File structure violation

Books/magazines appear empty after import/upload/send

Before uploading, check the field “Indication of the relevance of previously submitted information” in the accounting program (line 001). If the number “1” is entered, the data will not be downloaded. This code is used when providing an adjustment if the data in this particular section does not need to be adjusted and it is not required to be provided again.

The structure of the XML file is broken. The file NO_NDS.xx_xxxx_xxxx _xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx_xxxxxxxxxx_xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxxxxxxx.xml cannot be processed

Try opening the file using the Internet Explorer browser without using Online Sprinter: double-click on the file saved in the folder. If it is empty or contains a list of dates, repeat the upload from the accounting program: the file structure is damaged. If the message persists, contact your accounting software vendor to set up the correct download.

Note.

Please check your invoice numbers. The characters > < ” & ' are not allowed.

An application error has occurred. Please contact support

If this message appears when you try to view imported sections of information, try opening the file using the Internet Explorer browser without using Online Sprinter: double-click on the file saved in the folder. If it is empty or contains a list of dates, repeat the upload from the accounting program: the file structure is damaged. If the message persists, contact your accounting software vendor to set up the correct download.

Note.

Please check your invoice numbers. The characters > < ” & ' are not allowed.

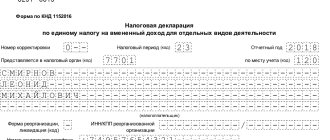

Method of submitting a tax return

- Title page;

- Section 1 “The amount of single tax on imputed income subject to payment to the budget”;

- Section 2 “Calculation of the amount of single tax on imputed income for certain types of activities”;

- Section 3 “Calculation of the amount of single tax on imputed income for the tax period.”

Declaration form for UTII

Filling begins with the taxpayer attribute code (page 005). For individual entrepreneurs that do not make payments to employees, we indicate code “2”, for all other categories - code “1”. The fact that an individual entrepreneur has or does not have employees affects the amount of reduction in the single tax on insurance premiums paid. Thus, an individual entrepreneur without employees can reduce the amount of tax on UTII according to the declaration by the entire amount of fixed insurance contributions paid in the reporting quarter. The resulting tax amount payable in this case cannot be less than 0.

Inconsistency of completeness

The attachment "NO_NDS.xx_xxxx_xxxx_ xxxxxxxxxxxxxxxxxxxxxxxxx_xxxxxxxxxx_xxxxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxxxxxxx.xml" specified in the main file.

Upload detail files (purchase/sales ledgers, invoice journals).

How to do it:

- In the "Referent" program;

- In the Online Sprinter system.

The “RecognalXX” element cannot take the value 0 if any of the following conditions are met: “Appendix 1 to section XX has been completed...”

Upload detail files (purchase/sales ledgers, invoice journals).

How to do it:

- In the "Referent" program;

- In the Online Sprinter system.

File ID *** does not match the file ID of the main document

Check the correspondence between the TIN/KPP and the Federal Tax Service code in the file names - main (sections 1–7) and additional (8–12).

The structure (mask) of the file name should be as follows:

- NO_NDS_aaaa_bbbb_ ccccccccccdddddddddd_ eeeeffgg_ххххххххх-хххх-хххх-хххх-хххххххххххх.xml - main declaration file (sections 1–7).

- NO_NDS.8_aaaa_bbbb_ ccccccccccddddddddd_ eeeeffgg_ххххххххх-хххх-хххх-хххх-хххххххххххх.xml – purchase book (section 8).

- NO_NDS.81_aaaa_bbbb_ ccccccccccdddddddddd_

- NO_NDS.9_aaaa_bbbb_ ccccccccccddddddddd_ eeeeffgg_ххххххххх-хххх-хххх-хххх-ххххххххххххх.xml – sales book (section 9)

- NO_NDS.91_aaaa_bbbb_ ccccccccccddddddddd_ eeeeffgg_хххххххх-хххх-хххх-хххх-хххххххххххх.xml - information from additional sheets of the sales book (section 9.1)

- NO_NDS.10_aaaa_bbbb_ ccccccccccddddddddd_ eeeeffgg_хххххххх-хххх-хххх-хххх-хххххххххххх.xml – journal of issued invoices (section 10)

- NO_NDS.11_aaaa_bbbb_ ccccccccccddddddddd_ eeeeffgg_хххххххх-хххх-хххх-хххх-хххххххххххх.xml - log of received invoices (section 11)

- NO_NDS.12_aaaa_bbbb_ ccccccccccddddddddd_ eeeeffgg_хххххххх-хххх-хххх-хххх-хххххххххххх.xml - information on invoices issued by VAT defaulters (section 12), where: aaaa - transit tax inspectorate code (for all except the largest taxpayers, code s of transit and final IFTS match up)

- bbbb - final Federal Tax Service code (for all but the largest taxpayers, the transit and final Federal Tax Service codes are the same)

- cccccccccc - Taxpayer Identification Number

- ddddddddd - KPP (if the taxpayer is an individual entrepreneur, instead of TIN/KPP - a 12-character TIN)

- eeeeffgg - date, for example, April 27, 2015. displayed as 20150427

- хххххххх-хххх-хххх-хххх-ххххххххххх - unique file identifier

Inconsistencies in Sections 1–7

If the value of the code at the location (accounting) (title page) is equal to 231, the code according to OKTMO (section 1, line code 010) may not be specified and is required for other values of the code at the location (accounting).

When the value of the code at the location (accounting) (title page) is equal to 231, the budget classification code (section 1, line code 020) may not be specified and is required for other values of the code at the location (accounting).

When filling out OKTMO (section 1, line code 010), one of the following amounts must be indicated:

- The amount of tax payable to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation (section 1, line code 030);

- The amount of tax payable to the budget in accordance with paragraph 1 of Article 173 of the Tax Code of the Russian Federation (section 1, line code 040);

- The amount of tax calculated for reimbursement from the budget in accordance with paragraph 2 of Article 173 of the Tax Code of the Russian Federation (section 1, line code 050).

In the absence of OKTMO (section 1, line code 010), the amounts are not indicated.

Section 1 of the VAT return must be completed. If the details in the settings are filled in, open section 1 for editing and click “Save” - the section will be filled in automatically.

Note.

Section 1 must be completed, even if the declaration is “zero”.

The tax period code (title page) can take values from 01 to 12 only if the code value at the location (accounting) is equal to 250

If the location code is other than 250, check the Tax Period (Code) field on the cover page. Possible values: “21 | I quarter", "22 | II quarter", "23 | III quarter", "24 | IV quarter" (in case of reorganization/liquidation - a separate list of codes). It is impossible to change the period in a declaration that has already been downloaded: you need to make corrections in the accounting program and upload the file again.

If the value of the tax amount payable to the budget in accordance with paragraph 5 of Article 173 of the Tax Code of the Russian Federation is greater than 0, the element “Priznal12” must be present and have a value.

If line 030 of section 1 is full, you must generate section 12. If you do not provide section 12, clear line 030 in section 1.

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) decreases (section 4, line code 110), the amount by which the tax base is adjusted when the price of sold goods (work, services) increases (section 4) must be indicated. , line code 100).

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) increases (section 4, line code 100), the amount by which the tax base is adjusted when the price of sold goods (work, services) decreases must be indicated (section 4 , line code 110)

In section 4, clear lines 060 and 090.

Note.

These lines must be filled out for the printed form, in accordance with Order of the Federal Tax Service of Russia dated October 29, 2014 No. ММВ-7-3/ [email protected]

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) decreases (Section 6, line code 140), the amount by which the tax base is adjusted when the price of sold goods (work, services) increases (Section 6 , line code 120).

If there is no amount by which the tax base is adjusted when the price of sold goods (work, services) increases (section 6, line code 120), the amount by which the tax base is adjusted when the price of sold goods (work, services) decreases must be indicated (section 6 , line code 140)

In Section 6, clear lines 070 and 110.

The file does not match the schema. Element: “Information about the taxpayer - seller (legal entity)” parameter “Section 2, line 030. INN of the taxpayer - seller” has the incorrect value “0000000000”. The parameter must contain 10 characters. Taxpayer identification number of the organization.

In section 2, check line 030: if the seller taxpayer does not have a TIN, leave the line empty without filling it with zeros. If the taxpayer-seller is an individual entrepreneur, please indicate the appropriate o.

If the value of the transaction code (section 2, line code 070) is equal to 1011712 or 1011703, information about the taxpayer - the seller (section 2, line code 020 and 030) must be indicated. If the value of the transaction code (section 2, line code 070) is equal to 1011703, the TIN of the taxpayer - the seller (section 2, line code 030) must be indicated.

In section 2, fill in information about the taxpayer-seller: lines 020 (name) and 030 (TIN). Information must be filled in for transaction codes 1011703 and 1011712.

Fill out OKTMO in 1C 8.3

The OKTMO details are filled in by the user along with the rest of the data in the organization’s card. Let's go to the menu section "Main" - "Organizations".

Fig.1 Let’s go to the menu section “Main” - “Organizations”

Let’s open the data of our organization and follow the hyperlink at the top of the window - “Registration with the tax authorities.” By clicking the “Create” button, in the window that opens, fill in the registration data with the tax office.

Fig.2 Registration data at the tax office

Fig.3 Registration data at the tax office

In this card we indicate our OKTMO - the code of the territory in which, in accordance with the All-Russian Classifier, our activities are registered.

Inconsistencies in sections 8–12 (TIN/KPP)

When filling out the transaction type code (section xx, line code 010) with a value from the list: 01, 02, 03, 04, 05, 07, 08, 09, 10, 11, 12, 13, the TIN/KPP must be indicated ... (section xx , line code xxx)

In the specified invoice, check the line with information about the counterparty. If the organization/individual entrepreneur does not have a TIN/KPP, leave the line blank. It is possible not to indicate the TIN/KPP only for certain transaction type codes (line 010). The list of codes used before July 1, 2021 can be viewed in the Order of the Federal Tax Service of the Russian Federation dated February 14, 2012 No. ММВ-7-3/ [email protected] and the Letter of the Federal Tax Service of Russia dated January 22, 2015 No. ГД-4-3/ [email protected] From July 1, 2021, the codes specified in the Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

The file does not match the schema. Element: “Information about the organization - …” parameter “Section x, line xxx. Organization INN" has the incorrect value '0000000000'. The parameter must contain 10 characters. Taxpayer identification number - organization

In the specified invoice, check the line with information about the counterparty. If the organization/individual entrepreneur does not have a TIN, leave the line blank. It is possible not to indicate the TIN/KPP only for certain transaction type codes (line 010). The list of codes used before July 1, 2021 can be viewed in the Order of the Federal Tax Service of the Russian Federation dated February 14, 2012 No. ММВ-7-3/ [email protected] and the Letter of the Federal Tax Service of Russia dated January 22, 2015 No. ГД-4-3/ [email protected ] From July 1, 2021, the codes specified in the Order of the Federal Tax Service of Russia dated March 14, 2016 No. MMV-7-3/ [email protected]

The file does not match the schema. Element: “Information about the organization - …”. The parameter “Section x, line xxx” is missing. Checkpoint." Registration reason code (KPP) - 5 and 6 characters from 0–9 and A–Z

In the specified invoice, check the line with information about the counterparty. If the organization/individual entrepreneur does not have a TIN, leave the line blank. It is possible not to indicate the TIN/KPP only for certain transaction type codes (line 010). The list of codes used before July 1, 2021 can be viewed in the Order of the Federal Tax Service of the Russian Federation dated February 14, 2012 No. ММВ-7-3/ [email protected] and the Letter of the Federal Tax Service of Russia dated January 22, 2015 No. ГД-4-3/ [email protected ] . From July 1, 2021, the codes specified in the Order of the Federal Tax Service of Russia dated March 14, 2016 No. ММВ-7-3/ [email protected]

If a message is issued when checking an invoice from a counterparty who is an individual entrepreneur (TIN is indicated, 12 characters), in the corresponding line, set the switch to “FL | Individual".

Filling out section 1

Section 1 consists of eight blocks of lines 010 and 020. This is due to the fact that each municipal formation, inter-settlement territory, settlement included in the municipal formation has its own OKTMO code. Therefore, if you operate in different territories subordinate to the same tax office, then you will have to fill out the block of lines 010 and 020 several times.

For example, you do business in the cities of Dolgoprudny and Khimki, but you are registered as a UTII payer with one inspection - Interdistrict Inspectorate of the Federal Tax Service of Russia No. 13 for the Moscow Region. This means that you will submit one declaration, but in section 1 you will fill out two blocks of lines 010 and 020.

Note. If you operate in more than eight locations, you will need to complete several sheets in Section 1.

On line 010 you enter the OKTMO code for the place of activity. If you are engaged in motor transport services, delivery or distribution retail trade, or advertising on vehicles, then in line 010 you write the OKTMO code at the location of your organization (place of residence of the entrepreneur) (clause 2 of Article 346.28 of the Tax Code of the Russian Federation).

In line 020 , reflect the amount of UTII payable to the budget using the OKTMO code from line 010. To calculate it, use the following formula:

CH = OSN × SIN: ASPIN,

where CH is the value of line 020 of section 1;

OSN - the value of line 040 of section 3;

SIN - the sum of the values of lines 110 of all completed sections 2 with the specified OKTMO code;

OSIN - the value of line 010 of section 3.

General requirements for filling out the UTII declaration

When filling out the declaration, you must remember several basic rules.

- The declaration should be filled out in black, purple or blue pen and in capital letters only.

- When filing a declaration using software, you must use Courier New font with a height of 16-18 points.

- The declaration should be filled out from left to right. If the declaration is filled out on a computer, all numerical indicators must be aligned to the right.

- If any indicator is missing, a dash is placed in the corresponding field. The exception is when the declaration is completed on a computer.

- The values of physical indicators must be indicated in whole units, and all cost indicators - in full rubles.

- Errors may not be corrected by correction or other similar means.

- Double-sided printing of the declaration on paper and stapled sheets are not allowed.

Inconsistencies in Sections 8–12 (Other)

The file does not match the schema. Element: “Information on a line from the purchase book about transactions reflected for the expired tax period” parameter “Section x, line xxx. Customs declaration number" has the incorrect value "...". The parameter can contain up to 1000 characters.

If the total number of characters of customs declaration numbers for a specific invoice exceeds 1000, the Federal Tax Service recommends filling out only the first 1000 characters. In this case, there will be no claims against the taxpayer.

The file does not match the schema. Element: “Composition and structure of the document.” The “Adjustment number” parameter is missing

This message appears if a document was incorrectly unloaded from the accounting program. Open the document for editing and click “Save”, “Check”. If the report is an adjustment, fill in the fields “Adjustment number” and “Indication of the relevance of previously submitted information.”

Note.

If the relevance indicator is “1”, the section will be sent empty.

The tax amount on the invoice (section xx, line code xxx) is filled in only if the number of the adjustment invoice (section xx, line code xxx) is not filled in.

This message appears when the VAT rate is 0%. In the line “Including the amount of VAT on the invoice, in rubles.” and a cop." enter the value “0” (without quotes).

When filling out the currency code according to OKV with a value other than 643 (section xx, line code xxx), the cost of sales on the invoice, the difference in cost on the adjustment invoice (including tax), in the currency of the invoice (section xx, code) must be indicated lines xxx).

It is necessary to fill in the line “Cost of sales according to the invoice, difference in cost according to the adjustment invoice (including tax) in the currency of the invoice” (in section 8 - line 170; in section 9 - line 150). If the currency indicated on the invoice is rubles, check the currency code according to OKV. You must specify the value "643".

The indicator of the relevance of previously submitted information (section xx, line code 001) is not filled in when submitting the primary document, that is, when the correction number is 0.

If the value of the indicator of relevance of previously submitted information (section xx, line code 001) is equal to 1, information from the purchase book about transactions reflected for the expired tax period is not filled in.

If the value of the indicator of relevance of previously submitted information (section xx, line code 001) is equal to 0, information from the purchase book about transactions reflected for the expired tax period is required to be filled out.

Open the downloaded section for editing and change the value in the “Indicator of relevance of previously submitted information (001)” field to “0 | the information is out of date” if the declaration is primary. If it is an adjustment, enter the adjustment number and fill in the field “Indicator of the relevance of previously submitted information (001)” as follows: the value “0 | information is not current" must be selected if you are making changes to the section; value "1 | the information is current” - if you do not make changes to the section and the previously submitted information in the entire section is correct (in this case, this correction section is sent empty).

How to submit a UTII report if activities are carried out at several addresses

Starting from 2021, UTII has been abolished; the information from this article will only be useful if you submit reports for previous years or undergo a tax audit. If you are an individual entrepreneur, read about a profitable alternative to UTII - the patent taxation system. If it is an LLC, you will have to use the less profitable and more complex simplified tax system.

The procedure for reporting on UTII depends on how many types of imputed activities the individual entrepreneur carries out, as well as where they are located: in the same municipality or not.

IP has several “identical” points

The Ministry of Finance in its letter provided clarifications for those individual entrepreneurs who have several points on UTII with the same activity and in the same city. In order to fill out the UTII declaration, it is said that section 2 “Calculation of the amount of the single tax on imputed income for certain types of activities” is filled out separately for each place of activity, i.e. for each OKTMO. But if an individual entrepreneur works in the territory of one city, the OKTMO of open points and the type of activity may coincide, then the physical indicators can simply be summed up.

In this case, the UTII declaration is submitted with one section 2 for the entire type of activity as a whole with the sum of physical indicators at all points. The report is submitted to the tax office at the place of business where the company is registered as an imputed tax payer.

This news will please entrepreneurs who have the physical indicator “number of employees including individual entrepreneurs”, for example, household services, car services and car washes, fast food kiosks. Their tax amount will be reduced, because... entrepreneurs no longer have to count themselves multiple times at each point.

When opening additional points with the same type of activity, we recommend submitting an application for registration under UTII to each tax office at the place of business, even if you are already registered with this tax office for this type of activity. In this case, the address indicated in the first (or in the first) application for registration for this type of activity with this inspectorate will be indicated in the declaration as the address of the activity.

If an additional point is opened in another city (with another OKTMO), then in the UTII report the physical indicators are not summarized; a declaration is submitted to each tax office only for the corresponding place of activity.

Submit reports in three clicks

Elba is suitable for individual entrepreneurs and LLCs. The service will prepare a tax return, calculate the tax and reduce it by insurance premiums.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Various types of activities on UTII

When opening another imputed point on the territory of the same tax office, but for a different type of activity, an UTII-2 application was submitted to the tax office. Another sheet of Section 2 was added to the declaration and filled out separately for each point of activity. Submitted to the tax office at the place of business.

If a company operates in different cities or districts, then it had to register with UTII in each city (district) and submit several declarations to the tax inspectorates for the types of activities that it carries out in a particular municipality.