Today you can find a lot of different information in newspapers, on websites on the Internet, in online legal databases, which can help an accountant calculate vacation pay for employees in the appropriate form for one reason or another. This material will be useful to employees themselves who do not understand all the nuances of the rules for calculating vacation pay and amounts paid, because it is not easy to understand all this.

We will also try to clearly explain all the vicissitudes of the system for postponing weekends and how they differ from holidays, and also talk about how vacation pay and wages are paid along with vacation pay.

How vacation pay and salary are paid along with vacation pay

Theory

The vacation system is allocated a separate chapter in the Labor Code under number 19 with the same name - “Vacations”.

The first thing you need to know is that vacation is allocated to the employee annually. An employee has the right to take advantage of the opportunity to take leave after six months of continuous work. However, if there is an agreement, then leave can be issued earlier than six months (Article 122 of the Labor Code of the Russian Federation).

Important ! As stated in Article 125 of the Labor Code of the Russian Federation, by agreement between the employee and the organization, vacation can be divided into parts. In this case, one part should not be less than 14 calendar days.

Article 125 of the Labor Code of the Russian Federation

As stated in Article 114 of the Labor Code of the Russian Federation, personnel are given paid vacations every year with the right to retain their place of work and salary.

The number of days of paid leave annually, according to Article 115 of the Labor Code of the Russian Federation, reaches 28 days. It turns out that for a year of work an employee receives 28 days of vacation.

If you try to calculate everything, it turns out that 2.33 vacation days are given monthly for work (we divide 28 days by 12 months).

The employee has the right to receive 28 days of paid leave

Please note that work experience that provides leave with pay does not include the following:

- days of absence of a person without a good reason;

- vacation days that were used to care for children;

- days of vacation “at your own expense”, which exceeded fourteen days per working year.

Important ! Remember that according to the law, salary is a reward for the work on which you spend your time, which can be converted into working days.

This nuance hides the difference between salary and vacation pay:

- the salary is given for the time you worked and is calculated by working days.

- Vacation pay is given for calendar days and is calculated based on average income.

Vacation must be paid

How to correctly calculate vacation pay: procedure and calculation rules, what has changed in 2021

In modern society, employees are entitled to leave in almost every state. But its duration differs in different countries. Russian legislation in this regard is one of the most loyal.

The length of paid leave varies from country to country

In the Labor Code (LC) of the Russian Federation, issues of the duration of leave, extension or division of it into parts are established in Chapter 19. The duration of work in the company, sufficient to receive leave, is also regulated there.

Number of vacation days

Article 115 of the Labor Code gives each employee the right to rest for 28 calendar days once a year. If these days include public holidays, they are excluded from the calculation and the vacation becomes slightly longer.

For certain professions and industries (Article 120 of the Labor Code of the Russian Federation), longer vacations or days added to the main vacation are provided.

Table: who is entitled to additional annual leave

| Name | Base | Number of additional calendar days of vacation |

| Irregular working hours | Art. 119 Labor Code of the Russian Federation | 3 |

| Working conditions were found to be harmful or dangerous as a result of a special assessment | Art. 117 Labor Code of the Russian Federation | at least 7 |

| Work in the Far North | Art. 321 Labor Code of the Russian Federation | 24 |

| Work in areas equated to the regions of the Far North | Art. 321 Labor Code of the Russian Federation | 16 |

| General practitioners who have worked continuously for 3 years | Decree of the Government of the Russian Federation of December 30, 1998 N 1588 | 3 |

| Disabled people | Art. 23 Federal Law of November 24, 1995 N 181-FZ | basic leave up to 30 calendar days |

| Certain categories of employees at the discretion of the employer | Part 2 Art. 116 Labor Code of the Russian Federation, local regulations | by employer's decision |

| Due to occupational illness | pp. 10 paragraph 2 art. 17 Federal Law of July 24, 1998 N 125-FZ | for the entire period of treatment and travel time to the place of treatment and back |

| Junior medical staff caring for HIV-infected people | Decree of the Government of the Russian Federation of December 30, 1998 N 1588 | 14 |

| Air traffic controllers | Resolution of the USSR Ministry of Labor No. 11 of May 29, 1991 | up to 33 working days |

| Donors | Art. 186 Labor Code of the Russian Federation | 1 day for each day of blood donation (if not used immediately) |

| Astronauts | Government Decree No. 455 of May 17, 1993 | annually up to 45, after the flight - additionally - 30 days |

| Persons exposed to radiation | Law 2-FZ dated 10.01.02 | 14 |

| Municipal employees | Law 25-FZ of 03/02/07 | up to 30 everyone |

| Prosecutors, investigators, scientific and teaching staff of the department | Law 2202–1 of January 17, 1992 | 30 |

| Teaching staff at different levels | Decree of the Government of the Russian Federation of May 14, 2015 N 466 | Duration of vacation - 42 or 54 days by groups of employees |

| Health care workers at risk of contracting tuberculosis | Order of the Ministry of Health, Ministry of Defense, Ministry of Internal Affairs, Ministry of Justice, Ministry of Education, Ministry of Agriculture and Federal Border Guard Service of May 30, 2003 No. 225/194/363/126/2330/777/292 | 14 |

| Health care workers involved in mental health care | Resolution of the Ministry of Labor dated 07/08/93 No. 133 | 30 |

| Workers in mining operations for exploration and extraction of uranium, beryllium, thorium ores in nuclear energy | Resolution of the USSR State Committee for Labor of 02/05/91 No. 24 | from 7 to 42 days by employee category |

| Metallurgical and mining workers | Resolution of the USSR State Committee for Labor of 02/05/91 No. 23 | 28 |

| Coal, oil shale and mine construction workers | Resolution of the Council of Ministers of the USSR and the All-Russian Central Council of Trade Unions dated 07/02/90 No. 647, Resolution of the State Labor Committee of the USSR dated 02/05/91 No. 27 | from 7 to 14 |

| FFOMS employees | Order of the Federal Compulsory Medical Insurance Fund dated 01.09.09 No. 196 | from 6 to 21 by personnel category |

| Electric power industry workers with harmful and difficult working conditions | Resolution of the USSR State Labor Committee of 02/05/91 No. 25 | from 7 to 14 by personnel category |

| Workers in construction, reconstruction, technical re-equipment and major repairs of underground structures | Resolution of the USSR State Committee for Labor of 02/05/91 No. 26 | from 7 to 14 by personnel category |

| Workers extracting and transporting salt | Decree of the USSR State Committee for Labor of 03/01/91 No. 56 | from 7 to 14 by personnel category |

| Workers in the extraction and transportation of non-metallic minerals | Resolution of the USSR State Committee for Labor of 02/05/91 No. 28 | from 7 to 28 by personnel category |

| Employees of internal affairs bodies | Decree of the Government of the Russian Federation dated January 23, 2001 No. 48, Order of the Ministry of Internal Affairs dated December 28, 2007 No. 1236 | 15 |

| Customs officers | Law of July 21, 1997 No. 114-FZ, art. 36 | vacation 30 calendar days excluding travel to the place of vacation and back |

| Ministry of Emergency Situations employees | Law of August 22, 1995 No. 151-FZ Art. 28 | from 30 to 40 days depending on experience |

| Athletes and coaches | Article 348.10 of the Labor Code of the Russian Federation | 4 |

| Judges | Law of June 26, 1992 No. 3132–1 Art. 19 | 30 working days and additionally taking into account experience in law: 5–10 years - 5 rubles. d., 10–15 years - 10 rub. d., more than 15 years - 15 rubles. d. |

Leave time

To receive leave for the first time at a new place of work, you must work for at least six months.

The Labor Code provides for categories of employees who can receive leave without working for six months. This:

- workers under 18 years of age;

- women before going on maternity leave or immediately after maternity leave;

- employees who adopted a child (children) under the age of 3 months.

Typically, vacation days are set on a schedule, which allows employees to plan their vacation, and the employer to avoid critical gaps in business when too many employees go on vacation at the same time.

Leave for minors and those working in hazardous conditions must be granted annually. The rest are prohibited from not being released for two years in a row (Article 124 of the Labor Code of the Russian Federation). Cash compensation is allowed to replace only part of the annual leave exceeding 28 days (Article 126 of the Labor Code of the Russian Federation). An employee can use the next vacation all at once or in separate parts (Article 125 of the Labor Code of the Russian Federation). The only condition: one part of the vacation during the year should not be shorter than 14 calendar days.

A non-standard case is when an employee fell ill while on vacation, consulted a doctor and filed for sick leave. Then he can stay on vacation longer by as many days as he was officially ill (Article 124 of the Labor Code of the Russian Federation). In this case, the vacationer can agree with the employer to transfer the vacation days that he was sick to another period.

Formula for calculating the amount of vacation pay

Calculation of amounts to be included in vacation pay must be carried out in accordance with Art. 139 Labor Code of the Russian Federation. We start by determining the average daily earnings. For this:

- the amount of all accruals of payment to the employee for work activities for each of the 12 months preceding the month the vacation begins is taken;

- the resulting amount is divided by 12 months and the average monthly number of calendar days. This number is fixed at 29.3 days;

- if the year is not fully worked, all earnings are summed up and divided by the number of days. It is calculated as follows: the number of full months worked is multiplied by 29.3,

- to this is added the number of days worked in partial months.

Special formulas are used to calculate vacation pay

Average daily earnings are multiplied by the number of vacation days. This will be the amount of vacation pay. Income tax is calculated from it, and what remains after deducting the tax will be payment for the days of the next vacation, which the employee will receive before leaving.

If the calculation is carried out for an employee from a category of personnel for whom, according to the Labor Code of the Russian Federation, the duration of vacation is determined in working days (for example, these are judges), then the amount of accrued pay is divided by the working days of the six-day working week established by the working calendar for the same 12 months.

Please note that from May 1, 2021, the procedure for calculating vacation pay for low-paid employees who received monthly earnings less than the minimum wage has changed. For such workers, vacation pay should be calculated not on the basis of actual earnings, but on the basis of daily earnings calculated from the current minimum wage.

From May 1, the minimum wage became 11,163 rubles. It is important that for all those going on vacation, the average monthly earnings used to calculate vacation pay must, from May 1, be no lower than the newly established minimum wage amount. This is provided for in clause 18 of the Regulations approved by Decree No. 922 of the Government of the Russian Federation dated December 24, 2007. If a vacationer’s monthly earnings were less than the new minimum wage and his vacation began after May 1, 2021, he received vacation pay in April based on the previously valid minimum wage, then he should be given an additional payment to his vacation pay taking into account the new minimum wage.

Video: vacation pay - calculation, accrual, payment

What income is taken into account when calculating vacation pay?

Income included in vacation pay is subject to the rules for calculating average wages. They are defined in the Decree of the Government of the Russian Federation of December 24, 2007 N 922 “On the specifics of the procedure for calculating average wages.”

When calculating vacation pay, all amounts that are included in the wage system are taken into account:

- salary;

- payment for piecework;

- payments of interest from the sale of goods or provision of services, commissions;

- bonuses according to the bonus regulations;

- regular bonuses (regional, for length of service, qualifications, hazardous working conditions, etc.);

- royalties and royalties;

- wages paid in non-monetary form.

Bonuses accrued per month are included in full, and quarterly or annual bonus payments are first divided by the number of days of the bonus period, and then multiplied by the days of the bonus period worked by the employee in the months included in the calculation of vacation pay.

There are amounts that are not included in the calculation of vacation pay:

- social benefits and material assistance (payment for food, recreation, training);

- compensation payments, for example, payment for cellular communications, travel, etc.

Video: calculating vacation pay according to the law

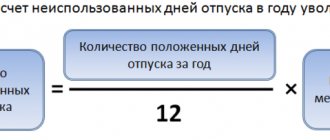

How are vacation pay calculated upon dismissal?

Art. 127 of the Labor Code of the Russian Federation gives each employee the right (except for those whom the employer dismisses for actions reflected in Article 81 of the Labor Code of the Russian Federation, for example, absenteeism or theft) to declare in writing that he intends to resign, having previously taken unused vacation days. Then the day of dismissal is considered the last day of vacation.

An employee may withdraw his resignation letter. But he has the right to do this only before going on vacation and if another person has not already been hired in his place.

If an employee simply resigns for any reason provided for by the Labor Code, the accountant, when making calculations, additionally accrues payment for vacation days that the employee did not use.

Preparation for calculating vacation pay begins with determining the number of vacation days already used by the employee over the last working year. The number of unspent vacation days is calculated by dividing the duration of the vacation by 12 and multiplying the result by the number of months remaining until the end of the employee’s working year. They calculate payment for unused days using the same formulas as if they were simply providing vacation. Vacation pay is paid to the employee simultaneously with full payment upon dismissal.

If a situation arises when an employee, before dismissal, spent more vacation days than corresponds to the part of the working year he worked, then upon dismissal, the amount of vacation pay for the overused days is deducted from the employee’s full pay.

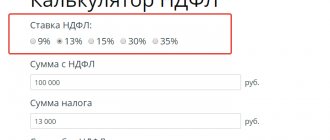

Information about 6-NDFL

Form 6-NDFL was introduced into the circulation of tax reporting documents not so long ago. Since the beginning of 2021, all companies and entrepreneurs who have hired employees are required to report in the form of this form.

6-NDFL must be filled out so that the organization can provide the income of employees and send it to the Federal Tax Service.

Important ! This declaration is submitted to the tax authorities quarterly by all companies that have entered into agreements with individuals.

Form 6-NDFL

6-NDFL must be completed if you need to pay your salary in installments. Moreover, if income tax was deducted from an employee twice in parts, then the information must also be provided twice. Similar actions must be taken for issuing vacation pay. How to properly fill out this declaration? When is it not necessary to issue it? And what should you pay special attention to when sending a report to the tax office?

Basic moments

Citizens who live on the territory of the Russian Federation and receive wages must pay taxes. The amount of taxes depends on the salary and status of the citizen.

The 2-NDFL certificate is already known to everyone and has become a reporting standard. This certificate is issued by both individuals and legal entities.

Important ! If it is not, then a fine will be charged.

2-NDFL

Last year, the Federal Tax Service introduced another form, which is submitted by companies and organizations every quarter. Declaration 6-NDFL shows special nuances that are associated with income and taxes.

This declaration is filled out by employers for the total payroll tax of employees who are individuals and working in the state, and the 2-NDFL certificate refers to reporting for a specific employee.

The declaration can be submitted:

- electronic;

- on paper.

If the declaration is submitted on paper, then this method is more suitable for organizations with no more than 25 employees.

Important ! If there are many employees, then the 6-NDFL certificate must be sent electronically.

Form 6-NDFL is completed by employers

Income that is subject to personal income tax is indicated in the above certificate. This includes, in addition to salary, bonuses, incentives and vacation pay.

How to indicate wages along with vacation pay in 6-NDFL?

When filling out this declaration, it is important to remember that it is not necessary to indicate non-taxable income. The document must contain all information about the tax agent and his obligations to the tax authorities.

In the 6-NDFL declaration, vacation pay and wages are required to be indicated, as are bonuses along with sick leave. These types of returns are taxed at a rate of 13 percent and must be reported on tax documents.

In addition to income received by individuals, the following data must also be displayed:

- date of sending money to the employee’s account (actual);

- date of withholding of personal income tax;

- the day the tax is sent to the tax authorities of the Federal Tax Service.

Form 6-NDFL indicates taxable income

One of the main requirements when submitting a certificate is the mandatory compliance with all deadlines set by the Federal Tax Service. The first certificate is sent to the authorities no later than May, and the last one – before April of the following year.

Important ! Moreover, the latest report must be submitted together with the first certificate for the next year that has begun, but no later than May.

In order not to delay the submission of 6-NDFL certificates, you should personally go to the tax authorities to submit the certificates. If the documentation is sent by mail, you must require official confirmation of receipt of the letter.

If the declaration is submitted electronically, then all dates will be indicated automatically and there is no need to worry about them.

You can submit the 6-NDFL declaration electronically

All information on employee income must be indicated in the document for a specific date. For example, if an employee took a vacation, but not a full one, but wanted to divide it into parts, then, accordingly, payments are indicated separately. Similar actions are performed with salaries: the date of the advance and the date of the main payment are indicated, which are written separately from each other.

Important ! In the case where wages and vacation pay were paid together, the company indicates this in the certificate, otherwise an error will occur, which will lead to various sanctions, including a fine.

Payment period

By law, salaries must be paid twice a month. The employee receives first an advance and then the principal amount. Along with the salary, temporary disability benefits are also paid.

Excerpt from Article 136 of the Labor Code of the Russian Federation

Employees have the right to leave once a year while maintaining their job and average salary. An employee must receive vacation pay 3 days before going on vacation.

It is also not prohibited to pay these funds ahead of schedule. Many employers do not particularly want to pay funds after the vacation has begun, since sanctions and fines are possible in the event of an audit.

There are special schedules indicating vacations. This is done in order to notify the employee in advance about the start of the vacation and prepare the money for him.

Vacation pay must be paid to the employee no later than three days before the start of the vacation.

Important ! If the period before the vacation falls on a holiday, weekend or any other day when the employee should not be at work, then vacation pay is paid on the working day that falls before the weekend or holiday.

The same rule applies to salary transfers. Banks and other organizations do not make payments on weekends, which means that funds will be transferred on a working day and before the start of the vacation.

Which fund is it paid from?

Temporary disability and maternity benefits come from the Social Insurance Fund and the employer.

These benefits are a guarantee of a social level in case of short-term disability. Vacation funds are paid by the employer, that is, at his expense.

An employee cannot be insured if he loses the opportunity to go on vacation every year. An employee can also refuse to go on vacation and receive funds for this in the form of compensation.

Article 126 of the Labor Code of the Russian Federation

Important ! It is necessary to take out insurance only when a person may lose his usual income. In such cases, the state undertakes to support citizens.

Only the employer is responsible for paying vacation pay. Each organization has special reserve funds for payment, as this is a legal requirement. The amount of money in reserves depends on the organization's initial capital.

Important ! In the case when reserve funds are greater than the authorized capital, the organization can use this money for other purposes and increase the authorized capital.

Employers may have different motivations for creating reserve funds. This may include costs to cover losses, pay off debts and provide benefits to employees. This fund is created to pursue only one goal - to pay various funds to employees, regardless of the income of the organization.

The enterprise must create a reserve wage fund

Important ! This reserve is created through payments for working hours, payments for unworked hours, incentives, allowances for food, apartments, and fuel. Salaries and vacation pay are paid from a single reserve.

What sizes?

The legislation of the Russian Federation acts as a guarantor of the right to rest while maintaining a job every year. In addition to the workplace, wages are also maintained. The amount of funds and compensation for untaken vacation depends on the amount of income.

The following types of calculations are used:

- the duration of the settlement period is calculated;

- the employee’s income for this period is calculated;

- average income is calculated;

- the amount of vacation pay is formed.

When an employee goes on another paid leave, he retains his workplace and SDZ

The rules for calculating the average salary are unified, and they include all types of income. The settlement period depends on the duration of work in the organization.

The specified period cannot exceed one year. Estimated time is calculated in calendar days and months.

Excerpt from Article 139 of the Labor Code of the Russian Federation

Important ! A calendar month is the time from 1 to 30 or 31. In February it is 28 or 29 days.

The calculation period will always be the year that elapsed before the start of the holiday. If an employee worked less than this period, then the calculation takes into account the time based on documents indicating his working time in the organization.

The table below will show the difference between calculations of income and expenses for vacation pay.

| When calculating the amount of vacation pay, it is necessary to deduct | When calculating income for vacation pay, they exclude |

| periods when the employee received average income; | vacation pay, income for business trips and other income established on the basis of average earnings; |

| days when the employee was temporarily disabled; | income for the time when the employee could not work temporarily and was on maternity leave; |

| days when the employee was on vacation without retaining his salary. | payment for caring for disabled children. |

When calculating earnings for calculating vacation pay, periods when the employee did not perform work for any reason are not taken into account.

After all the calculations, you need to calculate the average income per day.

Coefficient for calculating vacation pay in 2021 - formulas and calculation examples for different situations

Depending on various conditions, when a citizen receives vacation pay, different calculation procedures may be determined.

We list what situations may arise and how compensation will be calculated.

When working for a full year

The calculation formula is the same as we indicated above.

And the average daily earnings must be calculated using the following formula:

When working for less than a year or month

The calculation should be carried out using the same general formula, but the average daily earnings should be calculated using this formula:

The number of days worked in an incomplete month should be calculated using the following formula:

Follow these instructions when calculating vacation pay:

- First, let's use the second formula to count days.

- Next, we count the days that the employee worked in full. To do this, we multiply the number of months worked in full by the established coefficient - 29.3.

- Add to the resulting amount the number of days the employee did not work in the month.

- We divide the employee's total income by the resulting amount. This is how we get the average daily earnings.

- Then we multiply it with the number of vacation days.

Here's an example:

Citizen Soloviev worked from February 19, 2021 to January 31, 2018. He held the position of “fire safety inspector” and received a monthly salary of 20 thousand rubles.

|

For unused vacation

The formula for calculating compensation will not be general. It should be replaced not with the total number of vacation days - but with the days that the employee is entitled to rest, depending on the period worked.

That is, citizen Soloviev from the example above will receive a different vacation pay.

Since he worked for 10 months, he is entitled to 23.3 days of vacation. We multiply the average daily earnings of 551.5 with 23.3. We get: 12,849.95 rubles.

When paying bonuses

As we wrote above, some bonuses and additional payments are taken into account when calculating the employee’s total income.

When the full period , bonuses are simply added to annual earnings. The total income changes, but the calculation scheme does not change.

And when the period was not fully worked out , bonus payments are calculated as follows:

The annual or reporting bonus can be adjusted. But monthly and quarterly bonuses will be taken into account in full.

In this article, we indicated in more detail what payments are taken into account when determining vacation pay.

With a multiplying factor

The coefficient is easy to calculate:

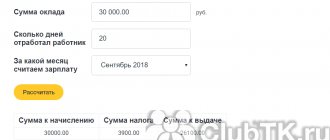

Vacation pay calculation

According to Article 139 of the Labor Code of the Russian Federation, the average salary allocated for vacation pay (and payments for vacations that were not used) is calculated for the previous twelve months. If you add up the salary and other payments issued monthly, you can get the total amount of income, and it is further divided by twelve months and multiplied by 29.4 (the average number of days in the calendar).

Important ! Using this method, you can calculate the “cost of one day” for vacation pay.

It is worth remembering: in the contract, internal rules or other internal document there may be other intervals for calculating the average salary.

As a rule, SDZ is calculated based on data from the previous 12 months

It follows that when determining other intervals for calculating SDZ, accountants must carry out operations as required in the Labor Code of the Russian Federation and as specified in the rules of the organization, and then compare the results.

Important ! These calculations are needed to provide reasoned confirmation that the situation of employees is not worsening.

There is the following formula for calculating the average salary when determining vacation pay.

Vacation day price = Amount of payments that is taken into account to calculate the average income for 12 months/12/29.3.

Vacation pay is calculated according to certain formulas

The amount of vacation pay is calculated using the formula:

Amount of vacation pay = cost of a day of vacation * number of days on vacation.

Calculation example.

Employee N. went to work at organization “E” on June 1, 2013. The employee wants to go on vacation from July 1, 2021 to July 28, 2019.

This period is taken from the period from July 1, 2019 to June 30, 2021. As a result, employee N.’s monthly salary will be 7,856 rubles.

In addition, the employee also received a bonus of 15 thousand. All this is included in the annual income, which will be 109,272 rubles.

Important ! If you have information about the billing period and total salary income, it will be possible to determine how much the employee received on average per day.

To do this, you need to perform the following calculations: 109272:12:29.3=311. The result is an average daily income of 311 rubles. The amount of vacation pay will be 8,708 rubles.

When calculating vacation pay, the price of the vacation day is taken into account

Vacation pay calculator

Go to calculations

Summer is coming, which means the holiday season begins. All employees are looking forward to a well-deserved rest, and accountants and HR officers stock up on patience and coffee, because they have to calculate a lot of vacation pay. Our article will help you understand all the intricacies of calculating vacation pay in 2021.

So, to calculate vacation pay in 2021, we will need the following information about the employee:

- Duration of vacation

- Billing period

- Average monthly number of days worked in the billing period

- Average employee salary

Let's start in order.

- The duration of annual leave is 28 calendar days. Typically, employees take 14 days of vacation approximately every six months in accordance with the vacation schedule or by agreement with management. It is important to remember that only an employee working under an employment contract has the right to leave.

- Billing period. If an employee has been working in an organization for more than a year, then his pay period is 12 calendar months preceding the month of vacation. If an employee has been working for less than a year, then the months that the employee worked in this company are taken into account.

For example, Ivan Sidorov has been working at Horns and Hooves LLC since January 15, 2021. On May 23, 2021, he should be granted annual paid leave. The billing period for Ivan Sidorov is from May 1, 2021 to April 30, 2021.

- The average monthly number of days worked by the employee in the reporting period. According to the amendments made to Article 139 of the Labor Code (Law No. 55-FZ), the average monthly number of calendar days is set to 29.3. If the employee’s pay period included excluded periods: vacations, business trips, periods of temporary disability, etc., then for each month the number of days worked is calculated individually using the formula:

For example, Ivan Sidorov was on sick leave from April 3 to April 9. This means that the average monthly number of days worked in April is: 29.3/31*(31-6) = 23.6.

- Average employee salary. What is included in the concept of accounted payments of the billing period? These are all the payments that were accrued to the employee for his work: salary, bonuses, allowances, etc. This also includes annual bonuses that were not included in the billing period.

For example, Ivan Sidorov goes on vacation on April 15, and on April 6 he was awarded an annual bonus. This premium is not included in the billing period (since the billing period is from April 1 to March 31), but must be taken into account when calculating payments.

The payments taken into account do not include sick leave, business trips, vacation pay, etc. The average daily salary of an employee is calculated using the formula:

Moreover, if in the billing period there was an incompletely worked month, then the formula looks like this:

For example, the amount of payments to Ivan Sidorov for the billing period amounted to 440,000 rubles. This means that the average daily payment was 440,000/12*29.3 = 1251.4. And if for some reason he did not work for 6 days in June and the amount of payments was 420,000, then the average daily payment would be: 420,000/29.3*11+23.4 = 1241.9.

Thus, we come to our main task - calculating vacation pay. The vacation pay itself is calculated simply:

The issue of payment of vacation pay along with salary

Legislatively, salary payments and all the nuances are enshrined in Article 136 of the Labor Code of the Russian Federation, which also stipulates the deadlines. Funds are paid twice a month, unless there are other conditions in the employment contract.

In addition, the employee has the right to receive funds for temporary disability and other compensation, including for not using legal leave. It is worth remembering that, as a rule, it is impossible to receive money for annual leave along with your salary, but this is not prohibited by law. In this case, however, all funds for vacation pay and salaries are calculated from the organization’s single reserve.

Important ! It is clear that it is better for accountants to deduct funds up to three days before the employee goes on vacation. This is due to the fact that documentation may be delayed and if funds go through the cash register, then it is better to pre-pay the required funds to the employee.

As a rule, wages and vacation pay are not paid together

Vacation pay is not a constant amount - everything is calculated based on the duration of the settlement period, total income, payments, average earnings per day and the number of vacation days.

The amount of vacation pay varies for everyone. These funds are not paid as a lump sum with the salary. Three days are specifically provided before the start of the vacation.

What happened in 2021?

Changes in the timing of vacation pay in 2021 are not related to amendments to the law, but to specific court decisions.

First, Perm Regional Court on January 23, 2018. declared it legal to hold the employing organization liable for late payment of vacation pay, then a number of similar decisions followed. The company's employees, including accountants and HR department inspectors, were brought to administrative liability. At the same time, the court did not take into account the references to the agreement with employees, since the indication of Art. 136 of the Labor Code of the Russian Federation is imperative.

The court also considered the defendant’s legal position and the reference to Rostrud’s letter to be untenable. And the organization’s fault was precisely the payment of vacation pay within three days, taking into account the day of payment (employees went on vacation on Monday and received funds on Friday). The court considered that this was a violation of workers’ rights, since the Labor Code obliges vacation payments to be made within 3 days without taking into account the day of payment, so that three full calendar days pass. The court refuted the reference to Rostrud’s letter with the norm of Part 8 of Art. 136 of the Labor Code of the Russian Federation, which states that if the date of payment coincides with a non-working day, the employer is obliged to make payment in advance, the day before.

Violation of the terms of payment of vacation pay is punishable quite harshly according to the norms of the Code of Administrative Offenses. An organization for violating labor legislation faces a fine of up to 50,000 rubles; officials may also be fined up to 5,000 rubles.

Taking into account all of the above, the employer should, in order to avoid fines, carefully consider the timing of payment of vacation pay, since transferring or issuing them earlier is not prohibited by labor legislation. If an employee goes on vacation on Monday, the funds must be provided to him on Thursday (or earlier if Thursday is also a non-working day).

Is it possible to quit without working for two weeks?

⇐Subscribe to our channel in

Yandex.Zen !⇒

What is the correct way to pay vacation pay: together with the salary or immediately

The law does not prohibit paying salary with vacation pay. As was written above, an employee can only ask for salary and vacation pay to be paid on the same day. Vacation pay is paid three days before the actual start of the vacation, and salary is paid twice a month.

Important ! Accordingly, payment days may not coincide.

The employer has the opportunity to pay vacation pay ahead of schedule. This is not prohibited by law.

The employer can issue vacation pay earlier

How to receive vacation pay along with salary? If the employer has such an opportunity, then he can pay the funds to the employee along with vacation pay. In addition, an employee can receive funds for temporary disability and funds for not going on vacation. All these funds are paid to the employee from the fund according to the salary.

Important ! In the case when the money comes from the bank, it is worth remembering that the funds will arrive only the next day.

The amount of vacation pay will be different for everyone. When employees have the same salary, even then they may end up receiving different amounts. It all depends on the number of days that are considered worked per year. Not subject to accounting:

- days of receiving average salary income;

- days when the employee is sick;

- days when the employee takes vacation at his own expense.

Important ! At such moments, accounting employees should be especially vigilant when working with documents and reports, and monitor each payment to a specific employee.

You can ask the employer to pay salary and vacation pay immediately

In the event that an employee has not received a salary while on vacation, he will have the opportunity to receive funds on the day of settlement of the salary. If it is possible to make calculations and accrue salary during vacation, the employee will be able to receive it.

FAQ

Is the company obliged to pay wages along with vacation pay for the days worked in a given month? An employee goes on vacation in the middle of the month.

According to the law (Article 136 of the Labor Code of the Russian Federation), 3 days before going on vacation, only the vacation itself is paid. The law does not provide for the payment of vacation pay along with payment for days actually worked.

It follows from this that the day before the vacation, the employer must pay the employee only the average earnings for the vacation period. The salary for employees on vacation for the period of work before going on vacation is paid within a single set time frame - on a day determined by the regulations within the enterprise and the contract.

However, the Labor Code of the Russian Federation allows for an improvement in the employee’s situation - salary can be accrued more often than twice a month.

Salary can be paid more than twice a month

Consequently, the company can pay the employee funds before the start of the vacation, immediately with vacation pay, i.e. before the due date for salary deduction. In this case, all the nuances of salary payment are agreed upon with the employee.

If the preliminary payment of the salary was a one-time payment, then it will be enough to write a statement indicating the desire to issue the salary earlier than the deadline.

If employees wish to continue to receive salaries earlier than the established period, we would recommend discussing this condition in the employment contract and other documents.

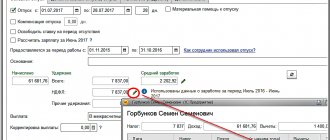

Calculation of average earnings for vacation pay - formula and calculation example

When calculating compensation for vacation, many have a problem with determining the amount of average earnings per day.

In 2021 we will use the same scheme as in the past:

Here's an example of a calculation:

| Citizen Ivanov worked from September 2021 to September 2018. During this time, he received a bonus payment of 5 thousand rubles. The amount of wages he received monthly was 15 thousand rubles. Let's determine what the amount of daily earnings and vacation pay will be.

So, we calculated the average daily earnings. It can be inserted into the general formula for calculating vacation pay. We multiply the resulting amount by the number of days allotted for rest. For example, 28. Vacation pay for Ivanov will be 14,732.48 rubles. |