Employers had until the end of 2021 to complete drawing up action plans for the implementation of professional standards. In particular, they should have established for which positions professional standards have been adopted, which employees meet their requirements, and who needs to be sent for training. Of particular interest is the position of chief accountant, which exists in almost every organization. But, as practice shows, many of the chief accountants, although they have extensive work experience, work as chief accountants without higher education. Is it necessary to fire such an employee because of this? Let's figure it out.

About the professional standard for the chief accountant.

The first professional standard “Accountant” was approved by Order of the Ministry of Labor of the Russian Federation dated December 22, 2014 No. 1061n. In 2021, by Order of the Ministry of Labor of the Russian Federation dated February 21, 2019 No. 103n, a new standard was approved, which changed the requirements for accountants and chief accountants.

Compared to the old standard, the new one establishes an expanded list of possible titles of accounting positions. So, if in the old standard there was only one title “accountant”, now there are three positions: “accountant”, “accountant of category I” and “accountant of category II”.

Instead of one position “chief accountant” with the 6th qualification level, the following positions have now been introduced:

- chief accountant (6th – 8th qualification levels);

- head (manager, director) of the department (management, service, department) of accounting (6th – 8th qualification levels);

- head (manager, director) of the department (service, department) of consolidated financial statements (8th qualification level);

- Director of Operations Management (8th qualification level);

- director of accounting outsourcing (8th qualification level);

- commercial director (8th qualification level);

- Business Development Director (8th qualification level).

According to the requirements of the old standard, in order to work as a chief accountant, an employee must have a higher (specialized) or secondary vocational education with additional programs for advanced training and professional retraining, as well as practical experience related to accounting, preparation of accounting (financial) reporting or auditing activities, for persons:

- with higher education – at least three of the last five calendar years;

- with secondary vocational education – at least five of the last seven calendar years.

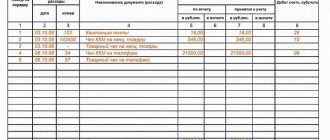

Now, in addition to the fact that two more qualification levels have been added for the chief accountant (7 and 8), which has significantly increased the requirements for this position, the requirements for his qualifications have also changed. Depending on the qualification level, different levels of education, work experience and general labor function are established. We present the requirements for chief accountants of all levels in the table.

| Level | Generalized labor function | Education Requirement | experience |

| 6 | Preparation and presentation of accounting (financial) statements of an economic entity | Higher education - bachelor's degree | At least five years of accounting and financial work |

| Secondary professional | At least seven years of accounting and financial work | ||

| 7 | Preparation and presentation of accounting (financial) statements of an economic entity that has separate divisions | Higher education - master's degree or specialty | At least five years of accounting and financial work in management positions |

| 8 | Preparation and presentation of consolidated reporting | Higher education - master's degree or specialty | At least five years out of the last seven years of work related to accounting, preparation of accounting (financial) statements or auditing activities (including in management positions); at least three years out of the last five years (including in management positions) with a higher education in economics with a specialization in accounting and (or) audit |

If workers at all levels have non-core higher or secondary education, they must have additional education through professional retraining programs.

In addition, chief accountants of all levels must receive additional education through advanced training programs in the amount of at least 120 hours for three consecutive calendar years, but not less than 20 hours in each year.

What does he do?

An accountant deals with many issues related to financial reporting, calculations and payroll, provision of documents to the tax and other authorities. The profession is multidisciplinary, since an accountant is able to specialize in certain categories of tasks. That is why large enterprises create departments where each employee is responsible for a separate financial area.

If we consider small companies, then the accountant’s functionality includes all the main responsibilities at once and almost everyone will have to deal with it, but the scale of activity in this case is much smaller.

If we roughly combine what an accountant does, then these are almost all issues related to the financial activities of the company and its reporting to the relevant authorities.

Where can I work?

A competent accountant can find himself in any company or work privately, which is often practiced by specialists at various levels. There is an option to be on the staff of a consulting firm or organization providing financial services. In all cases, the employee is responsible for his activities, his data appears in the documents.

If the enterprise is large, then the accountant works in the department in which he is more qualified. These could be cash transactions, economic planning, reporting on core activities, for example, logistics or production, settlement actions for salary projects, and so on. In some cases, companies hire private accountants to carry out certain financial transactions, which also pay well.

For whom are the requirements of professional standards mandatory?

Let us remind you that, by virtue of Art. 195.3 of the Labor Code of the Russian Federation, if this code, other federal laws, and other regulatory legal acts establish requirements for the qualifications necessary for an employee to perform a certain job function, then professional standards in terms of these requirements are mandatory for application by employers. That is, only those requirements of professional standards that are introduced either by the Labor Code, or federal laws, or other regulations are considered mandatory.

Let us turn to the Federal Law of December 6, 2011 No. 402-FZ “On Accounting”. In accordance with Part 3 of Art. 7 of this law, the head of an organization may entrust accounting to the chief accountant or other official of the organization or enter into a civil contract for the provision of accounting services.

The chief accountant or other official responsible for maintaining accounting records must meet the following requirements:

1) have a higher education;

2) have work experience related to accounting, preparation of accounting (financial) statements or auditing activities for at least three years out of the last five calendar years, and in the absence of higher education in the field of accounting and auditing - at least five years out of the last seven calendar years;

3) do not have an unexpunged or outstanding conviction for crimes in the economic sphere.

However, such requirements apply only to chief accountants:

- open joint-stock companies (except for credit organizations);

- insurance organizations;

- non-state pension funds;

- joint stock investment funds;

- mutual fund company managers;

- state extra-budgetary funds and their territorial branches.

For other organizations, the requirements of the professional standard “Accountant” are advisory in nature, and the employer himself decides whether to apply the qualification requirements established by the professional standard.

Education

The profession of accountant requires an employee to have a higher education, which can be obtained in more than 300 universities. In some cases, an average is enough, but such a base is not enough for further development in this profession and it will be difficult to apply for leadership positions.

From a large number of universities, the following institutions can be distinguished:

- National Research Technological University "MISiS" (Moscow).

- Russian Academy of National Economy and Public Administration under the President of the Russian Federation (Moscow).

- St. Petersburg Mining University (St. Petersburg).

- St. Petersburg State Economic University (St. Petersburg).

- National Research Nizhny Novgorod State University named after. N.I. Lobachevsky (Nizhny Novgorod).

- Yaroslavl State University named after. P.G. Demidova (Yaroslavl).

- Stavropol State Agrarian University (Stavropol).

- Saratov State Agrarian University named after N.I. Vavilova (Saratov).

- Ural State Forestry University (Ekaterinburg).

- Tyumen State University (Tyumen).

- South Ural State University (Chelyabinsk).

- Novosibirsk State University of Economics and Management (NINH) (Novosibirsk).

- Kemerovo Institute (branch) of the Russian Economic University named after G.V. Plekhanov (Kemerovo).

- Far Eastern Federal University (Vladivostok).

- Far Eastern State Transport University (Khabarovsk).

You can find a suitable university in almost any region, choose a budget option or a paid basis, which is much more common. The training lasts 5-5.5 years, there is a part-time or full-time course, which is considered preferable.

Additional education, courses

Having a diploma of higher economic or other education, you can additionally obtain the profession of an accountant. To do this, you should enroll in the appropriate university or complete distance learning. Each option has its advantages, as well as disadvantages in terms of time and knowledge gained.

The option of entering a university is suitable for young professionals who have not previously had anything to do with accounting; this area is completely new and unexplored. You can choose to study by correspondence; periodically you need to attend lectures, take exams, tests and, if necessary, undergo practical training.

One of the ways to gain a profession, doing it at a convenient time, is distance education. The material is provided electronically, studied independently, and tests and exams are taken during the specified period. There is no need to travel anywhere; upon successful completion, the diploma is sent by mail or directly to the educational institution. Thus, there is an opportunity to get a new profession and undergo retraining.

Additional education is mainly provided on a paid basis. If an employer sends a specialist for advanced training, the initiator can contribute part or the full amount. In other cases, payment is made at the expense of the listener.

Introduction of professional standards.

As noted, at the beginning of 2021, government institutions, as well as other state and municipal institutions, had to implement action plans for the implementation of professional standards: to establish, in particular, whether the requirements of professional standards are mandatory for employees of their organization, including chief accountants , conduct an analysis of the professional qualities of employees for compliance with these requirements, and also draw up plans for employee training and additional professional education within the budget for the corresponding year. The Ministry of Labor reminded us of this back in 2021 (Letter dated 04/04/2016 No. 14-0/10/B-2253).

For chief accountants of government institutions, the qualification requirements established by the professional standard are recommendations. However, if the employer is interested in competent employees, he can apply professional standards when developing job descriptions, recruiting personnel, organizing training, certification, etc. Accordingly, he can include in the job description of the chief accountant the knowledge, skills and functions established by the standard, as well as qualification requirements.

After changes are made to the job description, new employees will need to be hired in accordance with these requirements.

Features of training to become an accountant

The difficulties of training to become an accountant lie in the fact that the future economist must not only be able to make calculations, but also know some provisions of the law - for example, tax and labor laws. In addition, during training it is necessary to study and master accounting programs - certain software products that are used in enterprises to maintain expenses and income and other accounting operations. High-quality preparation is impossible without practice, and although students who choose the full-time format of study spend more hours on practical classes, it is quite possible to become a competent accountant even on a correspondence basis. Moreover, today even the distance learning format allows you to study to become an economist. It is not for nothing that it is widely believed that the quality of learning material depends not only on the student’s abilities, but also on his desire to gain knowledge, as well as on his readiness to gain experience.

To fire or not to fire?

Let us say right away that even if the employer is obliged to apply the professional standard for the chief accountant, but his qualifications do not meet the requirements of the standard, it is impossible to fire the chief accountant for this, since there is no such basis for dismissal as, for example, “inadequacy of qualifications.”

If before the employer began applying (either independently or by force of law) the professional standard, the chief accountant without a higher education was already working and, during the implementation of the standards, it was established that his qualifications do not meet the requirements of the standard, he can be fired only based on the results of certification. And this can only be done after the employer offers the employee to undergo advanced training, including it in the employee professional training plan.

At the same time, even if the employee refused to improve his qualifications, but has sufficient experience and knowledge in his position, then, on the recommendation of the certification commission, he can continue to remain in his position.

If, based on the results of the certification, it is established that the employee is not suitable for the position held due to insufficient qualifications, then he can be dismissed on the basis of clause 3 of part 1 of Art. 81 of the Labor Code of the Russian Federation (inconsistency of the employee with the position held or the work performed due to insufficient qualifications confirmed by certification results). Before dismissal, the employee should be offered a transfer to another job that matches his qualifications.

An employee’s compliance with the requirements of the professional standard can be established as a result of him passing, and with his consent, at the direction of the employer, an independent assessment of qualifications, which is carried out in independent assessment centers.

Do not forget that dismissal under clause 3, part 1, art. 81 of the Labor Code of the Russian Federation may not apply to all workers. For example, a pregnant woman, a single mother raising a child under the age of 14 (a disabled child under the age of 18), and a woman with a child under the age of three are not subject to dismissal.

Part-time training to become an accountant

Attracted by the prospect of obtaining a prestigious profession that will not leave you hungry, applicants storm the faculties of economics, and for the sake of the coveted diploma they are even ready to leave school after the 9th grade, enrolling in college to major in “accounting, analysis and auditing”, and often choosing a correspondence course of study to be able to work while studying. By the way, you can enroll in a college majoring in economics after the 11th grade. The next goal, if you want to develop in this direction, is an economics university, enrollment in which after graduating from college usually occurs on easier terms. For those who have chosen the accounting profession, the correspondence course provides the opportunity to find a job already from the first year, that is, at the same time receive a theoretical basis and full-fledged work experience, gradually increasing their professional level. And we can say that such tactics are justified: today it is customary to start building a career as early as possible, because the value of time increases, and the most active and young years should not be wasted.