Features of working with fuel cards

A fuel card is a special means of payment that allows you to purchase fuel and lubricants. Only legal entities can use this service. Card payment for fuel is widely used by many large sellers of fuel and lubricants. This is not exactly a means of payment - it does not allow you to pay for any other goods and services. They can only be used at certain gas stations.

This procedure for paying for fuel and lubricants is very convenient for any organization: one that is engaged in transport transportation, one that has a large fleet of vehicles, and one that owns only one car. Cards, depending on the order of the service, can be:

- monetary: they are credited with a certain amount of money that can be spent on purchasing fuel and lubricants;

- liter: a certain amount of fuel available for refueling at a gas station is credited.

Cash cards for purchasing fuel have become more widespread. This is what most large gas station chains offer.

Tax accounting of fuel costs

The idea of establishing a transport tax, the amount of which would be taken into account in the cost of fuel, appeared in 2010. This type of tax is regional, and therefore local authorities have the right to independently assert:

- rules for its calculation;

- machine power indicator for calculating the amount of tax at a certain rate;

- tax rate.

Today, fuel tax is a transport tax, and its amount directly depends on the vehicle’s power rating.

How the service works

All major petroleum products sellers offer this service. For example, information about it, as well as about connecting to the program, is provided by Lukoil.

Fuel is written off using legal entity fuel cards in the manner specified in the agreement concluded between the buyer and the gas station supplier.

In your personal account, you can quickly track and control all operations:

- transfer of advance payment to the fuel and lubricants supplier;

- writing off funds as payment;

- report on the quantity and cost of purchased fuel;

- cash balances.

For an employee-driver, this procedure for purchasing fuel and lubricants is also convenient, since there is no need to receive money, collect documents confirming their consumption and submit an advance report.

How do fuel cards work?

An agreement is concluded between the fuel/service supplier and the buyer; it can be of two types - an offer or a “subscription”, and in both cases, funds will be debited from the company’s account in the manner specified by the agreement.

After concluding the contract, you need to pay the fuel bill - thereby replenishing the company’s balance. The company's balance sheet is an account in the fuel supplier's system in which company funds are stored and spent. All fuel cards are linked to this account.

With each card refill or refund, all transactions are reflected in your personal account and occur only within the account and funds on the company’s balance sheet:

- replenishment of the company balance;

- debiting/crediting funds to the company account (when refueling at a gas station);

- transaction reports for each operation, indicating the name and address of the gas station, quantity, volume, and type of fuel;

- balance of funds on the company's balance sheet.

In the accounting of fuel cards at an enterprise, this system of work has proven itself to be the best, since the fuel supplier is the only counterparty under the contract - as a result of simplifying document flow and accounting.

On the other hand, for each card (driver) there are detailed statistics on fuel costs.

This approach is also very convenient for drivers; they do not need to prepare expense reports, store receipts or invoices, or carry cash with them.

How to account for fuel cards in accounting

A smart card for the purchase of fuel can be provided by the gas station network for a fee or free of charge. This is what determines the order on which account to take fuel cards into account.

Media received free of charge is not reflected on the organization’s balance sheet. To account for them, it is advisable to open a separate off-balance sheet account, assigning it a free number (not indicated in the Chart of Accounts), for example 012. It is also advisable to organize analytical accounting in the context of each medium and the persons who will be responsible for its use.

If the fuel and lubricants supplier charges a fee for the production of electronic media, it is advisable to reflect them upon receipt as part of the inventory and then write off their cost to the organization’s current expenses.

In any case, it is necessary to reflect on which account and how fuel cards are taken into account in the organization’s accounting policies.

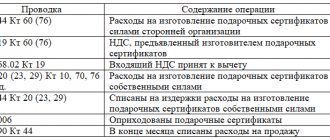

Postings for accounting of electronic media at gas stations

| Contents of operation | Debit | Credit |

| Purchase for a fee | ||

| Received acceptance certificate (invoice) for smart cards | 10 | 60 |

| Invoice received (if VAT is applied by the supplier) | 19 | 60 |

| The cost of smart cards is included in the amount of expenses of the current period | 20, 25, 26, 44 | 10 |

| Payment transferred to the supplier | 60 | 51 |

| VAT accepted for refund | 68 | 19 |

| Off-balance sheet accounting (both paid and free receipts) | ||

| Electronic media have been accepted for off-balance sheet accounting | 012warehouse | |

| A gas station smart card was issued to the responsible employee | 012employee | 012warehouse |

| The responsible employee returned the smart card to the organization | 012warehouse | 012employee |

| No longer used electronic media has been decommissioned | 012warehouse | |

Fuel card accounting

From the point of view of accounting for fuel cards, first of all, this is a separate means of payment with which the transaction for purchasing fuel is carried out.

Now fuel cards for legal entities and individual entrepreneurs are used at almost all gas stations, for example, “Full Tank” cards, the acceptance network of which includes more than 12,000 points in all regions of the Russian Federation.

When using fuel cards as a means of payment, it is worth considering the existing restrictions, for example:

- funds cannot be withdrawn (cash out) from the card;

- The card cannot be used to pay for services at gas stations, with the exception of car wash;

- cards are accepted for payment only at gas stations where the issuer’s terminal is installed;

- You cannot purchase goods using the card.

When paying for fuel with a card at a gas station, a non-cash transaction occurs, and the balance of the card and the owner’s company is reduced by an amount corresponding to the volume of fuel purchased.

This payment process is very convenient for any organization with any size of vehicle fleet; there is no need to collect receipts and invoices, issue cash from the cash register and control the target expenditure of the funds issued.

The balance of fuel cards can be of two types - liter and ruble. In the case of a liter balance, the processing side calculates the cost of fuel for the transaction based on the price per liter of purchased fuel and its volume. The invoice or UTD (universal transfer document) will indicate the following parameters for each transaction:

- Type of fuel;

- Volume (liters);

- Price per liter;

- The total cost.

This will allow you to enter all information on fuel costs into the purchase and sales ledger.

Issuing fuel cards to employees: how to apply

The issuance of electronic media to employees must be formalized. To do this, the organization itself can develop a document form. You can call it, for example, the act of acceptance of transfer.

Sample transfer and acceptance certificate

The return of electronic media from the responsible employee who will no longer use it is processed in a similar way. Give the same smart card to another employee.

If there is a large number of carriers and responsible employees, it is inconvenient to register issuance and return with a separate document each time - to record the movement of smart cards, you can use the issuance and return log.

The choice of documentation procedure is left to the organization. Its procedure and forms of documents must be fixed in a local regulatory act.

Typically, electronic media have a shelf life. After its completion, smart cards that are no longer usable must be written off off-balance sheet. To document the write-off, a write-off act is drawn up.

Fuel card write-off act: sample

Taxation of expenses for purchasing a card

The order on the enterprise's accounting policy must indicate which type of expenses is taken into account when purchasing a fuel card. It can be:

- material and production costs;

- vehicle maintenance costs;

- other production costs that relate to production and sales.

Conditions under which value added tax is deductible:

- the fuel card was purchased according to the submitted and paid invoice;

- using a fuel card, trade transactions are carried out, the cost of which is subject to value added tax;

- After fulfilling the requirements of the two previous paragraphs, the card was accepted by the accounting department for registration.

Gasoline accounting using fuel cards in accounting

Electronic media are part of the fuel supply contract. Account 60 of the Chart of Accounts is intended to reflect settlements with the fuel and lubricants supplier. Purchased fuel and lubricants are accounted for as part of inventory and materials on account 10. Receipt is reflected on the basis of documents provided by the supplier. He must convey to the organization:

- invoice (delivery and acceptance certificate);

- invoice;

- fuel card report on dispensed fuel.

To reflect the write-off of fuel and lubricants from accounting and reflect their value in costs, general rules are used.

To confirm the consumption of fuel and lubricants, it is necessary to approve write-off standards and issue waybills. Postings for fuel and lubricants accounting using electronic media

| Contents of operation | Debit | Credit |

| The balance of the gas station network smart card has been replenished | 60advances | 51 |

| Fuel and lubricants released using electronic media have been accepted for accounting | 10 | 60 |

| VAT is reflected on received fuel and lubricants | 19 | 60 |

| The previously transferred advance payment to the supplier has been credited | 60 | 60advances |

| The cost of fuel and lubricants is included in expenses | 20, 25, 26, 44 | 10 |

| VAT is accepted for deduction | 68 | 19 |

toplivnaya_karta.jpg

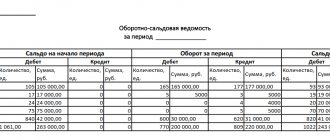

The fuel supplier provided the plant with a UTD (universal transfer document) with status 1: in July, 1,095 liters of fuel and lubricants were supplied in the amount of 50,481.05 rubles, incl. VAT RUB 8,413.51

The UPD was accepted for accounting, the fuel was subsequently written off to the appropriate cost accounts according to the turnover report. The following correspondence is recorded in the accounting records:

| The essence of the operation | Debit | Credit | Amount, rub. |

| Fuel cards received | 012 (warehouse) | ||

| Fuel cards were issued to the head of the convoy for use | 012 (head of the convoy) | 012 (warehouse) | |

| The personal account of JSC Instrument Plant has been replenished | 60.2 | 51 | 60 000,00 |

| Received fuel and lubricants from the supplier in July | 10 | 60.1 | 42 067,54 |

| VAT included | 19 | 60.1 | 8 413,51 |

| Advance offset | 60.1 | 60.2 | 50 481,05 |

| The cost of fuel and lubricants is included in the expenses: | |||

| for the O778KK car of main production: AI-92 (170 l) DT (150 l) | 20 | 10 | 6 570,58 5 674,83 |

| for GAZ R461KO, E544RK trucks and loader: AI-92 (425 l) DT (80 l) | 23 | 10 | 16 364,30 3 090,00 |

| for administrative vehicles R362OO, X302ST: AI-95 (190 l) DT (80 l) | 26 | 10 | 7 277,83 3 090,00 |

| VAT is accepted for deduction | 68 | 19 | 8 413,51 |

How to account for gasoline using fuel cards in a budget institution

Budgetary institutions use a special chart of accounts in accounting. But accounting for fuel cards is generally similar to accounting in a commercial organization. The Ministry of Finance recently spoke about this in Letter No. 02-07-10/70752 dated 10/02/2018.

According to the regulatory authority, in order to reflect fuel cards, accounting in the accounting department must be organized on an off-balance sheet account. This is due to the fact that they are not an independent accounting object. Further transfers of funds and their expenditure for the purchase of fuel will be reflected in account 20600 “Settlements for advances issued.”

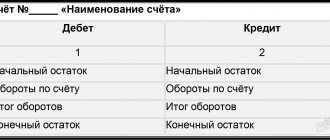

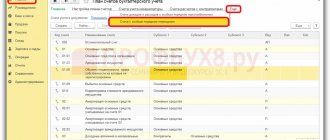

Accounting Recommendations

There are certain specifics of fuels and lubricants. In particular, the process creates a time gap between the delivery of the relevant papers to the accounting department and the date of refueling the vehicle. Vehicles are refueled every day, and reports from the material supplier are received on the last day of the month. Let's look at the basic accounting rules:

- You need an Accounting Policy, as well as a Chart of Accounts.

- The specialist needs to open an account and a sub-account. An alternative option is to reflect it on an off-balance sheet account.

- The policy for reflecting information sets out this information: the cost of writing off and capitalizing gasoline, the method of accounting for expenses, the method of placing cards on the balance sheet. The names of warehouses for receipt of fuel and lubricants must also be indicated.

- It is necessary to set the type of waybill.

- An order on the rate of gasoline consumption is approved. In this case, it is necessary to rely on the standards of the Ministry of Transport.

- Control is exercised over the consumption of fuel and lubricants in excess of the established indicator. The waybill indicates both the approved rate and the actual consumption. Overexpenditure is placed in account 91.2 “Non-production expenses”.

- It is required to keep a log of receipts and write-offs of TC. It indicates the date of issue, full name of the specialist, the moment of return of the technical documentation, and the designation of the vehicle.

- A spreadsheet is being developed.

IMPORTANT! All the listed documents must be in the company without fail. Accounting is carried out on their basis. This is true for both commercial and budget enterprises.

Fuel cards in accounting

TC without taking into account fuel and lubricants are recorded in the number of inventories at real cost. Spending is a central area of work. Expenses for the purchase of technical equipment are placed on account 10.6. Accounting is carried out on the basis of the invoice and supply agreement. Let's look at the wiring used:

- DT60 KT51. Transfer of funds for creating cards. The primary source is a bank statement.

- DT10 KT60. TC are reflected in the structure of the Inventory. The primary ones are the invoice and the delivery agreement.

- DT19 KT60. Accounting for VAT on the card. The basis document is the invoice.

- DT68 KT19. Acceptance of VAT for deduction. Primary: invoice.

- DT20, 26, 44 KT10. Write-off of the cost of TC. The primary source will be a certificate from the accounting department.

The specialist receiving the card does not purchase cash. Therefore, the provided TC should not be reflected in account 71. Also, the issuance of a card to a specialist is not recorded in accounting.

Accounting for fuel expenses

Information from gas station terminals is sent to the center of the organization. It is processed, after which a report on operations according to the TC is drawn up. On the last day of the month, the supplier sends these documents to the company that ordered the card:

- Invoice.

- Monthly payment report.

- Invoice.

- Reconciliation Act.

The documents must indicate the volume of actual purchased liters of fuel and lubricants. The information is verified with reports compiled on the basis of waybills and receipts. Fuel accounting on account 10-3 is carried out on the basis of the invoice and report. Let's look at the wiring used:

- DT60.2 KT51. Prepayment for fuel. Primary: bank statement.

- DT10.3 KT60.1. Acceptance of fuel purchased using a card for accounting. Documents: supply agreement.

- DT19 KT60.1. VAT accounting. Document: invoice.

- DT68 KT19. VAT accounting based on an entry in the purchase journal.

- DT60.1 KT60.2. Settlement of prepayment. Primary: a certificate from the accounting department, as well as an act of reconciliation of mutual settlements.

- DT20, 26, 44 KT10.3. Write off the cost of fuel. Documents: waybill.

If there is no source document, posting cannot be carried out.

Accounting for fuel costs

Fuel refers to fuels and lubricants that have two characteristics that rarely coincide:

- standard consumption;

- actual consumption.

Documentary evidence of fuel consumption at the enterprise are waybills.

The waybills provide information:

- car mileage;

- make and number of the vehicle;

- amount of fuel issued according to the fuel card;

- residual amount of fuel when leaving the line and returning to the enterprise;

- comparison of actual and standard fuel consumption;

- conclusions about fuel savings or excessive consumption.