Financial assistance according to the Labor Code

At the moment, Russian labor legislation does not contain a concept that would mean an additional payment of funds - that is, an increase in vacation pay. This payment is assigned to the employee at the discretion of the employer. And nothing obliges to pay.

Let's take a closer look at the payment of financial assistance. According to Art. 129 of the Labor Code of the Russian Federation, employees, in addition to the salary they are entitled to, can also count on additional increases. These include social support , which is paid in connection with events that affect the financial situation of the employee.

The next type of material support is incentive . It, in turn, depends entirely on the success and work of the employee. Even the fact of accrual also depends on performance . But this will no longer be financial assistance, but a bonus for special merits or achievements.

Right to a lump sum payment for vacation

Financial assistance is a one-time financial payment designed to increase an employee’s motivation to work. Typically provided before an employee goes on annual paid leave.

The very concept of mat. assistance is not interpreted in any way in Russian legislation. Article No. 136 of the Labor Code of the Russian Federation provides for mandatory payments for vacation for an employee, but there is no talk of additional financial incentives.

Articles No. 135 and 144 of this regulatory document talk about various types of additional payments and salary supplements. Based on this, we can conclude that paying financial assistance is not an obligation, but a right of the employer.

It is available to any employee, including representatives of a budget organization. The possibility and conditions for using financial incentives are prescribed in the local regulations of the enterprise. Cash assistance does not necessarily coincide with vacation.

The following situations may be grounds for receiving a payment:

- personal wedding;

- difficult financial situation;

- birth of a child;

- the need to undergo expensive treatment and recovery;

- death of a close relative.

The amount of financial assistance depends on the capabilities of the enterprise, since it is paid from the organization’s budget.

Expert opinion

Irina Vasilyeva

Civil law expert

It is recommended to declare your intention to receive funds in advance so that the accounting department has time to make the necessary calculations and make the payment of money.

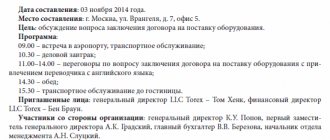

Distribution of financial assistance for vacation in organizations

The payment of financial assistance sometimes depends not only on the employer, but also on the type of organization in which people work.

For example, in commercial and non-state companies, financial assistance depends only on the discretion of the employer and his favor towards the employee. have in their labor (collective) agreement . Of course, subject to the financial capacity of the employer.

The circumstances are somewhat different in government organizations. In the public sector, with financial assistance, everything is much simpler . For persons working in government agencies, there is a separate federal law regulating the payment of financial assistance for vacation - Law No. 79-FZ of July 27, 2004 “On the State Civil Service of the Russian Federation.” In accordance with this law, an increase in payments is not only mandatory , but also regular . In this case, financial assistance does not depend on the results of the employee’s work.

The additional payment must be specified in the organization’s collective agreement, employment contract (or additional agreement to it), as well as in orders from management.

Please note that the amount of financial assistance for vacation should not legally exceed established standards (usually double the employee’s salary).

Next, we will consider the design and preparation of an application for financial assistance for vacation.

How is the provision of financial assistance during the next vacation regulated (article of the Labor Code of the Russian Federation, etc.)?

The Labor Code (hereinafter referred to as the Labor Code) does not explain the concept of material assistance if it is provided when an employee goes on his next annual paid leave.

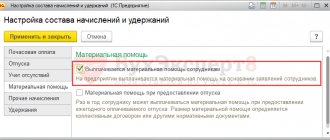

This term is used in practice and is enshrined in other legal acts, which, as a rule, are local in nature. At the same time, the regulation of such payments follows from a number of labor legislation, including the Labor Code. See the material “Regulations on the provision of financial assistance to employees” for more details.

If such assistance is not actually a social benefit and is established as a supplement to the salary and other allowances, then its regulation is carried out in accordance with Part 1 of Art. 129 Labor Code, i.e. as a component of wages. In this case, this payment is established by a local legal act or follows from departmental regulations and depends on the results of the employee’s work activity or has a fixed amount and is paid in any case when the employee goes on annual leave.

At the same time Art. 40 of the Labor Code provides for the possibility of using a collective agreement at a specific enterprise or other organization, which is concluded between representatives of the employer and the workforce. This act regulates not just labor, but social and labor relations. According to Art. 41 of the Labor Code, such an agreement, among other things, may include conditions governing the possibility of providing employees with financial assistance due to certain circumstances. In this situation, assistance is a social benefit and is provided if the employee is in need.

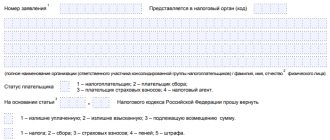

In addition, the regulation of such payments to a certain extent is carried out by the norms of tax legislation concerning the rules for calculating the tax base and the amounts for which insurance payments are calculated - Art. 217 and 422 of the Tax Code (hereinafter referred to as the Tax Code). On a number of issues, it makes sense to apply the practice developed by the courts. One of the most significant in regulating the issue under consideration is the Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated May 14, 2013 No. 17744/12 in case No. A62-1345/2012.

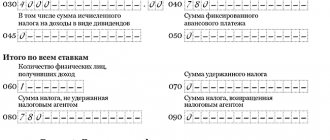

The limit of financial assistance, not subject to personal income tax and insurance contributions, is 4 thousand rubles. in year.

The rules for calculating tax and insurance contributions from financial assistance, as well as the procedure for reflecting payments in accounting, were explained by ConsultantPlus experts. Get trial access to the system and proceed to a Typical situation with a calculated example.

Read how to reflect financial assistance in 6-personal income tax here.

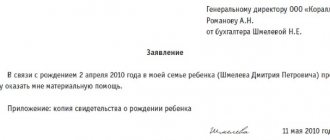

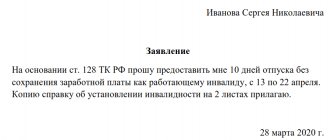

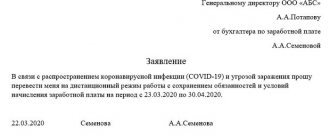

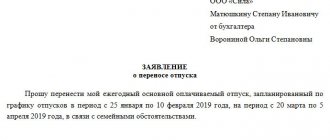

Application for financial assistance for vacation: sample

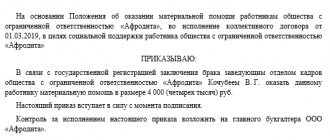

If you are an employee of a commercial organization, and the employer plans to pay incentive support, then this is possible by issuing an order . When paying social assistance, you must write an application .

Please note that there is no . Therefore, an employee can compose it in free form if local regulations do not provide sample .

An application for financial assistance for vacation must contain the following key points:

- applicant’s details – full name, position;

- name of company;

- grounds for payment of financial assistance (reason for payment);

- duration of leave and its terms;

- date of writing the application;

- signature with transcript.

You can find a sample application for financial assistance for vacation below:

Is financial assistance included in the calculation of vacation pay?

Let's talk about whether financial assistance is included in the calculation of vacation pay.

According to clause 3 of the Regulations on the specifics of the procedure for calculating the average salary, approved by Decree of the Government of Russia dated December 24, 2007 No. 922, and clause 6 of the Rules for calculating the salary of federal state civil servants, approved by Decree of the Government of the Russian Federation dated September 6, 2007 No. 562 (hereinafter referred to as the Rules) , financial assistance may not be taken into account when calculating vacation pay or may be included in it with some restrictions, which will be discussed below.

Whether or not to include financial assistance in the calculation of vacation pay depends on the form of ownership of the organization. In accordance with our legislation, organizations are of two types: budgetary, that is, state-owned, or commercial, private. Depending on this, financial assistance is included in the calculation of vacation pay or excluded.

Let us turn to the legislative acts already mentioned above. According to clause 6 of the Rules, financial assistance is partially included in the calculation of vacation pay, as 1/12 of all payments that were accrued during the calculation period before the vacation. This applies only to public sector companies. Financial assistance to employees of other commercial companies is not included in the calculation of vacation pay. An exception is the case when financial assistance for vacation is interpreted in the regulatory local acts of a commercial organization as an incentive and incentive payment and is included in the wage fund, then it can be included in the calculation of vacation pay.

Can an employer refuse payment?

Financial assistance for vacation is a one-time payment, due only once a year. If the employee’s vacation was divided into parts, then it is paid only when leaving for the first time. The rule on receiving vacation assistance only applies to working employees. Upon dismissal, it is no longer possible to receive it along with compensation for unused vacation days.

The reason for refusal to pay compensation may be the lack of experience necessary for the vacation. You can get your first vacation at a new job no earlier than after working there for six months. At the request of the employee and with the consent of the employer, rest may be granted earlier. But the rule may not apply to receiving financial assistance.

Most often, the reason for refusal to receive financial assistance at work is the absence of this type of incentive or compensation in internal documents. It all depends on the goodwill of the employer and the availability of the necessary funds to provide support to employees. If the collective agreement specifies the obligation to provide assistance, the refusal will be unlawful.

What is financial assistance

There is no concept of “material assistance” in the Labor Code of the Russian Federation. Article 135 deals with incentive bonuses and bonuses. The employer has the right to introduce them at his discretion into the remuneration system if he has enough financial resources to reward employees. Additional payments are paid by employers of all forms of ownership.

Usually, the right of employees to financial assistance for annual leave is secured in the following documents:

- collective agreement;

- regulations on remuneration and bonuses;

- other local acts;

- employment contract.

A one-time payment for annual leave to public sector employees may be established by regulations of the Russian Federation and a constituent entity of the Russian Federation.

Civil servants deserve special mention. Their labor activity is regulated by Law No. 79-FZ of July 27, 2004. According to clause 6 of part 5 of article 50 of the said act, a lump sum payment for vacation is included in the number of mandatory allowances. Financing is provided from the wage fund.

Who can receive financial assistance

An additional payment for vacation may not be an incentive for employees to conscientiously perform their duties during the year, but a measure of social support. Employees who find themselves in a difficult life situation that requires additional financial costs can count on it:

- death of a close relative;

- severe or long-term illness of the employee or members of his family;

- the need for an expensive operation, etc.

Funds in the form of financial assistance can also be paid for happier reasons: marriage, buying a home, the birth of a child, another vacation. All conditions must be documented.

An employee has the right to write an application for financial assistance in connection with one or another event in his life. The manager is obliged to accept the application for consideration. If the budget of the employing company contains the necessary funds, then financial assistance will be provided to the employee.

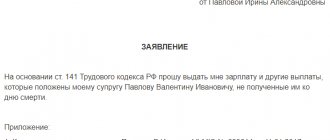

In what cases is an application for financial assistance at work required?

Employees have the right to apply to their employer for financial support. Types of financial assistance vary depending on the specific situation. In general, these are the following reasons:

- Birth of a child.

- Death of a close relative.

- Deterioration in the health of the employee or his relative.

- Vacation.

- Difficult life situation.

- Wedding.

- Training, etc.

The exact list of circumstances in which employees may receive financial assistance is approved by the employer in the LNA. They also provide the procedure for providing assistance, including deadlines, methods of transferring funds, conditions for refusal, etc.

To benefit from support, an employee submits an application for financial assistance to the manager.