List of documents

The list of documents that must be drawn up to confirm certain expenses, as well as the procedure for their preparation, are not defined by the Tax Code of the Russian Federation. Therefore, in practice, any documents an organization has must be assessed taking into account whether they (together with other evidence) can confirm the fact and amount of expenses incurred or not. Moreover, depending on the actual circumstances of the transactions and the conditions of the financial and economic activities of the organization, in each specific case, expenses can be confirmed by different documents.

In particular, the following may be submitted to support expenses:

- primary accounting documents: invoices, acts, waybills, sales and cash receipts, etc.;

- other documents directly or indirectly confirming the costs incurred: orders, contracts, customs declarations, travel certificates, documents drawn up according to the business customs of the country in which the costs were incurred (for example, invoices, vouchers), etc.

This procedure follows from the provisions of paragraph 1 of Article 252 of the Tax Code of the Russian Federation. The legality of this interpretation of this norm is confirmed by judicial practice (see, for example, the ruling of the Constitutional Court of the Russian Federation dated June 4, 2007 No. 320-O-P, the ruling of the Supreme Arbitration Court of the Russian Federation dated June 17, 2009 No. VAS-5445/09, the resolution of the FAS North -Western District dated February 17, 2009 No. A42-2570/2007).

All documents must be prepared in accordance with legal requirements. In particular, each primary accounting document must contain the mandatory details listed in Part 2 of Article 9 of the Law of December 6, 2011 No. 402-FZ. The absence of required details does not allow the document to be recognized as confirming the expenses incurred. In this case, other documents will be required to confirm them. For example, to confirm expenses for the purchase of goods (work, services) in cash, cash receipts alone are not enough. The cash receipt does not contain the names of positions and signatures of the persons who performed the transaction and are responsible for its correct execution. In addition, a cash receipt only indicates the fact of payment for goods (work, services) (clause 2 of the Regulations approved by Decree of the Government of the Russian Federation of July 23, 2007 No. 470). Therefore, to confirm the corresponding expenses for profit tax purposes, in addition to the cash receipt, you need to have:

- expense reports;

- sales receipts;

- receipts for the cash receipt order.

Similar clarifications are contained in the letter of the Federal Tax Service of Russia dated June 25, 2013 No. ED-4-3/3/11515.

Is it possible to confirm expenses with documents that are completed with errors? It is possible if the mistakes made allow you to correctly determine the seller and buyer, the type and amount of expenses, the date of the transaction and other important elements of the transaction. For example, a document can be accepted for accounting if it contains an abbreviated name of the service, a unit of change code is missing, grammatical errors or typos are made in the name or address of the counterparty. Or if, in addition to the required details of the document, it contains additional information. If the document contains distorted information about the cost of goods (work, services), or the date is unclear, then such a document cannot be accepted as confirmation of expenses.

This conclusion can be drawn from the letter of the Ministry of Finance of Russia dated February 4, 2015 No. 03-03-10/4547 (brought to the attention of lower inspections by letter of the Federal Tax Service of Russia dated February 12, 2015 No. GD-4-3/2104).

Documents in electronic form

Expenses incurred can be confirmed by electronic documents. To do this, a document drawn up in electronic form must be certified by the electronic signature of the person responsible for the business transaction. The ability to draw up documents with an electronic signature when making civil transactions is provided for in Article 4 of Law No. 63-FZ of April 6, 2011. At the same time, this norm provides conditions under which an electronic signature is recognized as equivalent to a handwritten one.

At the request of regulatory authorities (for example, during inspections), the organization must, at its own expense, ensure the production of paper copies of documents compiled in electronic form. Similar clarifications are contained in letters of the Ministry of Finance of Russia dated January 11, 2011 No. 03-03-06/1/3, dated July 28, 2010 No. 03-03-06/1/491, dated November 26, 2009 No. 03- 02-08/85, dated October 27, 2008 No. 03-03-06/1/605.

The act of providing services

Situation: when calculating income tax, how can you confirm expenses incurred for services if there is no certificate of provision of services?

If drawing up an act of provision of services is not necessary, confirm the expenses with other documents.

The fact of expenses can be confirmed by any document, even indirectly indicating this (clause 1 of Article 252 of the Tax Code of the Russian Federation). Therefore, if the organization does not have an act of provision of services, any other document will be sufficient to confirm the expense. This can be a payment order, cash receipt, invoice, receipt, etc. For example, any documents drawn up in accordance with the requirements of the law (agreement, rental payment schedule, property acceptance certificate, invoice for payment) can confirm rental payments services, etc.). For more information about this, see How a tenant can reflect rental payments in tax accounting.

The exception is cases when drawing up an act on the provision of services (performance of work) is mandatory.

NTVP "Kedr - Consultant"

LLC "NTVP "Kedr - Consultant" » Services » Consultations of auditors » All expenses must be documented. Such a document can be any organizational and administrative document of an organization containing a decision of an authorized person to recognize expenses

Question: The situation is this - we have carried out a major renovation of the house. During the installation process, our employees mixed up the wires in the electrical panel. As a result of this, a resident’s washing machine burned out where repairs were carried out. This case is considered non-warranty. A resident contacted us with a request to replace the machine.

The question is: if we buy this washing machine, how do we document this? And what accounting entries will be made in this case, and how will this affect taxes (VAT, profit)?

The tax regime is general.

Audit specialists answer:

In accordance with paragraph 1 of Article 1064 of the Civil Code of the Russian Federation, harm caused to the person or property of a citizen, as well as harm caused to the property of a legal entity, is subject to compensation in full by the person who caused the harm.

I. In accounting, this operation will be reflected as follows:

In accordance with PBU 10/99 “Expenses of the organization,” other expenses include, in particular, compensation for losses caused by the organization. Compensation for losses caused by the organization is accepted for accounting in amounts, in particular, recognized by the organization.

In accounting, compensation for damage will be reflected as follows:

— a washing machine was purchased (including VAT, since it is not subject to taxable transactions):

debit to account 10 “Materials” or 41 “Goods” / Credit to account 60 “Settlements with suppliers and contractors”;

- transfer of the washing machine to the injured party as compensation for damage:

debit of account 76 “Settlements with various debtors and creditors” / Credit of account 10 “Materials” or 41 “Goods”;

— the amount of recognized damage is reflected in the accounting records in terms of the cost of the washing machine (including VAT) to be transferred to the injured party:

debit of account 91-2 “Other expenses” / Settlement of account 76 “Settlements with various debtors and creditors”.

II. In tax accounting, this operation will be reflected as follows:

1. These expenses can be taken into account for corporate income tax. In accordance with paragraph 1 of Article 265 of the Tax Code of the Russian Federation, non-operating expenses not related to production and sales include reasonable costs for carrying out activities not directly related to production and (or) sales. These include, in particular, the costs of compensation for damage caused.

2. In our opinion, there is no subject to value added tax for this transaction. According to clause 1 of Article 146, the object of VAT taxation, in particular, is the sale of goods (work, services) on the territory of the Russian Federation.

In accordance with clause 1 of Article 39 of the Tax Code of the Russian Federation, the sale of goods, work or services by an organization or individual entrepreneur is recognized as the transfer on a reimbursable basis (including the exchange of goods, work or services) of ownership of goods, results of work performed by one person to another persons, the provision of services for a fee by one person to another person, and in cases provided for by the Tax Code of the Russian Federation, the transfer of ownership of goods, the results of work performed by one person for another person, the provision of services by one person to another person - on a free basis.

In our opinion, in this case there is no sale of goods, so there is no VAT subject to taxation.

Since in this case the operation is subject to non-taxable VAT, therefore, “input” VAT on the purchased washing machine cannot be deducted.

In this case, it is necessary to take into account that a tax risk may arise due to the fact that the tax authorities may classify this operation as a “gratuitous transfer” and charge additional VAT.

All expenses must be documented. Such a document can be any organizational and administrative document of an organization containing a decision of an authorized person to recognize expenses. This could be an order for the organization, a letter, a claim, or an official note with the corresponding visa of the manager, as well as a document on the transfer of the washing machine.

Documents from an unregistered organization

Situation: is it possible to take into account when calculating income tax expenses supported by documents issued on behalf of an organization not registered in the Unified State Register of Legal Entities?

No you can not.

According to regulatory agencies, expenses on documents drawn up on behalf of unregistered organizations cannot be taken into account when calculating income tax. This position is based on the following provisions:

- Article 153 of the Civil Code of the Russian Federation, according to which transactions are recognized as actions of citizens and legal entities aimed at establishing, changing or terminating civil rights and obligations. An organization that is not registered in the Unified State Register of Legal Entities is not a legal entity. Therefore, actions performed with its participation are not considered transactions, and costs arising in the course of these actions are not recognized as expenses when calculating income tax;

- Article 252 of the Tax Code of the Russian Federation, according to which expenses must be confirmed by documents drawn up in accordance with the law. Documents issued by unregistered organizations do not meet this condition; therefore, they cannot be evidence of expenses incurred.

The courts confirm the legality of this approach. They recognize that documents issued on behalf of non-existent legal entities cannot confirm expenses that reduce taxable profit (see, for example, resolutions of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 31, 2011 No. 17649/10, dated April 19, 2011 No. 17648 /10, dated February 1, 2011 No. 10230/10, determinations of the Supreme Arbitration Court of the Russian Federation dated June 6, 2011 No. VAS-4338/11, dated July 16, 2009 No. VAS-8645/09, dated June 22, 2009 No. VAS-7288/09, resolutions of the Federal Antimonopoly Service of the Volga-Vyatka District dated November 8, 2013 No. A38-92/2013, dated May 5, 2011 No. A43-14215/2010, dated April 28, 2011 No. A43-17064/2010 , West Siberian District dated January 18, 2013 No. A45-17992/2011, dated October 16, 2013 No. A27-20892/2012, East Siberian District dated February 2, 2011 No. A58-5163/2009).

Expenses are not documented: what to do?

During the next audit, tax officials will definitely pay attention to this and fine the company. After all, the absence of primary documents is considered a gross violation of the rules for accounting for income and expenses (Article 120 of the Tax Code of the Russian Federation). The fine for this violation is 10,000 rubles. If documents are missing for a period of more than a year, the fine will be 30,000 rubles. Well, if the lack of documents led to an underestimation of the tax, the fine will be 20 percent of the amount of unpaid tax, but not less than 40,000 rubles.

To avoid liability, you need to prove your innocence in the absence of primary documents. Draw up a report listing the missing documents and the reason for their absence. This act must be approved by the head of the company.

If documents are lost due to fire, theft or other emergency, you will also need a certificate confirming that such a situation actually occurred. So, if there is a fire, then a certificate from the fire department is required; if flooding occurs, a certificate from the organization that operates the building; if documents were stolen - a police certificate.

It also happens that a new accountant comes to a company and cannot understand the documentation, because his predecessor did careless accounting. To avoid such misunderstandings, we recommend that you take an “inventory” of the documentation before starting work. If such a check could not be carried out and the new accountant began work, then we advise you to contact the previous accountant and demand from him a written explanation of why certain primary documents are missing. Then draw up a statement of absence of documents. Thus, the new accountant will be relieved of responsibility for the lack of documents.

It also happens that a new accountant comes to a company and cannot understand the documentation, because his predecessor did careless accounting. To avoid such misunderstandings, we recommend that you take an “inventory” of the documentation before starting work.

Another unpleasant moment that threatens a company in such a situation is additional taxes and penalties.

The fact is that expenses that are not documented cannot be taken into account when calculating income tax. If such expenses were nevertheless taken into account, the tax authorities will consider that the tax base for income tax was underestimated, and will charge additional tax, as well as penalties.

To avoid tax penalties, we advise you to try to restore the missing documents. If, for example, there are no documents confirming the purchase of goods (works, services, property rights), agree with suppliers to issue you copies of them. Of course, you can restore the missing documents only if you know which documents are missing to confirm expenses, and also from which suppliers the goods (works, services, property rights) were purchased. It is much more difficult if, for example, documents confirming the issuance of money on account to an employee of a company who is no longer working for the company are lost.

The way out of this situation is to try to contact this employee and agree with him to re-issue the necessary documents.

electronic edition of 100 ACCOUNTING QUESTIONS AND ANSWERS BY EXPERTS

A useful publication with questions from your colleagues and detailed answers from our experts. Don't make other people's mistakes in your work! 7 issues of the publication are available to berator subscribers for free.

Get the edition

Documents from an unscrupulous supplier

Situation: is it possible to take into account, when calculating income tax, the costs of purchasing goods (work, services), the supplier of which submits “zero” declarations to the tax office?

Yes, you can.

Conscientious fulfillment by the supplier of taxpayer obligations is not a prerequisite for recognizing expenses from the buyer (clause 1 of Article 252 of the Tax Code of the Russian Federation).

In themselves, violations committed by the organization’s counterparties (including distortion of tax reporting) are not grounds for accusing it of receiving an unjustified tax benefit (clause 10 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53) . If an organization actually purchased goods (work, services) for use in its activities, and the supplier did not reflect these operations in the reporting, then, if there are correctly executed primary documents, the inclusion of such expenses in the calculation of the tax base for income tax is legal (see, for example, resolution of the Federal Antimonopoly Service of the Moscow District dated May 10, 2007 No. KA-A40/3705-07, dated March 1, 2007 No. KA-A40/814-07, dated October 17, 2006 No. KA-A40/9769-06).

But if the tax inspectorate proves that in reality the goods (work, services) were not purchased, and the primary documents were drawn up to inflate expenses, then the organization may be accused of receiving an unjustified tax benefit (clause 5 of the resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated October 12, 2006 No. 53). In this case, transactions made with the counterparty will be declared invalid, and the tax obligations arising from these transactions will be recalculated with fines and penalties.

There is no standard

One of the conditions for recognizing an organization’s expenses when calculating income tax is their documentary justification (clause 1 of Article 252 of the Tax Code of the Russian Federation). However, there is no list of documents that should be drawn up in certain cases.

Therefore, any documents that can be used to substantiate the fact and amount of expenses incurred can serve as documentary evidence. Moreover, supporting documents can often be taken into account only in conjunction with others. For example, the act of entertainment expenses 2021 is used in conjunction with other primary documents, in particular, cash receipts. Such conclusions follow from the ruling of the Constitutional Court dated June 4, 2007 No. 320-O-P, and the ruling of the Supreme Arbitration Court dated June 17, 2009 No. VAS-5445/09.

Documents issued abroad

Situation: how to confirm expenses for purchasing property abroad. Is the buyer a foreign representative office of a Russian organization? The property was registered by the head office of the organization in Russia.

You can confirm expenses incurred when purchasing property (work, services) abroad with documents drawn up in accordance with the business regulations of the country in which the transaction was made.

When purchasing property (works, services), such documents can be contracts, transfer deeds, invoices, as well as documents confirming that the seller (executor) has been paid off. In addition, to justify expenses incurred abroad, you can use documents that indirectly confirm the fact of expenses (customs declarations, travel orders, travel documents, etc.). This conclusion allows us to draw paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In this case, documents drawn up in a foreign language must have a line-by-line translation into Russian (paragraph 3 of clause 9 of the Regulations on Accounting and Reporting). This is explained by the fact that official paperwork in all organizations is conducted in Russian as the state language of Russia (Clause 1, Article 16 of Law No. 1807-1 of October 25, 1991, Article 68 of the Constitution of the Russian Federation).

Similar clarifications are contained in letters of the Ministry of Finance of Russia dated February 16, 2009 No. 03-03-05/23, dated March 20, 2006 No. 03-02-07/1-66.

Ways to document expenses incurred

Can sales receipts, receipts and other documents confirming the receipt of funds for the corresponding product (work, service) be equated to a cash receipt, as provided for strict reporting forms, to confirm expenses when calculating income tax when purchasing goods (work, service) services) for UTII taxpayers who do not use cash register systems? How are the records and storage of these documents organized? What documents are understood by the term “other documents” in Federal Law No. 54-FZ of May 22, 2003?

Content

According to Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as justified and documented expenses (and in cases provided for in Article 265 of the Code, losses) incurred (incurred) by the taxpayer.

In this case, documented expenses mean expenses confirmed by documents drawn up in accordance with the legislation of the Russian Federation, or documents drawn up in accordance with business customs applied in the foreign state in whose territory the corresponding expenses were made, and (or) documents indirectly confirming the expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

In accordance with clause 2.1 of Art. 2 of the Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making cash payments and (or) settlements using payment cards” organizations and individual entrepreneurs who are taxpayers of the single tax on imputed income for certain types of activities, not subject to clauses 2 and 3 of Art. 2 of the Federal Law of May 22, 2003 N 54-FZ, when carrying out types of business activities established by clause 2 of Art. 346.26 of the Tax Code of the Russian Federation, can carry out cash payments and (or) payments using payment cards without the use of cash register equipment, subject to the issuance, upon request of the buyer (client), of a document (sales receipt, receipt or other document) confirming the receipt of funds for the corresponding product (work, service). Federal Law of May 22, 2003 N 54-FZ, as the name of the document issued, along with some examples of such documents (sales receipt, receipt), used the general name “document confirming the receipt of funds” and established its content.

Thus, the corresponding expenses when making cash payments and (or) payments using payment cards in cases of sale of goods, performance of work or provision of services must be confirmed by cash register receipts printed by cash register equipment or documents confirming the receipt of funds for the relevant product (work , service). The specified documents containing the information provided for in clause 2.1 of Art. 2 of the Federal Law of May 22, 2003 N 54-FZ, can be issued by organizations and individual entrepreneurs - taxpayers of the single tax on imputed income for certain types of activities when they carry out the corresponding business activity, subject to taxation with a single tax on imputed income for certain types of activities.

Reason: Letter of the Ministry of Finance of the Russian Federation dated October 22, 2009 N 03-01-15/9-470

A selection based on materials from the Financier information bank of the ConsultantPlus system. Compiled by E.V. Zernova, O.B. Soldatova.

Legal documents

- Art. 252 of the Tax Code of the Russian Federation

- Art. 265 Code

- Federal Law of May 22, 2003 N 54-FZ “On the use of cash register equipment when making cash payments and (or) payments using payment cards”

- Art. 346.26 Tax Code of the Russian Federation

- Letter of the Ministry of Finance of the Russian Federation dated October 22, 2009 N 03-01-15/9-470

Documents drawn up in foreign currency

Situation: is it possible to take into account when calculating income tax expenses supported by documents drawn up in foreign currency?

Yes, you can.

Documents drawn up in foreign currency can confirm the organization’s expenses:

- for transactions within the framework of foreign trade contacts or abroad;

- for transactions made on the domestic market, if Russian legislation allows settlements between counterparties in foreign currency (Article 9 of Law No. 173-FZ of December 10, 2003).

In both cases, the organization has the right to recognize expenses that are confirmed by documents drawn up in foreign currency. The main thing is that these documents are drawn up either in accordance with the rules in force in foreign countries, or in accordance with Article 9 of the Law of December 6, 2011 No. 402-FZ.

When determining taxable profit, expenses expressed in foreign currency are subject to conversion into rubles (clause 5 of Article 252 of the Tax Code of the Russian Federation).

What expenses are unreasonable?

According to Art. 252 of the Tax Code of the Russian Federation, the following expenses can be included in tax calculations:

- economically justified;

- documented;

- expressed in monetary terms.

The norms of this article are related to the norms of Art. 346.16 of the Tax Code of the Russian Federation, therefore, the criteria apply to both calculations for income tax and simplified tax.

Question: Is it possible to deduct VAT if income tax expenses are economically unjustified (clauses 1, 2, Article 171 of the Tax Code of the Russian Federation)? View answer

In practice, it follows from the above that the Federal Tax Service has the right not to recognize certain expenses as economically justified, despite the absence of strict prohibitions in the legislation on the inclusion of certain types of expenses in calculations:

- Costs, according to the law, that are not related to the economic activity carried out by the taxpayer.

- Costs of paying for the services of consultants, auditors, lawyers, advertising agencies without detailing the work performed and the use of this work in business activities.

- Material costs not provided for by production technology or used in excess of technological standards.

- Inventory and materials (works, services) purchased at prices above average market prices for similar product items.

- Inventory materials used in the production of products that are subsequently sold at prices below the cost of inventory materials. The same applies to works and services.

- Costs that are not associated with the organization's receipt of income or with the intention of receiving it.

- Expenses incurred outside the scope of activities aimed at generating income, not having the purpose of generating income (reducing losses), and inflated compared to standard indicators are not considered economically justified.

How are economically unjustified expenses made for the purpose of tax evasion identified?

Important! The taxpayer is obliged to structure his document flow in such a way that it is clear from concluded contracts, primary documents, accounting registers, supporting and reference documents which goods, works and services were subsequently included in the tax calculation and for what purpose certain costs were incurred. When checking, the Federal Tax Service will, first of all, pay attention to their connection with business activities.

Documents without decrypted signatures

Situation: is it possible to take into account when calculating income tax expenses supported by documents that do not contain transcripts of official signatures?

No you can not.

The tax base for income tax is determined on the basis of primary accounting documents (Article 313 of the Tax Code of the Russian Federation). At the same time, the concept of “primary accounting documents” should be defined in accordance with the legislation on accounting (clause 1 of Article 11 of the Tax Code of the Russian Federation, letter of the Ministry of Finance of Russia dated April 5, 2005 No. 03-03-01-04/1/167).

Deciphering the signatures of the persons responsible for carrying out a business transaction is a mandatory requisite of the primary document (subclause 7, clause 2, article 9 of the Law of December 6, 2011 No. 402-FZ). Therefore, if the documents confirming the organization’s expenses do not contain transcripts of signatures, such expenses cannot be taken into account when calculating income tax.

The legitimacy of this position is supported in arbitration practice (see, for example, decisions of the FAS of the Far Eastern District dated August 4, 2006 No. Ф03-А73/06-2/2540 and dated May 31, 2006 No. Ф03-А73/06-2/ 1369, Northwestern District dated February 2, 2006 No. A13-1712/2005-28).

At the same time, there are examples of court decisions from which it follows that certain shortcomings in the preparation of primary documents do not entail an automatic refusal to recognize expenses (see, for example, resolutions of the Federal Antimonopoly Service of the Moscow District dated August 19, 2009 No. KA-A40/ 7963-09, North Caucasus District dated February 28, 2007 No. F08-721/2007-293A). In particular, in its resolution dated August 19, 2009 No. KA-A40/7963-09, the FAS Moscow District indicated that the lack of decoding of signatures in the acceptance certificate for work performed (if there is such a decoding in the contract for their implementation) cannot be grounds for exclusion costs of paying for work from the income tax base.

Reimbursement for undocumented travel expenses

How to reflect in the organization's accounting the reimbursement of an employee's expenses for renting housing on a business trip if the employee has not provided documents confirming these expenses? The employee's advance report indicates that the cost of renting housing amounted to 700 rubles. per day. According to the travel certificate, the employee was at the place of travel for five days. In accordance with the regulations on business trips (appendix to the collective agreement), expenses for renting residential premises that are not supported by documents are paid in the amount of 700 rubles. per day. The purpose of the business trip is to organize sales of manufactured products.

Content

Labor Relations

When sent on a business trip, the employer is obliged to reimburse the employee, in particular, for the costs of renting living quarters. The procedure and amount of reimbursement of expenses associated with business trips are determined by a collective agreement or local regulations (parts 1, 2 of Article 168 of the Labor Code of the Russian Federation, clauses 11, 14 of the Regulations on the specifics of sending employees on business trips, approved by Government Resolution RF dated October 13, 2008 N 749).

Accounting

In accordance with clause 11 of the Procedure for conducting cash transactions in the Russian Federation, approved by Decision of the Board of Directors of the Central Bank of the Russian Federation dated September 22, 1993 N 40, employees of the organization are issued funds for travel expenses on account. No later than three days after returning from a business trip, an employee of the organization must submit an Advance Report (Form N AO-1) on the amounts spent and make a final payment for them. Documents confirming expenses are attached to the advance report. In this case, the advance report indicates the costs of renting housing, but the employee did not provide documents confirming the costs. However, on the basis of an advance report approved by the head, the organization has the right to recognize these expenses as travel expenses, since reimbursement of documented unconfirmed expenses for renting housing during a business trip is provided for by the regulations on business trips.

As of the date of approval of the advance report, business trip expenses are taken into account in this case as part of business expenses. Selling expenses are included in the cost of sales during the period when they are recognized as expenses for ordinary activities (clauses 5, 7, 9, 16 of the Accounting Regulations “Organizational Expenses” PBU 10/99, approved by Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n ).

Accounting for settlements with an employee to whom funds have been issued on account is carried out using account 71 “Settlements with accountable persons”. When an expense is recognized, an entry is made in the debit of account 44 “Sales expenses” in correspondence with the credit of account 71. From account 44, expenses are written off to the debit of account 90 “Sales”, subaccount 90-2 “Cost of sales” (Instructions for using the Chart of Accounts financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n).

Corporate income tax

In accordance with paragraph 1 of Art. 252 of the Tax Code of the Russian Federation, expenses are recognized as documented expenses of the organization. In this case, reimbursement of expenses for hiring living quarters to the employee is made in accordance with the terms of the business travel regulations, and the amount of expenses is reflected only in the advance report without attaching supporting documents. According to the Ministry of Finance of Russia, such expenses for renting residential premises are considered undocumented and cannot be taken into account in accordance with paragraph 49 of Art. 270 of the Tax Code of the Russian Federation (Letter of the Ministry of Finance of Russia dated April 28, 2010 N 03-03-06/4/51).

Personal income tax (NDFL)

According to paragraph 3 of Art. 217 of the Tax Code of the Russian Federation, when the employer pays the taxpayer expenses for business trips both within the country and abroad, the income subject to taxation does not include actually incurred and documented targeted expenses for renting residential premises. If the taxpayer fails to provide documents confirming payment of expenses for renting residential premises, the amount of such payment is exempt from taxation in accordance with the legislation of the Russian Federation, but not more than 700 rubles. for each day you are on a business trip in the Russian Federation.

In this case, the amount of compensation does not exceed the specified maximum amount, therefore, the employee does not have income subject to personal income tax.

Insurance premiums

In accordance with Part 2 of Art. 9 of the Federal Law of July 24, 2009 N 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and territorial compulsory medical insurance funds” are not subject to insurance contributions to the Pension Fund of the Russian Federation, the Federal Social Insurance Fund of the Russian Federation, FFOMS and TFOMS actually incurred and documented target expenses for renting residential premises. If documents confirming payment of expenses for renting residential premises are not provided, the amounts of such expenses are exempt from insurance premiums within the limits established in accordance with the legislation of the Russian Federation.

In this case, in accordance with the legislation of the Russian Federation, the organization established in the regulations on business trips that if supporting documents are not provided, expenses for renting residential premises in the amount of 700 rubles are subject to reimbursement. Consequently, the organization does not charge insurance premiums for the amount of reimbursement of expenses for renting residential premises (clause 2 of the consultation of the specialist of the Pension Fund of the Russian Federation D.I. Pokshan dated July 21, 2010).

Application of PBU 18/02

Since the costs of renting residential premises are recognized only in accounting, the organization has a permanent difference, which corresponds to a permanent tax liability (PNO) (clauses 4, 7 of the Accounting Regulations “Accounting for calculations of corporate income tax” PBU 18 /02, approved by Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n).

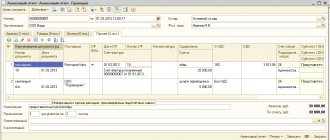

| Contents of operations | Debit | Credit | Amount, rub. | Primary document |

| On the date of issue of funds for reporting | ||||

| Funds were issued to the employee on account (700 x 5) | 71 | 50-1 | 3 500 | Manager's order, Cash order |

| As of the date of approval of the advance report of the posted worker | ||||

| Unconfirmed expenses for renting residential premises are reflected | 44 | 71 | 3 500 | Advance report |

| Expenses are written off as cost of sales for the current month (excluding other expenses) | 90-2 | 44 | 3 500 | Accounting information |

| PNO reflected (3500 x 20%) | 99 | 68 | 700 | Accounting certificate-calculation |

This scheme does not consider other travel expenses and accounting entries are given only for the amount of expenses for renting residential premises.

E.V. Feshchenko, Consulting and Analytical Center for Accounting and Taxation

Legal documents

- Art. 168

- Decree of the Government of the Russian Federation of October 13, 2008 N 749

- The procedure for conducting cash transactions in the Russian Federation

- By Order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

- By Order of the Ministry of Finance of Russia dated October 31, 2000 N 94n

- Art. 252

- Art. 270

- Art. 217

- Federal Law of July 24, 2009 N 212-FZ

- By Order of the Ministry of Finance of Russia dated November 19, 2002 N 114n

Document storage period

As a general rule, an organization must keep documents confirming expenses for at least four years (subclause 8, clause 1, article 23 of the Tax Code of the Russian Federation). At the same time, special storage rules are established for documents confirming:

- the amount of losses that the organization transfers to the future must be kept for the entire period of reduction of the tax base, but not less than four years (clause 4 of Article 283 of the Tax Code of the Russian Federation);

- expenses in the form of depreciation deductions, the four-year storage period for such documents must be counted from the end of depreciation in tax accounting.

Similar clarifications are contained in the letter of the Ministry of Finance of Russia dated April 26, 2011 No. 03-03-06/1/270.

Documents confirming actual expenses

The actual entertainment expenses can be confirmed by an advance report with the following documents attached:

- accounts of public catering organizations;

- KKM checks;

- contracts for the provision of transport services and (or) the provision of translation services, certificates of work performed, invoices and payment documents drawn up under the contracts;

- sales receipts, invoices;

- other documents.

An approximate list of documents to confirm entertainment expenses is also contained in Letters of the Ministry of Finance of Russia dated March 22, 2010 N 03-03-06/4/26, dated November 13, 2007 N 03-03-06/1/807.