Changes from 04/23/2018 for individual entrepreneurs

Changes in the content of budget classification codes for expenses and income for insurance payments were regulated by Order of the Ministry of Finance of Russia No. 35n from 02/28/2018 to April 23, 2021. According to this Decree, the rules for attributing expenses to the corresponding types and subtypes of the code in relation to social policy have been changed. Thus, subclause 3.2 is supplemented with information that this paragraph reflects the costs of medical care, including insurance premiums for individual entrepreneurs in 2021. The BCC was changed in accordance with Order of the Ministry of Finance No. 255n, which established a new code for depositing funds in the amount of 1% for compulsory health insurance for IP for yourself. According to Decree No. 29n, these codes can be used from February 20 of last year.

But on April 23, 2018, the code was canceled and now businessmen who received an income of more than 300,000 rubles for 2021 pay 1% on compulsory pension insurance according to the previous coding for fixed contributions. Thus, the BCC for individual entrepreneurs in 2019 for themselves is 18210202140061110160.

KBK IP – fixed payment 2021

Entrepreneurs pay fixed contributions, the amount of which is set at the federal level, for pension insurance (PIP) and medical insurance (CHI). Upon receiving a total annual income of over 300,000 rubles. The individual entrepreneur is also obliged to transfer an additional amount to the OPS from the excess amount at a rate of 1%. In order for payments to be credited to the payer’s personal account in a timely manner, the budget classification codes must be correctly specified.

How to find out the BCC for 2021 for individual entrepreneurs for fixed payments? First of all, remember that from 01/01/17 all insurance premiums are transferred not to the Pension Fund of the Russian Federation, but to the Federal Tax Service. Payments for 2021 must be fully paid by 01/09/18. When generating payments, enter the following code values.

Fixed payments for individual entrepreneurs in 2021 - KBK:

- 18210202140061110160 – for transferring contributions to OPS.

- 18210202103081013160 – for paying contributions to compulsory medical insurance.

- 18210202140061110160 – to pay an additional contribution to compulsory pension insurance in the amount of 1% on the amount of income above the limit of 300,000 rubles.

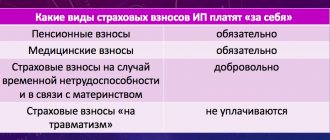

Note! Individual entrepreneurs are not required to pay social insurance contributions in terms of contributions for temporary disability and maternity “for themselves,” but can do this voluntarily by registering with the Social Insurance Fund.

When and where to pay

Individual entrepreneurs contribute funds for insurance to the Federal Tax Service at their actual location. For businessmen who pay contributions for themselves, payment deadlines are delimited depending on the annual profit received:

- up to 300,000 rubles - until December 31 of the current year;

- more than 300,000 rubles - before July 1 of the year that ended after the reporting year.

If a businessman interrupts work, then the money for insurance is transferred within 15 days from the date of deregistration with the Federal Tax Service. According to Art. 430 of the Tax Code of the Russian Federation, individual entrepreneurs have the right not to contribute money for insurance in five situations.

The amount of insurance premiums for individual entrepreneurs in 2019-2020

Fixed payment calculated from the minimum wage

Regardless of whether the entrepreneur has employees or what type of taxation is applied, he is required to pay contributions to the Pension Fund and compulsory medical insurance:

| In the Pension Fund of Russia, rubles | In the Federal Compulsory Medical Insurance Fund rubles | Total, rubles | |

| For 2021 | 29 354, 00 | 6 884, 00 | 36 238, 00 |

| For 2021 | 32 448, 00 | 8 426, 00 | 40 874, 00 |

Attention! If the individual entrepreneur did not begin activities from the beginning of the financial year or ceases activities before December 31, then contributions are calculated for the corresponding period worked.

1% on excess income

Nothing has changed in the calculation of 1% - it is paid if the income exceeds the amount of 300 thousand rubles. The formula is simple: (Income – 300,000 rubles) * 1%.

Attention! It is necessary to take into account that fixed payments when combining tax regimes are summed up, after which the calculation is carried out.

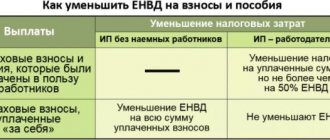

So, when calculating 1%, the following must be taken into account:

- For UTII payers, it is necessary to take the amount of imputed income, and not the actual profit received.

- For the simplified tax system of 6%, the actual profit received is taken.

- Under the simplified tax system, income is reduced by the amount of expenses; currently, only income is taken as the basis for calculating 1%; expenses are not taken into account.

- For OSNO, the base will be the difference between income and expenses.

- For a Patent, it is necessary to take the calculated amount of the maximum profit, based on which payments under the patent are calculated.

Fixed contributions

Contributions to compulsory health insurance and compulsory medical insurance for individual entrepreneurs for themselves, assigned to the Tax Code of the Russian Federation, are calculated in accordance with Art. 430 Tax Code of the Russian Federation. The calculation formula is uniform and depends on the current minimum wage, so the fixed insurance payment changes annually.

Table 1. Formulas for calculating insurance premiums for individual entrepreneurs for compulsory health insurance and compulsory medical insurance.

| Annual profit amount | On OPS | On compulsory medical insurance |

| up to 300,000 rubles | 1 minimum wage * 26% * 12 months | 1 minimum wage * 5.1% * 12 months |

| more than 300,000 rubles | 1 minimum wage * 26% * 12 months + 1% of the businessman’s total profit 300,000 rubles <, but not more than 8 minimum wage |

When paying the contribution amount for an annual income that exceeds the established norm, the businessman indicates in the payment slip the appropriate BCC for 1%. Over 300,000 rubles, the subtype code in the cipher changes. Thus, the amount of insurance premiums a businessman makes for himself with a profit of more than 300,000 in 2021 at a single percentage rate is calculated as much as possible using the formula:

8 minimum wage * 26% * 12 months.

To pay the assigned fee, you need to indicate the appropriate BCC. Individual entrepreneurs make a fixed payment for 2021 according to the codes from tables 2 and 2a.

Table 2. Payment codes for compulsory medical insurance and compulsory medical insurance for fixed payments for businessmen for themselves in the billing period before January 1, 2017.

| Name of payments | Annual profit | OPS | Compulsory medical insurance |

| Standard | up to 300,000 rubles more than 300,000 rubles | 18210202140061110160 18210202140061210160 | 18210202103081011160 |

| Penalty | 18210202140062100160 | 18210202103082011160 | |

| Fines | 18210202140063000160 | 1821020210308301116 |

Table 2a. Codings of payments for compulsory medical insurance and compulsory medical insurance for fixed payments for businessmen for themselves in the billing period after January 1, 2021.

| Name of payments | OPS | Compulsory medical insurance |

| Standard | 18210202140061110160 | 18210202103081013160 |

| Penalty | 18210202140062110160 | 18210202103082013160 |

| Fines | 18210202140063010160 | 1821020210308301316 |

KBK IP – fixed payment in 2021

To correctly credit the paid amounts of insurance premiums, in field 104 of the payment slip, you must enter the code that corresponds to the type of fiscal fee. KBK differ in the insurance part for fixed payments of individual entrepreneurs in 2021, as well as in the purpose of the transfer - payment of tax, penalty or fine. So, in 2021, it is necessary to indicate the following values of budget codes in the payment order:

- 18210202140062110160 – when paying penalties on contributions to compulsory pension insurance.

- 18210202140063010160 – when paying penalties for contributions regarding compulsory health insurance.

- 18210202103082013160 – when paying penalties on compulsory medical insurance contributions.

- 18210202103083013160 – when paying penalties for compulsory medical insurance contributions.

Note! In accordance with Law No. 335-FZ of November 27, 2017, a new amount of contributions to compulsory health insurance and compulsory health insurance was approved for 2021, 2021 and 2020. The amount of amounts no longer depends on the minimum wage and in 2021 is 5840 rubles. – for medical insurance (subclause 2, clause 1 of Statute 430 as amended from 01/01/18) and 26,545 rubles. – for pension insurance (Subclause 1, Clause 1, Statute 430 as amended from 01/01/18). Read more about this in our article.

Amount of contributions for individual entrepreneurs for themselves in 2021

The calculation of the amount of contributions is legalized by the Tax Code of the Russian Federation and is also recorded in the formula. To deposit funds for a future pension, according to Art. 425 of the Tax Code of the Russian Federation, the amount of unsecured contributions is calculated based on annual income:

- up to 300,000 rubles - 20%;

- more than 300,000 rubles - 10%.

The applicable tariff for medical support for unsecured payments is 5.1%.

Fixed payments for future pensions and healthcare, which a businessman pays for himself in 2021, are calculated according to annual profit using the formula:

- OPS: up to 4 rubles;

- more than 300,000 - no more than 234,832 rubles;

Due dates for payment of contributions

An entrepreneur has the right to pay fixed CB at any time during the year until December 31 inclusive. Individual entrepreneurs have the opportunity to make payments in installments throughout the year or make a lump sum payment at the end of the year.

There are cases when a business entity had no income for two quarters, and in the third quarter there was income. It is easier for an individual entrepreneur not to pay contributions in the two previous periods, but to pay it in full in the third quarter. If, due to the specific nature of the type of activity, the individual entrepreneur received the main income at the beginning of the year, then he can pay it in a lump sum, without waiting for the end of the period. The main advantage of paying fixed CB for individual entrepreneurs is the lack of clear payment deadlines.

For an individual entrepreneur who is on a simplified taxation system, it is preferable to transfer CT once a quarter to reduce advance payments for the purpose of tax optimization (tax regime - “STS income minus expenses”). It is important to remember that the SV amount must be paid before calculating the single tax to accept this type of expense.

Table: payment terms for individual entrepreneurs in 2021, with the breakdown of CB amounts in equal shares

| Payment period | Interval |

| 1st quarter 2018 | from January 1 to March 31, 2018 |

| 2nd quarter 2018 | from April 1 to June 30, 2018 |

| 3rd quarter 2018 | from July 1 to September 30, 2018 |

| 4th quarter 2018 | from October 1 to December 31, 2018 |

As a result, it turns out that fixed payments are divided into 4 equal parts, so payment once a quarter will be the following amounts:

- RUB 6,636.25 — expenses for OPS;

- RUB 1,460 — expenses for compulsory medical insurance.

For those individual entrepreneurs who use UTII, it is best to split the payment of SV quarterly in equal shares, since the amount of imputed income for each quarter will remain the same.

Additional SV to the Pension Fund, which amounts to 1% of annual income, must be paid before July 1 of the next year. In this case, exceeding the limit during the year will be the basis for paying this SV as it arises in order to take such expense into account in a single tax. It is best to pay the additional CB at the time when the decision is made to pay for the fixed CB.

If an individual entrepreneur pays SV for temporary disability and in connection with maternity on a voluntary basis, then this transfer must also be made before December 31.

If the individual entrepreneur has ceased his activities, he should pay the SV within the next 15 days.

Video: about paying fixed amounts to individual entrepreneurs at the beginning of the year

Formula for calculating insurance premiums

The formula for calculating insurance premiums for 2021 was as follows:

Minimum wage * 12 * TSV, where:

Minimum wage is the minimum wage at the beginning of the year. Let us remind you that as of January 1, 2021, the minimum wage amounted to 7,500 rubles. From January 1, 2021, the minimum wage is 9,489 rubles, but the calculation of fixed contributions in 2021 is based not on the minimum wage, but on other values.

12 — the number of months for which insurance premiums are paid.

TSV - insurance premium tariff. In 2021, the following tariffs are established:

- 26% for pension insurance contributions

- 5.1% for health insurance premiums

- 2.9% for insurance premiums in case of temporary disability and in connection with maternity

Basis for the new procedure for calculating insurance premiums Federal Law No. 335-FZ dated November 27, 2017.

Thus, for 2021, the individual entrepreneur had until December 31, 2017 to pay for himself mandatory insurance premiums in the following amounts:

- Pension insurance contributions of individual entrepreneurs for themselves in 2021 in the amount of 23,400 rubles (7,500 * 26% * 12).

- Medical insurance premiums for individual entrepreneurs for themselves in 2021 in the amount of 4,590 rubles (7,500 * 5.1% * 12).

From 2021, insurance premiums for compulsory pension insurance are calculated in the following order:

- if the payer’s full annual income in 2021 does not exceed 300,000 rubles, the amount payable in 2021 will be 26,545 rubles for the billing period

- if the payer’s total annual income for the billing period exceeds 300,000 rubles, then two amounts must be paid: the first in a fixed amount of 26,545 rubles for the billing period; the second is calculated as 1.0% of the payer’s income exceeding 300,000 rubles for the billing period.

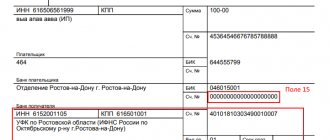

Payment orders for insurance premiums in 2020

Due to the fact that the administration of insurance premiums was transferred to the Federal Tax Service in 2017, you can forget about the old details of the Pension Fund and the Social Insurance Fund (except for the “injury” contribution). The following details for paying insurance premiums have changed since 2021 in payment orders ( these changes are also relevant in 2021 ):

- "Recipient";

- "TIN";

- "Checkpoint";

- "KBK."

Thus, a payment order for payment of insurance premiums should be completed as follows:

1. Column “Recipient”: indicate in abbreviated form the name of the treasury body of the Russian Federation (in brackets - the full name of the Federal Tax Service). 2. Column “TIN”: indicate the Federal Tax Service code. 3. Column “Checkpoint”: indicate the checkpoint of the Federal Tax Service. 4. Column “KBK”: indicate the required BCC.

In 2021, the KBK code for insurance premiums begins with “182” - this indicates the new administrator of insurance payments - the Federal Tax Service, which the Federal Tax Service became from 01/01/2017.

In the payment order there is now no need to indicate the number of the policyholder in the fund in the “Purpose of payment”. This rule applies to all contributions to the Federal Tax Service. Some Federal Tax Service Inspectors ask that in the payment instructions, in addition to the traditional wording, indicate the contractor’s phone number. Since 2021, other details in payment orders for payment of insurance premiums have also changed, which remain relevant for 2021:

- in field 101 (payer status) the code “08” was previously set. What payer status must be indicated in payment orders for 2020, read here;

- in field 104 - indicate the new BCC for insurance premiums (except for the “injury” contribution);

- OKTMO code is now 8-digit;

- in field 106 - indicate the basis for payment (for TP insurance premiums);

- in field 107 - indicate the tax period (for insurance premiums - MS. Month number. Year, for example, for January 2019 " MS.01.2019 "; for March 2020 " MS.03.2020 ".

The number, as well as the date of the document (on the basis of which the payment is made) is filled in after the organization pays insurance premiums, penalties or fines at the request of the tax service. In such a situation, in fields 108–109 you need to indicate the number and date of the Federal Tax Service’s request.

Detailed instructions for filling out payment orders for payment of insurance premiums in 2021 are published here. Samples of filling out payment orders for 2021 are also posted there.