Functionality provided by the invoice

An invoice (hereinafter we use the accepted abbreviation сч-ф) is the most important document that is used to account for value added tax.

In general, the seller and buyer apply the common taxation system (CTS). That is, they are VAT payers.

There are several types of invoices:

Our material is devoted to the corrected invoice. Below we will look at the cases in which a correction invoice is used in document flow, and how it differs from a correction invoice.

Minor errors in the invoice

Minor errors are those that cannot be classified as significant errors. That is, these are errors that do not interfere with identifying the seller, buyer, name, cost of goods (work, services, property rights), tax rate and amount.

An insignificant error cannot be the reason for refusal to deduct VAT (clause 2 of Article 169 of the Tax Code of the Russian Federation).

Minor errors, for example, include:

1) typos in the name and address of the buyer or seller

, For example:

- indication of full name buyer-entrepreneur without the words “IP” (Letter of the Ministry of Finance of Russia dated 05/07/2018 N 03-07-14/30461);

— replacing capital letters with lowercase ones in the names of the seller and buyer (Letter of the Ministry of Finance of Russia dated January 18, 2018 N 03-07-09/2238);

— extra characters, such as dashes or commas (Letter of the Ministry of Finance of Russia dated May 2, 2012 N 03-07-11/130);

- abbreviations in the address, replacing capital letters with lowercase ones or vice versa, reversing words, additional indication of the country if this is not in the Unified State Register of Entrepreneurs or the Unified State Register of Legal Entities (Letters of the Ministry of Finance of Russia dated 04/02/2019 N 03-07-09/22679, dated 04/25/2018 N 03-07-14/27843, dated 04/02/2018 N 03-07-14/21045, dated 01/17/2018 N 03-07-09/1846, dated 11/20/2017 N 03-07-14/76455);

2) violation of invoice numbering;

3) indicating the graphic symbol of the ruble instead of the name of the currency

(Letter of the Ministry of Finance of Russia dated April 13, 2016 N 03-07-11/21095);

4) indication of the code of the type of goods according to the Commodity Nomenclature of Foreign Economic Activity of the EAEU when selling goods in Russia

(Letter of the Ministry of Finance of Russia dated 01/09/2018 N 03-07-08/16);

5) a dash instead of the phrase “without excise tax” in column 6

(Letter of the Ministry of Finance of Russia dated April 18, 2012 N 03-07-09/37);

6) absence of the symbol “%” in column 7 “Tax rate” of the invoice

(Letter of the Ministry of Finance of Russia dated March 3, 2016 N 03-07-09/12236).

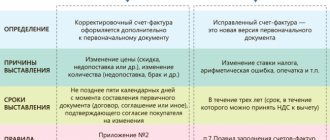

Differences between corrected and adjusted invoices

The names of the documents are very similar, so an inexperienced accountant may have a question about which invoice to issue in which case. Correction and adjustment - what's the difference?

Thus, we conclude that a corrective invoice is drawn up when erroneous data is identified in the primary account.

Errors can be found both in a regular invoice for shipment or advance payment, and in an adjustable invoice. Therefore, the corrected one can be either a regular sch-f or a corrective one.

How risky is it to claim a deduction if the checkpoint on the invoice is incorrect?

KPP is the reason code for registration. It contains information on the basis on which the organization was registered with the tax authority, and thus is a kind of addition to the TIN.

IMPORTANT! KPP is not assigned to individual entrepreneurs.

If the checkpoint is incorrectly indicated in the invoice, then the buyer can safely accept the tax as a deduction without fear of tax refusals. In any case, this position is set out in letters from the financial and tax departments.

For example, the Ministry of Finance in letter dated 05/18/2017 No. 03-07-09/30038 explains that the indication of the checkpoint of the parent organization that the shipment or receipt of products occurs through a separate division is not a reason for refusing a deduction on such an invoice .

Also, a simple error in the checkpoint number should not serve as a basis for refusal - see letters from the Ministry of Finance dated 08/26/2015 No. 03-07-09/49050, Federal Tax Service dated 09/07/2015 No. GD-4-3/15640.

The departments' arguments basically boil down to the fact that an error in the checkpoint does not prevent the identification of the seller or buyer (depending on whose checkpoint the error was made).

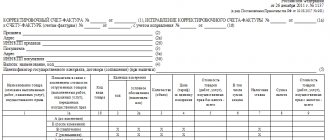

Form and sample of a corrected invoice

In order to draw up a corrected invoice, you must use the form of the document that we are correcting . That is, either a regular account form, or a corrective account form. Moreover, they use the form that was in force at the time of drawing up the primary account.

Both forms were approved by Decree of the Government of the Russian Federation dated December 26, 2011 No. 1137.

You can download official invoice forms on our website. For example, in the article “Samples of filling out invoices in various situations.”

How to correctly enter data into the corrected accounts is also described in detail in the Resolution we mentioned.

Let's look at an example of filling out a corrected invoice.

Example

Let the accountant of Paradox LLC issue an invoice for the shipment of goods on 09/07/2020. However, on 09/22/2020 it turned out that an error was made in the name of the buyer and his INN/KPP (highlighted in red in the figure).

To correct this error, a corrected account has been compiled:

The filling principle is as follows:

- in line 1 – indicate the number and date of the account with an error;

- in line 1a - indicate the correction number and the date of correction;

- In all other respects, we fill out the account in the same way as the original document, but we replace erroneous data with correct ones.

How to write out a corrected ESF?

Fig. 2 General scheme of working with a corrected invoice

The legislation does not establish restrictions or specific requirements regarding how the corrected electronic invoice is issued. This means that you can make edits an unlimited number of times.

For example, instead of . After identifying this error, a new form of the original document is created independently or by the counterparty and issued to the other party. Simply put, if an error is not detected by the tax authorities, the document is simply redone.

Required documents

If errors are identified after registration of the invoice, in order to make changes, the buyer must contact the seller in writing with a statement about the need to correct the document.

The seller corrects the invoice in accordance with the procedure provided for in subclause. “b” clause 1, clause 7 of the Rules for filling out an invoice. The algorithm is as follows:

- Create a new ESF document;

- Indicate in line 1 the date and number of the ESF entered with an error;

- In line 1a – registration data of the new document;

- Make any necessary edits.

Applying the rules for filling out an invoice is appropriate only if the document has already been officially registered; in all other cases, issue a new invoice without reference to the version with typos.

Reflection in the book of sales and purchases

All invoices are entered into the sales ledger or purchase ledger. At what point and in what order should the corrected account be reflected in these forms? It depends on in which quarter the error was discovered and the corrected account was compiled.

Corrections are made in the same quarter when the primary invoice is drawn up

Let's say the corrected invoice relates to the same quarter as the primary invoice. We register it in the sales book and in the purchase book with the date of correction . In order to prevent doubling the amount of tax to be paid or deducted, the original account is re-registered as the date of correction with negative total values.

Thus, in the sales book and in the purchase book, the total VAT value for this operation will remain in the amount indicated in the corrected invoice.

Corrections are made in the following tax periods

Let's say an error in the primary invoice was discovered in the next tax period, when the VAT return has already been submitted. In this case, fill out an additional sheet of the sales book and purchase book, where 2 lines are entered:

- canceling the primary account;

- corrected sf.

reflected in the sales book or purchase book has been changed a clarifying VAT return.

If an error was made, for example, in the address of the counterparty, which is not reflected in the lines of the sales and purchase books, there is no point in clarification.

Corrective invoices in 1C: Accounting - reflection rules

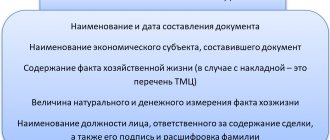

Published 10/22/2018 11:11 Author: Administrator An error in accounting and reporting is the incorrect reflection (non-reflection) of the facts of economic activity. Identified errors and their consequences are subject to mandatory correction (PBU 22/2010). Corrections to sales documents are necessary if errors are found in them that do not allow the tax authorities to unambiguously identify the seller, buyer, name of goods (work, services) and their cost; tax rate and VAT amount.

Distinctive features of correction invoices:

- corrections to the price are made in case of arithmetic or technical errors, they are not agreed upon by any documents;

- the mechanism for recording in the seller’s sales book and the buyer’s purchase book does not depend on whether the VAT amount in the corrective invoice has increased or decreased.

Regardless of the date of correction, rights and obligations to the budget relate to the period when the original invoice was issued.

The numbering of invoices within one period is continuous, and the numbering of corrections within one invoice always starts from No. 1, the number of corrections is not limited. The corrective invoice reflects the completely correct data of the primary invoice and the corrected data instead of the erroneous data.

Anatomy of a vendor fix

Correcting errors of the current tax period

The corrected invoice has the same serial number and date, the correction is recorded under serial number 1, the current date of the quarter.

Reversing entries are generated for the difference in the cost of sales and the difference in the amount of VAT.

In this case, two entries are generated on the “VAT Sales” tab (accumulation register): reversing the primary sale and corrective sale.

In the sales book of the current period, three entries are formed: primary, cancellation of the primary and corrected.

We compare similar indicators in accounting and tax accounting.

Correcting errors from the previous tax period

Corrections are reflected in the additional sheet of the sales book, and, accordingly, in Appendix 1 of Section 9 of the corrective VAT Declaration.

We compare accounting and tax accounting data. Please note: corrective data in accounting is reflected in the current period, and in tax accounting - in the period of initial sales.

The buyer's received correction documents are registered in the same way:

- if the seller changed the data before the end of the tax period - using “three entries” in the purchase book (primary, canceling the primary and corrective);

- if the seller “changed the testimony” after the end of the tax period - using “two entries” of an additional sheet of the purchase book (cancelling and correcting).

If the amount of the discrepancy declared by the seller is significant, the buyer finds himself in a disadvantageous situation with any correction option: if the amount of the tax deduction is reduced, this will lead to additional payment of VAT and the payment of penalties; if the amount of the tax deduction is increased, this may lead to a refund from the budget, which is also undesirable.

And a little about other rules: “The feeling of fullness in life depends on your worldview, and not on momentary success. We move forward to make our way, not to find a way out. Working and interacting with other people, we are always stronger than I am.”

Author of the article: Irina Kazmirchuk

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

JComments