Concept and legislative regulation

The invoice form is prepared by the seller.

The 2021 Invoice Log displays information about these activities.

If manipulations are subject to tax, then this is also done using books to record purchases/sales.

The invoice form has a standard template; it is written out by the seller and provided to the buyer after receipt (shipment) of the goods and materials.

The invoice sample has no significant changes since January 1, 2021.

Invoice form

The main legal acts on the issue under consideration, approved standard forms and Rules on how to maintain a journal for registering invoices in 2021, as well as reflecting the changes that have appeared:

- Tax Code of the Russian Federation;

- Resolution No. 1137.

A sample invoice in 2021 may change its external form, provided that the order in which the indicators are displayed and their number compared to the standard form are not violated.

In the process of purchase and sale, two parties interact: the seller, who also acts as a contractor or executor obligated to pay VAT, and the buyer/customer.

It is the latter who receives the document after receiving the goods or services performed. The first party also keeps one copy.

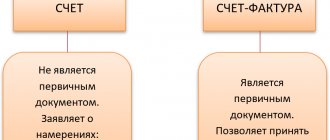

Important: An invoice in 2021 is the basis for the client to accept the amounts of value added payments presented by the seller for deduction.

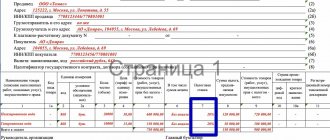

The 2021 invoice sample is a form with a table indicating the list of goods/services, their price, rate and tax amount, as well as excise taxes, digital codes, details of customs documents, inventory codes and their calculation measures.

The invoice form also comes in different types: for advance payments, corrective.

Information about issued and accepted invoices forms the Purchase/Sales Book

back to menu ↑

Sales invoice details

This account is used very often, and it requires a full set of details:

- Date and document number;

- Data of the buyer and seller (name, address, TIN);

- Shipper's address and name;

- Address and name of the consignee;

- Details of the payment and settlement document;

- Currency in which the document will be issued;

- Contract ID;

- Name of goods, works, services and indicate the code of the type of goods;

- Total amount of goods excluding VAT, excise tax amount, VAT rate and amount;

- Total amount including taxes;

- Country of origin of the goods;

- Signature of responsible persons;

The documents may be missing:

- Buyer's checkpoint;

- Seller's checkpoint;

- Data of the consignor and consignee, if it is not the goods that are sold;

- Details of the payment document if the advance is not received;

- Units of measurement – if the unit is not defined;

- Unit quantity and price – if the unit is not specified;

- Product code, if the product is imported to countries (EAEU);

Latest changes and news

Starting from January 1, 2021, the invoice has some improvements in its appearance and in the standards for filling it out (Resolution No. 1137):

- the sample invoice in 2021 is supplemented with a column for the code of the type of goods and materials, which is filled in by organizations supplying them to the EAEU (Eurasian Economic Union);

- the invoice from January 1, 2021 must have the location of the parties entered in the Unified State Register of Legal Entities and the Unified State Register of Individual Entrepreneurs;

- for import, not a serial number is entered, but the registration digital value of customs declarations;

- For the sale of scrap metal in 2021, the invoice is issued in accordance with changes in legislation, since such commercial activities have become taxable. An invoice is created from January 1, 2021 for transactions with them;

- The invoice for 2021, the sample of which has undergone some innovations, has also changed the form of VAT declarations.

back to menu ↑

What invoices are included in the journal for Q2 2021?

The journal is a document consisting of 2 parts:

- 1st part of the journal - invoices issued;

- The 2nd part of the document is the received invoices.

The first part of the form records all invoices drawn up for the 2nd quarter. For example, developers and freight forwarders who use third party labor indicate here the invoices that they sent to investors and their clients.

The second part of the document reflects the invoices received by the intermediary in the 2nd quarter, taking into account the following:

- For intermediaries on OSNO - received before the submission of the VAT return, i.e. before the 25th day of the month following the reporting period, in our case - until July 25, 2021.

- For intermediaries in a special regime - received before the journal is submitted for verification, i.e. before the 20th day of the month after the end of the reporting quarter, in this case - before July 20, 2018.

Invoices for own remuneration are not subject to recording in the journal (clause 1 (2) of the Journal Rules).

For a sample of filling out the journal of received and issued invoices for the 2nd quarter of 2021, see here .

Application example

Enterprises whose activities include the sale of scrap metal in 2021 must issue an invoice.

These changes in the invoice are due to the fact that the benefits for such transactions have been canceled (Federal Law No. 335 of November 27, 2017).

When scrap metal is sold in 2021, the invoice is issued by the seller, as with regular goods and materials.

Let's consider several nuances of the process of its registration, depending on who pays VAT.

When purchasing scrap from a VAT payer, the client is obliged to perform the functions of a tax agent for this tax and the provisions of the law do not exempt sellers from creating an account. When the specified payment must be made by the tax agent (client), the seller-taxpayer issues an invoice for scrap metal in 2021 from o. This tax on such transactions is not calculated by the seller.

For his part, the acquirer must charge the specified duty (18%) and reflect this in the sales books.

An invoice in 2021 will allow him to deduct this payment when using the general tax regime.

This is why you need an invoice for scrap metal in 2018.

It should be noted that when applying the special regime n/a, the buyer must also calculate VAT on the price of scrap, but in this case it is impossible to apply for a deduction.

If the buyer is an individual, then the seller must decide on the value added payment himself and pay it to the budget.

For him, this will be a transaction subject to the specified tax. After such a sale of scrap metal is carried out in 2021, an invoice is created according to standard rules.

back to menu ↑

Peculiarities

| Parameter | Meaning |

| Who issues it and why? | The invoice for scrap metal in 2021 is issued by the seller. Sales of scrap in 2021 are displayed in invoices according to standard rules, as for ordinary goods and materials. The obligation to pay VAT lies with buyers. But this does not apply to cases when it is purchased from individuals who do not have individual entrepreneur status. The purchaser purchasing from a VAT payer pays the specified payment, regardless of whether he himself has the status of a taxpayer, and he needs an invoice in 2018 in order to reimburse the tax paid. That is, entities on special regimes and exempt from non-taxation must still pay VAT when purchasing goods, but only if they bought from an entity that is a payer of this tax. |

| Example | If the receiver of recyclable materials accepts it from an individual who is not an individual entrepreneur, there is no need to pay VAT to the collection point. Similarly, when a plant buys from non-paying counterparties who, for example, are on the simplified tax system (Simplified Taxation System). |

| Mark if purchased from a defaulter | It is important for the client to have confirmation of what he is purchasing from the defaulter, therefore such an invoice for scrap metal in 2018 contains the indication “Without tax” (paragraph 6, paragraph 8, article 161 of the Tax Code). |

| Peculiarities | The invoice from January 1, 2021 is issued by the seller. When the client is a VAT payer and pays it upon purchase, the seller, if he also has taxpayer status, is obliged to invoice it. This sample invoice in 2021 has the indication “VAT calculated n/a”, since it is the client who makes the payment. The above fully applies to partial payments, then the invoice is issued against future shipments, and the invoice adjustment form is also used. In this case, all numerical values can be changed, but this must be confirmed by primary documents justifying the change in the quantity of goods and materials, prices (for example, confirmation of an increase in the cost of consumables, electricity). |

| Export | During export manipulations, the sale of scrap in 2021 will issue an invoice at zero rates. |

So, let’s summarize and derive the features that the 2021 scrap invoice has:

back to menu ↑

We prepare the invoice correctly

The detailed procedure for filling out invoices is presented in Government Decree No. 1137 dated December 26, 2011, as well as in Art. 169 of the Tax Code of the Russian Federation. A list of required details has been established: for a shipping invoice - clause 5 of Art. 169 Tax Code, for an invoice for an advance payment, when an advance payment form is issued - clause 5.1 of Art. 169 NK.

Several types of filling out the invoice form are allowed:

- entirely by hand;

- partly by hand and partly on the computer;

- fully printed version;

- electronically (without paper).

A sample invoice for 2021 must be signed by the head of the budget organization and the chief accountant or other authorized persons. For electronic forms, an enhanced qualified electronic signature of an authorized person is used.

The date and numbering of the issued documentation must be in strict chronological order. Information in the new column of invoice No. 1a “Product Type Code” is entered in accordance with the Commodity Nomenclature of Foreign Economic Activity of the EAEU. Only exporting organizations that import goods into the territory of the EAEU fill out this column. If the type of goods cannot be determined from the Product Nomenclature, a dash should be placed in the column.

Generating an invoice online is also easy. There are many free Internet services or specialized accounting programs. Most of them will require you to register your organization on the website, and then you can download and print a sample already filled out with your data.

When to exhibit and when not to

Let's consider when a document is indispensable and when it is not required:

| Required | Not required |

| The invoice form does not require filling out for transactions without VAT, except for goods and materials sold to the EAEU region. | |

| For all transactions with VAT, including receipt of advance payments on transactions subject to it. | The buyer or customer is not a VAT payer and has a non-invoicing agreement with the seller. |

| In commercial relations with interdependent persons, the seller increases the cost to the market level and adjusts the tax base. |

When goods and materials exempt from taxation are sold, the invoice is issued at the request of the seller.

That is, it is not required, but it is not prohibited to issue it, for example, if the client requires it.

At the same time they put about. The register of invoices in 2021 should be maintained as usual.

back to menu ↑

Issuance procedure

A sample invoice in 2021 is created both on paper and through electronic forms.

The prepared invoice form is handed over or sent to the counterparty during the process of receiving the goods or immediately thereafter.

For this purpose, the law establishes special deadlines and rules.

The invoice form prepared electronically is used when there is mutual agreement and the availability of compatible technical means.

Such invoices must be sent only through certain operators of this type of document flow; their list is on the Federal Tax Service website.

Important : The rules for filling out invoices allow them to be issued simultaneously on paper and electronically. Accounts are drawn up for each primary document, but it is not prohibited to combine transactions for several such documents in one form, indicating the total number of inventory items.

back to menu ↑

Deadlines

The rules for filling out invoices have their own deadlines, limited to a period of 5 days (calendar) from the date of advance payment or acceptance of the completed goods, or shipment of the goods.

The last day in the last two cases is considered to be the time of issuance of the first primary paper.

If the deadline is the same for several such documents, then they can be combined in one form.

| For goods | For services |

| 5 days from the date of | 5 days from the date of |

| Shipment or transfer of rights to an object. | Signing acts confirming acceptance of works/services. |

| Receiving an advance payment (the invoice for advance payment for 2021 has separate rules for filling out) | Receiving an advance |

| The deadlines are counted from the date following the date when the shipment (transfer of rights) or receipt of the advance occurred. | The deadlines are calculated from the day following the day when the act was signed or when the money arrived in the executor’s account. |

This can be done if the relationship between the counterparties is carried out on an ongoing basis (for example, daily sales to the same entity). The sample invoice from January 1, 2021 allows you to issue one general document for all goods and materials sold at the end of the month.

In the case of an account, it is created every month before the 5th day.

An invoice prepared as one form is possible for many transactions, if during the 5-day period after the first transaction several more sales agreements for the same client are drawn up. One account will be issued within the specified period.

When trading retail, if payment is made in cash, the rules for filling out invoices allow you not to indicate VAT in a special line on price tags and other forms.

It is included in the price and the formation of the document in question is not required.

Important : For multiple non-cash transactions, the document can be created in one form at the end of the tax period.

back to menu ↑

Who exhibits

The account is drawn up, as well as the journal for registering invoices in 2018, by the following entities:

- suppliers;

- companies performing construction and installation work for their own needs or when they performed work (services) for intra-organizational needs, the costs of which are not taken into account when calculating income tax;

- tax agents for VAT. That is, companies purchasing inventory and materials from foreign legal entities not registered for tax purposes in the Russian Federation, including tenants of state real estate and buyers of such objects not assigned to state organizations;

- intermediaries on their own behalf, but using the customer’s funds, if such a person applies the general taxation regime;

- forwarders organizing transportation for customers using third party resources, as well as developers or customers performing their functions;

- those involved in organizing construction work for investors by attracting contractors;

- suppliers of goods to the EAEU exempt from VAT.

back to menu ↑

How to fill out

The sample invoice for 2021 contains the following fields to fill out:

At the very end, the sample invoice for 2021 is certified by the signature of management and an accounting specialist; if the latter is not at the enterprise, then only the former.

The completed invoice is affixed with the organization’s seal from January 1, 2018; a sample of it, as before, is issued to the buyer.

The registration details of the enterprise must be indicated.

The rules for filling out invoices must be observed - this is the basis for subsequent accounting actions when calculating VAT.

back to menu ↑

Who and when should submit the invoice journal for the 2nd quarter of 2021 to the Federal Tax Service?

All organizations and individual entrepreneurs who are responsible for maintaining a journal of invoices will have to submit it to the Federal Tax Service at the place of tax registration. This allows tax authorities to control the “mirroring” of VAT charges and deductions within the framework of intermediary activities. After all, it is important for the budget that the tax that is presented for deduction has already been paid by someone. Then the logic of the formation of fiscal payments is not violated.

Having received the journal, controllers compare the amount of VAT accrued by the counterparty with the amount of tax claimed for reimbursement by its partner. In order for the reconciliation to take place in a timely manner, the department has set clear deadlines for when the journals must be received by the Federal Tax Service.

The general rule is this: you need to submit the journal for inspection to inspectors by the 20th day following the reporting period of the month. Since the reporting period is a quarter, the deadline for submitting the journal after the 2nd quarter will be July 20, 2021.

If your company is a VAT payer (VAT tax agent), submitting the journal to the tax office for control is not required: information from it is included in section. 10 and 11 of the VAT declaration (clauses 49-50 of the Procedure for filling out the declaration).

You can submit the journal to the tax office only in electronic format, which means you need to take care in advance about the connection set up through telecommunication channels (letter of the Federal Tax Service dated 04/08/15 No. ГД-4-3/5880). But it can be maintained both electronically and on paper.

The document form is unified. Its paper version and the rules for filling it out are established by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137 (as amended on February 1, 2018). The form in electronic form is also approved by law - by order No. ММВ-7-6/93 dated 03/04/15.

From 05/08/2018, the Federal Tax Service of the Russian Federation updated the electronic formats of VAT tax documents, including the journal of received and issued invoices.

How to number

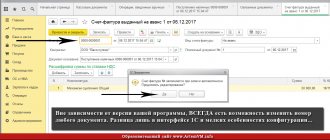

The invoice from January 1, 2021 does not have an officially established number format.

The numbering of invoices is established by the organization itself and is enshrined in its internal documents (by order of the enterprise management).

The main thing is that the details (numbers) have a high degree of uniqueness.

It is recommended to use end-to-end order for them, in ascending order. Numbering of invoices, if done correctly, will eliminate backdating statements.

Composite numbers are used in the following circumstances:

- exhibiting as separate parts of organizations;

- if commerce is carried out by managers under trust agreements or members of a simple partnership.

In other cases, a dividing line can also be used - this will not cause a refusal to deduct - but it is not advisable to do this.

Numbering of advance invoices is carried out for all accounts in the company; if necessary, “AB” is added to the numbers of such forms.

Important : Incorrect numbering of invoices does not entail any liability if this does not prevent the authorized bodies (tax inspectorate) from identifying information when conducting audits. This applies to all errors, not only in numbering, and this is also not a reason for refusing to accept a document for deduction (clause 2 of Article 169 of the Tax Code of the Russian Federation).

Corrections

The seller must make changes to the invoice. This is done by drawing up new s/f - already correct ones.

This also applies to cases where the buyer submitted a clarifying document electronically.

In this case, changes to the field of the original form “Invoice No. ..., from ...” are prohibited.

The field “Correction No...., from...” is filled in with the serial number of the correction and its date.

So, the first copy of the paper account is issued to the client. The second one remains for the seller.

It is generated for each document when selling inventory items subject to VAT.

Its correct formation is a guarantee of tax deduction.

back to menu ↑

Again a new invoice

How to fill it out?

In accordance with Resolution No. 1137 of December 26, 2011, as amended on August 19, 2017, the following filling method is defined:

- The date when the ESF was issued and its number: correction number and date of changes made. A dash is added if no corrections were made.

- The name of the legal entity corresponding to the constituent document or full name of the individual entrepreneur.

- location indicated in the constituent document, place of residence of the individual entrepreneur;

- if the ESF was issued by a branch, then the parent organization must be indicated.

- In accordance with the constituent document, we indicate the name of the shipper.

- Same as in point 3, plus indicate the postal address.

- Number and date of the payment document for prepayment.

- Full or abbreviated name of the buyer in accordance with the constituent documents:

- location of the buyer in accordance with the constituent documents;

- if the goods are delivered to separate divisions of buyers, then in line 6b you need to indicate the parent organization and division.

- The currency for all listed goods in the invoice is the same and we indicate its digital code, the list of which is indicated in the All-Russian Classifier of Currencies.

- Government contract identifier for the supply of goods. If it is missing, the line can be left blank.

Next, we will take a closer look at filling out the table in the invoice:

- The name of the goods must match the document on shipment of the goods.

- The unit of measurement code is set in accordance with the All-Russian Classifier of Units of Measurement:

- if there is no code, a dash is inserted;

in the “advance” invoice, a dash is placed in column 2 (you can find out more about how to correctly draw up an advance invoice, as well as see a sample of filling out documents here);

- when providing services, you can put a dash in column 3.

- Column 3 indicates the quantity (volume) based on the corresponding unit of measurement:

- if columns 2 and 2a contain dashes, column 3 also contains a dash;

- the total quantity of goods must match what is indicated in the shipment document;

- in the “advance” invoice, a dash is placed in column 3;

- in the invoice drawn up for the provision of services, you can put a dash in column 3.

- If columns 2, 2a and 3 are completed, then column 4 indicates the price per unit of measurement in accordance with the contract, excluding VAT, and in the case of using state regulated prices that include VAT, taking into account the amount of tax:

- if columns 2, 2a and 3 contain dashes, then column 4 contains a dash;

- the price (tariff) is indicated in currency (rubles and kopecks, dollars and cents, etc.);

- in the invoice drawn up for the provision of services, you can put a dash in column 4.

- The cost without VAT is calculated as the quantity (column 3) multiplied by the price (column 4) on the corresponding line (in the “advance” invoice, a dash is placed in column 5).

- For excisable goods, the amount of excise tax is indicated. For goods that are not excisable, it is indicated “without excise tax” (in the “advance” invoice, a dash is placed in column 6).

- Tax rate:

- 0% - in the case of the sale of goods and works (provision of services) that are related to exports;

10% - when selling certain types of preferential goods, which are listed in paragraph 2 of Art. 164 Tax Code of the Russian Federation;

- 18% - in other cases.

- To calculate the total amount of VAT, use this formula: the cost without tax (column 5) multiplied by the rate (column 7) in this line.

In column 8 indicate “without VAT” for trade turnover, if exempt from VAT in accordance with Article 145 of the Tax Code of the Russian Federation. - To calculate the cost of VAT, the following formula applies: cost without VAT (column 5) plus the amount of VAT (column

in this line:

in this line:- the cost of the goods must correspond to the goods, the cost of which is indicated in the document for shipment of the goods;

- “advance” indicates the entire amount received after payment, including VAT.

- Code of the country of origin of the goods in accordance with the All-Russian Classifier of Countries of the World (in the “advance” invoice, a line is placed in column 10).

10a) The same as in column 10. - The customs declaration number is indicated (a line is drawn in column 11 in the “advance” invoice).

2a) The same as in column 2.

Estimated rate: 10/110 or 18/118 for prepayment or withholding of VAT by tax agents and in other cases specified in clause 4 of Art. 164 Tax Code of the Russian Federation.

The ESF is signed with one electronic digital signature (EDS). As a rule, this is a manager or authorized person and an individual entrepreneur.

The use of facsimile signatures or, in other words, cliché seals is not permitted.