The Tax Code of the Russian Federation allows you to receive benefits for property that is owned by an enterprise during taxation. But for this, the objects in question must comply with a number of features.

Only in the case of individual real estate objects provided for by the Government of the Russian Federation, a zero property tax declaration for 2021 is possible.

Due to some difficulties in understanding whether it is possible to receive a zero rate or not, the tax service provided clarification on filling out the second section of the declaration. You need to familiarize yourself with it to avoid problems with the Federal Tax Service.

Do I need to submit

The law approves the mandatory filing of property declarations for private entrepreneurs. This paper contains information about both purchased objects and those that have been owned for a long time.

If there is no property as such, then there cannot be a planned filing of the declaration. This document is submitted to the tax service only when acquiring ownership of any movable or immovable object. After purchasing it, you should fill out a declaration and submit it to the Federal Tax Service. However, there are no specific deadlines.

When purchasing a vehicle, you must register with the traffic police. Only after this the entrepreneur will have the necessary notes in his hands, which will be included in the declaration for the tax office.

The acquired land plot is also subject to registration. First, a package of documents is submitted to the state registration service. There the owner receives a receipt indicating that the organization has received the necessary documentation. Next, you should enter all the information about the land in the declaration and submit the document to the tax office.

Sample declaration of real estate: filling algorithm

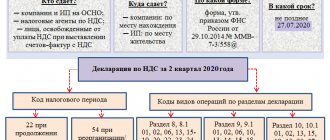

If there is property on the organization’s balance sheet for which the benefit is applied in accordance with clause 25 of Art. 381 of the Tax Code of the Russian Federation, filling out tax calculations and property tax declarations has the following features.

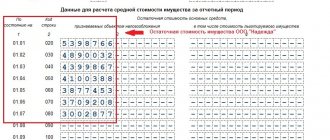

In section 2 of the declaration (tax calculation), data is filled in on the residual value of fixed assets recognized as objects of taxation (column 3), including the value of preferential property (column 4).

When calculating tax (advance tax payment) in line 160 “Tax benefit code” (in line 130 of the tax calculation), the first part of the composite indicator indicates tax benefit code 2010257 (according to Appendix 6 to Order of the Federal Tax Service of the Russian Federation dated March 31, 2017 No. MMV-7 -21/ [email protected] ). The second part of the composite indicator is not filled in in this case.

Otherwise, the declaration (tax calculation) is filled out in the generally established manner.

What is important to consider

Role and data requirements

Due to changes to the Tax Code in 2015, everyone must submit a zero return. In this case, the lack of income does not matter. They submit a declaration in cases where the entrepreneur did not work and did not receive income, or worked, but the level of income was low - without making a profit.

A zero declaration for individuals should be considered one that indicates the sale of property, but its price was the same as when purchased. In this case, you need to fill out the document, but the income will be listed as zero.

For individual entrepreneurs, a zero property tax return for 2021 will indicate that although the businessman did not receive a profit for the specified period, he continues to carry out his activities.

There are several categories of business in which such a declaration can be submitted:

- activities tied to the season - based on climatic and weather conditions;

- during the reporting period, the entrepreneur was employed in another institution;

- no payroll was processed. This case is possible at the start of activity;

- if the operation of the enterprise was stopped.

Among the data required to be provided, the following should be highlighted:

- Full name of the person paying the tax;

- You will need individual identification codes responsible for the tax period, OKATO.

- passport and registration information;

- type of adjustment.

It is worth noting that most of the document and its column will be empty.

Main provisions

The declaration should indicate those assets that are subject to average annual property tax and real estate with cadastral value.

When filling out the document, you should use the following tips:

| Preferential objects should be separated from others | Movable depreciation objects are classified as preferential, so you cannot simply add the value of the property without taking into account the preferential one. This indicator should be entered in column 3 of the second section. And in line 130 you will need to indicate the required benefit code. |

| The assets of the two groups are reflected in the document | According to the Federal Tax Service letter No. BS-4-11/13906 dated August 7, 2015, line 270 should contain data on the cost of funds from the first and second depreciation groups. However, these figures are not included in the tax calculation. |

| The third section is filled in for each of the objects | This section provides information on objects of cadastral value. Even if there is no property, you should fill out the TIN, KPP and put down the serial number of the page. The remaining columns are filled with dashes. Moreover, if the institution has property on its balance sheet, a separate sheet should be filled out for each of the objects. |

Conditions, terms and responsibilities

When filling out the declaration, you should take into account the conditions prescribed by law:

- All prices in the document should be indicated in rubles. Non-integer values should be rounded to the nearest ruble.

- The numbering should be continuous and should be placed on all pages, starting with the title page. There are special fields for numbers in the declaration. Numbering should begin with the value 001.

- Blots and errors cannot be corrected; the sheet must be filled out again.

- Duplex printing is not permitted.

- Fill out the declaration using ink of three colors - blue, black and purple.

- All data is entered exclusively in the fields provided for them.

- Text data is indicated in capital block letters.

- If there is no data in the field, you must put a dash there.

All taxpayers in the country provide the necessary information to tax authorities in accordance with the deadlines established by the Federal Tax Service and for the specified periods.

The following terms are considered standard:

- until the 28th - should be counted from the moment the reporting period ends;

- for the past period, data must be provided by March 28;

- If the deadline coincides with a weekend or holiday, you can submit documents both in advance and on the day following the weekend.

If the deadline for submitting a tax return to the Federal Tax Service is missed, fines and penalties should be expected.

The Tax Code of the Russian Federation in Article 119, paragraph 1 states that an administrative fine is provided for failure to submit tax reports. Its size depends on the amount of tax that should have been paid. Typically this figure is 5 percent of the amount.

It is worth considering that there is a maximum and minimum fine. Today, the fine cannot be less than 100 rubles and more than 1000. The maximum fee will not exceed 30% for the reporting period.

Objects of activity

According to Federal Law No. 242-FZ of October 30, 2009, only those organizations that have objects subject to taxation must pay property tax. These are indicated in the Tax Code in paragraph 1 of Article 373. This change came into force on January 1, 2010.

Such property may include objects that are on the balance sheet of the institution as fixed assets of the company:

- movable and immovable;

- received for rent or for permanent use;

- transferred on the basis of a power of attorney;

- added to joint business activities.

As for benefits, they can apply to all objects owned by the enterprise. But they are not exempt from filling out a tax return and must submit all calculations. Since this property has a place and must obey general orders.

General requirements for document preparation

A declaration is generated, property tax is calculated in accordance with the requirements specified in the Procedure for filling out the tax form, approved by Order of the Federal Tax Service No. MMV-7-21/271.

The requirements for preparing a tax report are:

- Numerical indicators in the cells of the form must be indicated in full rubles without kopecks (the rounding rule applies).

- All sheets of the document are numbered, starting with the Title Book.

- Errors and corrections are prohibited, including the use of any corrective means.

- Inspectors are prohibited from printing the document form on both sides of the sheet (when generating a document on paper).

- As recommended by the Procedure for filling out a property tax return, the fields of the form should be filled out in black or blue ink only.

- The document must be stapled. It is forbidden to use a stapler, as this leads to damage to the paper sheets.

- In fields where alphabetic characters are entered, information is filled in capital block letters.

- Rows are filled from left to right, starting from the first row cell.

- The computer version of filling is characterized by filling in numerical indicators with the values aligned to the right (outermost) line cell.

- If the property tax declaration 2021, a sample of filling is given below, is compiled using a computer typesetting, then it is allowed not to put dashes in empty cells, which is unacceptable when filling out the document manually.

- When typing indicators on a computer, the Courier New font is used, the height is 16-18 points.

There is a system of penalties for late submission of a tax document, as well as for late payment of obligations. The size of the fines depends on the amount.

(Form) Zero property tax declaration

Similar articles

- Filling out a property tax return

- Property tax declaration

- Property tax benefit - code 2010257

- Organizational property tax

- Property tax calculation

Completing and submitting a zero property tax return for 2021

Individual entrepreneur and legal entity persons who use the simplified taxation system must fill out only three sheets of the document.

First, you should provide the following information:

- , tax office code;

- Full name of the entrepreneur or name of the organization;

- , information about the director of the company;

- date and signature.

The second sheet contains information about the property, OKATO and information on income and expenses.

The last page should reflect the tax rate. The remaining cells are not filled in - dashes are placed in them.

If the enterprise operates according to the OSNO scheme, then a zero declaration should be submitted via the Internet. To do this, you will need to install special software and acquire.

Methods for filing a property tax return

A property tax return can be sent to the tax office in one of three existing ways:

- In two copies in paper form through a representative or during a personal visit to the tax authority. One copy of the report remains at the Federal Tax Service Inspectorate, the second copy is marked with acceptance, after which the copy is returned to the taxpayer. Confirmation of timely submission of the document in case of disputes will be a stamp with the date of receipt of the declaration by the Federal Tax Service.

- By a valuable letter by mail with a description of the attachment. In this case, a list of the attachment and a receipt indicating the date of sending the letter will serve as proof of sending the declaration.

- Through operators of electronic document management in electronic form via TKS.

Organizations with more than 100 employees are required to submit reports electronically.

Submitting a declaration through a representative requires drawing up a power of attorney, which will be certified by the company’s seal and the signature of the manager.

Some branches of the Federal Tax Service may impose the following requirements when submitting reports on paper:

- Provide the declaration in electronic form on a flash drive or floppy disk;

- Print a barcode on the declaration that duplicates the information contained in the report.

Such requirements are not provided for by the Tax Code of the Russian Federation, but are quite common in practice and may lead to refusal to accept the declaration.

Detailed algorithm

The first thing you need to do is enter the data on the title page. There they indicate information about the institution and declaration. After this, filling is carried out in reverse order. First you should complete the third section, then the second and finally the first.

The third section should be completed for each property. In this case, the tax on it is calculated based on the cadastral value. If such real estate is not owned by the company, then dashes should be placed in all columns except the TIN and KPP.

If the object was owned by the organization for part of the reporting period, then line 090 should be filled in. It should indicate the figure obtained as a result of the ratio of the period of ownership of the object to the full number of months in the year.

It is worth considering that the month in which the property was acquired or sold will be considered complete - regardless of the date of the transaction. For example, the purchase of property took place on September 30. Then the value 4/12 is indicated in the corresponding column.

There may also be several second sections in a document. It all depends on what code the property is located under. It happens that on the same territory, two buildings will have different codes. In the event that one of the objects enjoys a tax benefit, another sheet of the second section is filled out.

The residual price for the main objects is entered in line 270 of the section.

The exception is land plots and some groups of property:

- which is included in the first and second depreciation groups;

- buildings that are subject to taxation according to cadastral value;

- objects that are on the balance sheet of a separate enterprise.

If documentation is submitted to one tax organization, lines 270 for the OP and the enterprise will be identical.

The first section includes six groups with columns from 010 to 040. They are intended to indicate tax amounts that should be paid or reduced. In this case, the OKTMO classification is used.

The decoding of the line codes is as follows:

To fill out line 030, you will need the amount of tax received from the book value and the amount of tax based on the cadastral value. In this case, the OKTMO codes must be the same.

Submit property tax reports for 2019 on new forms

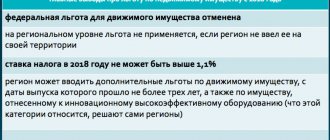

The Federal Tax Service approved changes to the forms by order dated October 4, 2018 No. ММВ-7-21/575. The amendments are due to the abolition of the movable property tax from January 1, 2021 and new rules for calculating the tax on cadastral value. The new rules will be applied in situations where the qualitative or quantitative characteristics of real estate have changed during the year. All changes are spelled out in laws dated 03.08.2018 No. 302-FZ and 03.08.2018 No. 334-FZ.

From 2021, only those companies that own real estate must submit property tax reports. If there is no real estate on the balance sheet in 2019, the calculation of advance payments and the declaration do not need to be submitted (letters from the Ministry of Finance dated 02/28/2013 No. 03-02-08/5904, dated 04/17/2012 No. 03-02-08/41).

The main changes affected sections 2, 2.1 and 3 of the reporting.

The changes in section 2 are as follows: line 210 was removed from the calculation of advance payments. Now it must indicate the residual value of fixed assets as of April 1, July 1 and October 1, respectively.

The declaration no longer contains line 270. It now reflects the residual value of fixed assets as of December 31.

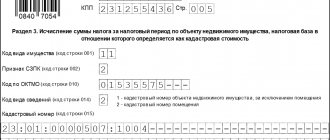

Section 2.1 of the reporting was supplemented with fields in which the address of the property must be indicated. Fill them out if the object has an inventory number, but does not have a cadastral or conditional number. But, if the object has not been assigned an address, put dashes in the new fields. Now in the reports it is necessary to indicate the cadastral, conditional or inventory number of the object.

In section 3 of the reporting, a field has appeared in which you must indicate the code of the cadastral number of the property. Code 1 – for buildings, structures, structures. Code 2 – for premises, garages, parking spaces. In current forms, only cadastral numbers of objects are indicated.

Also in section 3 the lines “Ki coefficient” were added. In the calculation this is line 085, and in the declaration - 095. They will need to be filled out if the qualitative or quantitative characteristics of the property have changed during the year. For example, the area or purpose of the object has changed. Based on the new cadastral value, calculate the tax from the day when the new characteristics were entered into the unified real estate register.

In addition, the K coefficient was renamed Kv (line 080 in the calculation, 090 in the declaration).

The procedure for filling out calculations and declarations has been supplemented with Appendix 7. It contains the codes of Russian regions.

Only in the case of individual real estate objects provided for by the Government of the Russian Federation, a zero property tax declaration for 2021 is possible.

Due to some difficulties in understanding whether it is possible to receive a zero rate or not, the tax service provided clarification on filling out the second section of the declaration. You need to familiarize yourself with it to avoid problems with the Federal Tax Service.

The law approves the mandatory filing of property declarations for private entrepreneurs. This paper contains information about both purchased objects and those that have been owned for a long time.

If there is no property as such, then there cannot be a planned filing of the declaration. This document is submitted to the tax service only when acquiring ownership of any movable or immovable object. After purchasing it, you should fill out a declaration and submit it to the Federal Tax Service. However, there are no specific deadlines.

When purchasing a vehicle, you must register with the traffic police. Only after this the entrepreneur will have the necessary notes in his hands, which will be included in the declaration for the tax office.

The acquired land plot is also subject to registration. First, a package of documents is submitted to the state registration service. There the owner receives a receipt indicating that the organization has received the necessary documentation. Next, you should enter all the information about the land in the declaration and submit the document to the tax office.

Due to changes to the Tax Code in 2021, everyone must file a zero return. In this case, the lack of income does not matter. They submit a declaration in cases where the entrepreneur did not work and did not receive income, or worked, but the level of income was low - without making a profit.

A zero declaration for individuals should be considered one that indicates the sale of property, but its price was the same as when purchased. In this case, you need to fill out the document, but the income will be listed as zero.

For individual entrepreneurs, a zero property tax return for 2021 will indicate that although the businessman did not receive a profit for the specified period, he continues to carry out his activities.

There are several categories of business in which such a declaration can be submitted:

- activities tied to the season - based on climatic and weather conditions;

- during the reporting period, the entrepreneur was employed in another institution;

- no payroll was processed. This case is possible at the start of activity;

- if the operation of the enterprise was stopped.

Among the data required to be provided, the following should be highlighted:

- Full name of the person paying the tax;

- IIN;

- You will need individual identification codes responsible for the tax period, OKATO.

- passport and registration information;

- type of adjustment.

It is worth noting that most of the document and its column will be empty.

Features of corporate property tax

The declaration should indicate those assets that are subject to average annual property tax and real estate with cadastral value.

When filling out the declaration, you should take into account the conditions prescribed by law:

- All prices in the document should be indicated in rubles. Non-integer values should be rounded to the nearest ruble.

- The numbering should be continuous and should be placed on all pages, starting with the title page. There are special fields for numbers in the declaration. Numbering should begin with the value 001.

- Blots and errors cannot be corrected; the sheet must be filled out again.

- Duplex printing is not permitted.

- Fill out the declaration using ink of three colors - blue, black and purple.

- All data is entered exclusively in the fields provided for them.

- Text data is indicated in capital block letters.

- If there is no data in the field, you must put a dash there.

You can find a correct example of filling out a property tax return here.

All taxpayers in the country provide the necessary information to tax authorities in accordance with the deadlines established by the Federal Tax Service and for the specified periods.

The following terms are considered standard:

- until the 28th - should be counted from the moment the reporting period ends;

- for the past period, data must be provided by March 28;

- If the deadline coincides with a weekend or holiday, you can submit documents both in advance and on the day following the weekend.

If the deadline for submitting a tax return to the Federal Tax Service is missed, fines and penalties should be expected.

The Tax Code of the Russian Federation in Article 119, paragraph 1 states that an administrative fine is provided for failure to submit tax reports. Its size depends on the amount of tax that should have been paid. Typically this figure is 5 percent of the amount.

It is worth considering that there is a maximum and minimum fine. Today, the fine cannot be less than 100 rubles and more than 1000. The maximum fee will not exceed 30% for the reporting period.

According to Federal Law No. 242-FZ of October 30, 2009, only those organizations that have objects subject to taxation must pay property tax. These are indicated in the Tax Code in paragraph 1 of Article 373. This change came into force on January 1, 2010.

Such property may include objects that are on the balance sheet of the institution as fixed assets of the company:

- movable and immovable;

- received for rent or for permanent use;

- transferred on the basis of a power of attorney;

- added to joint business activities.

As for benefits, they can apply to all objects owned by the enterprise. But they are not exempt from filling out a tax return and must submit all calculations. Since this property has a place and must obey general orders.

Individual entrepreneur and legal entity persons who use the simplified taxation system must fill out only three sheets of the document.

First, you should provide the following information:

- INN, KPP, tax office code;

- Full name of the entrepreneur or name of the organization;

- OKVED, information about the director of the company;

- date and signature.

The second sheet contains information about the property, OKATO and information on income and expenses.

The last page should reflect the tax rate. The remaining cells are not filled in - dashes are placed in them.

If the enterprise operates according to the OSNO scheme, then a zero declaration should be submitted via the Internet. To do this, you will need to install special software and acquire an electronic digital signature.

The first thing you need to do is enter the data on the title page. There they indicate information about the institution and declaration. After this, filling is carried out in reverse order. First you should complete the third section, then the second and finally the first.

The third section should be completed for each property. In this case, the tax on it is calculated based on the cadastral value. If such real estate is not owned by the company, then dashes should be placed in all columns except the TIN and KPP.

If the object was owned by the organization for part of the reporting period, then line 090 should be filled in. It should indicate the figure obtained as a result of the ratio of the period of ownership of the object to the full number of months in the year.

It is worth considering that the month in which the property was acquired or sold will be considered complete - regardless of the date of the transaction. For example, the purchase of property took place on September 30. Then the value 4/12 is indicated in the corresponding column.

There may also be several second sections in a document. It all depends on what OKTMO code the property is located under. It happens that on the same territory, two buildings will have different codes. In the event that one of the objects enjoys a tax benefit, another sheet of the second section is filled out.

Difficult situations

There are situations in which filling out a declaration becomes more difficult.

Most often, difficulties arise in three cases:

| No objects | If there is no property subject to taxation, then the organization is not automatically a tax payer. Based on this, this enterprise should not submit documentation to the tax office. |

| All property is subject to exemption | Property tax benefits provided by the state can apply to the entire range of activities of the enterprise. In such situations, the organization does not pay tax, but does not cease to be a taxpayer. Therefore, such an enterprise is required to fill out a declaration in accordance with the general procedure. |

| Residual value is zero | If all property that is subject to tax is depreciation and its residual value is zero, then there will be no tax payable. In this regard, the tax will be zero, but the very fact of taxation remains. Based on this, the company must provide a tax return even for objects with zero residual value. |

It is worth remembering that the absence of an amount to pay tax does not relieve the taxpayer of the obligation to submit a report to the tax office. After all, obligations both for the object and for the taxpayer remain.

Filing a property tax return is a simple process. It is important to determine the situation when it is possible not to submit it and the one when reporting is required even with zero indicators.

We indicated the deadline for submitting the property tax return for 2021 in the article.

The company is required to file a property tax return

Even if the residual value of fixed assets is zero, the company must file a property tax return, says Art. 386 of the Tax Code, according to which all taxpayers are required to file tax returns for property tax (letter of the Federal Tax Service dated 02/08/2010 No. 3-3-05/128), reports the newspaper “Accounting. Taxes. Right".

If the residual value of fixed assets that are recognized as an object of taxation is zero, the tax base and the amount of tax indicated in the declaration will be equal to zero.

Source Russian Tax Portal

FEDERAL TAX SERVICE OF THE RUSSIAN FEDERATION LETTER dated February 8, 2010 No. 3-3-05/128

About corporate property tax

Sent to the Interregional Inspectorate of the Federal Tax Service of Russia for the largest taxpayers No. 6

The Federal Tax Service has considered the appeal regarding the application of tax legislation on corporate property tax and reports the following.

In accordance with paragraph 1 of Article 373 of the Tax Code of the Russian Federation (hereinafter referred to as the Code) (as amended in force before the entry into force of the Federal Law of October 30, 2009 No. 242-FZ “On Amendments to Article 373 of Part Two of the Tax Code of the Russian Federation” ( hereinafter referred to as Law No. 242-FZ)) Russian organizations were recognized as tax payers.

By virtue of paragraph 1 of Article 386 of the Code, taxpayers of corporate property tax are required to submit to the tax authorities the relevant tax returns and tax calculations for advance payments for this tax. Taxpayers of the property tax of organizations were the organizations specified in paragraph 1 of Article 373 of the Code, with the exception of the organizations specified in paragraph 1.1 of the said article. At the same time, the recognition of organizations as taxpayers of corporate property tax was not made dependent on the presence or absence of the corresponding object of taxation.

Thus, organizations that are taxpayers of the corporate property tax were required to submit tax returns (tax calculations for advance payments) for this tax to the tax authorities in accordance with Article 386 of the Code, regardless of the fact that the property of these organizations was not recognized as an object of taxation on the basis Article 374 of the Code or was completely exempt from paying tax in connection with the provision of tax benefits. A similar position was contained in the letter of the Ministry of Finance of Russia dated 03/04/2008 No. 03-05-04-02/14, communicated to the tax authorities by the letter of the Federal Tax Service of Russia dated 04/03/2008 No. ШС-6-3/

In connection with the entry into force of Law No. 242-FZ on January 1, 2010, the wording of Article 373 of the Code has changed. From 01.01.2010, taxpayers are recognized as organizations that have property recognized as an object of taxation in accordance with Article 374 of the Code.

Objects of taxation for Russian organizations are movable and immovable property (including property transferred for temporary possession, use, disposal, trust management, contributed to joint activities or received under a concession agreement), accounted for on the balance sheet as fixed assets in accordance with the procedure established for accounting, unless otherwise provided by Articles 378 and 378.1 of the Code.

Taking into account the above, from 01.01.2010 organizations that do not have property recognized as an object of taxation on their balance sheet are not taxpayers of the corporate property tax, therefore, they do not have the obligation to submit declarations (tax calculations for advance payments) for this tax to the tax authorities.

The tax base for the property tax of organizations, when determining which, in accordance with Article 375 of the Code, takes into account the residual value of fixed assets, is formed for tax purposes in accordance with the established accounting rules approved in the accounting policy of the organization.

According to paragraph 29 of the Accounting Regulations “Accounting for Fixed Assets” PBU 6/01, approved by Order of the Ministry of Finance of Russia dated March 30, 2001 No. 26n, disposal of an item of fixed assets occurs in the event of: sale; termination of use due to moral or physical wear and tear; liquidation in case of an accident, natural disaster and other emergency situation; transfers in the form of a contribution to the authorized (share) capital of another organization, a mutual fund; transfers under an agreement of exchange, gift; making contributions under a joint venture agreement; identifying shortages or damage to assets during their inventory; partial liquidation during reconstruction work; in other cases.

Thus, until the moment of disposal (write-off from the balance sheet), fixed assets are recorded on the organization’s balance sheet as fixed assets, including fully depreciated fixed assets that have zero value. Consequently, the organization retains the obligation to submit declarations (tax calculations for advance payments) on corporate property tax to the tax authorities.

Acting State Advisor of the Russian Federation, 2nd class S.N. Shulgin

A paper that indicates that the payment tax is equal to the zero mark is called a zero declaration. Quite often, entrepreneurs do not know whether they need to submit a zero tax return on their own property to the control authority. Self-filling also causes difficulties. Therefore, it would be a good idea to find these answers, as well as understand what the payer can expect if he fails to submit property tax documentation for verification on time.

When must Nil Returns be filed for taxable property?

Responsibility for late submission of the declaration Failure to submit the annual declaration within the time limits approved at the federal level entails the collection of penalties under clause 1 of the article. 119 NK. This is 5% of the unpaid amount of tax due on the basis of an unfiled return. Each month of non-payment is taken into account for the billing month, but the maximum amount of sanctions should not exceed 30% of the indicated amount. The minimum is 1000 rubles. and is charged if a zero report is not submitted.

If the taxpayer violated the legislative norms regarding the submission of advance payments, liability is applied according to stat. 126 NK. According to clause 1, 200 rubles will be charged for each payment submitted late.

A decision by control authorities to hold a legal entity liable is possible only after inspection activities have been carried out.

Attention

In such a situation, they are still taxpayers, since according to the reporting documentation it has not yet been written off from the balance sheet of the organization or private entrepreneur. Therefore, these categories of taxpayers are required to submit a declaration of absence of property in 2021 to the tax office in 2021.

Solve your problem without leaving home! Promotion: 350 rubles FREE until May 30, 2021 Ask your question, and within 6 hours a property expert lawyer will study it and provide you with a solution.

In accordance with tax legislation, the tax base is formed in relation to each individual group of property, as well as for those types of fixed assets that have different taxes on the property of legal entities; the declaration reflects their calculations in separate columns. Submission deadline According to the general rules of tax legislation, the declaration must be submitted no later than the established deadlines - this is the last day of the month that follows the reporting period.

But in accordance with Article 383 of the Tax Code of the Russian Federation, the property tax, declaration, and deadlines for 2021 are established by regional authorities, so the deadline for filing in each region may be different. A frequent question among accountants is the question of submitting a zero calculation. If interest rates are not determined, then property tax, when a declaration for the year is submitted, is calculated at the maximum established rates in accordance with Article 380 of the Tax Code of the Russian Federation:

- for calculating property liabilities based on the average residual value - 2.2%;

- for calculating property obligations according to cadastral valuation - 2%.

The same article 380 provides a list of types of property that are subject to taxation at rates that change every accounting year. The new property tax declaration reflects the tax calculation for these objects in a separate column. In 2021, the following bet rates are set:

- list of objects in clause 3 of Art. 380 (power lines, pipelines and their components) – 1.6%;

- list of objects in clause 3.2 of Art.

There is no need to worry that the tax service will begin checking the lack of income; legislators understand that the business sector is not stable and it is quite possible that during the year expenses and income are equal, that is, there is no profit.

It’s worse if the declaration is not filed on time, in which case the individual or businessman will face a fine of 1,000 rubles. If it is ignored, a criminal case may well be opened.

In some regions, a practice is used in which a zero declaration is submitted to the inspector who deals with such reporting. Before submitting the completed form, you must review it to ensure it is complete and accurate.

When sending by mail, it is necessary to make an inventory of the contents - this will be a guarantee for the payer that he handed over the documents.

You can also fill out the declaration in electronic format, but to do this you need to register on the State Services portal. There, select the section called “Taxes and Fees”, subsection “Filing a Declaration”. A previously prepared and completed reporting form must be attached to the submission form.

When do you need to submit a declaration?

According to the amendment, which is provided for in the current legislation of the country, all payers without exception must submit a zero property tax return. You need to send a reporting document, regardless of whether the profit came in the reporting period or was zero. That is, if an entrepreneur works under the OSN system, he in any case needs to submit a property tax return, even if the working period brought zero profit. It can also be obtained in the following situations:

- if business activity is not carried out during a certain period, therefore the individual cannot receive income;

- if the work process is carried out, but not at the proper level, in the end the income does not come, which means it turns out to be zero.

To pass or not to pass - that is the question

Fixed assets owned by a taxpayer are a circumstance that obliges him to calculate and pay the property tax, fill out and submit the appropriate reporting forms.

However, not all types of property assets are taxable items. This means that the tax calculation, as well as the declaration, should not include the entire base of fixed assets that are listed on the balance sheet of an economic entity, but only those in respect of which appropriate legislative decisions have been made. This means that legislators have determined a closed list of property assets that are taxable objects under the property tax.

What to do if there are no taxable objects? In this case, the zero property tax return for 2021 is not completed and submitted. In other words, if there is no object on which tax must be calculated and paid, then there is no need to submit a report.

How to file a zero property tax return

If no business activity was carried out during the reporting period, then the property tax declaration is prepared using a different system. The document should contain the following sections:

- the first title page, which is drawn up according to the general rules; a sample of the filling can be seen at the tax authorities;

- the first part of the document displays KBK and OKATO. Since no numerical profit was received, dashes must be placed in these sections;

- the second part of the document also indicates income figures. Due to the fact that no profit was made, dashes are placed in these places.

It may happen that in the process of activity there were both income and expenses, but the profit still turned out to be zero. In this case, you need to submit a declaration drawn up according to a standard template and enter into the document all the indicators of the work process. A zero declaration can be called a very simple document, because only two subparagraphs will be left unfilled, which reflect the amount of the tax payment and the main base for payment; the provision of the remaining information should be fully reflected in the property tax documentation.

Zero tax calculation

We draw conclusions: if an organization does not have fixed assets on its balance sheet, it means that it does not have objects of taxation and is not a payer of property tax. Accordingly, such a company should not have submitted advance payments and property tax declarations in 2021.

Thus, if there is no data to fill out the calculation, it can be considered zero. And as we found out, a zero calculation for property tax is not submitted to the tax office. At the same time, there are no legislative instructions to additionally inform the tax authorities about the organization’s lack of fixed assets on its balance sheet, so in this case, you can simply not submit property tax reports without writing additional explanations to the Federal Tax Service.

Subscribe to our newsletter

Yandex.Zen VKontakte Telegram

When do you need to submit your property tax return?

According to the legislation of the country, all taxpayers must submit a property tax declaration to the control authority by the end of the reporting period indicated by the tax authority. The general rules for submitting documentation are as follows:

- Documentation must be submitted to the control body by the 28th calendar day; the report is made from the date on which the reporting period ends.

- If a declaration is submitted for the past tax period, submission must be made no later than the 28th day of the first spring month.

- If the reporting day falls on a weekend or holiday, the documentation must be submitted the next day or the day before the weekend.

There is property on the balance sheet, but there is no tax

Since 2021, movable property has been removed from taxation. In addition, in paragraph 4 of Art. 374 lists property that is not recognized as an object of taxation. This includes, in particular:

- land plots, water bodies, natural resources;

- monuments of culture and art;

- nuclear installations;

- ships registered in the International Register of Ships;

- icebreakers;

- space objects.

Thus, the situation with a zero declaration for property tax is similar to that indicated in the previous section: if we have only the property listed above on the balance sheet, then there is no object of taxation, therefore the business entity is not a tax payer and does not submit a declaration.

Who must submit the quarterly report?

Taxpayers whose reporting periods are quarters, that is, the first quarter, six months and nine months, must submit documents for reporting quarterly, as well as based on the results of the entire year:

- no later than April 28, documentation for the first working quarter is submitted;

- the report for the entire half-year must be submitted by July 28;

- before October 28, a zero declaration for a period of 9 months is submitted;

- The property tax declaration for the entire reporting year is submitted to the control authority by the 28th day of the first spring month.

Cancel quarterly reports

There will no longer be quarterly property tax payments. Such amendments to the Tax Code were introduced by Law No. 63-FZ of April 15, 2019.

However, advance payments must still be made.

These innovations are taken into account in the new declaration form.

In connection with the cancellation of the submission of tax calculations while maintaining the obligation to calculate advance tax payments, Section 1 of the Declaration has been supplemented with lines containing information on the calculated amount of tax payable to the budget for the tax period, and on the calculated amounts of advance tax payments.

Lines containing information on the amounts of advance tax payments calculated for the reporting periods are excluded from sections 2 and 3 of the Declaration.

“VAT, Income Tax, Property Tax, taking into account the latest clarifications from the Ministry of Finance, the Federal Tax Service and court decisions” is the topic of the seminar, which will take place on January 30.

The host of the event is A.M. Rabinovich, author of more than 600 articles and 9 books on tax topics.

Monthly report 2016-2017

A monthly report must be submitted to the control body if payment is calculated on actual profits. In this case, the declaration is submitted by month and after a year:

- the first report must be submitted before February 28 of the current year;

- the second report is submitted by March 28;

- For activities of the third month, documentation must be submitted by April 28.

The remaining monthly reports are carried out in the same way, and the declaration for the entire year must be submitted before the 28th day of the first spring month of the next reporting year. It should be noted that the final report for the year has not yet been submitted, and a new period of activity has already begun, so current declarations are submitted earlier than annual ones.

Do I need to prepare and submit an income tax report for non-profit companies?

Non-profit companies do not pay property tax because they do not have one. This means that they do not have to prepare and submit a zero declaration; they must submit only a report for the year to the control body. This provision applies to the following organizations:

- state theaters and museums;

- public concert venues;

- non-profit organization.

The deadline for submitting the annual report for these companies is the same, that is, March 28 of the next reporting period.

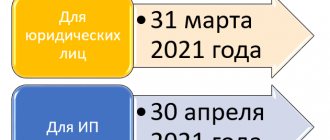

Submission deadlines

Guided by Article 386 of the Tax Code of the Russian Federation, payers of property obligations must submit reports to the regulatory authority within the established deadline for submitting a property tax return. According to legislative norms, such a day for reporting for 2021 is considered to be March 31, 2021, but since this day falls on a weekend, the transfer rule applies (Article 6.1 of the Tax Code of the Russian Federation), that is, the final day for submitting the document is April 2, 2021.

For quarterly calculations, the submission deadline is set to the last day of the month following the reporting period. The following deadlines have been set for 2018:

- 1st quarter – April 30;

- half-year – July 31;

- 9 months – October 31.

Which companies are tax agents?

Companies operating in the Russian Federation act as tax agents if they make payments for:

- interest rate regarding payment of the cost of securities of state or municipal importance for both Russian and foreign companies that have a representative office in Russia;

- a certain amount of money is paid for foreign companies that have representative offices on the territory of the Russian Federation, but do not operate with representative offices;

- Dividends are paid to both domestic and foreign companies with a representative office in Russian territory.

A zero property tax return is a paper that states that the tax payment is zero. Often, even entrepreneurs, not to mention ordinary citizens, do not know whether they need to submit such a property tax return. It is important to understand that even if there is no property, you need to submit these reports to the regulatory authority.

Zero calculation

In the event that an enterprise does not have objects recognized as objects of taxation listed in Article 374 of the Tax Code of the Russian Federation, then such organizations do not submit a zero declaration for property tax for 2021. However, it is important to understand here that if the tax base is 0, due to the application of tax incentives, or depreciation of equipment and other objects is calculated at 100%, then a document with a zero calculation must be sent to the fiscal authorities (Letters of the Federal Tax Service No. ED-21-3 /374 and No. 3-3-05/128).

Note that when organizations are not payers of property tax, they are not required to send inspectors a written notification about this and, accordingly, they also do not submit a zero property tax return. Any claims from the regulatory authority regarding the delay in submitting a document are considered unlawful and can be appealed in accordance with Article 374 of the Tax Code of the Russian Federation.

Why is a zero declaration needed?

The changes that were made to the tax code in 2015 also affected zero property declarations in 2021. Now absolutely everyone is required to submit this paper to the fiscal authority for real and movable property.

Those who had no profit in the reporting period or it was zero are subject to zero taxation. This applies more to entrepreneurs, and you will have to submit a zero declaration in this case:

- If at a certain time there was no business activity, then there was no profit.

- If the activity was carried out, but not at the proper level, as a result, there was no profit from it.

If the case concerns individuals, then it is also important to know who submits such a declaration for real estate or movable property.

For example, the declaration will be zero if an apartment has been sold that has been owned for less than 5 years and the purchase and sale prices are the same. In this case, it is necessary to submit a declaration, although there will be no profit in it. Otherwise, a fine will be issued, or worse, a notification will be sent to pay tax on this amount of the sale.

Necessity for individual entrepreneurs

Filing a zero return for last year is not a whim of the NSF, but a necessity. Because with such documents the individual entrepreneur confirms that he continues his activities, but his work is simply temporarily suspended. The categories of entrepreneurs who submit such reports include:

- Seasonal business, which depends on the climate and weather.

- If during the past period the entrepreneur worked as an employee.

- If a businessman has not paid the salary, this happens if he is only at the beginning of his entrepreneurial activity and has not yet had time to receive income.

- In case of termination of activity.

Nuances

A zero declaration is a standard form for individuals. It is not its appearance that differs, but its filling. It is necessary to indicate information about the payer. In this case, all calculations and amounts of income are missing. That is, the form does not contain data on the movement of funds, which means there is no tax base for calculating the payment.

Important! It is necessary to submit a declaration for any type of property, including movable property, once a year until April 30, following the reporting period. That is, in 2021 it is necessary to submit a zero declaration before April 1, 2021 for 2021.

In what form should I submit the document?

According to the general requirements of the law, filling out a property tax return can be done both on paper and in electronic form. The form of document submission depends on the number of staff:

- if the workforce is 100 people or less, it is allowed to fill out and submit a paper report form;

- If the workforce is more than 100 people, only an electronic version is provided.

Also, an electronic declaration format must be generated by newly created enterprises, including those registered as new owners during reorganization.

Mandatory data

There are no difficulties with filling it out, since you don’t need to make any mistakes, you just have to have an idea of the codes. The first 2 sheets must be filled out; they contain information about the tax payer, more specifically:

- Full name of the payer.

- Codes:

- Categories of individuals.

- Identity cards.

- Tax period.

- OKATO.

- Passport and registration details.

- Type of adjustment.

Most fields are left blank.

The most common mistakes:

- Blots and corrections.

- Incorrect codes.

- Use of correctors.

- Lack of payer's signature on all sheets.

Declarations with such errors will not be accepted.

What and how to fill out

For a businessman who has just started his journey, there will certainly be difficulties with maintaining records, but it is not always necessary to involve an accountant, because you can fill out the form yourself.

The zero property tax declaration has the same form as the standard declaration form. You only need to fill out the first sheets. 4-NDFL is submitted along with this form; it must indicate how much profit it is planned to receive in the coming year. There are categories of persons for whom the question of whether it is necessary to submit a zero declaration is not worthwhile, these include:

- Individual entrepreneurs who work on the general taxation system.

- Individual.

- Lawyers, notaries and anyone involved in private practice.

- Farm owners.

- An individual who sold real estate or movable property in the past period.

- Those who have won the lottery.

- If the income was received from a source located outside the country.

- If the profit is received in the form of salary, but the employer has not paid the tax.

What to give your wife when she is discharged from the maternity hospital?

27.01.2021

How to teach a child to hold a pen correctly consultation on the topic Correct holding of a pen when writing

27.01.2021

Responsibilities of parents in raising children What responsibilities do children have towards their parents?

27.01.2021

Who reports property taxes?

The obligation to submit a property declaration with the calculation of the tax payable at the end of 2021 is assigned to legal entities that have fixed assets on their balance sheet that are subject to the specified tax.

When reporting for 2021, you need to submit information about the average annual value of property. In this regard, the tax authorities finalized the property tax declaration, approving its new form. The order with the updated form comes into force on March 14, 2021. Is it possible to report for 2021 using the new form? Let’s find out here.

If the company does not have taxable objects, then zero (as, for example, for VAT) does not need to be submitted.

Special regimes under the simplified tax system reflect in the corporate property tax return for 2021 only those properties for which the cadastral value was determined as of January 1 of this year. Simplified residents are exempt from calculating and paying property tax, assessed at the average annual value.

Enterprises on the Unified Agricultural Tax show in the report assets that were not involved in agricultural activities (clause 3 of Article 346.1 of the Tax Code of the Russian Federation).

Individuals, regardless of whether they have the status of individual entrepreneur, lawyer, notary, etc., do not report on property tax. Their responsibility is to pay tax upon notification, where the amount of the liability has already been calculated by the tax authority.