agent (subagent), attorney, commission agent.

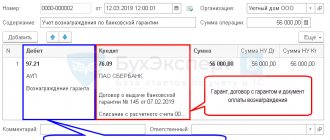

The bank payment agent or bank payment subagent must indicate the following additional details on the cash receipt:

- agent sign: BANK. PL. AGENT or BANK. PL. SUBAGENT;

- payment agent phone number;

- payment agent operation;

- other details provided for by Federal legislation.

A complete list of details that the bank payment agent (subagent) must indicate in a cash receipt or BSO is given in Appendix No. 2 to the Federal Tax Service Order No. 229 dated March 21, 2017.

The paying agent or paying subagent must indicate the following additional details in the cash receipt:

- agent sign: PL. AGENT or PL. SUBAGENT

- payment agent phone number;

- telephone number of the payment acceptance operator;

- other details provided for by Federal legislation.

A complete list of details that the paying agent (subagent) must indicate in the cash receipt or BSO is given in Appendix No. 2 to the Federal Tax Service Order No. 229 dated March 21, 2017.

A reseller acting on behalf of a principal on the basis of an agency agreement must indicate the following additional details on the cash receipt:

- agent attribute: ATTORNEY;

- supplier's tax identification number;

- other details provided for by Federal legislation.

A complete list of details that the attorney must indicate in the cash receipt or BSO is given in Appendix No. 2 to the Federal Tax Service Order No. 229 dated March 21, 2017.

A reseller acting on behalf of a principal on the basis of a commission agreement must indicate the following additional details on the cash receipt:

- agent attribute: COMMISSIONER;

- supplier's tax identification number;

- other details provided for by Federal legislation.

A complete list of details that the attorney must indicate in the cash receipt or BSO is given in Appendix No. 2 to the Federal Tax Service Order No. 229 dated March 21, 2017.

Another agent who is not a bank paying agent (subagent), paying agent (subagent), attorney, commission agent, must indicate the following additional details in the cash receipt:

- agent attribute: AGENT;

- supplier's tax identification number;

- other details provided for by Federal legislation.

Are a payment aggregator and a payment agent equal?

To figure out whether a payment aggregator can simultaneously be a payment agent, let’s define the latter.

In accordance with Art. 2 clause 3 FZ-103 “On activities for accepting payments from individuals carried out by payment agents.” An agent is a legal entity (with the exception of a credit organization) or an individual entrepreneur engaged in accepting payments from individuals.

We see that credit institutions, which are all payment aggregators, do not have the right to print checks on behalf of the online store. To confirm our reasoning, we can cite the words of a representative of the Yandex Money service.

Yandex.Money operates under a license from the Central Bank as an NPO - a non-bank credit organization.

By law, a credit institution is not and cannot be a paying agent. It has different functionality and a different purpose. For exactly the same reason, banks are not payment agents. So our aggregator (Yandex.Checkout), which is a Yandex.Money service, has exactly the same responsibilities as banks that provide online stores with Internet acquiring services. And among these responsibilities is not sending an electronic fiscal receipt.Yandex.Checkout technically accepts payments from customers and notifies the store as soon as the payment has been completed. At this point, the seller must send an electronic check to the buyer and provide a copy of it to the tax office.

What then is the point of existence of payment aggregators?

Since payment aggregators will not be able to become payment agents, a logical question arises: what are the benefits for entrepreneurs from cooperation with aggregators?

The main value of payment aggregators is that they are created to relieve the end user of the need to enter into several agreements with various banks or payment systems to accept online payments using bank cards and electronic money.

It can be assumed that the lack of functionality for printing receipts for online stores will not discourage entrepreneurs from collaborating with payment aggregators.

KORADA.NEWSLETTER - WE WRITE ABOUT PEOPLE, STORIES AND WORK

- Interesting and Useful articles and cases.

- Seminars and trainings of the “Business in Slippers” project.

- Important information on 1C and not only “in human language”.

More information about the newsletter

Agent details in the cash receipt

You should be very careful about setting up the agent's cash register so that the Federal Tax Service does not accept the entire amount of the position that the agent indicates in the cash receipt on behalf of the principal as the agent's income. After all, the agent's profit in the form of agency fees or commissions is usually significantly less than the amount indicated on the cash receipt. In order to avoid lengthy and unpleasant proceedings, it is better to do everything right at once.

In addition, incorrect setup of the cash register itself can lead to a violation of the procedure and conditions for the use of cash register systems (Clause 4 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation).

The principal and his agent may apply different tax systems, and this will also be reflected in the cash receipt. For example, the agent uses the simplified tax system, and the principal uses the simplified tax system. In this case, in the check item relating to the principal's goods or services, the agent must indicate the VAT rate. The tax amount for each rate in the appropriate tag will be sent to the Federal Tax Service, and therefore care should be taken to ensure that the principal's taxes are separated from the agent's taxes on the cash receipt.

Errors in indicating tax rates and in allocating the amount of tax are at least Article 14.5 of the Code of Administrative Offenses of the Russian Federation. Incorrect details on the check are a violation of Article 4.7 of 54-FZ.

Cash register has several options for indicating agency characteristics in a cash receipt, since the law does not prohibit registering your own goods/services in a cash receipt along with agency goods/services. Our specialists will help you set up your cash register correctly.

What else should be on the cash receipt?

Responsibility of the paying agent

If a legal entity has violated the law in the area of using an account or not transferring money (not transferring the entire amount or not transferring it), then it may be brought to administrative liability. The fines for this are as follows: legal entities - 40-50 thousand rubles*, individual entrepreneurs - 4-5 thousand rubles. Moreover, if a person does not have registration with the financial monitoring service, he will be held accountable for lack of registration to carry out entrepreneurial activities or for violating registration rules. Penalties are regulated by the Law of the Code of Administrative Offenses of the Russian Federation No. 15.1, paragraph 2.

How to include additional agent details in a cash receipt

In order for the cash register to be able to indicate the characteristics of the agent and their additional details in the cash receipt, the following conditions must be met:

— you need to clearly know what type of agent you are: a bank payment agent (subagent), a payment agent (subagent), an attorney, a commission agent, or another agent who is not a bank payment agent (subagent), a payment agent (subagent), an attorney , commission agent;

— program an agent attribute into the cash register; it is permissible to specify several agent attributes;

— the cash register firmware must support the agent scheme for using the cash register;

— when using a fiscal registrar, the agent operating scheme must also be supported by cash register software.

How to conduct cash transactions for paying agents

Payment agents are organizations or entrepreneurs providing services for accepting payments from citizens in favor of suppliers of goods, works, services (Part 1, Article 1, Clause 1, 3, Article 2 of the Law of June 3, 2009 No. 103-FZ).

Application of CCP

Payment agents using payment terminals or ATMs are required to:

— install a cash register in a payment terminal or ATM, regardless of who owns it. The cash register must be installed inside the terminal (ATM) housing containing a device for accepting or dispensing cash;

— register the cash register with the tax office. When registering a cash register, the agent must indicate the address of the place where it is installed as part of the terminal (ATM);

— use a working cash register and operate it in a fiscal mode;

— issue a cash receipt;

— maintain and store documentation on CCP;

— provide inspectors with access to the cash register and documentation for it.

This procedure is established by paragraph 2 of Article 5 of the Law of May 22, 2003 No. 54-FZ, parts 1, 3 of Article 6 of the Law of June 3, 2009 No. 103-FZ.

CCP models that can be used are included in the State Register (Clause 1, Article 3 of Law No. 54-FZ of May 22, 2003).

Maintaining the State Register of CCPs is entrusted to the Federal Tax Service of Russia (clause 5.5.11 of the Regulations approved by Decree of the Government of the Russian Federation of September 30, 2004 No. 506). The procedure for maintaining the register, the requirements for its structure and composition are established by the Rules approved by Decree of the Government of the Russian Federation of January 23, 2007 No. 39.

The list of cash register models that payment agents (subagents) have the right to use is given in the letter of the Federal Tax Service of Russia dated April 15, 2014 No. ED-4-2/7212.

Rules for conducting cash transactions

Paying agents are required to comply with the general rules for conducting cash transactions. But there are also features:

— when determining the cash balance limit for the general cash register, payments received from citizens should not be taken into account (paragraph 3, paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014);

— payments received from citizens are received at the cash desk in a separate cash receipt order according to form No. KO-1 (paragraph 2, clause 5.2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014);

— to record payments from citizens, you need to keep a separate cash book in form No. KO-4 (paragraph 2, clause 4.6 of the Bank of Russia Directive No. 3210-U dated March 11, 2014).

Situation: how can payment agents set a cash balance limit: with or without taking into account funds received from the public?

When calculating the cash balance limit, only the volume of receipts (expected volume of receipts) of cash for goods sold, work performed, services rendered or the volume of cash issued is taken into account. In this case, the paying agent should not include in the calculation funds received from citizens as payments. Thus, the paying agent should not set a limit on the cash balance for citizens’ funds.

If a paying agent charges a commission for its services, then when calculating the cash balance limit, the commission itself must be taken into account.

Determine the cash balance limit for the billing period based on the volume of cash receipts for goods sold, work performed, services rendered using the formula:

| The volume of cash proceeds accepted for calculating the limit | = | Volume of cash receipts for all types of activities for the billing period (including commissions) | – | Volume of revenues from the activities of the paying agent |

When calculating the limit, if there is no cash proceeds, use only the amount of cash issued for the billing period.

This conclusion follows from the provisions of paragraphs 2 and 3 of clause 2 of Bank of Russia Directive No. 3210-U dated March 11, 2014, and annex to Bank of Russia Directive No. 3210-U dated March 11, 2014.

Determine the amount of payments accepted from the population on the basis of separately issued cash receipt orders. This follows from paragraph 2 of clause 5.2 of the Bank of Russia instruction dated March 11, 2014 No. 3210-U.

An example of calculating the cash balance limit at the cash register. Cash proceeds and payments from citizens are received daily

Hermes Trading Company LLC calculates the cash balance limit based on accounting data, based on the volume of cash receipts for January, February and March of the previous year. Hermes has no separate divisions. The proceeds are deposited in the bank every fifth day.

Hermes is open seven days a week from 10 a.m. to 10 p.m. Therefore, the billing period is 90 working days (31 days + 28 days + 31 days).

The turnover from the debit of account 50 “Cash” in correspondence with the credit of accounts 90 “Sales”, 62 “Settlements with buyers and customers” in terms of cash advances received in the billing period, which were offset in the same period, 76 “Payments of citizens” amounted to RUB 2,969,998: - in January - RUB 977,388. (including payments from citizens - 90,000 rubles); — in February – 877,015 rubles. (including payments from citizens - 75,000 rubles); — in March – 1,115,595 rubles. (including payments from citizens - 105,000 rubles).

The Hermes accountant calculated the permissible limit for the cash balance in the cash register: RUB 149,999.89. ((RUB 2,969,998 – RUB 270,000): 90 days × 5 days).

Based on these data, the head of the organization, by his order, set a limit on the cash balance in the amount of 150,000 rubles.

Situation: how often should the payment agent submit payments received from citizens to the bank?

Submit payments received from citizens to the bank for crediting to a special account daily.

This is explained as follows.

The paying agent is obliged to hand over the cash received from the population for crediting to his special bank account in full (Parts 14, 15 of Article 4 of the Law of June 3, 2009 No. 103-FZ). They cannot be accumulated and stored in the cash register. These amounts will be considered above the limit, as they are not taken into account when calculating the cash balance limit. Therefore, deposit them in the bank every day. This procedure follows from paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014.

If payments from citizens are received on days when the bank is not open, hand over the funds on the next banking day (see, for example, decision of the Arbitration Court of the Yaroslavl Region dated March 12, 2013 No. A82-59/2013).

Advice: there are factors that allow citizens to submit payments to the bank on a date other than the day they are received. They are as follows.

The provisions of Law No. 103-FZ of June 3, 2009 do not establish deadlines for payment agents to deposit received cash in order to be credited to a special bank account. Such deadlines are not specified in the Bank of Russia instruction No. 3210-U dated March 11, 2014. Moreover, paragraph 3 of paragraph 2 of the Bank of Russia Directive No. 3210-U dated March 11, 2014 actually provides the opportunity to accumulate funds. This is due to the fact that money received during the activities of paying agents is not taken into account when determining the cash balance limit.

As a general rule, the frequency of delivery of excess revenue should not exceed seven working days. This period may be increased to 14 working days, provided that there is no bank in the locality where the entrepreneur or organization is located. This procedure follows from paragraphs 1 and 2 of the appendix to the instruction of the Bank of Russia dated March 11, 2014 No. 3210-U.

In arbitration practice, there are decisions confirming this approach (see, for example, decision of the Arbitration Court of the Khanty-Mansiysk Autonomous Okrug dated February 21, 2013 No. A75-7786/2012).

Situation: can a payment agent deposit payments received from the public minus his commission to the bank?

Answer: no, it cannot.

Payment agents can provide services for accepting payments from citizens in favor of suppliers of goods, works, services for a fee (Part 1, Clause 1, Part 2, Article 1, Part 2, Article 3 of the Law of June 3, 2009 No. 103- Federal Law). In this case, the payment agent itself can be considered as a supplier in terms of the services it provides (Clause 1, Article 2 of Law No. 103-FZ of June 3, 2009).

The payment agent must submit all accepted payments to the bank for crediting to a special account (Parts 14, 15, Article 4 of Law No. 103-FZ of June 3, 2009). Funds received into a special bank account can, in particular, be transferred to other accounts (Clause 4, Part 16, Article 4 of Law No. 103-FZ of June 3, 2009). At the same time, Law No. 103-FZ of June 3, 2009 does not specify to whose accounts funds can be debited.

Thus, the payment agent must submit to the bank all payments received from the population for crediting to a special bank account, and only then transfer the commission due to him for the service provided to his account.

Attention: the paying agent may be brought to administrative liability if he does not transfer all the cash received from citizens to his special bank account (Part 2 of Article 15.1 of the Code of Administrative Offenses of the Russian Federation).

For such a violation, the payment agent faces a fine:

— for an organization – from 40,000 to 50,000 rubles;

- for officials (chief accountant, and if he is not there - the head of the organization), entrepreneurs - from 4,000 to 5,000 rubles.

Entrepreneurs can be held liable only as officials. This follows from the definition of the category “officials”, which is given in Article 2.4 of the Code of the Russian Federation on Administrative Offenses.

It is possible that both the organization and its leader may be held administratively liable at the same time. The legitimacy of this position is confirmed by the letter of the Ministry of Finance of Russia dated March 30, 2005 No. 03-02-07/1-83 and arbitration practice (see, for example, the resolutions of the Federal Antimonopoly Service of the Moscow District dated July 14, 2005 No. KA-A40/6231-05 , Far Eastern District dated May 17, 2005 No. F03-A16/05-2/984, West Siberian District dated July 5, 2005 No. F04-4410/2005(12792-A03-32)).

Features of the use of CCP agents

In the event that an agent makes a transaction with a third party on behalf and at the expense of the principal , then the obligation to use the cash register falls on the principal. It does not matter whether the agent is an organization, an individual entrepreneur or an individual. The organizational solution to this issue falls entirely on the principal (supplier); it is he who is obliged to ensure at the time of settlement the use of the cash register registered with the Federal Tax Service in his name. It is possible to defer the moment of using the cash register only if the funds have been transferred to the principal’s current account from an individual, but for no more than one day.

Just like all other owners of cash registers, in some cases the agent is required to use accounting for preliminary payments (advance payments) and their offset when issuing a cash register receipt, and also include the buyer’s TIN in the check if the buyer is an organization or individual entrepreneur.

Concept and legislative regulation of the activities of payment agents

Let's consider the regulation of banking activities at the legislative level.

From the Federal Law “On Banking Activities”, it follows that the payment agent is the person who accepts funds to pay for various services of individuals. persons for crediting them to a bank account. Since 2011, bank payment agents have received additional rights:

- acceptance and issuance of physical to the person material funds, and carrying out transactions with funds independently using terminals and ATMs;

- acceptance with further transfer (the purpose of the payment does not matter);

- it became possible to involve subagents, i.e. persons to whom the direct agent delegated his functions;

- carry out identification of the client without resorting to opening a bank account;

- providing clients with the opportunity to transfer funds through non-cash payments.

You can find out what a payment order is and how to fill it out correctly in this video:

Obligations assigned to the banking agent for payments

The security of payments directly depends on the fulfillment of the obligations listed below:

- Signing the contract. Without it, the agent's activities are impossible.

- The operator must be registered with the Federal Service for Finance. monitoring.

- Opening an account for transactions with certain assets, when accepting payments.

- The bank should not act as an operator or a person to whom a direct agent has delegated its functions, i.e. subagent.

Sample agreement with a bank payment agent.

For failure to issue a sales receipt or transfer of funds bypassing special accounts, admin is imposed. fine of 3,000 rubles. – for a responsible employee, from 30,000 to 40,000 – for the enterprise as a whole.

The individual entrepreneur is held accountable solely as an official.

Conditions under which activities are carried out

The payment agent must receive the payer's funds transferred by the intermediary to his account. Next, the bank transfers the required amount to the account of the company supplying the goods or services (supplier), and the agent receives a fee for working as an intermediary agent.

The supplier cannot accept the amount transferred to him from agents into his own bank account. Evasion of compliance with this rule entails criminal liability. For agents this is the admin. fine of 4,500 - 5,000 rubles, legal. individuals – 40,000 – 50,000 rubles.

Receiving payment from individuals. of the payment agent is carried out using a terminal or cash register equipment. It is necessary that it be equipped with a random access memory device and a carrier of product information reproduced on tape for monitoring and restoring information if necessary.

Registration of equipment with the Federal Tax Service is required.

Methods of customer service

Terms of service for accepting payments from a payment agent is carried out in one of two ways:

- deposit;

- credit. You can read what rules are used to draw up an accounting statement about writing off accounts payable here.

Accounting for transactions and the procedure for accepting payments

Transactions on monetary claims and obligations between the agent and the bank are executed within the time limits specified in the agreement. From the moment the bank receives the list of justified applications to be executed on special. the intermediary's account and until the day the funds are transferred from the agent, the bank performs actions in the following order:

- Takes into account operations on special account.

- On open to special personal accounts, displays obligations to the paying agent. The condition is valid if the contract contains a clause on extending the period of validity of the commission payment. What is an employee’s personal account and how to correctly draw up documentation for this account - read the link.

Powers of the paying agent under the law.

What else does an agent need to know?

The issue of processing a refund using a cash receipt generated by an agent deserves a separate discussion. Should we return or not return commissions, agency fees, or funds for additional related services provided by the agent?

In what cases and how should an agent generate a cash correction receipt?

What should be on an agent's cash receipt if the agent and the principal use different tax systems? For example, an agent is on the simplified tax system, and the principal is on the special tax system.

We are waiting for clarification from the Federal Tax Service and following the news on the REMKAS website.

Payment agent functions

The activity of this person is the acceptance of material resources (including online) that are aimed at fulfilling obligations to an entrepreneur or organization for goods, services or work. This could be payment of utilities or rent of premises.

Regardless of the type of person, payment can be made through the terminal

The supplier is a legal entity or individual entrepreneur, which cannot be a credit institution. He receives remittances from the payer for services or goods provided. Suppliers can be organizations that contribute funds for renting premises, or government agencies.

Cash register required for working with the cash register

Between this group of persons and payers there is interaction regulated by law, namely Federal Law No. 103. From the definition in the previous section it follows that the functions of an agent are limited and involve receiving money from people and transferring it to suppliers for services rendered, work performed or goods purchased.