Accounting entries

The receipt of materials into the organization is carried out under supply contracts, by manufacturing materials by the organization, making a contribution to the authorized (share) capital of the organization, receiving the organization free of charge (including a gift agreement). Materials include raw materials, basic and auxiliary materials, purchased semi-finished products and components, fuel, containers, spare parts, construction and other materials.

The following are accounting entries reflecting the receipt of materials into the organization.

- Accounting for receipt of materials under a supply agreement. Accounting entries

- Accounting for receipt of materials based on advance reports. Accounting entries

- Accounting for the receipt of materials under an exchange agreement. Accounting entries

- Accounting for receipt of materials under constituent agreements. Accounting entries

- Accounting for free receipt of materials. Accounting entries

- Accounting for the receipt of materials produced in-house

List of accounts involved in accounting entries:

|

|

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Postings reflecting the accounting for the supply of materials with payment to the supplier after receipt of the materials | ||||

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 51 | The fact of repayment of accounts payable to the supplier for previously received materials is reflected. | Purchase price of goods | Bank statementPayment order |

| Postings for accounting for the supply of materials on prepayment | ||||

| 60.02 | 51 | Prepayment to the supplier for materials is reflected | Advance payment amount | Bank statementPayment order |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 60.02 | The previously transferred prepayment is offset against the debt for the materials received. | Purchase cost of materials | Accounting certificate-calculation |

Receiving materials from the supplier

Accounting at actual price (excluding VAT) + transportation and procurement costs (for example, delivery).

Postings:

| Account Debit | Account Credit | Description | Sum | A document base |

| When paying after receiving materials: | ||||

| 10.01 | 60.01 | Received materials from supplier | Cost of materials (excluding VAT) | Receipt order, Consignment note |

| 19.03 | 60.01 | VAT on materials received | VAT amount | Consignment note, Invoice |

| 68.02 | 19.03 | VAT is transferred to reimbursement from the budget | VAT amount | Purchase book, Invoice, Delivery note |

| 60.01 | Payment to the supplier for materials | Cost of purchasing materials (including VAT) | Bank statement Payment order | |

| Receiving prepaid materials: | ||||

| 60.02 | Prepayment for materials to the supplier | Prepayment amount | Bank statement Payment order | |

| 60.01 | 60.02 | Repayment of accounts payable to the supplier (offset of prepayment) | Cost of purchasing materials (including VAT) | Accounting certificate-calculation |

Accounting for receipt of materials based on advance reports. Accounting entries

Below are accounting entries reflecting the accounting of receipt of materials from accountable persons on the basis of advance reports and the primary documents attached to them (delivery notes, invoices).

The receipt of materials from an accountable person can be reflected in two options:

- In the first option, a standard posting scheme is considered, reflecting the receipt of materials from account 71 “Settlements with accountable persons”. The disadvantage of this option is that the accounting does not reflect the supplier from whom the materials were received and for which VAT was refunded.

- In the second option, the receipt of materials is reflected in correspondence with account 60 “Settlements with suppliers and contractors” and further, the debt to the supplier is closed in correspondence with account 71 “Settlements with accountable persons”. With this reflection option, there is an additional opportunity to analyze supplies by supplier

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to the standard scheme | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 71 | The receipt of materials from the accountable person to the organization's warehouse is reflected on the basis of primary documents attached to the advance report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) Advance report |

| 19.3 | 71 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| A variant of accounting entries reflecting the receipt of materials from accountable persons according to a scheme using a accounts payable account | ||||

| 71 | 50.01 | The issuance of funds from the organization's cash desk to an accountable person is reflected. | Amount issued for reporting | Account cash warrant. Form No. KO-2 |

| 10 | 60.01 | The receipt of materials from the supplier to the organization's warehouse is reflected on the basis of primary documents attached to the expense report. Subaccount 10 is determined by the type of materials received | Cost of materials excluding VAT | Consignment note (form No. TORG-12) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Consignment note (form No. TORG-12) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | Invoice Purchase book Consignment note (form No. TORG-12) |

| 60.01 | 71 | Reflects payment to the supplier by the accountable person for materials received | Purchase cost of materials | Accounting certificate-calculationAdvance report |

Completeness and correctness of the procedure

For the process to proceed correctly, two main factors are necessary. The first is experienced and skillful employees who can easily cope with their official responsibilities. The second is suitable software. After all, we are talking about how to post goods in 1C. An excellent choice would be the “Warehouse” version or other complex products that include this configuration. The difficulty lies in the fact that such software must not only be purchased, but also integrated into the system. Roughly speaking, adapt to current conditions, to the specific features of the selected enterprise. And this task can be handled by auxiliary programs that significantly expand the functionality. You can purchase this entire array of utilities from Cleverence; we are always happy to offer effective services.

- Standard solutions for enterprises.

- Universal boxed products.

- Programs adapted to Russian legislation that will work in strict accordance with the law.

And for employees who are going to carry out the process themselves, there are also several important recommendations.

- Quantity comes first. The very first step should always be to reconcile the quantitative factor. This makes it easier to carry out all the other stages, no matter how you distribute them.

- Do a spot check. It is better to open several boxes right on the spot, randomly checking the quality. If any complaints arise, it is better to resolve this issue with the supplier at the preventive stage. Otherwise, the task may become much more difficult later. Once signatures have been placed on the invoices, filing a claim will become difficult.

- Distribute the received inventory items in the room in exact accordance with their numbers. To simplify further search, inventory, movement and dispatch to points of sale.

Accounting for the receipt of materials under an exchange agreement. Accounting entries

The legal basis that determines the procedure for forming an exchange agreement is defined in Chapter 31 “Barter” of the Civil Code of the Russian Federation. The methodology for reflecting supply transactions under an exchange agreement is discussed in more detail in the article “Accounting for the purchase and sale of goods under an exchange agreement”

The cost of materials to be transferred is established based on the price at which, in comparable circumstances, the organization determines the cost of similar materials.

Below are accounting entries reflecting the accounting for the receipt of materials from suppliers under an exchange agreement with the usual procedure for transferring ownership of materials, in accordance with Article 223 “Moment of the emergence of the acquirer’s right of ownership under the agreement” of the Civil Code of the Russian Federation and Article 224 “Transfer of a thing” of the Civil Code of the Russian Federation.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 60.01 | The receipt of materials from the supplier under an exchange agreement is reflected. Subaccount 10 is determined by the type of materials received | Market value of materials excluding VAT | Invoice (TMF No. M-15) Receipt order (TMF No. M-4) |

| 19.3 | 60.01 | The amount of VAT related to the materials received is reflected. | VAT amount | Invoice (TMF No. M-15) Invoice |

| 68.2 | 19.3 | The VAT amount applies to reimbursement from the budget. Posting is done if there is a supplier invoice | VAT amount | InvoicePurchase book |

| 62.01 | 91.1 | The transfer of exchanged materials to the supplier under the exchange agreement is reflected | Market value of transferred materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 10 | The write-off of transferred materials from the organization’s balance sheet is reflected. Subaccount of account 10 is determined by the type of materials transferred | Cost of materials | Invoice (TMF No. M-15) Invoice |

| 91.2 | 68.2 | The amount of VAT accrued on the transferred materials is reflected | VAT amount | Invoice (TMF No. M-15) Invoice Sales book |

| 60.01 | 62.01 | The debt of the second party under the exchange agreement is offset | Cost of materials | Accounting certificate-calculation |

Accounting for receipt of materials under constituent agreements. Accounting entries

According to the constituent agreement, the founders (participants) contribute various types of property, including materials, to the authorized (share) capital of the organization. According to clause 8 of PBU 5/01 “Accounting for inventories”, the actual cost of inventories (materials) contributed to the contribution to the authorized (share) capital of the organization is determined based on their monetary value, agreed upon by the founders (participants) of the organization .

Based on the above provisions, the receipt of materials under the constituent agreement can be reflected in the accounting below with the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 75.1 | We reflect the receipt of materials under the constituent agreement. Subaccount 10 is determined by the type of materials received | Estimated cost of materials agreed upon by the founders | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

| 19 | 83 | If the founder transferring materials to the authorized capital of the organization, in accordance with clause 3 of Article 170 of the Tax Code of the Russian Federation, restores VAT, the receiving party must make this posting | The amount of VAT restored by the founder | InvoiceAct of acceptance of transfer of materials |

Accounting for free receipt of materials. Accounting entries

In accounting, according to clause 16 of PBU 9/99 “Income of the organization,” income in the form of gratuitous receipt of property is recognized “as it is generated (identified).”

In tax accounting, according to paragraphs. 1 clause 4 of Article 271 “Procedure for recognizing income under the accrual method” of the Tax Code of the Russian Federation, income in the form of gratuitous receipt of property is recognized on the date the parties sign the property acceptance and transfer act.

According to clause 9 of PBU 5/01 “Accounting for inventories”, “the actual cost of inventories received by an organization under a gift agreement or free of charge ... is determined based on their current market value as of the date of acceptance for accounting.”

Based on the above provisions, the gratuitous receipt of materials can be reflected in the accounting below using the following entries.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| 10 | 91.1 | We reflect the free receipt of materials. Subaccount 10 is determined by the type of materials received | Market value of materials on the date of acceptance for accounting | Receipt order (TMF No. M-4) Certificate of acceptance of transfer of materials |

Receipt of materials from the supplier: postings and reflection in accounting

The materials belong to the enterprise's inventories, that is, to current assets. Accounting for materials is maintained on account 10 “Materials”, the account is active.

Sub-accounts of account 10:

Like any other asset, materials can enter the enterprise in several ways:

- Purchase;

- Own production;

- Free transfer, etc.

Accounting for the receipt of materials produced in-house

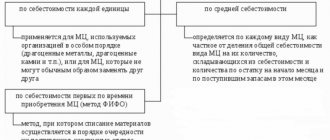

According to the methodological instructions, materials are accepted for accounting at actual cost. The actual cost of materials when manufactured by the organization is determined based on the actual costs associated with the production of these materials. Accounting and formation of costs for the production of materials are carried out by the organization in the manner established for determining the cost of relevant types of products. Those. The procedure for reflecting materials produced in-house in accounting depends on the methodology for calculating the cost of products used in the organization.

Currently, the following types of assessment of finished products are used:

- At actual production cost. This method of assessing finished products (manufactured materials) is used relatively rarely, as a rule, in single and small-scale production, as well as in the production of mass products of a small range.

- Based on the incomplete (reduced) production cost of products (manufactured materials), calculated based on actual costs without general business expenses. Can be used in the same industries where the first method of product evaluation is used.

- At standard (planned) cost. It is advisable to use in industries with mass and serial production and a large range of products.

- For other types of prices.

Below we will consider two options for recording the receipt of materials produced in-house in accounting.

| Account Dt | Kt account | Wiring Description | Transaction amount | A document base |

| Accounting for materials at standard (planned) cost. | ||||

| 10 | 40 | The release (manufacturing) of materials is reflected at the planned cost | Planned cost | Receipt order (TMF No. M-4) |

| 40 | 20 | The actual production cost is reflected | Actual cost of manufactured materials | Accounting certificate-calculation |

| 10 | 40 | The write-off of deviations between the cost of materials at actual cost and their cost at standard (planned) cost is reflected. | The amount of deviation is “black” or “red” depending on the balance of the deviation | Accounting certificate-calculation |

| Accounting for materials at actual cost. | ||||

| 10 | 20 | The release (manufacturing) of materials is reflected at actual cost | Actual production cost | Receipt order (TMF No. M-4) |

conclusions

Now we know what the posting of goods in 1C is. This is a very convenient procedure that simplifies the original, classic version tenfold. In fact, you don’t need to carefully fill it out, because the automatic system will do everything itself using a standard script. And what is more important, she will not make mistakes and will always enter information completely correctly. If necessary, it will identify a shortage, create a request for a refund, or take any other action. The benefits are obvious. All that remains is to select the specific software, or rather, the version, as well as the company that will carry out the integration and supplement this package with auxiliary utilities that allow you to control the entire mechanism from one device. And various boxed offers from Cleverens do an excellent job of fulfilling this role.

Number of impressions: 10230