The need to write off VAT stuck in accounting data and not accepted for deduction often arises. For whatever reason, deductions are denied, these amounts must be written off in a timely manner, otherwise the company will be forced to provide explanations to external users examining its financial statements. Significant amounts of non-deductible VAT may indicate careless accounting and negatively affect the prestige of the company.

In what cases is “input” VAT not deductible ?

Postings with example

Let’s assume that a company purchased materials from a supplier in the amount of 180,000 rubles, incl. VAT 20%. The supplier did not record the transaction in sales (the so-called tax gap), and as a result the company was denied a deduction. 180,000: 1.2 = 150,000 rub. 180,000 – 150,000 = 30,000 rubles.

Question: Is it permissible to include in the supply contract a provision for the supplier to reimburse the buyer for the amount of VAT not accepted for deduction by the buyer due to the supplier’s failure to fulfill its tax obligations? View answer

Postings:

- D10 K60 — 150,000 rub.

- D19 K60 — 30,000 rub. — inventory items are capitalized and VAT is allocated on them.

- D68 K19 — 30,000 rub. — input VAT is deductible.

After checking by the Federal Tax Service and refusing the deduction:

- D68 K19 — 30,000 rub. — the posting is reversed.

- D91 K19 - write-off of VAT as expenses.

Instead of 91, the score 99 can be used.

Please note that according to tax legislation, the counterparty can send a confirming invoice not immediately, but within 3 years. It is advisable to write off VAT no earlier than this period expires.

Question: Can the seller, in the event of the return of goods not accepted by the buyer for registration, reduce the tax base rather than deduct VAT in accordance with clause 5 of Art. 171 and paragraph 4 of Art. 172 of the Tax Code of the Russian Federation? View answer

By default, “stuck” VAT is not reflected in income tax calculations (Article 170 of the Tax Code of the Russian Federation):

- does not reduce the taxable amount;

- is not included in the costs of goods, services, and works.

The given wiring diagram complies with the norms of the Tax Code of the Russian Federation.

What are the conditions and procedure for applying VAT deductions ?

Writing off VAT on expenses: step-by-step instructions, prohibitions, postings

Individual entrepreneurs have special rights and some opportunities that allow them to reduce the tax burden on authorities.

The regulatory legal framework in the field of taxation provides for cases where taxes cannot be reimbursed or deducted.

As a rule, in such a situation it is possible to write off VAT on expenses, for example, for entertainment and other types.

Possibility of such an event

VAT on non-acceptable expenses, on expenses of future periods, re-invoicing of expenses without tax by payers, writing off the restored VAT as expenses - all this can terrify an unprepared person. Therefore, let's try to understand the jungle of such concepts.

The Tax Code states that in order to write off VAT, a number of mandatory requirements must be met:

Knowing about expenses subject to VAT, it is important to understand when writing off as expenses is impossible. The video below will tell you about separate VAT accounting for indirect expenses in trade:

The video below will tell you about separate VAT accounting for indirect expenses in trade:

The impossibility of such an event

Individual entrepreneurs are often forced to change the tax regime in their activities. Before this procedure, the accounting service carries out audit activities in order to reduce material balances. In these conditions, writing off VAT on costs is impossible according to current legislation, in particular:

- VAT accepted for deduction before the change in the tax regime must be paid to the treasury afterwards;

- You cannot multiply capitalized amounts by including VAT in them.

The procedure for writing off VAT for expenses in tax accounting is discussed below.

The video below will tell you whether travel expenses are subject to VAT and how they are reimbursed:

Mandatory actions

The goods and services that an organization purchases to carry out its activities are used in various operations. Some of them are subject to VAT, while others are not. In order to be able to write off VAT in the future, it is necessary to keep separate records of input tax. However, such a requirement is not regulated, but is a practical conclusion.

Mandatory actions when writing off VAT on expenses are:

- The cost of the purchased product must be confirmed by relevant documents.

- When an individual entrepreneur applies UTII, during capitalization the tax is reflected in the cost of the product.

- With various types of “simplified” VAT can be taken into account at any time or after payment for the product is made.

Writing off VAT on expenses is actually a simple procedure, since it is automated by the 1C system. The software package has a section regarding accounting policies. It is necessary to select the option of inclusion in the cost or write-off. The entered data will be shown in the invoice request. In the section that reflects inventories, you need to select accounting by batch, quantity or amount.

The entries regarding the attribution of VAT to income tax expenses are discussed below.

Product for sale

In accounting and tax accounting, in order to write off VAT on expenses, it is necessary to create transactions (where Dt is a debit, Kt is a credit) that correspond to each specific transaction if the goods are purchased for sale:

- Dt 41 Kt 19 means that VAT is included in the price of a product or service;

- Dt 60 Kt 51, 50. 71 – the cost of goods and services has been fully paid;

- Dt 41 Kt 60 – purchased goods;

- Dt 19 Kt 60 tax was allocated;

- Dt 90.2 Kt 41 means that the cost is transferred to the cost price.

Products for your own activities

If products are purchased for your own activities, then the following transactions must be completed:

- Dt 20.23 Kt 10 – cost written off as cost;

- Dt 10 Kt 19 means that VAT is included in the price of products after payment;

- Dt 60 Kt 51 – purchased goods paid for;

- Dt 19 Kt 76, 60 – VAT is indicated in the documents of the seller from whom the goods were purchased;

- Dt 10 Kt 60 – the cost is indicated at the time of capitalization.

From this video you will learn whether and how to write off VAT as expenses under the simplified tax system:

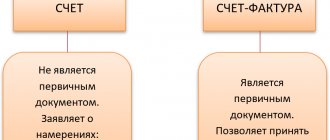

How to avoid denial of deductions

VAT accounting practice shows that the Federal Tax Service may refuse to deduct in the following cases:

- the invoice from the supplier contains errors;

- there is no invoice from the supplier, and the tax is highlighted in the receipt documents;

- the supplier did not reflect the transaction in tax documentation (in the sales book);

- The three-year period for submitting VAT for deduction has expired.

The risk of failure can be minimized if:

- carry out preliminary reconciliation with counterparties, primarily permanent, large transactions associated with the company;

- store primary accounting and tax documents in full;

- do not miss the deadlines specified in the legislation for VAT deductions.

Postings for accounting for “incoming” VAT upon receipt of fixed assets for non-production purposes in 1C 8.2

According to accounting

Postings for accounting for “input” VAT on the debit of account 19.01 are generated by the document Receipt of goods and services - type of operation Equipment:

For tax accounting

The following entries were created in the VAT accumulation register:

Entry by movement type Receipt in the VAT register presented – event Presented by VAT by supplier. This entry is a potential purchase ledger entry:

Entry by the type of movement Receipt in the VAT register for acquired values, type of fixed assets value. The tax amount related to a specific batch of fixed assets is registered:

Recording by the type of movement Receipt in the VAT register for fixed assets, intangible assets, type of value of fixed assets. The tax amounts accepted for accounting on purchased fixed assets are registered in order to track the conditions under which these tax amounts can be accepted for deduction:

Tags: balance sheet, accountant, job description of the general director, capital, loan, tax, VAT, expense, write-off

Nuances

Let us highlight some features of accounting for unrecovered VAT. If VAT is highlighted in the purchase document, but it is clear to the accountant that it will not be confirmed by an invoice (for example, in a document, invoice), the tax office, with a high degree of probability, will not accept this amount for deduction. It is advisable to write it off to account 91 immediately when a bad amount is discovered.

VAT on business trips is deductible (Article 264-1(12) of the Tax Code of the Russian Federation). It must be clear from the supporting documents that these costs are related to production activities. If such information is missing, you can immediately write off the tax to 91 accounts, since the Federal Tax Service will not reimburse it.

Another nuance related to business trips. The tax office insists that the transaction for which the tax is refunded must be confirmed by an invoice presented to the company, or a strict reporting form, issued similarly to cash register checks, where VAT must be highlighted. Judicial authorities enter into controversy with regulators and a number of their decisions cancel this requirement, indicating that something that is not marked as a separate line in a VAT document (for example, in a receipt) can be accepted for deduction. This decision was announced, for example, by the FAS MO (No. KA-A40/6657-11 dated 07/26/11), this is not the only court case.

When can VAT be included in expenses?

We said earlier that VAT cannot be taken into account in a company’s expenses. There are, however, exceptions to this rule. In some cases, it is not possible to claim VAT for deduction, but it is possible to write it off as expenses (according to the text of Article 170 of the Tax Code of the Russian Federation, paragraph 2.5, Article 169-3(1), letters of the Ministry of Finance No. 03-07-07/72 dated 02/11/10, 03-07-08/195 from 01/10/09, 03-11-06/3/227 from 03/09/09):

- The VAT amounts actually paid at the time of import of goods into the territory of the Russian Federation, if they will be used, in turn, in the production of tax-free goods. The same applies to works and services.

- Amounts of VAT on purchased goods, works, services, if they are subsequently used in production or sales outside the Russian Federation.

- The company is in a special regime and is exempt from paying taxes. Here you need to keep in mind that invoices may not be issued to such companies upon purchase, however, provided that an agreement on this is concluded between them and the seller.

- The acquisitions will be used in operations that are not sales under the Tax Code of the Russian Federation.

- In certain cases of the Tax Code of the Russian Federation, VAT is included in the profit costs of banks, pension funds (non-state), insurance companies, clearing firms, stock market participants, etc.

When creating transactions, it would be correct to first allocate VAT and then charge it to expenses.

Example

The company purchased raw materials for the production of goods for export in the amount of 240,000 rubles, including VAT 20%

Postings:

- D10 K60 — 200,000 rub.

- D19 K60 — 40,000 rub.

- D10 K19 — 40,000 rub.

VAT is fully included in the cost of goods and materials.

Attention! VAT on expenses under the simplified tax system “income minus expenses” is reflected only after the sale of an asset or product (Articles 346.16, 346.17, letter of the Ministry of Finance No. 03-11-09/6275 dated 17/02/14).

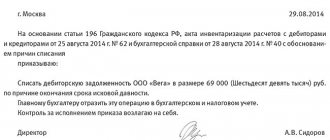

Write-off of VAT not accepted for deduction in tax accounting

So, VAT is not accepted for deduction - where to write it off in tax accounting (TA)? Can such a tax be taken into account in profit expenses? We will answer in the next section. Taxpayers working on the simplified tax system for “income” have the right to take into account VAT in expenses at the time at their own discretion - the taxation procedure will not change.

Through an advance report, VAT is written off automatically if materials (or goods) are purchased in cash. II. Subject to deduction are tax amounts presented to the taxpayer by contracting organizations when they carry out capital construction, VAT amounts presented to the taxpayer for goods, works, services purchased for construction and installation work; tax amounts presented to the taxpayer upon acquisition of unfinished capital construction projects.