Often in enterprises, some employees work part-time. That is, they do some work in their free time from their main job and receive an appropriate salary for it.

A prerequisite for part-time work is the regularity of the work performed and the number of working hours is half less than the number of working hours at the main place of work. Otherwise, the part-time worker remains the same employee as everyone else, and part-time work is paid on a general basis.

Registration of a part-time worker

In order to allow a part-time worker to work, you must sign an employment contract with him. To do this, the employee must bring to the enterprise a copy of his passport data, a copy of his education documents - if work conditions require it, and write an application for a part-time job. The hiring procedure is the same for both external part-time workers and internal ones - except that the internal part-time worker may already have the necessary documents stored in the HR department of the enterprise.

After receiving the documents, the employer and part-time worker sign an employment contract.

The contract must contain:

- official details of the document (name, date of preparation, addresses and signatures of the parties);

- clauses on the rights, duties and responsibilities of the parties (employee and employer);

- clause on the duration of the contract and the procedure for its termination;

- clauses on the employee’s work and rest schedule;

- clauses on payment for part-time work.

A part-time work contract can be drawn up on the basis of a standard employment contract that is used at the enterprise. It is only necessary to rewrite some points taking into account the peculiarities of the work of a part-time worker.

Who can be a part-time worker

When working on a part-time basis, the employee performs other work at the same working time, in addition to the duties specified in the employment contract.

There are no restrictions on who can work part-time. According to the law, this can be any employee, including a manager, provided that the combination does not involve working in the control or supervisory bodies of the organization.

It is worth noting that until 2009, the state prohibited persons holding the positions of chief specialists, managers and their deputies from working part-time. Today this restriction has been lifted.

Combining positions is a work situation when one employee, in addition to the work specified in the employment contract, performs additional work at the same working time.

In this case, additional work means work in a different position. The legislation does not limit the number of possible combinations.

Until 2009, the state prohibited the combination of positions for a certain list of persons, for example, chief specialists, managers and their deputies. Currently, there are practically no restrictions on who can be a part-time worker. This can be any employee, including a manager, but only on the condition that, if combined, he will not be part of the control and supervision bodies of the enterprise.

Additionally, there are some restrictions on combinations based on age and depending on working conditions. For example, the following employees are prohibited from working in multiple positions:

- minors;

- working in hazardous conditions.

Part-time and combination

It is necessary to clearly distinguish between the concepts of part-time and part-time work, since these are two different categories that are formalized differently and paid differently.

A part-time worker is always an employee who performs other duties in his free time and such work can be indefinite.

A part-time worker is a person who, during his working hours, combines the performance of his main duties and additional ones. Such work is always temporary and cannot be performed without the written consent of the employee.

Remuneration for part-time workers and part-time workers occurs on different bases and is calculated differently. The first - based on the provisions of the employment contract, the second - by agreement of the parties. Usually this is a percentage of wages or a strictly agreed amount.

In addition, these two categories of employees are issued with different documents and are taken into account differently when filling out documents for the tax service. These two categories of workers - part-time and part-time workers - must be correctly taken into account and properly registered at the enterprise in order to avoid fines.

In addition, there is a certain circle of people who cannot perform part-time work:

- heads of enterprises and organizations;

- minors;

- performing work under harmful and difficult working conditions, if part-time work implies the same conditions.

COMBINATION OF PROFESSIONS (POSITIONS)

According to Art. 151 of the Labor Code of the Russian Federation, with the written consent of the employee, he may be entrusted with performing, during the working day (shift), along with the work specified in the employment contract, additional work in a different or the same profession (position) for an additional fee. The amount of additional payment is established by agreement of the parties to the employment contract, taking into account the content and (or) volume of additional work.

At the same time, in order to fulfill the duties of a temporarily absent employee without release from work specified in the employment contract, the employee may be assigned additional work in either a different or the same profession (position).

The period during which the employee will perform additional work, its content and volume is established by the employer with the written consent of the employee.

How is part-time work paid?

The main thing to remember when calculating part-time wages is that a part-time worker is the same employee as everyone else, he just works part-time or part-time, depending on his work schedule.

p>Wages for part-time workers are calculated on a general basis, taking into account all additional payments, bonuses, coefficients and allowances that are due to main employees.

For example, those performing work in the Far North and similar areas are entitled to a bonus for working conditions - this bonus also applies to part-time workers.

Remuneration for combined labor

The work of employees who perform additional duties within one working day (shift), along with their main activities, is regulated by Article 60.2 of the Labor Code of the Russian Federation. It says that such additional functions must be paid additionally. Let's look at how this happens in practice.

How are combined positions paid on weekdays?

The law does not establish any restrictions or even recommendations for additional payment for combining positions; payment is determined by agreement between the employee and the employer. The main thing is that the principle of its calculation or size is indicated in a written document. Such a document is an additional agreement to the main agreement.

Payment for combination can be:

- piecework (depending on the volume of work performed);

- time-based (proportional to the time spent);

- in a fixed amount agreed upon by the parties.

Combination: payment for work on holidays

But what if an unusual situation arises? For example, an employee must go to work on a holiday or weekend or work part-time.

Let’s assume that the management of an organization has a production need to involve an employee in the performance of official duties on a public holiday. During the New Year holidays, the company carried out a full inventory, so the presence of accountant Kurochkina, who also holds the position of economist, was required to replace Myshkina, who had gone on maternity leave. Article 153 of the Labor Code of the Russian Federation states that in such conditions payment is provided in double amount:

- double piece rates;

- double time tariffs;

- double salary

However, what if there is only one person, but he performs the duties for two? Since this situation is not separately regulated in labor legislation, the employer can be guided by the principle of paying only for the work that a person performs under given conditions. In our example, an accountant is needed for inventory; all the company’s economists were on vacation. Therefore, these days it is necessary to pay double salary for the position of an accountant, and the work of an economist may not be paid at all.

Also, when calling an employee to work on holidays, do not forget to comply with the requirements of Article 113 of the Labor Code of the Russian Federation: request the employee’s written consent to leave, ask the opinion of the trade union (if any) and issue an appropriate order.

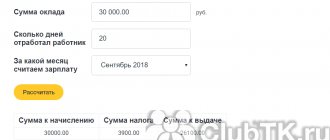

Part-time salary

The specifics of calculating wages for a part-time worker are regulated by Article 285 of the Labor Code of the Russian Federation.

As a rule, part-time workers are paid based on hours worked. Therefore, the minimum wage for part-time workers is lower than for main workers, even taking into account all the bonuses, incentives and allowances.

The legislation does not limit either the number of part-time jobs or the number of hours that a part-time worker can spend on other duties in his free time from his main job. But for civil servants, a part-time working day cannot exceed four hours.

However, sometimes in enterprises it happens that a part-time worker receives a salary equal to the salary of the main employee and even exceeding it. This is a rather risky move on the part of the administration, since the main workers, receiving wages according to the payroll, may be outraged by this state of affairs and complain to the State Labor Inspectorate about wage discrimination. Theoretically, this should not happen, because a part-time worker works half as much as the main employee, and under the same conditions, according to the law, remuneration should be carried out equally for everyone. At the same time, the Labor Code provides for the possibility of setting wages for part-time workers not according to the number of hours worked, but according to other conditions.

For example:

- by the number of assembled production units;

- by the quantity of goods sold;

- by volume of services sold.

Thus, for half a working day, a part-time worker with higher qualifications, better skills and greater efficiency can earn more than the main employee. If this point is stipulated in the employment contract, the employer has the right to pay a part-time worker greater amounts than the main employees of the enterprise receive - the law will not be violated, and the labor commission inspector will not have any questions for you.

Amount of surcharge

Remuneration for combined work must be differentiated. When agreeing on a specific size, the importance of additional work, its volume, complexity of implementation, and the overall workload of the employee when combining two activities are taken into account.

In practice, limits are rarely set for the amount of co-payments. There are also frequent cases when the responsibilities of an absent employee are not completely transferred to his colleague, but are redistributed among several employees at once. But even in this case, according to the Labor Code, they are entitled to pay for part-time work. With one limitation: the total amount of additional payments should not exceed the savings in the salary fund for vacant positions.

Minimum wage for part-time work

Since a part-time worker has all the rights and social guarantees of an ordinary employee, the provisions on the minimum wage (minimum wage) also apply to him - according to the Labor Code, the employee cannot receive less than this amount. At the same time, the legislation stipulates that the minimum wage is established subject to fully worked working hours; accordingly, a part-time worker who has worked half the established working time during the billing period receives half the minimum wage for part-time workers. If a part-time worker has worked a quarter of the established working hours, he receives a quarter of the minimum wage, and so on.

In this case, when calculating wages, taking into account all allowances and coefficients, the amount may be less than the minimum wage. For example, from January 1, 2013, the minimum wage per month is 5,205 rubles per month. Your part-time worker works at a quarter of the rate, a quarter of 5205 rubles is 1301 rubles. After making all the calculations, the amount you must pay to your part-time partner is 1000 rubles - that is, it turns out to be below the established minimum.

What to do in this case? The law provides for additional payment up to the minimum wage for part-time workers. That is, the employer pays an additional 301 rubles to the part-time worker from the above example to get the minimum wage.

How is part-time work different from combination?

Part-time work is a slightly different form of labor relations, different from combination work. Here, the employee performs labor functions not together with his main job, but before or after it. It is also possible that registration for different positions is carried out not on a full-time basis (for example, 0.25; 0.5; 0.75 rates).

Distinctive features of part-time work are the following:

- for each position, labor relations are formalized with the employee;

- the employee is obliged to obey the current internal rules of the organization regarding working hours;

- the type of part-time activity can be very different;

- the number of part-time jobs is not limited by law (the main thing is that the employee is physically able to fulfill all the obligations assumed), with the exception of certain cases (in particular driving vehicles).

Remember, the main difference between a part-time job and a part-time job is the opportunity to work in various positions in your free time, both within the enterprise and outside it. In this case, such labor relations are formalized in a separate employment contract.

It is important to note that with a part-time job, the employee actually has additional full-time work, and not a temporary increase in the scope of responsibilities for the main job. He is obliged to fully fulfill the obligations assigned by job descriptions for each place of work.

Duration of work when combining and part-time

An important question is how much work you will have to do if you have a part-time job or a combination of positions. The answer to the question lies in the very nature of such relationships. If combining positions is work performed simultaneously with one’s main job, then the maximum amount of time that an employee must perform it should be limited to the same standard hours.

An exception may be the work of employees with irregular work schedules. But even here there are certain restrictions and compensations.

As for part-time work, this is actually a different job. Therefore, it should be performed during periods of time free from main work. Its duration should be sufficient for a person to have the opportunity to rest and prepare for his main work.

Typically, such work is limited by the time limit established by law. When an incomplete rate is not issued, its duration (and, accordingly, payment terms) are proportionally reduced.

Remember, with a combination job, you work one standard number of hours, as in your main job, while with a part-time job, you will have to work more than one monthly standard of hours.

Increased pay for a part-time worker

Compliance with the proportion “payment to a part-time worker is equal to 50% of the payment to the main employee” is not mandatory. The law does not establish such rules for payment of part-time work. Therefore, if desired, the parties can agree on other payment parameters.

In practice, there are cases when increased wages for part-time workers are challenged by regulatory authorities. As a rule, this happens if a part-time worker is assigned a payment from the social insurance fund (for example, in connection with sick leave). In such cases, the courts usually side with the employer.

Expert opinion

Labor Lawyer Olga Smirnova

For example, in a dispute considered by the Federal Arbitration Court of the Ural District in case No. A50-4231/2011 dated December 30, 2011, the court did not find any violations in the actions of the employer who set a part-time salary in the amount of the full salary of the general director. The arguments of the pension fund authorities that this situation was created artificially for the purpose of unjustifiably receiving funds from a state extra-budgetary fund did not find support.

Minimum wage for part-time worker

The opposite case is when the employer wants to set a part-time worker the minimum possible salary. The minimum wage is established by federal law (Article 133 of the Labor Code of the Russian Federation), while regions can establish their own minimum wages.

For part-time workers, the minimum wage is set in proportion to the time worked. The employee's salary should not be lower than the minimum wage, recalculated for full working time. This position is set out in letter of the Ministry of Labor of the Russian Federation dated June 5, 2021 No. 14-0/10/B-4085.

If the part-time worker’s payment is lower than this rate, an additional payment must be made up to the minimum wage.

For example, if the general director works in an organization at 0.1 rate, his salary should be no less than 0.1 minimum wage in a given region.