Insurance costs and its main types

These expenses are expressed in the form of payment of an insurance premium, i.e. remuneration to the insurer for its services (Article 954 of the Civil Code of the Russian Federation). Depending on the terms of the contract, it can be paid in a lump sum or in installments.

An enterprise may use different types of insurance in its activities:

- Personal (life and health of their employees).

- Property – in terms of the risks of loss or damage to the company’s property.

- Responsibility, which, in particular, includes the well-known compulsory motor liability insurance.

- Other risks (financial, legal, technical, etc.).

Insurance compensation under a property insurance contract

This opinion was expressed in the letter of the Ministry of Finance dated April 9, 2021 No. 03-03-06/2/66, according to which, in the event of refusal to recover damages from the employee, the amount of the organization’s costs for restoring the vehicle after an accident and the amount paid to another participant in the accident , cannot be attributed to non-operating expenses for the purposes of accounting for income tax, since these expenses will not be economically justified and, therefore, the requirements established by Article 252 of the Tax Code of the Russian Federation will not be met.

Article 238 of the Labor Code obliges an employee who causes damage to the organization’s property to compensate the amount. In order to correctly reflect this operation in accounting, it is necessary to have documentary evidence. They can be either a court decision or an employee’s statement recognizing the amount of material damage (10.2 PBU 9/99).

25 Jul 2021 jurist7sib 76

Share this post

- Related Posts

- 159 By Insignificance

- VAT refund for UTII

- In the Saratov Region What is needed to become a Veteran of Labor?

- Mortgage Insurance If You Repay More Than 30 Percent of the Amount Early

Insurance in accounting (BU)

To account for calculations for compulsory and voluntary insurance, an account is used. 76, to which separate sub-accounts are opened.

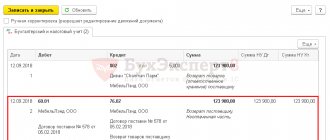

When the insurance premium is paid, the accounting entries will be as follows:

DT 76 – CT 51 (50) - premium amount paid

These services are not subject to VAT, so there will be no tax postings here (clause 7, clause 3, article 149 of the Tax Code of the Russian Federation).

From the point of view of accounting, the insurance premium refers to “ordinary” expenses (clauses 5, 6 of PBU 10/99). The contract may have a validity period covering several reporting periods. Current regulatory documents do not contain specific instructions on how costs should be taken into account in this case - immediately, or distributed over periods. The organization can determine the methodology itself, reflecting the chosen option in its accounting policies.

For the first option, when the entire insurance premium is written off at once, the postings will be as follows:

DT 20 (23,25,26,44) – CT 76 – the amount is charged to expenses in full.

The cost account is selected based on the category of assets the insured object belongs to.

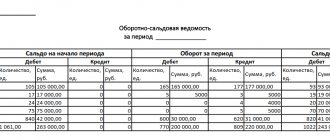

If you decide to distribute costs over several periods, then you should use account 97 “Deferred expenses”. That part of the premium that relates to the first month of the contract is written off as shown above. The remaining premium is distributed over the months until the expiration of the policy:

DT 97 – KT 76.1 – the remaining part is assigned to RBP,

DT 20 (23,25,26,44) – CT 97 – monthly attribution to expenses.

If an insured event occurs, the company receives insurance compensation. The accounting entries will be as follows:

DT 76 – CT 91.1 – insurance compensation accrued;

DT 51 – CT 76 – funds received from the insurer.

Thus, compensation under an insurance policy from the point of view of accounting is other income.

Cost accounting in this case does not depend on the type of contract or object. These can be accounting entries for motor vehicle, cargo, personal insurance, etc.

The exception is mandatory insurance contributions to extra-budgetary funds. They are taken into account in a special manner (in fact, they can be considered payments similar to taxes) and are not discussed in this article.

Example

The company purchased an MTPL policy for a passenger car it owned. The policy period is 1 year, the cost is 2400 rubles. The accounting policy states that costs associated with compulsory motor liability insurance are reflected using accounts. 97 "RBP". The car was involved in an accident, damage amounted to 10 thousand rubles. was compensated by the insurance company of the person responsible for the accident. According to the MTPL agreement, the accounting entries are as follows:

DT 76.1 – CT 51 (RUB 2,400) – MTPL policy has been paid for for a period of 1 year;

DT 26 – CT 76.1 (200 rub.) – expenses for the first month of the policy are written off (2400 / 12 months);

DT 97 - CT 76.1 (RUB 2,200) - the balance of the premium is allocated to the RBP;

DT 26 – CT 97 (200 rub.) – monthly write-off;

DT 26 – CT 60 (RUB 10,000) – repair costs after an accident;

DT 76.1 – CT 91.1 (RUB 10,000) – insurance compensation accrued;

DT 51 – CT 76.1 (RUB 10,000) – compensation received from the insurer.

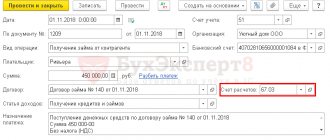

The MTPL agreement was terminated early

The organization entered into an MTPL agreement with the insurance company for a period of one year from April 9, 2007 to April 8, 2008 in the amount of RUB 9,084.38. The fixed asset was sold on June 27, 2007, and the contract was terminated on July 6, 2007.

The organization made the following entries: for April - Debit 26 - Credit 97 - 546.06 rubles; for May - Debit 26 - Credit 97 - 758.16 rubles; June 27 - Debit 26 - Credit 97 - 681.44 rubles. (9084.38 rub. x 80 days: 366 days - - (546.06 rub. + 758.16 rub.)). The insurance company counted RUB 5,294.01 to be refunded.

How correctly should all transactions related to the closure of this contract be reflected in tax and accounting records, in particular the amount of the refund and the 23% commission that the insurance company withheld?

Accounting.

Expenses under MTPL agreements are taken into account by the organization as part of expenses for ordinary activities as other expenses (clauses 5, 7 and 9 of PBU 10/99).

Costs incurred by the organization in the reporting period, but related to the following reporting periods, are reflected in the balance sheet as a separate item as deferred expenses (clause 65 of the Regulations on Accounting and Financial Reporting in the Russian Federation). Account 97 “Deferred expenses” is intended for their accounting.

During the term of the agreement, the amount of the insurance premium recorded in the debit of account 97 is written off from the credit of this account to the debit of account 26 in the manner established by the organization.

Tax accounting.

Car owners must insure their civil liability in accordance with Federal Law No. 40-FZ dated April 25, 2002 “On compulsory civil liability insurance of vehicle owners.” Costs for compulsory types of property insurance are classified as other expenses (clause 2 of Article 263 of the Tax Code of the Russian Federation). Therefore, insurance premiums under the MTPL policy reduce taxable profit. The specific procedure for their tax accounting depends on the accounting policy of the policyholder.

With the accrual method, insurance premiums are expensed evenly throughout the entire term of the contract in proportion to the number of calendar days of its validity in the reporting period (clause 6 of Article 272 of the Tax Code of the Russian Federation). That is, tax accounting in this case fully corresponds to accounting.

If an organization terminates an MTPL agreement early on its own initiative, for example, when replacing the owner of a vehicle (subclause “b” of clause 33.1 of the Rules for compulsory civil liability insurance of vehicle owners, approved by Decree of the Government of the Russian Federation of 05/07/2003 N 263; hereinafter referred to as the Rules), An application is submitted to the insurer to change the owner of the car and return the insurance payment. In addition to the application, a contract for the sale of the car is presented.

The insurance company is obliged to return to the policyholder part of the insurance premium for the unexpired term of the MTPL agreement.

The calculation of this period begins from the day following the day the insurer receives a written application from the policyholder for early termination of the MTPL agreement (clause 34 of the Rules). In this case, the insurance premium is returned from the moment the ownership of the car is transferred to another owner.

The Ministry of Finance of Russia, in a letter dated November 16, 2005 N 03-03-04/1/372, explained that in accordance with the structure of the tariff rate, 3% of the insurance premium under the MTPL agreement is sent by the insurer to reserves for compensation payments, 20% goes to cover the insurer’s expenses for the implementation of compulsory insurance.

Thus, the taxpayer takes into account expenses for compulsory motor liability insurance as part of other expenses within the limits of the amounts of paid insurance premiums, which contain the specified deductions in the amount of 23%. In case of early termination of the MTPL agreement, the organization includes the amounts received from the insurance company as income for profit tax purposes.

In this situation, the organization needs to make the following entries.

Debit 76/1 - Credit 51 - 9084.38 rub. — the insurance premium has been paid to the insurance company;

Debit 97 - Credit 76/1 - 9084.38 rubles. — expenses under the MTPL agreement are reflected as deferred expenses;

Debit 26 - Credit 97 - 546.06 rubles. (RUB 9,084.38: 366 days x 22 days) - expenses under insurance contracts are included as expenses.

Debit 26 - Credit 97 - 769.44 rubles. (RUB 9,084.38: 366 days x 31 days) - expenses under insurance contracts are included as expenses.

Debit 26 - Credit 97 - 670.16 rubles. (RUB 9,084.38: 366 days x 27 days) - expenses under insurance contracts are included as expenses.

Debit 91 - Credit 97 - 7098.72 rubles. (9084.38 - (546.06 + 769.44 + 670.16)) - insurance premiums for the period after termination of the insurance contract are expensed;

Debit 76/1 - Credit 91 - 5294.01 rub. — income associated with termination of the insurance contract is taken into account (the amount returned by the insurance organization);

Debit 51 - Credit 76/1 - 5294.01 rub. — money has arrived in the organization’s bank account.

I. Kim, tax consultant at First House of Consulting “What to do Consult”

Features of tax accounting for insurance (TI)

The NU rules here differ significantly from the BU rules:

- Accounting for expenses can begin only after payment of the premium to the insurer.

- You can immediately write off costs only if the contract period is “within” the reporting period for income tax, i.e. quarter. If the contract is long-term, then the costs must be distributed evenly during its validity period (Clause 6 of Article 272 of the Tax Code of the Russian Federation)

- Tax accounting contains restrictions on costs that can be recognized for compulsory types of insurance, for example, for compulsory motor liability insurance, only within the established norms - insurance tariffs (clause 2 of Article 263 of the Tax Code of the Russian Federation). For voluntary types, expenses are taken into account in the actual amount (clause 3 of Article 263 of the Tax Code of the Russian Federation).

To minimize deviations between the two types of accounting, it is advisable to use account 97 for accounting for long-term contracts. In this case, subject to cost limits, tax differences do not arise.

Insurance premium wiring

Regulations on the composition of costs for the production and sale of products (works, services), included in the cost of products (works, services), and on the procedure for the formation of financial results taken into account when taxing profits, approved by Decree of the Government of the Russian Federation dated 05.08.1992 N 552, in the amount 1% of revenue. However, arbitration practice is not in favor of the tax authorities. In the decisions of the FAS of the East Siberian District dated 03/02/2021 in case No. A33-13049/04-С6-Ф02-572/05-С1, FAS of the Volga District dated 09/22/2021 in case No. A49-656/2021-75A/17, FAS Volga-Vyatka District dated 08.26.2021 in case No. A43-34874/2021-38-630, dated 01.27.2021 in case No. A43-21719/2021-16-672, these types of insurance are recognized as mandatory for each specific taxpayer.

VAT D-t 76-2 – K-t 41-2 Goods accounted for at retail prices were written off D-t 68-2 – K-t 18 REVERSE The amount of tax deductions for VAT as a result of disposal of inventories was adjusted (except for damage, loss of goods in connection with emergency circumstances: fire, accident, natural disaster, traffic accident) D-t 76-2 – K-t 18 The restored amount of VAT is attributed to the increase in losses due to the insured event D-t 51 – K-t 76-2 Insurance compensation received D-t 90-10 – K-t 76-2 The amount of damage not covered by insurance compensation has been written off D-t 76-2 – K-t 90-7 The amount of insurance compensation exceeding the actual amount of damage has been written off VAT In case of loss of property (for excluding damage, loss due to emergency circumstances: fire, accident, natural disaster, traffic accident), it is necessary in the current period to reduce the amount of tax deductions for VAT by the amount of “input” VAT previously accepted for deduction on it.