Few people know this interesting fact: a certain part of the taxes paid by law on the funds received can be returned in the form of a tax deduction. Now we will get acquainted with one of the types of deductions, called professional.

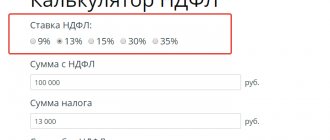

Tax deduction is an amount of money controlled by law and provided to various categories of citizens who pay taxes on time. It does not imply taking into account the personal income tax, which is 13%.

Professional tax deductions

One of the terms included in tax plan deductions is professional tax deductions. They mean the amount by which the income subject to taxes from the work of an entrepreneur or private practice is reduced. The basis is taken from documentation that outlines the amount of expenses.

Professional tax deduction: what is it?

Following well-known rules, tax deductions involve the use of the amount of actual expenses approved in various documents. Note: there are situations when actual expenses may not be taken into account (applies to individual entrepreneurs). Then there is the right to provide a deduction of 20% of the amount of money earned.

Important ! As for awards for authors or incentives for the invention, execution and other use of scientific, literary and cultural works, payment for discoveries, inventions, industrial designs made by people - when there is no documentation recording expenses, the income received is subject to reduction according to given rules (percentage is used ratio to the amount of calculated income) - this is stated in paragraph three of Article 221 of the Tax Code.

Excerpt from Article 221 of the Tax Code of the Russian Federation

To identify the tax base, monetary expenses specified in official papers cannot be taken into account along with expenses that are within the framework of the established rules.

The type of tax deduction we are considering, when received, for several reasons, is not absorbed by one another, but is provided to the citizen in full, since each deduction involves taking into account one basis. There is no possibility of offsetting.

The expenses of citizens paying taxes also include the amount of taxes assumed by the law on taxes and fees for the types of activities prescribed in this article (excluding personal income tax), credited or paid for any tax period in a manner controlled by the laws on taxes and fees. This can also include money paid for insurance premiums for compulsory pension insurance, insurance premiums for compulsory medical insurance, credited or paid for a certain time period provided for by the legislative acts of our country.

The expenses of citizens paying taxes also include the amount of taxes

Important ! The exercise of a citizen's right to provide him with professional payments occurs through the execution of a written application sent to the tax agent. When it is absent, implementation is ensured by filing an application with the tax authority along with the simultaneous filing of a tax return at the end of the corresponding time period.

List of income subject to deductions:

- money received by an individual entrepreneur;

- funds received by a notary working privately, a lawyer who has created his own office and other citizens who carry out private practice;

- money received for performing labor duties specified in a civil contract;

- incentives for authors, payment for the creation, execution and other application of achievements of science, literature and art, rewards to scientists for discoveries, inventions and industrial designs received by taxpayers.

Excerpt from Article 221 of the Tax Code of the Russian Federation

Professional deduction in the author’s “execution”

In the event that the citizens indicated in the last paragraph cannot confirm their expenses (for example, in creativity, invention and scientific research), then they can still count on receiving a professional deduction, but only under the following circumstances:

- In the case of the creation of a literary work, including for theatrical production, cinema, variety and circus use (scripts for filming and television) - then the professional deduction, when calculated, will be 20% of the total income of the money paid to the author according to the terms of the contract .

- In the case of creativity in the creation of various works that have an artistic and graphic orientation and in the implementation of creative tasks that are related to the tasks of design, architecture and photography, the deduction will be 30% of the author’s total earnings specified in the contract.

- In the case of creativity in the creation of various works that have a decorative and applied orientation, that is, when carrying out creative tasks that are associated with design tasks, decorations, graphics in various performing manners - the deduction is 40% of the total earnings of the creator specified in the contract.

- In the case when a video product (video clip) is created, the deduction will be equal to 30% of the revenue portion.

- In the case of production of various musical works intended for use on the theatrical stage, in films and television films, then the deduction will be 40% of the amount earned. And when composing any other works of music, this amount will be 25% of the income.

- In the case of a demonstration of performing arts as part of a literary work, the deduction amount will be 20% of income.

- In the case of writing scientific papers, various development programs, using scientific information, the deduction is equal to 20% of the scientist’s earnings.

- In the case of creating useful inventions and models, the deduction will be 30% of all earnings received during the first 2 years of operation of these inventions.

Important information! Russian legislation strictly prohibits the simultaneous use of confirmed expenses and a percentage of earnings when calculating professional deductions.

We remind you that even if you thoroughly study all the data that is in the public domain, this will not replace the experience of professional lawyers! To get a detailed free consultation and resolve your issue as reliably as possible, you can contact specialists through the online form .

Conditions for obtaining a professional tax deduction for personal income tax

In order for you to be provided with the type of personal income tax deduction in question, the three listed criteria must be met together:

- the individual is not engaged in entrepreneurial activity;

- an individual is a tax resident of Russia;

- an individual has completed an application requesting the said deduction.

Important ! The deduction is provided in the form of the amount of expenses incurred by the person and due to the fulfillment of obligations under the GPA. The time period over which these expenses were made is not important.

Providing a professional deduction for individual entrepreneurs and persons implementing private practice

If you study the rules presented in paragraph one of Article 221 and paragraph one of Article 227 of the Tax Code, individual entrepreneurs and citizens working “for themselves” are able to reduce their own income by professional tax deductions.

Clause 1 of Article 227 of the Tax Code of the Russian Federation

This type of deduction is not provided to individuals who work “for themselves” but are not registered as a self-employed citizen.

It is permissible to reduce only that income that is received specifically from entrepreneurial work and private practice. Other money (for example, remuneration for work) is not reduced for the professional deduction of an individual entrepreneur, notary, lawyer, and other citizens working for themselves.

General provisions

Professional tax deductions apply to representatives of the following professions (all of them are required to pay personal income tax in the amount of 13 percent of earnings):

- Authors of works. Here the size of the benefit depends on the type of product (from 20 to 40%).

- Citizens working under GPC.

- Individual entrepreneurs.

- Persons who earn money from private practice.

Registration of a professional tax deduction is carried out taking into account the earnings received in the process of conducting the mentioned activity. Costs when calculating benefits include payments for compulsory medical insurance and compulsory medical insurance, customs duties, as well as official taxes and fees. At the same time, the amount of deductions is controlled - it should not exceed the amount of profit. If these indicators are equal, there is no tax base. This means that a representative of one of the professions mentioned above does not have to remit tax.

In general, to receive a deduction, you need to fill out an application and submit it to the tax agent. In the absence of one, a recalculation is made in the tax report (3-NDFL). If the tax service transferred the amount of the premium without a tax deduction, the citizen has the right to expect compensation for the withheld funds (this is stated in the Tax Code of the Russian Federation, Article 231, paragraph 1). Up to three months are allocated for refunds.

Amount of deduction, composition of expenses

Individual entrepreneurs, notaries, lawyers and other people working independently are provided with a deduction in the amount of expenses actually made that have official confirmation.

All individuals calculate their own expenses required to qualify for the deduction on their own. If you carefully study the second paragraph of paragraph one of Article 221 of the Tax Code, you can see that these actions follow the procedure provided for in Chapter 25 of the Tax Code of the Russian Federation. It follows from this that only those expenses that should be taken into account when taxing profits are used for deduction, based on Articles 253-269 of the Tax Code.

The procedure for paying taxes is specified in the articles of the Tax Code of the Russian Federation

The Supreme Arbitration Court of our country declared illegal for citizens paying taxes the procedure for recognizing cash expenses for the purchase of goods, from where these expenses are taken into account only during the time period when income from the sale of the purchased goods was received. Based on the provisions of Article 273 of the Tax Code, the moment of approval of expenses is not linked to the day of receipt of income. Hence, the Supreme Arbitration Court of Russia stated that the fifteenth paragraph of the Procedure for accounting for income and expenses and business transactions for an individual entrepreneur does not correspond to paragraph three of Article 273 of the Code.

Let's note ! The Ministry of Finance of our country continues to explain: the norms of Chapter 25 of the Tax Code are used only in relation to the list of expenses (Letters dated 02/17/2011 No. 03-04-05/8-97; dated 02/17/2011 No. 03-04-05/8-99; dated 02/16/2011 No. 03-04-05/8-91; dated 02/09/2011 No. 03-04-08/8-23). As for the moment of calculating income and expenses, the Ministry said that the former should relate only to the time period when they were actually received. The latter are subject to accounting for the current or future tax periods, since Chapter 23 of the Code contains no explanations on this issue.

Criteria that expenses made by a citizen must meet:

- the costs must be justified;

- expenses should be approved in documentary form;

- expenses must be made for work that involves generating income.

Expenses must be supported by documents

These statements are considered mandatory when accepting production costs and profit reductions. When an expense does not fit the criteria listed above, then such expense for tax purposes is not taken into account (based on paragraph one, paragraph one of Article 221, paragraph one of Article 252, paragraph forty-nine of Article 270 of the Tax Code).

Article 221 specifies a list of expenses that a citizen paying taxes can take into account when filing a deduction.

The procedure for obtaining a professional deduction

Individual entrepreneurs, lawyers, notaries and other persons working “for themselves” are able to request the type of deduction we are considering only from tax authorities, because these categories of citizens themselves calculate and pay taxes on personal income.

Individuals who work for themselves can request a tax deduction from tax authorities

To ensure a deduction, a person is obliged to send a tax return to the tax office at the end of the tax period (the third form is personal income tax). Other criteria for receiving the deduction we are considering are not established. A corresponding application is also not required.

Important ! According to the control authorities, an important condition for ensuring this type of deduction is the preparation of documentation where the expenses are stated. The reason, according to them, is that the deduction is provided in the form of the amount of expenses approved in the documents (Letters of the Ministry of Finance dated January 26, 2007 No. 03-04-07-01/16, Federal Tax Service of Russia dated February 9, 2007 No. GI-6 -04/ [email protected] ).

Tax return 3-NDFL

But this kind of statement does not correspond to reality, and this is confirmed by the Decision of the Supreme Arbitration Court of August 6, 2008, number 7698/08 (it was recognized as lawful on the basis of the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation of November 11, 2008, number 7307/08), by which the SAC:

- noted that the indication of paragraph one of Article 221 of the Tax Code to “documented expenses” does not mean that a citizen is obliged to show the tax authorities, along with the declarations, the papers where these expenses are recorded;

- indicated that a citizen paying taxes should not provide such documentation during a desk tax audit by order of the tax authorities, because there are no corresponding notes in the Tax Code.

The reason is that a desk audit is done based on the data of the tax return and the documentation attached to the declaration (the list is specified in the Tax Code). Taxpayers can attach some documents at their own discretion. This statement is based on paragraphs 1-3 of Article 88 of the Tax Code.

Based on paragraph 7 of Article 88 of the Code, during desk audits, tax control authorities cannot demand side information and documentation from a citizen when the law does not stipulate that they must be necessarily attached to the declaration.

Excerpts from Article 88 of the Tax Code of the Russian Federation

And due to the fact that when sending a personal income tax return, a citizen does not have to attach documentation approving a professional deduction, tax control is not able to demand these papers.

Important ! The letter of the Ministry of Finance of Russia dated January 26, 2007, number 03-04-07-01/16, was recognized as not meeting the criteria established by the Tax Code and not valid in the part where the Ministry of Finance issued additional explanations.

To summarize, let's say that in order to receive a professional tax deduction, you do not need to attach papers confirming the deduction to your declaration and application. They are not sent to the tax office and are not needed during a desk audit.

To receive a tax deduction, you do not need to attach documents confirming the deduction.

How are professional deductions calculated?

Algorithm for calculating the deduction:

- The total amount of income from activities falling under the rules for applying the benefit is determined.

- Documentation confirming expenses incurred (if any) is analyzed.

- The tax agent subtracts expenditure amounts from the amount of income; the personal income tax rate of 13% is applied to the remaining value.

Individual entrepreneurs, if they have documents confirming movement on expense items of their activities, can count on the use of a professional deduction in relation to the following types of expenses:

- purchase of goods and materials;

- wages;

- depreciation deductions;

- insurance premiums;

- tax payments (except personal income tax and VAT).

REMEMBER! The amount of property tax can be classified as a professional deduction if property assets are operated in the course of business activities.

If the individual entrepreneur does not have documents for expenses incurred, the deduction will be equal to a fixed rate of 20%.

Example of a professional deduction for copyrighted works without proof of expenses

Citizen P. created his own video course on payroll in various modifications of the 1C program. At the end of the year, he received 123,500 rubles as payment for the use of video materials. There are no documents that could justify and confirm the expenditure of funds.

Since there is no supporting documentation, the professional deduction will be provided as a percentage of the income received for the year. The percentage scale for benefits is given in Art. 221 Tax Code of the Russian Federation. Tuition fees for the video course are classified as royalties. The product being sold, according to its intended purpose, is classified as a video film. In accordance with Art. 221 of the Tax Code for video films, the rate of professional deduction is 30%.

Calculation of deduction: 123,500*30%=37,050 rubles.

Determination of the taxable base: 123,500-37,050=86,450 rubles.

Calculation of personal income tax payable after applying the deduction: 86,450*13%=11,239 rubles.

BY THE WAY! If supporting expense documents are collected for a small amount, then it is beneficial for the taxpayer not to present them at all, since according to fixed standards the amount of the deduction will be larger.

Documentation required to apply for a professional deduction

Article 221 of the Tax Code does not provide an exact list of documentation that allows confirming the expenses of a particular citizen. To find out information about expenses, the first paragraph of this article advises you to refer to Chapter 25 of the “Organizational Income Tax”, which states that documented expenses mean expenses recorded in official papers, drawn up according to the rules prescribed by law. . Also taken into account may be documents drawn up taking into account business customs used in foreign countries where monetary expenses occurred. Another option - documentation that indirectly confirms the expenses incurred (this includes customs declarations, business trip orders, travel documentation, reports on work performed under contracts) - is stated in the fourth paragraph of the first paragraph of Article 252 of the Code.

Important ! In other words, citizens who pay taxes can confirm information about their own expenses not only through documentation that meets the requirements of the law (contracts, payment orders, cash register checks, cash receipts, etc.), but also through other official papers that provide indirect confirmation of the fact of spending Money.

People can approve information about expenses using various official papers

Income from rental property

At the moment, the issue of mandatory registration of housing rental activities is quite acute. Now we will consider a situation in which such actions are registered as entrepreneurship.

It is no secret that a person who rents out a home spends a certain part of the money on utilities and other nuances of maintaining the home. Is it possible to take such expenses into account for professional tax deduction?

The Russian Ministry of Finance reports that an entrepreneur has the right to receive a tax professional deduction in the amount of actual and officially confirmed costs for the maintenance of rented property only when such activity of a citizen (“renting out one’s own non-residential (or residential) real estate” in accordance with OKVED) is subject to registration in the Unified State Register of Individual Entrepreneurs. In any other situations, there is a possibility of facing questions from the Federal Tax Service.

If the activity (renting an apartment) is registered in the Unified State Register of Individual Entrepreneurs, a person can receive a professional tax deduction for housing maintenance

Insurance premiums under the GPC agreement

Working under a civil contract, an organization has the opportunity to save on the amount of insurance premiums paid.

- Payments under the GPC agreement do not need to be charged insurance premiums in case of temporary disability and in connection with maternity in accordance with subparagraph 2 of paragraph 3 of Article 422 of the Tax Code of the Russian Federation. The savings are not very big, but still. At regular rates, the savings will be 2.9%.

- Payments under the GPC agreement do not need to be charged insurance premiums against industrial accidents and occupational diseases.

The amount of savings depends on the tariff established for the company, and the maximum, in rare cases, can be 8.5%.

Contributions to the Pension Fund and medical contributions under civil contracts are calculated in the same way as under employment contracts in accordance with paragraph 2 of Article 425 of the Tax Code of the Russian Federation.

If the GPC agreement provides for the payment of an advance, insurance premiums must be calculated and paid during the period of accrual of remuneration, and not after signing the act. This procedure is established by the provisions of: paragraph 1 of Article 421, paragraph 1 of Article 424, paragraphs 1 and 3 of Article 431 of the Tax Code of the Russian Federation. Explanations on this topic were given in the letter of the Ministry of Finance dated July 21, 2017 No. 03-04-06/46733.

If there are no papers confirming the fact of spending money

Naturally, there are cases when a person simply does not have documentation indicating the expenses incurred. In this case, it is possible to reduce the cost of professional tax payments by twenty percent of the total amount of money received for work activities.

This rule is relevant only for individual entrepreneurs. In other words, the following cannot take advantage of the 20% professional tax deduction:

- a citizen engaged in private practice - lawyer, notary, etc.;

- a person providing services specified in civil contracts and not registered as an individual entrepreneur,

- It will not be possible to take into account expenses that do not have official confirmation (information from Letters of the Ministry of Finance dated April 27, 2007 No. 03-04-05-01/129, dated 06.06.2007 No. 03-04-05-01/179).

Excerpt from Letter of the Ministry of Finance dated April 27, 2007 No. 03-04-05-01/129

When determining a professional tax deduction, an individual entrepreneur can only take into account those expenses that have official confirmation. You can also take into account the money spent in the amount of 20% of what you earned. Please note that these two methods cannot be used simultaneously.

Important ! Receipt of this type of deduction by people providing services or performing work is made on the basis of civil law contracts.

Based on paragraph two of Article 221 of the Tax Code, citizens working on the basis of civil contracts are able to reduce the money they receive for professional tax deductions.

The type of deduction we are considering can be used by any individual who earns money for work or civil services. This also applies to lawyers engaged in their work in the legal college, and also applies to individual entrepreneurs (legal basis - Letter of the Ministry of Finance dated July 28, 2005 No. 03-05-01-05/140).

Excerpt from Letter of the Ministry of Finance dated July 28, 2005 No. 03-05-01-05/140

If this form of agreement was drawn up with an organization or individual entrepreneur, this company or entrepreneur acts as a tax agent. Therefore, they should provide the person with a professional tax deduction.

If a similar form of agreement is drawn up with a person who is not an individual entrepreneur, you will have to contact the tax office to receive the required deduction.

This form of deduction is issued to a citizen who earns money on the basis of a civil contract involving the performance of various types of work or the provision of any services. What can be included here:

- contract agreement;

- a contract involving the performance of scientific, research, design or technological work;

- contract for the provision of services on a reimbursable basis.

Let's celebrate ! The Ministry of Finance claims that individuals receiving funds from contracts for the delivery or rental of housing cannot be provided with this type of deduction (based on Letters dated September 3, 2010 No. 03-04-05/3-521, July 13, 2010 No. 03- 04-05/3-389).

This form of deduction can be issued to a citizen earning money on the basis of a civil contract

However, tax officials have a different opinion. They argue that it is quite possible to use a tax deduction in such situations (Letters of the Federal Tax Service of the Russian Federation dated October 2, 2008 No. 3-5-04 / [email protected] , UNFS of the Russian Federation for Moscow dated March 5, 2008 No. 28-11/021762).

Where to apply for a deduction

The professional deduction is provided to the taxpayer by his tax agent on an application basis. Documents confirming the costs incurred (if any) must be attached to the application.

The application can be written in any form or use the provided form.

If the citizen has not submitted an application for a deduction, the agent pays personal income tax in full. In this case, the overpaid tax can subsequently be compensated in the manner established by the Tax Code of the Russian Federation (by submitting an application to the agent for the return of the overpayment of personal income tax).

Individuals who do not have a tax agent (individual entrepreneurs, lawyers, notaries, etc.) declare a deduction in the annual 3-NDFL declaration submitted to the Federal Tax Service within the established time frame following the results of the tax period. There is no need to submit an application for a deduction to the Federal Tax Service.

Scope of deduction and components of expenses

The deduction is provided in the form of funds actually spent that have official confirmation.

Let us note that there are no rules for determining the money spent by citizens working under civil contracts. It follows that citizens should independently identify the costs associated with the work they perform. They also differentiate what cannot be included in these expenses. It must be remembered that these expenses should not have been taken into account previously for the professional deduction.

What else applies to taxpayer expenses:

- taxes (excluding personal income tax) credited or paid for a given tax period (third paragraph of the third paragraph of Article 221 of the Tax Code);

- state duty paid for performing professional activities (seventh paragraph of the third paragraph of Article 221 of the Tax Code);

- insurance premiums related to compulsory pension or health insurance (third paragraph of the third paragraph of Article 221 of the Tax Code).

Taxpayer expenses also include insurance premiums, state duties, taxes

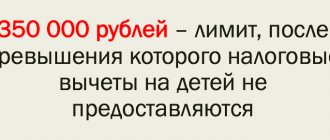

Since the 17th year, when calculating insurance plan contributions for compulsory pension insurance for people working “for themselves” and paying personal income tax, only actual expenses that have official confirmation are taken into account. They are considered in Chapter 23 of the Tax Code. If you study the Letter of the Ministry of Finance dated February 6, 2017 No. 03-15-07/6070, you can find out that people engaged in private practice (lawyers, individual entrepreneurs, notaries) in the process of identifying the basis for calculating insurance premiums can reduce income from of their work activities by the number of expenses made. The rules for calculating insurance contributions for compulsory pension insurance for such people are specified in subparagraph one of Article 430 of the Code (when the amount of money received does not exceed three hundred thousand rubles for a given period, then calculations are made on the basis of the minimum wage and tariffs. Otherwise, the contribution is calculated using adding one percent to the excess amount). If a citizen paying taxes receives more than three hundred thousand rubles in a year, this formula should be used:

Minimum wage x 12 x 26% + (income - 300,000 rubles) x 1% (but not more than 8 minimum wage x 26% x 12).

The amount of insurance premiums for self-employed citizens depends on the size of their income

The amount of money earned through self-employment in this case should be reduced by the amount of professional tax deductions described in article number 221 of the Tax Code.

Important ! If a citizen cannot provide documentation approving his expenses, then the general principle is used - 20 percent of the total amount of money earned in the course of business activities.

Deduction for persons conducting private practice

Persons conducting private practice, unlike individual entrepreneurs, can use only one option for using NVD - in the amount of expenses incurred.

The composition of costs is determined in a similar way (as for entrepreneurs).

In addition, during the years of validity of Art. 221 of the Tax Code of the Russian Federation, numerous clarifications have been issued by the Ministry of Finance on what expenses can be included in the PNV for various categories of persons engaged in private practice, in particular:

1. Arbitration managers have the right to reduce the tax base for personal income tax by the amount of expenses in bankruptcy cases.

- for the maintenance of the premises (including utilities);

- for remuneration of employees;

- for making membership fees and other payments for the general needs of the notary chamber;

- to pay for the services of third parties for keeping records of a notary office, etc.

This is important to know: Medical examination when applying for a job: where to go, how much it costs

3. Lawyers who have established law offices take into account the following expenses:

- for professional liability insurance;

- for training (training and/or retraining must be carried out in educational institutions that have the appropriate license, and upon completion of training a diploma or certificate of the established form must be issued);

- for payment of membership fees to the bar association, etc.

Providing professional tax deduction by tax agents

To ensure this deduction from tax agents, a person must send them an application in writing. You don't have to wait until the end of the year to do this.

In addition to the application, the tax agent must receive from the taxpayer documentation approving monetary expenses (based on the Letter of the Department of Tax Administration of the Russian Federation for Moscow dated September 27, 2004, number 28-11/62835).

Letter of the Department of Tax Administration of the Russian Federation in Moscow dated September 27, 2004 number 28-11/62835

In general, there is no exact list of documents required to be submitted. There is no specific list anywhere in the laws. But it would be logical to say that all documents provided must confirm the person’s expenses and talk about their connection with the performance of work under civil law contracts. It follows from this that it is necessary to collect contracts, sales receipts, cash receipts, cash register receipts, and receipts from individuals.

When an agent is presented with a request for a professional tax deduction, he must comply with the citizen's request in the course of paying the monetary incentive specified in the contract.

Obtaining a professional deduction from a tax agent

To receive a deduction from a tax agent, you must write a corresponding application. It is compiled in any form. It should indicate that you want to receive a professional deduction and its amount. Supporting documents, such as sales receipts, contracts, invoices, should be attached to the application.

If the costs are not documented, but there is an established cost standard, then the amount of the tax deduction percentage should also be indicated in the application. Based on this application, the employer will deduct royalties.

Sample application (actual expenses)

Sample application (standard)

The organization is obliged to maintain registers for personal income tax withheld by it, including organizing accounting of professional deductions provided upon applications of individuals. The tax agent annually submits information about calculated and withheld personal income tax to the Federal Tax Service on Form 2-NDFL by April 1. In it he will reflect the amounts of the provided professional deduction by codes:

- 403 - in the amount of confirmed expenses under contracts for the performance of work or provision of services;

- 404 - in the amount of actual expenses of the authors;

- 405 - according to cost standards.

Obtaining a professional tax deduction from the tax authority

When your profit was provided by an individual, and not by tax agents, you need to make a visit to the tax office. Only then will you be able to receive the type of deduction we are considering.

For this purpose, a citizen is obliged to draw up a tax return at the end of the year of profit and send it to the appropriate institution.

To receive a deduction, you must file a tax return.

Important ! Please note that an application is not required from you then.

Tax control authorities, by the way, say that in addition to the tax return, a person is required to attach documentation confirming the expenses he has made. It should be assumed that this statement applies not only to individual entrepreneurs, but also to individuals who earn money by performing work based on civil contracts.

Providing this type of deduction to people receiving various types of remuneration

Some people receive money from royalties or awards for inventing, performing, or otherwise applying scientific findings, works of literature, and art. This point also applies to the authors of discoveries, inventions and industrial designs. All of these people are entitled to a reduction in income for professional tax deductions using the first paragraph of Article 221 of the Tax Code.

Important ! In the law of November 24, 2014 No. 367-FZ, these rules began to apply to developers of utility models. From now on, they also have access to a type of similar deduction.

The type of deduction we are studying can be used by any individual who is provided with the listed incentives, including individual entrepreneurs (Letter of the Ministry of Finance of Russia dated March 19, 2007, number 03-04-05-01/85).

Persons who receive money from royalties or awards for invention, etc., are entitled to a reduction in income for professional tax deductions

A professional tax deduction can be obtained by the authors of various scientific works, studies, developments, and the like. Then it concerns the expenses related to this scientific work.

This type of tax deduction is not provided when the author is given royalties for a work that is the result of his labor activity.

The procedure for obtaining a valid document

In order to receive a professional deduction, an individual entrepreneur must:

- Draw up a declaration in form 3-NDFL with the obligatory completion of sheet G;

- Submit reports and documents confirming the expenses incurred (if the actual expenses are declared) no later than April 30 of the year following the reporting year.

It should be noted that at present individual entrepreneurs do not submit an application for a deduction, as was previously the case.

Professional tax deduction

allows you to reduce income taxed with personal income tax at a rate of 13% (except for income from equity participation in organizations) by the amount of actually incurred and documented expenses directly related to the performance of work (provision of services) under a civil contract (clause 3 of Art.

210, paragraph 2 of Art.

221, paragraph 1, art.

224 of the Tax Code of the Russian Federation).

In this case, civil law contracts should be understood as contract agreements for the provision of services for a fee, the performance of scientific research work (Articles 702, 769, 779 of the Civil Code of the Russian Federation).

Thus, a professional tax deduction for personal income tax can be provided when paying remuneration under a civil law agreement (CLA):

to individuals performing work or providing services (clause 2 of Article 221 of the Tax Code of the Russian Federation);

authors of works of science, literature, art, inventions and industrial designs (clause 3 of article 221 of the Tax Code of the Russian Federation).

Practical examples

Let's say an individual entrepreneur makes money by selling food products through a store. Note that the profession of this citizen relates to the construction industry, so sometimes he is engaged in relevant work activities, concluding civil contracts. It follows from this that for part of the profit for the provision of construction services, he has the right to use a professional deduction.

The monetary expenses of a person paying taxes, similar to the cases with an individual entrepreneur implementing a private practice, can include the amount of relevant taxes (excluding personal income tax) credited or paid for the tax period.

The monetary expenses of a person paying taxes include the amount of taxes (except personal income tax)

Example: a citizen provides services to an organization on the basis of a contract agreement. The money paid for his work is 150 thousand rubles. The citizen is not an individual entrepreneur, the expenses related to the service provided amounted to 130 thousand rubles - this is the price of materials spent during the provision of the service.

Important ! To receive a professional tax deduction, a person must send a written application to the organization asking to be provided with this deduction. With the application, he must provide for review the papers where the expenses incurred by him are recorded.

In other words, the tax basis for calculating personal income tax is 20 thousand rubles (150 thousand minus 130 thousand). The tax required to be paid to the budget is 2 thousand 600 rubles (20 thousand rubles * 13%).

Who belongs to the category of taxpayers rewarded for the authorship or creation, performance and other use of scientific works, achievements of literature and art? This includes any individuals who are rewarded for the invention, execution or other application of scientific achievements, literary works, and works of art. It is worth mentioning here the citizens who made any discovery, invention, or created industrial designs. It is important to say that both authors and other people provided with this kind of incentive have the right to receive this type of tax deduction.

Both authors and other people provided with this kind of incentive have the right to receive a tax deduction.

The volume of professional deductions for this category of citizens paying taxes is those expenses that are actually incurred and are confirmed in official papers. When it is not possible to draw up documents, you must adhere to the following standards:

| Kind of activity | Cost standard (in % of the amount of income received) |

| Creation or use of works of literature, including theater, cinema, stage and circus | 20 |

| Creation of graphic works, artistic works, photographic works for printing, architectural works, design | 30 |

| Creation of musical or stage works for film, television, theater | 40 |

| Creation of other musical works (this includes those that are ready for publication) | 25 |

Example: a citizen is a composer. He created a piece of music and received an incentive of 300 thousand. The professional plan deduction here is 32 thousand (expenses are officially confirmed). At the same time, the citizen wrote a book for which he received 15 thousand, but there is no official confirmation of expenses. The person decided to use the percentage reduction as the best option: in the first scenario, the professional type of deduction will be 120 thousand, in the second - three.

To summarize, we can say that if you correctly analyze all the available data, you can very advantageously use the deduction that we talked about. This applies not only to individual entrepreneurs, but also to creative, scientific people, and people working under temporary civil contracts. The main thing is to keep documentation of costs and carefully study the Tax Code. Naturally, it is very difficult to understand the abyss of laws, so an experienced lawyer will be able to answer all the questions that interest you in detail.

Cost standard for expenses that cannot be documented

Cost standards (as a percentage of the amount of accrued income)

Creation of literary works, including for theatre, cinema, stage and circus

Creation of artistic and graphic works, photographs for printing, works of architecture and design

Creation of works of sculpture, monumental and decorative painting, decorative and decorative art, easel painting, theatrical and film set art and graphics, made in various techniques

This is important to know: How to sell an apartment without a realtor: sales procedure, step-by-step instructions

Creation of audiovisual works (video, television and films)

Creation of musical works: musical stage works (operas, ballets, musical comedies), symphonic, choral, chamber works, works for brass band, original music for film, television and video films and theatrical productions

other musical works, including those prepared for publication

Performance of works of literature and art

Inventions, utility models and creation of industrial designs (to the amount of income received during the first two years of use)

Please note that documented expenses cannot be taken into account simultaneously with expenses within the established standard.