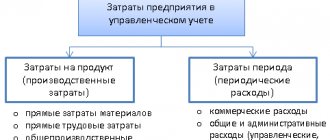

The profitability of any economic entity depends on the correct reflection and accounting of costs. Their optimization, control, and distribution affect the cost of goods (services) and reduce the risks of sanctions from tax authorities. At the initial stage of activity, each company plans and forms a list of costs necessary to implement production processes. An important aspect reflected in the accounting policy is the methods for distributing general production and general business expenses.

Cost classification

The pricing policy of an enterprise takes into account the market situation regarding a certain type of goods, services or work, while the cost is regulated due to the amount of invested profit or the redistribution of business expenses. Production costs are a constant value that is the sum of actual cost indicators. The selling price (of work, services, goods) includes cost, commercial expenses and the amount of profit.

Each organization creates provisions in its accounting policies that regulate the accounting of expenses, methods of their distribution and write-off. Accounting regulations (Tax Code, PBU) recommend a list and classification of costs included in the cost price. The consumption rate of each item is established by the internal documents of the enterprise. Costs are systematized according to various criteria: by economic content, by time of occurrence, by composition, by the method of inclusion in the cost, etc. To formulate calculations, all costs are divided into indirect and direct. The principle of inclusion in the cost depends on the number of types of products manufactured by the company or services provided. Methods for distributing direct costs (salaries, raw materials, depreciation of capital equipment) and indirect (expertise and maintenance work) are determined in accordance with regulatory documents and internal regulations of the company. It is necessary to dwell in more detail on general and general production expenses, which are included in the cost by the distribution method.

Direct and indirect production costs

Articles 271-273 of Chapter 25 of the Tax Code of the Russian Federation provide for income tax payers two alternative ways of determining income and expenses. The desired method must be fixed in the accounting policies of the organization.

- Accrual method . It is universal and suitable for all occasions.

- Cash method . Sometimes it is more convenient, but it has a number of limitations.

Payers of income tax are organizations that apply the general taxation system (OSNO). For these organizations, the 1C Accounting 8 program uses only the accrual method.

According to paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, income tax payers who use the accrual method are required to maintain costs for the production and sale of goods (works, services), dividing them into direct and indirect costs. This is explained by different conditions for their recognition in tax accounting, see clause 2 of Art. 318 Tax Code of the Russian Federation.

- Indirect costs . Indirect costs of production and sales incurred in the current reporting (tax) period are fully recognized as expenses in the same tax period. That is, even if there was no sale in the current period, indirect expenses still reduce the taxable profit of this period.

- Direct expenses . Direct expenses refer to expenses of the current reporting (tax) period as products (works, services) are sold, in the cost of which they are taken into account in accordance with Article 319 of this Code. That is, taking into account the balance of work in progress.

An exception may be cases when an organization provides production services. Such taxpayers have the right to attribute the amount of direct expenses incurred in the reporting (tax) period in full to the reduction of income from production and sales of this reporting (tax) period without distribution to the balances of work in progress.

Subscribers to the ITS can find details of the recognition of direct and indirect expenses in the article “Production-related expenses” on the website of the Internet version of the ITS.

The list of direct expenses is not regulated by law. This means that the organization independently determines in its accounting policy the list of direct expenses, but taking into account the provisions of paragraph 1 of Art. 318 Tax Code of the Russian Federation.

- Material costs . Determined in accordance with paragraphs 1 and paragraph 4 of paragraph 1 of Art. 254.

- Labor costs . Expenses for remuneration of personnel involved in the production of goods, performance of work, provision of services, as well as expenses for compulsory pension insurance, used to finance the insurance and funded part of the labor pension for compulsory social insurance in case of temporary disability and in connection with maternity, compulsory medical insurance, compulsory social insurance against industrial accidents and occupational diseases, accrued on the specified amounts of labor costs.

- Depreciation . Amounts of accrued depreciation on fixed assets used in the production of goods, works, and services.

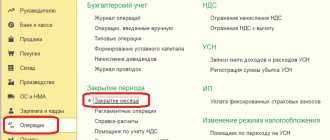

To separate direct and indirect costs in tax accounting in the 1C: Accounting 8 configuration, the information register “Methods for determining direct and indirect production costs in tax accounting” is intended.

But before studying it, open “ENTERPRISE\Chart of Accounts\ Chart of Accounts ” and pay attention to the following points. Those accounts on which tax accounting is maintained are marked with the sign of tax accounting - the presence of a flag in the “NU” column. The cost accounts (20, 23, 25, 26) also have a tax accounting feature. In addition, these accounts have a subaccount “Cost Items”.

In turn, cost items are described in the directory of the same name “Cost Items”. Among the details of this directory there is the attribute “Type of expense”. Its value is used for tax accounting purposes.

If the entire list of cost items could be divided into two non-overlapping lists (direct and indirect cost items), then it would be enough to simply create two corresponding directories and solve the problem of dividing costs into direct and indirect.

However, the difficulty is that the same cost item in some situations may relate to direct costs, in others to indirect costs. For example, a cost item with the expense type “Payroll”. This is a direct expense for remuneration of production personnel. But remuneration of management personnel is an indirect expense.

ODA: composition, definition

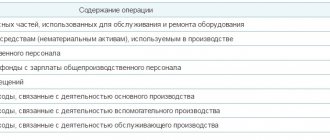

With a branched production structure aimed at producing several units of products (services, works), the enterprise incurs additional costs that are not directly related to the main type of activity. At the same time, accounting for expenses of this type must be kept and included in the cost price. The structure of the ODA is as follows:

— depreciation, repair, operation of equipment, machinery, intangible assets for production purposes;

— maintenance, modernization of workshop premises;

— contributions to funds (FSS, Pension Fund) and wages of personnel serving the production process;

— utility costs (electricity, heat, water, gas);

- other expenses related directly to the production process and its management (write-off of used equipment, equipment, travel expenses, rent of space, services of third-party organizations, provision of safe working conditions, maintenance of auxiliary units: laboratories, services, departments, leasing payments). Production costs are costs associated with the process of managing the main, service and auxiliary departments; they are included in the cost price as general production costs.

Accounting

Methods for distributing general production and general business expenses are based on the total value of these indicators accumulated during the reporting period. To summarize information on ODA, the chart of accounts provides for a cumulative register No. 25. Its characteristics: active, collectively distributive, has no balance at the beginning of the month and the end (unless otherwise provided by the accounting policy), analytical accounting is maintained by divisions (shops, departments) or types of products. During a certain period, information on actual expenses incurred is accumulated in the debit of account 25. Typical correspondence includes the following operations.

- Dt 25 Kt 02, 05 – the accrued amount of depreciation of fixed assets and intangible assets is allocated to OPR.

- Dt 25 Kt 21, 10, 41 – goods of own production, materials, inventory are written off as production expenses.

- Dt 25 Kt 70, 69 – salary accrued to the personnel of the operational development department, deductions were made to extra-budgetary funds.

- Dt 25 Kt 76, 84, 60 – invoices issued by contractors for services rendered and work performed are included in general production expenses; the amount of shortfalls identified based on the results of the inventory is written off.

- The debit turnover of account 25 is equal to the amount of actual expenses, which at the end of each reporting period are written off to the calculation accounts (23, 29, 20). In this case, the following accounting entry is made: Dt 29, 23, 20 Kt 25 - accumulated expenses are written off for auxiliary, main or servicing production.

Methodology for the distribution of general production and general economic costs

Since the actual cost can only be formed from direct costs, general production and general business costs collected in accounts 25 and 26, respectively, are written off in accordance with the accounting policies of the organization.

There are several options for distributing overhead costs:

1. costs recorded in account 25 “General production costs” are included in the cost of goods sold, work, services and are written off from this account to the debit of accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities” and other accounts.

2. costs recorded in account 25 “General production costs”, which are semi-fixed costs, should be debited to account 90 “Revenues and expenses for current activities” (subaccount 90-5 “Administrative expenses”). Costs recorded on account 25 “General production costs”, included in the cost of sold products, works, services, are distributed among the objects of calculation in proportion to the total amount of direct costs.

3. costs recorded on account 25 “General production costs”, subject to distribution, are distributed among the objects of calculation:

• in proportion to direct material costs;

• in proportion to the cost of remunerating production workers;

• using other distribution criteria [17, p.498].

General business expenses are distributed between types of activities in proportion to the amount of revenue received from the corresponding operations.

The accounting policy of Utes OJSC stipulates the opening of three sub-accounts for account 25:

— general production costs for crop production;

— general production costs for livestock farming;

— general production costs of industrial production.

During the year, costs are collected in the debit of account 25, and at the end of the year they are credited to the accounts for accounting for production costs by accessory and are included in the cost of production in proportion to the total amount of costs, with the exception of the cost of seeds, feed, as well as raw materials and materials in auxiliary industrial production.

This is reflected in accounting by the following entries (Table 2.3):

Table 2.3 – Correspondence accounts for the distribution of overhead costs at JSC Utes:

| Contents of a business transaction | Account correspondence | |

| Debit | Credit | |

| General production costs of crop production industries have been written off | 20-1 | 25-1 |

| General production costs of livestock industries have been written off | 20-2 | 25-2 |

| General production costs in industrial production are written off | 20-3 | 25-3 |

Note - Source: own development

Since 2012, the new chart of accounts provides for the write-off of management expenses recorded on account 26 “General business expenses” when determining financial results in the debit of account 90 (subaccount 90-5 “Administrative expenses”) in the full amount, except in cases established by law. Thus, general business expenses should not be distributed to the cost of manufactured products. They are expenses associated with the implementation of the period in which they arose.

The accounting policy of OJSC “Utes” stipulates that account 26 “General business expenses” is closed during the year to account 90-5 “Administrative expenses” [9, p.56].

To distribute general production and general business expenses, the organization draws up a statement of distribution of general production and general business expenses, form No. 606-APK.

Thus, the organization consolidates the methodology for distributing general production and general economic costs in its accounting policies. If an organization, in accordance with its accounting policy, writes off semi-fixed expenses recorded on account 25 directly to account 90, then account 20 will collect direct costs for the production of products, performance of work, provision of services and semi-variable expenses previously collected on account 25 As a general rule, the main part of the expenses that an organization reflects on account 25 are semi-fixed expenses, so in the end, direct expenses will practically be reflected on account 20.

If the organization provides in its accounting policy for the complete write-off of expenses collected on account 25 to account 20, then on account 20 the cost of products, work performed, services provided will be collected based on direct and general production costs - the so-called workshop cost.

CHAPTER 3

WAYS TO IMPROVE ACCOUNTING

ACCOUNTING FOR PRODUCTION ORGANIZATION COSTS

AND MANAGEMENT

Maintaining accounting records in an organization is carried out in accordance with the accounting policy of the organization, formed in accordance with the legislation of the Republic of Belarus [12, p.1]. An essential feature of accounting at Utes OJSC is the use of a memorial-order form of accounting, which, on the one hand, has certain advantages over other forms, but, on the other hand, is associated with a certain complexity of accounting and labor-intensive work of the accounting service.

The main disadvantage of the memorial-warrant form of accounting is the multiple entries, a large number of rewrites of data from documents into accumulative statements, into memorial orders, then into the registration journal, synthetic and analytical accounting registers. And the more intermediate records, the more opportunities for all kinds of errors to occur. Significant labor costs are associated with calculating totals and mutual reconciliation of registers of synthetic and analytical accounting, chronological and systematic records [20, p. 259].

The disunity between synthetic and analytical accounting leads to a lag between analytical accounting and synthetic accounting.

Accounting work is distributed unevenly throughout the month, a significant part of it occurs at the end of the month, and this causes an uneven workload for accountants.

Therefore, as a measure to improve accounting at Utes OJSC, we can propose a transition to a less labor-intensive form of accounting - journal-order.

Expenses for organizing production and management at JSC Utes are recorded in accounts 25 “General production costs” and 26 “General operating costs”.

The accounting policy of the organization establishes the procedure for their distribution. For general production costs - distribution is carried out at the end of the year by individual industries, for general business costs - throughout the year.

In this regard, as measures to improve the accounting of costs for organizing production and management at JSC Utes, we can also propose:

1. in the working chart of accounts, do not allocate subaccount 25-3 “General production costs of industrial production”, since the organization does not have its own production, and this account takes into account the industry costs of such small production facilities as a sawmill. It would be more appropriate not to allocate these costs separately, but to take them into account together with the main costs in subaccount 20-3 “Industrial production”.

2. distribute costs from account 25 not at the end of the year, but monthly or quarterly, since the distribution procedure established at Utes OJSC distorts the cost during the year, and, therefore, distorts the interim accounting reporting data.

CONCLUSION

The study of the theory, practice and regulatory support of the cost accounting system for servicing production and management of an organization based on JSC Utes allowed us to conclude that determining the amount of production costs and their timely reflection in accounting affect not only the production process, but and to determine the financial result. The problems of cost accounting and management must be solved in a comprehensive manner. This approach contributes to a sharp increase in the economic efficiency of the enterprise. Cost management in an enterprise involves performing all the functions inherent in managing any object: developing and implementing solutions, as well as monitoring their implementation. Timely coordination and regulation of costs allow the enterprise to avoid serious disruption in achieving the planned economic result of its activities. And accounting, as an element of cost management, is necessary for preparing information in order to make the right business decisions.

One of the most important tasks facing the management of the enterprise is to reduce the cost of products, develop ways to reduce costs and increase efficiency, which should occur at all stages of the production process. Of great importance in finding ways to reduce production costs is the identification of costs not directly related to the production process, and, first of all, the reduction of these types of costs. These expenses include the costs of organizing and managing production. Their share in the cost price is very significant.

At JSC Utes, accounting is carried out using a memorial order form of accounting. Accounting for production maintenance and management costs is carried out on account 25 “General production costs” and account 26 “General business costs”. Since the costs of production maintenance and management are overhead, they cannot be directly attributed to the cost of specific types of products.

The accounting policy of OJSC Utes provides that general production costs are distributed among industries at the end of the year, and general business expenses during the year are charged to account 90-5 “Administrative expenses.”

Thus, the total amount of production costs consists of current expenses and part of one-time expenses attributed to the product. But in order to ensure that maintenance and production management costs are taken into account in a timely manner, it can be proposed as an improvement measure to distribute the 25th invoice monthly or quarterly. This will allow a more accurate and complete reflection of the cost of production in the reporting period.

Having examined the composition of general production and general business expenses, having studied the organization of accounting for maintenance and production management costs at an agro-industrial complex enterprise, in the course of writing the coursework, a methodology for improving the accounting of this type of costs was proposed.

Distribution

The amount of overhead costs can significantly increase the cost of manufactured products, work performed, and services provided. At large industrial enterprises, pilot projects are planned and the concept of “consumption rate” is introduced; deviations of this indicator are carefully studied by the analytical department. In organizations engaged in the creation of one type of product, methods for distributing general production and general business expenses are not developed; the sum of all costs is fully included in the cost price. The presence of several production processes implies the need to include all types of costs in the calculation of each of them. The distribution of general production costs can occur in several ways:

- Proportional to the selected basic indicator, which optimally corresponds to the combination of ODA and the volume of output (volume of goods produced, wage funds, consumption of raw materials or supplies).

- Maintaining separate accounting of ODA for each type of product (costs are reflected in analytical sub-accounts opened to register No. 25).

In any option, methods for distributing indirect costs must be enshrined in the accounting policies of the enterprise and not contradict regulations (PBU 10/99).

Allocation of costs via working document

The first way to set the program the desired cost distribution algorithm is to add it to the document. In 1C:UPP there are several documents that contain the cost distribution option, these are:

- “Production report for the shift”;

- “Act on the provision of production;

- “Distribution of materials for release”;

- "Distribution of other costs."

Let’s begin by looking at how distribution is carried out through an option in a document using the example of the document “Production Report for a Shift”, designed to reflect information about daily (every shift, if the company operates around the clock) output of finished products. Along with information about the nomenclature and quantitative indicators of production, the document contains bookmarks:

- “Distribution of materials” - in the tab when creating a document, data on materials and raw materials allocated for the production of the final batch of products is entered. Data is entered in quantitative and total terms. Here you can immediately specify the costing item to which one or another type of the specified inventories should be distributed. Further calculations are made automatically by the program when posting the document.

- “Distribution of other costs” - the tab, similar to direct costs, indicates indirect costs related to manufactured products. Here you also need to specify the distribution method (the basis on which the distribution will be calculated).

Similar bookmarks can be found in the documents “Receipt from processing” and “Act on the provision of services”. The distribution process in these cases follows the principle:

- We calculate the output and distribute the costs.

The reverse option for working with data is also possible:

- We collect costs and distribute them to output.

For the second case, there are separate distribution documents. Let’s consider “Distribution of other costs” as an example. It also contains information:

- on the nomenclature and quantity of products leaving production;

- about indirect costs associated with the release (which are subject to distribution);

- about the method of distribution.

Each of the listed items corresponds to a separate bookmark in the document. After entering all the necessary information, the distribution will be performed by the program after posting the document.

OCR, composition, definition

Administrative and economic costs are a significant factor in the cost of goods, work, products, and services. General business expenses are a total reflection of management costs, they include:

— maintenance and servicing of structures, non-production buildings (offices, administrative areas), rental payments;

— contributions to social funds and remuneration of management personnel;

— communication and Internet services, security, postal, consulting, audit expenses;

— depreciation charges for non-production facilities;

— advertising (if these expenses are not commercial);

— office, utility bills, information services;

— expenses for personnel training and compliance with industrial safety rules;

- other similar costs.

The maintenance of the management apparatus is necessary for the implementation of production processes and further marketing of products, but the high proportion of this type of expense requires constant accounting and control. For large organizations, the use of the standard method of calculating operational and technical expenses is unacceptable, since many types of administrative expenses are variable in nature or, in case of a one-time payment, are transferred to the cost of production in stages, over a certain period.

Analysis of direct and indirect production costs

To analyze direct and indirect costs of production (work, services), ordinary standard accounting reports are suitable. It is only important to remember the following.

The division into direct and indirect expenses is carried out by the regulatory document “Closing accounts (20, 23, 25, 26)”. Therefore, information about expenses in tax accounting in standard accounting reports can only be obtained after posting this document. We will focus on specialized reports.

Report “Register of accounting for production costs”.

This report can be opened using the command “REPORTS\Tax accounting registers for income tax\ Production expenses accounting register ”. Depending on the value of the “Type of expenses” attribute, it generates a list of direct or indirect expenses.

Let us immediately note that the list of direct expenses in this report is only potential direct expenses for now. Some of them will become so only after implementation. Remember “direct expenses relate to the expenses of the current reporting (tax) period as products (works, services) are sold ...”, Art. 318 Tax Code of the Russian Federation.

Indirect expenses in tax accounting are recognized as they arise. That is, there is no need to wait for the products to be sold. Their list can be seen if you indicate “Indirect expenses” in the “Type of expenses” detail.

The report “Register of accounting for production costs” can be generated both before and after the regulatory document “Closing accounts (20, 23, 25. 26”).

Report “Analysis of the state of tax accounting for income tax.”

After completing the document “Closing accounts (20, 23, 25. 26,” the data from the report “REPORTS \ Analysis of the state of tax accounting for income tax " becomes relevant. It allows you to analyze direct and indirect taxes that went to reduce the tax base for income tax .

The report can be generated only if there were income, or more precisely sales, for the specified period.

Click on the "Expenses" section. A form will open in which you can see the amounts of direct and indirect expenses recognized in tax accounting.

Let's analyze it. And so, the report shows that the program recognized direct expenses in the amount of 30,720 rubles. However, we saw above that direct expenses should be twice as much - 61,440 rubles. The reason is that we used exactly two chairs worth of materials for production. They also released two chairs. But they sold one chair. And direct costs, as we remember, are accepted as products are sold.

You can further drill down into the report data by clicking on the appropriate accounting sections. But we'll move on to other reports.

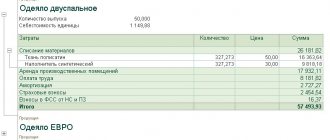

Help-calculation “Product cost”.

This report can be opened using the command “REPORTS\References-calculations\ Cost of products ”. It allows you to display the actual cost of production, both in accounting and tax accounting.

The printed form of the report is an accounting document. It approves the distribution of production costs into the cost of manufactured products and the cost of services provided in the month the report is generated.

Help-calculation "Calculation".

This report can be opened using the command “REPORTS\Calculation references\ Calculation ”. It allows you to display the composition of expenses that formed the actual cost of production, both in accounting and tax accounting.

The printed form of the report is an accounting document. It approves the composition, quantitative and monetary characteristics of the costs for the production of manufactured products and the provision of production services in the month the report is generated.

Accounting

Account No. 26 is intended to collect information about the company’s management expenses. Its characteristics: active, synthetic, collecting and distributing. Closed monthly to accounts 20, 46,23, 29, 90, 97, depending on what methods of distribution of general production and general business expenses are adopted by the internal regulatory documents of the enterprise. Analytical accounting can be carried out in the context of divisions (departments) or types of products (work performed, services provided). Typical account transactions:

- Dt 26 Kt 41, 21, 10 - the cost of materials, goods and semi-finished products is written off for maintenance.

- Dt 26 Kt 69, 70 – reflects the calculation of wages for administrative and economic personnel.

- Dt 26 Kt 60, 76, 71 – general business expenses include services of third-party organizations paid to suppliers or through accountable persons.

- Dt 26 Kt 02, 05 – depreciation of non-production objects, intangible assets and fixed assets was accrued.

Direct cash costs (50, 52.51) are usually not taken into account as part of the OCR. An exception may be the accrual of interest on loans and borrowings, and this accrual method must be specified in the accounting policy of the enterprise.

Formation of ODA

General production expenses are formed on accounting account 25 of the same name. Costs are formed or accrued in the debit of account 25. In addition to the synthetic section, the account provides analytical sections:

- Divisions;

- Expenditures.

Accumulated overhead costs can be analyzed using a typical standard accounting report, for example, “Account balance sheet”:

Fig. 1 Account balance sheet

On a monthly basis, general production expenses are posted to account 20 “Main production”. Account 25 should have a zero balance at the end of the month.

Account 20 also has analytical sections:

- Divisions;

- Nomenclature groups;

- Expenditures.

We also analyze the accumulated expenses of the main production through the account balance sheet:

Fig.2 Accumulated costs of main production

The distribution of 25 accounts to 20 accounts occurs between product groups, where the types of produced PRU are concentrated.

Write-off

All general business expenses are collected in monetary terms as a debit turnover of account 26. When closing a period, they are written off to the main, servicing or auxiliary production, may be included in the cost of goods to be sold, charged to future expenses, or partially allocated to the enterprise's loss. In accounting, this process is reflected by the following entries:

- Dt 20, 29, 23 Kt 26 – OChR are included in the cost of production of the main, service and auxiliary production.

- Dt 44, 90/2 Kt 26 - general business expenses are written off in trading enterprises, to the financial result.

Register of information “Methods for determining direct and indirect production costs in tax accounting”

We have already noted above that to resolve this problem, a periodic register of information “Methods for determining direct and indirect production costs in tax accounting” has been introduced into the configuration.

It is not uncommon to hear the following phrase. This register contains a list of direct expenses. All costs that are not described in it are indirect costs. This is not entirely true. It does not contain a list of direct expenses, but a list of rules (conditions) for determining direct expenses. Each entry is a condition. If at least one condition described in the register is met for an expense, then such expense is recognized as a direct expense in the program. For those expenses for which none of the conditions are met, they are indirect expenses.

Often entries in this register are called patterns or masks. It is possible that all this is not very clear yet. So let's take it in order.

The organization independently approves the list of direct expenses in its accounting policies. Therefore, it is best to register it through the information register form “Accounting Policies of Organizations”. Go to the “Income Tax” tab and click on the “Indicate a list of direct expenses” button.

If for a given organization the information register “Methods for determining direct and indirect production costs in tax accounting” does not yet contain a single entry, then the program will offer to fill it out automatically.

You don’t have to think long about choosing a button. After approximately 20 seconds, the program will open the register for manual generation of the necessary entries in it. In principle, you can close it and click on the “Specify list of direct expenses” button again.

Don’t be surprised if, when you open this register using the command “OPERATIONS \ Information Register \ Methods for determining direct and indirect production costs in tax accounting,” the program does not prompt you to fill it out. In this mode, it doesn't really offer to fill it out.

After clicking on the “Yes” button, the register will be filled with the following entries.

Each entry in this register represents a condition for recognizing an expense as a direct expense. The actual division of expenses in tax accounting into direct and indirect is made at the end of the month by the regulatory document “Closing accounts (20, 23, 25, 26).”

Using the example of the 1st entry, let’s see how the document “Closing accounts (20, 23, 25, 26)” “reasons” to recognize the expense as direct or indirect. In a simplified way, we can distinguish the following stages of “making” a decision.

- 1st step . For the current month (for example, March 2012), for the organization “Trading house “Complex”, in the accounting register “Journal of entries (accounting and tax accounting)” the document finds all records (accounting entries) of type 20.01\69.11.

- 2nd step . Among the found records, only those whose date is not earlier than the date of the template in the register “Methods for determining direct and indirect production costs in tax accounting” remain for further analysis. In our example, this is 01/01/2012.

- 3rd step . Since the “Division” attribute is not specified in the register template, the entries 20.01\69.11 made in any division of the organization are considered below.

- 4th step . The item “Cost Item” is also not filled in, but this does not mean that any cost items are being considered. Only those cost items that have the value “Other expenses” indicated in the “Type of expense” attribute are taken into account. Why is that? Yes, because in the entry in question, in the “Type of expenses NU” detail, the value “Other expenses” is indicated.

Thus, if the entry 20.01\69.11 made in accounting satisfies all the listed conditions, then the program will classify its amount as direct expenses.

If an expense is detected in accounting for which no suitable template is found in this register, then in tax accounting this expense is recognized as indirect and its program writes it off as a debit to the corresponding subaccount of account 90.08 “Management expenses”.

Now let’s take a closer look at the details of the information register “Methods for determining direct and indirect production costs in tax accounting.” It contains two groups of details: Mandatory and Additional.

Required details.

- Date . Here we indicate the date from which this register entry is valid. If over time the accounting policy for the list of direct expenses changes, then it will be necessary to enter new entries with new dates of their activity.

- Organization . Each organization independently determines its own list of direct expenses. Since direct expenses are stored in this register for all organizations, for each entry it is necessary to indicate its affiliation with a particular organization.

- Type of expenses in NU . Type of consumption in accordance with the classifications in paragraph 1 of Art. 318 Tax Code of the Russian Federation. The choice of expense type in NU limits the list of possible cost items. For this record, only those cost items can be considered that have the same value indicated in the “Type of expense” attribute as in the “Type of expense in NU” attribute.

Additional (optional) details.

- Division . We indicate the division for which, in accordance with the adopted accounting policy, the costs are direct. Typically these are production units. If a department is not specified, then costs for all departments are considered.

- Account Dt . If necessary, you can specify any of 4 cost accounts: 20, 23, 25 or 26. If the account is not specified, then any of these accounts is assumed by default.

- Kt account . If necessary, you can indicate any account that corresponds in debit with the cost account in accordance with the Instructions for using the Chart of Accounts (Order 94n).

- Cost item . The program will allow you to indicate only that cost item for which the value of the “Type of expense” attribute coincides with the value of the attribute “Type of expense in NU” in the information register in question.

It is very important to understand that until the end of the month, the organization’s production costs are not divided into direct and indirect costs. In accordance with the settings of the Chart of Accounts, they are reflected as expenses at the time of registration of a business transaction in accounting (AC) and in tax accounting (TA).

It is equally important to understand, depending on what settings, certain postings occur in the control unit and in the control unit. For clarity, consider the following example. Let the document “Request-invoice” write off materials to account 26 “General business expenses”. Let also, for the sake of simplicity, in the information register “Methods for determining direct and indirect production costs in tax accounting” there is not a single entry. That is, all expenses in tax accounting are recognized as indirect. After closing the month, depending on the accounting policy settings, we will see the following transactions.

Option 1: The “Direct costing method” flag is cleared.

- BU: 26\10.01 , the posting is generated by the “Request-invoice” document in accordance with the settings of the information register “Item Accounting Accounts”.

- NU: 26\10.01 , the posting is generated by the document “Request-invoice” in accordance with the settings of the information register “Item Accounting Accounts” and the presence of the sign of maintaining NU on account 26 “General expenses” and account 10.01 “Raw materials and materials”.

- NU: 90.08.1\26 , the posting is generated by the document “Closing accounts (20, 23, 25, 26). In our setting, all costs are indirect.

Pay attention to the last posting, 90.08.1\26. It has nothing to do with the state of the “By direct costing” flag. It is due to the fact that there is not a single entry in the information register “Methods for determining direct and indirect production costs in tax accounting.” This means that all expenses in NU are recognized as indirect and are written off at the end of the month to account 90.08.1.

Option 1: The “By direct costing method” flag is set.

- BU: 26\10.01 , the posting is generated by the “Request-invoice” document in accordance with the settings of the information register “Item Accounting Accounts”.

- BU: 90.08.1\26 , the posting is generated by the document “Closing accounts (20, 23, 25, 26), if the flag “By the direct costing method” is set.

- NU: 26\10.01 , the posting is generated by the document “Request-invoice” in accordance with the settings of the information register “Item Accounting Accounts” and the presence of the sign of maintaining NU on account 26 “General expenses” and account 10.01 “Raw materials and materials”.

- NU: 90.08.1\26 , the posting is generated by the document “Closing accounts (20, 23, 25, 26). In our setting, all costs are indirect.

From the analysis of this example, attention should be paid to the following point.

The state of the flag “By the direct costing method” affects the formation of transactions only in accounting when closing the month. It has nothing to do with tax accounting

In tax accounting, the write-off of expenses as cost or administrative expenses is determined by their nature. Direct expenses at the end of the month are written off from expense accounts to the debit of account 90.02.1 “Revenue from activities with the main taxation system.”

On the contrary, indirect expenses when closing the month are directly debited to account 90.08.1 “Administrative expenses for activities with the main taxation system.”

Distribution

General business expenses in most cases are written off similarly to general production expenses, i.e., in proportion to the selected base. If this type of cost is long-term in nature, then it is more appropriate to attribute them to future periods. Write-offs will occur in certain parts attributable to cost. Conditionally variable general business expenses can be attributed to the financial result or included in the price of the goods produced (in trading enterprises or those providing services). The method of distribution is regulated by internal documents.

Automatic cost distribution

Above, we examined options for manually entering initial data for distribution when registering the release of each individual batch. However, using 1C:UPP, distribution can be carried out automatically.

To do this, when you start working with the program, you need to set the appropriate settings:

- in the register “Methods of distribution of cost items of the organization” - the corresponding cost distribution algorithms are set both for the purposes of regulatory accounting and for the purposes of management accounting;

- in the register “Methods of distribution of cost items” - additional distribution parameters are entered specifically for management purposes.

As a rule, management distribution and the reports resulting from it differ from standardized accounting, although both types of accounting can be maintained in the same database.

Additional cost allocation options are often required by managers for a detailed analysis of the costs incurred.

Find out more about the types and purposes of cost analysis: “Analysis of costs for production and sales of products.”

For management purposes, costs in 1C:UPP can be divided:

- By output volume - in this case, the volume of output is taken as the base (usually in quantitative terms, but you can set the distribution depending on the price of a unit of output). As a result, such a distribution will show what share of the distributed expense fell on a unit of production.

- By sales volume - in this case, the base is taken of the products actually sold during the period. The standard period is a month. Sales volume with this method is usually also taken in quantitative terms. This distribution will show how much each unit of products sold during the period cost the company.

- At the cost of costs - in this case, the cost of direct production costs for manufactured products will be taken as the base. A characteristic feature of such a distribution will be that part of the distributed costs will be included in the work in progress indicator. Such a distribution will allow you to see how direct and indirect costs compare in the total cost of production.

- In terms of the main raw materials, the method is similar to the option described above in terms of cost. But instead of the full cost, only the cost of the basic (main) raw materials used for the manufacture of products is taken into account. Similarly, after distribution has been completed, it is possible to estimate the share of the base raw materials and the remaining costs related to it in the unit cost of production.

- According to the standards, how the distribution occurs is clear from the name. To apply this method, you must additionally set the appropriate norms for including distributed costs in the cost of finished products through the “Planned cost of items” register. In this case, the final report will show us the standard cost and help determine its deviations from the actual one.

- Manually - usually used when you need to set your own distribution bases for different departments. Setting o in the register window of the cost distribution method will display in the document: “Setting the distribution base.” The document specifies the distribution parameters in the analytics required for each specific case. Accordingly, in the reports we will see what manual distribution was performed for. For example, how much of the cost of electricity supply relates to the cost of own products and those produced from customer-supplied raw materials.

- By selection - used when different cost items need to be distributed in different ways. The selection is set on a separate tab for the selected distribution base. For example: the cost of costs is selected - you can establish that this method is used only for relevant costing items, for example, electricity supply.

After setting the distribution parameters, the automatic calculation is launched by the routine operation “Calculation of cost”. 1C will collect and distribute all costs as specified in the parameters for automatic distribution.

1C

Currently, accounting for general production and general economic costs is carried out in accounting databases and programs of the 1C group. Methods for distributing indirect costs are regulated by special settings. When calculating the cost of experimental work and industrial maintenance, it is necessary to check the boxes opposite the approved base in the “production” tab. When writing off as deferred expenses, it is necessary to establish the period and amount. To include costs in the financial result, fill in the appropriate tab. When the “period closing” function is launched, general production and general business expenses accumulated in registers 25 and 26 are automatically written off to the debit of the specified accounts. This process forms the cost of the finished product.

Distribution of overhead costs

Some companies use a special coefficient to distribute operating costs to the cost of finished products, which is calculated using the formula:

Kopr = OPRmes / Bopr,

Where:

- Kopr - coefficient of expenses attributed to ODA;

- OPRmes - expenses for the reporting month;

- Beaupr is the general basis for the distribution of overhead costs.

This indicator helps to find out the amount of ODA (how many rubles) that falls on 1 ruble of the distribution base.

General production costs can be distributed according to the volume of products produced by type of product, according to the amount of accrued wages of key personnel, for each type of GP, or according to the cost of inventories directed to OP.

For example, for March 2021, ODA amounted to 150,000 rubles. The company's accounting policy states that ODA is distributed in proportion to direct accrued wages of key personnel by type of finished product.

Accrued salary for March:

- product No. 1 - 500,000 rubles;

- product No. 2 - 750,000 rubles;

- product No. 3 - 250,000 rubles.

Total 1,500,000 rub.

We calculate the coefficient:

Kopr = 150,000 / 1,500,000 = 0.1.

We distribute general production costs among manufactured products:

- product No. 1 = 500,000 × 0.1 = 50,000 rubles;

- product No. 2 = 750,000 × 0.1 = 75,000 rubles;

- product No. 3 = 250,000 × 0.1 = 25,000 rub.

The amounts are reflected in the accounting entries:

| Operation | Debit | Credit | Amount, rub. |

| HMOs written off as main production | 20 | 25 | 150 000 |

| Including by type of finished product: | |||

| Product #1 | 50 000 | ||

| Product #2 | 75 000 | ||

| Product #3 | 25 000 |