Settlement. The main rules governing offset are found in Article 410 “Termination of an obligation by offset” and Article 411 “Cases of inadmissibility of offset” of the Civil Code of the Russian Federation. The practice of court decisions on offsets is summarized in Information Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation dated December 29, 2001 No. 65 “Review of the practice of resolving disputes related to the termination of obligations by offsetting counter-similar claims.” In order for the offset to take place, it is necessary to comply with certain conditions imposed in relation to such transactions by civil law:

Overpayments under one contract are asked to be transferred to payments to another

The decision on conservation is always made by either the customer or the investor. Where can I read about the offer “please consider. "? What is this - “please count.”?

I would also read that we are talking about offsets, if, of course, the contractor has an obligation to return the advance. Does she exist? Or should there be? and what circumstances prevent unilateral termination of the contract?! The decision on conservation is always made by either the customer or the investor.

And who always pays the contractor for smoking bamboo despite the proper performance of his duties? Your answer is interesting in the absence of an agreement in this top) consider the money paid under the 1st agreement as paid under the 2nd and a response letter with confirmation. If possible, could you qualify such actions: are these changes to the agreement or what? If possible, could you qualify such actions: are these changes to the contract or what?

There was a question - is it possible to set off the money if both parties agree. That is, in fact, the buyer made an advance payment for two contracts, but mistakenly indicated only one contract in the payment instructions.

You can pretend that you received the “wrong” advance.

But then the buyer will need to write a letter to correct the payment order. To correct this error, the buyer must send a letter to the seller notifying about the change in the purpose of payment in the advance payment order. After this, it will be considered that part of the advance was originally received under another agreement.

Keep in mind that such clarification of the payment purpose can only be done if: a little time has passed since the payment was made. What documents will you need to deal with an overpayment to a supplier? A statement of reconciliation of settlements with the counterparty. When is the document useful? Most often, an overpayment from a buyer occurs if the parties change the terms of the contract or terminate it. If there are disagreements with the counterparty regarding the transferred amounts, you cannot do without a reconciliation report.

Let me explain. The seller and buyer draw up a payment reconciliation report jointly. To get results faster, draw up such a document yourself with data from your accounting and send it to the seller.

Certification by a notary

The legislation of the Russian Federation does not clearly define the concept of “advance”.

The reservation is reflected only in Art. 380 of the Civil Code of the Russian Federation, where it is noted that an advance payment is considered to be the amount of prepayment to the Seller, unless the concluded agreement states that this is a deposit. The need to transfer an advance appears if the DPA cannot be concluded immediately, since the participants need time to prepare, that is:

- Collect the required amount.

- Prepare the necessary documents.

- Execute alternative transactions.

Mandatory notarized confirmation of the advance agreement is not required. However, participants can perform such a procedure by mutual consent for greater security, especially if we are talking about transferring a large amount of advance payment.

In this option, the notary will assist in correctly filling out the terms in the agreement, and will also witness the transfer of the advance amount to the future Seller.

The cost of notary services to confirm an agreement ranges from 1000-2500 rubles and depends on the volume of the agreement, as well as tariffs depending on the location. For example, in the capital, notary services amount to a larger amount than in small towns.

( Video : “Advance payment and deposit when buying an apartment: nuances and risks”)

Letter and acceptance of the amount against another agreement

If one party does not agree to offset the claims, the initiating organization has the right to go to court. Reservations about taxes and VAT VAT is calculated based on the amounts of debts of both organizations that will be written off. It is written in a separate line in the contract.

Failure to comply with this requirement will result in proceedings with the tax authorities. The amount of this tax is determined based on the market value of the credited services or goods.

Those who use the cash method report income on their taxes that is equal to the amount of debt written off. The basis will be an act or statement of mutual offsets. At the same time, an expense equal to the written off debt of the taxpayer to the partner is displayed. This can be done through a specialized program or using a personal account on the Federal Tax Service website if you have an electronic signature. Download the new application form for credit in 2021 (valid from 2021) How to correctly fill out the new application form in 2021 Let's look at how to offset the amount of overpaid tax using the new application form. This form must be used starting March 31, 2021.

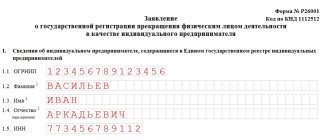

Filling out the document begins with a header in which you need to enter the applicant’s TIN and KPP codes. If the form is submitted by an organization, then two empty boxes must be crossed out in the TIN field.

If an entrepreneur does this, then the checkpoint field is completely crossed out. The page number in the document is written next to it.

Contents: Important In the organization and individual entrepreneur form, fill out only page 1.

The second is intended for individuals who are not entrepreneurs.

Info There is no procedure for filling out the form, but in general the rules for displaying data in it are intuitive. In addition, there are some explanations at the end of the form. Application for offset of overpaid tax: sample The sample we provided is also relevant for 2021.

Methods of filing an application You can submit an application to offset the overpayment to the tax office in one of 3 ways:

Settlement agreement between organizations - sample

> > January 06, 2021 you can download on our website - must comply with a strict list of civil law requirements.

Let us study the main nuances of drawing up such an agreement.

Settlement is an agreement between the parties to civil legal relations on the mutual termination of certain obligations to the established extent. For example, if the contractor performed work for the customer, while the customer delivered goods to the contractor, then each party can exempt itself from paying for the obligations performed by the other party in exchange for the fact that the other party, in turn, will also not pay for the fulfilled first obligation.

Legally, such a condition can be enshrined in an offset agreement for the provision of services (or supply of goods). It is important that (Article 410 of the Civil Code of the Russian Federation):

- the obligations had a sign of homogeneity;

- the deadline for fulfillment of obligations at the time of offset has arrived (exceptions - if it is not specified, is subject to a separate indication, or there are grounds not to comply with this condition by law).

Offsetting cannot be carried out if (Article 411 of the Civil Code of the Russian Federation):

- the conclusion of a netting agreement is expressly prohibited by law or agreement.

- the obligation of either party has expired;

- the obligation of any of the parties is related to compensation for harm to health, lifelong maintenance, payment of alimony;

Settlement can be legally established not only in an agreement, but also unilaterally - through a statement of offset drawn up by any of the parties to the transaction.

But in this case, the party drawing up the application must, if necessary, be ready to prove in court that:

- the application was clearly received by the counterparty;

- the counterparty had no objections to the offset.

Drawing up a bilateral agreement on mutual settlement has such disadvantages, and many companies use it.

How to properly arrange with a counterparty to set off the excess amount received against another agreement

Yes, you should agree with the counterparty on the issue of offsetting the excess amount received against another agreement.

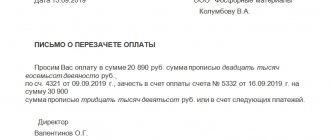

If there is no disagreement with the counterparty regarding the amounts paid, in order to offset the overpayment against another transaction, the partner should send a letter with a request to offset the money against other supplies. Write the letter on your company letterhead. In the letter, specify under which specific agreement the overpayment arose and in what amount.

At the same time, indicate what you expect from the seller - for him to offset other agreements. Provide the number and date of the contract to which you are asking to transfer the overpayment.

It is better to put live signatures and stamps on the document, send it by mail or deliver it with a courier.

The rationale for this position is given below in the materials of the Glavbukh System version for commercial organizations. Article: What papers to send to the supplier to return or offset the overpayment How this article will help: We will tell you what steps to take if you want to return the money overpaid to the seller or offset it against future contracts.

What it will protect you from: From confusion with payments if you terminate the contract or change its terms. It is rare that the seller, having learned about an overpayment under the contract, is ready to return the money simply on the grounds that the buyer asked for it over the phone. Typically, in order to sort out payments, partners have to reconcile accounts, exchange letters, or even enter into an agreement to change prices.

We have listed below common situations when a buyer may experience overpayments.

Reasons why a company may overpay in settlements with a counterparty 1.

The buyer made a mistake in the payment order. This is the simplest situation of all. An overpayment occurs if the buyer mistakenly transferred more than he should have.* 2. The supplier delays delivery of goods already paid for. The buyer can refuse the goods in accordance with Article 511 of the Civil Code of the Russian Federation.

Provided that this is not prohibited by the contract. 3. The seller provided low-quality goods for which he had previously received an advance payment.

We are drawing up an agreement on mutual offset: what to pay attention to?

1. The agreement must necessarily reflect the following information:

- on the composition of obligations that are repaid as part of the offset;

- contracts and other documents of title (acts, invoices, invoices) under which obligations arose;

- financial value of the claims.

2. It is advisable to provide motivational formulations justifying its preparation.

For example, indicate that the agreement is drawn up in order to simplify and increase the efficiency of calculations between the parties.

3. In the agreement, it is advisable to indicate that the mutually offset claims are homogeneous, and to provide the main sign of their homogeneity (for example, indicate that financial obligations in rubles, similar goods in pieces, similar services in specific units of volume are offset).

4. It is advisable to reflect in the agreement the balance of debt of either party, since it is likely to arise as a result of mutual offset.

It would be appropriate to indicate in the preamble or other part of the agreement that it is drawn up on the basis of the provisions of Art. 410 and 411 of the Civil Code of the Russian Federation.

Now it’s time to find out what tax consequences await the company when offsetting mutual claims.

VAT. The offset does not affect VAT. That is, on the day of offset there is no need to adjust either the amount of VAT payable accrued on the date of shipment of goods (performance of work, provision of services) or the amount of deductions sub. 1 clause 1 art. 167, paragraph 2 of Art. 171, paragraph 1, art. 172 of the Tax Code of the Russian Federation.

Problems with the deduction should not arise in the case where you were given an advance payment for upcoming supplies of goods (work, services), from which you paid VAT to the budget, but subsequently you did not sell the goods (work, services), and the advance was credited on account of the counter obligation. 23 Resolution of the Plenum of the Supreme Arbitration Court of May 30, 2014 No. 33; Letter of the Ministry of Finance dated September 11, 2012 No. 03-07-08/268.

Income tax. There will be no income tax consequences for you when making an offset. You will reflect the proceeds from the sale of goods (work, services) to your counterparty and the costs of purchasing goods (work, services) from him in tax accounting even before the offset. 3 tbsp. 271, paragraph 1, art. 272 of the Tax Code of the Russian Federation. And the fact of repayment of debt for goods sold (work, services) is not taken into account when reflecting income and expenses.

USNO. For simplifiers, the date of recognition of income is not only the day the money is received, but also the day the debt is repaid in another way. 1 tbsp. 346.17 Tax Code of the Russian Federation. Offsetting is that very different method. That is, on the basis of an act (agreement, application) of offset, you need to reflect income in the amount of the repaid debt of the counterparty.

DETAILS: Is it possible to donate a share in an apartment with a registered person

Accounting. Income from the sale of goods (works, services) and expenses for their purchase should be reflected in your accounts as usual. As a result, you, as a buyer of goods (works, services), will have accounts payable (balance on the credit of account 60 “Settlements with suppliers and contractors” or account 76 “Settlements with various debtors and creditors”) for their payment.

On the date of offset, make a debit to account 60 “Settlements with suppliers and contractors” (account 76 “Settlements with various debtors and creditors”) – credit account 62 “Settlements with buyers and customers” for the amount of less debt. Thus, receivables and payables will be fully or partially repaid.

Pay attention to one more important nuance. If you decide to set off unilaterally, you need to take into account that subsequently you will not be able to refuse your decision. 9 Information letter of the Presidium of the Supreme Arbitration Court dated December 29, 2001 No. 65.

VAT calculations when offsetting an advance received under another agreement

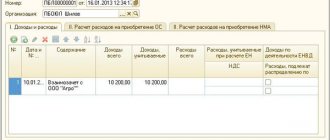

Accounting, taxation, reporting, IFRS, analysis of accounting information, 1C: Accounting

11/29/2016 subscribe to our channel

The Tax Code gives the seller the right, when changing the terms of the contract or terminating it and returning advance payments, to deduct the VAT calculated and paid on the advance payment. In the article, 1C experts, using the example of “1C: Accounting 8” edition 3.0, talk about the procedure for reflecting VAT calculations, including the formation of a tax return, when receiving an advance payment for the supply of goods and claiming tax deductions when offsetting the amount of the received advance payment against an advance payment under another agreement.

We recommend reading: Personal income tax from winnings in the drawing

In accordance with the terms of the contract, the buyer can make full or partial prepayment for goods (work, services), property rights. According to subparagraph 2 of paragraph 1 of Article 167 of the Tax Code of the Russian Federation, on the day of receipt of payment, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights, the moment of determining the tax base for VAT arises, and the tax base is determined based on the amount of payment received from taking into account tax (clause

1 tbsp. 154 of the Tax Code of the Russian Federation). Upon receipt of payment amounts, partial payment for upcoming deliveries of goods (performance of work, provision of services), transfer of property rights realized on the territory of the Russian Federation, the taxpayer is obliged to present to the buyer of these goods (work, services), property rights the amount of VAT calculated in the manner established by paragraph 4 of Article 164 of the Tax Code of the Russian Federation (clause 1 of Article 168 of the Tax Code of the Russian Federation). The seller must issue an invoice to the buyer for the amount of the prepayment received no later than five calendar days (clause

3 tbsp. 168 of the Tax Code of the Russian Federation). The invoice is filled out in accordance with Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137

“On the forms and rules for filling out (maintaining) documents used in calculations of value added tax”

(hereinafter referred to as Resolution No. 1137).

Inclusion of a netting clause in the Agreement

VAT calculated and paid to the budget on the amount of advance payment received is subject to deduction when making offsets.

Having received such a notification, on December 2, the cooperative wrote to the company a statement asking that the amount payable under the supply agreement be offset against the loan. Is such an offset legal?

To offset claims under each contract, the company needs to draw up a separate agreement with the counterparty (provided, of course, that he has claims against it in a similar currency). Netting and tax accounting: nuances Tax accounting of legal relations for netting obligations is characterized by the fact that: 1.

Letter to offset overpayment to supplier. sample, form 2021

SAMPLE LETTER ABOUT SETTLEMENT OF OVERPAYMENT ON AN ACCOUNT ON THE ORGANIZATION’S LETTERHEAD _______20____

To the Accounting Department of Public Press Capital LLC, please credit the overpayment to invoice No. _____ dated ___.__.06.

in the amount of _________ rubles, including VAT 18% - _______ rubles (payment order No._____ dated __.__.06 in the amount of __________ rubles.

incl. VAT 18% _______rub.) in partial payment of invoice No. _____ dated ___.___.06, the remaining funds in the amount of __________rub.

towards subsequent work. General Director (signature) signature transcript Chief Accountant (signature) signature transcript More details ON THE ORGANIZATION'S LETTERHEAD _______200...g.

To the bank Bank of the payer's organization According to payment order No. _____ dated ___.___.__________. for the amount of _________ rubles, the recipient of the payment is considered Public Press Capital LLC TIN 7725144901. Our bank details: DETAILS OF THE PAYER'S ORGANIZATION INN Account No. K/s No. BIC General Director (signature) transcript of signature Chief Accountant (signature) transcript of signature M.P.

More details SAMPLE LETTER ABOUT AN ERROR IN APPOINTING A PAYMENT ON THE ORGANIZATION'S LETTERHEAD __________200...g.

To the Accounting Department of Public Press Capital LLC In payment order No. ____ dated _________________ 20__. an error was made in the purpose of payment in the amount of _____________________ rubles. It should read: “for printed products on invoice No. ___ dated____, incl.

VAT 18% -_____rub.” further in the text. Our bank details: DETAILS OF YOUR ORGANIZATION INN Account No. Account No. BIC General Director (signature) transcript of signature Chief Accountant (signature) transcript of signature More details ON THE ORGANIZATION'S LETTERHEAD ______200...g. To the accounting department of Public Press Capital LLC, please return the overpayment on account No. ……… dated ………… in the amount of ………………… rub.

Agreement on offset of funds (sample)

→ → Update: July 4, 2021

(paid ……… item No. _____ in the amount of ………… rub.). Our bank details: TIN R/s in (name of bank) account BIC General Director (signature) transcript of signature Chief Accountant (signature) transcript of signature M.P. More details ON THE ORGANIZATION'S LETTERHEAD _______200...g.

On the territory of the Russian Federation, there are several legal ways to terminate the obligations of the parties. One of the most common methods is offset of debt amounts.

At the same time, it can be drawn up either by agreement or by a letter on the offset of funds, a sample of which is available for review at the link below.

The provisions of domestic acts of lawmaking allow for the termination of mutual monetary obligations both by making settlements and by conducting mutual offsets, as well as by other methods described in the Civil Code of the Russian Federation. In the case of using the offset option for fulfilling requirements, the parties to economic legal relations must take into account that:

- the deadline for execution by the time the described transaction is completed must have occurred.

- all terminated obligations of the parties must be homogeneous (for example, monetary claims);

It is important to note that the requirements of Russian legislative acts allow for the offset of funds:

- by agreement of the parties.

- unilaterally based on an application or letter from the counterparty;

In any case, the offset must comply with the requirements of the Civil Code of Russia. Ignoring this provision may call into question the legality of terminating mutual obligations in the described manner and lead to the agreement being declared invalid.

The netting agreement, like the letter of netting of funds, must contain the following information:

- Full name of the counterparties' managers;

- names of the parties to the relationship to be terminated;

- a description of the grounds for the emergence of initial mutual claims, their size and deadlines for execution;

- details and signatures.

- an indication of the fact of termination of counterclaims in whole or in part, reflecting the amounts of funds subject to offset;

In accordance with the established practice of signing treaties and other agreements establishing

Required documents

To draw up an advance agreement, you will need to prepare the following package of documents:

- For the buyer:

- You will need to prepare a passport or power of attorney from a representative.

- For the seller:

- You will need a passport or a representative's power of attorney.

- Confirmation of ownership of the item of sale (Extract from the Unified State Register or certificate of ownership).

- Title documents (DCP, inheritance document, etc.)

If payment will be made by bank transfer, bank details will be required.

If payment is made in cash, you will need to request a receipt from the Seller.

In addition, to assure the buyer of the “cleanliness” of the property being purchased, you can ask the seller (for example, if it is an apartment):

- Technical passport to verify the existence of redevelopments and their legality.

- The house register or an extract from it to find out the number of registered persons. It is especially necessary to check the registration of minors, since in this case, you will need permission to sell the apartment from the guardianship departments.

- Certificate of absence of debts for utility services (issued by the EIRC or management company).

- An extract from the Unified State Register to verify property rights transactions carried out with the object being sold.

As already noted, to confirm payment in cash, you will definitely need to request a receipt from the Seller. The document must be written personally by the Seller in the presence of the Buyer in order to be sure that the receipt has not been forged or written by another person.

The receipt must show:

- Passport details of the participants in the transaction, displaying full name, date of birth, series and number of the document, by whom and when it was issued, and registration information.

- The amount of the advance payment.

- It will certainly be necessary to write that the money is handed over on the basis of an agreement.

- Date of the receipt.

- The Seller's signature, which must be the same as in the passport.

Note. Sometimes a receipt is not issued, and instead the Seller signs for the receipt of the advance in the agreement itself.

- , doc

Letter to supplier about transfer of payment sample

» In the event that the transfer of an advance from one contract to another is carried out as a result of termination of the contract or a change in its conditions, i.e. the first of the above conditions established in paragraph. 2 clause 5 art. 171 of the Tax Code of the Russian Federation, then in order to apply a VAT deduction, the second condition must be met - the return of the advance to the counterparty.

Extreme case If the supplier somehow failed to fulfill his obligations (delivery of the goods was not complete, there was inadequate quality, unacceptable delay, etc.), then one letter about offset of the overpayment to the supplier will not be enough. The organization will have to change the terms of the existing contract or terminate it altogether.

How long is the letter stored and where is it registered? All business correspondence must go through the journal of outgoing documentation.

It notes the main content of the letter, its number and date.

This way you can confirm the existence of the paper if legal proceedings are subsequently held on this issue.

As for the storage period, for letters of this kind it is 5 years. This is due to the fact that it is directly related to the business relationship with the supplier of goods or services. Drawing up an application for tax offset from one BCC to another is an inevitable part of the procedure for correcting an error in the work of an accountant when transferring a tax or other payment to the state budget.

First fill out the form:

- details of the applicant - his name, TIN, OGRN, address, etc.

- addressee, i.e. the name and number of the tax authority to which the application will be submitted;

Then the main section states:

- amount (in numbers and words);

- new KBK.

- new payment purpose (if necessary);

- number of the article of the Tax Code of the Russian Federation, in accordance with which this application is being drawn up;

- the tax for which the incorrect payment occurred;

- KBK number;

Finally, the document is dated and the applicant signs it. Bring it to the tax office

How to work with advances and prepayments

From July 1, the law required that checks be punched in a new way, and details were added to checks. But the Federal Tax Service did not have time to prepare an explanation of how to work with the new checks, so some confusion arose. Therefore, we will try to sort out some relevant points for you. First, let’s clarify the concepts of “What is an advance and prepayment.”

How is prepayment different from advance payment?

Prepaid expense

- this is a partial or full payment for a product or service for which the final price, name or composition is unknown. For example, the final cost of making furniture or clothing may change depending on the fittings and materials.

Prepayment

- this is payment for goods or services for which the final cost, composition and names are immediately known. If you pay in advance, you know that none of these parameters will change. For example, the cost of renting a room.

Settlement of advance or prepayment

- this is the final settlement with the client when he received the service or finished product.

You only need to punch out a check for the advance payment if you previously punched out a check for the advance payment itself. If you are not required to punch a check for an advance payment, then you do not need to punch a check to offset the advance payment. For example, if the buyer is an organization that transferred money for services from a current account, then you did not run a cash receipt for the advance (clause 9 of Article 2 of Law No. 54-FZ). This means there is no need to punch a check to offset the advance payment. If you are required to punch a check for an advance, then you need to punch a check to offset the advance. One check per period.

Some sellers can issue one check to offset advances per billing period, and this check does not need to be sent to clients. When you can break one check, see the sidebar.

Issue one check if an individual has made an advance payment for services:

- — concerts, games and other services in the field of cultural events;

- — transportation of passengers, luggage, cargo and cargo luggage;

- - connection;

- — security;

- - public utilities;

- - educational services;

- — advertising on the Internet, granting rights to use programs and databases and other services in electronic form, which are named in Article 174.2 of the Tax Code;

- — other services from the list of the Government, in particular, organization of travel on toll roads (Government Decree No. 924 dated July 18, 2019).

If you fall into the category of organizations or individual entrepreneurs that have the right to issue one check for offset, set the billing period for which you will issue this check. It can be anything, but no more than a month.

The deadline can be set in the director’s order. The check must be generated no later than 10 calendar days following the end of the billing period.

Send this check only to the tax office; you do not need to give it to the client.

How to pass a single check to offset the advance, see example 1.

Example 1.

How to issue a single check to set off an advance payment

During August 2021, individuals paid for services: RUB 20,000. — repaid the debt for July, 12,000 rubles. — made an advance payment for August. No later than September 10, the cashier must issue a check to offset the prepayment. An example of a check for prepayment offset is in sample 1.

Sample 1. Single check for offset of advances

Select the payment method attribute “Full payment” and the payment item attribute “Service”. List the services provided during the billing period against which the advance payment is offset. Select the calculation method attribute “Amount by prepaid check” and enter the amount that you want to offset.

Check - to each client.

If you do not provide services from the preferential list, then a check for the advance payment must be generated at the time of transfer of goods, performance of work, provision of services, for which the buyer made an advance payment. Each client needs to punch a check. It is not entirely clear from the law when it is necessary to issue checks if, for example, services are extended over time.

See table for examples for different situations. 1.

Table 1. When to generate a check

Example 2.

How to make a check for each client

At the beginning of August 2021, buyer E.A. Ozerov made an advance payment for Product No. 1 and for Product No. 2 - 9,000 rubles. At this moment, the cashier of IP Pyatkin D.S. issued the first check for prepayment.

The cashier distributed the advance amount for each item in proportion to the share of payment in the total purchase price. In mid-August 2021, E.A. Ozerov took the goods and paid the balance in cash - 10,000 rubles. The cashier punched the second check to offset the prepayment.

In the receipt, the cashier showed the full cost of the goods. For examples of checks for advance payments and for prepayment offset, see samples 2 and 3 below.

Sample 2: Check for prepayment Sample 3: Check for offset of prepayment

Select the payment method as “Prepayment”. If you don’t know which goods the buyer paid for, instead of the names, indicate “Advance.” List the goods for which the buyer makes an advance payment. Distribute the prepayment amount in proportion to the cost of the goods.

Indicate the payment form “Cash” and the amount of advance payment made by the buyer. You must select the “Full payment” payment method attribute. Attribute of the subject of calculation is “Goods”. For each item, indicate the full cost. Indicate the amount of advance payment that the client made and the amount that the client pays when he picks up the goods.

How to issue checks when returning an advance payment and replacing goods

Refund of advance.

When you return the advance payment to the buyer, generate a check with the “Return of Receipt” sign. In it, indicate the same details as in the check for the advance payment. For example, the buyer made a 100% advance payment.

You entered a check with the “Receipt” attribute, and in the “Payment method attribute” you wrote “Advance payment 100%”.

At the moment when you return the advance, issue a check with the attribute “Return of receipt”, in the field “Attribute of payment method” - “Advance payment 100%”.

Replacement of goods.

If the client paid for one item in advance, and then decided to take another item, it will not be possible to run a check to offset the advance payment.

In the first check for prepayment, you indicated a specific name of the product, which must also be indicated in the check for crediting the prepayment. And since the buyer wants a different product, the names on the receipts will not match.

To solve the problem, issue a check for the refund of the advance payment and return the money to the buyer. And for a new product, issue a regular receipt for receipt.

Letter to offset overpayment to supplier

6773 A letter to offset the overpayment to the supplier is very useful if, under any agreement with a counterparty, there is a larger difference in payment for services or goods. FILES Overpayment between counterparties can occur for a number of reasons:

- If the supplier has delayed a delivery for which funds have already been transferred. If the agreement between organizations does not stipulate otherwise, then the recipient in this case may refuse to accept the goods altogether. This is clearly stated in Article 511 of the Civil Code of the Russian Federation, paragraph 3.

- Refusal by the buyer of a product due to its low quality (defects, etc.). If the supplier in this case has already been paid an advance, then an overpayment arises (Article 523 of the Civil Code of the Russian Federation).

- The simplest of situations. Due to an error by an accountant or other person responsible for transferring funds, more money was transferred to the supplier’s account than it should have been.

- The agreement under which the funds were transferred was terminated by one of the parties. In this case, there is, of course, no talk of offset by future supplies or services.

Before drawing up a letter about the offset of the overpayment, you need to make sure that the calculations by the organization’s accounting department were made correctly.

To do this, the supplier is asked to draw up a bilateral reconciliation report. This will allow you to reach a common opinion regarding the amount of the overpayment. Typically, this kind of paper is printed on the organization’s letterhead.

On their upper part are the company details. If a business letter is printed on a regular A4 sheet without notes, then at the very top you must indicate the name and basic information of the organization that is sending the message. The letter must contain:

- Date of signing.

- The amount of overpayment. It must be clearly known to both parties.

- Title of the paper.

- To which account the payment was made (link with document number and date).

- Information about the addressee. Full name of the head of the supplier’s organization, his position, the name of the company itself.

- Document Number. It is needed for subsequent accounting and recording of outgoing documentation.

How to register offset in a contract

Either take out a loan, or suspend commercial activities, which is not profitable, or use a scheme such as settlement among themselves without a financial component, that is, without transferring money from the account of one organization to the account of another.

Thus, an obstacle to the offset of claims under several contracts with a counterparty may be the heterogeneity of obligations reflected in different contracts.

Sending an SMS to a short number other than 7107, 7208, 7109, as well as sending the wrong text in the SMS body, makes it impossible for the subscriber to receive the service. The Subscriber agrees that the Provider is not responsible for the specified actions of the Subscriber, and payment for the SMS message is not refundable to the Subscriber, and the service for the Subscriber is considered completed.

The main thing is to consistently set out in the agreement the procedure for mutual offset of the parties’ claims with references to different agreements, and to correctly reflect the financial component.

Legal questions and answers

We recommend reading: How much money will we lose when issuing a ticket?

Letter to offset funds from another organization Current legislation (Art.

313 of the Civil Code of the Russian Federation) provides for the possibility of fulfillment of an obligation by a third party. So, for example, if the debtor organization lacks money, the debtor can ask another organization to pay the creditor for him. Receiving payment is beneficial to the lender, but difficulties often arise in processing such payment.

Fulfillment of the obligation to pay for another person is possible in two cases:

- At the request of the debtor, if the nature of the obligation does not imply that the debtor is obligated to fulfill the obligation personally.

- In the event that a third party is in danger of losing his property.

Letter of Settlement

Copyright: photobank Lori According to the Civil Code, it is possible for companies to terminate the obligations of the parties.

One of the most common methods is to offset debt amounts. Under what conditions is it possible to carry out offsets, in what form should a letter be drawn up, in what cases is it impossible to carry out the procedure - let’s take a closer look. In order for debt obligations to be repaid by offsetting mutual claims, certain conditions must be met:

- As a general rule, claims must be valid (depending on the timing of their repayment) and undisputed;

- The claims that are planned to be offset should not be among those claims that cannot be offset. Claims that cannot be offset: for compensation for harm caused to life or health, for the collection of alimony, for maintenance for life, and in other cases provided for by law or contract.

- The claims must be counter-claims, that is, the participants in the offset must simultaneously have debts to each other;

- The requirements must be uniform. In this case, homogeneity means the same method of repaying obligations. However, it is worth keeping in mind that by agreement of the parties, the contract may stipulate the termination of obligations with heterogeneous requirements (for example, obligations may be expressed in different currencies);

Settlement of debt claims is recognized as valid depending on their maturity dates, which:

- or are not specified in any way in the terms of the contract;

- or determined by the moment of demand.

- or have already occurred according to the terms of the contract;

According to civil law, the possibility of terminating an obligation by offsetting a counterclaim of a similar nature arises when the relevant document is sent to one of the parties.

This document can be drawn up in the form of a letter to the counterparty, an agreement on netting, an application for netting, or in another form.

Contract for the supply of goods payment by offset sample

, if the demand must be fulfilled within a certain period of time, according to the terms of the contract, then the debtor company cannot make such a demand for offset before the date of its fulfillment.

Thus, the obligations to fulfill the remaining part of the larger claim remain in full.

Let's say the debt to is 200,000 rubles. Info The contractor demanded money from the customer for the work performed.

However, he had a loan from a bank, and this same customer acted as a guarantor.

Since the contractor did not pay interest on the use of the money, the customer paid for it. Important Let's look at how to correctly draw up a netting agreement, under what conditions it is impossible to do this, what the consequences will be for those using the simplified taxation system and how to calculate VAT. What is offset? Offset under various contracts is a procedure in which the obligations of an organization are considered fulfilled through the performance of similar services.

Letter to transfer payment to another contract

0 Analytical accounting of settlements with suppliers or customers is usually carried out, at a minimum, in terms of contracts. Accordingly, payment is made according to contracts or invoices issued under a specific agreement.

The payer indicates where exactly the payment is to be credited in the payment order in field 24 “Purpose of payment” or in his notification sent immediately after payment (if, say, the purpose of payment simply states “for goods”) (). A situation is possible when, after payment, the payer wants to transfer the payment amount in whole or in part to another agreement. We will tell you how to arrange such a transfer in our material.

Payment is transferred to another agreement, for example, when the payer transferred a larger amount under the agreement than it should have. Or, say, an advance made under one contract wants to be split into two contracts.

The procedure for offsetting the amount of an overpayment under a specific agreement or payment for which the purpose of the payment has not been specified may be provided for in an agreement between the counterparties.

Otherwise, as a rule, a letter is drawn up allocating the payment amount to a specific agreement. Indeed, without such a letter, the recipient, in general, has the right to offset the payment against the obligation, the due date of which will occur earlier (,).

And even more so, you cannot do without a letter when the payer wants to transfer payment from one contract to another and such payment was not unnecessary. Unless otherwise provided by the agreement between the parties, the recipient of the money may refuse to “transfer” payment by letter. However, as a rule, the payer is not usually denied such “maneuvers” if the creditor’s property interests are not violated.

After all, it is unlikely that the supplier will want to transfer the payment received under the expired contract to the advance payment under the new contract, if after the advance payment has been “passed over” to him, the payer wants to receive, in fact, the next batch of goods on credit. But if, say, the payer wants to transfer payment from one contract to another, and at the same time

Settlement without problems

The article from the magazine “MAIN BOOK” is relevant as of June 19, 2015. Yu.V.

Kapanina, certified tax consultant

The court decisions mentioned in the article can be found: When a company and its counterparty have mutual debts, they can simplify and speed up their settlements through offset. This will allow you to avoid sending money “you to me, I to you” and thereby save on bank commissions. You will learn about the nuances of netting, the preparation of related documents and the reflection of this operation in accounting from our article.

Offsetting counterclaims is a way of terminating (in whole or in part) already existing mutual obligations.

The amounts of mutual debt very rarely coincide; usually the debt of one party is greater than the debt of the other.

Then offset is made for the smaller amount. And the party whose debt was greater will have part of the obligation remaining unpaid. Settlement of obligations is possible only if the following conditions are met.

Requirements are considered homogeneous when they have the same subject and can be compared.

Let's say that monetary claims expressed in one currency are homogeneous. For example, one party has a debt to pay for work performed, and the other has a debt to repay the loan, while each party owes the other money, which means that such obligations can be offset.

The courts consider it possible, for example, to set off claims for payment of the customer’s debt for work performed and for payment of a penalty for the contractor’s violation of deadlines for completing work, because, despite their different legal nature, these claims are monetary, that is, homogeneous.

In principle, the parties can agree on the offset of heterogeneous claims, for example, when the debt of one party is expressed in rubles, and the other - in foreign currency.

But then the companies need to agree on the rate at which the foreign currency debt will be converted into rubles. At the time of offset, the payment deadline for each claim under the contract must already have arrived.