Deadlines

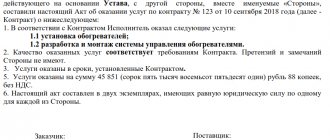

The current legislation does not state exactly when the consumer must transfer money to the contractor for the service provided. However, both the Civil Code of the Russian Federation and the Federal Law of the Russian Federation “PZZPP” state that payment must be received within the time limits specified in the agreement concluded between the parties. Thus, the parties to the transaction independently determine this date. As a rule, such information is written down in the “Cost and payment procedure” section.

Money can be paid in cash or non-cash (for example, transfer to a card, transfer of funds to an electronic wallet, etc.).

What if the agreement does not specify the period for receipt of funds?

Sometimes there are cases when the contract for the provision of paid services does not stipulate a specific moment by which payment must be received from the customer. In this situation , one should be guided by the norm set out in paragraph 2 of Article 314 of the Civil Code of the Russian Federation.

Thus, according to this provision, if the obligation does not have a deadline for its fulfillment or a condition that would help determine this date, then it must be fulfilled within 7 days from the date of receipt of the corresponding request from the creditor.

Documents confirming the provision of services

Without evidence, it is difficult to confirm that the service was provided.

Therefore, we recommend that after execution of the contract, you draw up a document that will prove that you have fulfilled the conditions and the customer is satisfied with the result. The following are evidence of service provision:

- Certificate of provision of services or certificate of acceptance. This is the main evidence. It indicates exactly what services are provided.

- Performer's report. You can include in the service agreement a condition that the contractor must submit a report on the services provided. And even if there is no such condition, you still have the right to submit a report. This document certainly does not confirm the provision of services, but it will be taken into account along with other evidence.

- Correspondence with the performer. It is also indirect evidence that the service has been provided. Together with the executor's report, it can convince the court of your good faith. Correspondence can be in different forms, for example, on social networks, by email, or by regular mail.

The act of providing services

The document is drawn up in any form. In accordance with paragraph 4 of Art. 421 of the Civil Code of the Russian Federation, you can think through the form yourself. In the main service agreement, you can agree on the form in advance.

Most often, the document is drawn up by the contractor and handed over to the customer for signing.

The act should indicate the following information:

- Title of the document (for example, “Certificate of Services Rendered”).

- Date of compilation.

- Data about the customer (full name, address, if the customer is an individual or individual entrepreneur, or name, legal address, OGRN, if this is a legal entity).

- Data about the contractor, in the same volume as data about the customer.

- Data about the main agreement (for example: name, date of conclusion, number).

- Type and volume of services provided. The more detailed, the better, so that you can understand exactly what service was provided, completely or not.

- Price of services, with or without VAT.

- Information about identified deficiencies in the provision of services, if they were identified.

The deed is signed by both parties to the transaction.

“ConsultantPlus” has ready-made solutions, including how to draw up an act of provision of services. If you don't have access to the system yet, sign up for a free trial online. You can also get the current K+ price list.

Performer's report

This document, like the act, is drawn up in any form, since the legislation does not regulate the procedure for filling it out. However, please note that if the main service agreement stipulates how the report should be prepared, you must follow these rules. The contract may contain the form of this document.

The report states:

- The name of the document, for example: “Report of the contractor on the performance of the service.”

- Date of compilation.

- Link to the service agreement (date, number).

- The name of the service provided and the scope of its provision or a list of services provided.

If there are documents confirming the provision of the service, they are provided in the appendix.

Letter of guarantee

In certain situations, in order to prevent delays in payment and the accrual of penalties, the customer sends a letter of guarantee to the contractor.

This document means a written confirmation of the existence of a debt for a service provided , containing a promise to repay this obligation by a certain date.

In what cases is it written?

As a general rule, a letter of guarantee is sent to the contractor if the customer cannot timely pay for the services specified in the contract.

The reasons for this circumstance may be:

- lack of free working capital (if we are talking about an organization);

- temporary stay in another country;

- difficult financial situation, etc.

In most cases, such a letter acts as a response to the pre-trial claim of the contractor, containing a request to fulfill his payment obligations. However, sometimes it is sent in advance if the consumer is sure that he will not be able to make payment by the date specified in the contract for the provision of paid services.

Content

The legislation does not stipulate any rules regarding the procedure for drawing up letters of guarantee. Nevertheless, in the practice of business writing, a certain standard model of such a document has developed. Its contents should include the following information:

- Introductory part - here the details of the addressee and the applicant are indicated, namely:

- name of the organization (if a legal entity);

- Full name and position of the official representative (usually written in the name of the general director);

- address.

- The name of the document and its registration data (date and entry number in the outgoing correspondence journal).

- Content part - the following information is presented sequentially:

- the amount of debt owed to the customer as of the date of writing the letter of guarantee;

- details of the agreement on the basis of which it arose;

- a promise to fulfill one's obligations specifying a specific date.

- Signature of the applicant and official seal of the organization.

We do not recommend completing the documents yourself. Save time - contact our lawyers by phone:

8 (800) 350-14-90

If the customer is a citizen, then it is prepared on a regular A4 sheet. If the applicant is a legal entity, then you can use your own letterhead for these purposes.

Is the invoice under 223 Federal Law, the Civil Code an offer, supply agreement?

In order to secure the rights and obligations of the parties, a contract is signed, which will confirm consent to complete the transaction. The subject of the contract may be goods and material assets, the performance of work or the provision of services. In general, it specifies the item itself, payment terms and time to complete the transaction. However, the law does not provide for a standard sample contract, so you can add your own conditions, the most important thing is that they do not contradict the law.

In some cases, in addition to the signed contract, an invoice is issued, which represents the need to pay a certain amount. But is the invoice an agreement under 223-F3? This Federal Law does not provide that an invoice can replace an agreement, and payment under it without signing a contract will be considered a violation. In any case, when checking, the tax inspectorate will require an agreement signed by both parties; if the submission is refused, penalties will be imposed. Thus, we can get an answer to the question, is payment of an invoice a contract of offer? Even if goods are supplied, such action will be illegal. At the same time, there are several exceptions that, according to the Civil Code, do not require the signing of an agreement, and payment of the invoice will be sufficient.

Responsibility for violation of deadlines

Violators of payment terms for services under the contract may face the following types of liability:

- Penalty – in almost every contract you can find a condition according to which, in case of late payment for certain services, a penalty is charged for each day of delay. This may be a fixed amount or a certain percentage of the debt amount.

- Litigation - if the other party ignores the demand for payment of money in every possible way, then the executor can sue him in court. In this case, the claim may include not only a demand to pay for services rendered, but also compensation for moral damage. Moreover, if the claim is satisfied, the defendant will have to reimburse the state fee and other legal costs incurred by the plaintiff.

If a court decision on payment of the amount due under a contract for paid services is not fulfilled, bailiffs may be involved in the case. It should be borne in mind that these authorized persons by law have the right to use a variety of mechanisms of influence on the debtor, ranging from the seizure of accounts and up to the sale of his personal property at auction. Thus, it is better not to escalate the situation to such an extent.

Read about the procedure for collecting debt under a service agreement here.

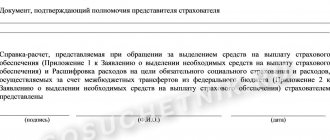

Procedure

Based on the provisions set out in Part 2 of Article 37 of the Federal Law of the Russian Federation “On ZPP”, three options for paying the fee can be distinguished:

- in full after the service is provided;

- in the form of 100% prepayment;

- advance payment.

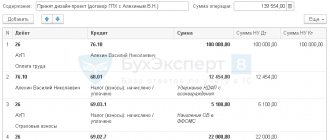

Prepayment

When concluding an agreement, the parties to the transaction may agree to make an advance payment , which will include such information in the section “Cost and payment procedure.” This term means the transfer of money to the executor before he begins to fulfill his obligations.

The prepayment can be 100% or only a certain part of the total cost of the service provided (for example, 50%, 30%, etc.). Pre-payment of funds acts as a kind of guarantee of the seriousness of intentions on the part of the client.

Postpay

In most cases, customers pay for the service after it has been completed. This is the most classic version of settlements between the parties to the transaction. In this case, the contract clearly states the date by which the client must pay for the services provided by the contractor.

Step-by-step transfer of funds

In practice, staged payment is also common .

In this case, money is transferred to the contractor as a certain volume of services is completed. Quite often, such a calculation scheme can be found in construction, when repairing elevator equipment, and when providing massage therapist services. For example, in the latter case, the treatment course may include 10 massage sessions. In this case, the client will have to pay for these services after each procedure.

Reasons

The following documents may serve as the basis for transferring fees to the contractor:

- agreement concluded between the parties to the transaction;

- act on the provision of a specific service;

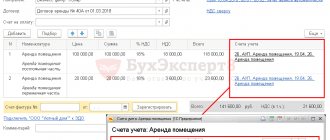

- invoice.

Our website contains information about the nuances of providing medical, educational, transport, financial, legal, household, postal, auditing, and hotel services.

Why do you need an account?

An invoice for payment can be issued in relation to any transactions related to the receipt of payment.

This could be: sales, supply, provision of services and others. As a rule, an invoice is issued in order to receive an advance payment for the transaction. This is a kind of receipt to justify the payment. Payment for goods or services can also be made on the basis of contracts, invoices, acts and other primary documents. The account is often used to correctly fill in the merchant's bank details on payment documents. In fact, the invoice does not confirm anything. The transfer of funds is confirmed by a payment order. The transfer of goods and materials is accompanied by the execution of invoices, acts and other primary documents. It must be understood that an invoice for payment is not a document by which claims can be made against the supplier in connection with non-compliance with the contract. The main purpose of an invoice is to tell the buyer the final amount due. And when the buyer receives the invoice, he already decides whether he is satisfied with the assigned price or not.