In what cases is a zero VAT return submitted?

Do I need to submit a zero VAT return?

Yes need! Moreover, like any VAT return, the zero return must also be submitted within the deadline established for this report. A zero VAT return is submitted in cases where there are no digital indicators to fill out its sections 2–12. This may occur at the beginning or at the end of the taxpayer’s work, during seasonal activities, or temporary breaks in work.

Note! The VAT declaration was updated by order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected] The form is used from the reporting campaign for the 4th quarter of 2021.

You will find a line-by-line algorithm with examples of filling out all twelve sections of the report in ConsultantPlus. Trial full access to the system can be obtained for free.

The declaration will not be zero if there is data to fill out at least one of these sections.

It must be submitted by all those persons who have an obligation to file a VAT return. This obligation applies to VAT taxpayers, tax agents, as well as non-payers of taxes or those exempt from paying VAT but issuing invoices. Tax payers are considered to be all legal entities and individuals - entrepreneurs who have chosen the general taxation system.

For information about who becomes a tax agent for VAT, read the article “Who is recognized as a tax agent for VAT (responsibilities, nuances)” .

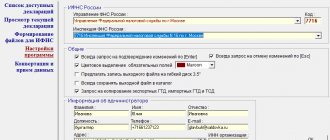

The VAT return must be submitted electronically. This also applies to a zero VAT return. As an exception, permission to submit this tax report on paper is granted only to tax defaulters (or exempt from payment under Articles 145, 145.1 of the Tax Code of the Russian Federation) who acted as tax agents in the reporting period (letter of the Federal Tax Service dated February 19, 2016 No. ED-3- 15/679, dated January 30, 2015 No. OA-4-17/ [email protected] ).

How will the VAT report be reflected in the single simplified tax return?

In a single simplified tax return, an entrepreneur will have to fill out only one sheet (the first, since the second is intended for individuals who are not individual entrepreneurs). It, as in a regular VAT report, will necessarily show:

- INN IP, his full name and contact phone number;

- the year to which the report relates;

- name and code of the tax authority;

- OKTMO codes (it should be reflected in the field intended for OKATO) and OKVED;

- number of completed pages (one);

- zeros (they act as dashes in this declaration) in the fields intended to indicate the number of documents attached to the report.

The differences will boil down to the following:

- You will need to enter data about the type of document (primary or corrective). In the case of an initial zero declaration, the number 1 will be reflected here.

- Information about the tax will appear in the main table of the report and will be indicated by entering its full name (value added tax) and the number of the chapter of the Tax Code of the Russian Federation regulating the application of this tax (for VAT this is 21). Here you should also make a note that the tax period for the tax is a quarter (this is equivalent to putting the number 3 in the corresponding field) and indicate the number of this quarter (01, 02, 03 or 04).

Thus, the same information will be included in a single declaration as in a regular VAT report compiled on the basis of zero data, but they will have a slightly different appearance.

Simplified VAT return

If during the reporting quarter there was no activity at all, and there was no movement in the current accounts and in the cash register of the enterprise, then the taxpayer can submit a single simplified declaration, which provides for the submission of information about the absence of grounds for payment of several taxes at once. A simplified VAT return (single) is submitted to the Federal Tax Service by the 20th day of the month following the reporting month (clause 2 of Article 80 of the Tax Code of the Russian Federation).

The form of such a simplified declaration was approved by Order of the Ministry of Finance dated July 10, 2007 No. 62n. The same order describes the procedure for filling it out and submitting it to the tax authority.

ConsultantPlus experts provided a step-by-step algorithm for filling out a single simplified declaration. If you do not have access to the K+ system, get a trial demo access for free.

Export deduction rules 2021

Currently (from July 1, 2016), the deduction of VAT on exports depends not only on the presence of documents confirming this activity, but also on what type of goods were shipped abroad:

- For non-commodity goods purchased after 01.07.2016, there is the right to deduct tax during the shipment period (paragraph 3, paragraph 3, article 172 of the Tax Code of the Russian Federation), i.e., to receive it, it is not necessary to wait for the collection of the full set of documents provided for in art. 165 Tax Code of the Russian Federation. Such deductions will not be shown in section 4. They should be reflected in section 3 (letter of the Federal Tax Service of Russia dated October 31, 2017 No. SD-4-3/ [email protected] ).

- For raw materials shipped for export, the deduction procedure has not changed; you can still claim it only after receiving the last document confirming the fact of export from the Russian Federation. The list of raw materials is determined by Decree of the Government of the Russian Federation dated April 18, 2018 No. 466.

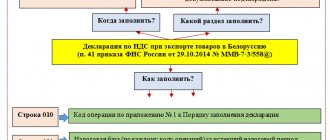

In the VAT return for taxes related to the export of raw materials that require confirmation, 3 special sections must be completed:

- 4 - for transactions with a confirmed right to apply a 0% rate;

- 5 - for transactions for which documents were collected earlier, but the right to deduction arose only now;

- 6 - for transactions that were found to have an incomplete package of supporting documents at the time of expiration of the period allotted for their collection.

The declaration form for the reporting periods for 2021 and the reporting periods of 2021 contains the order dated October 29, 2014 No. ММВ-7-3 / [email protected] as amended. Order of the Federal Tax Service dated August 19, 2020 No. ED-7-3/ [email protected]

ConsultantPlus experts explained in detail how to correctly fill out a VAT return when exporting. If you do not have access to the K+ system, get a trial online access for free.

A description of possible errors in the declaration can be found here .

How to fill out a zero VAT return

How to fill out a zero VAT return? Which sheets should be submitted in the zero VAT return?

A zero VAT return is drawn up on the form of this report valid for the corresponding period. Since there are no digital data to fill it out, only 2 mandatory sections are drawn up in it:

- title page;

- section 1.

You will find the details of how to fill them out below.

For individual entrepreneurs, we recommend our article “Zero VAT return for individual entrepreneurs on OSNO.”

Delivery method

The declaration, including the zero one, according to the generally accepted rules of tax legislation, is submitted only in electronic form. Before you fill out a zero VAT return on paper, you should know that the paper version of filing a document is allowed only in certain situations stipulated by the Tax Code of the Russian Federation. That is, a paper version of the report can only be submitted by legal entities or individual entrepreneurs that are not registered as VAT payers, but acted as such during the tax reporting period.

If a zero VAT return was filled out by VAT payers on paper, the fiscal authority may accept the document, but this will still be regarded as a violation of the Reporting Procedure and penalties may be applied to the taxpayer.

Features of filling out the title page

The title page contains information about the taxpayer, the Federal Tax Service and the tax period for which the report is being prepared. It states:

- Taxpayer codes and name.

When filling out the title page, the taxpayer must indicate his INN and KPP codes, the exact name (for legal entities - as stated in the charter, and for individual entrepreneurs - full full name, as in the passport). You should fill in the number of your Federal Tax Service (it is easy to find out by looking at your registration documents, or you can use the search on the Federal Tax Service website).

In the field “at location (accounting)” the codes are indicated that are given in Appendix 3 to the Procedure for filling out the declaration (hereinafter referred to as the Procedure) (Federal Tax Service order No. ММВ-7-3 dated October 29, 2014 / [email protected] ).

- Adjustment symbol.

When submitting the first declaration for the reporting period, you should enter code 0 in the “Adjustment number” field, and when submitting clarifying reports, the following serial numbers should be entered.

- Taxable period.

When specifying the tax period, the appropriate code is entered (their list is contained in Appendix 3 to the Procedure). So, when submitting a reporting declaration for the 1st quarter, code 21 is entered. And if, for example, a declaration for the 1st quarter of a company that is being liquidated or reorganized is submitted, then 51 should be indicated.

- Other marks.

The title page should indicate the number of pages on which the declaration is drawn up. Also indicate whether the report was submitted by the taxpayer himself (tax agent) or his authorized representative. It is imperative to decipher the full name and position of the responsible person who signed the declaration.

For an example of filling out a zero VAT return, see ConsultantPlus, having received trial demo access to the K+ system. It's free:

The information in the field “To be completed by a tax authority employee” is entered into the title page by tax officials.

Completing Section 1

Section 1 must reflect the following information:

- OKTMO code;

- code KBK;

- in cells 030, 040, 050 – the value “0” is entered;

- cells 060, 070, 080 - code 227 is entered, in the case when this code is reflected on the title page in the line “at the place of registration”.

Submission of a declaration with a zero calculation is carried out within the deadlines approved by tax legislation, that is, no later than the 25th day of the month following the reporting period (quarter).

Zero VAT return (filling sample)

Similar articles

- VAT return for the 3rd quarter of 2017

- Unified simplified tax return 3rd quarter 2017

- Filling out the VAT return for the 3rd quarter

- Zero VAT return

- VAT declaration form

Responsibility for failure to submit a declaration

If a declaration (including a zero declaration) is not submitted within the prescribed period, a fine of 1,000 rubles is imposed on the legal entity or individual entrepreneur. (clause 1 of article 119 of the Tax Code of the Russian Federation). Since 2015, a VAT return submitted on paper is also considered not submitted (clause 5 of Article 174 of the Tax Code of the Russian Federation).

In addition, administrative penalties will be imposed on officials (fines ranging from 300–500 rubles). If the reporting is delayed by more than 10 working days, the Federal Tax Service will be able to exercise its right to block the organization’s current accounts (subclause 1, clause 3, article 76 of the Tax Code of the Russian Federation).

Read more about this responsibility here.

Reasons for using a zero declaration

If the company has chosen the usual regime for calculating taxes - OSN, it will act as a VAT payer. All categories of legal entities must submit a VAT return of the established form. This applies to both companies carrying out activities subject to taxation, and those exempt from payment, but highlighting the amount of tax in settlement documents. In addition, a similar responsibility is assigned to tax agents.

For submitting declarations with calculated tax or refundable tax and zero VAT returns

strictly defined deadlines have been established.

The basis for taxation, and accordingly, the grounds for drawing up full VAT reporting, do not arise under the following conditions:

- The company did not carry out any business transactions that generated a tax base (in this situation, they are limited to the title page and section 1 of the declaration).

- All activities during the reporting period were subject to the benefits provided in paragraph 2 of Art. 149 of the Tax Code of the Russian Federation (then, in addition to the sheets specified in paragraph 1, section 3 is filled out).

- Transactions are not subject to taxation under Art. 146 of the Tax Code of the Russian Federation (the title page, sections 1, 2, 7 must be filled out in the document).

- The amounts of advances for the upcoming production of finished products, the delivery of which should be made only after six months due to the specifics of the production cycle, also do not form the basis for calculating VAT (in this case, the title page, sections 1 and 7 are filled out).

- The company is obliged to allocate VAT in settlement documents under Art. 145–145.1 of the Tax Code of the Russian Federation, although she does not pay tax (in addition to sections 1, 2 and the title page, section 12 is completed).

- Foreign transactions were carried out, the place of which was recognized as foreign states on the basis of Art. 147–148 of the Tax Code of the Russian Federation (when filling out the declaration, they are limited to the title page, sections 1 and 7).

Although, as a general rule, a zero VAT return

must be electronic, exempt from taxation under Art. 145 of the Tax Code of the Russian Federation, persons performing the functions of agents may use a paper form. But this is an exception that does not apply very often.

Results

Ordinary taxpayers must submit a VAT return for each tax period, even if in that period there is no digital data to complete sections 2–12 of the report.

A declaration that does not have digital data is called zero. Form it on a valid form, filling out 2 mandatory sections (title page and section 1). You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Features of filling out a zero VAT declaration

Order of the Federal Tax Service of Russia No. ММВ-7-3/ [email protected] in addition to the declaration form also contains the procedure for filling it out. This procedure provides that the title page and section 1 of the report, reflecting the results of tax assessment (clause 3 of Appendix No. 2), are mandatory for submission to the tax authority. The remaining sections, if there is no data to be included in them, are not filled out in the declaration.

That is, VAT reporting with zero indicators will consist of only two sheets. The individual entrepreneur will include information about himself in them, taking into account the features inherent in this information in comparison with similar data reflected by the legal entity:

- will provide a TIN consisting of 12 digits (not 10, like a legal entity);

- in the fields intended for checkpoints (this IP code is not assigned), will put dashes (clause 16.3 of Appendix No. 2 to the order of the Federal Tax Service of Russia No. MMV-7-3 / [email protected] );

- The taxpayer will indicate his last name, first name, and patronymic as the name of the taxpayer.

Other data on the title page should be shown in the usual order for the declaration, without any exceptions depending on who applies it:

- adjustment number (there will be dashes here in the original declaration);

- tax period code and the year to which this period relates;

- codes of the tax authority and place of registration;

- activity code (OKVED);

- telephone number for contact;

- number of sheets (two);

- information about the person who signed the declaration.

The data on the reorganization has nothing to do with the individual entrepreneur, and he will enter dashes in the appropriate fields. The same should be done in the fields provided to indicate the number of documents attached to the report.

In section 2, in addition to the TIN, it is necessary to indicate the codes OKTMO (indicating a certain territorial affiliation of the taxpayer) and KBK (for regular tax it corresponds to the value 18210301000011000110), and in all other lines dashes should be entered.

How to design the first page

Most of the data required to prepare the cover page of the zero VAT return is

taken from registration and constituent documents. This is TIN, checkpoint, inspection number, company name, surname and initials of the entrepreneur.

In the cell “By location (registration)” the digital codes from Appendix 3 to the Procedure for filling out the declaration, approved by Order No. ММВ-7-3 / [email protected]

We must not forget to put down the serial number of the corrective declaration when submitting clarifying or correcting information. The numbering starts from 0 for the initial submission, when making an adjustment it is set to 1, if it needs to be repeated - 2, etc.

To reflect the reporting period, the digital code from the corresponding annex to the filling procedure is also recorded in the declaration. So, if information is presented for the first 3 months of the current year, 21 is entered in the specified field; in liquidation reporting, code 51 must be entered.

To indicate OKVED, the code of the main type of activity conducted by the taxpayer is used. This code is in the extract from the Unified State Register of Legal Entities (USRIP). In the absence of an extract from the registration authorities, you must use the code of the main activity in accordance with the approved All-Russian classifier.

It is necessary to indicate the total number of pages contained in the report, and also indicate who is submitting it - the payer himself or his representative. We must also not forget about deciphering the signature of the person who drew up the declaration.

The section for employees of the Federal Tax Service is filled out by a tax officer. Employees of the company's financial department do not need to enter data into it.

Is it worth submitting a fake VAT tax return?

An amendment to any declaration can be submitted without consequences (in the form of a fine in the amount of 5–30% of the calculated tax, but not less than 1000 rubles), if (not counting the situation when it is submitted within the reporting deadline):

- It is submitted before the expiration of the tax payment deadline, but on the condition that the tax office did not inform the taxpayer about errors in the original report by the time the clarification was received (clause 3 of Article 81 of the Tax Code of the Russian Federation).

- It is presented after the expiration of the tax payment period, but on the condition that (clause 4 of article 81 of the Tax Code of the Russian Federation):

- The tax office did not inform the individual entrepreneur about the errors by the time the clarification was received;

- the tax arrears and penalties have been paid by the time the update is sent to the Federal Tax Service.

Many enterprises that do not have time to prepare a correct VAT return submit a zero tax return to the Federal Tax Service in order to then, taking into account the deadlines specified above, send an update with the correct data and avoid sanctions. But this scheme has a number of disadvantages.

Firstly, it is useless if the company is actually late in submitting the primary declaration by the time the zero is prepared. In any case, the fine will be calculated based on the final declared amount of tax (Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated November 15, 2011 No. 7265/11).

Secondly, if the actual declaration - clarification - reflects significant figures on the tax payable, then based on their entire value, the individual entrepreneur will have to calculate and pay penalties.

Therefore, there is a more economical alternative for the company to submitting a fake zero - submitting a full declaration with an approximate tax calculation. In this case, it will be possible to minimize penalties. Submitting a declaration with obviously inflated VAT payable will allow you to completely avoid the accrual of penalties. The resulting overpayment can be offset against future payments or refunded. However, it should be taken into account that in this case the Federal Tax Service will require an explanation of the reasons for reducing the tax payable (clause 3 of Article 88 of the Tax Code of the Russian Federation).

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram