General approach

It is advisable to complete the certificate in question in one of 2 ways:

- On company letterhead.

- Place a corner stamp of the company indicating the legal address.

Here is the most important thing that needs to be reflected in the certificate of average earnings for the employment center in 2021:

- TIN and OKVED of the employer;

- FULL NAME. a former employee who requested a certificate;

- legal name of the enterprise;

- the entire period of work of the former employee;

- the amount of calculated average earnings for the last 3 months (in numbers and in words);

- number of calendar weeks of paid work 12 months before dismissal;

- the number of working hours per day and working days per week on a full-time basis, indicating dates;

- the number of working hours per day and working days per week on a part-time basis, indicating dates;

- article of the Labor Code of the Russian Federation, on the basis of which part-time work is established;

- periods excluded from the calculation (dates and reasons for exclusion);

- the basis for issuing the certificate (indicate the employee’s personal account, pay slips, etc.);

- FULL NAME. and signatures of the head of the organization and the chief accountant;

- date of issue of the certificate;

- phone number to contact the company.

Also see “How to fill out a certificate of average earnings for the employment center.”

How to fill out form 0504425

The form consists of 3 parts:

The first (header) indicates the name of the organization and its affiliation, and the personal data of the employee.

The second part (substantive): section 1 contains information that serves as the basis for further calculations - the number of days, accrued amounts, billing period, and so on; Section 2 - the calculation of average earnings and the derivation of the final amount to be paid to the employee.

The third (formal) – the signatures of the responsible persons are required; in this form, not only the last sheet of the document is drawn up, but also the data given in section 1 of the second part (since it is from them that the funds due to be paid to the employee will be calculated).

On the form of the Ministry of Labor

To begin with, we will give an example of a certificate of average earnings, the form of which was developed and recommended by the Ministry of Labor of the Russian Federation in letter dated August 15, 2021 No. 16-5/B-421. You can download it from our website using the following direct link .

EXAMPLE

Shirokova Elena Alekseevna worked at Guru LLC from October 1, 2009 to November 25, 2021. The main activity of the company is non-specialized wholesale trade. According to OKVED it has code 46.90.

Address of Guru LLC: 111456, Moscow, st. Tkatskaya, 17, building 6. Contact phone number. TIN 7719123456.

Throughout the entire period of her work at Guru LLC, Shirokova had a standard working week – an eight-hour, five-day week.

During the 12 months before the day of dismissal, Shirokova was on sick leave from 09/06/2016 to 09/14/2016 (period excluded from the calculation).

Shirokova’s average earnings over the last 3 months before leaving the company were 45,000 rubles 10 kopecks.

Based on these data, the accountant of Guru LLC needs to prepare and issue to her a completed certificate of average earnings for the employment center within 3 working days from the date of receipt of Shirokova’s application (Article 62 of the Labor Code of the Russian Federation).

Below is a sample certificate of average earnings in 2021 on the form of the Ministry of Labor.

Since the rules for filling out this certificate are not approved by law, it is not entirely clear, it is necessary to provide specific details of the employee’s personal account and payment documents on the basis of which he received earnings and the company made the corresponding calculations.

Also see “Form for a certificate of average earnings for the employment center.”

Legislative framework of the Russian Federation

valid Editorial from 15.12.2010

detailed information

| Name of document | ORDER of the Ministry of Finance of the Russian Federation dated December 15, 2010 N 173n “ON APPROVAL OF FORMS OF PRIMARY ACCOUNTING DOCUMENTS AND ACCOUNTING REGISTERS APPLIED BY PUBLIC AUTHORITIES (STATE BODIES), LOCAL GOVERNMENT BODIES, MANAGEMENT BODIES OF STATE NON-BUDGETARY FUNDS, STATE ACADEMIES OF SCIENCES, STATE (MUNICIPAL) INSTITUTIONS AND METHODOLOGICAL INSTRUCTIONS FOR THEIR APPLICATION" |

| Document type | order, guidelines, list |

| Receiving authority | Ministry of Finance of the Russian Federation |

| Document Number | 173N |

| Acceptance date | 01.01.1970 |

| Revision date | 15.12.2010 |

| Registration number in the Ministry of Justice | 19658 |

| Date of registration with the Ministry of Justice | 01.01.1970 |

| Status | valid |

| Publication |

|

| Navigator | Notes |

ORDER of the Ministry of Finance of the Russian Federation dated December 15, 2010 N 173n “ON APPROVAL OF FORMS OF PRIMARY ACCOUNTING DOCUMENTS AND ACCOUNTING REGISTERS APPLIED BY PUBLIC AUTHORITIES (STATE BODIES), LOCAL GOVERNMENT BODIES, MANAGEMENT BODIES OF STATE NON-BUDGETARY FUNDS, STATE ACADEMIES OF SCIENCES, STATE (MUNICIPAL) INSTITUTIONS AND METHODOLOGICAL INSTRUCTIONS FOR THEIR APPLICATION"

Note-calculation on the calculation of average earnings when granting leave, dismissal and other cases (form code 0504425)

A note-calculation on calculating average earnings when granting leave, dismissal and in other cases (hereinafter referred to as the Note-on-calculation (f. 0504425) is used to calculate average earnings to determine the amount of payment for vacation, compensation upon dismissal and other cases in accordance with current legislation .

Information about the type of leave, the start and end date of the leave, its duration, the period for which the leave is granted is filled out on the basis of the order. The number of the Note-Calculation (f. 0504425) corresponds to the number of the order (instruction) of the institution on granting leave to the employee.

The header part of the Calculation Note (f. 0504425) indicates the period for which leave is granted, as well as the period of time in which the employee is granted leave.

In the table “Number of billing days” you should indicate the number of days of the main, additional or (in the free column) other type of vacation.

The “Salary by month” table is filled out on the basis of the Certificate Card (f. 0504417). This table is filled out if the calculation period for calculating average earnings is 12 months (for example, payment for the duration of training in advanced training courses). The amount of annual earnings and the number of days actually worked for the year from the column “Total for the year” is transferred to page 2 in the corresponding columns of line 04 “Total for billing months.”

In the table for calculating accrued wages, lines 01, 02, 03 are filled in when the payroll period is 3 months. The number of days worked and the amount of accrued wages in a given billing period is filled out on the basis of the Certificate Card (f. 0504417) taking into account the provisions established by labor legislation.

The indicators “Days” and “Amount” on line 04 are equal to the sum of the indicators on lines 01, 02, 03 of the corresponding columns.

The indicator “Average monthly earnings” on line 05 is determined by dividing the amount on line 04 “Total for billing months” by 12 months or by 3 months (depending on the length of the billing period).

The indicator “Average daily earnings” on line 06 is determined by dividing the amount on line 04 by the number of days on line 04 of the corresponding column.

The amount for vacation for the current month on line 07 and for the next month on line 08 is determined by multiplying the average daily earnings indicated on line 06 in column 12 by the number of vacation days falling respectively on the current and future months.

The amount on line 09 “Total for vacation” is equal to the amount of lines 07, 08.

Line 10 “Salary for the current month” reflects the salary for the time actually worked in the current month before the onset of vacation on the basis of the Certificate Card (f. 0504417).

Indicators for column 12 “Total” are determined by summing columns 4, 7, 10 for each line (01-11).

In the table for calculating “Deducted from wages,” the amount of income tax (columns 3-5) is determined by multiplying the amount from page 2 to line 11 “Total accrued” minus the established tax deductions by the tax rate separately for each type of source.

The indicators in the sections “Other deductions” and “Paid wages” (columns 6-10) are filled in on the basis of the Certificate Card (f. 0504417).

The sum in column 11 “Total” is equal to the sum of columns 3 - 10.

The amount payable is determined as the difference between column 12 on line 11 on page 2 “Total Accrued” and column 11 on line 01 on page 3 “Deductions”.

The amount payable is recorded as an accounting entry in the debit and credit of the corresponding accounts.

On a regional form

It should be noted that your sample certificate of average earnings for an employment center can be approved at the level of a constituent entity of the Russian Federation by the body responsible for labor relations in the region.

For example, in Moscow - this is Appendix 1 to the order of the Department of Social Protection of the City of Moscow dated December 24, 2021 No. 1721. Appendix No. 1 approves the form of the Moscow certificate. You can download it from the official website using the link. Here is her form.

The following is an example of filling out a certificate of average earnings, which can be used by employers registered in Moscow if they wish. Let's take the same conditions as a basis. And we additionally point out that from February 8 to July 15, 2016, Shirokova, on the basis of Part 1 of Article 93 of the Labor Code of the Russian Federation, worked part-time.

In our opinion, the second (Moscow) sample for filling out a certificate of average earnings in 2021 is even easier to complete than the one developed by the Ministry of Labor, since it includes a smaller number of mandatory details related to calculating the average earnings of a resigned (dismissed) employee for the last 3 months.

Also see “Average earnings for 3 months: how to calculate.”

It is important to say that each regional employment center develops its own form. Therefore, before filling out the certificate, contact the territorial office of the employment service for the form. Submission of a certificate not in the form approved by the regional employment center may be the reason for refusal to assign unemployment benefits (letter of Rostrud dated November 8, 2010 No. 3281-6-2).

Read also

26.04.2017

For which organizations is it valid?

A note-calculation on calculating average earnings was developed for use by public sector organizations:

- authorities;

- local government;

- off-budget funds;

- other recipients of budget funds.

This is the primary document that serves as an accounting register for wages (vacation pay and other payments) for government agencies - based on its results, the accounting department makes entries in the debits and credits of the corresponding accounting accounts.

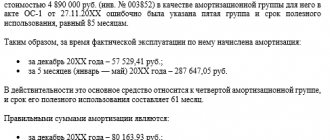

Despite the fact that the form approved by Order of the Ministry of Finance of March 30, 2015 No. 52n is relatively new, when filling it out one should, among other things, be guided by Government Decree on the calculation of the average salary No. 922 of December 24, 2007 - this is confirmed by the letter of the Ministry of Finance dated October 27, 2017 No. 02-06-10/70870.

SDZ for sick leave

Step 1: Determine the billing period

The billing period is two calendar years before the employee’s sick leave.

Nikolai fell ill on June 17, 2021. The billing period is from January 1, 2018 to December 31, 2021.

If during the billing period the employee was on parental leave or maternity leave, one or both years can be replaced by others - before the leave. But only if the replacement increases the benefit amount. To do this, the employee writes an application to replace one or two years of the pay period with the years before the vacation.

Step 2: calculate the employee’s earnings for the pay period

Take into account all payments to the employee from which contributions for disability were transferred: for example, salary, bonuses, vacation pay.

Do not take into account sick leave, financial assistance up to 4,000 rubles, daily allowance up to 700 rubles and other payments from Article 422 of the Tax Code.

If an employee has been working for you for less than two calendar years, look at his income in the salary certificate from the previous company.

Income must be taken into account within limits. The maximum amount of income per year is limited by the amount from which contributions are calculated. Minimum - the minimum wage multiplied by the number of months in the billing period. If your income for the year does not fit into these limits, take the minimum or maximum amount.

Maximum income:

- for 2021 - 718 thousand rubles

- for 2021 - 755 thousand rubles

- for 2021 - 815 thousand rubles

- for 2021 - 865 thousand rubles

The minimum income is calculated using the formula 24 x minimum wage:

- from January 1, 2021 to June 30, 2021 - 148,896 rubles

- from July 1, 2021 to June 30, 2021 - 180 thousand rubles

- from July 1, 2021 to December 31, 2021—RUB 187,200

- from January 1, 2021 to April 30, 2021 - 227,736 rubles

- from May 1, 2021 to December 31, 2021 - 267,912 rubles

- from January 1, 2021 - 270,720 rubles

- from January 1, 2021 — 291,120 rubles

If your income for the year does not fit into these limits, take the minimum or maximum amount.

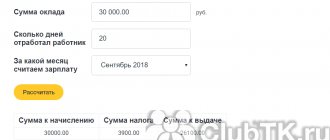

Step 3: Calculate your average daily earnings

Average daily earnings = Payments for the billing period / 730