Salary payment - sample

The remaining fees must be returned and paid again. (subparagraph 4, paragraph 4, article 45 of the Tax Code of the Russian Federation). Also, a payment order can be generated (and sent via the Internet) in Internet banking (for example, Sberbank-online, Alpha-click, client bank). Internet banking is not needed for small organizations and individual entrepreneurs, because

it is complicated, expensive and less safe. It is worth considering for those who make more than 10 transfers per month or if the bank is very remote.

You can also generate payments using online accounting, such as this one.

Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual.

Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; “Purpose of payment” – INN and KPP of the payer for whom the payment is made and the one who pays; “Payer status” is the status of the person whose duty is performed.

Advance on Salary, Personal Income Tax from Advance

Advance on Salary

Salaries are paid at least every half month:

- for the first half of the month - from the 16th to the 30th (31st);

- for the second half - from the 1st to the 15th of the next month

(Part 6 of Article 236 of the Labor Code of the Russian Federation).

Bonuses and incentive payments are paid monthly, quarterly, and annually.

Each organization can set its own terms for these payments in a collective agreement or local regulation.

If the salary is not paid on time, this may result in a fine of 30 thousand to 50 thousand rubles for the employer.

When determining the amount of the advance, the following are taken into account:

— salary (tariff rate) of the employee for the time worked;

— allowances for hours worked, the calculation of which does not depend on the assessment of the results of work for the month as a whole (for example, compensation payments for night work, allowances for combining positions, for length of service, etc.).

Incentive payments, which are accrued based on the employee’s performance indicators, compensation payments, the calculation of which depends on the fulfillment of the monthly working time standard (for example, for overtime work, work on weekends and holidays) are included in the final calculation of wages at the end of the month.

A decrease in wages for the first half of the month when calculated can be considered as discrimination in the labor sphere and a deterioration in the labor rights of workers.

Personal income tax on salary advance

It is believed that personal income tax must be withheld from advance wages. However, it is not.

The advance payment is not considered the employee’s income and therefore there is no need to withhold personal income tax from it.

The income receipt date is the last day of the month.

Clause 2 of Art. 223 of the Code establishes that the date of actual receipt of income is recognized

the last day of the month for which the employee was accrued income for work performed

responsibilities in accordance with the employment contract.

In a payment order, when transferring an advance to an employee, it is necessary to indicate in the payment purpose field that it is the advance salary, and not the salary, that is being transferred.

ADVANCES UNDER CIVIL CONTRACTS

Advances received by an individual under civil contracts are included in income for personal income tax purposes in the period in which they were received.

The period of performance of work or services does not matter.

This is interesting: Postings on alimony from wages

The organization paying the advance is recognized as a tax agent and must withhold tax and transfer it to the budget.

Tax agents for personal income tax are Russian organizations, individual entrepreneurs, notaries, lawyers, separate divisions of foreign organizations in the Russian Federation, which are the source of payment of income.

Accounting Entries

Postings for advance payment, accrual and payment of wages:

On the date of payment of the advance:

Debit 50 Credit 51 - money was received from the bank to pay advance wages;

Debit 70 Credit 50 (51) - advance paid to employees.

On the last date of the month for which wages are calculated:

Debit 20 (26, 44) Credit 70 - monthly wages accrued;

Debit 70 Credit 68, subaccount “Calculations for personal income tax” - personal income tax is withheld from wages.

On the date of payment of the remaining part of the salary:

Debit 50 Credit 51 - money received from the bank to pay wages;

Debit 70 Credit 50 (51) - wages paid;

Debit 68, subaccount “Calculations for personal income tax” Credit 51 - personal income tax is transferred to the budget.

The procedure for paying salaries to a bank card

136 of the Labor Code of the Russian Federation indicates options for settlement with an employee, where there is information on the procedure for using a bank account or card; Art. Procedure, place and timing of payment of wages When paying wages, the employer is obliged to notify in writing each employee: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments,

Salary payment procedure: is advance payment required?

It should be noted that the Labor Code does not contain such a thing as an “advance” at all: according to its wording, this is wages for the first half of the month.

And the widely used concept of “advance” came from a Soviet-era document, Resolution of the USSR Council of Ministers dated May 23, 1957 No. 566 “On the procedure for paying wages to workers for the first half of the month,” which is still in effect to the extent that does not contradict the Labor Code of the Russian Federation.

Therefore, to make it easier to understand, in this article, advance means wages for the first half of the month. So, for wages, the frequency of payment is established at least every half month. At the same time, other payments to employees have their own deadlines:

- vacation pay must be paid no later than 3 days before the start of the vacation;

- Severance pay must be paid on the day the employee leaves.

But how to pay for sick leave

Payment order for salary advance - sample

Subscribe to our accounting channel Yandex.Zen If the salary is paid through a bank account, the payment form in both of the above cases is filled out almost identically. The only difference is in filling out the details “Purpose of payment”: when transferring the advance, you need to provide wording reflecting the fact that the salary is transferred specifically for the 1st half of the month.

Detail “Payment amount”: reflects the advance amount according to statement T-51 (or similar), which is compiled for the 1st half of the month. Field "Destination"

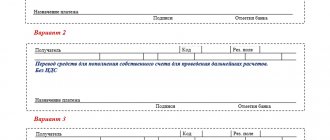

Settlements by payment orders

Payments are used to settle accepted obligations and more. The following options are available for public sector employees:

- Payment of obligations to suppliers and contractors, advance payments are acceptable. Indicate the exact details of the accounts and agreement in the assignment. Do not fill in fields 104–110 and 101 and 22. Be sure to indicate VAT in the cost of goods, works, services, and if it is missing, write “Without VAT”.

- Payments for loans and borrowings in banking and financial institutions. Enter the details of the agreement (loan agreement) in field 24. Do not fill in fields 104–110, 101, 22.

- Transfers of wages, advances, vacation pay and benefits to employees of a budgetary institution. Pay attention to filling out the queue (cell 21); for salary, enter “3” (Article 855 of the Civil Code of the Russian Federation). The transfer deadlines specified in the collective agreement must be observed. Leave fields 22, 101, 104–110 blank.

- Advances for travel expenses for employees. Indicate the number of the basis document (estimate) in the purpose of payment. Do not fill in the fields to clarify tax payments.

- Transfer of insurance premiums, taxes, fees. Check that fields 104–110 of the form are filled out correctly. The BCC can be clarified with the Federal Tax Service or the Social Insurance Fund (for payments for injuries).

Let's look at the features of transferring taxes and insurance premiums using examples.

Samples of filling out payment orders 2019

Cm.

Also: . From 2021, tax contributions can be clarified if the correct bank name and correct beneficiary account were provided. The remaining fees must be returned and paid again.

Payments can also be generated using online accounting, for example. Starting from 2021, someone else can pay taxes for an individual entrepreneur, organization or individual. Then the details will be as follows: “TIN” of the payer - TIN of the one for whom the tax is being paid; “Checkpoint” of the payer – checkpoint of the one for whom the tax is transferred; “Payer” – information about the payer who makes the payment; "Appointment

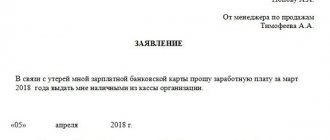

We arrange salary transfers at the request of the employee to third parties

In addition, for transferring money to third parties, your organization will pay a bank commission, which will then have to be collected from the employee.

There are no restrictions on the amount of transfers.

After all, this is not a deduction from an employee’s salary by order of the employer or on the basis of executive documents, but the disposal of the employee’s salary.

So if an employee asks to transfer to someone 100% of his salary due to him after withholding personal income tax and other mandatory payments (for example, alimony, compensation for material damage by decision of the employer), feel free to do it. The employee must draw up an application addressed to the head of the organization in any form.

It must indicate the following data: what amount is to be transferred to third parties (you can specify a fixed amount or a percentage of the wages due); what payments will be made of

Read more: How to impose disciplinary action on an employee

How are salaries and advances paid?

It’s worth starting with the fact that such a concept as an “advance” in relation to wages does not exist in the legislation of 2021.

Based on the norms of Article 136 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation), in 2021, wages must be paid at least once every half month.

This payment occurs on the day established by contracts with employees (collective or labor), internal labor regulations, for example, the 15th of each month.

Thus, it turns out that the advance is the first part of the payment of wages for a certain period. Although the specific period for making such payments is not fixed by law, regulatory authorities have provided some clarification.

This conclusion is confirmed by oral consultations with Rostrud employees, who recommend paying the advance in the middle of the month (15th or 16th).

This is interesting: 6-NDFL for the 1st quarter of 2021: instructions for filling out with examples

Naturally, if such a violation is discovered during an inspection, the employer can appeal the decision of state inspectors, in accordance with Art. 361 of the Labor Code of the Russian Federation, by submitting a corresponding application to the immediate supervisor of the inspector who drew up the protocol on the violation, to the chief state labor inspector of the Russian Federation, or in court. But it will be much calmer and cheaper if payments are made in accordance with the recommendations of control authorities.

For the employer, the main thing is not to forget to indicate in the relevant contracts or VTR rules the specific dates for the payment of the advance and salary. Indicating only the periods of their payments will be considered a violation. This requirement is enshrined in Art. 136 Labor Code of the Russian Federation.

How to transfer salary

Indicate its number and date, the amount of payment in numbers and in words, TIN, KPP and payment details of your company (current account, name of the bank, its BIC and correspondent account), last name, first name, patronymic, TIN and payment details of the employee.

Receive an electronic digital signature (EDS) to sign and transfer to the bank lists for crediting money to the personal accounts of your company’s employees.

3 Create a general payroll for wages. Prepare

What to write in the payment purpose of a payment order when transferring salary to a card?

04/15/16 Question: Tell me what should be written in the “purpose of payment” field (field 24) of the payment order when transferring part of the earnings to a plastic card?

Answer: The Regulations on the rules for transferring funds, approved by the Central Bank of the Russian Federation on June 19, 2012 No. 383-P, states the following about the purpose of payment:

- Field 20 (Name of pl.) - Payment purpose code. The value of the details is not indicated unless otherwise established by the Bank of Russia.

- Field 24 (Purpose of payment) - The purpose of payment, the name of goods, works, services, numbers and dates of contracts, commodity documents, and other necessary information may also be indicated, including in accordance with the law, including value added tax.B for the total amount with the register, a reference is made to the register and the total number of orders included in the register, while the symbol “//” is indicated before and after the word “register”. In the total amount, compiled on the basis of orders, payers - individuals, a reference is made to the register (application) and the total number of orders included in the register (application), while the symbol “//” is indicated before and after the words “register”, “application”

If you are transferring funds from yours to yours, then you can write “Replenishment, excluding VAT.” If the transfer is made by the employer, then the purpose of payment indicates: Salary for... month... year, number and date of the document on the basis of which the transfer is made (number, date of the employment agreement/contract concluded with the employee). Here a record is made that: payroll taxes were withheld and paid in such and such an amount.

Due to the introduction of a new

“Regulations on the rules for transferring funds”

, it is also worth agreeing with the servicing bank on everything that you should write in the “purpose of payment” section. Full information on how to fill out the props field 24 can be found in the material: “” No comments yet. Commenting disabled 10/24/18 10/26/18

How to fill out a personal income tax payment form

Therefore, if on the same day you transfer personal income tax from the salary for the previous month and from vacation pay for the current month, then you need to fill out your payment order for both salary and vacation pay (letter of the Federal Tax Service dated July 12, 2016 No. Specify the amount in full rubles.

5.1 Art. 70 of the Law “On Enforcement Proceedings” dated October 2, 2007 No. 229-FZ as amended by Law No. 12-FZ).

The rule applies: transfer taxes to the budget in full rubles, rounding kopecks according to the rules of arithmetic: if less than 50 kopecks, discard them, and if more, round to the nearest full ruble.

All fields are required.

The date and amount of the write-off are indicated in numbers and in words. Payment orders are numbered in chronological order. Each field is assigned its own number.

We recommend reading: What documents to provide to the insurance company after an accident under compulsory motor insurance

Let's look at the rules in more detail. The payer status must be indicated. When paying personal income tax, a budget organization is a tax agent, so we indicate code 02.

In the “Recipient” column, indicate “Federal Treasury Department for the corresponding region”, in brackets - the name of the tax office.

Sample payment slip for transferring salary to card

To prevent this, it is necessary to take into account the time period that the bank allocates for crediting money to accounts.

A payment order for the transfer of salaries to staff is a document whose execution is not difficult, but it is worth taking into account the nuances of filling out the details.

To ensure the normal passage of the payment, they are filled out, adhering to the following requirements: in the “Payment Recipient” field, indicate the bank institution that has the company’s salary project under the concluded agreement and the account number to which the transfer is made; in the “Payment amount” column, the transfer amount is recorded, which is similar to the calculated amount to be handed over to the company - an advance payment or final payment for the month; in the “Purpose of payment” field they must reflect for what period the transfer is being made.

New deadlines for issuing salaries and processing payments

The column “to the cash desk for payment on time” indicates the period during which the money will be at the cash desk for payment of the advance. The law sets a three-day period, after which the balance of the money is deposited and returned to the bank.

Do I need to withhold personal income tax from the amount? This is followed by the signatures of the manager and chief accountant with a transcript. In field T-53 of the payroll, to indicate the billing period, the first half of the calendar month for which the advance is issued is indicated - from the first to the fifteenth. The content of the document contains a list of employees indicating the serial and personnel numbers, surnames and initials. The amount to be paid is indicated next to each name.

Having received the advance, the employee signs the statement. If the employee does not receive cash within three days, the funds are deposited with the appropriate mark. After three days, the issued and deposited amount is entered in the statement.

The person issuing the money (cashier) signs the form. Based on form T-53, the accountant issues a cash order, the number of which is entered in the statement. After this, the payment document T-53 is registered in the journal and stored in the general order of accounting documents.

zarplata_na_kartu.jpg

Related publications

Labor legislation establishes the employer’s obligation to pay employees wages at least once every six months. The usual gradation for advance payment and payment. The payment deadlines are (Article 136 of the Labor Code of the Russian Federation):

- 30th day of the current month – for advance payment for the 1st half of the month;

- The 15th day of the next month is for monthly calculations.

Full compliance with these deadlines also applies to salaries transferred to the card, if the company practices issuing salaries not through a traditional cash register, but by bank transfer to staff cards.

Purpose of payment advance on wages

How to arrange an advance payment The advance can be transferred to the current account specified by the employee, or issued in cash from the cash desk (Part 3 of Article 136 of the Labor Code of the Russian Federation). When transferring an advance to an employee’s account (including to a “salary” card), the employer reflects the amount due for payment in the payslip or other primary document intended for calculating wages.

Based on the “settlement” primary payment order, the employer generates a payment order (Regulations on the rules for transferring funds, approved by the Bank of Russia on June 19, 2012 No. 383-P) for each of the transferred amounts or one payment order, accompanied by a register for crediting funds to plastic cards, if An agreement was concluded with the bank for a “salary” project.

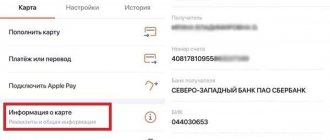

Payment order for salary to card

The transfer is executed by payment order, the details of filling which are discussed in our publication. It is important to take into account the fact that the payment day is usually considered the day the funds are credited to the card, and this day should not be later than the deadlines established by tax legislation. In order to prevent delays in salary payments, it is necessary to take into account the time period that the bank allocates for crediting money to accounts.

A payment order for the transfer of salaries to staff is a document whose execution is not difficult, but it is worth taking into account the nuances of filling out the details. To ensure normal payment processing, they are filled out in accordance with the following requirements:

- in the “Payment recipient” field indicate the bank institution that has the company’s salary project under the concluded agreement and the account number to which the transfer is made;

- in the “Payment amount” column, the transfer amount is recorded, which is similar to the calculated amount to be issued in person in the company’s accounting records - an advance payment or final payment for the month;

- in the “Purpose of payment” field they must reflect for what period the transfer is being made. For example, when transferring an advance, it is formulated as follows: “Payment of wages for the 1st half of the month according to register No. _ dated _._.2018.” A mandatory attachment to the payment order for the transfer of salary amounts is a register indicating the payments due to each employee of the company.

Read more: Constitution, duties of parents and rights of children

Sample payment slip for transferring salary to a card:

Non-cash payments are becoming increasingly widespread, since this option has many advantages, and the use of bank cards in various places for payment contributes to the popularity of their use when paying an employee.

The legislation provides for the option of using cards at enterprises, but it is necessary to comply with all the requirements and subtleties of the process.

How to fill out a payment order

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Document number and date of preparation Follow the chronology when creating payment orders Indicate the type of transfer of the payment order (by mail, electronically, telegraph) or leave the field blank if another type of data transfer is used Amount (in words and figures) Enter the amounts in words and figures in the columns accordingly Fill in the full name organization (maximum 160 characters) Personal account of the payer Write down the twenty-digit number of the current personal account opened in a credit or financial organization We fill in the full name of the banking, credit or financial organization in which the current personal account is opened Bank identification code is filled in in accordance with the “BIC RF Directory” »

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

Indicate the number of the bank's correspondent account, if available. Block information about the recipient. Fill out similar information about the recipient, his bank and personal account. Enter “01”, the value for this column is constant, approved by the rules of accounting in credit and banking companies in Russia. Leave these fields blank. , to fill out this information, special instructions from the bank are required. We indicate the priority in accordance with the norms approved by civil legislation (Article 855 of the Civil Code of the Russian Federation). The UIN of the payment should be entered if it is assigned for a specific type of transfer. If the organization pays independently, and not according to the stated requirement, then write “0.” Here, indicate for what and on what basis (documentation) the payment is made. The accountant can indicate the deadlines for fulfilling obligations under the contract or the deadlines for paying tax obligations, if necessary. Or establish a legislative reference that establishes the basic requirements for making payments. Write in these fields the TIN of the payer (60) and the recipient (61) Indicate the checkpoint of the organization of the payer (102) and the recipient (103)

If you have any questions, you can consult for free via chat with a lawyer at the bottom of the screen or call by phone (consultation is free), we work around the clock.

The block of fields 104–110 is filled in ONLY when transferring payments to the budget system of the Russian Federation and extra-budgetary funds. Fill in only when making payments to the budget or customs duties (fees). The rules for filling out this detail are given in Appendix No. 5 to Order No. 107n of the Ministry of Finance of Russia dated November 12, 2013. We register the BC code in accordance with Order No. 132n of the Ministry of Finance dated June 8, 2018. Read more about the new BCC in the topic “Changes to the BCC from 2021: what is important for public sector employees and NPOs to know.” Specify the code in accordance with the current OKTMO classifier. You can clarify the codes at the Federal Tax Service. The grounds are listed in paragraphs 7 and 8 of Appendix No. 2 of Order of the Ministry of Finance dated November 12, 2013 No. 107n, you need to enter the appropriate code:

- “TP” - payments of the current year;

- “ZD” - voluntary repayment of debts for expired tax, settlement (reporting) periods in the absence of a requirement from the tax authority;

- “BF” - current payment of an individual - bank client (account holder);

- “TR” - repayment of debt at the request of the tax authority;

- “RS” - repayment of overdue debt;

- “OT” - repayment of deferred debt;

- “RT” - repayment of restructured debt;

- “PB” - repayment by the debtor of debt during the procedures applied in a bankruptcy case;

- “PR” - repayment of debt suspended for collection;

- “AP” - repayment of debt according to the inspection report;

- “AR” - repayment of debt under a writ of execution;

- “IN” - repayment of investment tax credit;

- “TL” - repayment by the debtor’s founder of the debt during the procedures applied in a bankruptcy case;

- “ZT” is the repayment of current debt during the procedures used in a bankruptcy case.

Is it possible to perform similar operations

According to legislative acts, payment of wages to an employee is permissible in several ways:

- Cash payment – issuance of funds in person;

- Non-cash – transfer to bank plastic.

If the choice is given to the employee, then he must write an application for the transfer of wages to the card indicating the details of the recipient’s bank 5 days before receiving the money.

Important: the employer does not have the right to prevent an employee from choosing a credit institution, even if all employees receive funds from the same bank.

The procedure for accounting for salary payments on a card in the 1C program is in this video:

The legislative framework

This issue is regulated by several legislative acts:

- Initially, this should be a local internal act of production - a collective or labor agreement, which describes this possibility in detail; if this is not the case, changes can be made if necessary;

- Art. 136 of the Labor Code of the Russian Federation indicates options for settlement with an employee, where there is information on the procedure for using a bank account or card;

- Art. 372 of the Labor Code of the Russian Federation - form of pay slip;

- Regulations on the issue, issued in 2004 by the Central Bank of the Russian Federation on the features of plastic cards and their handling;

- The Tax Code of the Russian Federation and the Civil Code of the Russian Federation indicate the simultaneous deduction of funds to non-budgetary organizations when transferring wages to the employee’s card.

Article 136. Procedure, place and terms of payment of wages

When paying wages, the employer is obliged to notify each employee in writing: 1) about the components of the wages due to him for the corresponding period; 2) on the amount of other amounts accrued to the employee, including monetary compensation for the employer’s violation of the established deadline for payment of wages, vacation pay, dismissal payments and (or) other payments due to the employee; 3) about the amount and grounds for deductions made; 4) about the total amount of money to be paid. The form of the pay slip is approved by the employer, taking into account the opinion of the representative body of employees in the manner established by Article 372 of this Code for the adoption of local regulations. Wages are paid to the employee, as a rule, at the place where he performs the work or transferred to the credit institution specified in the employee’s application, under the conditions determined by the collective agreement or employment contract. The employee has the right to change the credit institution to which wages should be transferred by notifying the employer in writing about the change in the details for transferring wages no later than five working days before the day of payment of wages. The place and timing of payment of wages in non-monetary form are determined by a collective agreement or employment contract. Wages are paid directly to the employee, except in cases where another method of payment is provided for by federal law or an employment contract. Salaries are paid at least every half month. The specific date for payment of wages is established by internal labor regulations, a collective agreement or an employment contract no later than 15 calendar days from the end of the period for which it was accrued. For certain categories of employees, federal law may establish other terms for payment of wages. If the payment day coincides with a weekend or non-working holiday, wages are paid on the eve of this day. Payment for vacation is made no later than three days before it starts.

Important: in connection with this, the employer will not be able to delay the payment of wages, as he will be subject to penalties.

Is such a calculation required?

Important: if wage payments are made to a card without documentation, the employer bears criminal liability.

Read more: Is a power of attorney valid after changing a passport?

What should you write about tax when transferring an advance to an employee?

If such the nearest day is the day of payment of the advance, then the benefits must be paid along with it.

! Please note: the requirement of the Labor Code to pay wages at least twice a month does not contain any exceptions and is mandatory for all employers to fulfill in relation to all employees (Rostrud Letter No. 3528-6-1 dated November 30, 2009). Attention In addition, the employer cannot “bind” its employees to a specific bank: labor legislation gives the employee the right at any time to change the bank to which his wages should be transferred. In this case, it is enough for the employee to notify the employer in writing about the change in payment details for payment of wages no later than five working days before the day of payment of wages (Art.

136 of the Labor Code of the Russian Federation). The procedure for calculating and paying personal income tax and insurance contributions from wages We have found that wages to employees must be paid at least twice a month.

Payment order to transfer wages to a card: sample for 2021

The employee has the right to choose the bank to transfer his salary. He must notify the employer of this in writing no later than five working days before payment of wages.

This is stated in Part 3 of Article 136 of the Labor Code of the Russian Federation.

Keep in mind that the terms of the agreement with the bank for servicing the card account may stipulate that money is credited after a certain time period (for example, the next day after receiving the corresponding payment document).

Most enterprises, when choosing a method of paying staff remuneration, give their preference to non-cash payments.

For employees, this option for receiving salaries is the most convenient; there is no need to receive cash from the company’s cash desk.

The article describes typical situations. To solve your problem , write to our consultant or call for free:

+7 (499) 490-27-62 — Moscow — CALL

+7 — St. Petersburg — CALL

+8 ext.849 — Other regions — CALL

It's fast and free!

For accounting employees, the non-cash form has many positive aspects; the process of paying employees is easier.

Labor legislation obliges you to pay wages to your subordinates at least once every six months, as a rule, on the 30th day - payment of an advance for the current month, on the 15th day of the next month - final payment for the month.

Notifying the employee about the receipt of funds on the card

If initially, when signing a contract with an employee, the payment section did not provide for payments to be made to the card, when deciding to use them, it is necessary to draw up an appendix to the main document.

In this case, an order is initially issued indicating the date the changes become effective.

Application for transfer of salary to card.

In addition, the following activities are carried out:

- The regulations on remuneration are changing;

- Responsible persons are appointed for processing the entire procedure for the state’s transition to cashless payments;

- The accounting department receives the appropriate order to apply the necessary entries;

- If necessary, the HR department is obliged to provide the bank with information about employees, for example, the number of staff, etc. Here you will learn how to create a report on the average headcount.

Rules for transferring salaries to a card

If there is a payslip, the company must enter into an agreement with the credit institution, since this is precisely the responsibility of the employer, and submit a list of documents:

- List of all employees;

- Copies of their passports;

- Application from each employee to agree to the calculation in a similar way.

At the same time, a schedule for the disbursement of funds is drawn up and the person responsible for the transfer is determined, who, if necessary, will have up-to-date information.

Then, before each issue, a payment order is drawn up indicating the amount of the transfer, to which is attached a register indicating the bank details, full names of employees and the amount of each salary.

Important: the document must be signed by an authorized person and marked with the seal of the enterprise.

If the organization does not have a payslip, the list of documents submitted when issuing cards is supplemented by the constituent documents:

- Charter;

- Memorandum of association;

- Card with sample signatures;

- Registration certificate;

- Minutes of the general meeting of shareholders with the corresponding decision;

- TIN of the enterprise. Here you will learn how to obtain information about the OGRN by TIN.

At the same time, the commission for opening accounts will be slightly higher; the employer must pay it. After the cards are made, they are distributed to employees against signature.

If an employee chooses a bank with an account, all expenses will be borne by him.

If an employee wishes to transfer funds to a relative’s card, this is not prohibited by law; it is necessary to provide:

- Bank details;

- Passport details of the card holder;

- Stipulate the time frame within which the transfer will be carried out, most importantly, in this case the bank will increase the commission.

The conclusion of an agreement with the bank must be completed 5 working days before the payment of wages, and it must display specific deadlines for the receipt of money into the account.

Advantages and disadvantages of non-cash payments

There are many advantages of using a plastic card as a payment method for both parties:

- The procedure for paying funds to the staff for the accounting department will be simplified - there is no need to go to the bank and withdraw huge sums to make payments to staff;

- The employee will receive many benefits as a preferential cooperation with the bank as a salary card holder;

- At the same time, the cards make it possible to travel to other countries without carrying cash;

- The ability to control your account without leaving home through online banking.

However, there is also the other side of the coin:

- Unavailability of funds from the card in rural and remote areas;

- Refusal of the employee to receive wages in this way;

- Some banks impose fees for withdrawing funds from a salary card;

- The organization bears the costs of concluding an agreement and issuing cards.

Application form for salary transfer to card.

Payment order

The costs of transferring money are displayed in the debit and credit of accounts, while the accounting entries displayed in them should be well known to accounting employees.

Before submitting a payment to the bank, certain deductions are made:

- Personal income tax withdrawn from the income of each individual - for this purpose, a paper is attached indicating its payment;

- Insurance, pension and medical contributions, which must be transferred by the 15th of each month.

In addition, the payment card carries the name and details of the bank, the total amount, purpose of payment, as well as the registry number.

How to apply for a salary advance?

Depending on the method of issuing the advance (cash, transfer to a bank card, payment in kind), the list of documents that need to be completed will vary.

The general rule is that the advance payment must be issued using the same documents as the final payroll payment.

If an advance is issued:

- In cash: issuance is issued according to the statement of form T-53 or by cash order KO-2. Since the advance is paid for an incomplete month, drawing up a statement in the T-49 form is not necessary. It is used to record deductions, accruals and payments for the whole month.

- Transfer to a bank card or account: the purpose of payment when paying an advance on wages should not be too long; a few symbols will suffice, for example: “Salary for the 1st half of June 15.” In this case, it is necessary to make two entries: when transferring the advance - DEBIT 70 CREDIT 51 “monies were transferred for wages”, when transferring the bank commission - DEBIT 91-2 CREDIT 51 “commission retained by the bank.”

- In kind: based on the provisions of Art. 131 of the Labor Code of the Russian Federation - a non-cash form of advance cannot be more than 20% of the total salary. It is necessary to make 5 entries: DEBIT 70 CREDIT 90-1 “revenue from the transfer of finished products to payroll”, DEBIT 90-2 CREDIT 43 (41) “writing off the cost of finished products”, DEBIT 90-3 CREDIT 68 SUBACCOUNT “VAT CALCULATIONS” “VAT accrual”, DEBIT 90-9 CREDIT 99 “profit from the transfer of property for salary” or DEBIT 99 CREDIT 90-9 “loss from the transfer of property for salary”.

In accordance with Art. 268 of the Tax Code of the Russian Federation, a loss resulting from the transfer of products or goods of own production reduces taxable profit in the usual manner.

Thus, it is quite difficult to clearly determine what percentage of the salary the advance will be in 2021. Logically, this payment should be from 20-50% depending on the form.

Taxes on salary advances

Due to the fact that the advance is a payment of part of the salary, no taxes or contributions are withheld from it, including personal income tax, contributions for medical, social, pension insurance, accidents and occupational diseases.

Insurance premiums are calculated after all necessary payments have been made based on the results of the month, at the end of the month.

Contributions for accidents and occupational diseases are calculated from wages, and the advance is only part of it.