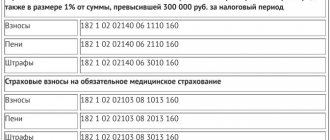

KBK for payment of the minimum tax under the simplified tax system (until 01/01/2016)

| NAME | PAYMENT TYPE | KBK |

| Minimum tax under simplification for tax periods expired before 01/01/2016. | tax | 182 1 0500 110 |

| penalties | 182 1 0500 110 | |

| interest | 182 1 0500 110 | |

| fines | 182 1 0500 110 |

FILES

Important clarifications on the BCC for paying taxes under the simplified tax system

“Simplified” is the most attractive tax system for small and medium-sized businesses. Its popularity is explained by its minimal tax burden and the simplest reporting and accounting procedure among all systems. This is especially convenient for individual entrepreneurs. The two versions of this system differ in the tax rate, base and method of calculating taxes:

- STS - Income (or STS -6%): 6% of the entrepreneur’s profit is allocated to the state;

- STS - Income minus expenses (or STS-15%): the state is entitled to 15% of the difference declared in the title of the tax.

Should I follow one or the other of these varieties? An entrepreneur can change the decision annually by notifying the tax authority of his intention before the end of the year.

Can everyone choose the simplified tax system?

In order to switch to the “simplified” system, the enterprise must meet some conditions that are not difficult for small businesses:

- have less than 100 employees;

- do not aim at an income of more than 60 thousand rubles;

- have a residual value of less than 100 million rubles.

For legal entities, these requirements are supplemented by a ban on branches and representative offices and a share of participation of other organizations exceeding a quarter.

IMPORTANT INFORMATION! A pleasant tax innovation regarding the simplified tax system: the 6% rate on the simplified tax system - Income, already the lowest among taxation systems, can be reduced to 1% from 2021 according to a regional initiative. And the USN-15 rate can turn into 5% if regional legislation so dictates.

We pay a single tax

A tax that replaces several deductions common to other tax systems (personal income tax, VAT, property tax) is called a single tax. Regardless of what type of simplified tax system is chosen by the entrepreneur, it must be deducted in advance payments at the end of each quarter.

The tax amount at the end of the year will need to be calculated, taking into account the advance payments made.

To transfer the tax amount to the budget, you must fill out the payment order correctly, because taxes cannot be paid in cash.

In field 104, you must indicate the correct BCC for paying the single tax to the simplified tax system:

- for simplified tax system-6% – 182 1 0500 110;

- for simplified tax system-15% – 182 1 0500 110.

If advance payments are not made on time, penalties are imposed for each missed day. To pay them, you need the following BCCs:

KBK for payment of penalties under the simplified tax system “income”

In 2021, the KBK penalty for the simplified tax system “income” remains unchanged:

182 1 0500 110.

This code is used to transfer penalties to the budget, the same as in 2021. It should be taken into account that the KBK for penalties under the simplified tax system “income” 2019 differs from the KBK for penalties under the simplified tax system “income minus expenses”. It is worth checking the KBK carefully before sending a payment: an error in one digit turns the payment into an unclear one. This subsequently leads to the search and clarification of payment - a long-term and troublesome process for the taxpayer.

Payment of penalties under the simplified tax system “income” according to the correct BCC and details is especially relevant in the case of filing an updated declaration under the simplified tax system with increased amounts payable. To avoid subsequent charges of penalties by tax authorities, you first need to calculate and then transfer penalties from the amount of the increase in the simplified tax system and only then submit a declaration to the Federal Tax Service.

Penalties under the simplified tax system “income” are accrued for each day of delay. For example, if the due date for payment of the simplified tax system for companies for the past 2018 was April 1, 2021, then penalties are calculated starting from April 2, 2021. The last overdue day is considered the day of fulfillment of the obligation to pay tax - this rule is included in clause 3 of Art. 75 of the Tax Code of the Russian Federation by Law No. 424-FZ of December 27, 2018.

The Federal Tax Service previously argued that the day of payment should be included in the period of accrual of penalties, but then the position of the tax authorities on this issue changed (letter of the Federal Tax Service dated December 6, 2017 No. ZN-3-22/7995) and began to coincide with the opinion of the Ministry of Finance, which believed that the day of transfer debt is not included in the calculation (letter of the Ministry of Finance of the Russian Federation dated July 5, 2016 No. 03-02-07/39318). Now, in relation to debt incurred after December 27, 2018, only the provisions of the Tax Code of the Russian Federation need to be applied.

Payment order under the simplified tax system with the object of taxation “income” in 2021: sample

When deciding to apply the simplified tax system in 2021 (subject to compliance with the necessary requirements) with the taxable object “income”, the taxpayer assumes the obligation to pay:

- advance payment at the end of each reporting period;

- tax amount based on the results of the tax period.

Payment of the advance payment is made no later than the 25th day of the first month following the reporting period.

Let us remind you that the reporting periods under the simplified tax system are the first quarter, half a year and nine months.

Tax under the simplified tax system must be paid no later than March 31 following the expired tax period. This is a general rule for all organizations using the simplified tax system.

Individual entrepreneurs using the simplified tax system pay tax at the end of the year no later than April 30 of the year following the previous year (clause 2, clause 1, article 346.23 of the Tax Code of the Russian Federation).

Such tax rules are provided for in Art. 346.21 Tax Code of the Russian Federation.

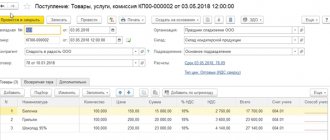

When paying advance payments and tax through the bank under the simplified tax system with the object “income,” you should use a payment order form. We have filled out a sample payment form and provided it below.

sample payment order under the simplified tax system with the object of taxation “income”

Tax payment deadlines

According to the current version of the Tax Code of the Russian Federation, organizations are required to transfer to the budget not only the annual payment, but also advance tranches. The deadline for the transfer is strictly defined, and for violation there are fines and penalties.

So, transfer advance payments to the budget no later than the 25th day of the month following the reporting period - 1st quarter, 1st half of the year, 9 months. And send the annual payment to the Federal Tax Service no later than March 31 of the year following the reporting year.

Please note that if the payment deadline falls on a non-working day or holiday, you can pay the tax on the first working day. So, for example, you need to pay the simplified tax system for 2021 no later than 03/31/2019. But this day falls on Sunday, which means that the payment can be sent to the bank on 04/01/2019. Payment made later will be considered a violation, and tax authorities will charge penalties. Therefore, it is important to check that the correct BCC and other details are indicated

Payment form according to the simplified tax system in 2017

Two main documents regulate the procedure for applying and filling out a payment order:

- A sample payment form in 2021 is provided by the Bank of Russia in the Regulations on the rules for transferring funds approved on June 19, 2012 No. 383-P (see Appendix 2 to the Regulations). Here the values of all details are established, including their list and description, as well as the requirements for the minimum number of characters (symbols) in each payment details according to the simplified tax system (see Appendix No. 1 and Appendix No. 3 to the Regulations);

- the second document is Order of the Ministry of Finance of Russia dated November 12, 2013 No. 107n and Appendix No. 2 to it.

Payment order under the simplified tax system with the object of taxation “income-expenses” in 2021: sample

For those taxpayers who have chosen the object of taxation “income minus expenses” under the simplified tax system, the obligation to pay the minimum tax is provided (clause 6 of Article 346.18 of the Tax Code of the Russian Federation).

The taxpayer pays the minimum tax if, at the end of the tax period, the amount of tax calculated in the general manner under the simplified tax system is less than the minimum tax.

Let us remind you that the minimum tax is the same for the entire territory of Russia and is 1% of income for the tax period.

In 2021, in the payment order on the simplified tax system “income-expenses” when paying the minimum tax, pay attention to the change in the details when specifying the BCC. We have filled out a sample payment slip with the new KBK and provided it below.

sample payment order under the simplified tax system with the object of taxation “income - expenses”

sample payment order under the simplified tax system with the object of taxation “income - expenses” for payment of the minimum tax

Simplified penalties

Not in all cases, but still, an incorrectly specified BCC can lead the taxpayer to unnecessary problems. The tax authorities either return the order to the taxpayer, which contains the incorrect code, or transfer it to a category called “unclarified”. In such cases, the taxpayer will have to pay a penalty for late tax payment.

Without a code that serves as a guideline for accepting a tax payment, the tax authorities will not be able to see the transferred payment. In this regard, the taxpayer will need to pay not only the amount of the penalty, but also the amount of the entire tax again. There is a possibility that the amount of tax paid for the wrong code will be used to pay another tax. However, this situation is also difficult. To get this money back you will have to spend quite a lot of time and effort.

The only way out is to submit an application to the tax office to transfer the overpaid amount from one tax account to another. But penalties for incorrectly indicating codes will be charged in any case. If the tax payer indicated the wrong code, but the money was received as intended, no penalties will be charged.

Taxpayers should take into account that penalties and fines are assessed according to different BCC codes. They are also different for different objects of taxation and categories of tax payers. If you pay a fine using the wrong code, the situation will again become problematic, and you will have to pay double the amount.

Similar articles

- BCC for transport tax in 2021 for legal entities

- What is kbk in a payment card?

- KBC for insurance premiums for 2021

- KBK FFOMS

- How to reduce the simplified tax system on insurance premiums?

Article

A payment order under the simplified tax system (income) in 2021 is issued when transferring the tax for 2021. See the sample with the current KBK, OKTMO, payer status and other details.

When do you need to make a payment using the simplified tax system?

Before we tell you what to pay attention to when filling out a payment order under the simplified tax system (income) in 2021, let’s talk about the timing of its preparation.

Companies pay the single tax annually no later than March 31 of the following year. For entrepreneurs, the payment deadline is April 30 next year.

During the code, companies and individual entrepreneurs must transfer advance payments according to the simplified tax system. The deadline for their submission is no later than the 25th day of the first month following the reporting period. Reporting periods are 1st quarter, half a year and 9 months.

Accordingly, every year companies and individual entrepreneurs must make at least 4 payments under the simplified tax system.

How to fill out a payment order using the simplified tax system (income) in 2017

A payment order under the simplified tax system (income) in 2021 must be drawn up in the form given in Appendix 2 to Bank of Russia Regulation No. 383-P dated June 19, 2012. Each field is assigned a number. Next we will tell you how to fill out the main fields.

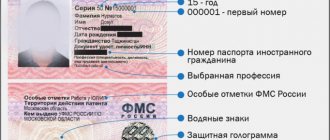

Payer status in the payment order (field 101). This field is filled in differently depending on who pays the tax - a company or an entrepreneur. If a company pays tax, the status will be 01, entrepreneur – 09.

Payment order (field 21). In this field, you should enter the order of payment - 5, if the tax or advance payment of the company (IP) is transferred themselves, and not at the request of the Federal Tax Service. Otherwise, in field 21 you need to write down the order of payment – 3.

KBK (field 104). BCC for companies and entrepreneurs on the simplified tax system differ depending on what object of taxation is applied. For the simplified tax system with an object, the income of the KBK is as follows: 182 1 05 01011 01 1000 110.

If penalties for tax and advance payments for the object of income are transferred, in field 104 put KBK 182 1 0500 110, fines - KBK 182 1 0500 110.

OKTMO (field 105). In field 105, enter 8 or 11 digits of the locality code in accordance with the classifier (Order of Rosstandart dated June 14, 2013 No. 159-ST).

Reason for payment (field 106). In this field you must put “TP”, since advance payments and a single tax are paid for the current period. If the company (IP) voluntarily repays the debt for previous years, the code “ZD” is entered. And if the tax is paid on the basis of an inspection requirement - TR.

Tax period (field 107). This field indicates the month, quarter or year to which the payment relates. When paying advances or annual tax according to the simplified tax system, in field 107 you need to put the number of the last quarter to which the payment relates. Field 107 contains 10 characters. For convenience, we have provided information on filling out field 107 in the table below.

Table. What values to put in field 107 of a payment order under the simplified tax system (income) in 2021

| Payment Description | What to write in field 107 |

| Advance payment for the 1st quarter of 2021 | KV.01.2017 |

| Advance payment for the first half of 2021 | KV.02.2017 |

| Advance payment for 9 months of 2021 | KV.03.2017 |

| Single tax according to the simplified tax system for 2021 | KV.04.2017 |

Document number (field 108). This field is set to zero if the company (IP) transfers the single tax or advance payment independently.

Document date (field 109). When making advance payments, a zero is entered in this field. And when paying a single tax - the date of signing the declaration or 0 if the payment is transferred before the submission of the declaration.

Payment type (field 110). This field does not need to be filled in (clause 1.3 of the Instructions of the Central Bank of the Russian Federation dated November 6, 2015 No. 3844-U).

Sample payment slip

What budget classification codes should I pay tax for “simplified”, have the BCC changed since January 1, 2021 or not? We will give answers to these questions in our article.

The reporting period for the first half of 2021 continues. Many companies and entrepreneurs have not yet paid the advance payment under the simplified tax system for the second quarter. We hasten to remind you which BCCs payments should be made to.

KBK 2021 for simplified tax system

182 1 0500 110 – for those who work with the tax object “Income” 6%; 182 1 0500 110 – for those who work with the tax object “Income minus expenses” 15%; 182 1 0500 110 – for those who pay the minimum tax.

Please note that you do not need to pay advance payments for the minimum tax in the middle of the year. We pay the minimum tax if: 1) You work “Income minus expenses”; 2) You made a loss at the end of the year. In other words, you pay the minimum tax only at the end of the year.

KBK when transferring penalties under the simplified tax system “income minus expenses” in 2020–2021

Payers of the simplified tax system with the object “income minus expenses” must enter the code 182 1 0500 110 when paying a fine in the payment slip. This BCC is also indicated when paying penalties under the simplified tax system with the object “income minus expenses” from 2015 to the present.

“Payment order for penalties - sample” will help you fill out the payment order correctly and not miss all the necessary details .

You can see the BCC for the transfer of penalties for other taxes in the analytical material from ConsultantPlus. To avoid mistakes, get free trial access to the system and go to the Ready-made solution.