Regulations

Accounting for account 63 is regulated by the Chart of Accounts and Instructions for its application (Order of the Ministry of Finance dated October 31, 2000 No. 94n), Guidelines for inventory of property and financial liabilities (Order of the Ministry of Finance of the Russian Federation dated June 13, 1995 No. 49), PBU 4/99 “Accounting reporting of the organization”, PBU 21/2008 “Changes in estimated values”, the Law “On Accounting” dated December 6, 2011 No. 402-FZ and other regulatory documents.

Any organization may encounter an unscrupulous counterparty: for example, the buyer may not pay for goods delivered to him on time, and the prospective supplier may receive advance payment under the contract, but fail to fulfill the subject of the contract by the specified time - fail to provide goods, perform work, or fail to provide services.

Such a debt is recognized in accounting as a doubtful debt - a debt not guaranteed by any property security, which most likely will not be paid in the future.

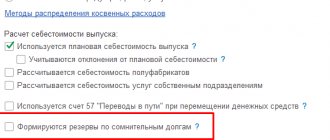

The conditions for recognizing doubtful debts are established in the Accounting Policy.

ATTENTION! The formation of such a reserve is the responsibility (not the right!) of the company.

Accrual of reserve

In practice, several effective methods are used to create a reserve for doubtful debt obligations. Their formation within the framework of accounting is carried out as follows:

- determination of the debt of counterparties that was not repaid within the time limits determined by the contractual relationship and is not secured by the required set of guarantees;

- determining the amount separately for each debt, depending on the financial situation of the debtor and assessing the likelihood of repaying the obligation in part or in full.

If you study in detail the methods of creating a reserve, they can be as follows:

- Interval. When using this method, the amount of deductions is calculated every quarter or month as a percentage of the debt amount, based on the duration of the delay.

- Expert. In this case, the calculation of the amount of deductions to the reserve for doubtful debts occurs for each obligation in an amount that, according to the organization’s forecasts, will not be repaid on time.

- Statistical. In the case of using this methodology, the amount is calculated based on data for the last several years as a share of bad debts in the total amount of debt of a certain type.

An event such as inventory of the reserve for doubtful debts deserves special attention. Monitoring must be carried out on an ongoing basis and as of the reporting date. During the five-year period from the moment the bad debt is written off, it is necessary to ensure monitoring of the possibility of collecting the debt if the debtor’s financial situation suddenly changes.

Characteristics of account 63 (active or passive, reflected in the balance sheet as a line... etc.)

After conducting regular (monthly/quarterly/annual) inventory, before reporting is generated, accounts receivable are identified in the accounting of the affected organization (according to Dt 60, 62, 76, 58.3), which any company (small enterprise is no exception!) is obliged to recognize as doubtful and create a reserve according to Kt 63 in correspondence with Dt 91.2. The creation of these reserves is another expense of the organization.

Is count 63 active or passive? Of course, the account is passive, the recognition of the reserve is accounted for as a credit to the account, and its decrease is recorded as a debit.

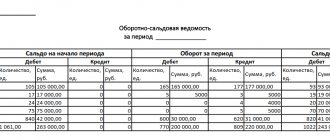

The amounts of the credit balance (unused reserve) are included in the calculations of the amount of accounts receivable when preparing the balance sheet and in the results of the income statement. Account 63 in the balance sheet is reflected in line 1230 “Accounts receivable” of the balance sheet with a minus sign (the amount of doubtful debts is subtracted from the total amount of receivables) and as part of line 2350 “Other expenses” of the income statement.

Information about reserves should be disclosed in the notes to the financial statements.

There are no subaccounts to the account in the Chart of Accounts. Analytics for account 63 represents a separate accounting of the amounts for each doubtful debt.

Accounting for provisions for doubtful debts

Features of accounting and creation of a reserve for doubtful debts in accounting and accounting are given in the table below:

| BOO | WELL | |

| Duty | Yes | No |

| Type of debt | Any debt not secured by collateral or guarantee, accounted for in the debit of accounts: 60, 62, 76, 58-3 | Accounts receivable that a company has incurred in connection with the sale of goods, provision of services or performance of work, not secured by collateral or guarantee |

| Debt period after which a reserve is created | It does not matter whether the debtor's solvency is assessed | From 45 to 90 days – 50% of the debt From 90 days – 100% of the debt |

| Restrictions | The amount of the reserve is not limited | — The greater of the amounts: 10% of the current or previous year’s revenue. — A reserve is not created if the debt of the organization and its debtor is of a counter nature. That is, when not only the debtor owes the company, but the company itself owes the debtor |

After completing the inventory and identifying doubtful debts, entries are generated to the debit of account 91.2 “Other expenses” and the credit of account 63 “Provisions for doubtful debts”. In the future, the unpaid debt can be written off at the expense of this reserve Dt 63 Kt with 60, 62, 76, 58-3 accounts depending on the type of debt.

Amounts of unused reserves are taken into account when preparing the balance sheet and income statement. The addition of unused amounts of reserves to the profit of the reporting period is taken into account by entry Dt 63 “Provisions for doubtful debts” and Kt 91 “Other income”.

In the balance sheet, accounts receivable are always reflected minus the provision for doubtful debts.

Rules for writing off bad debts in accounting

Doubtful debts may eventually be classified as bad debts. In this case, the debt is written off from the created reserve.

The criteria for recognizing a counterparty's debt as bad are established in clause 2 of Art. 266 Tax Code of the Russian Federation. Bad debts that are impossible to collect are debts for which:

- The statute of limitations (3 years) established by law has expired.

- The obligation was terminated due to the impossibility of fulfilling it on the basis of:

- act of a government agency;

- liquidation of the enterprise;

- resolution of the bailiff (the whereabouts of the debtor, his property/valuables have not been found, or the debtor does not have property that can be recovered).

If the amount of the created reserve was not enough to write off bad debts, the required amount is written off against other expenses from Dt 91.2.

The written-off amount of bad debt must be reflected in off-balance sheet account 007 for a period of 5 years, so that changes in the financial condition of the bad counterparty can be monitored and the possibility of restoring this write-off.

ATTENTION! There are significant differences in the legal requirements for accounting for provisions for doubtful debts in accounting and tax accounting.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

In accounting:

- the exact duration of the debt in days is not taken into account;

- the debtor's solvency is assessed;

- the amount of the reserve is not limited;

- when applying PBU No. 18/02, DTA (deferred tax assets) are formed.

Results

The reserve for doubtful debts, which is an object of accounting, is fully subject to the rules of this accounting. Therefore, accounting entries for transactions with this reserve are formed in accordance with the instructions contained in the PBU.

Sources:

- Tax Code of the Russian Federation

- Law “On Accounting” dated December 6, 2011 N 402-FZ

- Order of the Ministry of Finance of the Russian Federation “On approval of the Regulations on accounting and financial reporting in the Russian Federation” dated July 29, 1998 No. 34n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

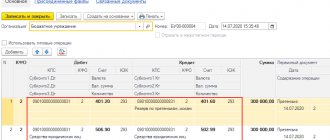

Postings to account 63 with an example of accounting with ONA accrual

The most typical entries for account 63 - Provision for doubtful debts:

| Debit | Credit | Contents of operation |

| 91.2 | 63 | A decision was made to create a reserve for doubtful debts |

| 63 | 60, 62, 76, 58.3 | The bad debt of the supplier / buyer / other debtor / borrower is written off from the reserve |

| 63 | 91.1 | The reserve amount has been restored |

An example of accounting with the accrual of IT

Conditions:

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

On 06/03/2017, the seller shipped a consignment of goods in accordance with the supply agreement in the amount of 158,000 rubles. Payment from the buyer must be received within 25 days after shipment. On July 3, 2017, partial payment was received in the amount of RUB 65,000. By the end of the year, the remaining debt had not been repaid.

Calculations:

158,000 × 20% = 31,600 - IT when creating a reserve

65,000 × 20% = 13,000 - SHE to be restored with partial payment

| Debit | Credit | Sum | Contents of operation |

| 91.2 | 63 | 158 000 | The creation of a reserve for doubtful debts is reflected |

| 09 | 68.2 | 31 600 | SHE is taken into account |

| 51 | 62 | 65 000 | Partial payment received |

| 63 | 91.1 | 65 000 | Part of the reserve has been restored |

| 68.2 | 09 | 13 000 | Part of ONA restored |

How is the provision for doubtful debts formed?

Doubtful debt in accounting is any unsecured debt to a company that, with a high degree of probability, will not be repaid in the future.

The criteria for classifying receivables as doubtful are determined by the enterprise independently. Typically this is:

- expiration of the payment period;

- information about the debtor's insolvency;

- information about the debtor’s inability to manufacture products in the event of an advance payment;

- the presence of enforcement proceedings and bankruptcy proceedings.

Unlike tax accounting, in accounting, any debt accounted for in the debit of accounts: 60, 62, 76, 58-3 is considered doubtful.

Postings to account 63 are created on the basis of an inventory of accounts receivable and a value judgment about the possibility of repaying the debt:

A reserve for doubtful debts can be created monthly or quarterly for part or all of the debt including VAT. In any case, this procedure must be fixed in the accounting policy. For example, you can focus on the timing of creating a reserve for doubtful debts in tax accounting, but it is important to remember that the procedure for creating reserves in tax accounting and accounting is very different.

***

After inventory of receivables, in case of doubts about their repayment by the debtor, the company must create a reserve for doubtful debts. This reserve is taken into account in account 63 of the same name as other expenses.

If a doubtful debt is recognized as a bad debt, its amount is written off at the expense of this reserve under Dt 63 and Kt 60, 62, 76 or 58.3. If the amount of the reserve for write-off is not enough, the remaining part is written off from Dt 91.2. The entire amount written off is written off to the balance of account 007 and the possibility of changes in the financial condition of the bad debtor is monitored over a period of 5 years.

The balance of the reserve for doubtful debts is subtracted from the amount of accounts receivable at the end of the year and the resulting value is shown on line 1230 in the balance sheet. The credit balance of account 63 is included in line 2350 in the income statement. Information on reserves for doubtful debts should be disclosed in the notes to the financial statements.

Typical accounting entries

So, typical entries when creating designated reserve funds look like this:

1) Dt 91.2

Kt 63 – formation of a reserve fund for other expenses;

2) Dt 63

Kt 62 – recognizing the amount of debt as bad and writing it off from the fund;

3) Dt 63

Kt 91.1 – accounting for the unused amount of the fund;

4) Dt 63

Kt 76.2 – write-off of fund funds due to debt repayment.

Accounting procedure

In the accounting reporting documentation, the resulting receivables should be shown minus the reserve that was formed on it. Information about the reserve must be disclosed in the explanations. In this situation, there are several key scenarios:

- restoration in the process of debt repayment (in this case, the amount is included in other income and reflected in account 91);

- restoration due to lack of payment from the buyer based on the results of the annual period that follows the time the reserve was created;

- use, i.e. write-off from the reserve for bad debts of the accounts receivable plan.

In reporting, doubtful debts can be reflected on lines 1230 or 2350 of the balance sheet.