Select what you need:

Move the cursor to the black dates and find out the last date, etc.

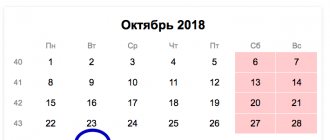

If the final date of the report or payment falls on a weekend or holiday, then the last day of receipt is postponed to the next weekday after the non-working day. It is better to submit reports and make payments a week before the deadline.

| Tue | Wed | Thu | Fri | Sat | Sun |

| 1 |

| 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the fourth quarter* Payments and receipts

|

| 16 | 17 | 18 | 19 | - 20

For all tax regimes *annual* Form (50 kb.) Information on the AVERAGE number of employees - Submit a UTII declaration *for the fourth quarter* UTII declaration calculator + form

- Quarterly: Report 4-FSS (paper) for employees. Sample 4 FSS

| 21 | 22 |

| 23 | 24 | - 25

Pay UTII *for the fourth quarter* Payments and receipts - Submit a VAT return *for the fourth quarter* Sample declaration

- Pay VAT *for the fourth quarter* Payments and receipts

- Quarterly: Report 4-FSS (electronic) for employees. Sample 4 FSS

| 26 | 27 | 28 | 29 |

| 30 | 31 |

FebruaryMon

| Tue | Wed | Thu | Fri | Sat | Sun |

| 1 | 2 | 3 | 4 | 5 |

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | - 15

Personalized accounting (for employees) (paper) Q4. RSV-1 report to the Pension Fund: instructions - Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts

- Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 |

- 20

Personalized accounting (for employees) (electronic) IV quarter. RSV-1 report to the Pension Fund: instructions

| 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 |

MarchMon

| Tue | Wed | Thu | Fri | Sat | Sun |

- 1

Submit a report to the Pension Fund of Russia *for the year* Report RSV-2 to the Pension Fund of the Russian Federation to the heads of peasant (farm) farms (individual entrepreneur is not needed)

| 2 | 3 | 4 | 5 |

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | - 28

Pay tax Income tax *for the year* Payments and receipts - Submit an income tax return *for the year* Income tax for LLC.xls

| 29 | - 30

Submit financial statements: Form No. 1 Balance sheet *for the year*. Form: Balance Sheet.XLS - Submit financial statements: Form No. 2 of the Profit and Loss Statement *for the year*. Form: Profit and Loss Statement.XLS

| - 31

For Organizations (not individual entrepreneurs): Pay the simplified tax system *for the year* Payments and receipts - For Organizations (not individual entrepreneurs): Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

undefined

|

|

April

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Submit 2-NDFL declaration for employees to the tax office *annual* Sample 2-NDFL - Submit 6-NDFL declaration for employees to the tax office *for the year* Sample 6-NDFL

- Pay the Pension Fund OPS for the individual entrepreneur himself (additional 1%) *for the last year* Payments, receipts and calculator

| 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Confirmation of the type in the FSS

| 16 | | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the first quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | | 24 | - 25

Pay the simplified tax system *for the first quarter* Payments and receipts - Pay UTII *for the first quarter* Payments and receipts

- Submit a VAT return *for the first quarter* Sample declaration

- Pay VAT *for the first quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the first quarter* Payments and receipts - Submit an income tax return *for the first quarter* Income tax for LLC.xls

| 29 | - 30

For individual entrepreneurs: Pay the simplified tax system *per year* Payments and receipts - For individual entrepreneurs: Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

- Submit 3-NDFL declaration for individual entrepreneurs *annual* Payments and receipts

- Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

- Submit the 6-NDFL declaration for employees to the tax office within 3 months. Sample 6-NDFL

|

| MayMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | 21 | | 22 | 23 | 24 | 25 | 26 | 27 | 28 | | 29 | 30 | 31 |

| JuneMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | | 19 | 20 | 21 | 22 | 23 | 24 | 25 | | 26 | 27 | 28 | 29 | 30 |

| | July

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for last year* Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for six months* Payments and receipts

| 16 | | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the second quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | 23 | | 24 | - 25

Pay the simplified tax system *for six months* Payments and receipts - Pay UTII *for the second quarter* Payments and receipts

- Submit a VAT return *for the second quarter* Sample declaration

- Pay VAT *for the second quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the second quarter* Payments and receipts - Submit an income tax return *for the second quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit 6-NDFL declaration for employees to the tax office *for six months* Sample 6-NDFL

|

| AugustMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 | 31 |

| SeptemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | | 18 | 19 | 20 | 21 | 22 | 23 | 24 | | 25 | 26 | 27 | 28 | 29 | 30 |

| | October

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the third quarter* Payments and receipts

| | 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the third quarter* UTII declaration calculator+form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | | 23 | 24 | - 25

Pay the simplified tax system *for 9 months* Payments and receipts - Pay UTII *for the third quarter* Payments and receipts

- Submit a VAT return *for the third quarter* Sample declaration

- Pay VAT *for the third quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the third quarter* Payments and receipts - Submit an income tax return *for the third quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit the 6-NDFL declaration for employees to the tax office *within 9 months* Sample 6-NDFL

|

| novemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 |

| DecemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the ESSS (PFR and Social Insurance Fund) for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund from the Tax Service for employees. Payments and receipts

| 16 | 17 | | 18 | 19 | 20 | 21 | 22 | 23 | 24 | | 25 | 26 | 27 | 28 | 29 | 30 | - 31

Pay the Pension Fund OPS for the individual entrepreneur himself (fixed part) *per year* Payments, receipts and calculator

|

| | Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the fourth quarter* Payments and receipts

| 16 | 17 | 18 | 19 | - 20

For all tax regimes *annual* Form (50 kb.) Information on the AVERAGE number of employees - Submit a UTII declaration *for the fourth quarter* UTII declaration calculator + form

- Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | | 22 | 23 | 24 | - 25

Pay UTII *for the fourth quarter* Payments and receipts - Submit a VAT return *for the fourth quarter* Sample declaration

- Pay VAT *for the fourth quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | 28 | | 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| 31 |

| FebruaryMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | 17 | 18 | | 19 | 20 | 21 | 22 | 23 | 24 | 25 | | 26 | 27 | 28 |

| MarchMon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Submit new annual reports to the Pension Fund - SZV-Stazh and ODV-1 Sample SZV-Stazh - Submit a report to the Pension Fund of Russia *for the year* Report RSV-2 to the Pension Fund of the Russian Federation to the heads of peasant (farm) farms (individual entrepreneur is not needed)

| 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | 17 | 18 | | 19 | 20 | 21 | 22 | 23 | 24 | 25 | | 26 | 27 | - 28

Pay tax Income tax *for the year* Payments and receipts - Submit an income tax return *for the year* Income tax for LLC.xls

| 29 | - 30

Submit financial statements: Form No. 1 Balance sheet *for the year*. Form: Balance Sheet.XLS - Submit financial statements: Form No. 2 of the Profit and Loss Statement *for the year*. Form: Profit and Loss Statement.XLS

| - 31

For Organizations (not individual entrepreneurs): Pay the simplified tax system *for the year* Payments and receipts - For Organizations (not individual entrepreneurs): Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

|

| April

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Submit 2-NDFL declaration for employees to the tax office *annual* Sample 2-NDFL - Submit 6-NDFL declaration for employees to the tax office *for the year* Sample 6-NDFL

| | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

- Confirmation of the type in the FSS

| | 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the first quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | | 23 | 24 | - 25

Pay the simplified tax system *for the first quarter* Payments and receipts - Pay UTII *for the first quarter* Payments and receipts

- Submit a VAT return *for the first quarter* Sample declaration

- Pay VAT *for the first quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the first quarter* Payments and receipts - Submit an income tax return *for the first quarter* Income tax for LLC.xls

| 29 | - 30

For individual entrepreneurs: Pay the simplified tax system *per year* Payments and receipts - For individual entrepreneurs: Submit a declaration of the simplified tax system *for the year* Declaration of the simplified tax system calculator + form

- Submit 3-NDFL declaration for individual entrepreneurs *annual* Payments and receipts

- Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

- Submit the 6-NDFL declaration for employees to the tax office within 3 months. Sample 6-NDFL

|

| MayMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | | 7 | 8 | 9 | 10 | 11 | 12 | 13 | | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | 17 | 18 | 19 | 20 | | 21 | 22 | 23 | 24 | 25 | 26 | 27 | | 28 | 29 | 30 | 31 |

| JuneMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | | 4 | 5 | 6 | 7 | 8 | 9 | 10 | | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | 17 | | 18 | 19 | 20 | 21 | 22 | 23 | 24 | | 25 | 26 | 27 | 28 | 29 | 30 |

| July

Mon| Tue | Wed | Thu | Fri | Sat | Sun | - 1

Pay the Pension Fund OPS for the individual entrepreneur himself (additional 1%) *for the last year* Payments, receipts and calculator

| | 2 | 3 | 4 | 5 | 6 | 7 | 8 | | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for last year* Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for six months* Payments and receipts

| | 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the second quarter* UTII declaration calculator + form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | 22 | | 23 | 24 | - 25

Pay the simplified tax system *for six months* Payments and receipts - Pay UTII *for the second quarter* Payments and receipts

- Submit a VAT return *for the second quarter* Sample declaration

- Pay VAT *for the second quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the second quarter* Payments and receipts - Submit an income tax return *for the second quarter* Income tax for LLC.xls

| 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit 6-NDFL declaration for employees to the tax office *for six months* Sample 6-NDFL

|

| AugustMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | | 6 | 7 | 8 | 9 | 10 | 11 | 12 | | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | 17 | 18 | 19 | | 20 | 21 | 22 | 23 | 24 | 25 | 26 | | 27 | 28 | 29 | 30 | 31 |

| SeptemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | | 17 | 18 | 19 | 20 | 21 | 22 | 23 | | 24 | 25 | 26 | 27 | 28 | 29 | 30 |

| October

Mon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | 5 | 6 | 7 | | 8 | 9 | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

- Pay personal income tax 13% for individual entrepreneurs *for the third quarter* Payments and receipts

- Submit a new calculation to the Employment Center about pre-retirees Sample of a new report to the Central Employment Center

| 16 | 17 | 18 | 19 | - 20

Submit a UTII declaration *for the third quarter* UTII declaration calculator+form - Quarterly: Report 4-FSS NS and PZ (paper) for employees. Sample 4 FSS

| 21 | | 22 | 23 | 24 | - 25

Pay the simplified tax system *for 9 months* Payments and receipts - Pay UTII *for the third quarter* Payments and receipts

- Submit a VAT return *for the third quarter* Sample declaration

- Pay VAT *for the third quarter* Payments and receipts

- Quarterly: Report 4-FSS NS and PZ (electronic) for employees. Sample 4 FSS

| 26 | 27 | - 28

Pay tax Income tax *for the third quarter* Payments and receipts - Submit an income tax return *for the third quarter* Income tax for LLC.xls

| | 29 | - 30

Quarterly: Submit the calculation of the Unified Social Insurance Tax (USSS) to the Federal Tax Service. Sample report, fines

| - 31

Submit the 6-NDFL declaration for employees to the tax office *within 9 months* Sample 6-NDFL

|

| novemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | 3 | 4 | | 5 | 6 | 7 | 8 | 9 | 10 | 11 | | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | 17 | 18 | | 19 | 20 | 21 | 22 | 23 | 24 | 25 | | 26 | 27 | 28 | 29 | 30 |

| DecemberMon| Tue | Wed | Thu | Fri | Sat | Sun | | 1 | 2 | | 3 | 4 | 5 | 6 | 7 | 8 | 9 | | 10 | 11 | 12 | 13 | 14 | - 15

Monthly: Pay 13% personal income tax for employees (on the day the salary is paid). Payments and receipts - Monthly: submit SZV-M reports to the Pension Fund. Sample report, fines

- Monthly: Pay to the Pension Fund for employees. Payments and receipts

- Monthly: Pay to the Social Insurance Fund for employees. Payments and receipts

| 16 | | 17 | 18 | 19 | 20 | 21 | 22 | 23 | | 24 | 25 | 26 | 27 | 28 | 29 | 30 | - 31

Pay the Pension Fund OPS for the individual entrepreneur himself (fixed part) *per year* Payments, receipts and calculator

|

red - holidays and weekends, green - shortened days, black - days of reports and payments. The tax reporting calendar for accountants of organizations and individual entrepreneurs shows the main taxes and payments under the most popular tax regimes. Tax calendar for two years at once 2017-2018 in comparative tables. |

|

|

|

Changes for 2021

Big changes for employees. A new ESSS calculation has appeared that replaces RSV-1 and partially 4-FSS.

There are no changes to the deadlines for paying taxes and filing returns.

| Where to submit | What kind of reporting? | Submission deadline |

| Inspectorate of the Federal Tax Service | Unified Social Insurance Tax (USSS) (except for FSS contributions for injuries) | Quarterly no later than the 30th day of the following month: Q1. — May 2, 2021; II quarter — July 31, 2021; III quarter — October 30, 2017; IV quarter — January 30, 2021 |

| Pension Fund | SZV-M | Monthly, within 15 days after the end of the month |

| Pension Fund | Insurance experience report | Every year no later than March 1 of the following year |

| FSS | (FSS NS and PZ) Calculation of contributions for injuries | Quarterly: on paper - no later than the 20th day of the next month, electronically - no later than the 25th day of the next month |

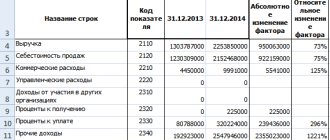

Professional accountant's table - reporting deadlines for the 2nd quarter of 2021.

Useful information for professional accountants - a table with current reporting deadlines

for the 2nd quarter of 2021. In addition to the quarterly ones, we have indicated forms that must be submitted monthly - so that you do not miss anything.

Save it for yourself so you don’t lose it!

| Document | Deadline |

| Social Insurance Fund |

| Form 4 FSS of the Russian Federation. Calculation of accrued and paid insurance premiums for compulsory social insurance against industrial accidents and occupational diseases, as well as expenses for payment of insurance coverage | - July 20 (hard copy)

- July 25 (in the form of an electronic document)

|

| Personal income tax |

| Calculation of personal income tax amounts calculated and withheld by the tax agent (6-NDFL) | July 31 |

| Insurance contributions for pension and health insurance |

| SZV-M Information about the insured persons | July 17th |

| DSV-3 Register of insured persons for whom additional insurance contributions for funded pension are transferred and employer contributions are paid | July 20 |

| Calculation of insurance premiums | July 31 |

| VAT, excise taxes and alcohol |

| Presentation of the log of received and issued invoices in the established format in electronic form for the second quarter of 2021. The log is submitted by non-VAT payers, taxpayers exempt under Article 145 of the Tax Code, not recognized as tax agents, in the case of issuing and (or) receiving invoices by them - invoices when carrying out business activities under intermediary agreements. | July 20 |

| Submission of a tax return on indirect taxes when importing goods into the territory of the Russian Federation from the territory of member states of the Eurasian Economic Union | May 22 June 20 July 20 |

| Tax return for value added tax | July 25 |

| Tax return on excise taxes on ethyl alcohol, alcohol and (or) excisable alcohol-containing products | May 25 June 26 July 25 |

| Tax return on excise taxes on motor gasoline, diesel fuel, motor oils for diesel and (or) carburetor (injection) engines, straight-run gasoline, middle distillates, benzene, paraxylene, orthoxylene, aviation kerosene, natural gas, cars and motorcycles | May 25 June 26 July 25 |

| Submission of declarations on alcohol (with the exception of declarations on the volume of grapes) | July 20 |

| UTII |

| Tax return for UTII | July 20 |

| Unified (simplified) tax return |

| Unified (simplified) tax return | July 20 |

| Income tax |

| Tax return for income tax of organizations calculating monthly advance payments based on actual profit received | June 28 July 28 |

| Tax return for income tax of organizations for which the reporting period is the first quarter, half a year and nine months | July 28th |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld (when calculating monthly payments) | June 28 July 28 |

| Tax calculation (information) on the amounts of income paid to foreign organizations and taxes withheld | July 28th |

| Tax return for income tax of a foreign organization | July 28th |

| Tax return on income received by a Russian organization from sources outside the Russian Federation | June 28 July 28 |

| Property tax |

| Calculation of advance payment for corporate property tax | July 31 |

| MET |

| Tax return for mineral extraction tax | June 30 July 31 |

| Water tax |

| Tax return for water tax | July 20 |

| Gambling tax |

| Tax return for gambling business tax | June 20 July 20 |

To protect yourself from fines, use the express account verification

at a reduced price from

900 rubles

!

* For remote connection. **Only until July 31st!

PROTECT FROM FINES

Find out more from managers

+7

Calculation for 2021

| 2018 | Amount of days | Working hours (in hours) |

| Calendar days | Work days | Weekends and holidays | with a 40 hour work week | with a 36-hour work week | with a 24-hour work week |

| January | 31 | 17 | 14 | 136 | 122.4 | 81.6 |

| February | 28 | 19 | 9 | 151 | 135,8 | 90,2 |

| March | 31 | 20 | 11 | 159 | 143 | 95 |

| I quarter | 90 | 56 | 34 | 446 | 401,2 | 266,8 |

| April | 30 | 21 | 9 | 168 | 151,2 | 100,8 |

| May | 31 | 20 | 11 | 159 | 143 | 95 |

| June | 30 | 20 | 10 | 160 | 144 | 96 |

| II quarter | 91 | 61 | 30 | 487 | 438,2 | 291,8 |

| 1st half of the year | 181 | 117 | 64 | 933 | 839,4 | 558,6 |

| July | 31 | 22 | 9 | 176 | 158,4 | 105,6 |

| August | 31 | 23 | 8 | 184 | 165.6 | 110.4 |

| September | 30 | 20 | 10 | 160 | 144 | 96 |

| III quarter | 92 | 65 | 27 | 520 | 469 | 312 |

| 9 months | 273 | 182 | 91 | 1453 | 1308,4 | 870,6 |

| October | 31 | 23 | 8 | 184 | 165,6 | 110,4 |

| November | 30 | 21 | 9 | 168 | 151,2 | 100,8 |

| December | 31 | 21 | 10 | 167 | 150,2 | 99,8 |

| IV quarter | 92 | 65 | 27 | 519 | 467 | 311 |

| 2nd half of the year | 184 | 130 | 54 | 1039 | 935 | 623 |

| 2017 | 365 | 247 | 118 | 1972 | 1774,4 | 1181,6 |

Calculation for 2021

| Month / Quarter / Year | Amount of days | Working time (hour) |

| Calendar | workers | Weekends | 40 hours/week | 36 hours/week | 24 hours/week |

| January | 31 | 17 | 14 | 136 | 122.4 | 81.6 |

| February | 28 | 18 | 10 | 143 | 128.6 | 85.4 |

| March | 31 | 22 | 9 | 175 | 157.4 | 104.6 |

| April | 30 | 20 | 10 | 160 | 144 | 96 |

| May | 31 | 20 | 11 | 160 | 144 | 96 |

| June | 30 | 21 | 9 | 168 | 151.2 | 100.8 |

| July | 31 | 21 | 10 | 168 | 151.2 | 100.8 |

| August | 31 | 23 | 8 | 184 | 165.6 | 110.4 |

| September | 30 | 21 | 9 | 168 | 151.2 | 100.8 |

| October | 31 | 22 | 9 | 176 | 158.4 | 105.6 |

| November | 30 | 21 | 9 | 167 | 150.2 | 99.8 |

| December | 31 | 21 | 10 | 168 | 151.2 | 100.8 |

| 1st quarter | 90 | 57 | 33 | 454 | 408.4 | 271.6 |

| 2nd quarter | 91 | 61 | 30 | 488 | 439.2 | 292.8 |

| 3rd quarter | 92 | 65 | 27 | 520 | 468 | 312 |

| 4th quarter | 92 | 64 | 28 | 511 | 459.8 | 306.2 |

| 2017 | 365 | 248 | 117 | 1973 | 1775.4 | 1182.6 |

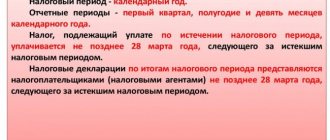

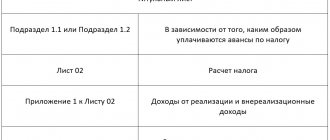

Corporate income tax – due in 2021

According to stat. 289 of the Tax Code, it is necessary to submit the final annual profit declaration before March 28 of the following reporting year. Additionally, enterprises should report on interim accounting data – reporting periods. The form of the form and the procedure for its preparation were approved by the Federal Tax Service in Order No. ММВ-7-3/572 of October 19, 2016.

Income tax posting

Income tax – reporting deadlines:

| Submission period | Submission deadline |

| For businesses calculating tax in quarterly payments |

| 1 sq. 17 | Until April 28, 2017 |

| 2 sq. 17 | Until 28.07 |

| 3 sq. 17 | Until 30.10 |

| 4 sq. 17 | Until March 28, 2018 |

| For businesses calculating tax in monthly payments |

| 01.17 | Until 02/28/17 |

| 01-02.17 | Until 28.03 |

| 01-03.17 | Until 28.04 |

| 01-04.17 | Until 29.05 |

| 01-05.17 | Until 28.06 |

| 01-06.17 | Until 28.07 |

| 01-07.17 | Until 28.08 |

| 01-08.17 | Until 28.09 |

| 01-09.17 | Until 30.10 |

| 01-10.17 | Until 28.11 |

| 01-11.17 | Until 28.12 |

| 01-12.17 | Until March 28, 2018 |

Calculation for 2021

| Month / Quarter / Year | Amount of days | Working time (hour) |

| Calendar | workers | Weekends | 40 hours/week | 36 hours/week | 24 hours/week |

| January | 31 | 15 | 16 | 120 | 108 | 72 |

| February | 29 | 20 | 9 | 159 | 143 | 95 |

| March | 31 | 22 | 9 | 175 | 157.4 | 104.6 |

| April | 30 | 21 | 9 | 168 | 151.2 | 100.8 |

| May | 31 | 20 | 11 | 160 | 144 | 96 |

| June | 30 | 21 | 9 | 168 | 151.2 | 100.8 |

| July | 31 | 21 | 10 | 168 | 151.2 | 100.8 |

| August | 31 | 23 | 8 | 184 | 165.6 | 110.4 |

| September | 30 | 22 | 8 | 176 | 158.4 | 105.6 |

| October | 31 | 21 | 10 | 168 | 151.2 | 100.8 |

| November | 30 | 21 | 9 | 167 | 150.2 | 99.8 |

| December | 31 | 22 | 9 | 176 | 158.4 | 105.6 |

| 1st quarter | 91 | 57 | 34 | 454 | 408.4 | 271.6 |

| 2nd quarter | 91 | 62 | 29 | 496 | 446.4 | 297.6 |

| 3rd quarter | 92 | 66 | 26 | 528 | 475.2 | 316.8 |

| 4th quarter | 92 | 64 | 28 | 511 | 459.8 | 306.2 |

| 2016 | 366 | 249 | 117 | 1989 | 1789.8 | 1192.2 |

Fines

Penalty for reporting to the Pension Fund

not on time: “1)

if less than 180 days have passed,

5% of the amounts of contributions payable on the basis of this calculation (for example, the fine for an individual entrepreneur with 16159.56 will be 807.98 rubles and it does not matter whether he paid or not) for each month, but no more than 30% and no less than 100 rubles.

2) if more than 180 days have passed

, 10% of the amount, but not less than 1000 rubles” (Article 46 212-FZ).

Penalty for Declarations

to the tax office not on time: “5 percent of the unpaid amount of tax subject to payment (additional payment) on the basis of this declaration, for each full or partial month from the day established for its submission, but not more than 30 percent of the specified amount and not less than 1,000 rubles ." (27.07.2010 No. 229-FZ). Those. If you paid the simplified tax system, but did not submit the declaration, then the fine is 1000 rubles. Fines and penalties are not displayed in the declaration. Fine calculator.

If taxes or payments to the Pension Fund are not paid on time, a penalty

in the amount of 1/300 multiplied by the payment amount and multiplied by the refinancing rate per day. Penalty calculator

Where are financial statements submitted?

As a general rule, companies are required no later than three months after the end of 2021 to submit annual financial statements to the tax office at their location (clause 5, clause 1, article 23 of the Tax Code of the Russian Federation).

The annual accounting (financial) statements of a joint-stock company, subject to mandatory audit, are disclosed by publishing its text together with the auditor’s report on the Internet page no later than three days from the date of drawing up the audit report, but no later than three days from the date of expiration of the period established by the legislation of the Russian Federation for the submission of a mandatory a copy of the prepared annual accounting (financial) statements. A mandatory copy of the prepared annual accounting (financial) statements is submitted no later than three months after the end of the reporting period (clause 10, article 13, clause 2, article 18 of Law No. 402-FZ, clause 71.3 and clause 71.4 of Regulation No. 454-P ).

REPORTING OF JOINT STOCK COMPANIES

REPORTS OF JOINT STOCK COMPANIES

Important!

Information on the accounting (financial) statements of the JSC for 2021 must be disclosed no later than 04/03/2018.

In addition, the company is required to submit a legal copy of its annual financial statements to the state statistics body.

And if the reporting is subject to mandatory audit, then the organization is obliged to submit an audit report to the state statistics bodies (clause 2 of Article 18 of Law No. 402-FZ). The audit report is submitted to statistics together with the annual financial statements or no later than 10 business days from the day following the date of the audit report, but no later than December 31 of the year following the reporting year (clause 2 of article 18 of Law No. 402-FZ, Appendix to the Letter of the Ministry of Finance of the Russian Federation dated January 29, 2014 No. 07-04-18/01).

The audit report is not submitted to the tax authorities (Letters of the Ministry of Finance of the Russian Federation dated January 30, 2013 No. 03-02-07/1/1724, Federal Tax Service of the Russian Federation for Moscow dated March 31, 2014 No. 13-11/030545).

CRITERIA FOR MANDATORY AUDIT

In addition, companies are required to submit financial statements to other addresses provided for by the legislation of the Russian Federation, the constituent documents of the organization, decisions of the relevant management bodies of the organization (clause 44 of PBU 4/99, Information of the Ministry of Finance of the Russian Federation No. PZ-10/2012).

AUDIT OF ACCOUNTING REPORTS

Deadlines and composition for submitting reporting forms for taxes and contributions for 2021