Meet the accountant

Maintaining accounting records is an obligation for organizations enshrined in law. There are practically no privileges or exemptions from this requirement. Therefore, someone in the company must be responsible for the work of the financial department.

In large companies, accounting work is performed by an entire structural unit. In small ones, one person can handle it. And some institutions even outsource accounting to third-party companies. For example, centralized accounting departments in the public sector and outsourcing companies in a commercial environment.

But regardless of who will do the accounting: a third-party company or a full-time employee, the requirements for accountants are determined by law. Who is an accountant?

An accountant is a responsible employee whose responsibilities include documenting the facts of the financial and economic activities of an organization in accordance with established standards and requirements. In essence, the employee registers the operations and facts of the company’s life in specialized forms of documents (primary documents, books, magazines). And on the basis of accounting registers it compiles reports.

Use a free accountant job description template from ConsultantPlus.

Recommendations for implementation and automation specialists

When communicating with the company’s chief accountant, it is necessary to take into account the problems listed above and an understanding of the enormous responsibility of the specialist. At the same time, there are simple recommendations that will help find a common language for those who, for one reason or another, are forced to interact with accounting in the process of automating business processes, introducing new software, service maintenance, etc.

- Read at least a little about accounting. Take the time to look through the textbooks and understand at least the basics. And if you work in software, including for accountants, on an ongoing basis, you can even complete accounting courses. This will help you speak the same language with them: you will understand their problems, they will understand the solutions you propose.

- Try to keep consultation time with accountants to a minimum. Remember about their high workload

, and also that no one pays them extra for consultations. If you have basic knowledge of accounting, study the work of the company at the level of documents and consultations with employees of the same sales department, and only then come to the accounting department for final consultations and approvals, you will be grateful.

And most importantly, remember: the chief accountant builds the accounting and document flow in the company. The features of the structure itself depend on his personality. And the success of your cooperation with the company as a whole depends on how much you are able to find a common language with this person.

Specialization of positions and responsibilities of an accountant

The work responsibilities of an accountant directly depend on the structure of the enterprise in which he works. For example, in a small company you will have to keep records of all objects. In a large company, accounting positions may be specialized. Typically, specializations are divided into categories of accounting objects:

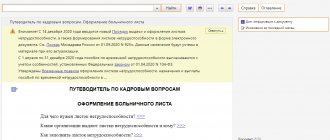

- Salary, vacation pay and benefits. This specialization is also called “payroll accountant.” For example, the responsibilities of an accountant in an LLC include calculating wages for company personnel, calculating and paying taxes and payroll fees, preparing reports to the Federal Tax Service and funds, as well as calculating disability benefits, vacation pay and other types of payments.

- Fixed assets. The employee’s tasks for accounting for fixed assets include systematically calculating depreciation, recording the receipt and disposal of fixed assets in accounting, periodically conducting inventories, reconciliations and monitoring the actual availability of property. You will also have to prepare reports to the Federal Tax Service, Rosstat and other regulatory agencies.

- Cash register. The cashier's job includes receiving and issuing cash, as well as reporting on all cash flow transactions. It is important to familiarize the cashier with the Directive of the Central Bank of Russia No. 3210-U.

- Materials and warehouse. Accounting for warehouse operations and provision of material supplies to enterprises. The work includes not only the reflection in accounting of operations on the movement of raw materials, fuel and lubricants and other materials, but also systematic monitoring of the actual availability of assets. It is necessary to exclude facts of theft and shortages.

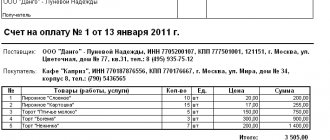

- Settlements with counterparties. The employee’s tasks include reflecting in accounting the services and work provided by third parties. The employee is required to conduct systematic reconciliations of mutual settlements with counterparties in order to eliminate delays. Responsibilities also include working with debtors to reduce the level of accounts payable and receivable in the enterprise.

- Bank operations. The rate is introduced in large institutions. The work consists of reflecting transactions on the company's current accounts. Preparation of payment orders for settlements with the budget and counterparties, as well as reflection of inflows and outflows from banking operations.

The position of chief accountant closes the list. This is the head of the financial service, who monitors the correct reflection of business transactions by subordinates, and is responsible for the preparation of financial and tax reports. But the accounting responsibilities of an accountant can be separated, for example, assigning a separate employee to prepare tax returns and calculations.

Accountant Profession Skills

It is clear that when constantly working with numbers, the key skill of an accountant is to be able to count well. Of course, calculators and special programs now help him with this, but nevertheless, quick counting skills are a very significant option when finding a job.

The second key skill of an accountant is attentiveness. Needless to say, accounting errors are costly for both himself and the company. You need to be able to notice the slightest inconsistencies in the balance and correct them immediately.

Finally, the third most important skill for an accountant is excellent knowledge of financial legislation. All laws and regulations related to economic activity, all changes to tax legislation, methodological recommendations on accounting - an accountant must know all this perfectly.

In a word, people with a special mindset are suitable to be accountants:

- meticulous and scrupulous;

- attentive;

- diligent;

- with a good memory and analytical mind;

- disciplined and responsible;

- capable of continuous learning.

Professional standards

A separate regulation has been approved for the position of “accountant” - the professional standard. Unlike the classification of positions by specialization, the professional standard does not provide for a similar division. Thus, officials identified only three categories in the professional accounting standard:

- Accountant. It is allowed to assign 1 or 2 categories to the specified position.

- Chief accountant or head of the accounting service.

- Head of Accounting and Financial Reporting Department.

The current standards are established by Order of the Ministry of Labor of Russia dated February 21, 2019 No. 103n. Moreover, the requirements regarding education and necessary work experience in the position held have been significantly tightened. For example, an employee with a higher education and at least five years of experience in accounting can be appointed to the position of head of the accounting service. If the chief accountant has secondary vocational education, then the required work experience increases to seven years.

How to become an accountant?

To begin with, to become a good accountant you need to obtain secondary or higher professional economic education. Accounting courses, which are divided by narrow specialization and focus, can also help you master the basics of accounting.

Remember that a good accountant-analyst constantly improves his level of professionalism; the learning process should not be limited to graduating from a university.

In addition to a good education, a person must have the following personal qualities:

- pedantry;

- responsibility;

- high intellectual performance;

- developed logical thinking;

- independence;

- good concentration;

- a tendency to work with large numbers of documents and volumes of information.

You can write a lot about how to become a good accountant, but the most important thing is the desire to obtain relevant knowledge and apply it as much as possible in business activities, constantly strive for self-improvement and professional growth. This is the key to the success of a good and sought-after accountant.

Job description

The procedure for conducting accounting work must be documented. The employer specifies some tasks and general functions in the employment contract with the accountant. But besides this, the work process should be detailed in a special document - a job description.

Job description structure:

- General provisions. Disclose information about the employee, work area and location. Then the qualification requirements for the employee are listed. The standards and acts that a financier must know are indicated. It is also recorded which category of specialists a specific position belongs to.

- Responsibilities. What tasks, responsibilities and functions should a hired accountant perform?

- Rights. What powers does the employee have to perform the tasks and responsibilities assigned to him?

- Responsibility. What penalties are provided for violation of the specified requirements.

Example of a job description for a chief accountant

Let's look at the subsections of the job description in more detail.

Main functions

But the functions of accounting are in themselves more of a theoretical category. Typically, accounting functions include 3 main ones:

- informational;

- control;

- analytical.

Let's reveal each of them.

| Information | Basic function in an organization's management system. Accounting, by virtue of registration, systematization and generalization of information about completed business transactions, provides users with information:

|

| Control | Accounting not only ensures verification of compliance of transactions performed with the law, but also allows you to monitor the availability, feasibility and efficiency of using the organization’s resources - material, financial, labor, etc. |

| Analytical | Accounting itself is the basis for analysis. Using data on actual performance indicators, you can:

These measures will contribute to making the necessary management decisions and increasing the efficiency of the company as a whole. |

Finally, we note that for the accounting service, each specific organization determines the functions and tasks independently - based on its specifics, scale of activity and other nuances. However, the functionality of the accounting department is still determined by the main tasks and functions of accounting as a whole.

Also see “Accounting for dummies - professional advice.”

Read also

31.08.2018

Accounting: responsibilities

The list of responsibilities of an accountant depends on the specialization of the position and the need to apply a professional standard. Let us outline the main tasks.

Responsibilities of a payroll accountant (salary):

- calculation of wages and other remuneration for labor on the basis of personnel documentation and accounting sheets;

- calculation of benefits, scholarships, vacation pay and other types of payments;

- calculation and payment of taxes, fees and contributions from wages;

- preparation of salary reports to the Federal Tax Service, Rosstat, Social Insurance Fund and Pension Fund of Russia;

- participation in audits by extra-budgetary funds and the tax service.

Responsibilities of a material table accountant (property: fixed assets, inventories, warehouse)

- reflection of receipts, movements and disposals of property assets of the enterprise;

- depreciation calculation for fixed assets;

- conducting an inventory of fixed assets and medical supplies;

- preparation of reports to regulatory authorities on property assets.

Responsibilities of a billing accountant

- accounting of settlements with counterparties;

- carrying out inventory and reconciliation of calculations;

- work with accounts payable and receivable;

- preparation of reports on the designated area.

Cashier responsibilities

- drawing up cash documents, orders;

- reflection of cash flow transactions in the cash book;

- responsibility for preparing the cashier's daily report;

- control over compliance with the cash limit, transfer of surplus to current accounts;

- strict compliance with the requirements of Directions 3210-U;

- conducting settlements with accountable persons;

- reflection of transactions on the organization's current accounts;

- Preparation of reports for the designated area.

Responsibilities of the chief accountant:

- control over the work of subordinates;

- preparation of financial statements;

- organization of internal financial control;

- participation in the planning and development of regulatory and administrative local documents for the institution;

- drawing up and adjusting accounting policies for the corresponding financial period.

Rights and powers

The financier not only performs duties, but also has a number of powers and rights. For example, an accountant has the right to demand that company employees provide timely primary documents. In addition, the accountant can carry out counter-reconciliations with counterparties, inspectorates and funds to identify debts and adjust the correctness of calculations. Take part in control, audit and other verification activities.

Rights, powers and procedures for interaction with other structural divisions of the company should be specified in as much detail and clearly as possible. If we leave only general formulations, then disputes and disagreements are inevitable.

Example of wording

The role and tasks of an accountant in accounting automation

Accounting needs to be automated - any accountant understands this. But not everyone knows what needs to be done for this and what their role is in this process. The result is passivity on the part of the accountant when implementing an automated accounting system at the enterprise, and his disagreements with management. But he is an interested person and should, if not “steer” the system installation process, then at least actively participate in it. In this article we will look at what an accountant should pay attention to when designing and implementing an automated accounting system.

Olga NETSOVA Vologda State Dairy Academy

Source: Magazine “Accountant and Computer” No. 4 2004

Automation of enterprise activity management is impossible without accounting automation. Moreover, it is with the latter that it is advisable to begin control automation. This is caused by the following factors: