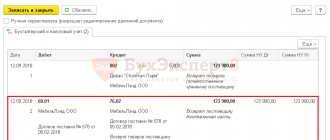

Accounting entries

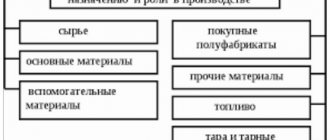

The receipt of materials into the organization is carried out under supply contracts, by manufacturing materials by the organization, making a contribution to the authorized (share) capital of the organization, receiving the organization free of charge (including a gift agreement). Materials include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, containers, spare parts, construction and other materials.

The following are accounting entries reflecting the receipt of materials into the organization.

- Accounting for receipt of materials under a supply agreement. Accounting entries

- Accounting for receipt of materials based on advance reports. Accounting entries

- Accounting for the receipt of materials under an exchange agreement. Accounting entries

- Accounting for receipt of materials under constituent agreements. Accounting entries

- Accounting for free receipt of materials. Accounting entries

- Accounting for the receipt of materials produced in-house

List of accounts involved in accounting entries:

|

|

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting the accounting for the supply of materials with payment to the supplier after receipt of the materials | ||||

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 51 | The fact of repayment of accounts payable to the supplier for previously received materials is reflected. | Purchase price of goods | Bank statementPayment order |

| Postings for accounting for the supply of materials on prepayment | ||||

| 60.02 | 51 | Prepayment to the supplier for materials is reflected | Advance payment amount | Bank statementPayment order |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 60.02 | The previously transferred prepayment is offset against the debt for the materials received. | Purchase cost of materials | Accounting certificate-calculation |

Accounting for receipt of materials based on advance reports. Accounting entries

Below are accounting entries reflecting the accounting of receipt of materials from accountable persons on the basis of advance reports and the primary documents attached to them (delivery notes, invoices).

The receipt of materials from an accountable person can be reflected in two options:

- In the first option, a standard posting scheme is considered, reflecting the receipt of materials from account 71 “Settlements with accountable persons”. The disadvantage of this option is that the accounting does not reflect the supplier from whom the materials were received and for which VAT was refunded.

- In the second option, the receipt of materials is reflected in correspondence with account 60 “Settlements with suppliers and contractors” and further, the debt to the supplier is closed in correspondence with account 71 “Settlements with accountable persons”. With this reflection option, there is an additional opportunity to analyze supplies by supplier

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to the standard scheme | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 71 | The receipt of materials from the accountable person to the organization's warehouse is reflected on the basis of primary documents attached to the advance report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) Advance report |

| 19.3 | 71 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to a scheme using a accounts payable account | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected on the basis of primary documents attached to the expense report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 71 | Reflects payment to the supplier by the accountable person for materials received | Purchase cost of materials | Accounting certificate-calculationAdvance report |

Accounting for the receipt of materials under an exchange agreement. Accounting entries

The legal basis that determines the procedure for forming an exchange agreement is defined in Chapter 31 “Barter” of the Civil Code of the Russian Federation. The methodology for reflecting supply transactions under an exchange agreement is discussed in more detail in the article “Accounting for the purchase and sale of goods under an exchange agreement”

The cost of materials to be transferred is established based on the price at which, in comparable circumstances, the organization determines the cost of similar materials.

Below are accounting entries reflecting the accounting for the receipt of materials from suppliers under an exchange agreement with the usual procedure for transferring ownership of materials, in accordance with Article 223 “Moment of the emergence of the acquirer’s right of ownership under the agreement” of the Civil Code of the Russian Federation and Article 224 “Transfer of a thing” of the Civil Code of the Russian Federation.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 60.01 | The receipt of materials from the supplier under an exchange agreement is reflected. Subaccount 10 is determined by the type of materials received | Market value of materials excluding VAT | Invoice (TMF No. M-15) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Invoice (TMF No. M-15) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | InvoicePurchase book |

| 62.01 | 91.1 | The transfer of exchanged materials to the supplier under the exchange agreement is reflected | Market value of transferred materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 10 | The write-off of transferred materials from the organization’s balance sheet is reflected. Subaccount of account 10 is determined by the type of materials transferred | Cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT accrued on the transferred materials is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 60.01 | 62.01 | The debt of the second party under the exchange agreement is offset | Cost of materials | Accounting certificate-calculation |

Receipt of materials to the warehouse under an exchange agreement

The cost of the exchanged materials is determined by agreement of the parties to the transaction. The price must be market price.

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| 10.01 | 60.1 | Receipt of materials from the counterparty | Cost of materials (excluding VAT) | Receipt order, Consignment note |

| 19.03 | 60.01 | VAT on materials received | VAT | Consignment note, Invoice |

| 68.02 | 19.03 | VAT is transferred to reimbursement from the budget | VAT | Purchase book, Invoice |

| 62.01 | 91.01 | Transfer of materials to the counterparty under an exchange agreement | Market price of materials | Invoice, invoice |

| 91.02 | 10.01 | Transferred materials are written off from the balance sheet | Cost of materials written off (FIFO, piece, weighted average) | Invoice, invoice |

| 91.02 | 68.02 | VAT on transferred materials | VAT of transferred materials | Invoice, Invoice, Sales Book |

| 60.01 | 62.01 | Settlement of exchange debts | Cost of materials | Accounting certificate-calculation |

Accounting for receipt of materials under constituent agreements. Accounting entries

According to the constituent agreement, the founders (participants) contribute various types of property, including materials, to the authorized (share) capital of the organization. According to clause 8 of PBU 5/01 “Accounting for inventories”, the actual cost of inventories (materials) contributed to the contribution to the authorized (share) capital of the organization is determined based on their monetary value, agreed upon by the founders (participants) of the organization .

Based on the above provisions, the receipt of materials under the constituent agreement can be reflected in the accounting below with the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 75.1 | We reflect the receipt of materials under the constituent agreement. Subaccount 10 is determined by the type of materials received | Estimated cost of materials agreed upon by the founders | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

| 19 | 83 | If the founder transferring materials to the authorized capital of the organization, in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation, restores VAT, the receiving party must make this posting | The amount of VAT restored by the founder | InvoiceAct of acceptance of transfer of materials |

Accounting for receipt of materials at actual cost (postings, example)

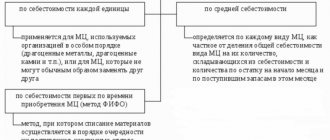

If inventory items are accepted for accounting at actual cost, then they are immediately debited to account 10 at the cost indicated in the supplier’s documents. If the organization is a VAT payer, then the tax amount is allocated for reimbursement from the budget to a separate sub-account. Postings when accounting for materials at actual cost are as follows:

| Debit | Credit | Operation name |

| 60 | 51 | The cost of received goods and materials was paid to the supplier |

| 10 | 60 | Inventory and materials are accepted for accounting at actual cost excluding VAT |

| 19 | 60 | VAT is allocated from the cost of inventory items |

Transportation and procurement costs (TPC) when purchasing materials in accounting can be taken into account in different ways:

- Can be included in the actual cost of materials on account 10.

- May be reflected in a separate subaccount of account 10.

- Can be taken into account on account 15.

The organization chooses one of these methods of accounting for transportation and procurement costs and reflects this in the accounting policy order

Example of accounting for receipt of materials upon purchase

| The organization Alpha LLC purchased 5,000 cubic meters of parquet for 600,000 rubles. including VAT 91,525. For delivery they paid 6,000, including VAT 915 rubles. 3,000 cubic meters of parquet were put into production. These transactions must be reflected on the balance sheet. Note: (How VAT is calculated from the amount can be found in the article: “How to calculate VAT. VAT tax rates.”). Transport and procurement work is accounted for on account 10 of the TZR subaccount. |

Postings for accounting for receipt of materials upon purchase

| Sum | Debit | Credit | Operation name |

| 600000 | 60 | 51 | Paid the cost of parquet |

| 508475 | 10 | 60 | Parquet was capitalized excluding VAT |

| 91525 | 19 | 60 | VAT allocated |

| 6000 | 60 | 51 | Delivery paid |

| 5085 | 10 subaccount TZR | 60 | Parquet delivery costs taken into account |

| 915 | 19 | 60 | VAT allocated |

| 360000 | 20 | 10 | Materials written off for production |

| 360000 | 20 | 10 subaccount TZR | TZR written off for production |

TZR are written off once a month in one transaction. To determine the amount of write-off of transportation and procurement costs, the following ratio is determined:

Accounting for free receipt of materials. Accounting entries

In accounting, according to clause 16 of PBU 9/99 “Income of the organization,” income in the form of gratuitous receipt of property is recognized “as it is generated (identified).”

In tax accounting, according to paragraphs. 1 clause 4 of Article 271 “Procedure for recognizing income under the accrual method” of the Tax Code of the Russian Federation, income in the form of gratuitous receipt of property is recognized on the date the parties sign the property acceptance and transfer act.

According to clause 9 of PBU 5/01 “Accounting for inventories”, “the actual cost of inventories received by an organization under a gift agreement or free of charge ... is determined based on their current market value as of the date of acceptance for accounting.”

Based on the above provisions, the gratuitous receipt of materials can be reflected in the accounting below using the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 91.1 | We reflect the free receipt of materials. Subaccount 10 is determined by the type of materials received | Market value of materials on the date of acceptance for accounting | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

How to reflect the sale of finished products in transactions

When accounting without using an account, the actual cost of production is written off to account 90.02. If an account is used to account for finished products at their standard cost, then another entry is made to correct deviations of the actual cost from the planned one.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 90.02 | Finished products are sent for sale at actual production costs | 10000 | Help-calculation, TTN | |

| 90.02 | Adjusting cost variances | 200 | Help-calculation |

Accounting for the receipt of materials produced in-house

According to the methodological instructions, materials are accepted for accounting at actual cost. The actual cost of materials when manufactured by the organization is determined based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials are carried out by the organization in the manner established for determining the cost of relevant types of products. Those. The procedure for reflecting materials produced in-house in accounting depends on the methodology for calculating the cost of products used in the organization.

Currently, the following types of assessment of finished products are used:

- At actual production cost. This method of assessing finished products (manufactured materials) is used relatively rarely, as a rule, in single and small-scale production, as well as in the production of mass products of a small range.

- Based on the incomplete (reduced) production cost of products (manufactured materials), calculated based on actual costs without general business expenses. Can be used in the same industries where the first method of product evaluation is used.

- At standard (planned) cost. It is advisable to use in industries with mass and serial production and a large range of products.

- For other types of prices.

Below we will consider two options for recording the receipt of materials produced in-house in accounting.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for materials at standard (planned) cost. | ||||

| 10 | 40 | The release (manufacturing) of materials is reflected at the planned cost | Planned cost | Receipt order (TMF No. M-4) |

| 40 | 20 | The actual production cost is reflected | Actual cost of manufactured materials | Accounting certificate-calculation |

| 10 | 40 | The write-off of deviations between the cost of materials at actual cost and their cost at standard (planned) cost is reflected. | The amount of deviation is “black” or “red” depending on the balance of the deviation | Accounting certificate-calculation |

| Accounting for materials at actual cost. | ||||

| 10 | 20 | The release (manufacturing) of materials is reflected at actual cost | Actual production cost | Receipt order (TMF No. M-4) |

Cost of products in accounting

To reliably know how much profit an organization received in the course of its activities, being able to calculate revenue and taxes is not enough. It is important to determine exactly what resources she spent on this. Resources can be very different, but they are all reduced to a common measure - money.

Cost ─ is the cost of resources that were spent on producing products, performing work, and providing services. This indicator is at the intersection of enterprise economics and accounting. This is the main difficulty ─ the accountant needs to understand the principles of calculating cost and correctly reflect it on the accounting accounts.

The content of the article:

1. Product cost accounts

2. What is the cost of production in accounting?

3. Accounting for reduced actual costs

4. Accounting for full production costs

5. Distribution of costs between types of products

6. Example of cost distribution

7. Methods for calculating production costs

8. Comparison of accounting using semi-finished and unfinished methods using an example

9. What should be included in the accounting policy

10. Cost calculation in 1C 8.3

Now let's go through all these points in more detail.

Product cost accounts

To collect costs and calculate the cost of products, the Chart of Accounts provides the following accounting accounts:

20 ─ “Main production” ─ to collect costs that are directly related to the manufacture of products, performance of work, provision of services (direct costs)

23 ─ “Auxiliary production” ─ to collect costs for products, works, services that are not typical for a given organization, but are necessary for the production of main products. For example, production of components for main production, equipment repair

25 ─ “Overall production costs (OPC)” . This account collects costs that are associated with the operation of the entire production, without reference to specific products. For example, heating of the workshop building, the salary of the head of the department and deductions for it

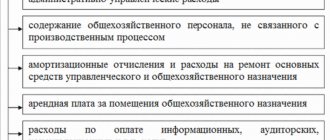

26 ─ “General expenses (OCH)” ─ to account for costs not related to the production process. This includes expenses for managers: salaries, building maintenance, stationery, purchased services

28 ─ “Defects in production” . This account is used to collect information about the amount of defects issued and the costs of correcting them.

29 ─ “Service industries and farms” . The account reflects the costs of non-core production. For example, dormitories, holiday homes, sanatoriums, baths, laundries, kindergartens

Account 21 “Semi-finished products of own production” differs in meaning from the above . It reflects the movement of produced semi-finished products (PF): on the debit side, receipt (release from production), and on the credit side, use.

What is the cost of production in accounting?

In economic science, there are different types of cost: planned, standard, estimated, technological, per unit of production and others. But it is important for an accountant to understand what reduced and full cost are.

Reduced (production) cost ─ these are all costs that are directly related to the manufacture of products (materials, wages, contributions to funds, energy) plus general production costs.

To calculate the full cost of production in accounting, you need to add administrative expenses to the reduced cost.

If we speak in the language of balance sheet accounts, then the reduced cost is accounts 20 + 23 + 25, and the full cost is 20 + 23 + 25 + 26.

Accounting for reduced actual cost

Stage 1

During a period, usually a month, costs are collected in the debit of the corresponding accounting accounts 20, 23, 25, 26 with the credit of such accounts as:

- 02, 05 ─ depreciation of fixed assets and intangible assets is calculated

- 10, 16 ─ materials are written off for the production of main products, performance of work, provision of services, for the needs of auxiliary production, workshop and administration

- 69, 70 ─ salaries of workers and management and arrears of contributions to extra-budgetary funds are calculated

- 60, 76 ─ services of third parties are reflected

- 68 ─ taxes are charged that are included in the cost price, for example, property tax, transport tax

Read the detailed article on writing off materials for production . And here you can read about utility accounting .

Once the costs have been collected, they need to be distributed. This means adding to the direct costs on account 20 those amounts from other accounts that relate to the production of products (works, services).

Stage 2

If one workshop has both main and auxiliary production, then first you need to distribute the entire amount of ODA between them. And make the wiring:

Dt 20 ─ Kt 25 and Dt 23 ─ Kt 25

If there is no auxiliary production, then everything that is collected in the debit of account 25 must be written off to the main production.

As a result, the balance of account 25 will become zero.

Stage 3

After two stages of collection and distribution, the costs were collected on accounts 20 and 23. Next, you need to analyze what was done in auxiliary production and, depending on this, write off the costs from account 23:

- if the entire output of auxiliary production was used in the work of the main one and there is no work in progress, then you need to post Dt 20 ─ Kt 23 for the entire amount of costs collected on the account

- if there is “work in progress” left in auxiliary production, then it must be left in account 23, and only the difference between accumulated costs and the amount of work in progress must be written off as a debit to account 20

- if finished products were manufactured in auxiliary production or services were provided to third parties, then only that part of the costs that relates to the work of the main production is written off to account 20. The rest needs to be closed to accounts 43 “Finished products” and 90-2 “Cost of sales”

Stage 4

Before this stage, all costs that relate to the production of main products (works, services) are in the debit of account 20. If there is work in progress, then its value should remain in the balance of this account. And all those costs that relate to the production of the current period must be written off from the credit of account 20 to the debit of account 43 when transferring finished products to the warehouse or 90-2, if the customer accepted the work or services and signed the Certificate of Completion.

As a result of such calculations, a reduced actual cost of manufactured products, works, services and work in progress will be formed in accounting.

Stage 5

Costs collected in the debit of account 26 must be completely written off in the debit of account 90-8 “Administrative expenses”.

Accounting for full production costs

To determine the full production cost in accounting, you need to go through the same steps as when determining the reduced cost, but along with account 25, you need to similarly distribute the costs that were collected on account 26 between the main and auxiliary production.

When production costs are included in accounting, there should be no balance on account 26 after the distribution of costs.

Distribution of costs between types of products

In order to distribute costs, you need to determine the basis that will be the basis for calculations. Typically used as a base:

- workers' wages or standard hours

- raw material costs

- machine hours

- energy costs in physical or monetary terms, for example, kW for electricity, Gcal for heat, cubic meters for water

- other indicators

The main criterion for choosing an indicator is that it can be determined for all types of products (works, services). The bases for the distribution of ODA and OHR may differ.

Next, based on the selected indicator, it is necessary to carry out a proportional distribution of costs collected in accounts 25 and 26 by type of product produced.

Cost Allocation Example

The flour mill produces flour from various grains: wheat, rye, rice. The basis for cost distribution is workers' wages.

The amount of ODA for the month is 50 thousand rubles, the amount of OCR is 60 thousand rubles.

| Flour, output in kg | Production costs without pilot and experimental work, thousand rubles. | Distribution of ODA, thousand rubles. | Distribution of environmental protection, thousand rubles. |

| Wheat, 600 kg | 15, including salary 5 | 50/15*5=16,7 | 60/15*5=20 |

| Rye, 700 kg | 10, including salary 3 | 50/15*3=10 | 60/15*3=12 |

| Rice, 800 kg | 25, including salary 7 | 50/15*7=23,3 | 60/15*7=28 |

| Total | 50, including salary 15 | 50 | 60 |

The reduced actual cost will be:

- wheat flour 15+16.7 = 31.7 thousand rubles, 1 kg ─ 52.83 rubles.

- rye flour 10+10 = 20 thousand rubles, 1 kg ─ 28.57 rubles.

- rice flour 25+23.3 = 48.3 thousand rubles, 1 kg ─ 60.38 rubles.

Full cost of production:

- wheat flour 15+16.7+20 = 51.7 thousand rubles, 1 kg ─ 86.17 rubles.

- rye flour 10+10+12 = 32 thousand rubles, 1 kg ─ 45,717 rubles.

- rice flour 25+23.3+28 = 76.3 thousand rubles, 1 kg ─ 95.38 rubles.

Another article on the site will help you when preparing transactions for the sale of finished products .

Methods for calculating production costs

Process method . To determine the cost per unit of production, all costs of the period are summed up and then divided by output in physical terms.

This method is suitable for industries with the same type of small product range, short cycle times and no work in progress. Vivid examples are energy, heat and water supply.

Custom method . For each unit, batch of the same type of product or service, a separate order is opened, where costs are collected specifically for this issue. With this method, you need to determine the basis for distributing overhead costs between orders.

Until the final production of the product or transfer of the work results to the customer, all costs on the order are taken into account in work in progress.

The cross-cutting method is used in cases where the production of products occurs in several stages. All processing stages, except the last one, produce semi-finished products, and only the last one produces finished products.

The transverse calculation method is divided into two types: semi-finished and unfinished.

In the first case, the cost of the PF is determined, with which it is transferred to the next stage of processing. It will be included in the cost of the PF of the next processing stage under the item “Raw materials and materials”.

The non-semi-finished type of cross-distribution accounting involves only the physical transfer of PF between processing stages, and the costs of their production form the cost of production in accounting.

The company can choose any method for calculating production costs. Usually, when choosing, they focus on technological processes, ease of collecting data for work analysis and other factors. For example, an organization calculates costs by workshop; in this case, the semi-finished accounting method is more suitable.

Comparison of accounting using semi-finished and non-semi-finished methods using an example

Matryoshka LLC produces flannel. It is made in several stages: processing cotton fibers into yarn, producing fabric, and applying a design.

Processing costs:

- fiber processing. Materials ─ 100 rubles, salary with accruals ─ 50 rubles, electricity ─ 60 rubles, ODA ─ 40 rubles

- fabric production. Materials ─ 10 rubles, salary with accruals ─ 40 rubles, electricity ─ 50 rubles, ODA ─ 60 rubles

- fabric dyeing and design. Materials ─ 60 rubles, salary with accruals ─ 20 rubles, electricity ─ 70 rubles, ODA ─ 50 rubles

There is no work in progress.

Semi-finished method

The output of each stage is the raw material for the next.

| Pereditel | Issue cost, rub. | Postings, rub. |

| 1 | 100+50+60+40 = 250 | Dt 20 ─ Kt 10 ─ 100 Dt 20 ─ Kt 69, 70 ─ 50 Dt 20 ─ Kt 60 ─ 60 Dt 20 ─ Kt 25 ─ 40 Dt 21 ─ Kt 20 ─ 250 (production of PF of the first stage) |

| 2 | 250+10+40+50+60 = 410 | Dt 20 ─ Kt 21 ─ 250 (write-off of the PF of the first stage) Dt 20 ─ Kt 10 ─ 10 Dt 20 ─ Kt 69, 70 ─ 40 Dt 20 ─ Kt 60 ─ 50 Dt 20 ─ Kt 25 ─ 60 Dt 21 ─ Kt 20 ─ 410 (production of PF of the second stage) |

| 3 | 410+60+20+70+50 = 610 | Dt 20 ─ Kt 21 ─ 410 (write-off of the PF of the second stage) Dt 20 ─ Kt 10 ─ 60 Dt 20 ─ Kt 69, 70 ─ 20 Dt 20 ─ Kt 60 ─ 70 Dt 20 ─ Kt 25 ─ 50 Dt 43 ─ Kt 20 ─ 610 (production of finished products |

No-semi-finished method

The costs of all stages are collected on account 20:

Dt 20 ─ Kt 10 ─ 100+10+60

Dt 20 ─ Kt 69.70 ─ 50+40+20

Dt 20 ─ Kt 60 ─ 60+50+70

Dt 20 ─ Kt 25 ─ 40+60+50

Dt 43 ─ Kt 20 ─ 610

As a result, the cost of production in accounting turned out to be the same for both calculation methods. This is how it should be: all production costs “fell” into the cost of production.

What should be included in the accounting policy

In the accounting policy (by the way, there is a separate article on the website) it is necessary to specify:

- cost collection method

- type of cost (reduced or full)

- when using reduced cost, it is better to indicate that all administrative expenses at the end of the period are written off to account 90

- indicator that is used as a basis for the distribution of ODA and OHR

Cost calculation in 1C 8.3

How production accounting is kept in 1C Accounting 8 ed. 3.0 using subconto products:

How can a program take into account finished products without using planned cost:

Cost is an important indicator of a company’s performance and the basis for pricing. Regulatory acts do not establish a uniform procedure for collecting and distributing costs; there are many options. And each organization must decide for itself which way it will choose to calculate its cost. The accountant can only keep records correctly within the chosen option.

Tell us in the comments about the difficulties you encountered when accounting for costs. And, of course, ask questions.

Cost of products in accounting