Accounting is a specific activity of specific structures of any organization, which is aimed at accounting for all internal and external business transactions, settlements with counterparties and calculating the property status of a legal entity. Accounting is needed not only to submit reports to the tax office, but also to maintain the proper functioning of the enterprise. The work of accounting is impossible without the use of special features. Accounting accounts stand out prominently among them. They are special accounting positions in which all transactions and data on the condition of the property are recorded. This process is aimed at grouping and accounting for business transactions that are homogeneous in economic content, their sources and final results. Among the large number of accounts, there is account number 90. It stores data on sales, expenses and income of the organization. The article will tell you what accounting account 90 is, what revenue is, which account reflects income and expenses, how it corresponds with other registers, passive or active account 90.

Account Description

Account 90 “Sales” is a special register that stores and summarizes data on the expenses and income of a legal entity associated with ordinary activities. It is also used to determine the financial result of this activity. Based on the turnover of a particular subaccount, it may be classified as passive-active. This may mean that it can fall into both the Asset and Liability of accounting.

The work of accounting is based on the use of various accounts

When recognized in accounting, the amount of income from the sale of goods, provision of services or performance of work is reflected in the credit of accounting account 90 and the debit of account 62 “Settlements with buyers and customers”. At the same time, the cost of inventory, services or work is written off from Kt 43 of the “Finished Products” account, 41 “Goods”, 20 “Main Production” and others in Dt 90 of the “Sales” special account.

For legal entities that are engaged in the production of agricultural products, according to Kt 90, the revenue from the sale of these products, corresponding to account 62, can be reflected, according to Dt - the planned cost of production. The latter is determined during the reporting year, since the actual one may not yet be identified.

One of the uses of 90 accounting is to determine the results of financial activities for the reporting period

Analytical accounting for special account 90 is carried out separately for each criterion. Among them: inventory items sold, products sold, work performed, services provided and much more. Moreover, analytics on this special account can be carried out by sales regions and other areas that are necessary for the effective management of the organization. For reports, SALT and special account cards are used.

Important! The planned cost of products sold and the amount of differences between the planned and actual costs are written off in Dt 90 “Sales” in conjunction with other accounting accounts in which the products were recorded.

For legal entities engaged in retail trade and maintaining inventory records at sales prices, Kt 90 “Sales” reflects the sales value of products, and Dt - the accounting value of products, corresponding with account 41 “Goods” and at the same time reversing the amount of discounts on sold inventory items (by contacting special account 42 “Trade margin”).

Determining the financial result for special account 90 through the formation of a balance sheet

Purpose

Special account 90 is used to reflect revenue and cost for:

- Various types of finished products and semi-finished products produced by the enterprise itself;

- Carrying out works and providing services of industrial specifications;

- Performing work and providing services of non-industrial specifications;

- Purchase of products purchased for complete sets;

- Carrying out construction, installation, design, research and geological exploration work;

- Inventory assets;

- Providing services for cargo and passenger transportation;

- Carrying out transport, forwarding and loading and unloading operations;

- Providing communication services;

- Providing for the use of their excise taxes upon concluding contracts for a fee for a certain time;

- Granting rights to patents of inventions, created industrial designs and any other intangible property rights for a fee;

- With the direct participation of a legal entity in the creation of authorized capitals of other legal entities and entrepreneurs.

A diagram explaining the operation of special account 90 for debit and credit

Closing

The process of closing account 90 is one of the steps in generating the financial and economic result for the reporting period. Most often this is a month or reporting year. The peculiarity of this register is that at the end of the month there will be no balance according to synthetic accounting. Upon analysis, it is noticeable that amounts are accumulated in subaccounts 90 of the special account, which are written off only in December before the start of the new accounting year.

Important! Based on the results of closing an accounting period of one year, there cannot be a balance on the 90th accounting account “Sales” and its subaccounts. If it is, then this is an obvious error in the calculations.

Every month, the accounting department reports profit and loss indicators. This is done by closing special account 90. The transactions made will not affect the accumulated balances, which will remain until December 31. They will only affect the synthetic account.

First of all, determine the formula: Financial result = Revenue - Cost. The result is calculated over a period of one month. Revenue represents income received on loan 90.01. The cost includes the costs of performing operations described on debit subaccounts.

An example of a table that helps you understand how the 90 special account for debit and credit works

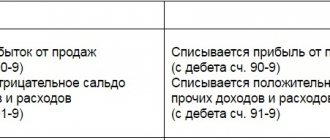

If a positive difference is obtained, then closing 90 accounts at the end of the reporting period will show a profit. A negative value will reflect the unprofitability of operations in this period.

The special account itself is closed as follows:

- If the FR is profitable, then the entry Debit 90.09 Credit 99 is created;

- If the financial account is unprofitable, then the entry Debit 99 Credit 90.09 is created.

Another option involves working with subaccounts:

- 90.1 The final balance is calculated. Since it is credit, then in order for it to be reset to zero, you need to post Debit 90.1 Credit 90.9;

- 90.2 The final balance is calculated. Since it is a debit, then in order for it to be reset to zero, you need to post Debit 90.9 Credit 90.2;

- 90.3 The final balance is calculated. Since it is a debit, then in order for it to be reset to zero, you need to post Debit 90.9 Credit 90.3;

- 90.9. If all of the above entries were completed successfully, then when calculating the final balance at 90.9 it will be equal to zero;

- Account 90 “Sales” is closed.

Account 90 is closed independently or when its subaccounts are closed

How to make final entries to create a balance sheet

At the end of the year, the account is closed, as a result of which the balance of all subaccounts is reset to zero.

The financial result is calculated at the end of each month and is reflected in the 9th subaccount of account 90, so the total balance in account 90 at the end of the month is zero.

Accounting example:

The organization sells goods subject to VAT. The cost price is collected from the purchase price of goods reflected in account 41, and selling expenses collected in account. 44.

The initial data is as follows:

- a batch of goods with a total cost of 100,000 rubles was purchased;

- sales expenses amounted to 10,000 rubles;

- the sale of this batch was carried out for a total cost of 236,000 rubles, including VAT.

Postings to account 90:

| Sum | Operation | Debit | Credit |

| The cost of goods for sale has been written off | |||

| Selling expenses included | |||

| Sales price reflected | |||

| VAT payable on this batch of goods has been accrued | 68.VAT | ||

| The profit from this operation is reflected | 90.9 |

During each month, revenue is reflected, costs are formed and VAT is calculated on all transactions related to ordinary activities. At the end of the month, the financial result for the month is calculated, which is reflected in the 9th subaccount of account 90 in correspondence with account 99.

At the end of the year, the procedure for closing account 90 should be carried out.

How to close a 90 account?

Each separate subaccount (from 1st to 4th) accumulates a balance - a credit balance for the first subaccount, a debit balance for the rest.

At the end of the year, each subaccount has a total balance accumulated over 12 months. The task is to reset this balance for each subaccount, thereby the entire account 90 will have a balance of 0.

How to close account 90:

- 1st subaccount - posting D90.1 K90.9 is performed for the amount of the credit balance at the end of the year;

- from the 2nd to the 4th subaccount - posting D90.9 K90.2 (90.3, 90.4) is performed for the amount of the debit balance for each subaccount;

- 9th subaccount - as a result of the actions indicated above, the balance on it will be equal to 0.

Thus, the postings for closing account 90 look like:

- D90.1 K90.9 - the first one closes;

- D90.9 K90.2 - the second one closes;

- D90.9 K90.3 - the third closes;

- D90.9 K90.4 - the fourth one closes.

The balance for each subaccount and for account 90 as a whole is equal to 0 at the end of the year. At the beginning of the year, the account should be reopened, again starting to accumulate cost, revenue and taxes on it.

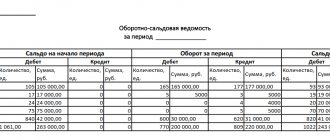

Example of closing account 90:

We have these numbers at the end of the year. Black shows the final balance for each subaccount at the end of the year.

To close an account, you need to make the following transactions:

| Sum | Operation | Debit | Credit |

| Closing subaccount 1 | 90.1 | 90.9 | |

| Closing subaccount 2 | 90.9 | ||

| 180000 | Closing subaccount 3 | 90.9 |

Subaccounts

Account 90, the subaccounts of which can be issued in connection with the specifics of the work of a legal entity, is aimed at summarizing data on expenses and income. The following subaccounts can be opened for it:

- 90.1 “Revenue”, the account of which takes into account the receipts of all assets recognized as revenue;

- 90.2 “Cost of sales”, taking into account the cost of sales for which revenue is recognized;

- 90.3 “VAT”, taking into account the amount of value added tax. It is due to be received from the client;

- 90.4 “Excise taxes”, taking into account the amounts of excise taxes. They are included in the final price of goods and materials;

- 90.9 “Profits and losses from sales”, taking into account the financial and economic results for the reporting period.

Important! Legal entities that pay export duties can open a subaccount 90.5, which takes into account the amount of export duties. In addition, separate sub-accounts can be established by the organization itself, based on the specifics of its activities. To do this, the list of subaccounts must be approved in the Chart of Accounts in the Accounting Policy.

Accounting for the process of selling inventory can be carried out in detail using subaccounts

Closing accounts 90 and 91

On December 31 of each year, after identifying the financial result from ordinary activities and other operations, it is necessary to reset the subaccounts to accounts 90 “Sales” and 91 “Other income and expenses” (Order of the Ministry of Finance dated October 31, 2000 No. 94n).

Synthetic (collapsed) accounts 90 and 91 should not have any balances at the time of closing the subaccounts. The absence of balances on these accounts is achieved by monthly comparison of debit and credit turnovers separately for accounts 90 and 91 and identifying the financial result in subaccounts 90-9 and 91-9, respectively. Consequently, by the time the subaccounts are closed, subaccounts 90-9 and 91-9 show the accumulated profit or loss for the year from ordinary activities or other operations, respectively.

When closing the year, transactions are usually generated automatically in the accounting program used.

We will show you what accounting entries should be made:

| Operation | Subaccount debit | Subaccount credit |

| The closure of subaccount 90-2 is reflected | 90-9 “Profit/loss from sales” | 90-2 “Cost of sales” |

| The closure of subaccount 90-3 is reflected | 90-3 "VAT" | |

| The closure of subaccount 90-4 is reflected | 90-4 "Excise taxes" | |

| The closure of subaccounts 90-1 and 90-9 is reflected | 90-1 “Revenue” | 90-9 |

| The closure of subaccount 91-2 is reflected | 91-9 “Balance of other income and expenses” | 91-2 “Other expenses” |

| The closure of subaccounts 91-1 and 91-9 is reflected | 91-1 “Other income” | 91-9 |

If other subaccounts were opened for accounts 90, 91 and debit balances were accumulated on them, they are closed in the same way: they are credited to the debit of subaccounts 90-9 or 91-9, respectively.

As a result of the entries made, all subaccounts to accounts 90 and 91 are closed.

Correspondence with other accounts

The correspondence of account 90 in the accounting department is quite extensive, both in debit and credit. According to Dt he corresponds with:

- 11 — Animals for growing and fattening;

- 20 — Main production;

- 21 — Semi-finished products of own production;

- 23 - Auxiliary production;

- 26 — General business expenses;

- 29 — Service industries and farms;

- 40 — Output of products (works, services);

- 41 - Goods;

- 42 — Trade margin;

- 43 — Finished products;

- 44 — Selling expenses;

- 45 — Goods shipped;

- 58 — Financial investments;

- 68 — Calculations for taxes and fees;

- 79 — Intra-economic calculations;

- 99 - Profit and loss.

The correspondence of the account in question is extensive due to the commonality of operations in it.

According to Kt, special account 90 and its subaccounts have the following correspondence:

- 46 — Completed stages of unfinished work;

- 50 - Cash desk;

- 51 — Current accounts;

- 52 — Currency accounts;

- 57 — Transfers on the way;

- 62 — Settlements with buyers and customers;

- 76 - Settlements with various debtors and creditors;

- 79 — Calculations within the subject;

- 98 - Deferred income;

- 99 - Profits and losses.

The main stages of closing accounts when preparing interim or annual financial and economic reporting

Postings

Typical postings for account 90:

- Debit 62 Credit 90.1. Recognition of revenue from sales of inventory items, invoices and invoices;

- Debit 90.2 Credit 20, 26, 41, 42, 43. Write-off of cost of sales, Cost calculators;

- Debit 90.3 Credit 68. Accrual of VAT on sales, Invoice;

- Debit 90.4 Credit 68 Accrual of excise taxes on sales, Invoice;

- Debit 99 Credit 90.0 Reflection of unprofitable financial results from the sale;

- Debit 90.9 Credit 99 Reflection of profitable financial result from the sale.

A typical entry for accounting account 90 is a reflection of the result of financial activity

. Thus, a complete description of account 90 in accounting was given. It is a register in which generalized data on transactions related to expenses and income from the ordinary activities of an enterprise or organization is placed, as well as the financial result determined from them. Ordinary activities mean the sale of goods, provision of services and performance of work. Often, revenue and cost for various types of activities are displayed on account 90.

How to close account 90 at the end of the month if there is a balance on subaccount 90.03?

Login to the site Registration Login for registered users: Close Login via Previously, you logged in via Password recovery Registration Password recovery Forum Forum

Helen12 (question author) 0 points July 25, 2021 at 4:27 pm Modified at 4:28 pm

| ||||||||||||||||||||||||||