List of persons entitled to receive money

The employing organization, by virtue of accounting legislation, is obliged to organize and maintain internal control of the facts of economic life. You can find such a requirement in Part 1 of Article 19 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. The procedure for control over the issuance of money to accountable persons must be determined by the general director of the company. He may issue an order with a list of persons who are entitled to receive funds. Here is a sample of such an order:

In order to comply with cash discipline, an employee is considered to be a person with whom an employment or civil law contract has been concluded (clauses 5 and 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014). Consequently, money can be issued, including to the contractor, on account. He may need them, for example, to purchase materials to perform work under a civil contract. This amount can be given to him for the report, for example, from the cash register.

A small reminder for accountants

Accountants should always remember the following rules:

- The employee must write an application to receive cash from the cash register.

- The operation to issue funds must be formalized with an expenditure order.

- If funds are not fully spent, they must be returned back to the cashier.

- A new advance cannot be issued until the employee has accounted for the old one.

- One accountable person cannot be given more than one hundred thousand at a time.

- The expenditure of funds must be confirmed by documents (checks, receipts, acts, invoices).

- In order to confirm payment for goods, one cash receipt is not enough; you also need a sales receipt.

- If the money is not returned within the prescribed period, it is withheld from the employee's salary. Personal income tax is charged on the amounts of accountable funds. If controversial situations arise, they must be challenged in court.

Read more about accounting for accountable funds in the article.

Similar articles

- Order for issuance and issuance of funds for reporting

- Settlements with accountable persons: postings

- Accounting for settlements with accountable persons

- Order for the issuance of accountable amounts (sample)

- The procedure for conducting cash transactions in 2016-2017

What amount can be issued for reporting in 2021?

What is the maximum amount that can be reported? Is it possible to give a large sum to the CEO for a long period of time? Is it true that you cannot issue more than 100,000 rubles? Such questions often arise among accountants and HR workers.

Let us remind you that the maximum cash payment limit of 100,000 rubles per transaction does not apply when issuing money on account (clauses 5 and 6 of the Directive of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U). After all, this maximum amount is applied exclusively in settlements with other organizations or individual entrepreneurs (clause 6 of the Instructions of the Central Bank of the Russian Federation No. 3073-U). Consequently, an employee of an organization can be given a larger amount. So, for example, a manager (director) can be given, say, 350,000 rubles and this will not be considered a violation of cash discipline.

In 2021, accountable amounts can be transferred to the bank card of the accountable person, incl. for salary (Letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288).

What changes affected the reporting in 2016-2017

In 2021, the main transformations in terms of accounting for accountable funds affected budgetary institutions. In connection with the adoption of amendments to the instruction on budget classification, approved by Order of the Ministry of Finance dated July 1, 2013 No. 65n, some KOSGU codes have changed, as a result of which the analytical accounts for accounting for accountable amounts have also changed.

For the procedure for accounting for accountable amounts in budgetary institutions, see the article “Settlements with accountable persons in budgetary institutions .

Also in 2021, amendments were made to the Tax Code of the Russian Federation. Now the date for personal income tax assessment of excess daily allowance paid is the last day of the month in which the employee submitted an advance report (subclause 6, clause 1, article 223 of the Tax Code of the Russian Federation). Previously, officials considered the date of receipt of income subject to taxation to be the moment of payment of excess funds to an employee (letter of the Ministry of Finance dated June 25, 2010 No. 03-04-06/6-135).

If excess daily allowances were paid in foreign currency, then they should be recalculated into rubles to determine income at the rate of the Central Bank of the Russian Federation valid on the last day of the month in which the advance report was approved (letter of the Ministry of Finance of the Russian Federation dated June 5, 2017 No. 03-04-06 /35510).

Let us recall that in tax accounting the daily allowance norms are approved by clause 3 of Art. 217 of the Tax Code of the Russian Federation and amount to 700 rubles. per day for business trips in Russia and 2,500 rubles. - for trips abroad. Amounts of daily allowance paid to employees in excess of the specified norms are subject to personal income tax and insurance contributions.

In 2021, 2 important changes were made to settlements with accountables, and more specifically, to clause 6.3 of the instructions of the Central Bank of the Russian Federation dated March 11, 2014 No. 3210-U:

- Now, to issue funds, an employee’s application is not necessary - it is enough to issue an administrative document on behalf of the director of the enterprise or individual entrepreneur.

- Accountable amounts can be issued even if there are previously unreturned accountable funds.

The changes are based on the instructions of the Central Bank of the Russian Federation dated June 19, 2017 No. 4416-U and came into force on August 19, 2017.

Otherwise, the procedure for settlements with accountants in 2021 remains the same. Let's look at it in more detail.

Report for the amount received: mandatory or not?

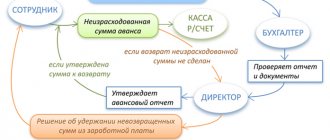

You can issue cash on account if the employee has not repaid the debt on previously issued funds. This can be done from August 19, 2021. However, this does not mean that employees no longer need to prepare advance reports on the amount spent. Even after August 19, 2021, the employee must submit reporting documents to the accounting department about the money spent.

Until August 19, 2021, it was impossible to issue money on account if the employee did not submit a report on previously received amounts. However, from this date, such requirements are excluded from paragraph 6.3 of Bank of Russia Instructions No. 3210-U dated March 11, 2014.

Money issued for reporting: posting and basic rules

Rule 1. When preparing cash documents, the accountant must be guided by the provisions of instruction No. 3210-U.

Rule 2. The issuance of money to an accountable person is issued on the basis of an order or other administrative document of the company’s management or a written application from an employee. The application must indicate the amount to be issued and the period for which the money is issued. In addition, it is necessary to describe the purpose for which accountable funds are needed, so that it is clear that the need for them is caused by production needs and is related to the activities of the enterprise (clause 6.3 of instruction No. 3210-U). Moreover, if during the day amounts are issued to different employees, then it is enough to issue one order from the manager indicating the full name and positions of all subordinates, the amount, goals and deadline for issuance. The order must be signed by the manager and contain the date and registration number (letter of the Central Bank of the Russian Federation dated 09/06/2017 No. 29-1-1-OE/2064).

NOTE! From August 19, 2017, an application for the issuance of money on account is not a mandatory procedure. The manager's order is enough.

Rule 3. The deadline for issuing accountable funds is established by a local act of the enterprise. But the refund period is the norm established by law; it is 3 days (paragraph 2, clause 6.3 of instruction No. 3210-U). After the expiration of the period for which the funds were issued, the accountable person is obliged to report and/or return the remaining money to the enterprise within 3 days.

Rule 4. The issuance of money for reporting from the cash register is formalized by an expense order. Return of balances of accountable amounts - receipt orders. Money can also be issued by transferring it to the applicant’s bank card (letter of the Ministry of Finance dated August 25, 2014 No. 03-11-11/42288). The accountant can also return the money by transferring funds to the company’s current account. However, the possibility of non-cash accountable payments should be enshrined in the accounting policy.

Read about transferring accountable amounts to an employee’s bank card and returning them here.

Rule 5. There is no limit on the amounts that can be reported. Therefore, the enterprise has the right to issue money to the accountable person in any amount. However, if the accountable person will pay in cash under agreements on behalf of his enterprise, then the settlement limit (RUB 100,000 per agreement) must be taken into account.

Rule 6. Issuing money on account to a person who has a debt on accountable amounts, from 08/19/2017, is not a violation of the law.

You can learn about the maximum amount that can be reported, how and when to do this, from the article “What is the maximum amount that can be reported in 2016?” .

Rule 7. Since 2014, enterprises and individual entrepreneurs can issue funds for reporting to employees, which means not only employees working on the basis of a permanent employment contract, but also those who are in civil legal relations with the enterprise (letter from the Central Bank of the Russian Federation dated 02.10.2014 No. 29-1-1-6/7859).

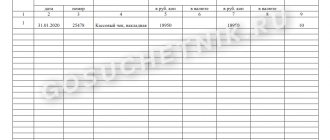

Issued from the cash register for reporting - how will this business transaction be reflected in the accounting accounts? The posting will have the following form: Dt 71 Kt 50. Let us recall that analytical accounting of accountable amounts is carried out in the context of accountable persons. This allows you to quickly check whether the accountable person has an outstanding debt on the funds issued.

Accountable funds and settlements with counterparties: what is the difference

Everyone has heard about the size of the restrictions on cash payments of 100 thousand rubles. Where did this figure come from?

The limit of 100 thousand rubles within the framework of one agreement is established by clause 6 of the Directive of the Bank of the Russian Federation “On making cash payments” dated October 7, 2013 No. 3073-U for settlements between legal entities and between legal entities and individual entrepreneurs. The same paragraph states that this restriction does not apply to the issuance of money to accountable persons. It turns out that the maximum reporting amount has nothing to do with this figure.

What if we need to give an employee funds to pay a supplier? Should we give an employee no more than 100 thousand rubles for these purposes? In this case, even if the debt to the supplier is above 100 thousand, the employee can transfer to the counterparty on behalf of the company within the framework of one agreement no more than 100 thousand rubles in cash, having previously received them from the cash register (at a time or in parts). If the advance was issued exclusively for these purposes, then issuing a larger advance will look at least strange.

Of course, if a company employee needs to pay in cash to several suppliers at once or under several contracts with one supplier, he can account for more than 100 thousand rubles.

Do not forget that the issuance of money is accompanied by the execution of an order (at the end of the article).

Application for issuance of accountable amounts

To receive cash on account, the employee must write an application in any form, in which he must indicate the required amount and for what purposes it will be spent.

There are no restrictions in the legislation on the amount of accountable amounts and the period for which they are issued. The head of the organization must confirm his consent to the issuance of money by putting his signature and date on the application. According to the new rules, from June 1, 2014, the head of the organization does not need to make a handwritten note on the application about how much cash is issued and for how long (clause 6.3 of Bank of Russia Directive No. 3210-U dated March 11, 2014).

Attention: the maximum amount for cash payments is RUB 100,000. for one transaction - does not apply when issuing accountable amounts to an employee (clauses 5 and 6 of the instruction of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U). However, this limitation applies to settlements with other organizations or entrepreneurs (clause 6 of the instruction of the Central Bank of the Russian Federation dated October 7, 2013 No. 3073-U). Therefore, when paying for goods (work, services) on behalf of the organization, the employee must comply with it. If the limit is violated, tax inspectors may fine the organization.

Inspectors may determine a violation of this rule when checking employee expense reports (cash receipts, receipts attached to it). The amount of the fine for the organization in this case can range from 40,000 to 50,000 rubles. Inspectors have the right to fine its manager in the amount of 4,000 to 5,000 rubles. This is stated in Article 15.1 of the Code of the Russian Federation on Administrative Offenses.

Typically, violations related to exceeding the cash payment limit are one-time in nature (settlement rules are not constantly violated over a long period of time). Such offenses are not considered ongoing (clause 14 of the resolution of the Plenum of the Supreme Court of the Russian Federation of March 24, 2005 No. 5). Therefore, inspectors must detect them within two months after the employee pays in cash (Part 1, Article 4.5 of the Code of Administrative Offenses of the Russian Federation). If they missed this deadline, the organization cannot be fined.

Changes in the procedure for issuing money for reporting

The previously applied procedure provided for the release of funds to the account upon the application of a company employee approved by the manager. From 08/19/17 the basis for payment may be:

- employee statement approved by the manager;

- administrative document of the head of the organization.

For example, when sending employees on a business trip, it is more convenient to issue an order to send them on a business trip, in which you can specify the amount and timing of payment of travel expenses.

In any case, in the application or in the administrative document, the manager should indicate the period for which funds are issued for reporting. After the end of this period, the employee is obliged to either submit a report and documents confirming expenses within three working days, or return the excess funds received.

The correctness of drawing up an order for the issuance of “accountable cash”

The order form is developed independently in each subject; there is no specialized form

The order contains information about the recipient of the accountable funds, the maximum amount of the “underreporting” funds issued, the purpose of issuing the accountable funds, as well as the deadlines for which the accountable amount was issued.

Accountable persons are obliged not only to spend the issued funds for appropriate purposes, but also to promptly submit to the accounting department a written report on the expenditure of accountable funds with supporting documents (cash receipts, sales receipts, etc.). If the issued account amount was not used in full, the accountable person is obliged to return these unused funds.

| The order on accountable persons must contain the following details: • in the header - the name of the company; • date(s) of drawing up/approval of the document; • a list of individuals, indicating their full name and position, who may be entrusted with funds for reporting purposes; • information about the maximum amounts and intended purpose of funds issued against the report, as well as the deadlines for submitting the report (return of unused funds); • Full name and signature of the manager; • Full name and signature of the official responsible for issuing accountable funds. |