Home / Taxes

Back

Published: 02/04/2020

Reading time: 10 min

0

461

Did you buy an apartment in 2021, pay for education for yourself or your children, or treatment? Or maybe acted as an investor and opened an individual investment account? Don't forget to get some of your spending back from the state in 2021. To do this, apply for a tax deduction and receive up to 520 thousand rubles.

- Tax deduction for IIS Types of tax deductions for IIS and maximum amount

- Which type to choose: “A” or “B”

- Registration procedure and required documents

- Requirements for the recipient and the property

- Maximum amount

- Maximum amount

What are tax benefits?

The system of discounts provided by government authorities for certain individuals and legal entities is called preferential taxation.

The main goal is to stimulate the development of entrepreneurship or provide support for citizens in need.

The provision is regulated by the Tax Code of the Russian Federation and is an integral part of the economic and social policy of the state.

A variety of preferential benefits are issued for large businessmen or private individuals and provide a range of benefits regarding taxation.

Social assistance is not provided to individual citizens, but is intended for certain groups of people distributed by legislative documents.

Forms and types of tax benefits

Tax benefits are provided in the following form:

- Tax exemption from payment of certain types of taxes for life;

- Withdrawal - one of the objects subject to tax levies is not subject to taxation rules. While everything else is affected in the standard form;

- Tax relief – a reduction in the tax rate is provided. In most cases, it applies to legal entities rather than individuals;

- Deferment of payment is the provision of opportunities to pay the tax rate at a later date than usual. All deadlines for deferment of taxation are maintained by the Tax Code of the Russian Federation;

- Tax relief is a representation for those who are late in paying taxes without legal grounds. In this case, you can make payment without penalties or interest.

All of the above types of preferential taxation can only be implemented if a citizen:

- Falls under the category of the population who has preferential taxation;

- Receives profit, which may not be considered taxable;

- Has a property that is not subject to taxes under special circumstances;

- Spends material resources for the intended purposes, from which the tax is reimbursed to him.

In addition, the preferential benefits provided are:

- State – benefits for federal taxes;

- Regional – discounts on regional taxes;

- Local – preferential programs for local tax rates.

Reducing the payment of taxes established by higher authorities cannot be carried out by authorities that are lower in rank.

As an example, the federal tax rate cannot be lowered by regional or local authorities.

The table below presents characteristics of special tax regimes.

| Tax system | Fees payable (excluding mandatory contributions to public funds outside the budget) | Object of taxation | Collection rate |

| UTII (Unified tax on temporary income) | Personal income tax withheld from employee salaries | Employee salaries | Thirteen percent for citizens of the Russian Federation and thirty percent for foreigners |

| Single tax paid due to the use of the UNDV system | The amount of income fixed by law for certain types of activities | Fifteen percent | |

| Unified Agricultural Tax (Unified Agricultural Tax) | Personal income tax, which is withheld from employee salaries | Employee salaries | Thirteen percent for citizens of the Russian Federation and thirty percent for foreigners |

| Single tax paid due to the use of the Unified Agricultural Tax system | Profit reduced by expenses | Six percent | |

| STS (Simplified Taxation System) | Personal income tax, which is withheld from employee salaries | Employee salaries | Thirteen percent for citizens of the Russian Federation and thirty percent for foreigners |

| Single tax paid due to the use of the simplified tax system | Profit | Six percent | |

| Profit reduced by expenses | Fifteen percent | ||

| Patent (the amount of profit established by law from a certain type of activity) | Six percent | ||

| PSN (Patent taxation system) | Patent payment | Potential profit from the activity for which a patent is issued | Six percent |

New deadlines for payment of insurance premiums

Resolution No. 409 also introduced holidays on the payment of insurance premiums, including for injuries.

They apply to organizations and individual entrepreneurs of small and medium-sized businesses, as well as micro-enterprises (legal entities and individual entrepreneurs). The deadlines for payment of insurance premiums, as well as contributions to the Social Insurance Fund for compulsory social insurance against industrial accidents and occupational diseases, have been extended:

- from payments and other remuneration to individuals for March-May 2021 - for 6 months ;

- from payments for June-July 2021 - for 4 months .

The table below shows all the new deadlines for paying insurance premiums for 2021, taking into account Resolution No. 409 and all the nuances.

Below are the normal and new 2021 coronavirus premium payment deadlines for small and medium-sized businesses in impacted industries.

KEEP IN MIND

Federal Law No. 172-FZ dated 06/08/2020 for individual entrepreneurs affected by coronavirus reduced the monthly fixed contributions to compulsory pension insurance (for themselves) by 1 minimum wage for the entire 2021 - from 32,448 rubles. up to 20,318 rubles. Also, Federal Law No. 172-FZ dated 06/08/2020 for organizations and individual entrepreneurs affected by coronavirus canceled (reset to zero) insurance premiums for the 2nd quarter of 2020 - from payments to individuals accrued for April, May and June 2020.

For more information, see “Features of payment of insurance premiums by organizations and individual entrepreneurs for the 2nd quarter of 2020.”

Read also

01.05.2020

What tax benefits are there?

Absolutely all tax benefits provided to individuals are recorded in the Tax Code of the Russian Federation. It determines the rules for issuing, types and sizes of discounts on tax rates.

For property

The Tax Code of the Russian Federation determines the tax levy on any type of property of an individual. In addition, the Code also specifies criteria under which property is not subject to taxes.

The classification of main income for property is given below:

- Taxation of living space and other premises. According to the law, every premises that belongs to an individual is subject to taxation. For certain categories of citizens, partial or complete exemption from payment of taxes may be provided;

- Collection of tax from vehicles. It is established and regulated by local authorities, but state laws set a limit that cannot be exceeded. A partial or full right to exemption from paying this tax may be granted to certain categories of citizens, or if the car meets the characteristics specified in the draft laws;

- Land taxes. Apply to absolutely all land plots owned by an individual. Release can be made if citizens meet certain criteria.

The provision of the above-mentioned preferential benefits can occur either for a certain period or on an ongoing basis.

Each case is considered individually by authorized bodies.

Tax deductions

This type of preferential benefit allows you to avoid paying taxes on funds paid for purposes specified in the legislation. Such a tax benefit can only be established upon payment of funds.

That is, an individual pays for personal needs that fall under this group. After this, you are required to provide a document confirming the expenses to the Tax Service of the Russian Federation.

Employees of the institution check the authenticity and, if the answer is positive, reimburse part of the money required by law.

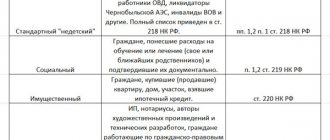

There are the following types of tax deductions:

- Social – intended for partial return of funds spent on training, treatment, insurance or pension contributions, as well as donations. All of these deductions have one specific amount;

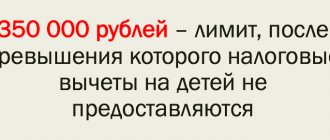

- Standard - determined for absolutely all categories of citizens of the Russian Federation who receive taxable income and have a child. Tax deductions are made monthly, in an amount depending on the status of the child (healthy or disabled child) and parent (single parent, large family);

- Property - used when purchasing living space, as well as when selling real estate or vehicles. When purchasing a home, the tax payer is entitled to a partial refund of the tax paid on the amount paid for the living space. When selling, he is not subject to tax on the profit received. Payments are expected only if a number of certain conditions are met.

Tax benefits can only be established upon payment of funds

Benefits for citizens' property

For certain categories of citizens there are benefits on property.

They are provided for the entire amount of tax to which the property is subject. Important! A prerequisite for granting a property tax benefit is the prohibition of using property for business purposes.

Exercising the right to a tax benefit consists of providing the tax office with an identification document and documents of title to the property. If a citizen learns about his right much later than its occurrence, he can apply for a tax recalculation and a refund of overpaid funds to the budget.

Read also: Benefits for Olympiads upon admission

If a citizen has the right to receive benefits for several types of property, he will have to make a choice in favor of one.

Right to tax benefits

Such social benefits apply only to certain categories of citizens, and can also be issued with a special status of the object of taxation.

The current tax system establishes benefits for the following categories of individuals:

- Citizens of retirement age receiving pension payments;

- Active military personnel and military retirees;

- Families with large status;

- Heroes of the Russian Federation, or the Soviet Union;

- People with disabilities;

- Labor veterans;

- Those who took part in military operations;

- Liquidators of the consequences of nuclear disasters (Chernobyl Nuclear Power Plant,);

- Widows or widowers of citizens who died while performing military duty, etc.

This list is approved at the state level and is valid regardless of the county of residence. At the regional level, the list of beneficiaries may expand, depending on the decisions of local authorities.

As for the special statuses of taxable objects, these include:

- Living space purchased with a mortgage. Fees are not imposed on all mortgage loan amounts up to three million rubles. If the cost of housing exceeds the mentioned one, the fee falls exclusively on the amount that is above the norm;

- A preferential offer is issued for any living space and their shares, only if the citizen who acquired them did not receive such compensation after two thousand and thirteen and did not exceed the amount of two million rubles;

- In some regions, motor vehicles with a certain amount of horsepower are exempt from tax, and the profit tax on the sale of a car is also removed if it meets the following criteria:

- Cost no more than two hundred and fifty thousand rubles;

- The car was owned by the citizen for at least three years;

- The sale amount is less than or equal to the amount of money that this car cost when purchased.

At the regional level, the list of beneficiaries may expand, depending on the decisions of local authorities.

Withdrawal of individual objects from taxation

First of all, this category of benefits is applied to mandatory payments that are levied on owners of material objects: property tax, land tax or transport tax.

For example, cultural heritage sites are not subject to corporate property tax, and transport tax does not apply to low-power vehicles (up to 100 hp) equipped for use by the disabled.

But the allocation of non-taxable objects is also possible for “current” taxes. The company as a whole may be a VAT payer, but at the same time engage in the sale of certain goods or services exempt from this tax (Article 149 of the Tax Code of the Russian Federation).

Such exempt categories include, for example, medicine, passenger transport or cultural and artistic services. To apply this benefit, a businessman must keep separate records for taxable and non-taxable activities.

How are preferential benefits distributed?

Different categories of citizens are entitled to different tax benefits.

For veterans

At the state level, for Heroes of the Russian Federation and the USSR, combat veterans, and World War II, there are the following preferential tax rates at the federal level:

- Exemption from property tax;

- Standard deduction;

- Special conditions for taxation of land plots. No tax is paid on land less than six hundred square meters. If there is a plot larger than the area mentioned, funds are charged according to standard rates;

- Discounts on transport taxes. Such benefits are provided by regional authorities. Depending on the citizen, taxation is completely or partially abolished.

For people with disabilities

If a person has an officially assigned disability group, then he can enjoy the following concessions:

- Exemption from property tax (exclusively for disabled people of the first and second groups, in case of disability since childhood);

- Preferential offers for land tax, the same as for veterans;

- Tax deduction made every month in the amount of three thousand rubles;

- Partial exemption from motor vehicle tax.

For pensioners

For citizens with official pensioner status, the following benefits are expected:

- Exemption from property taxation;

- Benefits for plots of land, on the above conditions;

- Preferential conditions for transport taxation;

- Deduction when purchasing living space. Pensioners who have an additional source of income, in addition to pension payments, can carry forward the balance of the deduction to property for three years that precede the submitted application. The deduction is provided only if personal income tax has been paid for all previous years. This right is enshrined in the Tax Code of the Russian Federation.

For large families

Tax advantages are provided only to those families that have three or more children, natural or adopted.

Such families are given the official status of large families and are given the following preferential benefits:

- Child tax credit . The payment is one thousand four hundred rubles for the first and second child, as well as three thousand rubles for the third or more. If a citizen has three or more children, he is exempt from five thousand eight hundred rubles. The remaining amount is subject to a fee of thirteen percent;

- Relaxation of transport tax . Provided at the regional level. In the capital, a complete tax exemption is issued. The power of vehicles and their type play an important role;

- Special conditions for land tax . Provided at the regional level, and may partially or completely remove the payment for this taxation;

- Preferential advantages when organizing farming . An exemption from land tax is issued for a certain period, and the collection rate is also reduced in the future.

Tax advantages are provided only to those families that have three or more children, natural or adopted.

Features by Category

Each category of citizens has the opportunity to receive benefits provided by the state within the framework of tax policy.

Benefits for disabled people

Disabled people belong to the category of citizens who have the right to receive benefits from the federal and regional budgets.

In addition to pursuing tax policy, the federation strives to implement the “Accessible Environment” program. Thanks to this project, people with disabilities are guaranteed social support, adaptation of public places to the needs of people with disabilities and the development of educational programs. Important! The possibility of receiving benefits is based on the legalized status of a disabled person and the receipt of a certificate by the citizen. The basis for this is the conclusion of the medical examination and the assignment of a group to the citizen in accordance with the existing disease.

The level of benefits depends on the citizen’s disability group. Disabled people of the first group can apply for:

- Payment of social pension;

- Obtaining medications at a special price from a social pharmacy;

- Free treatment in boarding houses and dispensaries;

- Free transportation to the place of treatment;

- Free travel in public transport;

- Compensation for payment of housing and communal services.

Disabled people of the second group have the right to free travel on public transport, to receive medications at significant discounts, free prosthetics, a discount on housing and communal services, and the right to priority admission to higher education institutions subject to successful testing.

Disabled people of the third group, subject to their official employment, have the right to apply for discounted medications and additional labor privileges. These include additional leave and reduced working hours.

Benefits for pensioners

A striking example of a benefit for a pensioner is the exemption of a citizen from paying property tax.

However, a pensioner can choose only one type of property that will not be taxed. This property should not be used by a citizen for business purposes. The procedure for paying transport tax is regulated by local legislation, so each municipality has the right to establish its own benefits depending on the technical characteristics of the car and the number of cars.

For example, in Moscow, pensioners do not fall into the category of persons who are exempt from paying transport tax. In St. Petersburg, each pensioner is exempt from paying tax on one taxable item.

Benefits for utilities apply only if the amount of a citizen’s expenses exceeds 22% of his total income. Only in this case can a pensioner qualify for a discount.

Read also: Are there any benefits for schoolchildren?

Parents, guardians and adoptive parents of children

The standard child tax credit is one of the most popular benefits. It obliges the employer not to take into account a certain part of the citizen’s income to calculate the tax. The final figure depends on the number of children. For one child, tax-free - 1,400 rubles, for two - 2,800 rubles, for three or more - 5,800 rubles. The same rules apply to guardians of minors and adoptive parents.

Parents with many children

To receive appropriate benefits, a citizen must obtain the status of a large family. State support for parents with many children is provided in the following areas:

- Labor and pension legislation;

- Medical care and food provision;

- Providing housing and land.

For legal entities and individual entrepreneurs

The following benefits apply to legal entities engaged in entrepreneurial activities:

- Exemption from VAT provided that the enterprise carries out new developments and engineering research;

- Reducing the corporate income tax rate.

Individual entrepreneurs have the right to defer or installment payment of taxes upon the occurrence of circumstances that prevent the timely payment of taxes. To do this, you need to provide the necessary documents to the relevant authorities. For the first three years, an individual entrepreneur may not think about audits, if there are no complaints against the entrepreneur from other persons.

What documents will be required?

To apply for a tax advantage in the form of benefits, you will need to collect the required package of documents and apply to the National Tax Service of the Russian Federation.

To receive standard tax deductions, you must provide documents and an application to your employer.

Registration of tax benefits will require the collection of relevant documentation:

- Passport;

- Pensioner certificate – for citizens of retirement age;

- Conclusion on assignment of a disability group – for people with limited abilities;

- Veteran of Labor Certificate - for eligible citizens;

- Military ID - for active military personnel or military retirees;

- Certificate of family composition, etc.

Labor Veteran Certificate

The package of documents may vary depending on which category of citizens are provided with benefits. To clarify the full package of documents, you need to contact the official websites of the departments, or the nearest Tax Service.

In a situation where only one item from a citizen’s property is subject to a tax benefit, the following package of documentation will be required:

- A document confirming the right to own property;

- Vehicle registration certificate;

- Conclusion on purchase and sale;

- Loan agreement for the purchase of living space;

- Conclusion on the provision of medical services;

- Contract for paid training.

The list of documentation will depend directly on the purposes for which the citizen wishes to receive a tax benefit.