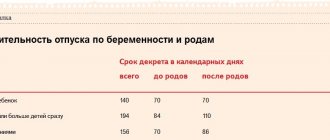

Question: When my firstborn was 10 months old, I interrupted my maternity leave and went on another maternity leave. How will I now be paid benefits for children up to the age of 1.5 years: only for the second or for both?

If you have any questions, you can chat for free with a lawyer at the bottom of the screen or call by phone for any region.

The benefit is paid for each child until he turns 1.5 years old. The payment amount is 40% of average earnings for working citizens.

Who is entitled to child care payments?

The following persons are entitled to monthly child care benefits:

- mothers, fathers and other relatives working under an employment contract;

- unemployed mothers, fathers and other relatives;

- full-time students;

- dismissed mothers, fathers and other persons during the liquidation of the enterprise;

- mothers and fathers serving under contract;

- mothers who adopted children under 3 months of age.

The amount of payments is established by Article 15 of Law No. 81-FZ of May 19, 1995 “On State Benefits for Citizens with Children” (hereinafter referred to as Law No. 81-FZ) and is:

- 40% of average earnings for working citizens;

- 40% of the minimum wage for working citizens if they have no income for the last 24 months or their average earnings are below the minimum wage;

- scholarship amount for students;

- a minimum fixed by law for the unemployed, dismissed persons and wives of conscripted military personnel.

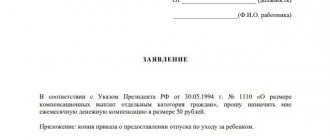

Working persons apply to the employer for payment, and all others apply to the social security authorities.

What payments are taken into account when calculating average per capita income

To calculate, it is necessary to determine the total family income. But not all citizens’ income should be taken into account when calculating. For example, if you include too much, the value will be overestimated, and the family risks not receiving the payments due.

What income should be taken into account when calculating:

- Salary and remuneration for work: official salary (rate), compensation and incentive additional payments. Salary of military personnel and maintenance of state (municipal) employees.

- Payment of vacation pay, business trips (average earnings), educational leave.

- Hospital benefits (for illness, injury, care, maternity leave, birth, etc.). Please note that benefits of all types provided for by the legislation of the Russian Federation are considered income.

- Severance pay and vacation compensation paid upon dismissal.

- All types of payments provided for in the employment contract with the employer and the Labor Code of the Russian Federation.

- State pensions and additional payments to them, including compensation.

- Scholarships, including social and academic.

- Benefits for unemployed citizens.

- Alimony.

- Income from business activities (counted in proportion to the calculation period).

- Remuneration under civil law contracts, author's orders.

- Payments related to election campaigns or public activities.

- Income from shares, dividends and from invested money.

- Money received from renting or selling property.

- Funds received from the household: growing vegetables and fruits, birds and livestock.

Receipts are taken into account for the billing period, usually 12 calendar months. But for certain types of benefits the calculation period is shorter. For example, to receive a social scholarship, you need to confirm your income for six months.

Calculation of benefits up to 1.5 years for unemployed people

Article 15 of Law No. 81-FZ establishes a single minimum amount of care allowance for the following categories of citizens:

- pregnant women dismissed during the liquidation of an enterprise;

- mothers, fathers, grandparents, and other relatives dismissed during the liquidation of the organization;

- unemployed persons.

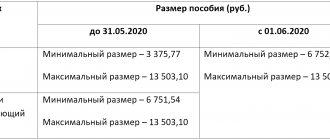

When caring for the first child from February 1, 2021, they pay 3,277.45 rubles, for the second and subsequent ones - 6,554.89 rubles.

For the unemployed, only the birth order of the child is taken into account. The indicated payment amounts do not depend on the minimum wage, but are only subject to annual indexation.

The benefit may be increased if the region applies the regional coefficient.

For example, an unemployed mother living in Orenburg applied for benefits for her second child. The region has a coefficient of 1.15. Let's calculate the amount:

6,554.89 × 1.15 = 9,832.33 rubles.

Read more: What benefits can a stay-at-home mother count on?

Average earnings for calculating benefits

In your average earnings for calculating benefits, include all payments and other remunerations from which contributions to the Federal Social Insurance Fund of Russia are calculated. This is provided for by paragraph 2 of Article 14 of the Law of December 29, 2006 No. 255-FZ, paragraph 2 of the regulation approved by Decree of the Government of the Russian Federation of June 15, 2007 No. 375.

Payments for which contributions to the Federal Social Insurance Fund of Russia are not calculated should not be included in the average earnings of the billing period. For example, such payments include hospital benefits and maternity benefits (Clause 1, Part 1, Article 9 of Law No. 212-FZ of July 24, 2009).

It is important to remember that the average earnings for each year of the billing period can only be taken within the limits of the base for calculating contributions to the Social Insurance Fund of Russia. That is, no more than the following amounts:

- in 2015 – 670,000 rubles;

- in 2014 – 624,000 rubles;

- in 2013 – 568,000 rubles;

- in 2012 – 512,000 rubles;

- in 2011 – 463,000 rubles;

- in 2010 – 415,000 rubles.

This procedure is established by part 3.2 of article 14 of the Law of December 29, 2006 No. 255-FZ and part of article 2 of the Law of December 8, 2010 No. 343-FZ.

Online FSS calculator

The Social Insurance Fund of Russia (hereinafter referred to as the FSS) has created a “Benefit Calculator”. The calculation algorithm includes all legal norms, minimums and maximums. The service will help you calculate the amount of child care payments.

To find out the payment amount you need to fill in the following fields:

- date of birth of the child;

- time of benefit payment;

- amount of earnings for 2017–2018. When you select the item “Employee’s application to change the years of accounting for earnings,” the service allows you to enter data on income for other periods;

- bet size;

- the number of hours worked and the number of calendar days excluded.

Let's check the operation of the calculator using the last example.

After entering all the data, click on the “Calculate” button and go to the “Calculation” tab.

100% of the average earnings and the amount of benefits per child coincide with manual calculations. The calculator helped save time.

The calculator user can print the calculation results or display the data in a third-party interface - Excel.

Factors influencing the amount of benefit

The amount of sick leave payment depends on several factors:

- the insurance experience accumulated by the employee;

- the average earnings of a particular citizen for the 2-year period preceding the illness;

- number of days of illness.

The average employee's earnings are taken for 1 calendar day. The method for calculating the average daily income of a citizen is given in the article below.

When calculating this indicator, all payments in favor of the employee from which insurance contributions were deducted are taken into account (clause 2, article 14 of Law No. 255):

Articles on the topic (click to view)

- What is the indication for issuing a certificate of incapacity for work?

- Periods of temporary disability after surgery

- Temporary disability benefit: required documents

- The procedure for calculating and calculating temporary disability benefits

- What determines the amount of temporary disability benefits?

- Calculation of temporary disability benefits: prize and posting

- Certificate of incapacity for work: conditions for filling out, sample for filling out 2021

- wage,

- all types of bonuses and rewards,

- all additional payments to salary,

- compensation for unused vacation or parts thereof,

- wages given to an employee in the form of goods or services,

- payment for vouchers to sanatoriums,

- payment for kindergarten for an employee’s child,

- payment of rent, etc.

The number of days of illness is recorded in the certificate of incapacity for work, confirmed by the signature of the doctor who observed the patient and certified by the seal of the medical institution.

Need to remember

- Allowance for child care up to 1.5 years is due to every person who is on this leave. But the size of the payment depends on factors such as the status of the recipient, the average income and the order of birth of the child.

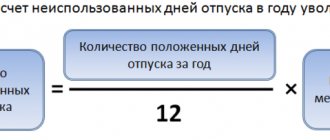

- Calculation for working citizens occurs according to the formula. The resulting value cannot be less or more than the established limits.

- The law prescribes benefits for unemployed persons and those laid off during the reorganization of enterprises in a fixed amount, which is indexed each year to the inflation rate of the previous year.

- If a person simultaneously cares for two or more children, then the total amount of the benefit cannot be more than 100% of average earnings and less than the sum of the minimum values for each child in order.

Emergency hotline for the population : we provide free consultations to pensioners, parents and beneficiaries of any category from legal experts over the phone.

Payment amounts and indexation

The benefit for up to 1.5 years for the first child in 2021

can be received by the person directly caring for the baby.

However, he does not have to be the child’s parent. For most categories of citizens, benefits are set as a percentage of earnings. In accordance with Art. 11.2. Law No. 255-FZ, the amount of payment is 40% of the average income of a citizen for the 2 years

preceding the application.

The result should be multiplied by the size of the regional coefficient, provided that it is established in the region.

If a parent has several children for whom he has the right to apply for benefits, then the payment is made for all children, but the transfers are summed up. The total cannot exceed 100%

of the applicant's average earnings.

Calculation formula

The calculation of the calculation of the certificate of incapacity for work in 2021 is made using the following formula: X = A x C x D, where:

- X – the required amount of sick leave payment;

- A – average daily earnings, a detailed description of the calculation is given in the previous section;

- C – coefficient depending on the insurance period. Standard values are given earlier in the article;

- D – the number of days of illness recorded on the sick leave.

How sick leave is calculated and paid in 2021 - watch in the video:

Child benefits

All benefits are divided into federal and regional. Federal benefits are paid to all Russians on equal terms and do not depend on their place of residence. We have compiled a list of basic certificates that will be required to process payments. The exact list of documents may vary depending on the situation. Regional benefits are assigned by regional authorities, so in some areas they may differ in size or be absent altogether. The list of documents for registration of regional benefits must be clarified with local social protection authorities.

| Type of benefit | Documentation |

| Maternity benefit These are payments that a woman receives for maternity leave 70 days before giving birth (84 days for a multiple pregnancy). Who can get it: expectant mothers who work (or worked and were laid off), full-time students in technical schools and universities, contract military personnel. |

Important. The deadline for submitting documents is no later than 6 months from the end of maternity leave |

| One-time benefit for women registered in the early stages of pregnancy Paid together with basic maternity benefits. Who can receive: an expectant mother who registered with a doctor before the 12th week of pregnancy |

|

| One-time benefit for the birth of a child One-time payment to one of the parents. For the birth of >2 children, the benefit is paid for each child. Who can receive: one of the parents | For working people

If the parents are divorced , a certificate of non-receipt of benefits from the second parent is not needed. Instead, you will need a divorce certificate and a certificate of the child living together with the employee. For non-working people

If you have never worked:

Important. Submit documents within 6 months from the date of birth of the child. |

| Monthly allowance for child care up to 1.5 years A monthly benefit that is paid after maternity leave until the child turns 1.5 years old. Who can receive: a parent, a relative who is caring for a child and therefore does not work, a guardian, an adoptive parent or a foster parent. | For working people

For non-working people

Important. Submit documents within six months before your child turns 2 years old. The benefit is paid for the entire period from the date of granting parental leave until the child reaches 1.5 years. |

Calculation of benefits in 2021 using an example

Let's calculate benefits for a certificate of incapacity for work using a specific example.

Expert opinion

Lebedev Sergey Fedorovich

Practitioner lawyer with 7 years of experience. Specialization: civil law. Extensive experience in defense in court.

Gr. Sidorov was hired on January 10, 2010. In April 2017, he was sick for 10 days, as evidenced by his sick leave. Total income for 2015 amounted to 500 thousand rubles, and for 2021 - 800 thousand rubles.

Therefore, we have the following initial data:

- insurance period = 7 years, therefore, coefficient = 0.8;

- number of days of incapacity for work = 10;

Let's calculate the average daily earnings for a 2-year period: in 2016, the amount of earnings exceeded the maximum allowable value, therefore, for the calculation we take the standard value for 2021, equal to 718 thousand rubles.

Next, we calculate the amount of the benefit: 1668.49 x 0.8 x 10 = 13347.92 rubles.

Dependence of the benefit amount on the insurance period

Federal Law (FZ) No. 255-FZ of December 29, 2006 regulates the proportions in which the amount of benefits for a certificate of incapacity for work depends on the citizen’s insurance experience. Let's look at specific indicators in the table:

| Insurance experience | Sick leave payment amount | Coefficient for calculating benefits |

| up to six months | 1 minimum wage* (clause 6, article 7 of Federal Law No. 255) per month | |

| from 6 months to 5 years | 60% of average earnings | 0,6 |

| from 5 to 8 years | 80% avg. earnings | 0,8 |

| over 8 years | 100% avg. earnings | 1 |

*MINIMUM WAGE – minimum wage.