How to account for expenses using the cash method

As a general rule, in accounting, expenses are recognized in the reporting period in which they occurred, regardless of the time of actual payment of funds (assuming the temporary certainty of the facts of economic activity). Organizations that have the right to use simplified accounting methods, including simplified accounting (financial) reporting, can use the cash method of accounting for income and expenses. Under the cash method, revenue from the sale of goods (work, services) is recognized after receipt of cash and other forms of payment, and expenses - after repayment of debt (clause 18 PBU 10/99 “Organization expenses”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n).

In “1C: Accounting 8” (rev. 3.0), revenue and expenses for accounting purposes can be accounted for without closing documents (“on payment”). With certain assumptions, this method of accounting can be considered the cash method. This method is only available to those who use the following special tax regimes:

- simplified taxation system (STS) with the object “income”;

- unified tax on imputed income (UTII);

- patent taxation system (PTS).

Accounting for expenses in the program without closing documents is based on the assumption that expenses for the purchase of goods (work, services) relate to the reporting period in which they were paid. And settlements with the supplier are made at the time of purchase of goods (works, services).

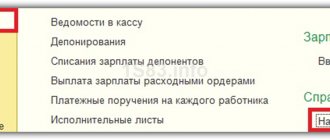

To use this method in the documents Debiting from a current account and Cash issuance (with the transaction type Payment to supplier), it is enough to select the method Without closing documents in the Payments indicator. When posting documents with the specified setting, an expense is recognized, which is reflected by the posting:

Debit 44 (26) Credit 51 (50.01) - for the amount of payment to the supplier.

The account specified in the Main cost account field of the Accounting Policy information register is substituted as a cost account.

The applied methodology for accounting for income and expenses should be fixed in the accounting policy for accounting purposes.

When applying special tax regimes, tax accounting is carried out only on a cash basis:

- under the simplified tax system - in accordance with paragraph 1 of Article 346.17 of the Tax Code of the Russian Federation;

- for PSN - in accordance with Article 346.53 of the Tax Code of the Russian Federation;

- when combining UTII with the simplified tax system, UTII income is also determined by the cash method (letter of the Ministry of Finance of Russia dated November 23, 2009 No. 03-11-06/3/271).

In “1C: Accounting 8” (rev. 3.0), tax accounting of income and expenses for special regimes is automated and supported through special mechanisms, including through the use of special accumulation registers. Entries in registers are entered, as a rule, automatically when posting documents that record business transactions.

In general, the accrual method is used for income tax purposes. With regard to expenses, this means that they are taken into account in the reporting (tax) period to which they relate, and are recognized in the presence of income for the receipt of which they were incurred (Clause 1, Article 272, Article 318-320 of the Tax Code of the Russian Federation).

A number of organizations have the right to determine the date of receipt of income (expense) using the cash method, if on average over the previous 4 quarters the amount of sales revenue excluding VAT did not exceed 1 million rubles. for each quarter (clause 1 of article 273 of the Tax Code of the Russian Federation). In 1C: Accounting 8, the cash method for income tax payers is not supported.

The principle of proportional attribution of expenses uncertain by type of activity

The taxpayer's expenses, which cannot be directly attributed to the costs of a specific type of activity, are distributed in proportion to the share of the corresponding income in the total volume of all income of the taxpayer.

In addition to the above principles, rules have been established for the recognition of expenses, which determine the date from which, in accordance with the established procedure, expenses can be included in the calculation of the tax base. The rules for recognizing expenses can be divided into general, special and special:

Rule 1: For expenses relating to several periods.

According to the rule under consideration, expenses are distributed by the taxpayer independently, taking into account the principle of uniform recognition of income and expenses in the event of the simultaneous presence of the following conditions:

- when income is received over more than one reporting period;

- The contract does not provide for the phased delivery of goods (work, services).

Rule 2: For material costs (raw materials, materials, work and services of a production nature).

The date of material expenses is recognized as follows:

- date of transfer of raw materials and materials into production - in terms of raw materials and materials attributable to the goods (work, services) produced;

- date of signing by the taxpayer of the certificate of acceptance and transfer of services (works) - for services (works) of a production nature.

Rule 3: For material costs (other material costs).

For material expenses for the purchase of tools, fixtures, inventory, devices, laboratory equipment, work clothes and other property, if they are not depreciable property, the date of their implementation is the date of commissioning.

Rule 4: Based on the costs of purchasing publications.

For other expenses for the acquisition of publications (books, magazines and other similar objects), the date of their implementation is the date of their acquisition.

Rule 5: By depreciation.

Depreciation is recognized as an expense on a monthly basis, based on the amount of accrued depreciation, calculated in the manner established by Articles 259, 322 of the Tax Code of the Russian Federation.

I would like to note that Federal Law 58-FZ introduced amendments to paragraph 3 of Article 272 of the Tax Code of the Russian Federation. According to the changes made, expenses in the form of capital investments provided for in paragraph 1.1 of Article 259 of the Tax Code of the Russian Federation are recognized as expenses of the reporting (tax) period for which, in accordance with Chapter 25 of the Tax Code of the Russian Federation, the start date of depreciation (date of change in the original cost) of fixed assets falls. in respect of which capital investments have been made. The changes made apply to legal relations arising from January 1, 2006.

Clause 1.1 of Article 259 of the Tax Code of the Russian Federation was also introduced by the above law. This paragraph states that the taxpayer has the right to include in the expenses of the reporting (tax) period expenses for capital investments in the amount of no more than 10 percent of the initial cost of fixed assets (except for fixed assets received free of charge) and (or) expenses incurred in cases completion, additional equipment, modernization, technical re-equipment, partial liquidation of fixed assets, the amounts of which are determined in accordance with Article 257 of the Tax Code of the Russian Federation.

Thus, taxpayers will be able to include in expenses expenses for capital investments in the amount of 10 percent of the initial cost of fixed assets and (or) expenses incurred by them in cases of completion, additional equipment, modernization, technical re-equipment, and so on. Objects received free of charge and when calculating the amount of depreciation, expenses for capital investments provided for in subclause 1.1 will not be taken into account.

Rule 6: For labor costs.

This rule applies to labor costs accrued in accordance with Article 255 of the Tax Code of the Russian Federation.

Labor costs are recognized as an expense on a monthly basis based on accrued amounts.

Rule 7: Regarding repair costs.

Expenses for repairs of fixed assets are recognized as an expense in the reporting period in which they were incurred in the amount of actual costs, regardless of their payment.

Rule 8: Regarding insurance costs.

This rule applies to expenses:

- on compulsory and voluntary insurance;

- non-state pension provision.

These expenses are recognized as expenses in the reporting (tax) period in which, in accordance with the terms of the agreement, the taxpayer transferred (issued from the cash desk) funds to pay insurance (pension) contributions.

A special rule is provided for these expenses: if the terms of the relevant agreement provide for the payment of an insurance (pension) contribution in a one-time payment, then under agreements concluded for more than one reporting period, expenses are recognized evenly over the term of the agreement in proportion to the number of calendar days of the agreement in the reporting period. period.

Rule 9: Based on expenses for the development of natural resources.

The list of expenses for the development of natural resources, as well as the procedure for their recognition for tax purposes, is established in Articles 265, 325 of the Tax Code of the Russian Federation.

Rule 10: For expenses on scientific research and (or) development.

The composition of expenses for scientific research and (or) development, as well as the procedure for their recognition, is established by Article 262 of the Tax Code of the Russian Federation. Based on the analysis of this article, the following rules for recognizing these expenses can be identified.

The taxpayer's expenses for R&D after their completion (completion of individual stages of research) are evenly included in other expenses for two years, provided that the said research and development are used in production and (or) in the sale of goods (performance of work, provision of services) from the 1st the day of the month following the month in which such studies were completed.

Taxpayer expenses for scientific research and (or) experimental development carried out for the purpose of creating new or improving used technologies, creating new types of raw materials or materials that did not produce a positive result are subject to inclusion in other expenses evenly over three years in the amount actual expenses incurred from the 1st day of the month following the month in which such studies were completed.

Thus, taxable profit can be reduced by all amounts spent on scientific research or development, with the exception of excess expenses provided for in paragraph 3 of Article 262 of the Tax Code of the Russian Federation.

Rule 11. For taxes and fees.

The date of recognition of expenses for the amounts of taxes and fees and other obligatory payments is the date of accrual of taxes (fees).

Rule 12. By contributions to reserves.

The date of recognition of expenses for the amounts of contributions to reserves, recognized as an expense for tax purposes, is the date of their accrual in accordance with the requirements of Chapter 25 of the Tax Code of the Russian Federation.

Rule 13. For certain types of expenses.

This rule applies to the following types of expenses:

- in the form of commission fees;

- in the form of expenses for payment to third parties for work performed (services provided);

- in the form of rental (leasing) payments for rented (leased) property.

The date of recognition of expenses in this case is the settlement date established in the agreement or the date of presentation of settlement documents to the taxpayer, or the last day of the reporting (tax) period.

Rule 14 By expenses:

- in the form of amounts of paid allowances;

- in the form of compensation for the use of personal cars and motorcycles for business trips.

The date of recognition of expenses is the date of transfer of funds from the current account (payment from the cash desk) of the taxpayer.

Rule 15. By expenses:

- for business travel expenses;

- for expenses on maintenance of official vehicles;

- for entertainment expenses.

The date of recognition of expenses is the date of approval of the advance report.

Rule 16. For expenses from transactions with foreign currency.

When carrying out transactions with foreign currency, the date of recognition of expenses is the date of transfer of ownership of foreign currency and precious metals.

For expenses from the sale (purchase) of foreign currency, the date of their recognition is the date of transfer of ownership of the foreign currency.

Rule 17. For expenses in the form of negative exchange rate differences.

Expenses in the form of negative exchange rate differences on property and claims (liabilities), the value of which is expressed in foreign currency, are recognized on the last day of the current month.

Rule 18. For expenses from the revaluation of precious metals.

Expenses in the form of negative revaluation are recognized on the last day of the current month.

Rule 19. For securities.

For expenses associated with the acquisition of securities, including their cost, the date of recognition of expenses is the date of sale or other disposal of securities.

Rule 20. For penalties (compensated damages).

This rule applies to the following types of expenses:

- in the form of fines, penalties and (or) other sanctions for violation of the terms of contractual or debt obligations;

- amounts of compensation for losses or damages.

The date of recognition of expenses for tax purposes is the date they are recognized by the debtor or the date the court decision enters into legal force.

21 rules. For expenses from borrowing operations.

This rule applies to expenses in the form of interest on loan agreements and other similar agreements (other debt obligations, including securities).

If the validity period of the specified agreements (other debt obligations) falls on more than one reporting period, then the date of recognition of expenses is considered to be the last day of the corresponding reporting period.

In the event of termination of the agreement (repayment of the debt obligation) before the expiration of the reporting period, the expense is recognized on the date of termination of the agreement (repayment of the debt obligation).

Rule 22. For expenses in the form of total differences.

The total difference is recognized as an expense in the following order:

- for the taxpayer-seller - on the date of repayment of receivables for sold goods (work, services), property rights, and in the case of advance payment - on the date of sale of goods (work, services), property rights;

- for the taxpayer-buyer - on the date of repayment of accounts payable for purchased goods (work, services), property, property or other rights, and in the case of advance payment - on the date of acquisition of goods (work, services), property, property or other rights.

Rule 23. For expenses related to the acquisition of leased property.

Expenses for the acquisition of leased property specified in subparagraph 10 of paragraph 1 of Article 264 of the Tax Code of the Russian Federation are recognized as an expense in those reporting (tax) periods in which, in accordance with the terms of the agreement, rental (leasing) payments are provided. In this case, these expenses are taken into account in an amount proportional to the amount of rental (leasing) payments.

Rule 24. For expenses in the form of the cost of acquiring shares, shares.

Law No. 58-FZ supplemented paragraph 7 of Article 272 of the Tax Code of the Russian Federation with subparagraph 10, which applies to legal relations arising from January 1, 2006.

The changes made establish that the date of expenses is recognized as the date of sale of shares, shares - for expenses in the form of the cost of acquiring shares, shares. In essence, this means that the date of sale of shares and shares and the date of acquisition of shares and shares are recognized as one day.

What settings need to be made in 1C to account for direct and indirect costs

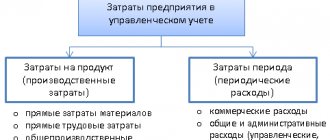

The concepts of direct and indirect expenses in accounting and tax accounting are different.

In accounting, expenses are divided into direct and indirect, depending on the methods of inclusion in the cost of certain types of products. Direct costs are understood as those costs that are associated with the production of certain types of products and that can be directly and directly included in their cost. By indirect we mean costs associated with the production of several types of products, included in their cost using special methods (clause 20 of the “Basic provisions for planning, accounting and calculating the cost of products at industrial enterprises”, approved by the State Planning Committee of the USSR, the State Committee for Prices of the USSR, the Ministry of Finance of the USSR , Central Statistical Office of the USSR 07/20/1970).

The procedure for accounting for costs of producing products, selling goods, performing work and providing services in the context of elements and items, calculating the cost of products (work, services) is established by industry regulations and guidelines for accounting (clause 10 of PBU 10/99).

Direct expenses are recorded in accounts 20 “Main production”, 23 “Auxiliary production”, 29 “Service production and facilities”. Indirect expenses are accounted for in accounts 25 “General production expenses” and 26 “General economic expenses” (Chart of accounts for accounting of financial and economic activities of organizations, approved by order of the Ministry of Finance of Russia dated October 31, 2000 No. 94n).

For profit tax purposes, direct expenses may include costs directly related to the production of products, performance of work, provision of services (material costs, personnel costs, insurance premiums, depreciation of fixed assets). The organization has the right to determine the list of direct costs associated with the production of products (performance of work, provision of services). Indirect expenses include expenses incurred in the reporting (tax) period and not classified as direct or non-operating expenses (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Direct expenses can be included in the expenses of the current reporting (tax) period only in the amount attributable to the sold products, works, services in the cost of which they are taken into account. And indirect expenses are included in full in the expenses of the period in which they are incurred (clause 2 of article 318 of the Tax Code of the Russian Federation).

The procedure for classifying expenses as direct or indirect must be economically justified and determined by the specifics of the technological process, and costs can be classified as indirect only if there is no real possibility of classifying them as direct (letter of the Ministry of Finance of Russia dated September 5, 2018 No. 03-03-06/ 1/ 63428).

The specifics of determining expenses for trade operations are determined by Article 320 of the Tax Code of the Russian Federation. For trading operations, direct costs include:

- the cost of purchasing goods sold in a given reporting (tax) period;

- the amount of costs for the delivery of purchased goods (transportation costs), if these costs are not included in the purchase price of the specified goods.

All other expenses of trading organizations incurred in the current month, with the exception of non-operating expenses, are recognized as indirect expenses and reduce the income from sales of the current month.

Now about the settings of “1C: Accounting 8”. To reflect production operations, the corresponding functionality must be enabled in the program (section Main - Functionality). On the Production tab, set the flag of the same name.

Methods for distributing indirect costs to include them in the cost of products (works, services) are indicated in the accounting policy settings (section Main - Accounting Policy).

The list of direct expenses for profit tax purposes is indicated in the register Methods for determining direct production expenses in NU. This register is available via the link List of direct expenses from the Income Tax form (section Main - Taxes and reports - Income Tax).

Let's take a closer look at the accounting policy settings (Fig. 3).

Rice. 3. Accounting policies

Please note that some of these settings affect the treatment of direct and indirect expenses in tax accounting.

If an enterprise produces products and/or performs work (provides services) to customers, then it is necessary to enable the flags Production of products and/or Performance of work, provision of services to customers. If at least one of the specified flags is set, the following become available in the Accounting policy form:

- block of settings for accounting general expenses;

- link Methods for allocating indirect costs

; - block of settings for calculating production costs.

In the general expenses accounting settings block there is a General expenses included switch, which can be set to one of the positions:

- In cost of sales (direct ct-costing

). All expenses recorded on account 26 will be written off to the financial result (to account 90.08 “Management expenses”) in the period of their implementation. In tax accounting, these expenses will also be indirect (regardless of the rules established for them in the register Methods for determining direct production costs in NU); - In the cost of products, works, services. All expenses recorded on account 26 will be written off to direct expenses (for example, to account 20.01) in accordance with the procedure specified in the register Methods for distributing general production and general business expenses.

The link Methods for distributing indirect expenses takes you to the register form Methods for distributing general production and general business expenses. The register is intended to store rules for the distribution of general production and general business expenses accounted for in accounts 25 and 26. The Distribution Base field is required, where you can select one of the values:

- Issue volume;

- Planned production cost;

- Salary;

- Material costs;

- Revenue;

- Direct costs;

- Individual items of direct costs;

- Not distributed.

General and general production expenses will be distributed in proportion to the indicator specified in the Allocation Base (for example, the volume of products produced in the current month and services provided, expressed in quantitative terms, etc.).

For general production and general business expenses, you can set the distribution method with detailing down to the department and cost item. This may be necessary when different types of expenses require different distribution methods.

If it is necessary to establish a single distribution method for all general and general production expenses, then when setting the distribution method, you do not need to specify the cost account, division and cost item. You can also set a general distribution method for all expenses accounted for in one account or in one department.

When establishing the distribution method, the register indicates the date from which the distribution method is applied. If it is necessary to change the method of distribution of expenses, a new entry is entered into the information register, which indicates the new method of distribution and the date from which the new method should be applied.

As for trading organizations, no special settings in the Accounting Policy will be required to account for direct expenses.

In accounting and tax accounting, the amount of transportation costs for purchased goods can be included:

- in the cost of goods (for example, using the document Receipt of additional expenses);

- as part of the company’s sales expenses - to account 44.01 “Distribution costs in organizations engaged in trading activities” (for example, using the document Receipt ( act, invoice)

with the type of Service). In order for transportation expenses to be calculated and written off automatically, when registering the receipt of services from a transport company, you must select the value of the expense type as Transportation expenses.

When closing a month using the regulatory operation Closing account 44 “Distribution costs”, sales expenses accounted for on account 44 are written off to account 90.07.1 “Sales expenses for activities with the main tax system” as follows:

- amounts of transportation costs - only in relation to goods sold;

- all other expenses are in full.

| 1C:ITS For more information about closing cost accounts using examples, including accounting for transportation expenses, see the section “Instructions for accounting in 1C programs.” |

Algorithm for accounting for company income and expenses

Accounting for income and expenses of an organization is carried out on the basis of the Law “On Accounting” dated December 6, 2011 No. 402-FZ, no.

Accounting for income and expenses is carried out using the double entry method using the corresponding accounts approved by order of the Ministry of Finance dated 31.10.2000 No. 94n. Analytics is carried out for each type of income and expense with the ability to identify the financial result for each operation.

To summarize information about income and expenses received from ordinary activities, the chart of accounts provides for account 90 “Sales”, to which the main sub-accounts are opened:

- 90.1 “Revenue” - for accounting for income recognized as revenue;

- 90.2 “Cost” - for cost accounting;

- 90.3 “VAT” - to account for tax due from buyers;

- 90.4 “Excise taxes” - for accounting for amounts of excise taxes (and also applicable when selling excise goods).

To account for other expenses, organizations can open other subaccounts to account 90.

To determine the financial result, which represents the difference between revenue and self-worth, subaccount 90.9 “Profit/loss from sales” is used. At the end of each month, the results of the company’s work are displayed by comparing debit turnover on subaccounts opened for accounting for expenses and other “negative” items (90.2-90.8ٜ), with credit turnover on subaccount 90 ٜ.1ٜ. The identified amount is written off by posting Dt 90.9 Kt 99 in case of excess of income over expenses or Dt 99 Kt 90.9 - in case of a loss. The sum of the subaccounts accumulates during the year, at the end of which they are closed internally:

Dt 90.1 Kt 90ٜ.9 - written off to the “Revenue” subaccount;

Dt 90.9 Kt 90ٜ.2 (90.3, 90.4...) - written off including subaccounts of costs, VAT and other items that reduce revenue.

To account for other income and expenses, account 91 “Other income and expenses” is used, to which the following subaccounts are opened:

- 91.1 “Other income” - for accounting for income not related to the main type of activity;

- 91.2 “Other expenses” - to account for other costs;

- 91.9 “Balance of other income and expenses” - to identify profit/loss from transactions related to other types of activities.

Similar to accounting for income and expenses from ordinary activities, the accountant at the end of the month compares the balance of accounts 91.1 and 91.2 and writes off the resulting result by posting Dt 91.9 Kt 99 - upon receipt of profit or Dt 99 Kt 91.9 - loss at the end of the month. Subaccounts are closed at the end of the year using internal transactions.

Tax accounting of income and expenses, as mentioned earlier, has some differences from accounting.

Example

entered into a car rental agreement with a company employee, according to which the monthly rent is 7,500 rubles. The car's engine capacity is less than 2,000 cm3.

When calculating taxable profit, you can take into account no more than 1,200 rubles. (Subclause 11, Clause 1, Article 264 of the Tax Code of the Russian Federation). That is, in accounting expenses it will be reflected in 6,300 rubles. (7,500 – 1,200) more costs than in the tax office. Tax accounting analytics can be displayed as follows:

| Check | Sum | Analytics |

| NU 91.2 “Other expenses” | 1 200 | Expenses accepted for tax purposes |

| 6 300 | Expenses not taken into account when calculating profit |

In this case, a permanent tax liability is formed, which is reflected in accounting by posting Dt 99 Kt 68 - 6,300 rubles.

Between tax accounting (TA) and accounting (BU), when recording certain incomes and expenses, not only permanent but also temporary differences can arise. This means that the event is displayed in accounting earlier (later) than in tax accounting.

The rules for accounting for permanent and temporary differences are shown in the table below.

| Permanent differences (between NU and BU arise in the same tax period) | ||

| Sign | Profit in BU is higher than in NU | In BU the profit is less than in NU |

| Consequence | Permanent tax liability (PNO) | Permanent tax asset (PTA) |

| Tax nuances | Conditional consumption | Conditional income |

| Wiring | Dt 99 Kt 68 | Dt 68 Kt 99 |

| Temporary differences (between BU and NU arise in different tax periods) | ||

| Sign | In NU profit is recognized earlier than in accounting | In accounting, profit is recognized earlier than in NU |

| Consequence | Deductible Temporary Difference (DTD) | Taxable temporary difference (TDT) |

| Tax nuances | Deferred tax asset (DTA) | Deferred tax liability (DTL) |

| Wiring | Dt 09 Kt 68 - form; Dt 68 Kt 09 - repay | Dt 68 Kt 77 - form; Dt 77 Kt 68 - repay |

More details about the algorithm for accounting for permanent and temporary differences can be found in the material “Differences between accounting and tax accounting.”

Tax accounting can be kept separately from accounting (most often this method is chosen by large companies) or on the basis of accounting data highlighting tax differences (this method is usually chosen by small taxpayers). In any case, correct tax and accounting management according to “double standards” is only possible using automated systems.

What settings determine the result of cost calculation?

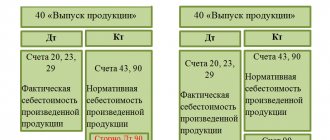

Cost is the monetary expression of the costs of production and sale of products, which consists of costs associated with the use of fixed assets, raw materials, materials, fuel and energy, labor, as well as other costs for its production and sale in the production process of industrial products (clause clauses 3, 8 “Basic provisions for cost calculation”).

The result of cost calculation (the actual cost of products in accounting and tax accounting) in “1C: Accounting 8” is reflected in the calculation certificates Cost of manufactured products and services and Cost calculation (Fig. 4), which are also available from the assistant form Closing the month

(section Operations).

Rice. 4. Costing

What does this result depend on? First of all, of course, it depends on the composition of direct costs and the order of distribution of indirect ones. But not only. Direct costs in the program include:

- directly to a specific product name;

- by type of product (per product group) with subsequent distribution by product name.

To understand how this happens, let's look at the cost account of the main production. In addition to cost items (which we wrote about above), analytical accounting for account 20.01 is carried out by types of products (works, services) (subconto Nomenclature groups) and by names of products (works, services) (subconto Products).

Each item group is an element of the Nomenclature Groups directory (section Directories), and each product name is an element of the Nomenclature directory (section Directories).

The Nomenclature Groups directory stores information about goods, products, works, and services in homogeneous groups, for which aggregated accounting of sales revenue and production costs is maintained.

The use of nomenclature groups is based on the assumption that many names of goods, products, works and services can be combined into groups with a homogeneous material composition.

Nomenclature is a directory for storing information about inventory items (including finished products), work performed, and services provided.

To get an accurate cost calculation, you need to fill in the Products field in production cost accounting documents (for example, Production Report for a Shift, Receipt from Processing, Request Invoice, etc.).

The Products field can be left blank for those costs for which it is either unknown or impractical to determine what specific product they were spent on. In this case, direct costs are distributed across the product group in a certain way.

| 1C: Accounting 8: setting up accurate cost calculations taking into account the use of specific materials |

How will direct costs be distributed within the item group? This depends on the accounting policy settings in the settings block for calculating the cost of production (see Fig. 3).

If the Use planned production cost flag is checked, then planned prices must be indicated in documents for the release of finished products and the provision of production services. Direct costs not allocated to specific products will be distributed within the product group in proportion to the planned cost.

If the Use planned production cost flag is not set, then planned prices are not required to be indicated in production documents. Costs that are direct in relation to the product group will be distributed in proportion to the costs that are direct in relation to specific products.

In any case, the actual cost is determined at the end of the month when performing a routine operation to close cost accounts.

| 1C: Accounting 8: how to distribute direct production costs without using planned cost |

Which expense group should the amounts of accrued depreciation be included in?

Within the meaning of paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, direct expenses may include the amounts of accrued depreciation on fixed assets used in the production of goods, works, and services. Classifying these expenses as direct costs is associated with high tax risks. This is confirmed by judicial practice. In particular, the inspectors pointed out that the company unreasonably included in indirect costs costs associated with the depreciation of fixed assets used in the production of cars.

Costs associated with the depreciation of fixed assets directly used in the production of cars, according to the court, are wrongfully excluded from direct expenses.

Thus, the court concluded that depreciation of fixed assets directly involved in the production of products is inextricably linked with the production process and, by its nature, should be included in direct expenses (Resolution of the Federal Antimonopoly Service of the North-Western District dated October 15, 2013 in case No. A56 -63786/2012).

In a different situation, the tax authority considered it unlawful to exclude from direct expenses the costs of depreciation of a part of fixed assets.

As the court found, the enterprise included in indirect expenses (tax accounting) the amount of depreciation of fixed assets not directly involved in the production process (shop buildings, buildings containing production equipment, workplaces - tables).

With regard to the building of workshop buildings, buildings in which equipment is located, workplaces (tables), the enterprise explained that the area of workshops is occupied by equipment no more than 30 - 50%, and therefore the operation of these fixed assets does not directly affect the production of products by the enterprise.

At the same time, in relation to fixed assets directly used in production (presses, furnaces, machine tools, equipment, mills, drying drums), depreciation is classified as direct expenses.

Taking into account the peculiarities of the enterprise’s production process, the court recognized the proven need to take into account depreciation of fixed assets not directly involved in the production process as indirect expenses. These conclusions were made in the Resolution of the Federal Antimonopoly Service of the North-Western District dated March 30, 2012 in case No. A44-1866/2011, the Determination of the Supreme Arbitration Court of the Russian Federation dated August 16, 2012 No. VAS-9792/12 in case No. A44-1866/2011.

Results

The legislation regulating accounting divides all expenses of an enterprise into two large groups: those associated with ordinary activities and other expenses. Expenses associated with ordinary activities are divided into elemental groups. And the enterprise chooses the grouping of expenses by cost items independently. The main and additional lists of cost items form a complete list of enterprise costs.

Read about the procedure for accounting for certain types of costs in the materials in our section “Accounting in 2020-2021 (rules, methods).”

Sources:

- PBU 10/99, approved. by order of the Ministry of Finance of Russia dated May 6, 1999 N 33n

- chart of accounts, approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.