Astral

February 1, 2021 5718

EGAIS

Any delivery of goods is accompanied by a consignment note. Upon receipt of the goods, you must check the goods that arrived to you with those indicated in the invoice. If everything is correct, information is sent to EGAIS that the invoices from the supplier have been accepted. If the invoice indicates the wrong product that you received, then a discrepancy report will be sent to EGAIS.

TTN must be confirmed in EGAIS within three days from the date of delivery if the supplier’s warehouse is located within your city. If the warehouse is located in the region, then confirmation of the invoice should take no more than seven days.

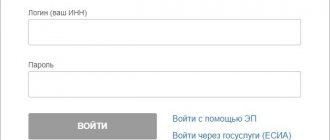

Confirmation of the TTN takes place in your personal EGAIS account using the connection of your accounting program and UTM with the system.

- Before confirming the TTN, recalculate the quantity of the products that were delivered to you. Compare it with the nomenclature and electronic invoice from the supplier in EGAIS.

- If the quantity of goods actually received matches the electronic invoice, a report is sent to EGAIS that the invoice has been accepted - this is confirmation of the TTN in EGAIS. After this, the system debits the amount and quantity of delivery from the supplier’s account and credits it to your account.

There are situations when the wrong product may be delivered that you ordered, or glass containers may be damaged during transportation. In this case, a certificate of refusal to accept the invoice is submitted to EGAIS, and the goods are returned to the supplier.

- If there is a significant discrepancy between the data in the invoice and the actual products delivered

- The supplier did not deliver the goods: regardless of whether you were warned about this or not, you can still refuse

- The delivered goods do not meet the quality: expired, damaged packaging, missing excise stamps, etc.

How does the TTN load into EGAIS?

The corresponding document is drawn up in a special accounting program. An information system is also used to record all data. To process the invoice after scanning the stamps in EGAIS, you need to issue a TTN manually or perform the operation using the special tab “Exchange UTM with EGAIS”. After uploading a document, it must acquire the appropriate status, for example, “Accepted for processing,” “Confirmed,” or “Rejected.” If EGAIS does not receive invoices, you need to edit the document in accordance with the methodological recommendations and then try to upload the document again.

Features and timing of confirmation of invoices in EGAIS

Recording of relevant information is usually carried out through your personal account on the egais web portal. Before uploading a document, it is necessary to check the invoices in the Unified State Automated Information System using the TTN. To do this, the manufacturer will need to perform the following steps:

- Calculate the available number of APs and compare them with nomenclature information.

- Compare the information on the consignment note provided in paper form with the data in the electronic system.

Wholesale and retail companies, at the time of receiving the goods, must check the invoices in the Unified State Automated Information System, checking all the data. If everything agrees, a corresponding act is drawn up. Then, automatically, the quantity and amount of the AP supply is debited from the account of the production association and transferred to the account of the wholesale and retail company.

If there are discrepancies in the data, you must ask the manufacturer to make the appropriate adjustments and re-send the invoice to EGAIS using your personal account. In addition, you will also have to send a discrepancy report to the production company. In the event that the production association refuses to accept the discrepancy report, your store will need to return the AP to the production association.

Based on the current legal norms and approved standards of the law regulator, the period for confirming the delivery note in the Unified State Automated Information System is 3 days after the official delivery date. This applies to all those production associations that are located in the city or near it. When the warehouse of a production association is located in a rural area, 7 days are allocated to confirm the document. If, after checking the status of the invoices, any difficulties arise, you will need to contact technical support on the official egais website.

Important! Data uploaded to the unified state information platform cannot be changed. If errors are subsequently identified during registration, it is necessary to post the invoice in EGAIS, that is, reject the document.

Invoices are not re-sent via EGAIS - solution

> Services

11.10.2019

All subjects of the alcohol market must ensure that the data required by law is uploaded into a single database. Recording of relevant information is necessary for the legal circulation of alcoholic beverages on the territory of the Russian Federation.

Confirmation of invoices in EGAIS is the basis of the document flow. Not only information about invoices, but also data about excise stamps and other information are loaded into a single platform.

This helps the government surveillance sector track all movements of the AP from the starting point to the ending point.

The EGAIS system was created for the purpose of checking invoices. This includes suppliers of strong alcohol-containing drinks, as well as beer products.

A production association engaged in the sale of AP must take care of providing the relevant information to a single electronic platform.

At the same time, a representative of the wholesale and retail segment is obliged to reconcile the actual delivery with what is recorded in the confirmed invoice through the EGAIS personal account. If there are discrepancies, appropriate documentation must be drawn up.

Working with TTN is easy! How to confirm invoices in EGAIS, refuse them and re-send them?

EGAIS stands for a unified state automated information system for monitoring the circulation of alcohol-containing goods on the territory of the Russian Federation.

The system began to operate relatively successfully in 2009, when the Government of the Russian Federation made a significant number of amendments to the operating procedure of the system, as well as to the system itself for regulating alcohol-containing products.

Due to the fact that EGAIS began to be used everywhere quite recently, many of its users still have questions regarding the operation of the service - we will talk about how to confirm and re-send invoices with its help in this article.

Dear readers! Our articles talk about typical ways to resolve legal issues, but each case is unique. If you want to find out how to solve your particular problem, please use the online consultant form on the right or call. It's fast and free!

Confirmation via personal account

The system provides not only for the creation of waybills , but also for the procedure for accepting the consignment note by the parties, re-sending if an error occurs, and filing a refusal. In addition, the system allows you to view delivery discrepancy reports and other documents directly related to the receipt of alcohol and other alcohol-containing goods in stores.

When is it needed?

Russia has established measures to control the circulation of alcohol-containing goods within the country. The EGAIS itself was initially introduced precisely with the goal of eradicating the phenomenon of counterfeit alcohol, which spread in the 90s.

Confirmation of invoices is one of the mandatory stages in controlling the circulation of alcohol: the alcohol supplier is obliged to send it to the TTN system, but only the recipient can indicate the legal purity of the delivery, the quality of the alcohol and other important things. It is he who makes the confirmation, refusal or statement of discrepancy - the entire operation of the system depends on his feedback.

Confirmation of invoices in EGAIS is an obligation, not a right:

How does the receiving company accept the invoice?

- Acceptance of goods. On the unified information portal, select the corresponding “Acceptance” tab.

- Excise scanning. During the period of receiving the AP, a representative of the wholesale and retail company scans each excise stamp from the bottle.

If the number of bottles of alcoholic beverages matches the invoice, you will need to select the “Accept” button. In case of refusal, a discrepancy report is automatically generated.

Who should confirm invoices and what is needed for this?

In accordance with current practice, the invoice in Unified State Automated Information System is usually accepted by the recipient of alcohol-containing products. He will need to upload the document and check the electronic information with the submitted papers and the number of APs. If there are no discrepancies, you need to confirm the invoice document in the Unified State Automated Information System, and if there are discrepancies, issue a statement of disagreement.

The manufacturer or supplier company has the right to provide the relevant document within 3 days. Therefore, usually the document is confirmed within a few days; of course, the reconciliation time also needs to be taken into account here, since the recipient also needs to check everything.

EGAIS from 07/01/2018

An innovation was introduced on the alcoholic beverages market on July 1, 2018. According to it, each participant in the mentioned market must carry out individual accounting of each product that is marked - in the process of writing off or receiving goods. Let us note the importance of such changes, which make it possible to track the movement of each unit of production from the factory to the end consumer. At the same time, the possibility of counterfeit alcohol becoming available for sale is eliminated. Please note that the changes affected the accompanying documentation, the declaration for alcohol, and the possibility of submitting documents through the public services portal.

Registration of batch and branded products If we are talking about alcoholic products that were received before the date of introduction of innovations, then sales deadlines will be introduced in relation to them, a period will be named during which such goods will have to be withdrawn from circulation. However, batch products are still available on sale today. The rules for registering and shipping such goods with Unified State Automated Information System have not changed. It turns out that in the process of receiving products it is necessary to confirm the invoice, check the goods, and also transfer it for registration to Register No. 2. As for sales, there are no observations noted here. When reading the excise stamp, when the receipt is punched at the cash register, alcoholic beverages are written off from the second register.

But when accepting labeled alcoholic beverages that come from the factory, retail companies are required to scan the excise stamp on each bottle. This measure will make it possible to verify the actual goods received with the products that were received according to the invoice documentation from the Unified State Automated Information System. However, if discrepancies are identified, action will be taken. Otherwise, the actual balances available in the warehouse will not correspond to the balances listed in the unified state automated information system. Note that with the new format of the specified system, such events are not allowed. Therefore, it will not be possible to consume alcoholic beverages.

Products for which import and production records are kept in batches have an appropriate name. For such goods, marks could also be linked previously. In other words, accounting in this case is carried out in the context of each commodity unit, and not as a whole batch. Batch products include alcohol, for which marking is not carried out during the production or import process. This also includes goods for which brands were not indicated during transportation, shipment or write-off. This applies to goods that were released or imported before July 1, 2018.

It should be noted that the innovations associated with the registration and acceptance of alcohol brands in Register No. 3 are associated only with brands of a new type, if excise stamps were indicated during the acceptance process from the supplier. If the alcohol was received with old brands, and the supplier does not provide information about them, then, as before, you can carry out accounting according to the data given in Registers No. 1,2.

Rules for working with Register No. 3 Please note that not everyone has the correct idea of Register No. 3 in EGAIS.

The third register has nothing in common with the first and second registers. This is just a reference document in which the stamps are stored. There is no need to enter any data into the third register, as was the case before. Then incoming products were transferred from the first and second register to the third register. For these purposes, a transfer document was created in a special form. Moreover, there is no need to write off certain products in the third register.

Goods entered into the Unified State Automated Information System by brand are written off from the first register immediately after sale in automatic mode.

Upon receipt of goods, alcoholic beverages are stored in Register No. 1. As for the information on stamps that were scanned upon acceptance, they are stored in the third register. Thus, when drinking alcohol with new brands, there is no need to transfer to Register No. 2. It will be enough to reconcile goods based on the mechanisms implemented in accounting programs. Next, all that remains is to confirm the invoice.

It is important to note that the rules for drinking alcohol with old excise stamps have not changed. Now, as before, the receipt operation is confirmed first, and only then is information about the product transferred to the second register.

Discrepancy between the balances in the declaration and the Unified State Automated Information System data

During the first quarter, business entities submitted declarations for the products under study. After that, they received notifications from FSRAR, which stated that the balances in the declaration for the 1st quarter did not coincide with the balances listed in the Unified State Automated Information System. It is noteworthy that all those who had a difference of more than 100 liters received a similar message. This means that a certain error in the declaration is allowed, since business entities use different procurement and sales methods. For example, a product shipped on March 31, 2018, but confirmed in the Unified State Automated Information System on April 1, 2018. In this case, the invoice dated March 31, 2018 must be taken into account in the declaration. As for EGAIS, the invoice will be accepted for registration in the next quarter, immediately after confirmation is made.

Based on data from the first quarter, not a single company received a fine. The fact is that it is possible to eliminate significant errors in the second quarter. Speaking of such discrepancies, if they are identified, inspections at the enterprise may begin. And if the commission reveals violations, the companies will be subject to sanctions:

— legal entities will receive a fine of 150-200 thousand rubles;

- individuals - 10-15 thousand rubles (according to Article 14.19 of the Code of Administrative Offenses of the Russian Federation).

O and “B” Note that the transition to accounting by brand has certain advantages. In particular, from July 1, 2018, the list of documents that accompany drinks such as cider, beer, and mead has been reduced.

According to the amendments made to Article 10.2 of Law No. 171 of November 22, 1995, there is no need to issue certificates in Forms A and B on paper. However, this rule only applies if the business transaction is recorded in the Unified State Automated Information System. Thus, if a company sells mead, cider, beer at retail with new brands, then certificates A and B are not included in the accompanying documentation.

However, a clarification is given: the law does not apply to the wholesale level, but is valid only for retail sales. Moreover, the law does not apply to alcoholic products that are labeled using old brands.

Obtaining a license for alcoholic beverages through the government services portal

At the moment, licenses for the retail sale of alcoholic beverages are issued. You can apply for a license on the government services portal. Consequently, the applicant can control every stage of the application review. For this purpose, the site provides an Online personal account. It is enough to register and submit an application in a special section.

Before applying for a license, it is very important to check whether the company has any debts. If there are any, they need to be paid off. Documents must be submitted no earlier than ten days after payment of the debt amount. This can be explained by the fact that requests for data on debts are requested from the Federal Tax Service. For these purposes, it takes at least 10 days for the debts to be paid.

So, the applicant must be very careful: if the debt is not repaid, then the state fee for obtaining a license will not be returned. Moreover, it will need to be paid a second time.

Changes in “1C: Retail 8”, “1C: Trade Management 8”, “1C: UNF 8” The main reform that concerns EGAIS in terms of configurations of the latest releases of “1C” is a check (mandatory) of labeled alcohol before confirming the invoice , which comes from EGAIS. This mechanism is the same in any configuration of the 1C program. After receiving the invoice, a reconciliation is carried out based on the fact of the received products, and the data is verified with the Unified State Automated Information System.

Thus, on the document “USAIS Consignment Note”, on the “Products” tab, you must select “Check received goods”. After which the “Checking incoming products” form will open. This is where each tax stamp is scanned.

Until the check starts, positions are assigned the “Not Checked” status. As soon as the stamp is scanned, the status changes: “In stock”. In some cases, the status is indicated as “Postponed” - if the position is not identified or there were failures during its search. If a product is unavailable, the status “Unavailable” appears.

When inconsistencies are identified in the system, it is important to accurately reflect the location in which the unit of production stands. It is noteworthy that you can leave the position unchanged (the program indicates the place automatically). In manual mode, you can move a product unit to the desired location.

Nowadays you can find a lot of batch alcoholic products on the market. Goods of this kind, in comparison with piece alcoholic products, are shipped without reference to the excise stamp.

In the “Checking incoming products” window, “Batch products” appears on a separate tab. Such goods can be received through two methods. Let's analyze each method.

Method No. 1. The company ships products piece by piece, scanning stamps and transferring them to Register No. 3. In this case, when checking, you need to scan excise stamps, as well as barcodes on packages. After confirmation of the invoice, excise stamps are transferred to the balance of the third register. The “Act of registration on the balance sheet of the Unified State Automated Information System” is used. Then select the option “Register in Register No. 3”.

Method No. 2. Goods for which there are no excise stamps on the invoice are accepted as consignment goods. On the “Checking incoming products” form, in the “Batch products” tab, in the “Fact” field, indicate the number of goods for which brands are not available.

At the end of the check, the “Check complete” command is executed. If the goods actually correspond to the invoice in Unified State Automated Information System, then the invoice is submitted for confirmation. If some discrepancies are detected, or if the required position is not found when scanning the excise stamps, then a confirmation is sent and a discrepancy report is generated automatically.

To keep records of discrepancies, during the process of registering receipts in the database, you need to check the “There are discrepancies” checkbox. Such a mark will become available only when the sending of the discrepancy report to the Unified State Automated Information System is confirmed.

And this is another change that is integrated into new versions of 1C. In early releases of programs from this document, a report on the presence of discrepancies was sent to the Unified State Automated Information System. The fact is that this act was not automatically generated during the process of sending confirmation. At the moment, the checkbox is only needed to record discrepancies directly in the database.

There are no changes observed in terms of labeled alcoholic products. As before, after the invoice is confirmed, the data is transferred to Register No. 2. Write-off of sold products is carried out from Register No. 2 through the “Write-off Certificate”.

An innovation was introduced on the alcoholic beverages market on July 1, 2018. According to it, each participant in the mentioned market must carry out individual accounting of each product that is marked - in the process of writing off or receiving goods. Let us note the importance of such changes, which make it possible to track the movement of each unit of production from the factory to the end consumer. At the same time, the possibility of counterfeit alcohol becoming available for sale is eliminated. Please note that the changes affected the accompanying documentation, the declaration for alcohol, and the possibility of submitting documents through the public services portal.

Registration of batch and branded products If we are talking about alcoholic products that were received before the date of introduction of innovations, then sales deadlines will be introduced in relation to them, a period will be named during which such goods will have to be withdrawn from circulation. However, batch products are still available on sale today. The rules for registering and shipping such goods with Unified State Automated Information System have not changed. It turns out that in the process of receiving products it is necessary to confirm the invoice, check the goods, and also transfer it for registration to Register No. 2. As for sales, there are no observations noted here. When reading the excise stamp, when the receipt is punched at the cash register, alcoholic beverages are written off from the second register.

But when accepting labeled alcoholic beverages that come from the factory, retail companies are required to scan the excise stamp on each bottle. This measure will make it possible to verify the actual goods received with the products that were received according to the invoice documentation from the Unified State Automated Information System. However, if discrepancies are identified, action will be taken. Otherwise, the actual balances available in the warehouse will not correspond to the balances listed in the unified state automated information system. Note that with the new format of the specified system, such events are not allowed. Therefore, it will not be possible to consume alcoholic beverages.

Products for which import and production records are kept in batches have an appropriate name. For such goods, marks could also be linked previously. In other words, accounting in this case is carried out in the context of each commodity unit, and not as a whole batch. Batch products include alcohol, for which marking is not carried out during the production or import process. This also includes goods for which brands were not indicated during transportation, shipment or write-off. This applies to goods that were released or imported before July 1, 2018.

It should be noted that the innovations associated with the registration and acceptance of alcohol brands in Register No. 3 are associated only with brands of a new type, if excise stamps were indicated during the acceptance process from the supplier. If the alcohol was received with old brands, and the supplier does not provide information about them, then, as before, you can carry out accounting according to the data given in Registers No. 1,2.

Rules for working with Register No. 3 Please note that not everyone has the correct idea of Register No. 3 in EGAIS.

The third register has nothing in common with the first and second registers. This is just a reference document in which the stamps are stored. There is no need to enter any data into the third register, as was the case before. Then incoming products were transferred from the first and second register to the third register. For these purposes, a transfer document was created in a special form. Moreover, there is no need to write off certain products in the third register.

Goods entered into the Unified State Automated Information System by brand are written off from the first register immediately after sale in automatic mode.

Upon receipt of goods, alcoholic beverages are stored in Register No. 1. As for the information on stamps that were scanned upon acceptance, they are stored in the third register. Thus, when drinking alcohol with new brands, there is no need to transfer to Register No. 2. It will be enough to reconcile goods based on the mechanisms implemented in accounting programs. Next, all that remains is to confirm the invoice.

It is important to note that the rules for drinking alcohol with old excise stamps have not changed. Now, as before, the receipt operation is confirmed first, and only then is information about the product transferred to the second register.

Discrepancy between the balances in the declaration and the Unified State Automated Information System data

During the first quarter, business entities submitted declarations for the products under study. After that, they received notifications from FSRAR, which stated that the balances in the declaration for the 1st quarter did not coincide with the balances listed in the Unified State Automated Information System. It is noteworthy that all those who had a difference of more than 100 liters received a similar message. This means that a certain error in the declaration is allowed, since business entities use different procurement and sales methods. For example, a product shipped on March 31, 2018, but confirmed in the Unified State Automated Information System on April 1, 2018. In this case, the invoice dated March 31, 2018 must be taken into account in the declaration. As for EGAIS, the invoice will be accepted for registration in the next quarter, immediately after confirmation is made.

Based on data from the first quarter, not a single company received a fine. The fact is that it is possible to eliminate significant errors in the second quarter. Speaking of such discrepancies, if they are identified, inspections at the enterprise may begin. And if the commission reveals violations, the companies will be subject to sanctions:

— legal entities will receive a fine of 150-200 thousand rubles;

- individuals - 10-15 thousand rubles (according to Article 14.19 of the Code of Administrative Offenses of the Russian Federation).

O and “B” Note that the transition to accounting by brand has certain advantages. In particular, from July 1, 2018, the list of documents that accompany drinks such as cider, beer, and mead has been reduced.

According to the amendments made to Article 10.2 of Law No. 171 of November 22, 1995, there is no need to issue certificates in Forms A and B on paper. However, this rule only applies if the business transaction is recorded in the Unified State Automated Information System. Thus, if a company sells mead, cider, beer at retail with new brands, then certificates A and B are not included in the accompanying documentation.

However, a clarification is given: the law does not apply to the wholesale level, but is valid only for retail sales. Moreover, the law does not apply to alcoholic products that are labeled using old brands.

Obtaining a license for alcoholic beverages through the government services portal

At the moment, licenses for the retail sale of alcoholic beverages are issued. You can apply for a license on the government services portal. Consequently, the applicant can control every stage of the application review. For this purpose, the site provides an Online personal account. It is enough to register and submit an application in a special section.

Before applying for a license, it is very important to check whether the company has any debts. If there are any, they need to be paid off. Documents must be submitted no earlier than ten days after payment of the debt amount. This can be explained by the fact that requests for data on debts are requested from the Federal Tax Service. For these purposes, it takes at least 10 days for the debts to be paid.

So, the applicant must be very careful: if the debt is not repaid, then the state fee for obtaining a license will not be returned. Moreover, it will need to be paid a second time.

Changes in “1C: Retail 8”, “1C: Trade Management 8”, “1C: UNF 8” The main reform that concerns EGAIS in terms of configurations of the latest releases of “1C” is a check (mandatory) of labeled alcohol before confirming the invoice , which comes from EGAIS. This mechanism is the same in any configuration of the 1C program. After receiving the invoice, a reconciliation is carried out based on the fact of the received products, and the data is verified with the Unified State Automated Information System.

Thus, on the document “USAIS Consignment Note”, on the “Products” tab, you must select “Check received goods”. After which the “Checking incoming products” form will open. This is where each tax stamp is scanned.

Until the check starts, positions are assigned the “Not Checked” status. As soon as the stamp is scanned, the status changes: “In stock”. In some cases, the status is indicated as “Postponed” - if the position is not identified or there were failures during its search. If a product is unavailable, the status “Unavailable” appears.

When inconsistencies are identified in the system, it is important to accurately reflect the location in which the unit of production stands. It is noteworthy that you can leave the position unchanged (the program indicates the place automatically). In manual mode, you can move a product unit to the desired location.

Nowadays you can find a lot of batch alcoholic products on the market. Goods of this kind, in comparison with piece alcoholic products, are shipped without reference to the excise stamp.

In the “Checking incoming products” window, “Batch products” appears on a separate tab. Such goods can be received through two methods. Let's analyze each method.

Method No. 1. The company ships products piece by piece, scanning stamps and transferring them to Register No. 3. In this case, when checking, you need to scan excise stamps, as well as barcodes on packages. After confirmation of the invoice, excise stamps are transferred to the balance of the third register. The “Act of registration on the balance sheet of the Unified State Automated Information System” is used. Then select the option “Register in Register No. 3”.

Method No. 2. Goods for which there are no excise stamps on the invoice are accepted as consignment goods. On the “Checking incoming products” form, in the “Batch products” tab, in the “Fact” field, indicate the number of goods for which brands are not available.

At the end of the check, the “Check complete” command is executed. If the goods actually correspond to the invoice in Unified State Automated Information System, then the invoice is submitted for confirmation. If some discrepancies are detected, or if the required position is not found when scanning the excise stamps, then a confirmation is sent and a discrepancy report is generated automatically.

To keep records of discrepancies, during the process of registering receipts in the database, you need to check the “There are discrepancies” checkbox. Such a mark will become available only when the sending of the discrepancy report to the Unified State Automated Information System is confirmed.

And this is another change that is integrated into new versions of 1C. In early releases of programs from this document, a report on the presence of discrepancies was sent to the Unified State Automated Information System. The fact is that this act was not automatically generated during the process of sending confirmation. At the moment, the checkbox is only needed to record discrepancies directly in the database.

There are no changes observed in terms of labeled alcoholic products. As before, after the invoice is confirmed, the data is transferred to Register No. 2. Write-off of sold products is carried out from Register No. 2 through the “Write-off Certificate”.

Where and how to view invoices in EGAIS?

Heads of production associations or their authorized representatives can do this by going to the official egais website. You can check the status of the invoice through your EGAIS personal account. In this case, you will need to enter the following information:

- Identification number of the sending holding company.

- ID of the recipient company.

- Corresponding invoice number.

It should be noted that if a manufacturing enterprise does not know the number, it can obtain the data by contacting the official fsrar resource. As soon as you find the invoice in EGAIS by the corresponding number, you will be able to see the answer in the status. The answers may be as follows:

- "Accepted". In this case, you can be sure that all data is entered correctly. All you have to do is wait for a response from the recipient company.

- “Waiting for a response from EGAIS.” In this case, you should immediately write to technical support indicating the store identification number and TTN.

- "Refusal". This means that some of the data was entered incorrectly.

At the moment, in addition to the official service, there are special applications through which you can track the status of a document, which greatly simplifies many processes. When using third-party resources, you must be sure that the information will not become available to unauthorized persons. Therefore, it is imperative to read reviews about a specific application.

If the TTN is successfully registered, the sending company receives a registration receipt; in case of refusal, a receipt of refusal is received. After confirming the data, the TTN is redirected to the sender. In some cases, it happens that invoice documentation is lost. In most cases, this happens due to a failure in the 1C platform or due to the reinstallation of UTM. To solve the problem, you can contact fsrar support directly. When applying, you will definitely need to provide your identification information.

In some cases, situations arise when it is necessary to re-send the received TTN. The presented function is provided only for the recipient company. The manufacturer, unfortunately, cannot send its own documentation through the web resource a second time. In this case, you will need to select the “Resend” tab on the official web portal. If you have any difficulties, contact technical support, where they will tell you how to re-request an invoice in EGAIS.

Checking information from EGAIS document flow

The virtual platform check1.fsrar.ru is designed to search for invoices and acts in UTM.

In order to find out where the invoice or act is located in the document flow system, you only need to know the identification number of the transport package, which was assigned before sending.

The search can also be carried out using the invoice identifier. Thus, you can obtain information about the date and time the document entered the recipient’s UTM, as well as clarify its status in the EGAIS system.

In addition, you can find the invoices of interest sent from the EGAIS-manufacturer.

How to find an invoice

To find a TTN in the fsrar system, you need to know its WBRegId (identifier). Obtaining information about a document is carried out in the “Search by invoice identifier” tab. You must fill in the required fields of the form: enter the WBRegId of the invoice, indicate the fsrarid of the sender or recipient and enter the security code from the image. When finished, click the “Request” button.

Based on the results of an automatic check of the entire database, the requested consignment note will appear with all the information on it and related documents.

Checking the TTN in EGAIS - the manufacturer will allow you to find information about invoices sent through the system only starting from 02/15/2021. Documents that were sent before this date cannot be obtained from the system.

To search by transport package identification number, you must first find out what number is assigned to the TTN sent to EGAIS by the manufacturer. It must be requested directly from the accountant of the relevant company.

After the information is received, you can find the invoice yourself through the system. To do this, you will need the “Search for an invoice from EGAIS - manufacturer” tab. A form will appear where you need to fill in the required fields: indicate the registration number of the TTN and fsrarid of the recipient.

After entering all the data, you need to click on “Request” with your computer mouse and wait for the system to respond.

To obtain information from check1 by searching by transport package identification number, you need to know some data - package id from the Transport database. If the file is outgoing, you need to look among the UTM log files. If incoming, request the number from the counterparty.

After the id is received, you need to go to the page https://check1.fsrar.ru/. The search will be carried out in the “Search by transport package identifier” tab. You will need to fill in the required fields in the same way as in the previous cases. The sender's idfsrar must be the company identification number in the PAP system.

After filling out the data, you need to enter the number from the picture and click “Request”.

After a while, the search results will appear on the screen. The report will contain information about when the TTN was sent to UTM. And further to EGAIS. You can also find out when and what documents were sent in response to the TTN from EGAIS

No invoices found. What to do?

It may happen that the TTN disappeared from the UTM system or was not received from it. This happens due to 1C failures and when reinstalling UTM. To solve these problems, you can try to check the location of the invoice, request that it be resent from the system, or contact FSRAR.

To use any of the options, you need to know your idfsrar. This is the 12-digit number that is located on the envelope of the JaCarta kit. In addition, it can also be taken from the JaCarta Single Client program. This information is contained in the PKI section. Another place where the required identification number is located is the UTM system itself. You need to go to the “Certificates” section.

The invoice number, which you also need to know, can be requested from the supplier. In addition, it may be in the email received from FSRAR.

Having found out these basic data, you can proceed to receiving invoices that have not arrived. Their repeated request is carried out through the “Personal Account” on the EGAIS website - https://service.egais.ru/checksystem/check.

After passing the verification, entering the PIN code and selecting a certificate, you need to select the “Resending invoices” section.

A form will appear on the screen, you need to fill out all its fields, check the accuracy of the data and click on the “Submit” button.

To find out the location of the invoice, you must follow the steps listed in the instructions in the previous section.

If the problem cannot be solved and you need to contact FSRAR, you should use the “Contacts” section on the EGAIS or FSRAR website.

There are several opportunities for feedback: fill out the feedback form and send it, write an email, call the support line.

Responsibility for violation of terms of confirmation of TTN

All alcohol market entities are required to keep records and promptly enter information required by law. If this is not done, supervisory units may issue orders and then impose penalties. In addition to the enterprise, a fine may also be imposed on the general director of the production association. Both the supplier company and the recipient organization can be held administratively liable for the lack of an invoice in the Unified State Automated Information System. In this case, all unaccounted products may be confiscated by supervisory authorities. Therefore, a market participant must always monitor the status of the invoice to avoid negative legal consequences.