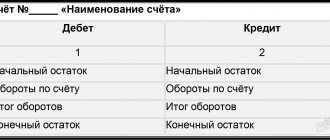

Account balance sheet

The “Account balance sheet” report is intended for generating a balance sheet for a selected account for a certain period of time.

In terms of the information displayed, the report resembles a fragment of the Turnover Balance Sheet report.

The report can be generated with detail by subaccounts or by analytical accounting objects (subaccounts).

Data can be displayed with an additional breakdown by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level and for the account as a whole.

Analysis of settlements with counterparties

The organization must secure the forms of primary documents and accounting registers. She can develop them independently or use standardized forms.

Read more Procedure for approving accounting registers

Form RT-12

Form RT-12 is used to record settlements with counterparties when there is a large volume of them in the organization.

Where can I find a card for analytical accounting of calculations in form RT-12 in 1C?

In 1C, the RT-12 form is not implemented; you can develop it yourself or use standard reports instead to analyze analytical accounting.

Standard reports are flexible in settings (grouping, selection, etc.), so you can get the necessary information from them, but in a slightly different form.

For example, the Account Card will allow you to view movements using the analyzed account in the context of each operation.

Account Turnover report will prepare data for analyzing general indicators for accounts.

If standard reports are not enough for you, you can always try creating your own using the Universal Report.

BukhExpert8 advises analyzing settlements with counterparties using the Subconto Analysis report. It allows you to look at calculations from the reverse side - starting from analytical accounting and showing data for all accounts at once.

Test yourself! Take the test:

- Test No. 4. Incorrect agreement when settling with a counterparty: detecting and correcting the error using the Subconto Analysis report

- Test No. 30. Analysis of subconto: Counterparties and Agreements

- Test No. 21. Correcting errors found in the Subconto Analysis report

See also:

- Reports are our everything (from the recording of the broadcast on January 30, 2019)

- Accountant Assistant – Universal Report

- How to make a reconciliation report with a counterparty in 1C 8.3

- Inventory of settlements with counterparties in 1C 8.3

- What is the 1C:Sverka service and how to work with it

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

- Report Turnover balance sheet

- Subconto Analysis report

If you haven't subscribed yet:

Activate demo access for free →

or

Subscribe to Rubricator →

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Did the article help?

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

Account Analysis

The “Account Analysis” report is designed to present data on turnover between the selected account and all other accounts for a certain period.

In terms of the content of the information displayed, the report is similar to the Account Turnover report. The difference lies in the form of presentation of information.

The report can be generated with detail by subaccounts or by analytical accounting objects (subaccounts).

Data can be displayed with an additional breakdown by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level and for the account as a whole.

Posting report

When the user needs data for several accounts at once, they take the “Posting Report”. The “Show settings” button in “Selection” also configures the selection of the required indicators. We can set the selection to “Equal” and indicate the selected account and set the subaccount “Counterparties”, indicating the desired counterparty.

Fig.7 Posting report

Fig.8 Selecting data type

When setting the selection, the following conditions can be used.

Fig.9 Selection conditions

We can set the “List of values” condition for selection, for example, account 60.01 and 60.02.

Fig.10 List of values

Fig. 11 Selection in the transaction report

Fig. 12 Posting report

Such conditions can be set when generating any report in 1C.

I would like to draw your attention to the fact that when selecting an account in the selection, you must select the final account, with the subaccount (60.01, 60.02), which forms the posting. Otherwise, by selecting a group account (60 in our example), the report will be generated empty, unlike the account card, where when selecting an account we can specify both the final account and the group account.

Fig.13 Group account selection

Other analytical reports are generated similarly - “Account Analysis”, “Subconto Analysis” and others from the “Standard Reports” group.

Account card

The “Account Card” report is intended to present a sample of invoice correspondences, ordered by date, that relate to the selected time period and in which the selected account was used.

The structure of the report is similar to the Subconto Card report.

Each line of the report corresponds to one account correspondence. The report displays summary information: the initial balance of the selected account, as well as the final balance and total turnover.

Data can be displayed with an additional breakdown by time periods: month, year, etc.

Subconto analysis

The “Subconto Analysis” report is intended to present data on the selected type of subconto: opening and closing balances, turnover for the period according to accounts. A report can be generated not only by a selected subconto or several subcontos, but also by a subconto value or a subconto value attribute.

The report is generated with details on accounts. The report settings allow you to specify additional detail for subaccounts.

Data can be displayed broken down by time periods: month, year, etc.

You can display the expanded balance in the report. In this case, the expanded balance is calculated for each grouping level.

You can set the following settings in the report:

- Indicators

- Grouping

- Selection

- Sorting

- Decor

- Additional data

- Diagram

Subconto card

The “Subconto Card” report is intended to present a sample of invoice correspondences, ordered by date, that relate to the selected time period and in which the selected type of subconto was used.

The structure of the report is similar to the Account Card report.

Each line of the report corresponds to one account correspondence. The report displays summary information: the initial balance of the selected account, as well as the final balance and total turnover.

Data can be displayed with an additional breakdown by time periods: month, year, etc.

Where is analytical accounting carried out?

Analytical accounting information is recorded on all the same accounts as synthetic ones. Before organizing analytical accounting, you should decide on the degree of specification of account information, as well as on what criteria the objects will be combined.

Maintaining such records can be carried out either in automatic computer programs or in paper form. For example, in order to take into account the movement of materials, a special accounting card is generated for each object. It is on its basis that entries are made in account No. 10.

main book

The “General Ledger” report allows you to display information for each account (subaccount) about the balance at the beginning and end of the period, the turnover of the account with other accounts (subaccounts) for the selected period of time. The report is generated based on accounting data.

The report is generated by clicking the Generate .

To generate a more compact report with a hidden header, click the Header .

Report generation parameters can be set using the Settings :

- In the Period , you can specify the period for generating the report: month, year, etc. If you need to display data in the report for periods in which there were no movements in the accounting accounts, then you need to check the All periods .

- To detail the data by subaccounts or by subaccounts of correspondent accounts, you need to select the By subaccounts or By subaccounts of correspondent accounts .

- To display the expanded balance, you need to select the Expanded balance . Additional parameters can be set on the Expanded balance , for example, specify by subaccounts or according to the account analytics, the expanded balance should be displayed in the report. By clicking the Default , you can fill in the settings that are set by default in the report and, if necessary, adjust them.

- When printing, you can display the data of each account (subaccount) on a separate sheet. To do this, you need to check the Split into sheets box .

Where in 1s 8 2 is the card for analytical accounting of settlements with debtors and creditors

To display information about debtors and creditors, with details of transactions down to the primary document, a card of the established form No. RT-12 is intended.

Let us immediately note that the report form of this card is not implemented in the “1C: Enterprise Accounting 3.0” configuration. But the program contains reports containing the data necessary for its compilation. These are all kinds of standard reports. All of them are located in the menu section “Reports” - “Standard reports”.

They have different shapes, but we can safely use them.

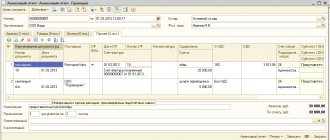

Having generated the “Account Card”, we will see detailed information on the movement documents for the selected account. To select data on contractors, we will create a card for account 60 – “Settlements with suppliers and contractors”. All 1C reports provide flexible settings using the “Show settings” button. In it we can set additional selection, for example, select a specific counterparty.

In the settings, there is a predefined selection for a given account - by counterparty, agreement, document of settlements with counterparties, but if necessary, using the “Add” button, you can include an additional selection option in the report. In this case, the user can save the report settings - the “Save settings” button. "

All analytical reports in 1C are convenient in that by double-clicking on the selected cell, we can open the primary document and view it if necessary.

When the user needs data for several accounts at once, they take the “Posting Report”. The “Show settings” button in “Selection” also configures the selection of the required indicators. We can set the selection to “Equal” and indicate the selected account and set the subaccount “Counterparties”, indicating the desired counterparty.

When setting the selection, the following conditions can be used.

We can set the “List of values” condition for selection, for example, account 60.01 and 60.02.

Such conditions can be set when generating any report in 1C.

I would like to draw your attention to the fact that when selecting an account in the selection, you must select the final account, with the subaccount (60.01, 60.02), which forms the posting. Otherwise, by selecting a group account (60 in our example), the report will be generated empty, unlike the account card, where when selecting an account we can specify both the final account and the group account.

Other analytical reports are generated similarly - “Account Analysis”, “Subconto Analysis” and others from the “Standard Reports” group.

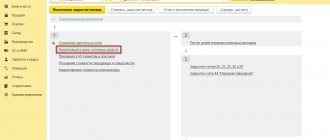

I would like to highlight one more type - “Universal report”. It can also be used to select analytical information to fill out an analytical accounting card. It is located in the “Reports” - “Standard Reports” section. To generate this type of information, you need to select the “Accounting Registers” report type. It also allows you to set various types of selections using the “Settings” button.

Using the “Add selection” button, you can set different conditions for generating data.

Please note that when selecting fields for selection, if you do not find the desired object for detailing, you can expand the data with the plus sign and select inside. That is, any data can be specified in the report settings.

In addition to selection, on the “Structure” tab we need to specify what data we want to see in the report. By clicking on the “Detailed records” field, we set the fields by which the output data is grouped. If there is no line for some reason, you can add detail using the “Add” button.

So, we add fields with the information we need.

As a result of the settings, the detail line looks like this:

After completing these settings and clicking the “Close and Generate” button, we received the report shown above.

Thus, being able to operate with standard reports provided by the 1C: Enterprise Accounting 3.0 program, the user can obtain any information from accounting data and select the necessary data, using any selection and analytics, on the basis of which to create any required report, for which there is no unified form in a programme.

Let's consider the analytical accounting of settlements with counterparties in 1C Accounting 8.3.

- Is there a card in 1C for analytical accounting of settlements with debtors and creditors in form RT-12;

- how analytical accounting is organized in 1C;

- how to analyze settlements with counterparties.

Analytical accounting in 1C is implemented using Subconto.

If we consider accounting for calculations, then in 1C the following is most often used for these purposes:

- Counterparties;

- Contracts.

The organization must secure the forms of primary documents and accounting registers. She can develop them independently or use standardized forms.

Form RT-12 is used to record settlements with counterparties when there is a large volume of them in the organization.

Where can I find a card for analytical accounting of calculations in form RT-12 in 1C?

In 1C, the RT-12 form is not implemented; you can develop it yourself or use standard reports instead to analyze analytical accounting.

Standard reports are flexible in settings (grouping, selection, etc.), so you can get the necessary information from them, but in a slightly different form.

For example, the Account Card report will allow you to view movements using the analyzed account in the context of each operation.

The Account Turnover report will prepare data for analyzing general indicators for accounts.

If standard reports are not enough for you, you can always try creating your own using the Universal Report.

BukhExpert8 advises analyzing settlements with counterparties using the Subconto Analysis report. It allows you to look at calculations from the reverse side - starting from analytical accounting and showing data for all accounts at once.

Test yourself! Take the test:

If you are a subscriber to the BukhExpert8 system, then read additional material on the topic:

If you haven't subscribed yet:

After subscribing, you will have access to all materials on 1C Accounting, recordings of supporting broadcasts, and you will be able to ask any questions about 1C.

Get another secret bonus and full access to the BukhExpert8 help system for 14 days free of charge

- Increasing the VAT rate and its impact on the amount of the contract In 2021, a serious event awaits us all - it is increasing.

- Advance invoice in 1C 8.3: how to issue When receiving an advance payment from the buyer, it is necessary to calculate VAT and issue it.

- Calculation of benefits for child care up to 1.5 years in 1C 8.3 Accounting 3.0 If you are faced with the question of how to carry out in 1C 8.3.

| Sections: | Legislation (ZUP), Salary (ZUP), Personnel (ZUP), Settings (ZUP) |

| Heading: | 1C Accounting 8.3 |

| Objects / Types of charges: | |

| Last change: | 09.04.2019 |

>ID, 'post_tag' ); // since the function returned an array, it would be logical to loop through it through foreach() foreach( $termini as $termin )name . "; > /* * You can also use: * $termin->ID - the ID of the element, of course * $termin->slug - the label of the element * $termin->term_group - the value of the term group * $termin->term_taxonomy_id - the ID of the taxonomy itself * $termin->taxonomy - taxonomy name * $termin->description - element description * $termin->parent - ID of the parent element * $termin->count - number of posts it contains */ ->

To post a comment you must log in or register.

Access to the “Ask a Question” form is only possible if you have fully subscribed to BukhExpert8. Submit an application on behalf of Legal Entity. or Phys. faces you can here >>

By clicking the “Ask a Question” button, I agree with the BukhExpert8.ru regulations >>

Leave your name and phone number, an operator will contact you during business hours within 2 hours.

I want to receive news about promotions, discounts and events from 1C:Franchisee Victoria

The newsletter is sent out once a week, your address will not be shared with third parties.

By clicking on the Send button, I consent to the processing of personal data

The program has various ways to analyze debt. For example, you can use the following tools:

If you need to analyze the debt for accounting purposes, you can create a document “Settlements Inventory Act” for the required date (Section Purchases or Sales – Settlements with counterparties – Settlements Inventory Acts). In the document, the Accounts Receivable and Accounts Payable tabs are filled in using the accounting data collected on settlement accounts with counterparties. From the document you can print the “Act of Inventory of Settlements with Buyers, Suppliers and Other Debtors and Creditors.”

If it is necessary to analyze the debt for tax accounting purposes, then you should create a tax accounting register “Accounts receivable and payable” (Section Reports – Income Tax – Tax accounting registers – 3. Registers for recording the status of a tax accounting unit – 3.10 Accounts receivable and payable).

The generated report is shown in the figure. In the report settings, you can select the type of debt Receivable or Payable.

A convenient tool for analyzing debt simultaneously for both accounting (AC) and tax accounting (TA) purposes is the standard “Subconto Analysis” report (Section Reports – Standard reports – Subconto Analysis).

In addition, the report allows you to evaluate settlements with counterparties by agreement. To build a report in the context of counterparties and contracts, you need to specify the subconto: Counterparties and Contracts in the report settings (the “Show settings” button) on the “Types of subaccount” tab.

Express accounting check

An express check of accounting in the 1C Accounting 8 program helps to obtain summary or detailed information about the state of the information base data at any time.

An express check is a set of checks grouped by accounting sections. Each check ensures that there are no errors in the infobase data. Control may consist in compliance of credentials with certain provisions of the law or in compliance of data with internal algorithms embedded in the program.

As a result of the express check, a report is generated that shows the total number of checks performed and the number of checks during which errors were detected. The report can be printed or saved to a file.

The results of the express check can be displayed with details up to the accounting section or before each check. The report can show comments for each check performed:

- subject of control - what exactly the current inspection checks;

- the result of the check - whether errors were found during the check;

- possible causes of errors;

- recommendations for troubleshooting.

The list of checks performed can be limited ( Show/hide settings ). To prevent a check or check section from being performed, you need to uncheck the box.

What accounts receivable reports are there in 1C?

In the 1C 8 program (hereinafter we will consider this version of the program as the most current and widespread) there are a large number of different reports in which you can see the status of receivables of counterparties.

Conventionally, they can be divided into 2 groups:

- Accounting reports are those reports and documents that are used in everyday practice by accountants who are responsible for keeping accounts or for maintaining records for the enterprise as a whole (chief accountants and deputies). Examples include:

- The turnover balance sheet (hereinafter referred to as the SALT) for the accounts of settlements with counterparties (accounts 60, 62, 76 of the Chart of Accounts, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n). Login to OSV is possible through:

- menu “Desktop” - “SALT by account” (select from the list);

- menu “Purchases and sales” - “Standard reports” - “SALT by account” (select from the list).

Read more about such a report as SALT in the article “Turnover balance sheet - sample filling out 2020”.

By clicking the “Show settings” button in the report form that opens, you can generate a report as you wish in the following sections:

- groupings - by counterparties, contracts, payment documents (for example, issued invoices);

- selection - from the groups listed above, you can select only the counterparties of interest;

- indicators - for example, by expanded balance (convenient for those partners who can have both debit and credit balances at the same time).

- Reconciliation report with the counterparty. Menu “Purchases and sales” - “Settlements with counterparties” - “Settlements reconciliation report”. In this document you can see all the data that is in the accounting for a specific debtor, including the amounts of shipments, payments and offsets.

- Management reports or reports for management. The menu for these reports is called “For Manager”. The menu has subgroups of reports:

- "Settlements with suppliers";

- "Settlements with customers."

These subgroups present summary analytical reports by groups of debts. The creators of 1C considered that they were needed primarily by the management of the enterprise, but nothing prevents other employees from using them. Let's talk about some summary reports in more detail.

ConsultantPlus experts explained what accounts receivable is and how to correctly reflect it in accounting. Get trial access to the system and switch to a ready-made solution.

Report “Analysis of the state of tax accounting for income tax”

The report is intended to identify possible errors in tax accounting data and take into account differences in the valuation of assets and liabilities.

The report contains an analytical analysis of the state of tax accounting and accounting for differences in the valuation of assets and liabilities, which is carried out by comparing data from accounting, tax accounting and accounting for differences in the valuation of assets and liabilities.

The report needs to be generated only after performing routine month-end closing operations.

The report indicators are grouped by economic content and presented in the form of graphic diagrams (block diagrams). Connections between blocks are reflected by arrows. The arrows illustrate the “transition” of value from one accounting object to another. The arrows come from blocks symbolizing objects being written off (their value decreases) and enter blocks symbolizing objects whose value is increasing.

Connections between circuits are indicated in two ways:

- using automatic transitions from one scheme to another;

- on the general diagram.

The transition from one scheme to another is made by double-clicking on the block with the indicators of interest. If the decoding of the requested indicator does not imply a transition to another scheme, then a transaction report opens, containing all the accounts for which this indicator was generated. Each account can be detailed by documents. To do this, you need to select the Expand by command panel documents checkbox. The document can be opened directly from the report and adjusted if necessary.

A general picture of the location of the schemes and the connections between the schemes can be found in the section “Structure of the tax base”. The structure of the tax base is available when opening a report and using the button of the same name on the command panel of any scheme and decoding table. Using the structure of the tax base, you can go to the accounting section of interest.

The “Production” diagram reflects production costs for the production of finished products and services provided to third-party customers. Expenses attributed to the cost of services provided to in-house production units are not reflected in the report.

In the “Cost of Assets” diagram, in the block “Cost of goods, RBP, written off as expenses and depreciation”, the value of assets written off for reasons other than sales (write-off for own needs, write-off for other expenses, returns to suppliers, etc.) is reflected. .

On the “Expenses for ordinary activities” diagram, in the block “Cost of goods, RBP, written off as expenses and depreciation”, the cost of assets written off as expenses for ordinary activities is reflected.

In the “Expenses for ordinary activities” diagram and in the “Production” diagram, a discrepancy between the data in the “Direct costs” block for multi-process production is allowed if at some production stage the reclassification of costs from direct to indirect and vice versa is allowed. The same rule applies to the “Indirect costs” block.

In the “Tax” diagram, the analysis of the state of tax accounting is carried out by comparing the amount of income tax according to tax accounting data (profit statement) and according to accounting data, taking into account the recognition and write-off of permanent and deferred tax assets and liabilities (profit and loss statement). If the amount of income tax according to accounting data coincides with the amount of income tax according to tax accounting data, then tax accounting is regarded as correct.

The blocks illustrate the value of the organization's assets, liabilities, income and expenses according to the following data:

- accounting (yellow background),

- tax accounting (blue background),

- accounting for permanent differences in the valuation of assets and liabilities (pink background),

- accounting for temporary differences in the valuation of assets and liabilities (green background).

If for the indicators of one block the rule “ Value assessment according to accounting data = Value assessment according to tax accounting data + Permanent and temporary differences ” is not followed, then the block is surrounded by a red frame. This is a signal of accounting errors. It is recommended to consider the history of the formation of block indicators, find out the reason for non-compliance with the rule and eliminate it.

The report is not intended to analyze data on income and expenses related to activities with a special taxation procedure. With the exception of those expenses that are classified as activities with a special taxation procedure, as a result of distribution according to income received. The report is not intended to analyze income that is not taken into account when determining the tax base (Article 251 of the Tax Code of the Russian Federation).

Report “Analysis of the state of tax accounting for VAT”

The report is intended for checking in the 1C Accounting 8 program the correctness of filling out the purchase book, sales book and VAT declaration. The report shows the amount of VAT accruals and deductions by type of business transaction.

The report needs to be generated only after completing regulatory VAT operations.

The report consists of a general scheme of the tax base and explanations of individual blocks of this scheme.

To return to the report scheme from the transcripts, click the Tax base structure .

Each block reflecting the accrual or deduction of VAT contains two indicators:

- amount of calculated VAT (yellow background),

- amount of uncalculated VAT (gray background).

If a block contains entries with errors, a red exclamation mark is displayed next to it.

The sum of each report block can be decrypted.

Analytical accounting code

Accounting is rarely carried out only on paper. In this regard, a special coding system is used. Analytical accounting code is a number that is special. the program assigns to objects in the accounting system.

Basically, codes are assigned to objects in chronological order during analytics expansion. Analytical accounting coding makes the process of computer data processing and reporting much faster and easier.

In addition, it is necessary to register the analytical accounting code in the cash receipt order, in the “credit” line. If the company does not maintain analytical accounting, then a dash is placed in this line.

Report “Availability of invoices”

The report is designed to monitor the availability of invoices received from suppliers.

When generating a report, you can set the following parameters:

- Availability of invoice - possible values: Yes - when building the report, documents for which invoices are generated are taken into account,

- No - documents for which invoices were not generated are taken into account,

- It doesn’t matter - all documents that can be used to generate invoices are taken into account.

- Depending on the value of the Selection , the report is generated either based on the documents specified in the List of documents , or based on all documents except those specified in the List of documents .

The results of report generation are displayed in the Result :

- Document-basis - displays the document on the basis of which the invoice is generated.

- Invoice – an invoice generated on the basis of a document. If the invoice details are specified directly in the base document, then the name of the base document is displayed.

- Posted —indicates that the invoice has been posted.

Report “Tax Audit Risk Assessment”.

The form contains report management commands, a “quick” user settings field, and a report result field.

When opened, the “quick” user settings field displays the current list of parameters (the current settings option) by which data can be selected for generating a report. The list of “quick” user settings includes only those parameters that are defined for this during configuration, as well as those for which the “ Quick access ” mode is specified in the user settings of each such parameter. By checking or unchecking options, and changing comparison conditions and comparison values, you can quickly obtain different slices of data.

To edit the full list of current settings, execute the “ Settings ” command. In the form that opens, the selection conditions for generating the report are created. The list may contain additional parameters.

To use existing settings, execute the command “ All actions - Select setting ”. In the list, select the desired setting and click the “ Select ” button. The selection command is present only if the report or configuration has the “ Storage of custom report settings ” property set.

The report may contain several options for report settings defined during configuration. To select the desired option, use the “ Select Option ” command. In the list, select the desired option and click the “ Select ” button. The list will contain those settings that were previously saved by the “ All actions - Save settings ” command.

If the values of all parameter settings are intended to be used to build a report in the future (possibly if the user has the “ Save user data ” right), then a version of these settings can be saved. To do this, execute the command “ All actions - Save option ”. In the form that opens, specify the name of the option and click the “ Save ” button.

If you need to change an existing option, run the command “ All actions - Change option ”. In the form that opens, select an option and click the “ Select ” button. Make the required changes and save the result.

If changes have been made to the “quick” user settings field and you want to return to the “standard” values (values that are saved for the current settings option), run the command “ All actions - Set standard settings ”.

To build a report, click the “ Generate ” button.

The result is displayed in the field of the spreadsheet document. In the upper part of which the values of the selection parameters used for this construction are indicated.

The report result can be saved in the 1C Accounting 8 program and also printed.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

Setting up functionality in the 1C Accounting 8.3 program

| Interface Taxi 1C Accounting 8.3 How to switch to bookmarks, 1C Accounting 7.7 |

| Preparing to work with 1C Accounting |

| 1C Accounting setting up accounting parameters |

| Warehouse operations in 1C Accounting |