No business can do without accounting. Entrepreneurs, at a minimum, submit tax returns and reports for employees, and LLCs are required to maintain full accounting and submit reports to the Federal Tax Service.

Hiring an accountant on staff is not always advisable. It is more profitable for small businesses to connect online accounting. We have collected the TOP online banking accounting systems for individual entrepreneurs and LLCs.

What is online accounting

What are the advantages of online accounting

TOP 7 services for accounting for individual entrepreneurs or LLCs

- Online accounting from Alfa-Bank

- Online accounting from ModulBank

- Online accounting from Sberbank

- Online accounting at VTB

- Online accounting at Tinkoff

- Online accounting at Tochka Bank

- Online accounting at Loko-Bank

How to choose online accounting in a bank

What is online accounting

What the work of an accountant looked like before - a trained employee worked with piles of documents, manually filled out books and accounting registers and personally went to the tax office and funds to submit reports.

Now life is easier for an accountant. Many special programs for accounting have appeared - for example, the well-known 1C. The employee enters data into the database and monitors that the program correctly draws up reports, fills out declarations, and so on. If a company has large revenues, many employees and a common taxation system, it cannot do without accounting.

A small business with a small number of employees and not so much revenue does not always need an accountant on staff, and instead of 1-C, a small business can choose one of the online services for accounting. With their help, you can work with primary documents, submit reports to government agencies, calculate salaries and vacation pay, and so on.

Accounting in banks and its features. Balance sheet of a commercial bank

Accounting in banks has distinctive features due to the specifics of servicing the sphere of money circulation, which is reflected in the organization of accounting and operational work.

Organization of accounting and operational work in a bank includes:

- construction of an accounting and operational apparatus;

- organization of the working day and document flow;

- intrabank control.

In the structure of the accounting and operational apparatus, accounting groups are distinguished that maintain accounts that are homogeneous in economic content. The number of groups and their composition depends on the direction and scale of the bank’s activities.

For example: accounts are maintained by accounting and operational employees, and then trusted bank employees draw up and sign settlement documents. Accounts and transactions are distributed among the relevant executors, registered in a special book, and signed by the chief accountant and employees.

The organization of accounting and operational work must ensure the fulfillment of the following conditions:

- all transactions with documents accepted from clients during an operating day are reflected in the accounting records for that day (operating time is chosen by the bank independently);

- cash flows according to client documents must be made on the same business day;

- The daily balance sheet is prepared no later than the beginning of the next day.

When registering banking transactions, it is necessary to ensure control over their legality and safety of funds. The responsible executor checks the correctness of the document and certifies it with his signature. If a document requires additional verification, then he transfers it to the controller, and after checking it, the operation is performed. All transactions performed are reflected in the accounting accounts with varying degrees of detail.

Accounting is one of the structural divisions of the bank. But the bank’s accounting apparatus is not limited to accounting as a structural unit, since almost all divisions of a large bank have accountants who form the bank’s balance sheet for the accounts of the relevant divisions (currency transactions, securities, etc.).

The final stage of the accounting process is a general description of the bank’s condition on a specific date (determined by drawing up a balance sheet and other forms of financial statements).

The bank's balance sheet characterizes in monetary terms the state of a commercial bank's resources, the sources of their formation and areas of use, as well as the financial results of the bank's activities at the beginning and end of the reporting period. A bank balance sheet is the main accounting document that reflects the balances of all personal accounts of analytical accounting. Analysis of the information reflected in the balance sheet allows us to give a comprehensive description of the bank’s activities for a certain period. Balance sheet assessment makes it possible to determine the availability of own funds, changes in the structure of sources of resources, the composition and dynamics of assets, etc. In addition, based on the balance sheet, one can judge the state of liquidity, profitability and possible prospects for the development of commercial banks.

The composition and structure of banks' balance sheets depend on the nature and specifics of their activities, the principles of accounting in credit institutions and the banking operations used. The following users of information contained in accounting are distinguished:

- internal (managers, founders, members of the organization),

- external (investors, creditors, etc.).

The main objectives of accounting are:

- generation of detailed, reliable and meaningful information about the activities of the credit institution and its property status;

- maintaining detailed, complete and reliable accounting records of all banking operations, the presence and movement of claims and obligations, and the use of material and financial resources by the credit institution;

- determination of internal reserves to ensure the financial stability of the credit organization and prevent negative results of its activities.

The bank's accounting policy is based on the chart of accounts of accounting in credit institutions of the Russian Federation and the Accounting Rules, which were developed on the basis of the accumulated experience of the banking system in our country and the established practice of banking accounting in foreign countries. Accounting is maintained in the currency of the Russian Federation - in rubles - by double entry on interconnected accounts continuously from the moment of registration of the bank as a legal entity until its reorganization or liquidation in the manner established by the legislation of the Russian Federation.

The chart of accounts and the Rules for its application are determined by the Regulations of the Bank of the Russian Federation No. 205-P1 and are based on the following international accounting principles . 1. The principle of business continuity. The essence of this principle is as follows: the preparation of annual financial statements assumes the continuation of the bank's activities in the foreseeable future. If liquidation of a bank is envisaged, changes must be made to the assessment of its assets and liabilities.

For example: in 1995, a bank purchased an office for 100 monetary units. The depreciation period is 20 years. Thus, the book value of the premises as of January 1, 1999 was equal to 80 monetary units [100—(4*100/20].

As of 01/01/1999, the selling price of the office due to the fall in real estate prices was 60 monetary units. Wherein:

- in case of continuity of operation, fixed assets (Fixed Assets) will be accounted for at a cost of 80 monetary units;

- in the event of liquidation of the bank, it should take into account the hidden loss and post additional depreciation at the rate of: 80-60 = 20 monetary units.

2. The principle of constancy of accounting rules. Banks must use consistent accounting methods that allow users of bank statements to analyze the bank's financial condition over time. If forced changes in accounting methods occur, the bank should reissue the financial statements for the previous year (in accordance with the new methods).

3. The principle of caution. In the course of banking transactions, it is necessary to evaluate assets and liabilities with a certain degree of caution. In particular, this rule concerns the transfer to the next year of uncertainties associated with the financial position of the bank. In this regard, income should be reflected only after they are realized, and expenses - as soon as it becomes possible to make them. This principle requires mandatory reserves of funds for doubtful loans if the financial position of the borrower is questionable or the guarantees provided to the bank do not inspire confidence.

4. The principle of increasing income and expenses. Banking operations are divided into monthly and quarterly periods. Annual reports are prepared for the financial year. Financial results (income and expenses) are reported immediately after their implementation on an accrual basis.

5. The principle of real reflection of assets and liabilities. Accounts payable and receivable, income and expense accounts of business entities must be assessed separately. For example, if bank A has two balance sheet accounts with bank B, say, for an interbank loan provided and an interbank loan received, then for each of them income and expenses are recorded accordingly.

6. The principle of inviolability of the incoming balance. Balances at the beginning of the current year must correspond to balances at the end of the previous year.

7. The principle of priority of content over form. Financial statements must fairly reflect the economic and financial substance of transactions. All banking transactions must be reflected in the balance sheet, based on their economic content and legal form. The implementation of this principle allows us to obtain a reliable and truthful assessment of the bank’s financial position. This principle does not allow artificial expansion of the balance sheet, which does not reflect real economic transactions. In particular, banks cannot lend each other equal amounts without using real credit resources.

8. Openness. Financial statements must be sufficiently detailed to reflect the essence of transactions and must not be ambiguous or misleading. In appendices to financial statements, you need to include transcripts of summary data on accounts payable and receivable, etc.

9. Consolidation. If a bank has branches, then it must draw up consolidated reports that will reflect the entire economic situation of the bank as a whole. To do this, it is necessary to unify the accounts of branches and departments and reduce the balance for interbranch transactions and mutual investments.

10. Materiality. Financial statements must contain all necessary information in sufficient volume. Non-essential information should not be included in reports. A commercial bank draws up a consolidated balance sheet and statements for the bank as a whole using second-order accounts.

Accounting accounts are intended for grouping and current accounting of homogeneous banking transactions. Accounts in the accounting of a commercial bank are defined only as active or only as passive .

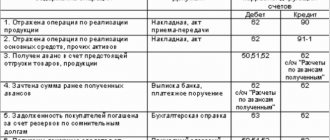

Active accounts are intended to record the bank's active operations, passive accounts - for passive ones. Each account has two sides: the left side of the account is debit, the right side is credit. The balance in the account is called the "balance". The formation of debit and credit balances in passive and active accounts is presented in the account diagrams (Tables 3.1 and 3.2).

The amount of each banking transaction is reflected in the accounts twice: in the debit of one account and in the credit of another account. Compliance with this condition always allows you to check the transaction based on the location of costs and their nature, since double entry is predetermined by the following objective factor “no income without expense.” Double entry is formalized by correspondence of accounts or accounting entries indicating the debited and credited account for the amount of the transaction.

As can be seen from this diagram, the general Chart of Accounts is divided into the following complexes:

- A. Balance sheet accounts;

- B. Trust accounts;

- B. Off-balance sheet accounts;

- G. Urgent operations;

- D. Deposit accounts.

The main activities of the bank are reflected in complex A. BALANCE ACCOUNTS. Let's consider each complex separately.

A. BALANCE ACCOUNTS . When developing the Chart of Accounts, the following structure was adopted: sections, first-order accounts, second-order accounts, personal accounts of analytical accounting. Section 1. Capital and funds. Section 2. Cash and precious metals. Section 3. Interbank transactions. Section 4. Transactions with Customers. Section 5. Transactions with securities. Section 6. Funds and property. Section 7. Performance results. Each section, in turn, is divided into groups of accounts depending on the economic content.

In order to adequately reflect the liquidity of the balance sheet of credit institutions, a unified time structure of active and passive operations has been introduced: on demand; for up to 30 days; from 31 to 90 days; from 91 to 180 days; from 181 days to 1 year; over 1 year to 3 years; over 3 years. For interbank loans and a number of deposit transactions, terms of 1 day and from 2 to 7 days are additionally provided.

To separate accounts by customer type, the Chart of Accounts provides for the use of a single classification of customers when recording various transactions. The basis for this classification are the following characteristics:

- residence - resident and non-resident;

- form of ownership - funds from the federal budget, budgets of constituent entities of the Russian Federation and local budgets and funds from enterprises that are in federal, state (except federal) and non-state ownership (including financial, commercial and non-profit organizations);

- Kind of activity.

Accounts in foreign currency are opened on all balance sheet accounts, where transactions in foreign currency can be accounted for in the prescribed manner. The currency account attribute is entered into the personal account structure as a currency code. All banking transactions in foreign currency carried out by credit institutions must be reflected in the bank’s daily unified balance sheet only in rubles.

In the “Transactions with securities” section, groups of accounts are distinguished by type of transaction. For active operations, these are: investments in debt obligations (except bills), including quoted and unquoted; investments in shares acquired for resale or investment; discounted bills. For passive operations, these are securities issued by banks (bonds, certificates, bills, bankers' acceptances, etc.). Settlements for transactions with securities, including on the organized securities market (OSM), are concentrated in one group of accounts.

The Chart of Accounts defines the accounts of intrabank transactions of commercial banks. To reliably reflect the results of the activities of commercial banks and a detailed study of the results of their work, analytical accounting should be actively used.

B. TRUST ACCOUNTS . Accounting for trust management operations is carried out in commercial banks that perform the functions of trustees under trust management agreements, separately - in specially designated accounts. All trust management transactions are carried out only between these accounts and within these accounts. A separate balance sheet is drawn up for trust management operations.

B. OFF BALANCE SHEET ACCOUNTS . Off-balance sheet accounts are divided into active and passive according to their economic content. In accounting, transactions are reflected using the double entry method.

D. EMERGENCY OPERATIONS . This section records purchase and sale transactions of various financial assets (precious metals, securities, foreign currency and cash), for which the settlement date does not coincide with the date of the transaction. On the day the settlement deadline arrives, the accounting of the transaction in off-balance sheet accounts is terminated with simultaneous reflection on balance sheet accounts.

D. DEPO ACCOUNTS . Depo accounts reflect depository transactions with emissive securities, shares, bonds, government bonds, and other types of securities that are emissive in accordance with current legislation (and transferred to the credit organization by its clients for storage and/or accounting, for trust management , for brokerage and other operations), as well as with securities owned by commercial banks under the right of ownership or other proprietary right.

The Chart of Accounts provides second-order accounts for recording income, expenses, profits, losses of commercial banks, the use of profits, reflecting the results of the activities of commercial banks, all expenses incurred and income received in the financial year. This allows you to study the structure and correlation of individual items of income and expenses of the bank, as well as their groups, analyze the profitability of specific bank operations, and factor-by-factor analysis of the profit of a commercial bank. Accounts for recording income and expenses are closed within the established time limits, on the last working day by transferring amounts to the “Profit of the reporting year” or “Loss of the reporting year” accounts. Credit institutions set the frequency of profit distribution themselves.

The profit and loss report is compiled by banks on an accrual basis for each item from the beginning of the year and is submitted to the relevant authorities in the prescribed manner at the end of each quarter. Profit is determined by subtracting total expenses from total income, adding the amount of profit charged directly to the credit of the profit account, and subtracting the amount of losses charged directly to the debit of the loss account.

What are the advantages of online accounting

The main advantage is budget savings. An accountant's salary is only one cost item. For successful work you will also need:

- license for accounting software;

- server where the accounting database will be located;

- system administrator who will maintain the server;

- The accountant's workplace is a computer, a desk, and so on.

It's easier with online accounting. All of the above costs disappear; you only need to pay monthly for access to the service.

You don’t even always need an accountant to work with online accounting. In a small company, the director himself or a specialist can handle the accounting remotely. And some services try to make your participation minimal and submit reports and declarations for you independently.

In addition to saving money, online accounting has several other important advantages:

- access to the accounting database from anywhere in the world via phone or tablet;

- there is no connection to a workplace - you work on a computer, and then you can switch to a tablet or phone without losing data;

- no need to bother with updates - the service does it automatically;

- you can integrate online accounting with online banking to download bank statements;

- information is reliably protected.

Banking services for issuing loans and providing guarantees

These types of banking services have specific features of reflection in accounting. The bank's tariffs for the use of loan funds are called interest on the loan and are reflected depending on the purpose of obtaining the loan in correspondence with cost accounts or are taken into account in the value of the assets for the purchase of which the loan was received. Accounting for short-term loans is kept on account 66, long-term - on account 67. Interest and principal are accounted for separately.

A feature of reflecting bank commissions for providing guarantees is that these costs should be evenly distributed over the entire period of validity of the guarantee.

Legal documents

- PBU 4/99 “Organization expenses”

- Article 149 of the Tax Code of the Russian Federation

How to choose online accounting in a bank

The first requirement of the bank is to have an open current account. Therefore, in fact, you cannot choose online banking accounting; you will open it only in the bank where the current account is opened.

The presence of online accounting and its functionality is an important criterion when choosing a bank where you intend to receive services. Therefore, when searching for a bank, pay attention to this.

The service will help you choose a bank. It contains information about all bank tariffs. Select the number of payments per month, your region, and the site will show which bank will suit you best. All you have to do is find out if the bank has online accounting

In addition, you can read our article “Where is the best place to open a current account for individual entrepreneurs.”

General rules for maintaining bank records

Maintaining bank records of a credit organization must be carried out continuously from the date of its state registration until the moment of reorganization or liquidation in the manner prescribed by law. When maintaining banking records, a credit institution must apply the same rules, with the exception of significant changes in activities or legislation. If these rules are violated for one reason or another, then in the explanations to bank statements it is necessary to ensure the comparability of accounting data.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

In general, banking accounting does not differ from accounting in other business entities. Property, banking and other business transactions are recorded in accounting accounts using the double entry method. The main difference is that a chart of accounts developed specifically for credit institutions is used for accounting. Credit organizations also form a working chart of accounts based on a legally approved plan.

Entry into banking registers is carried out on the basis of primary accounting documents recording the fact of commission or the fact of permission to carry out business transactions. Primary banking documents are drawn up at the time of or immediately after a business transaction.

Note 1

All entries in primary banking documents and accounting registers are made in Russian. If any banking document is drawn up in a foreign language, it is subject to mandatory translation into Russian.

Too lazy to read?

Ask a question to the experts and get an answer within 15 minutes!

Ask a Question

Non-cash transactions in accounting

Non-cash payments are regulated by Bank of Russia Regulation No. 383-P dated June 19, 2012.

Settlements between individuals and legal entities are carried out either in cash or in non-cash form. Non-cash payments are carried out through an intermediary - a bank, and are carried out on open accounts.

Main forms of non-cash payments:

- money orders,

- payment requests,

- letter of credit,

- collection,

- checks,

- electronic transfers.

The most common form of settlements between organizations and entrepreneurs is a payment order, drawn up on form No. 0401060.

Chart of Accounts

The legislation of the Russian Federation has approved a separate Chart of Accounts for credit organizations. Currently, the Chart of Accounts for credit institutions and the procedure for its application are in force, approved by the Regulation of the Central Bank on February 27, 2017 No. 579-P.

The chart of accounts of banking accounting has a structure in the order of division into chapters, sections and subsections, accounts of the first and second order.

The chart of accounts allows for the possibility of introducing additional personal accounts in the manner prescribed by law.

This Chart of Accounts provides information in three parts:

- The general part establishing uniform, binding methodological principles for organizing and maintaining records in credit institutions. This part of the document defines the objectives of banking accounting; procedure and requirements for the formation of the accounting policy of a credit organization; principles of banking accounting;

- Characteristics of accounts, providing a description of bank accounts indicating the features of accounting for both first- and second-order accounts. In this part, the characteristics of accounts are presented in the context of balance sheet accounts, trust accounts, off-balance sheet accounts, accounts for recording claims and obligations under derivative financial instruments and other agreements (transactions), settlements and delivery for which are carried out no earlier than the day following the day of conclusion of the agreement;

- The procedure for applying the Chart of Accounts for credit institutions when organizing accounting work, which determines the organizational aspects of banking accounting and document flow, the procedure for maintaining analytical and synthetic accounting, the organization of internal control and storage of documentation, as well as the procedure for generating financial statements.

Bank statement

All transactions that occur on the current account are reflected in the bank statement. An extract is the main source document on the basis of which the accountant reflects business transactions in accounting. Each banking operation is carried out on the basis of a settlement document.

The peculiarity of the statement is that the bank reflects transactions from its position, the receipt of money to the organization’s current account is reflected as a loan, because this increases the bank's debt to the client. The debit of money from the current account is reflected as a debit - the bank's debt has decreased.

Currently, most bank clients use online accounts to manage their accounts - it’s faster, cheaper and easier. Many banks do not provide paper statements, but you can print them from online banking.

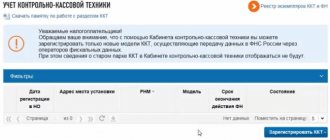

Tax authorities may block the account of an organization or an individual entrepreneur for violations. In this case, the company will not be able to spend funds in its current account until the decision to block the account is lifted. A company or individual entrepreneur will also not be able to open new accounts, deposits.