Receipt of goods from the supplier

Goods are material assets that an organization purchases from a supplier (seller) for the purpose of their further resale. Moreover, the sale of goods refers to the usual activities of the enterprise. Let's take a closer look at how to accept goods for accounting, at what cost they should be received and to what account.

Goods may be received at the enterprise warehouse by:

- Purchase price

- Sales price

- Registration prices

Moreover, wholesale trade enterprises can only use the first and third methods. Retailers can use any of the three presented.

Let us consider in more detail each of these methods of accounting for commodity values.

Accounting for goods at purchase price

If a trade organization chooses this method of accounting for goods, then its decision must be reflected in the order on accounting policies.

The purchase price includes the direct cost of the goods indicated in the supplier’s documents, minus VAT. In addition, this includes all associated costs associated with the receipt of goods at the warehouse (transportation costs, procurement costs, etc.).

Transportation and procurement costs (TZR) can either be included in the purchase price of the goods or be allocated separately to the account for accounting expenses for sales.

To reflect all transactions related to goods, there is account 41 “Goods”, this is an active account, the debit of which reflects the receipt of goods, and the credit their write-off (disposal).

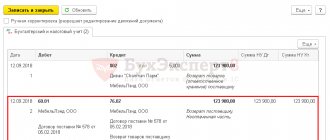

When accepting goods for accounting, the accountant performs posting D41 K60. The cost of this transaction does not include VAT. That is, if the supplier presented an invoice with a allocated amount of value added tax, then VAT is allocated from the cost of the goods by posting D19 K60, after which it is sent for reimbursement from the budget D68/VAT K19.

If transportation and procurement costs are also included in the purchase price of the goods, then posting D41 K60 (76) is reflected, VAT on TZR is also allocated separately by posting D19 K60 (76).

Postings upon receipt of goods:

| the name of the operation | ||

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT charged by suppliers has been highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

Accounting for goods at sales price

This method of accounting for goods is used only by retail enterprises. Its essence lies in the fact that commodity values are accounted for in account 41, taking into account the trade margin. For these purposes, additional account 42 “Trade margin” is introduced.

First, goods are debited to the account. 41 at the purchase price (posting D41 K60) excluding VAT, after which a trade margin is added using posting D41 K42.

When the goods are sent for sale, the trade margin will be deducted from the credit account 42 using the “reversal” operation (entry D90/2 K42). In this case, the amount of write-off of the trade margin must be proportional to the goods shipped.

If goods are sent for other needs, then the trade margin is written off to the account to which the goods are written off.

Postings to account 41:

| Debit | Credit | the name of the operation |

| 41 | 60 | Goods are accepted for accounting at supplier cost (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 41 | 60 | The cost of equipment and equipment is reflected (if these costs are included in the purchase price) (excluding VAT) |

| 19 | 60 | VAT has been allocated from the TZR system |

| 68.VAT | 19 | VAT is deductible |

| 44.TR | 60 | The cost of equipment and materials is reflected as part of sales expenses (if these expenses are allocated separately) |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 42 | Trade margin reflected |

Accounting for goods at discount prices

This method involves the use of pre-established discount prices. When goods arrive, they are debited to the account. 41 already at the discount price. In order to reflect the difference between the accounting value and the purchase value, two additional accounts are introduced: 15 “Procurement and acquisition of material assets” and 16 “Deviation in the cost of material assets”.

At the purchase price, goods are debited to the account. 15 using wiring D15 K60 (excluding VAT). After which the goods are credited to the account. 41 at discount prices using wiring D41 K15.

On account 15, a difference has formed between the debit and credit values (purchase and accounting prices), this difference is called a deviation and is written off to the account. 16.

If the purchase price is greater than the accounting price (debit is greater than credit), then the entry for writing off the deviation has the form D16 K15. Posting is carried out exactly for the difference between the book value of the goods and the purchase price.

If the purchase price is less than the accounting price (credit is greater than debit), then the posting looks like D15 K16.

After the manipulations on the account. 16 reflects the deviation in debit or credit, which at the end of the month is written off as selling expenses. If the deviation is reflected in the debit of account 16, then the posting for writing off the deviation looks like D44 K16. If the deviation is reflected on credit account 16, then the “reversal” operation is performed - posting D44 K16.

Postings upon receipt of goods at accounting prices:

| Debit | Credit | the name of the operation |

| 15 | 60 | The cost of goods is reflected according to the supplier’s documents (excluding VAT) |

| 19 | 60 | The amount of VAT presented by the supplier is highlighted |

| 15 | 60 | The cost of TZR is reflected (excluding VAT) |

| 19 | 60 | VAT is allocated from the amount of TZR |

| 68.VAT | 19 | VAT is deductible |

| 60 | 51 | Payment for transport services has been transferred |

| 60 | 51 | Payment for the goods has been transferred to the supplier |

| 41 | 15 | Goods are capitalized at accounting prices |

| 16 | 15 | The deviation between the accounting and purchase price is reflected |

The procedure for accounting for SOEs in the accounting of a business entity

The main feature of accounting for finished products is the fact that such accounting covers three stages of the movement of finished products at once:

- production stage;

- the stage of receipt of finished products to the appropriate warehouse;

- stage of release from the warehouse of finished products, i.e. its implementation.

The main goal of organizing and maintaining accounting records of finished products of a business unit is to provide complete, reliable, timely information about the availability, movement, release of finished products as a result of the technological process, and their shipment to third-party contractors.

Finished works on a similar topic

- Course work Accounting for finished products and their sales 450 rub.

- Abstract Accounting for finished products and their sales 240 rub.

- Test work Accounting for finished products and their sales 250 rubles.

Receive completed work or specialist advice on your educational project Find out the cost

The cost of finished products can be reflected in accounting using various methods:

- at planned cost;

- at actual cost;

- at cost calculated on the basis of direct production costs.

To account for the presence and reflection of the movement of the state enterprise of an economic entity, the Chart of Accounts is intended for account 43 “Finished products”.

It is worth noting that synthetic accounting of SOEs of economic entities can be organized by several methods:

- without using account 40 “Output of products (works, services)”. When using this method, the cost of finished products or work performed by a business unit is reflected by the accountant on account 43 “Finished products”, taking into account the actual cost of such products;

- using account 40 “Output of products (works, services)”. When using this method, the cost of finished products or those performed by a business unit is reflected by the accountant on account 43 “Finished products”, taking into account the standard (i.e. calculated planned) cost of manufactured products and services. In the future, if discrepancies arise between the actual and planned costs, deviations are reflected in account 40 “Output of products (works, services)”.

Need advice from a teacher in this subject area? Ask a question to the teacher and get an answer in 15 minutes! Ask a Question

Note 1

The method of accounting for finished products is approved by the management of the economic entity and is enshrined in the accounting policy of the economic entity.

Accounting for transportation and procurement costs

Receiving goods, materials, fixed assets, obtaining services, and work is accompanied by certain costs, which include delivery costs and various procurement works; these costs are called transportation and procurement costs (TPP). Their accounting in accounting can be done in two ways.

Let's imagine a situation: a supplier delivers goods. He can bear the costs of delivering the goods, or he can pass them on to the buyer. In the latter case, the buyer needs to somehow take them into account in his accounting. If transportation and procurement costs are paid by the buyer, then the supplier, as a rule, highlights them as a separate line in the invoice. Also, transport and procurement services can be provided by a third-party organization, for example, delivery of goods will be carried out by a transport company, which will provide the buyer with documents indicating the amount for delivery.

The buyer, having received the goods and documents indicating the cost of delivery, must make certain entries in his accounting department.

Accounting for goods and materials can be done in two ways:

- included in the price of the goods

- included in selling expenses

In the first case, delivery costs are taken into account on account 41 and are included in the purchase price of the goods; in the second case, they are taken into account on account 44 “Sale expenses”.

Transport costs are included in the price of the goods

This method of accounting for goods and materials is not the most convenient and not the most widespread, but, nevertheless, it can be used.

Upon receipt, goods are taken into account as a debit to account 41. In this case, VAT is allocated separately from the cost of purchased goods.

Transportation and procurement costs for these goods are also debited to account 41; if their cost includes VAT, then the tax is also allocated to a separate sub-account for reimbursement from the budget.

Postings for accounting of goods and inventory in this case have the form:

| Debit | Credit | the name of the operation |

| 41 | 60 | The cost of the goods is reflected according to the supplier’s documents |

| 19 | 60 | VAT is allocated from the cost of goods |

| 41 | 60 | The cost of fuel and equipment is reflected |

| 19 | 60 | VAT is allocated from the cost of goods and materials |

| 68.VAT | 19 | VAT is deductible |

Accounting for different types of goods can be kept in different subaccounts of account 41. If several consignments of different goods came from one supplier, and the amount of goods and materials is total for the entire delivery, then when accepting the goods for accounting, it is necessary to determine the transportation costs for each consignment. To understand how to do this, consider an example:

Example:

The following goods were received from the supplier: 10 sofas in the amount of 300,000 and 5 cabinets in the amount of 200,000, with a total cost of 500,000. Delivery costs amounted to 20,000. The goods are accepted for accounting taking into account the TZR.

We calculate transportation costs for each batch of goods:

Sofa delivery costs = 20,000 * 300,000 / 500,000 = 12,000.

Shipping costs for cabinets = 20,000 * 200,000 / 500,000 = 8,000.

The cost of the sofas, taking into account the costs of their delivery, was 312,000, the price for 1 sofa was 31,200.

The cost of the cabinets, taking into account the costs of their delivery, was 208,000, the price for 1 cabinet was 20,800.

Transportation and procurement costs are reflected in selling expenses

Trade organizations whose main activity is the sale of goods have a special account 44 “Sales expenses”, the debit of which collects all the organization’s expenses, after which they are included in the cost of goods sold.

If an organization wants to take into account TZR separately, then for the amount of these expenses it makes the posting D44 K60 (76).

On account 44, as a rule, several sub-accounts are opened in accordance with the organization’s expenses. To account for transportation costs, a sub-account “TZR” is opened.

During the month, transportation costs are collected in the debit of account 44/TZR, after which at the end of the month they are included in the cost of goods sold for the month by writing off using posting D90/2 K44/TZR.

The amount of transportation expenses to be written off at the end of the month should be in proportion to the goods sold.

This amount can be calculated using the following formula:

TZR = debit balance of account 44/TZR * credit balance of account 41 / debit balance of account 41.

The balance is calculated by adding the turnover for the month to the initial (incoming) balance.

Let's look at an example:

Example:

The organization received goods worth 500,000. TZR amounted to 20,000. At the time the goods were accepted for accounting, goods worth 200,000 were in the warehouse. TZR on account 44 at the beginning of the month were equal to 12,000. During the month, goods worth 400,000 were shipped. What should the amount of TZR be written off from account 44?

TZR = (12,000 + 20,000) * 400,000 / (200,000 + 500,000) = 18,286.

It is this amount that will be written off at the end of the month using posting D90/2 K44/TZR.

An organization can use any method convenient for itself to account for transportation costs. The chosen method must be indicated in the accounting policy order.

INVENTORY OF FINISHED PRODUCTS

To ensure the reliability of accounting and warehouse data, enterprises are required to conduct an inventory of finished products. During the inventory, the availability of goods, their quantity, condition and quality are determined.

An important detail: the procedure and frequency are determined by the head of the enterprise, with the exception of cases when conducting an inventory is mandatory.

In accordance with clause 27 of Regulation No. 34n, inventory is mandatory:

- when transferring property for rent, redemption, sale, as well as during the transformation of a state or municipal unitary enterprise;

- before drawing up annual financial statements (except for property, the inventory of which was carried out no earlier than October 1 of the reporting year). An inventory of fixed assets can be carried out once every three years, and of library collections - once every five years. In organizations located in the Far North and equivalent areas, inventory of goods, raw materials and materials can be carried out during the period of their smallest balances;

- when changing financially responsible persons;

- when facts of theft, abuse or damage to property are revealed;

- in the event of a natural disaster, fire or other emergency situations caused by extreme conditions;

- during reorganization or liquidation of the organization;

- in other cases provided for by the legislation of the Russian Federation.

Storage and disposal of goods

After goods are accepted for accounting, they can be stored in a warehouse for some time until they are sent to the buyer. The storage of goods in a warehouse must be properly organized so that there is no confusion either in accounting or in the warehouse itself. Proper organized storage will allow you to find the right item at any time in the shortest possible time.

There are two ways to store goods:

- Party

- Varietal

Batch method of storing goods

This method is characterized by grouping incoming goods into batches as they arrive at the warehouse. Each batch is stored separately.

When accepting goods into the warehouse, the storekeeper or other financially responsible person draws up a batch card in the MX-10 form for each individual batch. The card is drawn up in two copies, one copy is transferred to the accounting department, the other remains in the warehouse.

When goods are removed from a batch for sale, the storekeeper makes a note in the batch card about the number of disposed goods, the date of shipment and the document on the basis of which it was released from the warehouse.

After all the goods from the batch have been shipped, there is no need for a batch card for this batch and the document is transferred to the accounting department.

Thus, the batch card allows you to control the balance of goods in the warehouse for each batch and shows the number of valuables shipped.

This storage method is convenient if each subsequent batch is noticeably different from the previous one (in quality, price or other characteristics).

Variety method of storing goods

With this method, all goods are grouped not by batches, but by varieties, brands, and names. Grouping occurs regardless of the date of receipt of goods.

When the next batch arrives, the goods are divided by item and added to those already in stock.

To control the movement of goods using the varietal storage method, an accounting log form TORG-18 is used. When goods arrive at the warehouse, a receipt order is issued, on the basis of which a record of receipt is already made in the TORG-18 journal. Similarly, when goods are removed from the warehouse, an expense document is drawn up, on the basis of which an entry is made about the disposal in the TORG-18 journal.

A product label is attached to each variety, brand, or product name, which is issued using the unified TORG-11 form. The label is always located next to the product, which allows you to find out at any time what kind of commodity values are stored in a given place and in what quantities. This data is usually used in the inventory process.

Storing goods in a warehouse may also be accompanied by the execution of documents such as:

- Card of quantitative and cost accounting form TORG-28, which is used for more detailed accounting of goods (analytical) taken into account in quantitative and cost terms

- Invoice for internal movement, form TORG-13, is used when it is necessary to transfer goods from one division of an enterprise to another, that is, when moving goods within the organization

- Report on damage, damage, scrap goods and materials, form TORG-15, is filled out if damaged goods are identified that are subject to write-off

Disposal of goods

As a rule, goods are purchased for the purpose of their further sale. Therefore, they are removed from the warehouse when they are sold to customers.

The sale of goods belongs to the usual activities of the enterprise and is registered using account 90 “Sales”, this is a complex account with several sub-accounts:

- the credit of the first subaccount reflects the proceeds from the sale

- on the debit of the second - the cost of commodity assets

- on the debit of the third – accrued VAT payable

- on the debit or credit of the ninth subaccount - profit or loss from sales

Note that the posting reflecting the shipment of goods to customers has the form D62 K90/1.

Valuation of goods when written off for sale can be carried out in one of the following ways:

- Based on the average cost of each unit

- At average cost

- FIFO method

The organization chooses one of the methods for itself and reflects it in its accounting policies.

Write-off of the cost of goods for sale is recorded using posting D90/2 K41.

This also includes sales expenses, which are written off at the end of the month from account 44 in proportion to the shipped commodity values using posting D90/2 K44.

Selling expenses may include:

- Transport and procurement costs (if they are accounted for separately on the 44th account

- Staff salaries

- Expenses for renting premises and equipment

- Depreciation of fixed assets and intangible assets

- Advertising expenses

- Entertainment expenses

- Expenses for business travel, etc.

If an organization is a value added tax payer, then VAT must be charged on the cost of goods for payment to the budget; the corresponding entry has the form D90/3 K68/VAT.

Shipment is made on the basis of a delivery note.

These entries are made if the transfer of ownership of the goods occurs at the time of shipment. If the contract provides for the transfer of ownership at the time payment is received from the buyer, then slightly different entries are made in the seller’s accounting, and an additional account 45 Goods shipped is used.

THE CONCEPT OF FINISHED PRODUCTS

Finished products are part of inventories intended for sale (the final result of the production cycle, assets completed by processing (assembly), the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents, in cases established by law).

In other words, finished products are products and products that have passed all stages of the production process, accepted by the technical control department, and are ready for shipment to the customer. For accounting purposes, products are considered sold after shipment to the buyer or customer.

The production and sale of finished products characterize the activity of the enterprise as a whole and ensuring consumer demand. The fact of selling finished products is the end result of the entire cycle of the enterprise’s activities, which contributes to making a profit.

Accounting data (Financial Results Report, Purchase Book, etc.) are used as sources of information for accounting and analysis of finished products.

The main tasks of accounting and analysis of finished products:

- control over the correct and prompt documentation of finished products;

- control over the stock level of finished products in warehouses;

- prompt identification of surplus finished products in warehouses;

- control over the fulfillment of the terms of supply contracts and timely payment of goods (works, services) by customers;

- assessment of financial results from the sale of finished products;

- control over the execution of the production plan in accordance with customer requests and contracts.

Accounting and analysis of finished products are regulated at the legislative level:

- Federal Law No. 402-FZ dated December 6, 2011 (as amended on May 23, 2016) “On Accounting”;

- Regulations on accounting and financial reporting, approved by Order of the Ministry of Finance of Russia dated July 29, 1998 No. 34n (as amended on December 24, 2010, as amended on July 8, 2016; hereinafter referred to as Regulation No. 34n);

- Chart of accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n (as amended on November 8, 2010);

- Accounting Regulations “Accounting Policy of the Organization” (PBU 1/2008), approved by Order of the Ministry of Finance of Russia dated October 6, 2008 No. 106n.

Transfer of ownership of goods

As a result of the sale of goods, ownership rights are transferred from one person to another. A change of ownership of goods can occur at the time of shipment or at the time of payment for goods.

The Civil Code of the Russian Federation provides for the transfer of ownership at the time of transfer of commodity assets to the buyer, but there is a clause “unless the contract provides for a different procedure.”

Transfer of ownership of goods upon shipment

If ownership passes at the time of shipment to the buyer, then transactions for the sale of commodity assets in the seller’s accounting department must be reflected on the day of shipment.

Postings upon transfer of ownership at the time of shipment:

| Date of operation | debit | Credit | the name of the operation |

| Shipping day | 62 | 90/1 | Revenue from the sale of goods is reflected |

| Shipping day | 90/2 | 41 | The cost of goods intended for sale has been written off |

| Shipping day | 90/2 | 41 | Selling expenses are written off in proportion to the goods shipped |

| Shipping day | 90/3 | 68/VAT | VAT is charged on the cost of goods payable to the budget (if the seller is a payer of this tax) |

| Payment day | 51 | 62 | Payment received from buyer |

Transfer of ownership of goods upon payment

If an agreement is concluded between the buyer and seller, which stipulates that ownership passes at the time of payment, then the seller’s accountant must make slightly different entries.

In this case, account 45 “Goods shipped” is used, this account is used to reflect the movement of shipped goods, for which the proceeds from the sale cannot be recognized for some time by the seller.

This account can account for both shipped goods entering the debit of account 45 from the credit account 41 “Goods”, and shipped products entering the debit of account. 45 from credit account. 43 “Finished products”.

Also on the debit of the account. 45 reflects the costs associated with the shipment of commodity assets (for example, transportation and procurement costs), coming to the debit of account 45 from the credit of account 44 “Sales expenses”.

On loan account 45 reflects the write-off of shipped goods to the debit of account 90 “Sales” at the moment when sales revenue is recognized in the seller’s accounting.

Thus, if the agreement between the counterparties states that the transfer of ownership of the goods takes place at the time of payment, that is, at the time of recognition of revenue from sales, then the shipment of the goods is formalized using posting D45 K41, which will mean that the goods have been shipped, but also are listed on the seller's balance sheet.

After the buyer pays for the valuables received, posting D90/2 K45 will be made, which will mean that the goods are written off from the seller’s balance sheet and sent for sale.

As for value added tax, it must be charged at the time of shipment, that is, before the transfer of ownership occurs. The accrual of VAT is also reflected in account 45 using posting D45 K68/VAT. Thus, the goods will be listed on account 45 along with VAT.

Postings when changing ownership when paying:

| Day of surgery | Debit | Credit | the name of the operation |

| Shipping day | 45 | 41 | Goods shipped without transfer of ownership |

| Shipping day | 45 | 68/VAT | VAT is charged on the cost of shipped goods |

| Payment day | 51 | 61 | Receipt of payment from the buyer |

| Payment day | 62 | 91/1 | Reflected sales revenue |

| Payment day | 90/2 | 45 | Sold goods written off |

Accounting info

According to the Methodological Guidelines for Accounting for Inventory Inventory (MPI), finished products are part of the inventory intended for sale, the technical and quality characteristics of which comply with the terms of the contract or the requirements of other documents in cases established by law.The following can be used as accounting prices for finished products:

• actual production cost (full and incomplete);

• standard cost (full and incomplete);

• negotiated prices;

• other types of prices.

Actual production costs are used mainly for single small-scale production, as well as for the production of mass products of a small range.

It is advisable to use standard cost as accounting prices in industries with a mass and serial nature of production and with a large range of finished products. The advantages of these accounting prices are convenience in carrying out operational accounting of the movement of finished products, stability of accounting prices and unity of assessment in planning and accounting.

Negotiated prices are used mainly when such prices are stable.

Receipt of finished products from production is documented with invoices, specifications, acceptance certificates and other primary documents.

The release of finished products to customers is usually documented using invoices. As a standard form of an invoice, you can use form No. M-15 “Invoice for the release of materials to the side.”

Depending on the industry specifics, organizations can use specialized forms of invoices and other primary documents indicating the required details.

The basis for issuing invoices is the orders of the head of the organization or an authorized person, as well as an agreement with the buyer (customer).

Accounting for the section “Finished products and goods” combines the following accounts: 40 “Product output (works), 42 “Trade margin”, 43 “Finished products”, 44 “Sales expenses”, 45 “Goods shipped”, 46 “ Completed stages of unfinished work.”

Account 40 “Output of products (works, services)” contains the necessary information about the output of products, works delivered by the customer and services provided for the reporting period. This account can be used by organizations as needed.

The debit side of account 40 reflects the actual cost of products (works, services), and the credit side reflects the standard or planned cost.

The actual production cost of products (works, services) is written off from the credit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”, etc. to the debit of account 40.

The standard or planned cost of products (work, services) is written off from the credit of account 40 to the debit of accounts 43 “Finished Products”, 90 “Sales” and other accounts (10, 11, 21, 28, 41, etc.).

By comparing debit and credit turnovers on account 40 on the 1st day of the month, the deviation of the actual cost of production from the standard or planned one is determined and written off from the credit of account 40 to the debit of account 90 “Sales”. In this case, the excess of the actual cost of production over the standard or planned one is written off by additional posting, and the savings are written off using the “red reversal” method. Account 40 is closed monthly and has no balance at the reporting date.

When using account 40, there is no need to make separate calculations of deviations of the actual cost of products from their cost at accounting prices for finished, shipped and sold products, since the identified deviation for finished products is immediately written off to account 90 “Sales”.

Account 41 “Goods” is used mainly by organizations engaged in trading activities, as well as organizations engaged in the provision of catering services.

However, organizations engaged in industrial and other production activities apply account 41 “Goods” if they purchase materials, products and other property specifically for resale or if the cost of finished products purchased for assembly should not be included in the cost of products sold, and Reimbursable by buyers separately.

In organizations engaged in trading activities, goods are reflected in the balance sheet at the cost of their acquisition.

If a retail trade organization carries out accounting of goods at sales prices, then simultaneously with the entry in the debit of account 41 “Goods” and the credit of account 42 “Trade margin”, the difference between the acquisition cost and the selling price (discounts, markups) must be reflected.

When recognizing in accounting revenue from the sale of goods (income from ordinary activities), their value is written off in the case of the sale of goods from account 41 “Goods” to the debit of account 90 “Sales”.

If goods are transferred for processing to other organizations, they are recorded on the balance sheet of the transferring organization, and the processor records these goods in off-balance sheet account 003 “Materials accepted for processing.”

In retail trade organizations, trade margins (discounts, mark-ups) on goods are subject to accounting in account 42 “Trade margins”. This account contains discounts provided by suppliers to retail organizations for possible losses of goods, as well as for reimbursement of additional transportation costs.

On account 43 “Finished products”, organizations engaged in industrial, agricultural and other production activities take into account the movement of finished products, therefore the cost of work performed and services provided is not reflected in this account, and the actual costs for them in the event of sale (transfer) are written off from the accounts for recording production costs directly to account 90 “Sales”.

Organizations have the opportunity not to reflect on account 43 “Finished products” products that, due to production needs, are sent for use in the organization itself, due to the fact that they can be accounted for on account 10 “Materials”.

If revenue from the sale of products (income from ordinary activities) is recognized in accounting, its value is subject to debit to account 90 “Sales” from the credit of account 43 “Finished products”.

Taking into account the current regulatory documents on accounting, the main operations for accounting for finished products and goods are:

But organizations receive the bulk of their profits from the sale of products, goods, works and services (realization financial result). Profit from the sale of products (works, services) is defined as the difference between the proceeds from the sale of products (works, services) in current prices without VAT and excise taxes, export duties and other deductions provided for by the legislation of the Russian Federation, and the costs of its production and sale.

The financial result from the sale of products (works, services) is determined by account 90 “Sales”. This account is intended to summarize information about income and expenses associated with the organization’s normal activities, as well as to determine the financial result for them. This account reflects, in particular, revenue and cost:

• for finished products, semi-finished products of own production and goods;

• works and services of an industrial and non-industrial nature;

• purchased products (purchased for completion);

• construction, installation, design and survey, geological exploration, scientific research and the like;

• communication services and transportation of goods and passengers;

• transport - forwarding and loading - unloading operations;

• provision for a fee for temporary use (temporary possession and use) of one’s assets under a lease agreement, provision for a fee of rights arising from patents for inventions, industrial designs and other types of intellectual property, participation in the authorized capital of other organizations (when this is the subject of activity organizations) etc.

The following subaccounts can be opened for account 90 “Sales”:

• 90-1 “Revenue”;

• 90-2 “Cost of sales”;

• 90-3 “Value added tax”;

• 90-4 “Excise taxes”;

• 90-9 “Profit (loss) from sales.”

The amount of revenue from the sale of products, goods, performance of work, provision of services, etc. is reflected in the credit of subaccount 90-1 “Revenue” and the debit of account 62 “Settlements with buyers and customers”.

At the same time, the cost of sold products, goods, works, services, etc. is written off from the credit of accounts 43 “Finished products”, 41 “Goods”, 44 “Sales expenses”, 20 “Main production”, etc. to the debit of subaccount 90-2 " Cost of sales."

The amounts of VAT and excise taxes accrued on products sold (goods, works, services) are reflected in the debit of subaccounts 90-3 “Value Added Tax” and 90-4 “Excise Taxes” and the credit of account 68 “Calculations for taxes and fees”.

Organizations that pay export duties can open a subaccount 90-5 “Export duties” to account 90 to record the amounts of export duties.

Subaccount 90-9 “Profit (loss) from sales” is intended to identify the financial result from sales for the reporting month.

Entries for subaccounts 90-1, 90-2, 90-3, 90-4, 90-5 are made cumulatively during the reporting year. By monthly comparison of the total debit turnover in subaccounts 90-2, 90-3, 90-4 and 90-5 and credit turnover in subaccount 90-1, the financial result from sales for the reporting month is determined. The identified profit or loss is written off monthly with final entries from subaccount 90-9 to account 99 “Profits and losses”. Thus, synthetic account 90 “Sales” is closed monthly and has no balance at the reporting date.

At the end of the reporting year, all sub-accounts opened to account 90 “Sales” (except for sub-account 90-9) are closed with internal entries to sub-account 90-9 “Profit (loss) from sales”.

Analytical accounting for account 90 “Sales” is maintained for each type of product sold, goods, work performed and services rendered, and, if necessary, in other areas (by sales region, etc.).

The procedure for synthetically accounting for product sales depends on the chosen accounting method. Organizations are allowed to determine revenue from the sale of products for tax purposes either at the time of payment for shipped products, work performed and services rendered, or at the time of shipment of products and presentation of payment documents to the buyer (customer) or transport organization.

In accounting, products are considered sold at the time of their shipment (due to the transfer of ownership of the product to the buyer). That is why, with both methods of selling products for tax purposes, finished products shipped or presented to customers at sales prices (including VAT and excise taxes) are reflected in the debit of account 62 “Settlements with buyers and customers” and the credit of account 90 “Sales”.

At the same time, the cost of products shipped or presented to the buyer is written off to the debit of account 90 “Sales” from the credit of account 43 “Finished products”.

From the amount of revenue of organizations, value added tax and excise tax are calculated (according to the established list of goods).

With the “by shipment” sales method, the amount of accrued VAT is reflected in the debit of account 90 and the credit of account 68 “Calculations for taxes and fees.” This posting reflects the organization's debt to the budget for VAT, which is then repaid by transferring funds to the budget (debit account 68, credit cash accounts).

With the “on payment” sales method, the organization’s debt to the budget for VAT arises after the buyer pays for the products. Therefore, after the products are shipped to customers, organizations reflect the amount of VAT on products sold as a debit to account 90 and a credit to account 76 “Settlements with various debtors and creditors.”

Received payments for sold products are reflected in the debit of account 51 “Settlement accounts” and other accounts from the credit of account 62 “Settlements with buyers and customers”. After receipt of payments, organizations using the “on payment” sales method reflect the VAT debt to the budget with the following entry:

Debit of account 76 “Settlements with various debtors and creditors”

Credit to account 68 “Calculations for taxes and fees”

Repayment of debt to the budget for VAT is formalized by the following posting:

Debit account 68 “Calculations for taxes and fees”

Credit accounts 51 “Currency accounts”, 52 “Currency accounts”, etc.

Comments:

- In contact with

Download SocComments v1.3

Return of goods: accounting with the buyer and supplier

Upon receipt of the goods, the purchasing organization must carefully inspect the received valuables, conduct an external inspection for defects, malfunctions, damage to packaging, containers, and unpresentable appearance. In addition, it is necessary to carefully check the documents accompanying the goods and compare the data specified in the documents with the actual values received. Check that the documents are filled out correctly and that there is an invoice if the product is subject to VAT.

If the purchasing organization is satisfied with everything, it accepts the goods; if something is not satisfactory, then the buyer can return it to the supplier. How do I return goods? What are the features of return accounting for both parties to the transaction: supplier and buyer? What documents need to be completed? We'll talk about this below.

Documentation of returning goods

If the purchasing organization decides to return the goods to the supplier, then it must properly document this fact.

If inadequate quality of goods or incorrectly executed documents are detected at the acceptance stage, then the buyer draws up a statement of discrepancy, in which he states his complaints to the supplier and indicates what exactly is not satisfactory. For registration, you can use the existing unified TORG-2 form and fill out this document in the presence of the person who delivered the goods.

A letter of claim must be attached to the discrepancy report, in which the buyer states what he was not satisfied with and what further actions he expects from the supplier (replacement, refund if the goods have been paid for).

If the documents are drawn up in the presence of the forwarding driver or another person who delivered the goods, then the documents are transferred to this person along with the goods.

If a defect or discrepancy between documentary and factual data is detected later, after the driver’s departure, then the letter of claim along with the attached report is sent to the supplier in any other way.

Accounting for supplier returns

Having received a claim from the buyer, the supplier must take certain actions. Return the product or replace it with a quality one.

First of all, you need to find out whether payment has been received from the buyer.

If the item is paid for

If the buyer returns the paid goods, the supplier opens account 76 “Settlements with various debtors and creditors”, which will account for the received claim.

An accepted claim is reflected using posting D62 K76, posting is carried out for the amount of the claim indicated by the buyer.

If it is not planned to replace the product, then it is necessary to make transactions that neutralize the sales-related transactions made during its shipment. This is done using the “reversal” operation, that is, the same transactions are made for the same amounts, but they will be subtracted from those made earlier.

For example, if goods are shipped in the amount of 118,000 rubles, including VAT of 18,000 rubles, cost of 60,000 rubles, then the sales transactions will look like this:

- D62 K90/1 in the amount of 118,000 – revenue from the sale is reflected

- D90/3 K68/VAT – VAT charged on sales

- D90/2 K41 – cost written off

Postings for reversing a sale will look the same, only all amounts will be with a “-” sign, that is, they will be subtracted.

As a result of this, the sale is neutralized, but since the buyer paid for the goods, the supplier incurs a debt to the buyer. The supplier returns the money to the buyer, this is documented by posting D76 K51. Thus, account 76 will be closed, the sale will be reversed, and the buyer will return the goods.

If the item is not paid for:

If the buyer did not have time to pay for the goods, then the supplier simply makes transactions to reverse the sale and that’s it. There is no need to open account 76.

Postings when returning goods from the buyer:

| Debit | Credit | the name of the operation |

| 90/2 | 41 | The cost of goods is written off |

| 62 | 90/1 | Reflected revenue in connection with the sale |

| 90/3 | 68/VAT | VAT charged on sales |

| 51 | 62 | Payment received from buyer |

| 62 | 76 | A claim has been accepted from the supplier regarding the return of goods |

| 62 | 90/1 | Sales transactions are reversed (subtracted) |

| 90/3 | 68/VAT | |

| 90/2 | 41 | |

| 76 | 51 | Money returned to the buyer |

Categories for articles on product accounting:

- Accounting for goods in accounting: postings, examples, laws

- Revaluation of goods in accounting

- Movement of goods through warehouses: postings, rules, examples

- Resale of goods between the commission agent and the principal in accounting

- Reflection of goods in storage in accounting entries

- Expenses for selling goods - postings and examples

- Examples of warehouse postings

- Accounting entries for the transfer of goods free of charge

- Accounting entries for payment for goods and services

- Accounting for goods in transit

- Consignment goods: the relationship between the consignor and the commission agent

- Carrying out an inventory: receipt of surpluses and write-off of shortages

- How does the shipment of goods occur from an accounting point of view?

- Postings for the purchase of goods and services

- Postings for the sale of goods and services

- Returning goods to the supplier: reasons, postings, examples

- Postings for receipt of goods to the warehouse

- How to reflect the return of goods from a buyer in accounting

- Write-off of goods in case of shortage or damage in accounting entries

- Postings according to additional costs for delivery of goods

A short video on how to reflect the sale of a product in 1C 8.3: