Home / Labor Law / Payment and benefits / Wages

Back

Published: March 15, 2016

Reading time: 7 min

2

17658

The tariff rate is a constant component of an employee’s salary, as opposed to a variable component - bonuses, compensation, allowances and additional payments.

Based on the tariff rate (salary), the salary paid to the employee for performing a certain amount of labor duties (labor standards) at a specified time is calculated. This type of payment is fixed and is the minimum guaranteed amount accrued for work. It is fixed as required by law in the employment contract, along with other conditions.

Tariff rates, depending on the time period, are divided into monthly, daily and hourly.

- What might it be needed for?

- Calculation methods Depending on the standard working hours per month

- Depending on the average monthly number of working hours per year

A special type of working time recording – summarized

Summarized accounting is, in fact, a special operating mode based on compliance with certain schedules (as a rule, these are “sliding” or shift schedules).

The basis for establishing such schedules is the reason “by contradiction” - when it is not possible to plan the regime in such a way that the working week is the fixed number of hours provided for by the norms of Art. 91-92 Labor Code of the Russian Federation:

- 24 – for youth under 16 years of age;

- 35 – for those with a disability group;

- 36 – for teachers and workers in hazardous industries;

- 39 – for doctors

- 40 hours is the standard duration.

A working week cannot include more than 40 hours.

With RMS, shortcomings during one period can be compensated by processing in other time intervals, which in total reaches the result required by the standard.

Summarized working time schedule (SURV)

IMPORTANT! Recommendations for drawing up a schedule for summarized recording of working hours from ConsultantPlus are available here

When introducing an RMS system at an enterprise, a work schedule .

FOR YOUR INFORMATION! Art. 103 of the Labor Code of the Russian Federation clearly requires the drawing up of an RMS schedule only for an operating mode that includes shifts. For other operating modes, such a requirement is not legally binding. However, most often employers prefer to draw up such schedules, since it is practically impossible to ensure compliance of working hours with legal standards, especially in a long accounting period, in any other way.

The schedule is drawn up based on the regulatory documents of the enterprise:

- collective agreement;

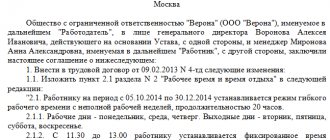

- individual employment contracts or additional agreements thereto;

- internal labor regulations;

- other local acts.

ATTENTION! The RMS schedule can be drawn up for the entire enterprise as a whole, or for individual groups of employees or individuals, applied on an ongoing basis or introduced temporarily.

The main difficulties when drawing up a schedule

Organizing a summary accounting schedule is a rather painstaking procedure. Compilers are faced with many difficulties during the planning process, which must be resolved based on specific situations. Let's consider the main difficulties that stand in the way of the RMS scheduler and outline possible ways to overcome them.

- Setting up alternating shifts and days off. Depending on the length of the shift, such a number of hours of work may accumulate during the accounting year that will not meet the established annual norm. This can happen if, for example, the norm for the year turns out to be odd, but the shift is designed for an even number. The solution may be to draw up a schedule with minimal shortcomings or adjust the work with additional days off. To do this, you should not prescribe in regulatory documents a too strict combination of the frequency of work shifts and days off in order to be able to “maneuver.”

- Sanctions for exceeding hourly standards. The law does not allow processing beyond established limits. Therefore, if the schedule is designed to include overtime, the inspection authorities may consider this a violation. Solution: if it is impossible to strictly comply with the norm in the schedule, a planned deficiency (minimal, of course) is less “traumatic” than even a small overwork. Shortcomings due to the employer's fault will simply have to be paid at the average wage level, and overtime is fraught with penalties.

- Familiarization of employees with the schedule. Art. 103 of the Labor Code of the Russian Federation requires the employee to familiarize himself with the shift schedule no later than 30 days before its introduction, subject to his written confirmation of consent. However, here the employer may have another difficulty. RMS is a mode in which production needs at any time can force the accepted schedule to be adjusted. Of course, the total number of hours for the reference period should in any case remain unchanged, but the ratio of weekends and work shifts may need to be adjusted. And familiarization with the employee's signature makes it impossible to make any changes to the schedule in less than a month.

If such changes are made, they will be recognized as a deviation from the work schedule; accordingly, their work will be classified as overtime work or work on days off, and these are different payment standards.In addition, such work again requires the consent of the employee and the issuance of a written order from management. Solution: the employer is, of course, obliged to familiarize the employee with the schedule, but the law does not say that consent must confirm the schedule for the entire accounting period, even if it is a whole year. It is advisable for the employer to draw up a preliminary annual schedule for accounting for RMS, and introduce it into work in small parts, most conveniently in monthly periods. Thus, the employee will become familiar with the new schedule and sign it monthly, and the necessary adjustments can be made to it in a timely manner.

WHAT IS SUMMARY ACCOUNTING

If in an organization, due to production conditions or when performing certain types of work, daily or weekly working hours cannot be observed, it is permissible to introduce summarized working time recording.

This is done to ensure that the duration of working hours during the accounting period (month, quarter and other periods) does not exceed the normal number of working hours. The accounting period cannot be more than one year. This is stated in Article 104 of the Labor Code of the Russian Federation. The normal number of working hours during the accounting period for employees whose working hours are taken into account cumulatively is determined based on the established weekly working hours. For those employees who work part-time or part-time shifts or part-time work weeks, the normal number of hours worked during the reference period is reduced accordingly.

Thus, if the specifics of the enterprise’s work do not allow establishing a working time schedule for employees, according to which they would work 40, 36, 35 or 24 hours per week, then it is more convenient to use summarized working time recording. In this case, the employer must organize the work process so that the standard working time is worked by the employee during the accounting period, for example, a month. Moreover, on each day of the accounting period, the duration of work may vary. The main thing is that it is balanced within the accounting period.

Payment and overtime (overtime for cumulative working hours)

Labor remuneration subject to compliance with the RMS schedule

The method of calculating payment is chosen by the employer and agreed upon with the employee being hired, which is fixed in the employment or collective agreement. It is possible to use different salary systems.

The most commonly used system of remuneration for actual time worked is :

- hourly tariff rates: the monthly amount paid is calculated based on the hours worked during each specific month;

- official salaries: a fixed amount is paid monthly if all shifts are worked in accordance with the planned schedule.

NOTE! With a salary system, the average salary for 1 hour of work will be different in one month or another, the total amount will “accumulate” only at the end of the accounting period. With hourly pricing, the cost per hour is always the same, since it is a fixed value, documented.

It is possible to use piecework wages , when remuneration is calculated depending on the number of units of products produced or operations performed.

Payment for processing during RMS

In the RMS mode, as in other working modes, sometimes there is a production need to work more hours than allowed by labor law standards.

Overtime work is overtime in excess of the standardized number of hours that make up the accounting period. The concept of “accounting period” is key here, since the very logic of RMS provides for processing in other time periods, compensated by less processing in other periods. Thus, with an annual accounting period, overtime for a week or month cannot be considered overtime, even if it was not included when drawing up the schedule.

REFERENCE! Overtime hours are calculated and calculated exclusively based on the results of the entire accounting period, and if the employee leaves, then on the date of his dismissal.

Inspection bodies are sensitive to the difficulties of planning RMS, allowing overtime that does not exceed the established limits: for each member of the work team, more than 120 hours cannot be overworked during the year, and over 2 days in a row - more than 4 hours (Article 99 of the Labor Code of the Russian Federation ).

If it is not possible to create a schedule without processing included in it, this means that the organization does not have enough staff and it should increase the number of personnel.

Overtime pay standards

Labor legislation provides for special regulations for calculating labor remuneration for overtime:

- for the first two hours overtime, pay time and a half;

- for subsequent hours - double the hourly rate (for hourly pricing);

- additional payment in the amount of one more corresponding hourly rate (for piecework payment).

REMEMBER! It is impossible to compensate for overtime in one accounting period with a shortage of working hours in the next.

For night work, additional financial bonuses are provided, amounting to at least 20% of the average tariff hourly rate for each hour worked on the night shift.

On holidays and weekends, pay for work also provides for an increased amount:

- hourly workers – double rate per hour;

- piece workers - double price;

- “sitting” on a salary - single or double average daily or average hourly earnings (doubling depends on whether overtime took place along with going on a non-working day).

Solving particularly complex issues of payment for work on weekends with summarized recording of working hours

Compensation is allowed not in financial form, but in the form of additional time for rest (this is agreed with the worker himself).

IMPORTANT! If an employee’s departure on a holiday or day off is provided for according to the RMS schedule, then this time is counted as working time and is included in the norm that is established for the accounting period.

Calculation for a month

Determining labor standards allows employers to correctly set work schedules, keep records of hours worked, pay wages and distribute vacations. Knowing how to correctly calculate the standard working time, you can easily determine how many hours an employee must work. One calendar month is often taken as the billing period.

Working hours are calculated as follows:

- First you need to find out how many working days there are in the selected accounting period, and how many weekends, holidays, etc.

- Next, the number of working hours per day is calculated. At the same time, do not forget that the normal length of a working week is 40 hours. This means you calculate the number of hours per working day. Example: 40/5=8.

- The number of days in a month when a subordinate works must be multiplied by 8 hours.

An example of such a calculation could be as follows:

- Let's say there are 21 working days in June.

- The authorized employee must determine the standards by which the personnel will work.

- For this, the time standard will be calculated using the following formula: 21*8=168 hours. This is exactly how much each subordinate must work on average.

To correctly calculate working hours, you need to check the production calendar. It contains all the information about the number of work shifts for each calendar month.

Summarized recording of working time by period

An important point when planning RMS is the choice of the optimal accounting period .

It is necessary to establish a time period during which personnel are guaranteed to accumulate a more or less constant amount of hours worked that meet the standards. The law leaves this choice to the employer, who makes it based on considerations of expediency. It can be:

- decade;

- month;

- two month period;

- quarter;

- half year;

- year.

NOTE! A period exceeding one year is not provided for by law!

For some types of activities, the accounting period is prescribed by law, for example, for drivers it should be equal to a month. For employees of hazardous industries and workers in hazardous conditions, the accounting period for RAS cannot exceed a three-month accounting period.

If the frequency of workdays and weekends is more or less constant, then it is worth establishing an “even” accounting period (2 months, half a year, a year) so that the overtime of one half covers the shortfall in working hours in the other. For seasonal work, a maximum accounting period is advisable, then the “season” will easily overlap the “off-season”.

Summary accounting: recommendations for the employer so as not to violate anything

Example of calculation of summarized working time accounting

Let us give a specific example of calculating RMS.

The organization has adopted summarized recording of working hours. A standard week of 40 hours is taken as the norm; a quarter is chosen as the accounting period.

First, the standard working time is calculated. To do this, 40 hours must be divided by 5 days (the standard length of the working week), and then multiplied by the number of working days in each month. Don't forget to deduct 1 hour for each pre-holiday day. You can not make these calculations, but simply look at the production calendar data, where they are already calculated in advance and given for different input data: for an accounting period of a week, month, quarter or year with a working week of different lengths.

Now let's look at the actually worked time indicators. For the 1st quarter of the year, the time actually worked in accordance with the schedule was:

- in January – 158 hours;

- in February – 150 hours;

- in March – 172 hours.

A total of 480 hours.

If you check the production calendar for this year, then in the 1st quarter the standard working time is 482 hours. Thus, we see a 2-hour shortfall due to the employer’s fault, which employees will need to pay at the average hourly rate, which is calculated by dividing the monthly amount earned by the number of hours worked in that month.

During the 2nd quarter, hours worked were:

- in April – 164 hours;

- in May – 156 hours;

- in June – 188 hours.

That's a total of 508 hours.

The production calendar provides for exactly this quantity, so the schedule is completed without rework or shortcomings.

In the 3rd quarter the following picture was observed according to the schedule:

- in July – 166 hours;

- in August –174 hours;

- in September – 172 hours.

The amount is 512 hours, while the production calendar for the 3rd quarter of a given year provides for 500 hours. This results in 12 hours of overtime, which according to the law must be registered and paid as overtime: 2 hours at one and a half rates, the remaining 10 hours at double rates. The additional payment is due in September.

Annual figures

In order to determine man-hours for a year, the calculation (formula) is similar. Only when calculating the amount of hours worked is calculated not per month, but for the whole year. Included and excluded periods are determined in a similar manner.

To correctly determine the statistical indicator, you will have to calculate how many hours each worker worked at the enterprise. And then the resulting numbers are summed up. Formula:

ГЧч = ГЧ1 + ГЧ2 + ГЧ3 + … + ГЧn,

Where:

- HRn is the total number of hours worked by a specific employee.

Rules for summarized working time recording

Let's summarize the requirements for RMS: the employer, when planning such an operating mode, must take into account the following important points.

- RMS is mandatory introduced in organizations that cannot ensure constant compliance with working hours throughout the working day (shift) or week.

- The amount of time worked during RMS during the accounting period should not exceed that provided for by law.

- The RMS schedule is mandatory when organizing shift work and is desirable in all other modes.

- The accounting period under the RMS regime is set arbitrarily, except for those types of activities where it is provided for by law, and it is unlawful to set it longer than 1 year.

- The following items must be regulated in the RMS schedule:

- the beginning and end of the labor process;

- duration of the shift (working day) in hours;

- frequency of work shifts and days off;

- rest time between shifts.

- It is forbidden to include significant rework in the schedule (this is fraught with administrative liability), and shortcomings are also undesirable. If this or that actually happened, this must be compensated by the employer in the manner prescribed by law.

- Overtime hours are calculated and paid after the end of the accounting period.

- Work on public holidays according to the schedule is included in the general standard of hours, although it is additionally paid or compensated, without being overtime.

- For an employee who does not begin his duties at the beginning of the accounting period, the total hourly rate is reduced.

- The absence of an employee for a valid reason, in particular due to sick leave or vacation, excludes the missed hours from his norm for the accounting period.

Rules and examples of working time calculation

Calculation of working hours takes into account a large number of factors, but the main one is the work schedule. It can be daily, weekly and cumulative. The latter assumes a shift schedule.

In addition, when accounting for radioactive substances, the following are provided:

- type of working week: five-day, six-day;

- daily duration of work;

- the time when the work was started and completed;

- breaks;

- sequence of working days with non-working days;

- number of shifts in 24 hours;

- the presence of holidays, when the working day is reduced.

Calculation per month

In general, the calculation of RP for a month during a five-day period is carried out using the following formula:

Ntotal = Prv: 5 x Krd – 1 h. x Kppd, where:

- Ntotal—RV norm;

- Prv - duration of RT per week (40.35, 36 or 24);

- Krd - number of working days in the period (month, year);

- Kppd - the number of pre-holiday days.

For example:

There are 21 working days in October 2021. This means that with a 40-hour week it will be: 40: 5 x 21 - 0 = 168 hours. At 36 hours: 36: 5 (days) x 21 = 151.2 hours. Hence the conclusion is this: the maximum working time in October 2021 should not exceed 168 hours.

Six days

A six-day week also cannot exceed 40 hours in total.

Let's take the same October with a six-day week. There will be 26 working days, the norm is 168 hours. 168 divided by 26 equals approximately 6 and a half hours a day. But in the Russian Federation, during a six-day working week, a 7-hour duration of work time is used, and before the weekend it is reduced to 5 hours.

On the eve of a holiday, during a five-day workday the working day is reduced by one hour, while during a six-day workday it cannot be more than five hours.

Number of working days between dates (formula)

Excel has a function called NETWORKDAYS. Its arguments are the start and end dates. These are required values to enter. And also an optional argument - holidays. When entering data about holidays, these days are excluded from the calculation.

How can an employee change their working hours? Find out from our article. What is meant by available working time fund? See here.