When should I pay the single tax under the simplified tax system in 2020? Are there new deadlines (postponement) due to non-working days, quarantine and coronavirus 2021? To which BCCs should tax be transferred under the simplified taxation system and advance payments for it in 2021 to organizations and individual entrepreneurs? Answers and tables with deadlines in this article.

Also see:

- All changes to the simplified tax system in 2021

- How to switch to the new tax regime “STS-online” from 2021

How are the deadlines for paying the simplified tax system calculated in 2021?

Reporting periods for the single tax on the simplified tax system are 1st quarter, half a year and nine months. Advance payments for simplified tax must be transferred no later than the 25th day of the first month following the reporting period (i.e. quarter, half-year and 9 months).

Accordingly, as a general rule, the tax must be paid to the budget no later than April 25, July 25 and October 25, 2021. Such terms follow from Art. 346.19 and paragraph 7 of Art. 346.21 Tax Code of the Russian Federation.

At the end of the year - the tax period under the single simplified tax - organizations and individual entrepreneurs use the simplified tax system to sum up the results and determine the final amount of tax.

With the object “income minus expenses” this is a single or minimum tax. Organizations transfer these payments to the budget no later than March 31 of the following year, and individual entrepreneurs - no later than April 30 of the next year.

It is possible that the tax payment deadline for the simplified tax system falls on a weekend, non-working day or holiday. In this case, a single tax or advance payment under the simplified tax system can be sent to the budget no later than on the next working day (clause 7, article 6.1 of the Tax Code of the Russian Federation).

KEEP IN MIND!

The tax according to the simplified tax system for 2021 and the payment for the 1st quarter of 2021 had to be paid to the budget before May 6, 2021 inclusive. This is due to the postponement of the payment deadline due to non-working days, quarantine and coronavirus 2021. But other deadlines apply for organizations and individual entrepreneurs from affected industries (see below).

Please note that when closing an individual entrepreneur, there are different tax payment deadlines under the simplified tax system. Moreover, this is a controversial issue, which was analyzed and resolved in ConsultantPlus:

The Tax Code of the Russian Federation does not establish specific deadlines for paying tax according to the simplified tax system when closing an individual entrepreneur. In our opinion, you need to calculate and pay the tax before... (read in full).

What happens if you don’t submit a declaration under the simplified tax system?

Failure to submit a return within the prescribed time limit may result in the following:

- A fine in the amount of 5% of the unpaid tax amount reflected in the declaration (clause 1 of Article 119 of the Tax Code of the Russian Federation). The minimum fine is 1,000 rubles, and it is collected even if the transfer to the budget has been made in full, but the declaration has not been filed. The maximum fine is 30% of the amount of the fiscal fee.

- If the tax return is overdue by more than 10 days, the Federal Tax Service will suspend transactions on the taxpayer’s bank accounts. The arrest will remain in effect until the reporting is submitted.

- An administrative fine of 300 to 500 rubles will be imposed on officials. (Article 15.5 of the Code of Administrative Offenses of the Russian Federation).

Legal documents

- Chapter 26.2 of the Tax Code of the Russian Federation

- Art. 119 Tax Code of the Russian Federation

- Art. 15.5 Code of Administrative Offenses of the Russian Federation

Table with the deadlines for paying the simplified tax system in 2021

The following is a table that summarizes the deadlines for making advance payments under the simplified tax system in 2021, and also indicates the deadline for paying the single tax for 2021.

| PAYMENT PERIOD | DEADLINE (region may set a later date) |

| For 2021 (only organizations pay) | No later than 05/06/2020 (postponement) |

| For 2021 (paid only by individual entrepreneurs) | No later than 05/06/2020 (postponement) |

| For the 1st quarter of 2021 | No later than 05/06/2020 (postponement) |

| For the first half of 2021 | No later than July 27, 2020 |

| For 9 months of 2021 | No later than October 26, 2020 |

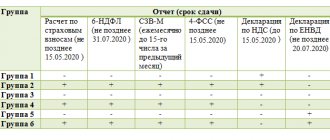

Now we will indicate new payment deadlines for organizations and individual entrepreneurs included as of 03/01/2020 in the Register of SMEs, whose main type of activity according to the Unified State Register of Legal Entities (USRIP) is in the government List of Affected Industries (approved by Decree of the Government of the Russian Federation dated 04/03/2020 No. 434).

Tax according to the simplified tax system for organizations (transfers) :

- 09/30/2020 – tax for 2021;

- 10/26/2020 – payment for the 1st quarter of 2020;

- 25.11.2020 – payment for the first half of 2021.

Tax according to the simplified tax system for individual entrepreneurs (transfers) :

- 10/26/2020 – payment for the 1st quarter of 2020;

- 10/30/2020 – tax for 2021;

- 25.11.2020 – payment for the first half of 2021.

We also note that in two cases the tax according to the simplified tax system is paid within special periods :

- When terminating an activity for which a simplified taxation system was applied, payers must pay tax no later than the 25th day of the month following the month in which, according to the notification submitted to the Federal Tax Service, such activity was terminated (clause 7 of article 346.21, clause 2 Article 346.23 of the Tax Code of the Russian Federation).

- If the right to use the simplified tax system is lost, the taxpayer must pay the tax no later than the 25th day of the month following the quarter in which he lost this right (clause 7 of article 346.21, clause 3 of article 346.23 of the Tax Code of the Russian Federation).

In the event of liquidation of an LLC, is it necessary to notify the tax authority about the termination of the application of the simplified tax system? The answer to this question is in ConsultantPlus:

As explained in Letter of the Ministry of Finance of Russia dated July 18, 2014 No. 03-11-09/35436 (sent for information and use in work by Letter of the Federal Tax Service of Russia dated August 4, 2014 No. GD-4-3/15196), as a general rule, loss of the status of a legal entity , applying the simplified tax system, means the simultaneous termination of the simplified tax system... (read in full).

KEEP IN MIND

Federal Law No. 172-FZ of 06/08/2020 wrote off tax under the simplified tax system for the 2nd quarter of 2021 for those affected by the coronavirus. Namely, an advance payment for the reporting period of half a year 2021, reduced by the advance payment for the reporting quarter 1 of 2021. For more information about this, see “To whom and which taxes will be written off for the 2nd quarter of 2021: list.”

How to pay at the end of the year

In addition to advances, entrepreneurs are required to pay for activities throughout the year. It follows from the Tax Code of the Russian Federation that payment of the simplified tax system for 2021 by organizations and individual entrepreneurs is made at different times, taking into account the dates when they submit tax returns. Tax authorities are waiting for reports and full settlements from legal entities no later than March 31, 2021, and the deadline for payment of the simplified tax system for 2021 for individual entrepreneurs has been postponed by a month - to April 30, 2021.

IMPORTANT!

So far, no decisions have been made to postpone reporting deadlines or budget settlements. If officials introduce new measures to support business, RRT.ru will definitely inform readers about this. Stay tuned for changes.

KBK 2021 for payment of simplified tax system

In 2021, advances under the simplified tax system, unified and minimum simplified tax must be transferred to two BCCs. One is for the “income” object, the other is for the “income minus expenses” object.

Object of the simplified tax system “income”

| Object of taxation “income” |

| Advance payments and single tax - 18210501011011000110 |

| Peni - 18210501011012100110 |

| Fine - 18210501011013000110 |

Also see “New BCCs under the simplified tax system “income” in 2021“

Object “income minus expenses”

The following is a table with the BCC according to the simplified tax system for 2021 for those who use a simplified system with the object “income minus expenses”.

| Object of taxation “income minus expenses” |

| Advance payments and single tax, minimum tax - 18210501021011000110 |

| Peni - 8210501021012100110 |

| Fine - 18210501021013000110 |

There are certain rules for how to fill out a payment order to pay tax according to the simplified tax system. The procedure, features of filling out payments and differences for different objects according to the simplified tax system are disclosed in ConsultantPlus:

There are slight differences in filling out payment slips for advance payments and for tax for the year in fields 107 and 24...

View the complete solution.

The day of payment of the simplified tax system is considered the day when the taxpayer submits to the bank a payment order for the transfer of a single tax from his current (personal) account to the account of the Treasury of Russia. In this case, it is important that there is enough money in the account for payment (letter from the Ministry of Finance of Russia dated May 20, 2013 No. 03-02-08/17543, dated June 21, 2010 No. 03-02-07/1-287).

Read also

30.07.2020

When will they be allowed to pay later and not be fined?

In Art. 64 of the Tax Code of the Russian Federation provides for situations when entrepreneurs will be provided with a deferment or installment plan for settlements with the budget. In some cases, when the deadline for payment of the simplified tax system is postponed, additional interest will be charged on the amount of debt. Those who are unable to fully pay off the budget due to signs of insolvency, a difficult property situation, or the production and sale of seasonal products will have to pay extra.

In order to be able to pay later and not be fined, the taxpayer sends to the Federal Tax Service an application and documents, the list of which is listed in Art. 64 Tax Code of the Russian Federation.

Legal documents

- Art. 346.21 Tax Code of the Russian Federation

- Art. 64 Tax Code of the Russian Federation

Advance payment according to the simplified tax system: calculation examples

Let's consider the procedure for calculating an advance payment according to the simplified tax system with different taxation objects.

Calculation of advances according to the simplified tax system “income” for the 3rd quarter of 2020

IP Rumyantsev I.E. rents out office space and is a payer of the simplified tax system on “income.” An entrepreneur does not hire hired labor.

In 2021, the income of individual entrepreneurs amounted to:

- for the 1st quarter – 526,500 rubles;

- for the 2nd quarter - 323,100 rubles;

- for the 3rd quarter – 297,400 rubles.

Advances were calculated based on the following results:

- 1st quarter – 31,590 rub. (526500 x 6%);

- 2 quarters – 19,386 rubles. ((526500 + 323100) x 6% - 31590).

In the 3rd quarter, individual entrepreneurs partially paid fixed insurance premiums in the amount of 13,000 rubles.

At the end of 9 months of 2021, individual entrepreneur Rumyantsev I.E. will once again calculate the advance payment according to the simplified tax system:

- income will be: 526,500 + 323,100 + 297,400 = 1,147,000 rubles;

- calculated tax from the beginning of the year is equal to: 1,147,000 x 6% = 68,820 rubles;

- advance payment for 9 months, taking into account previously calculated advances: 68,820 – 31,590 – 19,386 = 17,844 rubles;

- advance payment after reduction by individual entrepreneur's contributions “for oneself” (reduction is possible without limitation): 17,844 – 13,000 = 4,844 rubles.

Until October 26, 2020, the individual entrepreneur will transfer to the budget system an advance payment under the “simplified tax” for 9 months of 2021 in the amount of 4,844 rubles.

Calculation of advance payments according to the simplified tax system “income minus expenses” for the 3rd quarter of 2020

StroyKvartal LLC conducts wholesale trade in construction materials and is a payer of the simplified tax system on “income reduced by expenses.”

Based on the results of 9 months of 2021, the enterprise will calculate the advance payment using the simplified system (amounts in rubles):

Period Income Expenses The tax base Advance amount incrementally from the beginning of the year Amount to be paid taking into account previous payments 1st quarter 11 100 200 8 900 500 2 199 700 (11 100 200 – 8 900 500)

329 955 (2,199,700 x 15%)

329 955 2nd quarter 8 600 700 9 100 800 1 699 600 (11 100 200 + 8 600 700 – 8 900 500 – 9 100 800)

254 940 (1,699,600 x 15%)

0 (254 940 – 329 955)

3rd quarter 9 300 200 6 900 700 4 099 100 (11 100 200 + 8 600 700 + 9 300 200 – 8 900 500 – 9 100 800 – 6 900 700)

614 865 (4,099,100 x 15%)

284 910 (614 865 – 329 955 – 0)

Total for 9 months 29 001 100 24 902 000 4 099 100 614 865 614 865 Until October 26, 2020, StroyKvartal LLC will pay 284,910 rubles. advance payment according to the simplified tax system for 9 months of 2021.

At the end of 2021, the organization will additionally calculate the minimum tax (1% of the amount of income) to compare with the amount of the simplified tax system at a rate of 15%, and will pay the amount that turns out to be greater. But when calculating tax for 9 months, this is not required.

Advance payments according to the simplified tax system “Income minus expenses”: calculation and formula

So, what is needed to calculate the advance payment according to the simplified tax system “Income minus expenses”:

- The amount of income for the period on an accrual basis;

- The amount of expenses for the period on an accrual basis;

- Applicable tax rate;

- Amounts of advances already transferred earlier in the current year.

Then the expression for calculating the advance is the following expression:

Advance payment = (Income for the period – Expenses for the period) * Rate – Advance payments of previous periods

Now let’s look at an example: you are an individual entrepreneur without employees, at the end of the 1st quarter you received income of 100 thousand rubles, expenses for this period amounted to 60 thousand rubles. Your simplified tax rate is standard 15%.

Advance (after 1st quarter) = (100 thousand rubles – 60 thousand rubles) * 15% = 6 thousand rubles.

Then in the 2nd quarter you received another 150 thousand rubles. income and incurred expenses of 70 thousand rubles.

Advance (after 6 months) = ((100 + 150 thousand rubles) – (60 + 70 thousand rubles)) * 15% - 6 thousand rubles. = 12 thousand rubles.

Further calculations are done in a similar way.

Important! In this formula, contributions to insurance funds for yourself and for employees are not taken into account, since they are already included in expenses - there is no need to count them separately, they have already taken part in reducing the tax base.

How to calculate advance payments

Advance payments are considered as a cumulative total: for the calculation, they take income from the beginning of the year, calculate the tax, and then subtract the advances listed earlier.

Let's look at an example

The organization applies the simplified tax system “income minus expenses” at a rate of 15%. In the first quarter, the organization’s profit was 100,000 rubles, which means the advance payment for the first quarter: 100,000 rubles × 0.15 = 15,000 rubles. Everything is simple here.

Situation 1: profit for the first half of the year increased

At the end of the six months, the profit amounted to 140,000 rubles, then we calculate the advance payment as follows: (140,000 rubles × 0.15) - 15,000 rubles = 6,000 rubles. And here everything is clear.

Situation 2: profit for the first half of the year decreased

In the second quarter, the organization spent a lot, and profit decreased to 80,000 rubles. Then we calculate the tax for the six months as follows: (80,000₽ × 0.15) - 15,000₽ = - 3,000₽.

This is where the importance of the cumulative total is visible, because with this minus we will show the tax authorities that

— we do not have to pay tax for the first half of the year

— we overpaid tax in the first quarter by 3,000 rubles, and the charges need to be reduced.

The tax office will understand all this from the declaration that you submit at the end of the year.

Submit reports in three clicks

Elba - online accounting for individual entrepreneurs and LLCs. The service will prepare reports, calculate taxes and free up time for useful things.

Try 30 days free Gift for new entrepreneurs A year on “Premium” for individual entrepreneurs under 3 months

Is it possible not to pay for the 3rd quarter, but to pay for the entire 2021?

There are no fines for late transfer of advance payments under the simplified tax system, but according to Art. 75 of the Tax Code of the Russian Federation, penalties are charged for the entire period of delay in payment of the advance.

If the payment is overdue for less than 30 days, the amount of the penalty for each day will be 1/300 of the current interest rate established by the Central Bank. If the period is longer, then from the 31st day the penalty doubles - up to 1/150 of the refinancing rate for each day. For individual entrepreneurs, the penalty remains at 1/300 of the refinancing rate, regardless of the length of the overdue period.

Thus, if you do not make an advance payment under the simplified tax system for the 3rd quarter of 2021, then it can be paid later. However, you will need to pay a penalty.

Read also

26.10.2017