Select what you need:

Move the cursor to the black dates and find out the last date, etc.

If the final date of the report or payment falls on a weekend or holiday, then the last day of receipt is postponed to the next weekday after the non-working day. It is better to submit reports and make payments a week before the deadline.

| ← 2021 2021 |

January

Mon | Tue | Wed | Thu | Fri | Sat | Sun |

| 1 | 2 | 3 | 4 | 5 |

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the fourth quarter* Payments and receipts

| 16 | 17 | 18 | 19 |

- 20

For all tax regimes *annual* Form (50 kb.) Information on the AVERAGE number of employees - Submit a UTII declaration *for the fourth quarter* UTII declaration calculator + form

- Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay UTII *for the fourth quarter* Payments and receipts - Submit a VAT return *for the fourth quarter* Sample declaration

- Pay VAT *for the fourth quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 |

| 27 | 28 | 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| 31 |

FebruaryMon

| Tue | Wed | Thu | Fri | Sat | Sun |

| 1 | 2 |

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 |

MarchMon

| Tue | Wed | Thu | Fri | Sat | Sun |

- 1

Submit new annual reports to the Pension Fund - SZV-Stazh and ODV-1 Sample SZV-Stazh - Submit 2-NDFL declaration for employees to the tax office *annual* Sample 2-NDFL

- Submit 6-NDFL declaration for employees to the tax office *for the year* Sample 6-NDFL

- Submit a report to the Pension Fund *for the year* Report RSV-2 of peasant households (no individual entrepreneur required)

|

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

|

| 16 | 17 | 18 | 19 | 20 | 21 | 22 |

| 23 | 24 | 25 | 26 | 27 | - 28

Pay tax Income tax *for the year* Payments and receipts - Submit an income tax return *for the year* Income tax for LLC.xls

| 29 |

- 30

Submit financial statements: Form No. 1 Balance sheet *for the year*. Form: Balance Sheet.XLS - Submit financial statements: Form No. 2 of the Profit and Loss Statement *for the year*. Form: Profit and Loss Statement.XLS

| - 31

For Organizations (not individual entrepreneurs): Pay the simplified tax system *for the year* Payments and receipts - For Organizations (not individual entrepreneurs): Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

|

|

April

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Confirmation of the type in the FSS

| 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the first quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for the first quarter* Payments and receipts - Pay UTII *for the first quarter* Payments and receipts

- Submit a VAT return *for the first quarter* Sample declaration

- Pay VAT *for the first quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | | 27 | - 28

Pay tax Income tax *for the first quarter* Payments and receipts - Submit an income tax return *for the first quarter* Income tax for LLC.xls

| 29 | - 30

For individual entrepreneurs: Pay the simplified tax system *per year* Payments and receipts - For individual entrepreneurs: Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

- Submit 3-NDFL declaration for individual entrepreneurs *annual* Payments and receipts

- Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

- Submit the 6-NDFL declaration for employees to the tax office within 3 months. Sample 6-NDFL

|

| MayMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | | 18 | 19 | 20 | 21 | 22 | 23 | 24 | | 25 | 26 | 27 | 28 | 29 | 30 | 31 |

| JuneMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 | | 29 | 30 |

| | July

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Pay the Pension Fund OPS for the individual entrepreneur himself (additional 1%) *for the last year* Payments, receipts and calculator

| 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for last year* Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for six months* Payments and receipts

| 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the second quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for six months* Payments and receipts - Pay UTII *for the second quarter* Payments and receipts

- Submit a VAT return *for the second quarter* Sample declaration

- Pay VAT *for the second quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | | 27 | - 28

Pay tax Income tax *for the second quarter* Payments and receipts - Submit an income tax return *for the second quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit 6-NDFL declaration for employees to the tax office *for six months* Sample 6-NDFL

|

| AugustMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | | 17 | 18 | 19 | 20 | 21 | 22 | 23 | | 24 | 25 | 26 | 27 | 28 | 29 | 30 | | 31 |

| SeptemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 |

| | October

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the third quarter* Payments and receipts

| 16 | 17 | 18 | | 19 | - 20

Submit a UTII declaration *for the third quarter* UTII declaration calculator+form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for 9 months* Payments and receipts - Pay UTII *for the third quarter* Payments and receipts

- Submit a VAT return *for the third quarter* Sample declaration

- Pay VAT *for the third quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| | 26 | 27 | - 28

Pay tax Income tax *for the third quarter* Payments and receipts - Submit an income tax return *for the third quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit the 6-NDFL declaration for employees to the tax office *within 9 months* Sample 6-NDFL

|

| novemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| | 16 | 17 | 18 | 19 | 20 | 21 | 22 | | 23 | 24 | 25 | 26 | 27 | 28 | 29 | | 30 |

| DecemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 | - 31

Pay the Pension Fund OPS for the individual entrepreneur himself (fixed part) *per year* Payments, receipts and calculator

|

| | | 2021 | January

Mon | Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M and SZV-TD reports to the Pension Fund of the Russian Federation. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the fourth quarter* Payments and receipts

| 16 | 17 | | 18 | 19 | - 20

Canceled from 2021! Form (50 kb.) Information on the AVERAGE number of employees - Submit a UTII declaration *for the fourth quarter* UTII declaration calculator + form

- Quarterly: Report 4-FSS (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay UTII *for the fourth quarter* Payments and receipts - Submit a VAT return *for the fourth quarter* Sample declaration

- Pay VAT *for the fourth quarter* Payments and receipts

- Quarterly: Report 4-FSS (electronic) for employees. Sample 4 FSS

| 26 | 27 | 28 | 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| 31 |

| FebruaryMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| MarchMon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Submit a report to the Pension Fund *for the year* Report RSV-2 of peasant households (no individual entrepreneur required) - Submit new annual reports to the Pension Fund - SZV-Stazh and ODV-1 Sample SZV-Stazh

- Submit 2-NDFL declaration for employees to the tax office *annual* Sample 2-NDFL

- Submit 6-NDFL declaration for employees to the tax office *for the year* Sample 6-NDFL

| 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | - 28

Pay tax Income tax *for the year* Payments and receipts - Submit an income tax return *for the year* Income tax for LLC.xls

| | 29 | - 30

Submit financial statements: Form No. 1 Balance sheet *for the year*. Form: Balance Sheet.XLS - Submit financial statements: Form No. 2 of the Profit and Loss Statement *for the year*. Form: Profit and Loss Statement.XLS

| - 31

For Organizations (not individual entrepreneurs): Pay the simplified tax system *for the year* Payments and receipts - For Organizations (not individual entrepreneurs): Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

|

| April

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 01

Once every 5 years, IP is submitted by 1-IP, MP-SP organizations. Forms and details.

| 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Confirmation of the type in the FSS

| 16 | 17 | 18 | | 19 | - 20

Submit a UTII declaration *for the first quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for the first quarter* Payments and receipts - Pay UTII *for the first quarter* Payments and receipts

- Submit a VAT return *for the first quarter* Sample declaration

- Pay VAT *for the first quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| | 26 | 27 | - 28

Pay tax Income tax *for the first quarter* Payments and receipts - Submit an income tax return *for the first quarter* Income tax for LLC.xls

| 29 | - 30

For individual entrepreneurs: Pay the simplified tax system *per year* Payments and receipts - For individual entrepreneurs: Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

- Submit 3-NDFL declaration for individual entrepreneurs *annual* Payments and receipts

- Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

- Submit the 6-NDFL declaration for employees to the tax office within 3 months. Sample 6-NDFL

|

| MayMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | | 17 | 18 | 19 | 20 | 21 | 22 | 23 | | 24 | 25 | 26 | 27 | 28 | 29 | 30 | | 31 |

| JuneMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 |

| July

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Pay the Pension Fund OPS for the individual entrepreneur himself (additional 1%) *for the last year* Payments, receipts and calculator

| 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for last year* Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for six months* Payments and receipts

| 16 | 17 | 18 | | 19 | - 20

Submit a UTII declaration *for the second quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for six months* Payments and receipts - Pay UTII *for the second quarter* Payments and receipts

- Submit a VAT return *for the second quarter* Sample declaration

- Pay VAT *for the second quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| | 26 | 27 | - 28

Pay tax Income tax *for the second quarter* Payments and receipts - Submit an income tax return *for the second quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit 6-NDFL declaration for employees to the tax office *for six months* Sample 6-NDFL

|

| AugustMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| | 16 | 17 | 18 | 19 | 20 | 21 | 22 | | 23 | 24 | 25 | 26 | 27 | 28 | 29 | | 30 | 31 |

| SeptemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 |

| October

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the third quarter* Payments and receipts

| 16 | 17 | | 18 | 19 | - 20

Submit a UTII declaration *for the third quarter* UTII declaration calculator+form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | 24 | - 25

Pay the simplified tax system *for 9 months* Payments and receipts - Pay UTII *for the third quarter* Payments and receipts

- Submit a VAT return *for the third quarter* Sample declaration

- Pay VAT *for the third quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the third quarter* Payments and receipts - Submit an income tax return *for the third quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit the 6-NDFL declaration for employees to the tax office *within 9 months* Sample 6-NDFL

|

| novemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 | | 29 | 30 |

| DecemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 | - 31

Pay the Pension Fund OPS for the individual entrepreneur himself (fixed part) *per year* Payments, receipts and calculator

|

- purple - festive

- red - weekend

- green - shortened days

- black - days of reports and payments

- blue - special non-working days (coronavirus quarantine)

|

|

|

Changes for 2021

Now 2-NDFL and 6-NDFL must be submitted not before April 1, but before March 31.

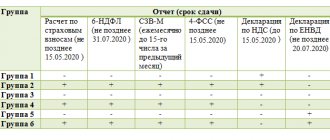

In the table below, new deadlines for filing declarations have been established. New reporting deadlines were approved by Government Decree No. 409 dated 04/02/2020.

Show/hide Postponement due to coronavirus

| Report type | Old due date | New due date |

| Special modes |

| STS for 2021 (see also KUDIR) | organizations - March 31, individual entrepreneurs - April 30 | organizations - June 30, individual entrepreneurs - July 30 |

| UTII for the 1st quarter of 2021 | 20 April | July 20 |

| Unified agricultural tax for 2021 | March 31 | July 30 |

| VAT |

| VAT return for the 1st quarter of 2021 | April 27 | May 15 |

| Reporting for employees |

| SZV-M for March | April 15 | didn't transfer! |

| SZV-TD for March | April 15 | didn't transfer! |

| Calculation of insurance premiums for the 1st quarter of 2021 | April 30 | May 15 |

| 6-NDFL for the 1st quarter of 2021 | April 30 | July 30 |

| 4-FSS | electronic - April 27 paper - April 20 | on May 15 or (it’s still not clear) electronic - July 27 paper - July 20 |

| Confirmation of the main type of FSS | April 15 | the 6th of May |

| 3-NDFL | April 30 | May 15 |

| Income tax |

| Income tax return for 2021 | 30th of March | 30 June |

| Income tax return for the 1st quarter of 2021 | April 28 | July 28th |

| Income tax return for March | April 28 | July 28th |

| Income tax return for April | May 28 | August 28 |

| Property tax |

| Property tax for 2021 | 30th of March | 30 June |

| Property tax for the 1st quarter of 2021 | April 30 | July 30 |

| Financial statements |

| Financial statements | March 31 | June 30 - no, still until May 6 (letter of the Ministry of Finance dated 04/07/2020 No. 07-04-07/27289/VD-4-1/5878) |

The period from March 30 to April 30 was declared non-working due to the coronavirus epidemic.

In 2021, the deadline for filing 2-NDFL and 6-NDFL was postponed from April 1 to March 1. Although the dates were later postponed again due to the coronavirus epidemic.

Frequency of payment of taxes for individual entrepreneurs on the OSN

The general taxation regime is characterized by the maximum number of taxes. The individual entrepreneur using it must pay:

- Personal income tax (NDFL).

- Value added tax (VAT).

- Property tax if used in commercial activities.

Individual entrepreneurs pay personal income tax on their income four times a year - quarterly - according to the following scheme:

- July 15 - simultaneously based on the results of last year and the first advance for the current year (these are two different payments made according to separate documents);

- October 15 - second advance for the current year;

- January 15 of the following year - the third advance for the previous year;

- July 15 - simultaneously the balance of personal income tax for the previous year and the first advance for the current one.

The amounts of all three advances are calculated by the tax inspectorate based on the individual entrepreneur’s information about the first income from the beginning of the year; the remaining amount due at the end of the year is determined by the individual entrepreneur himself when filling out a declaration, which is submitted once a year.

VAT is calculated based on the results of the quarter, but is paid monthly - in equal parts until the 25th day of each month of the new quarter. For example, for the second quarter of 2021, an individual entrepreneur will have to make three payments:

- one third of the amount – until July 25, 2021;

- another third - until August 27;

- the balance of the amount is until September 25.

Property tax is paid once a year - until December 1 of the following reporting year based on a notification from the tax office.

Frequency of payment of taxes for individual entrepreneurs on a “simplified” basis

An individual entrepreneur using the simplified tax system pays a single tax on his income due to the use of a simplified taxation system. It is transferred to the budget quarterly:

- until April 25 - for the first quarter;

- until July 25 - for the first half of the year;

- before October 25 - nine months;

- until March 31 of the following year - based on the results of the past year.

Frequency of payment of UTII for individual entrepreneurs

“Imputed” tax is also paid quarterly:

- for the first quarter - until April 25;

- for the second - until July 25;

- for the third - until October 25;

- for the fourth - until January 25 of the following year.

Procedure for payment of Unified Agricultural Tax for individual entrepreneurs

The unified agricultural tax is paid twice a year:

- until July 25 - for the first half of the year;

- until January 25 of the following year - for the second.

Deadlines for paying taxes for individual entrepreneurs on a patent

The timing of payment for the cost of a patent depends on the period for which it is purchased. An individual entrepreneur has the right to buy a patent for a period of one to twelve months within one calendar year. So, if an individual entrepreneur acquires a patent for the period from July of the current year, then its validity period will be a maximum of six months - from July to January inclusive. But if you purchase a patent from January - up to 12 months.

The validity period of the patent also determines the frequency of payments:

- for a period of one month to 90 days - no later than 40 days from the beginning of the patent;

- for a period of 90 days or more - the first third of the cost of the patent within 90 days from the beginning of its validity, the balance of the amount - until the expiration of validity.

Payment of personal income tax for employees

When an individual entrepreneur has at least one employee, including under a civil contract, regardless of the taxation system applied, the businessman becomes a tax agent for such employees. This means the obligation to withhold personal income tax from the accrued salary, remuneration or other payments at a rate of 13% and transfer it to the budget.

Personal income tax for an employee is paid every month until the 15th day of the next month: until February 15 from salaries accrued in January, until March 15 for February payments, etc.

Video: what taxes does an individual entrepreneur pay?

Working hours standards for 2021.

By number of working days

| Month / Quarter / Year | Amount of days |

| Calendar | workers | Weekends |

| January | 31 | 15 | 16 |

| February | 28 | 19 | 9 |

| March | 31 | 22 | 9 |

| April | 30 | 22 | 8 |

| May | 31 | 19 | 12 |

| June | 30 | 21 | 9 |

| July | 31 | 22 | 9 |

| August | 31 | 22 | 9 |

| September | 30 | 22 | 8 |

| October | 31 | 21 | 10 |

| November | 30 | 21 | 9 |

| December | 31 | 23 | 8 |

| 1st quarter | 90 | 56 | 34 |

| 2nd quarter | 91 | 62 | 29 |

| 3rd quarter | 92 | 66 | 26 |

| 4th quarter | 92 | 65 | 27 |

| 2021 | 365 | 249 | 116 |

By number of working hours

| Month / Quarter / Year | Working time (hour) |

| 40 hours/week | 36 hours/week | 24 hours/week |

| January | 120 | 108 | 72 |

| February | 151 | 135.8 | 90.2 |

| March | 176 | 158.4 | 105.6 |

| April | 175 | 157.4 | 104.6 |

| May | 152 | 136.8 | 91.2 |

| June | 167 | 150.2 | 99.8 |

| July | 176 | 158.4 | 105.6 |

| August | 176 | 158.4 | 105.6 |

| September | 176 | 158.4 | 105.6 |

| October | 168 | 151.2 | 100.8 |

| November | 167 | 150.2 | 99.8 |

| December | 183 | 164.6 | 109.4 |

| 1st quarter | 447 | 402.2 | 267.8 |

| 2nd quarter | 494 | 444.4 | 295.6 |

| 3rd quarter | 528 | 475.2 | 211.2 |

| 4th quarter | 518 | 466 | 310 |

| 2021 | 1987 | 1787.8 | 1190.2 |

Calendar with quarters for OSNO

Advance payments under the simplified tax system for individual entrepreneurs - what are they and are they required?

Some entrepreneurs, due to certain circumstances, can only work under the basic tax regime. This may be their type of activity that does not allow them to switch to a simplified approach, revenue that exceeds the allowable amount, or their personal choice.

OSNO is distinguished by a large number of reports and the complexity of filling them out. Therefore, individual entrepreneurs usually prefer a simplified regime. The main reports on OSNO are VAT and 3-NDFL declarations. Individual entrepreneurs submit quarterly reports on the same dates from year to year.

| Term | Action |

| May 02, 2021 | 3-NDFL for 2021 |

| April 30, 2021 | 4-NDFL, advance payments must be paid on July 15, 2018 and October 15, 2018. |

| April 25, July 25, October 25, 2021; January 25, 2021 | VAT returns for the 1st, 2nd, 3rd and 4th quarters of 2021 |

| July 1, 2021 | Payment of contributions to the Pension Fund for excess income of 300 thousand rubles. for 2018 |

| December 31, 2021 | Payment of fixed contributions of individual entrepreneurs to the Pension Fund for 2021. |

| July 1, 2021 | Payment of contributions to the Pension Fund for excess income of 300 thousand rubles. for 2019 |

Annual reports are prepared in March

Working hours standards for 2021. Taking into account the coronavirus quarantine.

For those who entered holidays related to coronavirus (Covid-19) - see the data in blue.

Show/hide Working hours standards for 2021

By number of working days

| Month / Quarter / Year | Amount of days |

| Calendar | workers | Weekends |

| January | 31 | 17 | 14 |

| February | 29 | 19 | 10 |

| March | 31 | 21 | 10 |

| March | 31 | 19 | 12 |

| April | 30 | 22 | 8 |

| April | 30 | 0 | 30 |

| May | 31 | 17 | 14 |

| May | 31 | 14 | 17 |

| June | 30 | 21 | 9 |

| June | 30 | 20 | 10 |

| July | 31 | 22 | 9 |

| August | 31 | 21 | 10 |

| September | 30 | 22 | 8 |

| October | 31 | 22 | 9 |

| November | 30 | 20 | 10 |

| December | 31 | 23 | 8 |

| 1st quarter | 91 | 57 | 34 |

| 1st quarter | 91 | 55 | 36 |

| 2nd quarter | 91 | 60 | 31 |

| 2nd quarter | 91 | 31 | 60 |

| 3rd quarter | 92 | 66 | 26 |

| 4th quarter | 92 | 65 | 27 |

| 2020 | 366 | 247 | 119 |

| 2020 (in quarantine) | 366 | 219 | 147 |

By number of working hours

| Month / Quarter / Year | Working time (hour) |

| 40 hours/week | 36 hours/week | 24 hours/week |

| January | 136 | 122.4 | 81.6 |

| February | 152 | 136.8 | 91.2 |

| March | 168 | 151.2 | 100.8 |

| March | 152 | 136.8 | 91.2 |

| April | 175 | 157.4 | 104.6 |

| April | 0 | 0 | 0 |

| May | 135 | 121.4 | 80.6 |

| May | 112 | 100,8 | 67,2 |

| June | 167 | 150.2 | 99.8 |

| June | 159 | 143 | 95 |

| July | 176 | 158,4 | 105,6 |

| August | 168 | 151.2 | 100.8 |

| September | 176 | 158.4 | 105.6 |

| October | 176 | 158.4 | 105.6 |

| November | 159 | 143 | 95 |

| December | 183 | 164.6 | 109.4 |

| 1st quarter | 456 | 410.4 | 273.6 |

| 1st quarter | 440 | 396 | 264 |

| 2nd quarter | 477 | 429 | 285 |

| 2nd quarter | 271 | 243,8 | 162,2 |

| 3rd quarter | 520 | 468 | 312 |

| 4th quarter | 518 | 466 | 310 |

| 2020 | 1979 | 1780.6 | 1185.4 |

| 2020 (in quarantine) | 1788 | 1608.8 | 1071.2 |

Using this online service, you can conduct accounting on OSNO (VAT and income tax), generate payment slips, 4-FSS, SZV-M, submit any reports via the Internet, etc. (from 350 rubles/month). 30 days free. With your first payment (via this link) three months free.

What other help are available to entrepreneurs?

Insurance premiums “for yourself” for individual entrepreneurs

The State Duma adopted the Law on insurance premiums for 2021 for individual entrepreneurs affected by the spread of coronavirus infection. The amount of insurance contributions for compulsory pension insurance in a fixed amount for 2021 for such individual entrepreneurs will be 20,318 rubles instead of 32,448 rubles. You can read more in a separate article.

Fines

Penalty for reporting to the Pension Fund

not on time: “1)

if less than 180 days have passed,

5% of the amounts of contributions payable on the basis of this calculation (for example, the fine for an individual entrepreneur with 16159.56 will be 807.98 rubles and it does not matter whether he paid or not) for each month, but no more than 30% and no less than 100 rubles.

2) if more than 180 days have passed

, 10% of the amount, but not less than 1000 rubles” (Article 46 212-FZ).

Penalty for Declarations

to the tax office not on time: “5 percent of the unpaid amount of tax subject to payment (additional payment) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles ." (27.07.2010 No. 229-FZ). Those. If you paid the simplified tax system, but did not submit the declaration, then the fine is 1000 rubles. Fines and penalties are not displayed in the declaration. Fine calculator.

If taxes or payments to the Pension Fund are not paid on time, a penalty

in the amount of 1/300 multiplied by the payment amount and multiplied by the refinancing rate per day. Penalty calculator

Deadlines for payment of fixed contributions

The deadline for paying fixed contributions to individual entrepreneurs “for themselves” is December 31 of the year for which payments are deducted. That is, in 2021, the individual entrepreneur must transfer fixed contributions until December 31, 2021 inclusive

.

But in 2021 the payment deadline will be postponed. In accordance with paragraph 7 of Article 6.1 of the Tax Code of the Russian Federation, if the payment deadline falls on a weekend, then the last day for paying the tax or contribution is the working day following the weekend.

Since December 31, 2021 is a non-working day in accordance with Government Decree No. 1648 dated October 10, 2020, the payment deadline will be postponed to the next working day. The exact date for payment of fixed contributions is not yet possible, since the postponement of holidays for 2022 has not yet been approved. But we can say for sure that the last day for paying fixed contributions to individual entrepreneurs “for themselves” for 2021 will be on January 10, 2022 or later

. Since, in accordance with Article 112 of the Labor Code of the Russian Federation, days from January 1 to January 8 are recognized as non-working holidays, and January 9, 2022 falls on a Sunday.

And for contributions to compulsory pension insurance for individual entrepreneurs whose income exceeded 300 thousand rubles, a different deadline has been established. 1% of the amount of income exceeding 300 thousand rubles must be transferred to the Pension Fund no later than July 1 of the year following the reporting year

. That is, contributions to compulsory pension insurance from an amount of income exceeding 300 thousand rubles, the entrepreneur must transfer:

- for 2021 – until July 1, 2021;

- for 2021 – until July 1, 2022.

It is worth noting that an individual entrepreneur can pay fixed contributions either in full or in part

– for example, once a month or quarterly.

But for late payment of contributions “for yourself,” the tax authorities may charge penalties for the entire amount of unpaid contributions. The amount of the penalty is calculated based on Article 75 of the Tax Code of the Russian Federation and depends on the period of delay (up to 30 days or more).

Liquidation of individual entrepreneurs, tax period

Liquidation of individual entrepreneurs on UTII

If an individual ceases to operate as an individual entrepreneur who is a payer of UTII, the declaration is submitted no later than the 20th day of the first month of the next tax period (clause 3 of Article 346.32 of the Tax Code of the Russian Federation). Tax payment is due no later than the 25th day of the first month of the next tax period.

Liquidation of individual entrepreneurs on OSNO, tax payment deadlines

In the event of termination of the activities of an individual entrepreneur when applying the general taxation regime, a declaration in form 3-NDFL is submitted for the current year within 5 working days from the date of entry into the Unified State Register of Entrepreneurs of an entry on the termination by an individual of activities as an individual entrepreneur (clause 3 of Article 229 of the Tax Code of the Russian Federation) .

Payment of tax accrued on a tax return is made no later than 15 calendar days from the date of filing such a return.

The VAT tax return is submitted to the tax authorities at the place of registration in electronic form via telecommunication channels through an electronic document management operator no later than the 25th day of the month following the expired tax period (clause 5 of Article 174 of the Tax Code of the Russian Federation).

Liquidation of individual entrepreneurs using the simplified tax system, tax period for submitting reports and paying taxes:

When liquidating an individual entrepreneur using a simplified taxation system

, a declaration under the simplified tax system is submitted and the tax is paid no later than the 25th day of the month following the month in which business activity was terminated (clause 2 of article 346.23 of the Tax Code of the Russian Federation).

Liquidation of individual entrepreneurs on the Unified Agricultural Tax

When the activity of an individual entrepreneur applying the taxation system for agricultural producers is terminated, a declaration under the Unified Agricultural Tax is submitted and the tax is paid no later than the 25th day of the month following the month in which business activity was terminated (clause 2 of Article 346.10 of the Tax Code of the Russian Federation).

Our company prepares declarations for individual entrepreneurs: UTII, 3-NDFL, simplified tax system

. With us you can connect to electronic reporting and no longer visit the tax office.