What is a penalty

Penalties for taxes and contributions are penalties for late or incomplete (partial) payment of taxes or contributions. We can say that this is a type of penalty for failure to fulfill obligations to pay taxes; they are also charged for failure to pay utility bills or alimony, supplies under the contract. But in this article we are interested in tax penalties; their purpose, calculation and payment are regulated in Art. 75 of the Tax Code of the Russian Federation.

Tax payments have strict deadlines. If the deadlines are violated, the tax service charges penalties, which will increase until the tax is paid in full. To stop the growth of penalties, pay your taxes or fees as soon as possible. The penalty is a percentage of the unpaid amount, and is accrued for each day of late payment. To calculate them, you need to know the key rate of the Central Bank at the time of the violation.

Penalty amount

The amount of the penalty can be determined independently, but there are certain restrictions in this matter.

The penalty should not be greater than the amount of debt or tax deductions.

A creditor who has assessed a high penalty must keep in mind that the debtor can challenge it. The challenge is carried out on the basis of Article 333 of the Civil Code. At the moment, the acceptable amount of the penalty is 0.2%. The indicator is determined based on the current Central Bank rate. On what grounds does the court reduce the penalty? Article 333 of the Civil Code does not provide for the circumstances under which the court will make a positive decision. However, this information can be obtained from court decisions. Consider these circumstances:

- Penalty above 0.2%.

- The total amount accrued for the penalty exceeds the amount of the debt. For example, the debt of an enterprise is 1,000 rubles, and the amount of the penalty is 2,000 rubles.

Courts rarely make positive decisions in the following situations:

- The debtor is trying to enrich himself by reducing fines.

- There are clear signs that the debtor had fraudulent goals and did not initially intend to return the funds.

- The debtor committed gross violations of the contract. For example, he only made the first installment on the loan; later he began to hide from the lender.

If the debtor does not go to court, he has almost no chance of reducing the penalty.

How to calculate and pay penalties for taxes and insurance premiums ?

Who calculates the penalty

If a taxpayer or employer fails to remit taxes or contributions on time, he or she will be assessed penalties. To pay penalties, you will have to wait for a request from the Federal Tax Service, which itself must establish the fact of non-payment and charge penalties.

If a taxpayer sees a tax arrears and plans to close it, he must act in the following order:

- calculate the amount of penalties yourself;

- pay the amount of arrears and penalties;

- submit an updated declaration.

In this case, the taxpayer will avoid a fine (see paragraph 1 and paragraph 4 of Article 81 of the Tax Code of the Russian Federation). If you first send an update and only then pay the arrears and penalties, the tax office will impose a fine.

Difference between penalty and penalty (ratio)

There is no legally established definition of the concept of penalty, which does not mean that it can be interpreted freely. A detailed definition of penalties was given by the Supreme Arbitration Court, now merged with the Supreme Court, in resolution No. 8244/95 dated February 20, 1996 in the case of collecting a penalty for payment for gas supplied after the expiration of the established deadlines. The interest in this judicial act is not so much the case itself as the definition of penalties given in it, which is actually used in the practice of civil legal relations, legal theory and in judicial disputes.

So, according to this document, penalties are:

- type of sanctions applied when a party violates the obligations assumed under a civil contract to perform certain actions;

- payment accrued at the current moment in time, changing (increasing) as the term increases (the more time has passed from the date of payment to the current moment of calculation of the sanction, the larger their size will be);

- a monetary sanction calculated as a percentage of the amount of debt, unfulfilled obligation, or other amount determined by law or agreement (including in the form of a clause in the contract);

- payment, the amount of which is calculated in calendar days (interest is accrued for each day, starting from the first day after the expiration of the period allotted for the performance of a specific duty).

A penalty has all these characteristics at the same time, which is its essence or definition. A shorter concept, which makes it easy to establish the difference between a fine and a penalty, follows from paragraph 1 of Art. 330 of the Civil Code: a penalty is one of the types of penalties in relation to an unscrupulous party to a transaction. Consequently, the concept of a penalty is broader and includes one of the types - a penalty, the characteristics of which are established both by judicial practice and by business customs.

For what days are penalties accrued?

The first day for accrual of penalties is considered to be the next day after the deadline for payment of taxes or contributions. Officials have differences regarding the last day for calculating penalties.

The Federal Tax Service clarified that penalties stop accruing the next day after payment, which means the day of payment is included in the calculation of penalties. However, there is a letter from the Ministry of Finance stating that there is no need to charge penalties for the day the arrears are paid. This letter was not sent to tax authorities for mandatory application, so you can be guided by these explanations at your own peril and risk.

If the amount of penalties per day is small, it is safer to include the day of payment in the calculation of penalties. If the amount is large, be prepared to have to defend your actions in court. In addition, the taxpayer can make a written request to clarify the calculation procedure from the Ministry of Finance in order to rely on the official response in the calculations.

UrDela.ru

Part 1. Penalty is recognized as the amount of money established by this article, which the taxpayer must pay in the event of payment of due amounts of taxes or fees, including taxes paid in connection with the movement of goods across the customs border of the Russian Federation, later than those established by law about taxes and fees deadlines.

Part 2. The amount of the corresponding penalties is paid in addition to the amounts of tax or fee due for payment and regardless of the application of other measures to ensure the fulfillment of the obligation to pay a tax or fee, as well as measures of liability for violation of legislation on taxes and fees.

Part 3. A fine is accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the day following the tax or fee payment established by the legislation on taxes and fees.

Penalties are not charged on the amount of arrears that the taxpayer could not repay due to the fact that, by decision of the tax authority or court, the taxpayer’s bank transactions were suspended or the taxpayer’s property was seized. In this case, penalties are not accrued for the entire period of validity of these circumstances. Filing an application for a deferment (installment plan) or an investment tax credit does not suspend the accrual of penalties on the amount of tax payable.

Part 4. The penalty for each day of delay is determined as a percentage of the unpaid amount of tax or fee.

The interest rate of the penalty is assumed to be equal to one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time. The paragraph is excluded. — Federal Law of July 9, 1999 N 154-FZ.

Part 5. Penalties are paid simultaneously with the payment of taxes and fees or after payment of such amounts in full.

Part 6. Penalties may be collected forcibly from the taxpayer’s funds in bank accounts, as well as from other property of the taxpayer in the manner prescribed by Articles 46 - 48 of this Code.

Forced collection of penalties from organizations and individual entrepreneurs is carried out in the manner provided for in Articles 46 and 47 of this Code, and from individuals who are not individual entrepreneurs - in the manner provided for in Article 48 of this Code.

Forced collection of penalties from organizations and individual entrepreneurs in the cases provided for in subparagraphs 1 - 3 of paragraph 2 of Article 45 of this Code is carried out in court.

Part 7. The rules provided for in this article also apply to fee payers and tax agents.

Paragraph 8 of Article 75 applies to written explanations given by authorized bodies after December 31, 2006.

Part 8. Penalties are not accrued on the amount of arrears that a taxpayer (fee payer, tax agent) incurred as a result of his compliance with written explanations on the procedure for calculating, paying a tax (fee) or on other issues of applying the legislation on taxes and fees given to him or an indefinite number of persons by a financial, tax or other authorized government body (an authorized official of this body) within its competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content related to the tax (reporting) periods for which the formation was formed arrears, regardless of the date of publication of such a document).

The provision provided for in this paragraph does not apply if the specified written explanations are based on incomplete or unreliable information.

‹ Article 74 (Tax Code of the Russian Federation). Surety Up Article 76 (Tax Code of the Russian Federation). Suspension of transactions on bank accounts of organizations and individual entrepreneurs ›

How to calculate penalties

The amount of penalties depends on the refinancing rate (or the key rate of the Central Bank). The amount is calculated differently for individual entrepreneurs and organizations, and also depends on the number of days of delay. All individual entrepreneurs with any number of days of delay and organizations with a delay of up to 30 days inclusive calculate penalties from 1/300 of the refinancing rate:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 300) * Number of days of delay

If the organization is overdue for 31 days or more, calculate the penalties as follows:

- First, we calculate penalties for the first 30 days of delay:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 300) * 30

- Then we calculate penalties for subsequent days of delay:

Amount of arrears * (Key rate of the Central Bank of the Russian Federation for the period of violation / 150) * Number of days of delay from 31 days

- Let's sum both values.

Different types of penalties

Although there are general principles of calculation, nevertheless, in various spheres of human activity there are specific features of calculating and paying penalties. The most common options will be discussed below.

5.1. Consumer loans

For financial organizations, the Central Bank has established two options for calculating penalties for a consumer loan:

- When interest stops accruing. In this case, the penalty cannot be more than 20% per annum.

- If interest is charged, the maximum possible penalty is 0.1% per day.

In most cases, banks prefer the first option. In this case, a fine is not allowed. In this case, the accrued penalty is added to the body of the debt. Thus, every day the amount of debt against which the penalty is calculated will increase. If such a situation arises, it is beneficial to contact the bank with a request for debt restructuring.

5.2. Microfinance organizations

In this case, a limitation of 20% per annum is applied to accrue penalties. The maximum interest rate on such loans is 1% per day. Legislation limits the total amount of interest and penalties for microfinance organizations. It cannot be more than 150% of the principal amount of the debt.

5.3. Public utilities

When calculating the penalty, it does not matter which utility service we are talking about. In all cases, the following accrual rules apply:

- No penalty is paid during the first 30 days.

- From 31 days to 60 days, the rate is 1/300 of the refinancing rate of the Central Bank of the Russian Federation.

- From 61 to 90 days, the percentage will be 1/170 of the SR of the Central Bank of the Russian Federation.

- From 91 days they pay 1/130 of this rate.

Management companies sometimes forgive penalties provided that the principal amount of the debt is paid. This can be done before the New Year, for example. This is a great opportunity to avoid paying penalties.

- If you don’t pay the loan, what will happen and what to do;

5.4. No size approval

If there is a financial relationship between the parties, but they have not agreed on the amount of the fine, then the violator will still have to pay it. In this case, Article 395 of the Civil Code of the Russian Federation applies. In accordance with it, to calculate penalties for each day, a rate equal to 1/360 of the refinancing rate of the Central Bank of the Russian Federation is applied.

5.5. According to the Labor Code

When an employee does not receive his salary on time, his employer is subject to late payment penalties. It should not be less than 1/150 of the SR of the Central Bank of the Russian Federation. The exact amount can be established by an employment contract, collective agreement, enterprise charter, and other local regulatory documents.

Conclusion

In case of non-fulfillment of obligations, a penalty, if provided for by law or contract. accrued every day. The most profitable way to avoid the accrual of penalties is timely payment. If this was not possible, it is important to know how the penalty is calculated correctly in this case and whether there is a limit for it. To do this, you need to carefully study the contract and relevant regulations.

Watch also the video “Tax penalties: everything you need to know”:

Related posts:

- Counterparty - who are they and why are they needed?

- Contract extension and its nuances - detailed description

- Rent - what is it and how does it work?

- Peculiarities of issuing bank guarantees in…

- Features of obtaining a loan secured by PTS

- Escrow accounts - how it works, what are its advantages

- Working under a contract without a work book - pros and cons

- Offer - what it is, types and example of design

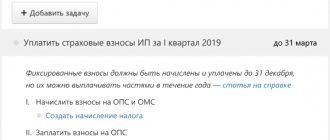

KBC for transferring penalties in 2021 and 2018

- Pension insurance - 182 1 0210 160

- Medical insurance - 182 1 0213 160

- Disability and maternity insurance - 182 1 0210 160

- Injury insurance - 393 1 0200 160

- Federal income tax budget - 182 1 01 01011 01 1000 110

- Income tax in reg. budget - 182 1 01 01012 02 1000 110

- VAT — 182 1 0300 110

- Property tax, except for the Unified State Social Insurance System - 182 1 06 02020 02 1000 110

- Tax on property included in the Unified State Social System - 182 1 06 02020 02 1000 110

- Personal income tax (and individual entrepreneurs “for themselves”) - 182 1 0100 110

- STS “income” - 182 1 0500 110

- STS “income-expenses” and minimum tax - 182 1 05 01021 01 1000 110

- UTII - 182 1 0500 110

Tax penalties when seizing a bank account

Does the tax authority have the right to charge penalties on the amount of arrears of taxes and fees if their payment is prevented by the seizure of the bank account of the taxpayer organization? Experts from the Legal Consulting Service GARANT Pavel Erin and Artem Barseghyan comment.

The tax authority has made a decision to collect taxes, fees, penalties, fines and interest from the taxpayer organization at the expense of its property within the amounts specified in the requirements for payment of taxes, fees, penalties, fines (specified requirement for payment of penalties and fines). But earlier, a bailiff seized the organization’s bank account for another enforcement proceeding, and, accordingly, the organization could not pay off the arrears. In this situation, does the tax authority have the right to charge penalties on the amount of arrears?

In accordance with paragraphs. 2, 3 tbsp. 75 of the Tax Code of the Russian Federation, a penalty is accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the day following the tax or fee payment established by the legislation on taxes and fees. The amount of penalties is paid in addition to the amounts of tax or fee due for payment and regardless of the application of other measures to ensure the fulfillment of the obligation to pay the tax or fee.

At the same time, paragraph two of clause 3 of Art. 75 of the Tax Code of the Russian Federation provides that penalties are not charged on the amount of arrears that the taxpayer could not repay due to the fact that, by decision of the tax authority, the taxpayer’s property was seized or by a court decision, interim measures were taken in the form of suspension of transactions on the taxpayer’s bank accounts , seizure of funds or property of the taxpayer. In this case, penalties are not accrued for the entire period of validity of these circumstances.

As literally follows from the above norm, the accrual of penalties on the amount of arrears for the period of validity of the circumstances specified in it is made dependent on whether the taxpayer could repay the debt as a result of interim measures taken against him. In other words, the seizure of property or other measures aimed at ensuring the fulfillment of the taxpayer’s obligations may be the basis for not accruing penalties on the amount of arrears on taxes (duties) not in themselves, but only insofar as they prevent the taxpayer from repaying the existing debt.

Of course, the seizure of funds located in the debtor’s bank account within the framework of enforcement proceedings leads to the impossibility of the debtor to dispose of these funds (Part 4 of Article 70, Article 81 of the Federal Law of October 2, 2007 N 229-FZ “On the Executive production"). However, the debtor may have funds in other bank accounts in respect of which the decision to seize was not made, as well as other property at the expense of which the debt can be repaid, including the payment of taxes (fees), so the question of the legality of the accrual penalties in the manner provided for in Art. 75 of the Tax Code of the Russian Federation, should be examined from the point of view of the impact of the interim measures taken on the taxpayer’s ability to repay the arrears.

This legal approach is essentially present in the letter of the Ministry of Finance of Russia dated April 18, 2005 N 03-02-07/1-100, in which specialists from the financial department noted in relation to the situation they considered that the suspension of debit transactions on the account does not prevent the taxpayer from paying the taxes due and a penalty.

The same legal position is adhered to by judicial practice, which has repeatedly noted the need to establish a cause-and-effect relationship between the suspension of transactions on a taxpayer’s bank accounts based on decisions of the tax authority, the seizure of his property and the impossibility for these reasons to pay off the arrears of the relevant tax. As the courts emphasize, the mere fact of taking interim measures is not enough to assert that the taxpayer did not have the opportunity to pay the tax (see, for example, resolutions of the FAS of the East Siberian District dated November 27, 2012 N F02-4837/12, FAS of the North-West District dated September 14, 2012 N F07-4060/12, FAS North-Western District dated August 30, 2011 N F07-7240/11, Fifth Arbitration Court of Appeal dated March 29, 2013 N 05AP-2313/13).

Thus, the Federal Antimonopoly Service of the North-Western District, in a resolution dated May 11, 2010 N F07-4321/2010, pointed out the unlawfulness of charging penalties on the amount of tax arrears, drawing attention to the fact that all property of the taxpayer was seized and transactions on his bank accounts were suspended. In a resolution dated 05/21/2010 in case No. A53-18951/2009, the Federal Antimonopoly Service of the North Caucasus District concluded that there is a cause-and-effect relationship between the seizure of funds, the suspension of debit transactions on the institution’s bank accounts and the inability of the taxpayer to repay arrears during disputed periods. At the same time, the court took into account that the funds received by the organization’s current account were written off on the basis of collection orders to pay off arrears of taxes and penalties, and the funds received by the institution’s cash desk were transferred to the settlement account of the bailiff service in account for repayment of arrears and penalties from previous years.

The Federal Antimonopoly Service of the Far Eastern District came to a similar conclusion in its resolution dated 09/06/2010 N F03-5256/2010, emphasizing that since the taxpayer did not have funds, property or receivables at his disposal, at the expense of which it was possible to pay the tax, penalties were accrued in violation of the requirements of paragraph 3 of Art. 75 of the Tax Code of the Russian Federation, which violated the rights and legitimate interests of the taxpayer.

The courts came to similar conclusions in many other situations (see, for example, resolutions of the Federal Antimonopoly Service of the Ural District dated 02/06/2012 N F09-105/12, FAS Moscow District dated October 28, 2011 N Ф05-11351/11, FAS East Siberian District dated 11.11.2010 in case No. A10-1014/2010, FAS Far Eastern District dated 05.31.2010 No. F03-3845/2010).

Therefore, we believe that if the seizure of the taxpayer’s funds in his bank account in the case under consideration objectively prevented the organization from repaying the arrears, the tax authority’s assessment of a penalty on the amount of the arrears is unlawful.

At the same time, as follows from existing arbitration practice, depending on the specific circumstances, the court may in such a situation come to the opposite conclusion. Therefore, the final answer to the question asked can only be given taking into account the entire set of factual circumstances, which, in the event of a dispute, can be examined by the court.

The texts of the documents mentioned in the experts’ response can be found in the

GARANT .

As an advertisement

When can you avoid paying penalties?

In some cases, penalties are not charged. For example, when a taxpayer’s account is blocked or money is seized by court order. Or when, when calculating taxes or contributions, a businessman was guided by a court ruling.

You will also avoid penalties if the arrears arose due to an error in the payment order, which can be corrected by clarifying the payment - in this case, the penalties will be reversed. The error is corrected by clarification if it is not associated with an incorrect indication of the account number, recipient bank or KBK.

Tax Code of the Russian Federation Article 75 Penalty

1. Penalty is the amount of money established by this article that a taxpayer must pay in the event of payment of due amounts of taxes or fees, including taxes paid in connection with the movement of goods across the customs border of the Customs Union, later than those established by tax legislation and collection deadlines.

2. The amount of the corresponding penalties is paid in addition to the amounts of tax or fee due for payment and regardless of the application of other measures to ensure the fulfillment of the obligation to pay a tax or fee, as well as measures of liability for violation of legislation on taxes and fees.

3. A fine is accrued for each calendar day of delay in fulfilling the obligation to pay a tax or fee, starting from the day following the tax or fee payment established by the legislation on taxes and fees, unless otherwise provided by Chapters 25 and 26.1 of this Code.

Penalties are not accrued on the amount of arrears that the taxpayer (a member of a consolidated group of taxpayers against whom, in accordance with Article 46 of this Code, measures were taken to forcibly collect taxes) could not repay due to the fact that, by decision of the tax authority, the taxpayer’s property was seized or by a court decision, interim measures were taken in the form of suspension of transactions on the accounts of the taxpayer (a member of a consolidated group of taxpayers against whom, in accordance with Article 46 of this Code, measures were taken to force the collection of taxes) in the bank, seizure of funds or property of the taxpayer (participant of a consolidated group of taxpayers). In this case, penalties are not accrued for the entire period of validity of these circumstances. Filing an application for a deferment (installment plan) or an investment tax credit does not suspend the accrual of penalties on the amount of tax payable.

4. The penalty for each day of delay is determined as a percentage of the unpaid amount of tax or fee.

The interest rate of the penalty is assumed to be equal to one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time.

The paragraph has been deleted.

5. Penalties are paid simultaneously with the payment of taxes and fees or after payment of such amounts in full.

6. Penalties may be collected forcibly from the taxpayer’s funds in bank accounts, as well as from other property of the taxpayer in the manner prescribed by Articles 46 - 48 of this Code.

Forced collection of penalties from organizations and individual entrepreneurs is carried out in the manner provided for in Articles 46 and 47 of this Code, and from individuals who are not individual entrepreneurs - in the manner provided for in Article 48 of this Code.

Forced collection of penalties from organizations and individual entrepreneurs in the cases provided for in subparagraphs 1 - 3 of paragraph 2 of Article 45 of this Code is carried out in court.

7. The rules provided for in this article also apply to fee payers, tax agents and a consolidated group of taxpayers.

8. Penalties are not charged on the amount of arrears that a taxpayer (fee payer, tax agent) has incurred as a result of his compliance with written explanations on the procedure for calculating, paying a tax (fee) or on other issues of application of the legislation on taxes and fees given to him or an unspecified circle of persons by a financial, tax or other authorized government body (an authorized official of this body) within its competence (these circumstances are established in the presence of a corresponding document of this body, in the meaning and content related to the tax (reporting) periods for which the arrears arose, regardless of the date of publication of such a document), and (or) as a result of the taxpayer (payer of the fee, tax agent) fulfilling the motivated opinion of the tax authority sent to him during tax monitoring.

The provision provided for in this paragraph does not apply if the specified written explanations or the reasoned opinion of the tax authority are based on incomplete or unreliable information provided by the taxpayer (payer of the fee, tax agent).

Procedure for collecting penalties

Peneus

is recognized as established by Art. 75 of the Tax Code of the Russian Federation is the amount of money that a taxpayer, payer of fees or tax agent must pay in the event of payment of due amounts of taxes or fees, including taxes paid in connection with the movement of goods across the customs border of the Russian Federation, later than those established by law about taxes and fees deadlines.

The concept of “penalty” contains several features.

Firstly, a penalty is a sum of money, the payment of which ensures the fulfillment of a tax obligation. If in civil legal relations it is allowed to establish a penalty by agreement of the parties to the contract (the amount of the penalty is determined at their discretion), then in tax relations the penalty is exclusively legal in nature (the amount of the penalty is fixed in the Tax Code). Tax authorities do not have the right to arbitrarily change the amount of penalties. The penalty is applied to ensure timely fulfillment of tax obligations, therefore, unlike a fine, which is usually calculated in a fixed amount, it is of a continuing nature (collected for each subsequent period of delay). However, some fines provided for in the commented Code, in the order of calculation, resemble the definition of penalties (for example, in paragraph 1 of Article 119 of the Tax Code of the Russian Federation).

Secondly, the basis for collecting penalties is the payment of due amounts of tax (fee) at a later date than those established by the legislation on taxes and fees. The deadlines for paying taxes are fixed for each tax and fee, subject to the conditions contained in Art. 57 Tax Code of the Russian Federation. Since late payment of taxes (fees) is a violation of the tax obligation of taxpayers, fee payers or tax agents (Articles 23-24 of the Tax Code of the Russian Federation), the penalty serves as a kind of form of liability for violation of this obligation and implies adverse property consequences for the violator. At the same time, the penalty in Art. 114 of the Tax Code of the Russian Federation is not recognized as a tax sanction. Note that previously a fine in tax legislation (clause 1 of Article 13 of the Law of the Russian Federation “On the Fundamentals of the Tax System in the Russian Federation”) and literature was considered as a sanction (a measure of financial responsibility).

Thirdly, the penalty is paid by the taxpayer, fee payer or tax agent voluntarily and simultaneously with the payment of tax (fee) amounts or after payment of such amounts in full. The law allows for forced (beyond the will of the taxpayer) collection of penalties due to:

1) the taxpayer’s funds in his bank accounts;

2) other property of the taxpayer in the manner prescribed by the Tax Code.

This position, in our opinion, is more consistent with general theoretical approaches to the concept of legal liability, which allow us to conclude that the tax and legal institution of penalties has all its main features, namely:

1) state coercion;

2) a clearly defined scope (measure) of coercion;

3) the connection between the accrual of penalties and the offense (violation of the payment deadline);

4) negative consequences for the violator (collection of part of the property owned by right of ownership);

5) the nature and extent of deprivation are established in a legal norm (monetary penalty in a certain amount);

6) the application of state coercive measures is carried out in the course of law enforcement activities of state bodies in the manner and forms specified by law (collection is carried out by the tax authority in the manner prescribed by Articles 46, 47, 48 of the Tax Code of the Russian Federation).

Thus, it can be stated that the penalty acts not only as a way to ensure the fulfillment of the obligation to pay a tax or fee, but also as a measure of responsibility.

The procedure for forced collection of penalties can be indisputable or judicial. In an indisputable manner (based on a unilateral decision of the tax authority), a fine is levied on organizations (legal entities), and in court - on individuals. This rule is established in the Tax Code taking into account the practice of the Constitutional Court of the Russian Federation. The indisputable procedure for collecting tax payments is recognized in principle as constitutional in the presence of subsequent judicial control as a way of protecting the rights of a legal entity. In accordance with this general postulate, the Constitutional Court of the Russian Federation recognized as constitutional the collection of arrears of taxes and penalties from legal entities in an indisputable manner. On the contrary, the Constitutional Court of the Russian Federation considered the indisputable procedure for collecting fines in case of disagreement of the taxpayer to be an excess of the constitutionally permissible (Articles 55 and 57 of the Constitution of the Russian Federation) restriction of the right enshrined in Part 3 of Art. 35 of the Constitution of the Russian Federation.

In paragraph 2 of Art. Article 75 of the Tax Code of the Russian Federation establishes the ratio of penalties and tax (fee) amounts, as well as measures of liability for tax violations. The ratio is imperatively enshrined in law and cannot be arbitrarily changed by tax authorities. At the same time, the Tax Code is based on the punitive principle, which is explained by the application of the penalty in question in public relations. Therefore, the amount of the penalty is paid in addition to the amount of tax or fee (arrears) and regardless of the use of penalties (fines) provided for violation of the legislation on taxes and fees. It should also be noted that a fine may be collected along with the use of other methods of ensuring the fulfillment of the obligation to pay a tax or fee (for example, a pledge of property).

The procedure for calculating the amount of penalties is determined in paragraphs 3-4 of Art. 75 of the Tax Code of the Russian Federation. A penalty is charged for each calendar day of delay in fulfilling tax obligations. Accrual begins on the day following the day of payment of the tax (fee) established by the legislation on taxes and fees. The penalty is determined as a percentage of the unpaid amount of tax (fee) for each day of delay in fulfilling the tax obligation. The basis for calculating interest is only the unpaid amount of tax or fee that the taxpayer was obliged to pay during the relevant period of time, without taking into account the amounts of fines. The interest rate of the penalty is taken to be equal to one three hundredth of the refinancing rate of the Central Bank of the Russian Federation in force at that time, but not more than 0.1 percent per day. The maximum amount of penalties collected is equal to the unpaid amount of tax.

It is impossible to accrue penalties on overdue arrears

The accrual of penalties for arrears, the possibility of collecting which has been forcibly lost, is unlawful. The courts of three instances came to this conclusion, siding with the taxpayer.

| Case card | Details of the judicial act | Resolution of the Administrative Court of the East Siberian District dated February 11, 2019 in case No. A19-10819/2018 |

| Plaintiff | Limited Liability Company "Targiz-geo" | |

| Defendant | Interdistrict Inspectorate of the Federal Tax Service of Russia No. 6 for the Irkutsk Region |

The crux of the matter

On January 30, 2021, the tax authority issued a demand to the company to pay taxes, fees, insurance premiums, penalties, fines and interest.

Due to the failure to comply with the payment requirement, the inspectorate decided to collect the amounts presented from funds in the taxpayer’s bank accounts.

Having disagreed with the amount of penalties specified in the request for late payment of land tax for 2021, the company filed a complaint with a higher tax authority, and then with the court. In the opinion of the company, the tax authority lost the opportunity to forcibly collect the amount of penalties specified in the demand. The tax authorities believed that the accrual of the disputed amount of penalties and its collection was legal, since they had taken measures provided for by law to forcibly collect the arrears of land tax.

Court decision

The courts of three instances supported the taxpayer. They came to the conclusion that it was illegal to take measures to collect penalties, since the demand did not contain information that would allow them to identify the arrears for which penalties were accrued for non-payment, and also to verify the correctness of their calculation. In addition, the documents submitted by the tax authority in support of the grounds for the occurrence of debt on land tax, for non-payment of which a disputed amount of penalties was accrued, indicate the loss of the possibility of forced collection of the tax due to the expiration of the deadlines for presenting for execution decisions adopted in accordance with Art. 47 Tax Code of the Russian Federation. The accrual of penalties for arrears, the possibility of collecting which has been forcibly lost, is unlawful.

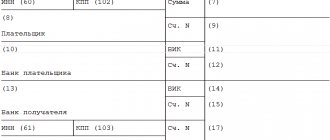

How are penalties collected?

From paragraphs 4 and 8 of Art. 69 of the Tax Code of the Russian Federation it follows that the requirement to pay taxes and penalties must contain information:

- about the amount of tax debt;

- the amount of penalties accrued at the time of sending the claim;

- deadline for fulfilling the requirement;

- measures to collect and ensure the fulfillment of the obligation to pay debts, which are applied in the event of non-fulfillment of the requirement.

In case of non-payment or incomplete payment of the tax within the period established in the requirement, the obligation to pay the tax is compulsorily fulfilled by foreclosure on the funds in the taxpayer’s bank accounts (Article 46 of the Tax Code of the Russian Federation). Collection of tax is carried out by decision of the tax authority, which is adopted after the expiration of the period established in the requirement to pay the tax, but no later than two months after the expiration of the specified period. A decision on collection made after the expiration of the specified period is considered invalid and cannot be executed.

Clause 7 of Art. 46 of the Tax Code of the Russian Federation establishes that if there is insufficiency or absence of funds in the taxpayer’s accounts, the tax authority has the right to collect tax at the expense of other property of the taxpayer in accordance with Art. 47 Tax Code of the Russian Federation. According to paragraph 1 of Art. 47 of the Tax Code of the Russian Federation, the decision to collect tax at the expense of the taxpayer’s property is made within one year after the expiration of the deadline for fulfilling the requirement to pay the tax.

By virtue of the provisions of paragraph 6 of Art. 75 of the Tax Code of the Russian Federation, forced collection of penalties from organizations and individual entrepreneurs is carried out in the manner prescribed by Art. 46 and 47 of the Tax Code of the Russian Federation.

Paragraph 57 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated July 30, 2013 No. 57 stipulates that when applying these norms, courts must proceed from the fact that penalties can be collected only if the tax authority has timely taken measures to force the collection of the amount of the corresponding tax. In this case, penalties are accrued on the day of actual repayment of the arrears.

Penalties are paid simultaneously with the payment of taxes and fees or after payment of such amounts in full and can be collected forcibly from the taxpayer’s funds in bank accounts, as well as from other property of the taxpayer in the manner prescribed by Art. 46-48 Tax Code of the Russian Federation.

Taking into account the above, the fulfillment of the obligation to pay penalties cannot be considered in isolation from the fulfillment of the obligation to pay tax. Consequently, after the expiration of the preventive period for collecting tax debt, penalties cannot serve as a way to ensure the fulfillment of the obligation to pay tax, and from that moment there are no grounds for their accrual.

What did the tax authorities violate?

The courts indicated that the demand presented to the company did not contain information about the periods and amount of arrears in land tax, the rate and period for calculating penalties. In addition, there is no evidence that the demand was sent to the taxpayer with the calculation of penalties attached. In the case under consideration, this is regarded as a violation of the provisions of Art. 69 Tax Code of the Russian Federation. At the same time, information about the grounds for the occurrence of the arrears in respect of which the disputed amount of penalties was accrued, and the period for accruing penalties, differ in the decision made by a higher authority based on the results of consideration of the complaint, and in the calculations submitted by the inspectorate to the court. Therefore, it is impossible to reliably establish the basis for the accrual of penalties specified in the request.

Tax officials tried to argue that they presented an updated calculation of penalties for the disputed period. But the courts indicated that this does not refute the conclusions about the presence in the case materials of three different calculation options, the contradiction of which does not allow checking the validity of the claim regarding the amount of penalties.

As for the documents presented by the tax authorities in support of the adoption of measures to indisputably collect the arrears of land tax, the courts found that the enforcement proceedings initiated by the bailiffs on the basis of decisions of the tax authority were returned on the basis of clause 3, part 1 of Art. 46 of the Federal Law of October 2, 2007 No. 229-FZ “On Enforcement Proceedings” (impossibility of establishing the location of the debtor, his property or obtaining information about the availability of funds in accounts). The tax authorities did not prove their repeated presentation, and the deadlines for their presentation for execution, established by Part 6.1 of Art. 21 of the said law had expired at the time the disputed demand was raised.

Tax officials tried to justify the failure to take measures to collect the arrears of land tax for 2021 by its repayment by the taxpayer in 2021. But the courts did not accept this justification, since, taking into account the specified date, measures to force the collection of penalties in this case were taken outside the set of deadlines established by p. 1 tbsp. 70 and paragraph 3 of Art. 46 Tax Code of the Russian Federation. Moreover, as already indicated, the disputed requirement does not allow us to reliably identify the arrears in connection with non-payment of which penalties were accrued, as well as the period of their accrual.

As a result, the courts came to the conclusion that the requirement for penalties does not comply with the law, including due to the impossibility of implementing measures to ensure the obligation to pay tax after the loss of the possibility of collecting it.